Professional Documents

Culture Documents

ACCT550 Homework Week 1

Uploaded by

Natasha DeclanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT550 Homework Week 1

Uploaded by

Natasha DeclanCopyright:

Available Formats

CA1-3 (Financial Reporting and Accounting Standards) Answer the following multiplechoice questions. 1.

GAAP stands for: D (d) generally accepted accounting principles. 2. Accounting standard-setters use the following process in establishing accounting standards: D (d) Research, discussion paper, exposure draft, standard. 3. GAAP is comprised of: D (d) any accounting guidance included in the FASB Codification. 4. The authoritative status of the conceptual framework is as follows. A (a) It is used when there is no standard or interpretation related to the reporting issues under consideration. 5. The objective of financial reporting places most emphasis on: A (a) reporting to capital providers. 6. General-purpose financial statements are prepared primarily for: B (b) external users. 7. Economic consequences of accounting standard-setting means: D (d) accounting standards can have detrimental impacts on the wealth levels of the providers of financial information. 8. The expectations gap is: B (b) what the public thinks accountants should do and what accountants think they can do. E2-5 (Elements of Financial Statements) Ten interrelated elements that are most directly related to measuring the performance and financial status of an enterprise are provided below. Assets Equity Distributions to owners Revenues Expenses Losses Liabilities Investments by owners Comprehensive income Gains Instructions Identify the element or elements associated with the 12 items below. (a) Arises from peripheral or incidental transactions. Gain, Losses (b) Obligation to transfer resources arising from a past transaction. Liabilities

(c) Increases ownership interest. Investment by owners, Comprehensive income (d) Declares and pays cash dividends to owners. Distribution to owners (e) Increases in net assets in a period from non-owner sources. Comprehensive income (f) Items characterized by service potential or future economic benefit. Assets (g) Equals increase in assets less liabilities during the year, after adding distributions to owners and subtracting investments by owners. Comprehensive income (h) Arises from income statement activities that constitute the entitys ongoing major or central operations. Revenue, Expenses (i) Residual interest in the assets of the enterprise after deducting its liabilities. Equity (j) Increases assets during a period through sale of product. Revenue (k) Decreases assets during the period by purchasing the companys own stock. Distribution to owners (l) Includes all changes in equity during the period, except those resulting from investments by owners and distributions to owners. Comprehensive income E3-1 (Transaction AnalysisService Company) Christine Ewing is a licensed CPA. During the first month of operations of her business (a sole proprietorship), the following events and transactions occurred. April 2 2 3 7 Invested $30,000 cash and equipment valued at $14,000 in the business. Hired a secretary-receptionist at a salary of $290 per week payable monthly. Purchased supplies on account $700. (debit an asset account.) Paid office rent of $600 for the month. Completed a tax assignment and billed client $1,100 for services rendered. (Use Service 11 Revenue account.) 12 Received $3,200 advance on a management consulting engagement. 17 Received cash of $2,300 for services completed for Ferengi Co. 21 Paid insurance expense $110. 30 Paid secretary-receptionist $1,160 for the month. 30 A count of supplies indicated that $120 of supplies had been used. Purchased a new computer for $5,100 with personal funds. (The computer will be used 30 exclusively for business purposes.) Instructions Journalize the transactions in the general journal. (Omit explanations.) SOLUTION:

April 2

Cash. 30,000 Equipment.... 14,000 Christine Ewing, Capital. 44,000 No entry not a transaction Supplies 700 Accounts Payable. Rent Expense 600 Cash..

2 3

700

600

11

Accounts Receivable 1,100 Service Revenue 1,100 Cash.. 3,200 Unearned Service Revenue... 3,200 Cash...... 2,300 Service Revenue 2,300 Insurance Expense 110 Cash..

12

17

21

110

30

Salaries Expense.. 1,160 Cash. 1,160 Supplies Expense. 120 Supplies

30

120

30

Equipment 5,100 Christine Ewing, Capital. 5,100

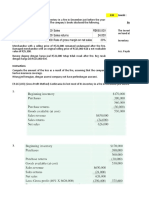

E3-5 (Adjusting Entries) The ledger of Chopin Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Debit Prepaid Insurance Supplies Equipment Accumulated Depreciation-Equipment Notes Payable Unearned Rent Revenue $3,600 2,800 25,000 $8,400 20,000 6,300 Credit

Rent Revenue Interest Expense Salaries and Wages Expense An analysis of the accounts shows the following. 1. The equipment depreciates $250 per month. -014,000

60,000

2. One-third of the unearned rent was earned during the quarter. 3. Interest of $500 is accrued on the notes payable. 4. Supplies on hand total $650. 5. Insurance expires at the rate of $300 per month. Instructions Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are: Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense. (Omit explanations.) ADJUSTING ENTRIES: 1. Depreciation Expense ($250 x 3) Accumulated Depreciation-Equipment 2. Unearned Rent Revenue ($6,300 x 1/3).. Rent Revenue... 3. Interest Expense Interest Payable.. 4. Supplies Expense.. Supplies ($2,800 - $650) 750 750 2,100 2,100 500 500 2,150 2,150

5. Insurance Expense ($300 x 3) 900 Prepaid Insurance

900

CA1-1 (FASB and Standard-Setting) Presented below are four statements which you are to identify as true or false. If false, explain why the statement is false. 1. GAAP is the term used to indicate the whole body of FASB authoritative literature. TRUE 2. Any company claiming compliance with GAAP must comply with most standards and interpretations but does not have to follow the disclosure requirements. FALSE. Any company claiming compliance with GAAP must comply with all standards and interpretations, including disclosure requirements.

3. The primary governmental body that has influence over the FASB is the SEC. TRUE 4. The FASB has a government mandate and therefore does not have to follow due process in issuing a standard. FALSE. In establishing financial accounting standards, the FASB relies on two basic premises: 1) the FASB should be responsive to the needs and viewpoints of the entire economic community, not just the public accounting profession, 2) it should operate in full view of the public through a due process system that gives interested people ample opportunities to make their view known. E2-6 (Assumptions, Principles, and Constraints) Presented below are the assumptions, principles, and constraints used in this chapter. 1. Economic entity assumption 2. Going concern assumption 3. Monetary unit assumption 4. Periodicity assumption 5. Historical cost principle 6. Fair value principle 7. Expense recognition principle 8. Full disclosure principle 9. Cost constraint 10. Industry practices Instructions Identify by number the accounting assumption, principle, or constraint that describes each situation on the next page. Do not use a number more than once. (a) Allocates expenses to revenues in the proper period. 7 (b) Indicates that fair value changes subsequent to purchase are not recorded in the accounts. (Do not use revenue recognition principle.) 5 (c) Ensures that all relevant financial information is reported. 8 (d) Rationale why plant assets are not reported at liquidation value. (Do not use historical cost principle.) 2 (e) Indicates that personal and business record keeping should be separately maintained. 1 (f) Separates financial information into time periods for reporting purposes. 4 (g) Permits the use of fair value valuation in certain industries. (Do not use fair value principle.) 10 (h) Assumes that the dollar is the measuring stick used to report on financial performance. 3 E2-7 (Assumptions, Principles, and Constraints) Presented below are a number of operational guidelines and practices that have developed over time. Instructions Select the assumption, principle, or constraint that most appropriately justifies these procedures and practices. (Do not use qualitative characteristics.)

(a) Fair value changes are not recognized in the accounting records. Historical cost principle (b) Financial information is presented so that investors will not be misled. Full disclosure principle (c) Intangible assets are capitalized and amortized over periods benefited. Expense recognition principle (d) Repair tools are expensed when purchased. Materiality (e) Agricultural companies use fair value for purposes of valuing crops. Industry practices or fair value p (f) Each enterprise is kept as a unit distinct from its owner or owners. Economic entity assumption (g) All significant postbalance sheet events are reported. Full disclosure principle (h) Revenue is recorded at point of sale. Revenue recognition principle (i) All important aspects of bond indentures are presented in financial statements. Revenue and expense recognition principle (j) Rationale for accrual accounting. Periodicity assumption (k) The use of consolidated statements is justified. Economic Entity assumption (l) Reporting must be done at defined time intervals. Periodicity assumption (m) An allowance for doubtful accounts is established. Expense recognition principle (n) Goodwill is recorded only at time of purchase. Historical cost principle (o) A company charges its sales commission costs to expense. Expense recognition principle

You might also like

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- ch04 PDFDocument4 pagesch04 PDFMosharraf HussainNo ratings yet

- Forum 6Document1 pageForum 6cecillia lissawatiNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- 6-GL and FR CycleDocument6 pages6-GL and FR Cyclehangbg2k3No ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Eden Smith Ethics of TP Aos Uk FinalDocument40 pagesEden Smith Ethics of TP Aos Uk FinalRaden Mas WirawanNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Jawaban P5-6 Intermediate AccountingDocument3 pagesJawaban P5-6 Intermediate AccountingMutia WardaniNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Sesi 9 & 10 Praktikum - SharedDocument9 pagesSesi 9 & 10 Praktikum - SharedDian Permata SariNo ratings yet

- ACCT 2062 Homework #2Document22 pagesACCT 2062 Homework #2downinpuertorico100% (1)

- CH 08Document10 pagesCH 08Antonios FahedNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- CH08SOLSDocument23 pagesCH08SOLSMiki TiendaNo ratings yet

- Assume The FollowingDocument3 pagesAssume The FollowingElliot RichardNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Calculating Income Tax ExpenseDocument21 pagesCalculating Income Tax ExpenseDhiananda zhuNo ratings yet

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaNo ratings yet

- Alpha BetaDocument13 pagesAlpha BetaJoel Christian MascariñaNo ratings yet

- Homework Week7Document3 pagesHomework Week7Arista Yuliana SariNo ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- Problem 21.3Document3 pagesProblem 21.3Fayed Rahman MahendraNo ratings yet

- Be16 P16 2aDocument7 pagesBe16 P16 2aLisa Hammerle ClarkNo ratings yet

- Task - Find Ps As Function ofDocument4 pagesTask - Find Ps As Function ofTinatini BakashviliNo ratings yet

- By - Product Problem Solving - AsifDocument4 pagesBy - Product Problem Solving - AsifJafa AbnNo ratings yet

- CH16Document80 pagesCH16mahinNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- Homework1 E3 10Document4 pagesHomework1 E3 10Jade NguyenNo ratings yet

- E10 16Document1 pageE10 16september manisNo ratings yet

- Akmen Soal Review Uas PDFDocument8 pagesAkmen Soal Review Uas PDFvionaNo ratings yet

- Test 2 HomeworkDocument12 pagesTest 2 HomeworkMiguel CortezNo ratings yet

- Audit 12 - Rizq Aly AfifDocument2 pagesAudit 12 - Rizq Aly AfifRizq Aly AfifNo ratings yet

- Pertemuan 11 - Dividen PDFDocument30 pagesPertemuan 11 - Dividen PDFayu utamiNo ratings yet

- Acct 3101 Chapter 05Document13 pagesAcct 3101 Chapter 05Arief RachmanNo ratings yet

- Cost-plus target return pricing and activity-based costing analysisDocument7 pagesCost-plus target return pricing and activity-based costing analysisAryan LeeNo ratings yet

- Pertemuan 8 Chapter 17Document29 pagesPertemuan 8 Chapter 17Jordan Siahaan100% (1)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- 17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoDocument6 pages17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoMajd MustafaNo ratings yet

- Exercises Chapter1Document4 pagesExercises Chapter1Huyen Siu NhưnNo ratings yet

- CH 06Document50 pagesCH 06Dr-Bahaaeddin Alareeni100% (1)

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- On January 1 2014 Palmer Company Acquired A 90 InterestDocument1 pageOn January 1 2014 Palmer Company Acquired A 90 InterestCharlotteNo ratings yet

- Beams11 ppt04Document49 pagesBeams11 ppt04Rika RieksNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Tugas 2 AklDocument3 pagesTugas 2 Akledit andraeNo ratings yet

- Intermediate Accounting III Homework Chapter 18Document15 pagesIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- GAAP and FASB Standards for Financial ReportingDocument3 pagesGAAP and FASB Standards for Financial ReportingHoang NguyenNo ratings yet

- FASB and GAAP standards for small dental practiceDocument6 pagesFASB and GAAP standards for small dental practiceNatasha DeclanNo ratings yet

- ACCT550 Week 1 Practice Question SolutionsDocument9 pagesACCT550 Week 1 Practice Question Solutionshy_saingheng_7602609No ratings yet

- Soutions To Practice Problems For Modules 1 & 2Document17 pagesSoutions To Practice Problems For Modules 1 & 2b1234naNo ratings yet

- CH 1 - End of Chapter Exercises SolutionsDocument37 pagesCH 1 - End of Chapter Exercises SolutionssaraNo ratings yet

- Aicpa Reg 6Document170 pagesAicpa Reg 6Natasha Declan100% (1)

- ACCT555 Midterm Exam 1.31.2014Document6 pagesACCT555 Midterm Exam 1.31.2014Natasha DeclanNo ratings yet

- ACCT 555 Audit Week 7Document5 pagesACCT 555 Audit Week 7Natasha DeclanNo ratings yet

- AC571 Week 1 HW AssignmentDocument1 pageAC571 Week 1 HW AssignmentNatasha DeclanNo ratings yet

- Acct571 Week 1 QuizDocument2 pagesAcct571 Week 1 QuizNatasha DeclanNo ratings yet

- Acct 555 Audit Week 4 MidtermDocument6 pagesAcct 555 Audit Week 4 MidtermNatasha DeclanNo ratings yet

- AC 571 - Final Exam (Study Guide)Document14 pagesAC 571 - Final Exam (Study Guide)Natasha Declan100% (1)

- AC 571 - Final Exam (Study Guide)Document14 pagesAC 571 - Final Exam (Study Guide)Natasha Declan100% (1)

- FIN515 MidtermDocument9 pagesFIN515 MidtermNatasha DeclanNo ratings yet

- AC 571 Quiz (Week 1)Document4 pagesAC 571 Quiz (Week 1)Natasha DeclanNo ratings yet

- ACCT 571 Week 4 AssignmentDocument4 pagesACCT 571 Week 4 AssignmentNatasha DeclanNo ratings yet

- FIN516 Week Quiz 6Document7 pagesFIN516 Week Quiz 6Natasha DeclanNo ratings yet

- MGT 597 SolutionsDocument6 pagesMGT 597 SolutionsNatasha DeclanNo ratings yet

- CPA A 4 Audit EvidenceDocument28 pagesCPA A 4 Audit EvidenceNatasha DeclanNo ratings yet

- MGMT 597 Week 6 HomeworkDocument8 pagesMGMT 597 Week 6 HomeworkNatasha Declan100% (1)

- FIN515 Week 1 Homework AssignmentDocument8 pagesFIN515 Week 1 Homework AssignmentNatasha DeclanNo ratings yet

- MGMT 597 Week 6 HomeworkDocument8 pagesMGMT 597 Week 6 HomeworkNatasha Declan100% (1)

- FIN 515 Week 6 Exam Set 1Document5 pagesFIN 515 Week 6 Exam Set 1Natasha DeclanNo ratings yet

- Acct557 Wk4 QuizDocument4 pagesAcct557 Wk4 QuizNatasha Declan100% (1)

- FIN515 Homework1Document4 pagesFIN515 Homework1Natasha DeclanNo ratings yet

- FIN515 Week 5 Project Graded ADocument2 pagesFIN515 Week 5 Project Graded ANatasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- AC555 - Audit Final ExamDocument8 pagesAC555 - Audit Final ExamNatasha Declan0% (1)

- FIN515 Week 2 Homework AssignmentDocument6 pagesFIN515 Week 2 Homework AssignmentNatasha DeclanNo ratings yet

- Fin515 Week 4 ExamDocument5 pagesFin515 Week 4 ExamNatasha DeclanNo ratings yet

- Acct557 Quiz 3Document5 pagesAcct557 Quiz 3Natasha DeclanNo ratings yet

- AC555 External Auditing Chapter 2 Test WK 1Document23 pagesAC555 External Auditing Chapter 2 Test WK 1Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- ACCT550 Homework Week 6Document6 pagesACCT550 Homework Week 6Natasha DeclanNo ratings yet

- Deed of Sale Donation of An Unregistered Land With A BuildingDocument2 pagesDeed of Sale Donation of An Unregistered Land With A Buildingjoelyn claire crisostomoNo ratings yet

- Chap 17Document34 pagesChap 17ridaNo ratings yet

- C14 - Tutorial Answer PDFDocument5 pagesC14 - Tutorial Answer PDFJilynn SeahNo ratings yet

- Aim Student Loan Application FormDocument3 pagesAim Student Loan Application FormCharles de belenNo ratings yet

- Credit Suisse AR 2010Document526 pagesCredit Suisse AR 2010Karl SvenningssonNo ratings yet

- Beams - Intercom Profit Transaction - BondsDocument12 pagesBeams - Intercom Profit Transaction - BondsAnggit Ponco100% (1)

- Officers Service RegulationsDocument78 pagesOfficers Service RegulationsSourav Chakraborty0% (1)

- Gravity Payments Salary Case StudyDocument13 pagesGravity Payments Salary Case StudyGhanshyam Thakkar67% (3)

- ACCOUNTING FOR DECISION MAKING MID TERM EXAMDocument5 pagesACCOUNTING FOR DECISION MAKING MID TERM EXAMumer12No ratings yet

- How To Compute The 13th Month Pay in The PhilippinesDocument2 pagesHow To Compute The 13th Month Pay in The PhilippinesJesa Marie100% (1)

- Farm LeaseDocument5 pagesFarm LeaseRocketLawyer100% (1)

- BOI Abridged AR 2015Document108 pagesBOI Abridged AR 2015KarishmaJunejaNo ratings yet

- Unit Trusts - African Alliance Kenya BrochureDocument16 pagesUnit Trusts - African Alliance Kenya BrochureManueli Kebbles MckubwaNo ratings yet

- 001 Company Contractor Information - COIN (Eng.) PDFDocument3 pages001 Company Contractor Information - COIN (Eng.) PDFBinarasiri FernandoNo ratings yet

- Appeals, Patents, Bonds and More: 40 Legal and Business TermsDocument3 pagesAppeals, Patents, Bonds and More: 40 Legal and Business Termszsuzsaprivate7365100% (1)

- Ohio Rubber Works Background StudyDocument4 pagesOhio Rubber Works Background StudyZahid UsmanNo ratings yet

- III Year QuestionBankDocument113 pagesIII Year QuestionBankercis6421100% (1)

- Drafting of Legal DocumentsDocument18 pagesDrafting of Legal DocumentsKailash Kashwani100% (1)

- Sample Complaint Letter Bank Fees IIDocument2 pagesSample Complaint Letter Bank Fees IIRoshan Khan100% (1)

- Sports Equipment Retail Business PlanDocument8 pagesSports Equipment Retail Business PlanSachinNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument57 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebNo ratings yet

- Chapter 5 Books of Original Entry and Ledgers (III) : Answer: The JournalDocument7 pagesChapter 5 Books of Original Entry and Ledgers (III) : Answer: The JournalMahmud Abdullahi SarkiNo ratings yet

- Ucc File # 2012-2611928-898204-54Document12 pagesUcc File # 2012-2611928-898204-54ADILAH CURRY ©™100% (6)

- MPS 08112022 151622Document2 pagesMPS 08112022 151622Tulsi KumarNo ratings yet

- Ayala Corporation Investment ProposalDocument13 pagesAyala Corporation Investment ProposalBOB MARLOWNo ratings yet

- Financial Statement Analisys Chapter 17Document37 pagesFinancial Statement Analisys Chapter 17titinNo ratings yet

- Kings College of The PhilippinesDocument6 pagesKings College of The PhilippinesIzza Mae Rivera KarimNo ratings yet

- Dividend PolicyDocument17 pagesDividend PolicyRemonNo ratings yet

- Table of Contents for Research Report on Factors Affecting the Indian Banking IndustryDocument50 pagesTable of Contents for Research Report on Factors Affecting the Indian Banking Industryjignas cyberNo ratings yet

- The Book of Me - Life Coach Yourself To Success PDFDocument192 pagesThe Book of Me - Life Coach Yourself To Success PDFchaitubhu0% (1)