Professional Documents

Culture Documents

US - Chicago Fed National Activity Index (CFNAI)

Uploaded by

Eduardo PetazzeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US - Chicago Fed National Activity Index (CFNAI)

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

US - Chicago Fed National Activity Index (CFNAI)

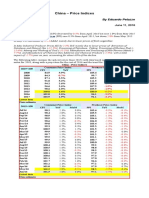

by Eduardo Petazze

Last updated: December 21, 2015

The Chicago Fed National Activity Index moved down to -0.30 in November 2015 (our previous estimate +0.23) from a revised -0.17 in

Oct15 (previous estimate -0.04). For December 2015 no change is expected.

The CFNAI is a weighted average of 85 existing monthly indicators of the U.S. economic activity.

It is constructed to have an average value of zero and a standard deviation of one

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values

indicate below-average growth; and positive values indicate above-average growth

Latest CFNAI Release: Economic Growth Slowed in Novemberr 2015 pdf, 2 pages

2014:01

2014:02

2014:03

2014:04

2014:05

2014:06

2014:07

2014:08

2014:09

2014:10

2014:11

2014:12

2015:01

2015:02

2015:03

2015:04

2015:05

2015:06

2015:07

2015:08

2015:09

2015:10

2015:11

2015:12

Own estimate

Last data

Summary

LT-avg

St. Dev

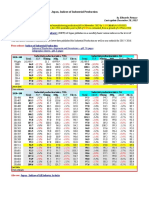

2011 average

2012 average

2013 average

2014 average

2015 average

2016 average

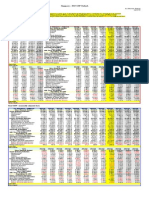

Employment,

Personal

Production and

Sales, Orders,

Unemployment Consumption

Income

and Inventories

and Hours

and Housing

-0.34

0.11

-0.27

-0.22

0.42

0.08

-0.08

0.14

0.28

0.21

-0.07

0.11

0.02

0.27

-0.09

-0.01

0.06

0.14

-0.15

0.07

0.11

0.26

-0.11

0.05

0.23

0.10

-0.11

0.28

-0.13

0.08

-0.08

-0.21

0.15

0.18

-0.14

0.01

0.08

0.22

-0.08

0.07

0.48

0.28

-0.06

0.07

-0.08

0.23

-0.11

0.09

-0.16

0.11

-0.09

-0.04

-0.23

0.12

-0.22

-0.09

-0.10

-0.04

-0.10

0.05

0.02

0.09

-0.06

0.11

-0.15

0.07

-0.05

-0.19

-0.13

0.12

-0.08

0.05

0.40

0.13

-0.06

0.03

-0.05

-0.07

-0.08

-0.05

-0.19

-0.04

-0.07

0.17

-0.11

0.08

-0.11

-0.03

-0.27

0.05

-0.06

-0.02

-0.31

0.07

-0.08

0.02

-0.01

0.43

0.03

-0.00

-0.02

0.11

-0.11

-0.39

-0.00

0.39

0.13

0.09

0.10

0.18

0.06

-0.08

-0.00

0.14

-0.29

-0.21

-0.15

-0.11

-0.09

-0.07

-0.00

0.22

0.03

-0.00

0.02

0.04

0.00

-0.03

CFNAI

CFNAI

MA3

-0.71

0.56

0.53

0.19

0.11

0.30

0.51

-0.33

0.19

0.30

0.77

0.13

-0.18

-0.43

-0.19

0.16

-0.32

-0.04

0.50

-0.24

-0.13

-0.17

-0.30

-0.30

-0.07

-0.07

0.13

0.43

0.28

0.20

0.31

0.16

0.12

0.05

0.42

0.40

0.24

-0.16

-0.26

-0.15

-0.12

-0.07

0.05

0.07

0.04

-0.18

-0.20

-0.25

DIFFUSION

-0.02

-0.03

0.20

0.38

0.33

0.27

0.33

0.19

0.12

0.11

0.36

0.32

0.20

-0.09

-0.18

-0.11

-0.05

-0.03

0.09

0.02

-0.05

-0.25

-0.20

CFNAI

less MA3

-0.64

0.63

0.40

-0.24

-0.16

0.10

0.20

-0.49

0.07

0.25

0.35

-0.27

-0.42

-0.27

0.08

0.31

-0.20

0.02

0.46

-0.32

-0.17

0.01

-0.10

-0.04

-0.01

0.99

-0.10

-0.12

-0.05

0.21

-0.14

-0.57

Difference: CFNAI less MA3

< -0.7

Increasing likelihood that a recession has begun

> -0.7

Increasing likelihood that a recession has ended

>+0.2

Significant likelihood that a recession has ended

>+0.7

Increasing likelihood that a period of sustained increasing inflation has begun

>+1.0

Substancial likelihood that a period of sustained increasing inflation has begun

Chicago Fed National Activity Index, by Categories, and CFNAI-MA3

Notes:

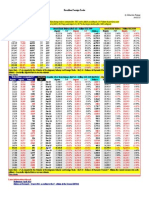

On average for 2016, the projection of the overall indicator was revised down to -0.57 from -0.32 projected last month.

The reduction is driven by production-related indicators, while indicators related to employment, although showing a

slowdown, would remain at acceptable levels.

For purposes of the projection for 2016 is taken as the most probable scenario of evolution of interest rates in the US, an

equivalent growth and driven by the scheduled increase of 100 basis points in the federal funds rate during 2016.

The increased cost of financing is the main driver of a slowdown in the growth rates of the new housing construction and

durable goods consumption and projected investments will remain in mining (including O&G) in heavily depressed

levels.

Also see:

Cfnai Background

U.S. Federal Open Market Committee - Federal Funds Rate

You might also like

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- Turkey - Gross Domestic Product, Outlook 2016-2017Document1 pageTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNo ratings yet

- India - Index of Industrial ProductionDocument1 pageIndia - Index of Industrial ProductionEduardo PetazzeNo ratings yet

- Reflections On The Greek Crisis and The Level of EmploymentDocument1 pageReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNo ratings yet

- Analysis and Estimation of The US Oil ProductionDocument1 pageAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNo ratings yet

- Highlights, Wednesday June 8, 2016Document1 pageHighlights, Wednesday June 8, 2016Eduardo PetazzeNo ratings yet

- Germany - Renewable Energies ActDocument1 pageGermany - Renewable Energies ActEduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- South Africa - 2015 GDP OutlookDocument1 pageSouth Africa - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- India 2015 GDPDocument1 pageIndia 2015 GDPEduardo PetazzeNo ratings yet

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Document1 pageCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNo ratings yet

- U.S. New Home Sales and House Price IndexDocument1 pageU.S. New Home Sales and House Price IndexEduardo PetazzeNo ratings yet

- U.S. Employment Situation - 2015 / 2017 OutlookDocument1 pageU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNo ratings yet

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocument1 pageChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNo ratings yet

- Singapore - 2015 GDP OutlookDocument1 pageSingapore - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- U.S. Federal Open Market Committee: Federal Funds RateDocument1 pageU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNo ratings yet

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- US - Personal Income and Outlays - 2015-2016 OutlookDocument1 pageUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNo ratings yet

- US Mining Production IndexDocument1 pageUS Mining Production IndexEduardo PetazzeNo ratings yet

- China - Power GenerationDocument1 pageChina - Power GenerationEduardo PetazzeNo ratings yet

- United States - Gross Domestic Product by IndustryDocument1 pageUnited States - Gross Domestic Product by IndustryEduardo PetazzeNo ratings yet

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocument1 pageUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNo ratings yet

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocument1 pageEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNo ratings yet

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- Mainland China - Interest Rates and InflationDocument1 pageMainland China - Interest Rates and InflationEduardo PetazzeNo ratings yet

- Highlights in Scribd, Updated in April 2015Document1 pageHighlights in Scribd, Updated in April 2015Eduardo PetazzeNo ratings yet

- South Korea, Monthly Industrial StatisticsDocument1 pageSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNo ratings yet

- Japan, Indices of Industrial ProductionDocument1 pageJapan, Indices of Industrial ProductionEduardo PetazzeNo ratings yet

- Chile, Monthly Index of Economic Activity, IMACECDocument2 pagesChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNo ratings yet

- Japan, Population and Labour Force - 2015-2017 OutlookDocument1 pageJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Federal Reserve System, Monetary Policy, and Interest RatesDocument4 pagesThe Federal Reserve System, Monetary Policy, and Interest RatesKristine RomannaNo ratings yet

- Understanding Stock Market CrashesDocument10 pagesUnderstanding Stock Market CrashespakusambenNo ratings yet

- 2016 - 01Document9 pages2016 - 01Bích ChâuNo ratings yet

- Princ Ch29 PresentationDocument36 pagesPrinc Ch29 PresentationCresca Cuello CastroNo ratings yet

- CTM 0310Document40 pagesCTM 0310ist0100% (1)

- The Monetary System Chapter Explains Money Supply and Bank ReservesDocument4 pagesThe Monetary System Chapter Explains Money Supply and Bank ReservesThanh NganNo ratings yet

- DNB Working Paper: No. 475 / June 2015Document35 pagesDNB Working Paper: No. 475 / June 2015Тимур ЯкимовNo ratings yet

- Wallstreetjournal 20221214 TheWallStreetJournalDocument32 pagesWallstreetjournal 20221214 TheWallStreetJournalmadmaxberNo ratings yet

- Chapter 6 - Money MarketDocument44 pagesChapter 6 - Money MarketShantanu ChoudhuryNo ratings yet

- Chapter 29 The Monetary SystemDocument48 pagesChapter 29 The Monetary SystemTrần Ngọc LinhNo ratings yet

- Econ 310-Test 3Document6 pagesEcon 310-Test 3Jimmy TengNo ratings yet

- Ch02 Asset Classes and Financial InstrumentsDocument39 pagesCh02 Asset Classes and Financial InstrumentsA_StudentsNo ratings yet

- MMT Knows The Fed Sets RatesDocument43 pagesMMT Knows The Fed Sets Ratesjsanto3248100% (3)

- Pialef Ar WebDocument10 pagesPialef Ar WebFaisalNo ratings yet

- Financial Crisis of 2008Document11 pagesFinancial Crisis of 2008Sohael Shams SiamNo ratings yet

- Chapter - 29 ECO121Document39 pagesChapter - 29 ECO121Le Pham Khanh Ha (K17 HCM)No ratings yet

- A New Frontier Monetary Policy With Ample Reserves SEDocument7 pagesA New Frontier Monetary Policy With Ample Reserves SEMike ClaytonNo ratings yet

- SUPA Economics Presentation, Fall 2023Document47 pagesSUPA Economics Presentation, Fall 2023bwangNo ratings yet

- Fed Reserve OMOs ExplainedDocument4 pagesFed Reserve OMOs ExplainedWickedadonisNo ratings yet

- Dissertation On Financial Crisis 2008Document115 pagesDissertation On Financial Crisis 2008Brian John SpencerNo ratings yet

- CHP 17 - Commercial Bank Sources & Uses of FundsDocument22 pagesCHP 17 - Commercial Bank Sources & Uses of Fundsrashu892No ratings yet

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- Chap 4PDocument39 pagesChap 4Pabhinnbhardwaj050701No ratings yet

- Group 2 Problem Set 1Document11 pagesGroup 2 Problem Set 1Nguyễn Thị Minh NgọcNo ratings yet

- Chapter 15 Test Bank PDFDocument29 pagesChapter 15 Test Bank PDFCharmaine Cruz100% (1)

- Chapter 10 Conduct of Monetary Policy (Chapter 10) MishkinDocument82 pagesChapter 10 Conduct of Monetary Policy (Chapter 10) MishkinethandanfordNo ratings yet

- Financial Markets and Institutions AssignmentDocument40 pagesFinancial Markets and Institutions AssignmentAhsan khanNo ratings yet

- MONETARY POLICY OVERVIEWDocument8 pagesMONETARY POLICY OVERVIEWHafiz Saddique MalikNo ratings yet

- Arlie O. Petters, Xiaoying Dong-An Introduction To Mathematical Finance With Applications - Understanding and Building Financial Intuition-SDocument499 pagesArlie O. Petters, Xiaoying Dong-An Introduction To Mathematical Finance With Applications - Understanding and Building Financial Intuition-SMatteoOrsini100% (8)

- April 2016: Six Potential 401 (K) Rollover PitfallsDocument4 pagesApril 2016: Six Potential 401 (K) Rollover PitfallsIncome Solutions Wealth ManagementNo ratings yet