Professional Documents

Culture Documents

Shale Insight 2013 Steve Pryor Remarks

Uploaded by

PennLiveCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shale Insight 2013 Steve Pryor Remarks

Uploaded by

PennLiveCopyright:

Available Formats

Stephen D. Pryor President, ExxonMobil Chemical Shale Insight 2013 Conference Philadelphia, Pa. Sept.

25, 2013 Thank you. It is a pleasure to be back in Pennsylvania and not just because I went to college here so many years ago. This region of the country played a pioneering role in Americas energy history. And the men and women of the Marcellus Shale Coalition continue that legacy today. Over the past 40 years, Ive seen many advances in energy technology reshape our industry, both here and abroad. But I've never seen anything as powerful as shale energy. In fact, shale development is emerging as the biggest energy breakthrough in this country since the dawning of the age of oil, some 150 years ago right here in Pennsylvania. The milestones are striking. U.S. natural gas production is at its highest level ever, up by more than 30 percent in the last seven years. U.S. oil production rose by 1 million barrels a day last year. This is the largest annual increase in U.S. history. In the downstream, the United States has become the world's largest exporter of refined products, with shipments of gasoline and other fuels doubling over the last five years. In fact, North America is on the road to becoming a net energy exporter by the middle of the next decade. And from the consumers standpoint, American households are seeing the benefit, saving an average of 1,200 dollars in energy costs last year, at a time when average household income remains below 2007 levels.

It's a remarkable turn of events, considering that just 10 years ago, in 2003, an article in Time magazine declared that the United States was "running out of energy." Clearly, shale and other unconventional resources have transformed Americas energy landscape. They also have the potential to transform the entire U.S. economy and help lift this country out of its persistent pattern of weak growth and high unemployment. IHS Global Insight projects that by 2025 shale energy could create an additional 1.8 million jobs and contribute more than half-a-trillion dollars to annual GDP. Petrochemicals, LNG are key to growth As producers, you understand this. But what many dont understand, is that in order to take full advantage of this historic opportunity, we must act now. The United States must encourage investment in downstream industries that drive demand for natural gas. While the largest domestic market of natural gas is, of course, power generation, two key markets farther downstream are petrochemicals and liquefied natural gas, which are what I would like to talk to you about today. Petrochemicals and LNG are American-made products that add value to our country's natural gas resources. Demand for these products is strong. Globally, demand for ethylene, a key petrochemical, is growing more than 50 percent faster than natural gas. The market for LNG is growing even faster. And, since most of this demand growth is outside the United States, this presents an outstanding opportunity to boost America's exports. If you as producers, and the nation as a whole, are to make the most of shale resources, investments in petrochemicals and LNG must be allowed to move ahead. The U.S. chemicals renaissance

Let me begin with chemicals, one of this countrys largest users of natural gas. The chemical industry together with other industrial sectors account for nearly 30 percent of U.S. natural gas demand. Shale development has given U.S. petrochemical producers a double benefit. In addition to using natural gas as an energy source, they also use the ethane and other liquids from natural gas as a key raw material to make plastics and other essential products. This is in contrast to most of the rest of the world, where petrochemicals are made from oilbased naphtha feedstocks, which today are far more expensive. A good example is ethylene, the world's largest-volume petrochemical building block. Today, manufacturers can make ethylene in the United States for less than half of what it costs in Europe, Asia and Latin America. This cost advantage has reversed the fortunes of the U.S. chemical industry. The total value of shipments from U.S. chemical manufacturers hit an all-time high during the past two years. And, over the last five years, capital spending by the American chemical industry has risen by more than 40 percent. Major capacity additions have been announced for the first time in more than a decade. And exports have been revived. Just five years ago, the U.S. was losing ground in the export market. In fact, the country was on the verge of becoming a net importer of chemicals. But today, chemicals are once again Americas single biggest export larger than agriculture, automobiles and aerospace. And this is just the beginning. Global demand for chemicals is expected to rise by 50 percent over the next decade. Most of that growth will happen in Asia Pacific and other developing regions.

While history tells us that regional cost differences fluctuate over time with energy prices, the United States is back in the game. Exports can be the springboard for a new era of American chemical growth.

The U.S. chemicals export opportunity ExxonMobil, one of the worlds largest chemical companies, is moving quickly to seize this opportunity. We are planning a multi-billion-dollar expansion at our Baytown, Texas, facility, already the countrys largest integrated refining and chemical complex. Industry-wide, some 125 new chemical projects have been announced in the United States. The American Chemistry Council estimates these projects to be worth as much as $84 billion. This is good news for U.S. natural gas producers because petrochemical investments create demand for ethane and other natural gas liquids. The bad news is that, today, U.S. chemical plants are already running at full capacity and therefore cannot absorb the growing surplus of ethane from natural gas. As a result, ethane, in many cases, is being left in the gas stream rather than being extracted and upgraded to chemicals. It is therefore crucial that planned U.S. petrochemical investments be allowed to move ahead quickly. Failure to do so will constrain investment in both natural gas production and infrastructure, thereby limiting economic growth and job creation. The LNG export opportunity The same logic applies to LNG.

The United States is poised to play a significant role in the global LNG market, which is expected to triple in size from 2010 to 2040. ExxonMobil projects that LNG exports from North America, which were essentially zero in 2010, will rise to about 15 billion cubic feet per day in 2040. By 2040, we expect North America to account for about 15 percent of global LNG supply. Study after study has concluded that North American LNG exports would benefit the U.S. economy. ICF International estimates that LNG exports could add more than $100 billion annually to U.S. GDP. The expansion of LNG globally would help countries around the world curb their energy-related greenhouse gas emissions as they shift away from coal. Natural gas emits up to 60 percent less CO2 than coal when used for power generation. Of course, how much LNG ultimately gets exported from the United States depends on how quickly the country can build the facilities to liquefy and export the gas. Just as with petrochemicals, if U.S. LNG capacity is allowed to lag it will constrain investment in natural gas development-- and limit U.S. economic growth and job creation. Natural gas equals jobs and renewal Let's talk about jobs for a moment. As gas producers, you know that growing natural gas production creates good-paying jobs. We are already seeing this in my home state, Texas, and here in Pennsylvania, two of the nations largest shale producers. Out of the nearly 2 million jobs that are associated with production of unconventional resources, Texas and Pennsylvania have close to 700,000, most of which have been created over the last five years. Similar job creation opportunities exist farther downstream. 5

In addition to our Baytown expansion, ExxonMobil also is part of a joint venture seeking to build an LNG export facility in Texas. ExxonMobil is progressing both of these projects subject to permit approval. Together, these two investments will create 55,000 new direct and indirect jobs nationwide during their construction phase and more than 12,000 permanent jobs once they are operational. This country needs the jobs made possible by shale energy. This was driven home to me a few months ago, when I spoke at a press conference in Houston to announce a grant program to expand vocational training at Houston-area community colleges. The goal is to train thousands of young people for skilled jobs such as technicians and pipefitters, where the average salary in the Texas chemical industry has risen to $95,000 a year. We labeled the program: Houston + Natural Gas = Jobs. As I described the program, and introduced some of the young people who are benefitting from it, the public- and private-sector leaders in the audience got really excited. People were bursting into rounds of applause. I can tell you, the atmosphere in the room was as close to a revival meeting as you get in our business. And in a sense, it is a revival, because shale energy, and the opportunities it is enabling in states all over the country, is helping to revive America's confidence, pride and hope for the future. The United States now has nearly a 100-year supply of clean-burning natural gas clearly enough to satisfy rising demand here at home while also supporting increased exports of American products. 6

And right now, North America is the only region of the world with meaningful shale energy production. Policies for the game-change So, as a nation, how does the United States capture this once-in-a-generation opportunity? How does it achieve the types of numbers that IHS said shale energy can make possible 1.8 million Americans in new, good-paying jobs by the middle of the next decade? Most Americans would be relieved to know that it wont require government programs, subsidies or mandates. What it will require are policies that clear the path for private-sector investment. This path will need to be very, very wide a superhighway. The United States needs tens of billions of dollars of investments not just in production, but in the infrastructure and processing facilities that can enable American-made gas and gas liquids to reach markets here and around the world. It needs pipelines and chemical plants and LNG export terminals. The United States needs to unite proudly behind shale gas the same way other countries do with their energy industries and the same way this country did with automobiles, the Internet or any other revolutionary American innovation. The need for timely permitting So what's holding us back? First and foremost, it's permitting. For example, permits to develop shale resources are on hold in five states amid an endless debate over the safety of hydraulic fracturing.

As you know, over the past 50 years, the U.S. energy industry has fractured more than 1 million wells. As ExxonMobil Chairman Rex Tillerson said recently, if hydraulic fracturing were a new drug treatment undergoing clinical trial, it would have been cleared decades ago. Another area of endless debate is LNG permits. Some continue to question whether LNG exports are in the national interest. Yet, the Department of Energy's own study and many others concluded months ago that the more LNG this country exports, the more our economy stands to benefit. Although the pace of approvals has picked up lately, we're still awaiting action on 20 proposed LNG projects. The DOE needs to act quickly on these applications. While we don't know how many of these projects ultimately will prove viable, we need to let the competitive market determine which ones get built and which don't. The DOE should adhere to its tradition of embracing free trade and avoid imposing artificial limits on U.S. LNG exports. Bear in mind, too, the nations disastrous experience with federal controls over the natural gas market in the 1970s and 80s. Those controls were ultimately scrapped by the Reagan administration. Turning to petrochemicals, the permitting picture is somewhat more encouraging. Thus far, one major ethane steam cracker has been fully permitted by the state of Texas and EPA. Those permits came within one year of the company submitting a complete application. That time frame sets an appropriate standard for action on the six other major ethane crackers that have been announced, including ExxonMobil's Baytown project.

So why should anyone outside this room care about how quickly regulators approve permits for chemical and energy projects? Because permit approval times are the leading indicator of how quickly our nation is capturing the benefits of shale energy. Delays could add billions to project costs, restrain job creation and erode America's new competitive advantage. As a nation eager for economic growth, the United States should be monitoring these approval times the same way it monitors other key economic indicators.

Free markets and free trade Beyond the issue of permitting, the United States must embrace free-trade policies for the products of natural gas, whether they are chemicals or LNG. Those who would limit LNG exports put this country at risk of shutting in a significant portion of projected natural gas production and forgoing the jobs and economic benefits that come with it. It's the energy-policy equivalent of keeping your money under your mattress. Limiting LNG exports would also likely have a boomerang effect on chemicals. As U.S. petrochemical exports are ramped up, these lower-cost American exports will put pressure on local producers in Latin America, Asia and Europe regions that rely on more expensive oil-based feedstocks. As a result, we can anticipate calls for protectionism against U.S. chemical exports. If this nation is to successfully counter those arguments and progress free trade agreements with these regions, it must itself be, as Ronald Reagan said, an unrelenting advocate of free trade.

Restricting LNG exports would be an affront to Americas trading partners and undermine the efforts underway to strengthen our trading ties. For example, why should the EU drop tariffs on U.S. chemicals and other goods made from advantaged natural gas if the U.S. blocks exports of that gas in liquefied form? Likewise, how can the U.S. ask Japan, a close ally suffering from energy shortages, to stop importing oil from Iran if we prevent Japan from importing U.S. gas? The answers are obvious. Limiting LNG exports would have a chilling effect on trade and restrict the ability of U.S. gas producers to reach global markets. It's protectionism pure and simple. It flies in the face of fairness, open markets, and free trade. It also ignores the humanitarian and environmental imperative that compels us to provide the cleaner-burning energy critical to human progress and economic development around the world. Today, about 1.3 billion people still do not have access to electricity. As an official of the World Bank said recently, "Without energy, there is no economic growth, there is no dynamism, and there is no opportunity." When will we get it? As a trustee of my alma mater, Lafayette College, about 75 miles from here, I have had many opportunities over the years to talk with student groups about energy. These bright young people all are concerned about the environment and making sure we develop our resources in a responsible way. They also are concerned about their economic futures. When I tell these students the whole story about natural gas development the facts versus the myths, the opportunity for job creation and economic renewal, and the humanitarian imperative 10

of expanding access to energy they get it. Whether they major in engineering, economics or English, they get it. I think that if all Americans could hear the whole story, they would get it, too. Our industry has a responsibility to communicate the facts about shale energy development to the American public. And that narrative cant stop at the wellhead. It must explain the once-in-ageneration opportunity for industrial renewal, job creation and revitalization of the U.S. economy. At the same time, our nation's leaders must not allow energy policy to be dictated by the few who put their economic interests ahead of the nation's and promote fear over facts. The United States must seize the opportunity created by shale energy. We need regulatory and trade policies now that enable industry to safely create millions of new jobs and a new era of prosperity. As John F. Kennedy once said, "The mere absence of recession is not growth. We have made a beginning but we have only begun." It was my pleasure to speak with you today. Thank you for your kind attention.

11

You might also like

- Do Democrats Hold The Majority in The Pa. House of Representatives?Document12 pagesDo Democrats Hold The Majority in The Pa. House of Representatives?PennLiveNo ratings yet

- Correspondence From Conference To Institution Dated Nov 10 2023Document13 pagesCorrespondence From Conference To Institution Dated Nov 10 2023Ken Haddad100% (2)

- Calling For Rep. Zabel To ResignDocument2 pagesCalling For Rep. Zabel To ResignPennLiveNo ratings yet

- Quinn's Resignation LetterDocument2 pagesQuinn's Resignation LetterPennLiveNo ratings yet

- Senate Subpoena To Norfolk Southern CEODocument1 pageSenate Subpoena To Norfolk Southern CEOPennLiveNo ratings yet

- Letter Regarding PASS ProgramDocument3 pagesLetter Regarding PASS ProgramPennLive100% (1)

- Ishmail Thompson Death FindingsDocument1 pageIshmail Thompson Death FindingsPennLiveNo ratings yet

- 23 PA Semifinalists-NatlMeritProgramDocument5 pages23 PA Semifinalists-NatlMeritProgramPennLiveNo ratings yet

- Wheeler's Letter To LeadersDocument2 pagesWheeler's Letter To LeadersPennLiveNo ratings yet

- Atlantic Seaboard Wine Association 2022 WinnersDocument11 pagesAtlantic Seaboard Wine Association 2022 WinnersPennLiveNo ratings yet

- Letter To FettermanDocument1 pageLetter To FettermanPennLiveNo ratings yet

- Greene-Criminal Complaint and AffidavitDocument6 pagesGreene-Criminal Complaint and AffidavitPennLiveNo ratings yet

- Letter To Chapman Regarding The ElectionDocument2 pagesLetter To Chapman Regarding The ElectionPennLiveNo ratings yet

- Description of Extraordinary OccurrenceDocument1 pageDescription of Extraordinary OccurrencePennLiveNo ratings yet

- Corman Letter Response, 2.25.22Document3 pagesCorman Letter Response, 2.25.22George StockburgerNo ratings yet

- Regan Response To Cumberland County GOP ChairmanDocument1 pageRegan Response To Cumberland County GOP ChairmanPennLiveNo ratings yet

- Project Milton in Hershey, 2022Document2 pagesProject Milton in Hershey, 2022PennLiveNo ratings yet

- Letter Regarding PPE and UkraineDocument2 pagesLetter Regarding PPE and UkrainePennLiveNo ratings yet

- Letter To Auditor General Timothy DeFoorDocument2 pagesLetter To Auditor General Timothy DeFoorPennLiveNo ratings yet

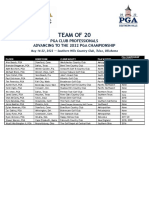

- 2022 Team of 20 GridDocument1 page2022 Team of 20 GridPennLiveNo ratings yet

- Letter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyDocument1 pageLetter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyPennLiveNo ratings yet

- Jake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoDocument5 pagesJake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoPennLiveNo ratings yet

- Pa. House Leaders' Letter Requesting Release of PSSA ResultsDocument3 pagesPa. House Leaders' Letter Requesting Release of PSSA ResultsPennLiveNo ratings yet

- Letter To Senator ReganDocument2 pagesLetter To Senator ReganPennLiveNo ratings yet

- TWW PLCB LetterDocument1 pageTWW PLCB LetterPennLiveNo ratings yet

- Redistricting ResolutionsDocument4 pagesRedistricting ResolutionsPennLiveNo ratings yet

- Cumberland County Resolution Opposing I-83/South Bridge TollingDocument2 pagesCumberland County Resolution Opposing I-83/South Bridge TollingPennLiveNo ratings yet

- James Franklin Penn State Contract 2021Document3 pagesJames Franklin Penn State Contract 2021PennLiveNo ratings yet

- Gov. Tom Wolf's LetterDocument1 pageGov. Tom Wolf's LetterPennLiveNo ratings yet

- Envoy Sage ContractDocument36 pagesEnvoy Sage ContractPennLiveNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PB 113Document45 pagesPB 113CLEAH MARYELL LLAMASNo ratings yet

- List Peserta FinalDocument8 pagesList Peserta FinalSyifa AryantiNo ratings yet

- SUV Program BrochureDocument4 pagesSUV Program BrochurerahuNo ratings yet

- Roque Module No.3 PDFDocument2 pagesRoque Module No.3 PDFElcied RoqueNo ratings yet

- Emarketer Influencer Marketing in 2023 RoundupDocument15 pagesEmarketer Influencer Marketing in 2023 RoundupMyriam PerezNo ratings yet

- Ford Motor CompanyDocument22 pagesFord Motor CompanyAngel WhuyoNo ratings yet

- Statement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionDocument43 pagesStatement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasNo ratings yet

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocument27 pagesDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsAmber QuiñonesNo ratings yet

- Convenience Stores AnalysisDocument8 pagesConvenience Stores AnalysisPedro ViegasNo ratings yet

- Event Management & MarketingDocument20 pagesEvent Management & MarketingChithra KrishnanNo ratings yet

- Corporate Finance Project On Descon in PakistanDocument43 pagesCorporate Finance Project On Descon in PakistanuzmazainabNo ratings yet

- X120 Cslides 19Document19 pagesX120 Cslides 19Jowelyn Cabilleda AriasNo ratings yet

- Strategy, Organization Design and EffectivenessDocument16 pagesStrategy, Organization Design and EffectivenessJaJ08No ratings yet

- Fintech FinalDocument34 pagesFintech FinalanilNo ratings yet

- Bambu Sebagai Alternatif Penerapan Material Ekologis: Potensi Dan TantangannyaDocument10 pagesBambu Sebagai Alternatif Penerapan Material Ekologis: Potensi Dan Tantangannyaaldi9aNo ratings yet

- A Study On Financial Statement Analysis of HDFC BankDocument11 pagesA Study On Financial Statement Analysis of HDFC BankOne's JourneyNo ratings yet

- Symbiosis Law School, Pune Course: Global Legal Skills: ST TH THDocument2 pagesSymbiosis Law School, Pune Course: Global Legal Skills: ST TH THUjjwal AnandNo ratings yet

- Partnership AccountingDocument8 pagesPartnership Accountingferdinand kan pennNo ratings yet

- 14th Finance Commission - Report Summary PDFDocument1 page14th Finance Commission - Report Summary PDFSourav MeenaNo ratings yet

- SBL Revision Notes PDFDocument175 pagesSBL Revision Notes PDFAliRazaSattar100% (3)

- BM2.MOD2 in Class Problems 12152010Document2 pagesBM2.MOD2 in Class Problems 12152010Pollie Jayne ChuaNo ratings yet

- AISM Rules BookDocument7 pagesAISM Rules Bookstyle doseNo ratings yet

- Ch2 PDFDocument52 pagesCh2 PDFOussemaNo ratings yet

- Corporate Governance, Business Ethics, Risk Management and Internal ControlDocument91 pagesCorporate Governance, Business Ethics, Risk Management and Internal ControlJoshua Comeros100% (3)

- Corporate Income Tax - 2023Document56 pagesCorporate Income Tax - 2023afafrs02No ratings yet

- Freight Transportation Modelling: International ExperiencesDocument13 pagesFreight Transportation Modelling: International ExperiencesShreyas PranavNo ratings yet

- University of Petroleum & Energy Studies: School of Business, DehradunDocument51 pagesUniversity of Petroleum & Energy Studies: School of Business, DehradunmayankNo ratings yet

- Warehouse Management Systems and Logistics ManagementDocument1 pageWarehouse Management Systems and Logistics ManagementSanjay RamuNo ratings yet

- Got Milk Case Study QuestionsDocument6 pagesGot Milk Case Study QuestionsSalman Naseer Ahmad Khan100% (1)

- Management Consulting Firms - Finding The Right Growth StrategyDocument140 pagesManagement Consulting Firms - Finding The Right Growth Strategyer_manikaur2221No ratings yet