Professional Documents

Culture Documents

Challenging and Opportunities in Indonesia Mining Tato Miraza

Uploaded by

Zamri Mahfudz0 ratings0% found this document useful (0 votes)

78 views0 pageslocal iron ore

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentlocal iron ore

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

78 views0 pagesChallenging and Opportunities in Indonesia Mining Tato Miraza

Uploaded by

Zamri Mahfudzlocal iron ore

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

Nickel Mining Activities in

North Maluku Mines Business Unit

IDX: ANTM | ASX: ATM

CHALLENGES AND

OPPORTUNITIES IN

INDONESIA MINING AND

MINERAL INDUSTRIES IN

THE FUTURE

Tato Miraza |

Development Director PT ANTAM (Persero) Tbk

PwC Asia School of Mines 2012 |

Bali, November 30 2012

Outlines

Introduction:

ANTAM JOURNEY

Indonesia Mining Industry:

OPPORTUNITIES AND CHALLENGES

ANTAM in the future:

GLOBAL MINING BASED CORPORATION,

WITH HEALTHY GROWTH AND WORLD-

CLASS STANDARDS

Downstream Mining Industry:

TOWARDS INDONESIA ECONOMIC

DEVELOPMENT ACCELERATION AND

EXPANSION

Shipping Activities in

North Maluku Mines Business Unit

ANTAM SUCCESS STORIES

Introduction:

Our history

INTRODUCTION: ANTAM JOURNEY

1960 1961 1962 1968 1974 1997 1999 2001 2003 2006 2011

PN ANEKA

TAMBANG was

established by

merging several

state-owned

single

commodity

companies

Status

Amandment from

PN Aneka

Tambang to PT

ANEKA

TAMBANG

(PERSERO)

PERUSAHAAN

NEGARA (PN)

TAMBANG EMAS

TJIKOTOK, was

established based

on Peraturan

Pemerintah No. 91

Year 1961

PERUSAHAAN

TERBATAS (PT)

NIKKEL

INDONESIA was

established based

on Akte Notaris

Mr. R.E.

Abdulkarnen in

Makassar dated

16 Juli 1960

No. 32

PERUSAHAAN

NEGARA (PN)

TAMBANG

BAUKSIT

INDONESIA, was

established based

on Peraturan

Pemerintah No.

89 Year 1961

BADAN

PIMPINAN

UMUM

PERUSAHAAN-

PERUSAHAAN

TAMBANG

UMUM NEGARA

(BPU

PERTAMBUN)

was established

PERUSAHAAN

NEGARA (PN)

NEGARA LOGAM

MULIA, was

established based

on Peraturan

Pemerintah No.

218 Year 1961 jo

Peraturan

Pemerintah No.

29 Year 1962

Listed in

INDONESIA

STOCK

EXCHANGE (IDX)

Listed in

AUSTRALIAN

SECURITIES

EXCHANGE

(ASX) as Foreign

Exempt

Antams status in

ASX was

upgraded to full

listing

Issued US$200

million bonds for

funding the

FeNi III smelter

construction

ANTAM change

its corporate logo

Issuance of Rp 3

Trillions bonds for

investment and

business

developments

Long journey in nickel

INTRODUCTION: ANTAM JOURNEY

1938

1959

1939

1962

1976

1973

1977

1992

1979

1995

2000

1998

2004

2010

2006

2011

2012

1909

DISCOVERY OF NICKEL

IN POMALAA,

SOUTHEAST SULAWESI

POMALAA SMALL SCALE OF NICKEL

ORE COMMENCED PRODUCTION

POMALAA FIRST NICKEL ORE SHIPMENT OF

LEMO ISLAND NICKEL MINE , NEAR POMALAA, COMMENCED

OPERATION BY PT NIKKEL INDONESIA

GROUNDBREAKING OF CONSTRUCTION FENI II SMELTER

FENI I SMELTER COMMENCED COMMERCIAL OPERATION

BRICK LAYING INSIDE ELECTRIC FURNACE DONE BY ANTAM ITSELF

GROUNDBREAKING OF FENI I SMELTER CONSTRUCTION

CLOSURE OF LEMO NICKEL MINE

GEBE ISLAND NICKEL

MINE COMMENCED

OPERATION

FENI II SMELTER COMMENCED COMMERCIAL OPERATION

MODERNIZATION ON ROTARY KILN WITH COPPER COOLER DONE BY ANTAM ITSELF.

TANJUNG BULI NICKEL MINE COMMENCED OPERATION

GEE ISLAND NICKEL

MINE COMMENCED

PRODUCTION

CLOSURE OF GEBE

NICKEL MINE

TAPUNOPAKA NICKEL MINE, COMMENCED OPERATIONS

FENI III SMELTER

COMMENCED

COMMERCIAL

OPERATION

GROUNDBREAKING OF CONSTRUCTION FENI HALMAHERA SMELTER

MODERNIZATION AND OPTIMATION OF FENI POMALAA PLANT

PAKAL NICKEL MINE

COMMENCED

OPERATION

GROUNDBREAKING OF CONSTRUCTION FENI III SMELTER

Nickel mine

FeNi smelter plant

Mine closure

LEGEND

MANIANG ISLAND NICKEL MINE , COMMENCED

OPERATION BY PT PERTAMBANGAN TORAJA

Long journey in gold

INTRODUCTION: ANTAM JOURNEY

1937

1971

1939

1977

1988 1982 1989

1994 1993

1937

FIRST GOLD REFINING BY

BRAANKENSIEK

LOGAS GOLD MINE, PEKANBARU,

COMMENCED OPERATION

LOGAS GOLD MINE CLOSURE

CIKOTOK GOLD MINE

COMMENCED OPERATION

LOGAM MULIA,

PULOGADUNG PLANT

CONTRUCTION

PONGKOR I PLANT COMMENCED OPERATION

PANGLESERAN GOLD MINE COMMENCED OPERATION

CIPICUNG GOLD MINE COMMENCED OPERATION

CIPUTER GOLD MINE

COMMENCED OPERATION

PONGKOR I PLANT STARTED CONSTRUCTION

1957

LOGAM MULIA ESTABLISHED

CIKOTOK MINING AREA

CLOSURE

1996

PONGKOR II PLANT

STARTED

CONSTRUCTION

1998

PONGKOR II PLANT

COMMENCED OPERATION

Gold mine

Gold mine+processing

/refinery Plant

Mine closure

LEGEND

2009 2010

PT CSD COMMENCED

OPERATION

PT CIBALIUNG

SUMBER DAYA (CSD)

AQUISITION

Long journey in bauxite

INTRODUCTION: ANTAM JOURNEY

1935

2011

2009 1920

DISCOVERY OF BAUXITE IN PULAU

BINTAN, KEPULAUAN RIAU

KIJANG BAUXITE MINE, PULAU

BINTAN, COMMENCED OPERATION

TAYAN CHEMICAL GRADE ALUMINA

PLANT CONSTRUCTION

KIJANG BAUXITE MINING CLOSURE

2010

TAYAN BAUXITE MINE

COMMENCED OPERATION

Bauxite mine

Alumina processing

plant

Mine closure

LEGEND

Long journey in iron sand and coal

INTRODUCTION: ANTAM JOURNEY

1979

1998

1982

2003

2011

1970

CILACAP IRON SAND

MINE COMMENCED

OPERATION

PELABUHAN RATU IRON SAND

COMMENCED OPERATION

LUMAJANG IRON SAND MINE

COMMENCED OPERATION

PELABUHAN RATU IRON SAND

MINING CLOSURE

CILACAP IRON SAND

MINING CLOSURE

1989

KUTOARJO IRON SAND MINE

COMMENCED OPERATION

Iron sand mine

Coal mine

Mine closure

LEGEND

SAROLANGUN COAL MINE ACQUISITION

BY PT INDONESIAN COAL RESOURCES

ANTAM mining closure

INTRODUCTION: ANTAM JOURNEY

BAUXITE MINING CLOSURE IN KIJANG

Revegetation

IRON SAND MINING CLOSURE IN CILACAP

Current operations

FERRONICKEL SMELTER

AND NICKEL ORE MINE

Pomalaa, Southeast Sulawesi

NICKEL ORE MINE

Tapunopaka, Southeast

Sulawesi

NICKEL ORE MINE

Tanjung Buli, North Maluku

COAL MINE

Sarolangun, Jambi

(PT Indonesia Coal Resources)

PRECIOUS METALS

PROCESSING & REFINERY

Pulogadung, Jakarta

GEOMIN

EXPLORATION UNIT

Pulogadung, Jakarta

GOLD MINE

Pongkor, West Java

GOLD MINE

Cibaliung, Banten

(PT Cibaliung Sumberdaya)

BAUXITE MINE

Tayan, West Kalimantan

Bauxite

Precious metals

Nickel

Coal

Commodities:

INTRODUCTION: ANTAM JOURNEY

Location: Tayan, Munggu Pasir and

Mempawah, West Kalimantan

Activities: grid measurement, test-

pitting, and sampling

BAUXITE

NICKEL

Location: Sungai Keruh, Jambi;

Sintang, West Kalimantan and

South Barito Selatan, Central

Kalimantan

Activities: drilling

COAL

Location: Mao, Batuisi and

Karosa, West Sulawesi

Activities: drilling and mapping

GOLD

Location: Oksibil, Bintang

Mountains, Papua

Activities: early exploration and

mapping

GOLD

Location: Batang Asai,

Sarolangun, Jambi

Activities: geological mapping,

sampling

GOLD

Location: Lalindu, Mandiodo

and Lasolo, Tapunopaka,

Southeast Sulawesi; Buli,

North Maluku and Gag, West

Papua

Activities: drilling, mapping

Location: Pongkor and Papandayan,

West Java and Cibaliung, Banten

Activities: geological mapping,

sampling

GOLD

In 1H12, ANTAM spent Rp114.5 billion on exploration and mine development activities

Exploration area

INTRODUCTION: ANTAM JOURNEY

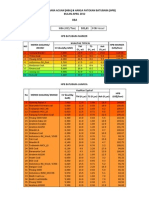

Since the IPO, the value per share increased 692% to Rp1.430 on May 22, 2012

Stock information

INTRODUCTION: ANTAM JOURNEY

Date Open High Low Close Avg Vol Adj Close*

Nov 1, 2012 1.290 1.310 1.220 1.250 4.963.400 1.250

Oct 1, 2012 1.340 1.380 1.260 1.280 8.405.500 1.280

Sep 3, 2012 1.250 1.430 1.220 1.350 16.130.100 1.350

* Close price adjusted for dividends and splits.

Current price (in rupiah)

S

t

o

c

k

p

r

i

c

e

(

I

n

r

u

p

i

a

h

)

Focus On Core

Business

Focus on segments that it knows best: Nickel, Gold and Bauxite

Creating

Sustainable

Growth

Adding value by moving away from selling raw materials & increasing processing activities

Expanding capacity to increase cash generation and lower unit costs

Continuously striving to obtain cost efficiencies and being environmentally and socially sustainable

Maintaining diversified customer base

Developing strategic alliances

Maintaining

Financial

Strength

Focus on long-term and sustainable profitability , and flexible dividend policy at 30 40% of profits

Maintain solid balance sheet and healthy debt leverage (Debt/Equity of 2.0x)

Maintain healthy liquidityensuring debt maturity well spread out over the next 5 years & focusing on long

term financing with matching maturity profile against cash flow generation

Development of growth projects without burdening balance sheet

ANTAM also maintains good and strong relationships with the Government and has a leverage on strong Government support

Business strategy

INTRODUCTION: ANTAM JOURNEY

Antam is a vertically integrated,

export-oriented, diversified mining

and metals company

We undertake all activities from

exploration, excavation, processing

through to marketing

Operations spread throughout the

mineral-rich Indonesian archipelago

Many licensed exploration areas and

joint venture projects

Diversified product/commodities.

Our current business portfolio:

NICKEL based commodity

GOLD based commodity

BAUXITE based commodity

COAL based commodity

INVESTMENT based company

CPO/PLANTATION based commodity

PROPERTY based company

IRON AND STEEL based commodity

9,592

8,711 8,744

10,346

4,492

0

4000

8000

12000

2008 2009 2010 2011 1H12

Solid Revenue Healthy Margins

Solid Cash Position

Rp Bn

Consistent Healthy Margins

Solid Cash Position to Support Growth Higher Leverage for Growth

Strong Revenues Supported with Solid Operational Performance

Leveraged for Growth

%

3,264

2,766

4,229

5,640

5,223

0

2000

4000

6000

2008 2009 2010 2011 1H12

Rp Bn

28

14

34

29

19

18

7

22

19

9

14

7

19 19

11

0

5

10

15

20

25

30

35

40

2008 2009 2010 2011 1H12

Net Margin Operating Margin Gross Margin

10

6

8

28

29

0

10

20

30

40

2008 2009 2010 2011 1H12

%

Financial performance

INTRODUCTION: ANTAM SUCCESS STORY

Reserves and resources

INTRODUCTION: ANTAM JOURNEY

JORC Compliant

*Reserves convertion from resources 1H 2012 still on evaluation

Saprolite Nickel (000wmt) Gold Ore (000 dmt)

Limonite Nickel (000wmt) Bauxite (000wmt)

4,450

4,058

4,834

6,427 6,427

886

4,246

3,838

2,870

4,970

2008 2009 2010 2011 1H 2012*

Reserve Resource

56,400

50,350

54,200

152,450

152,450

306,300

397,350

317,200

140,800

162,530

2008 2009 2010 2011 1H 2012*

Reserve Resource

- - -

- -

447,700

498,850

400,300

407,300

431,090

2008 2009 2010 2011 1H 2012*

Reserve Resource

70,900

104,500 105,700

106,350 106,350

130,300

242,700

263,800

267,500

276,700

2008 2009 2010 2011 1H 2012*

Reserve Resource

*unaudited

ANTAM contributions to nation and community

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2009 2010 2011 1H12*

Forestry area retribution

Production royalty

Land rent

Dividend payout

Local tax

Central tax

Tax and Non Tax (in billions rupiah)

Corporate Social Responsibilities Expenses (in billions rupiah)

CONTRIBUTION 2009 2010 2011 1H12*

Central tax 315 438 1,170 517

Local tax 24 52 75 25

Dividend payout 356 157 438 -

Land rent 2 3 5 8

Production royalty 120 211 178 94

Forestry area retribution - - 1 0

TOTAL 817 862 1,868 645

Net Income

1,368

604

1,683

1,928

240

163

210

382

120

*unaudited

Corporate Social Responsibilities Breakdown 2011

Community

Development

46%

Partnership

Program

19%

Community

Stewardship

7%

Environment

Management

28%

Column1

0%

INTRODUCTION: ANTAM JOURNEY

HR and HSE

INTRODUCTION: ANTAM JOURNEY

Our value

Employees are one of ANTAMs

main assets.

ANTAM puts occupational health

and safety for the employees as

top priority

Safety record

Total employee based on status

HR Productiviy

2009 2010 2011 2009 2010 2011

16

15

9

3 3 3

Productivity FeNi

per Employee

(TNi/Employee)

Productivity Gold

per Employee

(Kg Gold/employee)

External accolades and recognition

CORPORATE IMAGE AND LEADERSHIP

GOOD PERFORMANCE & BRONZE ACHIEVEMENT Indonesia Quality Award | Nov 2012

BEST IN BUILDING & MANAGING CORPORATE IMAGE 2011 & 2012 Corporate Image Award (IMAC) | June 2012

GREEN CEO Warta Ekonomi | July 2012

VERY BEST FOR NON-BANK SOE Infobank Award | Oct 2012

BEST FOR HC INITIATIVE IN PEOPLE DEVELOPMENT

BEST CEO COMMITMENT

Indonesian Human Capital Study Award | Oct 2012

MOST ORGANIZED INVESTOR RELATIONS

STRONGEST ADHERENCE TO CORPORATE GOVERNANCE

Alpha Southeast Asia Magazine | Sept 2011

BEST SUSTAINABILITY REPORTING ON WEBSITE 2011

RUNNER UP-2 BEST SUSTAINABILITY REPORTING 2010 CATEGORY

NATURAL RESOURCES

Indonesia Sustainability Reporting Award | Dec 2011

INTRODUCTION: ANTAM JOURNEY

GOOD CORPORATE GOVERNANCE

BEST OVERALL IICD, Corporate Governance Award | Dec 2011

THE BEST GCG IMPLEMENTATION 2011 Business Review Award | Dec 2011

MOST TRUSTED COMPANY CGPI Award | Dec 2011

CORPORATE SOSIAL RESPONSIBILITIES

INDONESIA GREEN AWARDS 2011 Business & CSR Magazine | Sept 2011

PLATINUM

Development Program of Biodiversity Center of Halimun-Salak Mountain National Park

Revitalisation Program and Devt Program of Community Areas of Bajo Tribe

GOLD

Community Empowerment Program in Former Iron Ore Mining Areas)

Indonesian CSR Award 2011 | Dec 2011

HEALTHY AND SAFETY ENVIRONTMENT

MOST ADMIRED COMPANY SRI KEHATI Award | June 2012

UPAKARTI UTAMA

UBPN Southeast Sulawesi UBPP Logam Mulia

UPAKARTI PRATAMA

UBPE Pongkor UBPN North Maluku

Mining Safety Awards 2011, Ministry of

Energy & Mineral Resources | Nov 2011

PROPER HIJAU

UBPE Pongkor

PROPER BIRU

UBPN North Maluku UBPP Logam Mulia

UBPN Southeast Sulawesi PT CSD

Ministry of Environment | Nov 2011

GLOBAL MINING BASED CORPORATION, WITH HEALTHY

GROWTH AND WORLD-CLASS STANDARDS

ANTAM in the future:

COMPANY

FORTUNE

500 RANK

REVENUE

(USD BILLIONS)

EBITDA

(USD BILLIONS)

ASSETS

(USD BILLIONS)

NPM ROA ROE

DEBT TO

EQUITY

- 1,0 0,3 1,3 19% 14% 18% 28%

140 56,6 26,0 112,4 25% 13% 25% 93%

159 52,8 38,1 88,9 24% 14% 26% 83%

186 45,3 35,5 129,1 38% 13% 25% 87%

315 30,5 18,5 69,7 15% 7% 12% 73%

331 28,9 0,0 56,8 0% 0% -1% 1380%

465 21,0 3,6 39,3 1% 1% 2% 189%

- 12,8 6,8 23,9 24% 13% 17% 33%

- 19,0 12,2 29,3 23% 1% 35% 134%

- 9,5 5,3 25,6 24% 1% 17% 92%

Source: annual reports 2010, fortune global 500

*

*

ANTAM vs competitors

GLOBAL MINING BASED CORPORATION, WITH HEALTHY GROWTH AND WORLD-CLASS STANDARDS

Exploration

Mining

Processing

Marketing &

Distribution

Strengthening Geomins core competencies to boost reserves and discover world-class resources

Expansion in scale of resources and project capacity

Development of in-house minings core operation and strengthening competencies

Increase in competitiveness of production and cash costs to meet global standards

Expansion of current capacity and improvement of process efficiency

Development of long-term strategic growth projects

Strengthening downstream marketing and distribution channels to accommodate the growing capacity and additional

downstream products

Market expansion and customer focus through effective use of business intelligence

Current 2011 (Projection)

Asset : ~USD 1,15 Bio

Revenue: ~USD 1,25 Bio

World class standard

Asset : ~USD 6,8 Bio

Rev : ~USD 4,7 Bio

Build capacity for downstream diversification (2012-2016) Increase scale & complexity of operation (2017-2020)

Supporting

Key Platform

Strengthen existing functions : 1) manpower competencies, 2) integration of CSR management within value chain, and 3) strong

R&D function backed-up by universities

Improving organization, GCG, and corporate management : 1) Holding structure, 2) Investment arm, 3) Marketing distribution

and Business Intelligence

Adequate financing which supports strategic growth projects

GLOBAL MINING BASED CORPORATION, WITH HEALTHY GROWTH AND WORLD-CLASS STANDARDS

Strategic vision 202o

Diversification, reserves and production capacity

growth focuses

Organic growth

initiatives:

1. Strategic projects:

FHT, SGA, CGA

2. Capacity

enhancement and

optimalization

project: MOP-PP

3. Targeted

replacement rate of

reserves from

existing resources

Projected Production*

18.688 Tni

66.000 Tni

Feronickel Gold

2.776 Kg

3.000 Kg

Alumina

0 Ton

1.700 KTon

Inorganic growth

initiatives:

1. Joint venture and

partnerships

2. Acquisition of

government shares

3. Acquisition of new

IUPs, mining assets

or processing

facilities

Nickel Ore Gold Bauxite

Projected Reserves*

54 M Wmt

420 M Wmt 280 Ton

40 Ton

202 M Wmt

106 M Wmt

GLOBAL MINING BASED CORPORATION, WITH HEALTHY GROWTH AND WORLD-CLASS STANDARDS

Coal

500 M ton

0 Ton

Current development projects

PROYEK PENGEMBANGAN ANTAM MENUJU HILIRISASI PERTAMBANGAN

Alumina plant

Ironmaking smelter plant

Nickel processing plant

SGA MEMPAWAH

PROJECT

Bauxite processing into SGA

Capacity: 1.2 mmt of SGA pa

Completion: 2016

Antam Share: 100%

CGA TAYAN

PROJECT

Bauxite processing into CGA

Capacity: 300,000 tonnes of CGA pa

Completion: 2014

Estimated Project Cost: US$450 M

Antam Share: 80% (20% is owned by

SDK Japan)

MODERNISASI, OPTIMASI DAN

POWERPLANT POMALAA

Efficiency improvement of existing

ferronickel smelters to 25,000-

27,000 tNi pa

Completion: 2014

Project Cost: US$450-500 million

Antam Share: 100%

NICKEL MANDIODO

PROJECT

Capacity: 12,000 tonnes of Ni pa

(10% Ni in product)

Completion: 2016

Estimated Project Cost: US$350-

400 million

Antam Share: 100% through

subsidiary PT AJSI

FENI HALMAHERA TIMUR

PROJECT

Capacity: 27,000 tonnes Ni pa

Completion: 2014

Project Cost: US$1.6 billion

ANTAM Share: 100%

SPONGE IRON MERATUS

PROJECT

Capacity: 315,000 tonnes of

sponge iron pa

Completion: 2012

Project Cost: US$150 million

Antam Share: 34% (66% is owned

by PT Krakatau Steel

GLOBAL MINING BASED CORPORATION, WITH HEALTHY GROWTH AND WORLD-CLASS STANDARDS

Mempawah SGA Project Mandiodo NPI Project

East Halmahera FeNi Project

MOP-PP Project

Tayan CGA Project

South Kalimantan Sponge Iron Project

Development projects updates

GLOBAL MINING BASED CORPORATION, WITH HEALTHY GROWTH AND WORLD-CLASS STANDARDS

CGA Tayan

ECA Financing and Equity Injection

Total project cost US$450 million funded by ECA Financing

US$292 million and equity iinjection US$157 million, ANTAMs

share 80%

East Halmahera

FeNi

Total project cost US$ +/-1,332.3 million will be funded by 65%

debt and 35% Equity

ECA Financing and/or investment loan +/- US$854.3 million

Equity injection and/or strategic partnership +/-US$460.14

million

MOP PP

ECA Financing, Investment Loan and Bond

Total project cost US$ +/- 500 million funded by combination

of ECA Financing, Investment Loan and Bond.

ANTAM will issue up to Rp 4 T Bond where Rp 3 T (or

equivalent with +/- US$ 323 million) of the Bond will be used

to finance MOP PP Project, while the rest of project cost or

+/- US$ 177 million will be funded by ECA Financing and or

Investment Loan

Top Priority

Development

Project

Sponge Iron

Financing plan for our development project

Indonesia Financing Institution and Equity Injection

Total project cost US$70 million funded by US$49 million loan

and equity injection US$21 million, ANTAMs share 34%

GLOBAL MINING BASED CORPORATION, WITH HEALTHY GROWTH AND WORLD-CLASS STANDARDS

OPPORTUNITIES AND CHALLENGES

Indonesia Mining Industry:

OPPORTUNITIES AND CHALLENGES

Mineral dan coal potency

RESOURCES

161.34 Billion Ton *)

RESERVES

28.17 Billion Ton

Precious Metal, a.l. : Gold, Silver and Platina

Ferro and Associates , a.l. : Nickel, Iron,

Nickel, Cobalt, Mangaan, Chromit

Base Metal , a.l. : Zinc, Copper, Tin, reciprocal

Rare metal, a.l. : Bauxite, Monazite

MINERAL POTENCY

COAL POTENCY

Source: Geological Agency, 2011 and Indonesia Ministry Of Energy and Mineral Resources, June 2012

*) Including 41 billion tons U/G

Very High (anthrasit) ( > 7.100 cal/gr )

High (Bituminus) ( 6.100 - 7.100 cal/gr )

Medium (Sub Bituminus)( 5100 - 6100 cal/gr )

Low (Lignite) ( < 5.100 cal/gr )

Challenge & opportunity to regulation

To build domestic metals processing and

refining due to Law of the Republic of Indonesia

No. 4 Year 2009

1

PERATURAN PEMERINTAH (PP)/GOVERNMENT REGULATION No. 9/2012

sets royalty (non-tax charge) on processed products such as aluminum,

alumina & FeNi

3

Export of Ore May

Continue Under

Specific Terms and

Conditions

Clear and Clean (C&C) Status

on Its Mining Permits

No outstanding financial

obligation to the state

Signing the Integrity Pact

Export tax burden

Mineral export quota

Minimum

Requirement of

Metals Processing and

Refining

The regulation

requires

mining

companies to

obtain the

necessary

approvals to

continue to

export ore

until 2014

Ni Matte > 70% Ni

FeNi (saprolite) > 20% Ni

FeNi (limonite/blended) > 10%

Ni

NPI > 6% Ni

SGA > 99% Al2O3

CGA > 99% Al2O3

CGA > 99% Al(OH)3

Al > 99%

OPPORTUNITIES AND CHALLENGES

UU No. 32/2009 REGARDING ENVIRONMENTAL

PROTECTION AND MANAGEMENT

RPP OF WASTE THAT WILL REVISE PERATURAN

PEMERINTAH No. 74/2001 REGARDING HAZARDOUS

AND TOXIC MATERIAL (B3) MANAGEMENT and PP No.

18 JO 85/1999 REGARDING B3 WASTE MANAGEMENT

Enclose Amdal and UKL/UPL

Certified Amdal and Licensed Amdal Committee

Environmental Risk Analysis

Periodic Environmental Audit

Criminal offence and fine for violation

Tighter B3 Waste Category

4

2

Considering the

competitiveness of national

industries and strategic value

of certain pioneer industries,

the Ministry of Finance (MOF)

Government of Indonesia

(GoI) may grant a tax holiday

facilities

This income tax exemption or reduction for

pioneer investment regulation No.

130/PMK.011/2011 dated 15 August 2011 gives

opportunity to ore processing industry to get

exemption from corporate income tax for a

period start from 5 years

Supreme Court Decision on Permen No. 7/2012

OPPORTUNITIES AND CHALLENGES

Supreme Court (MA) decision on judicial review filed by the Association of Nickel Indonesia (ANI) on 12 April 2012, MA granted in part

the petition article ANI. The decision revoked

ARTICLE 8 SECTION (3),

Cooperation plan for processing and/or refining/smelting as referred to in Article 8 section (2) may only be

implemented after obtaining approval from the Director General on behalf of the Minister

Article 8 section (2) : The cooperation for processing and/or refining/smelting as referred to in section (1) can be: a. sale and purchase of ore or

concentrate; b. services for processing and/or refining/smelting; or c. joint development of facilities for processing and/or

refining/smelting

Article 8 section (1) : In the event that the holders of IUP Production Operation and IUPK Production Operation as intended by Article 7, due to

economical reason, may not conduct their own processing and refining/smelting of mineral, they may conduct the cooperation for

processing and/or refining/smelting with other parties who hold: a. IUP Production Operation; b. IUPK Production Operation; or c.

IUP Production Operation specifically for processing and refining/smelting.

ARTICLE 9 SECTION (3)

The partnership as referred to in Article 9 section (1) may only be implemented after obtaining approval from

the Director General on behalf of the Minister

Article 9 section (1) : The holders of IUP Production Operation and IUPK Production as intended by Article 7 may conduct a partnership with other

entities to build the facilities for processing and/or refining/smelting

ARTICLE 10 SECTION (1).

Based on the feasibility studies, the holders of IUP Exploration and IUPK Exploration who cannot do their own

processing and refining/smelting due to economical reason and/or cannot conduct the cooperation or

partnerships as referred to in Article 8 and Article 9, shall consult with the Director General to implement this

Minister Regulation

ARTICLE 21

Upon effectiveness of this regulation, the holders of IUP Production Operation and IPR issued before the

operation of this Regulation of the Minister are prohibited from selling ore (raw material or ore) abroad within

3 (three) months of the operation of this Regulation of the Minister

DITJEN MINERBA ARE NO

LONGER AUTHORIZED TO

REGULATE THE EXPORT QUOTA

CREATES AN OPPORTUNITY FOR

MINING COMPANIES TO SUE

DITJEN MINERBA FOR THEIR

LOSSES

GOVERNMENT ENSURES

SUPPORT TO CONTINUE

DOWNSTREAM MINING

PROGRAM

?

?

Opportunities & challenges & to develop new business

ONE CONCEPT OF MINING BUSINESS

LICENSE SYSTEM

An integrated approach involving

central and local governments as well

as local parliament in issuing license

Avoid overlapping mining license

Specific penalties, both financial and

criminal, for any authorities that do

not follow the law

Higher degree of certainty for

ANTAMs mining licenses

The government will set a special

State Reserves Area (SRA)

State owned enterprise (SOE) and

local government owned enterprises

are given priorities to develop the

SRA

Additional output and product

diversification given ANTAMs status

as SOE

Potential increasing exploration

properties for ANTAM

SPECIAL MINING AREAS

Mining licenses holders have to

process and refine the minerals

domestically

Enhanced performance profile as

ANTAM can take advantage in

processing minerals from other

mining license holders as well as

reserves conservation

Potential risk in revenue loss from

ore sales

OBLIGATION FOR DOMESTIC ORE

PROCESSING

Lack of infrastructures, particularly in regions other than Java island.

Scarcity of human resources, especially in the professional and expert level.

De-centralization of authority due to sovereignty (autonomous) of regional Governments.

Based on current publications (July 2011-Jan 2012), issues raised up regarding to the Indonesian Mining Industries can be

categorized into 8 segment, such as Production (21%), License Overallap (20%), Environmental (18%), Contract Renegotiation

(15%), State Income (10%), labour (8%), Divestment (4%) and Mining Licenses (4%).

5

4

OPPORTUNITIES AND CHALLENGES

Permit

ANTAM in KEPPRES No.41/2004 granted permission to continue mining

activities in the area of protected forest, but in INPRES No. 10/2011, ANTAM

mining permits were included in Peta Indikatif Penundaan Izin Baru

INSTRUKSI PRESIDEN No. 41 YEAR 2004

REGARDING LICENSE OR AGREEMENT OF

MINING AREA INSIDE THE FOREST

Assign 13 (thirteen) permits or agreements in

mining that has existed prior to the enactment of

Law No. 41 Year 1999 on Forestry as stated in

Appendix decree, to continue its activities in the

forest until the end of the license.

INSTRUKSI PRESIDEN (INPRES) NO. 10 TAHUN

2011 REGARDING NEW LICENSE GRANT

POSTPONEMENT AND IMPROVEMENT OF

NATURAL FOREST GOVERNANCE OF PRIMARY

AND LAND PEAT

Delay granting new permits in primary natural forest

and peatland inside conservation forest, protected

forest, production forest and other used areas that

are set out in Peta Indikatif Penundaan Izin Baru

The obligation to Clear and Clean (CnC) based on UU No. 4/2009 dan PP No. 23/2010

Showstopper in ANTAM mining activities and operations

For companies that have

announced CnC, the

CERTIFICATE CnC can be

obtained by fulfil following

condition:

1) Administrative Aspects

2) Technical Aspects

3) Financial Aspects

Within 30 days after the CnC announcement, it shall:

Stages of Exploration:

- Submit proof of deposit of dues remained until last year

Stages of Production Operations:

- Convey the approval of UKL, UPL / EIA

- Submit a report complete exploration and feasibility study

- Submit proof of deposit of fixed fees and production fees (royalties) until last year.

Documentation

related to the

licensing and

administration of

documents should

be more integrated

Other issues

Bureaucracy

Overlapping with palm oil and or overlapping permit itself

Building permit (Izin Mendirikan BangunganIMB)

OPPORTUNITIES AND CHALLENGES

Foreign loan

KEPUTUSAN PRESIDEN REPUBLIK INDONESIA (KEPPRES)/PRESIDENTIAL DECREE NO. 59 / 1972 REGARDING FOREIGN LOAN

(Article 3 dan 4(1) KEPPRES No. 59 / 1972 revoked in KEPPRES No. 24 / 1998)

KEPPRES NO. 39 / 1991 REGARDING COMERCIAL FOREIGN LOAN MANAGEMENT COORDINATION

PP NOMOR 10 / 2011 REGARDING PROCEDURES FOR FOREIGN LOANS AND GRANTS

Will be misleading if the government handling private law, such as arrange SOE foreign loans which is

should have a permit from Tim PKLN headed by Cordinating Minister of Economy. Though

commercial loan is the business of the corporation, "

Obviously that legal product was inappropiate. Many laws are involving government into private law.

It is also improper, but has become the law

- Herman Hidayat Law Bureau Head in Ministry of SOE Bulletin Edition 58/ Year VI Date 29 Februari 2012-

Coordination for all commercial foreign loans

which is

Not include in the responsible framework of

Intergovernmental Group on Indonesia (IGGI) /

Consultative Group on Indonesia (CGI) and other

official loans required by the Government,

State Owned Enterprises (including State Bank

and Pertamina); and

Private Owned Enterprises (including banks and

non-bank financial institutions )

is conducted by Tim PKLN

Foreign loan

Tim PKLN is headed by the

Cordinating Minister for Economic

Affairs involving other Ministry

and Bank Indonesia

OPPORTUNITIES AND CHALLENGES

Lack of domestic technology innovation

The role of technology is essential in the production of the world's mining operations. In addition to lower production

costs, the technology can increase the value of the Company's mineral reserves.

Enormous budgets for mining technology research and the slow technology to be obstacles to innovation in mining

PERUSAHAAN R&D HIGHLIGHTS

R & D is focused on the Alcoa Technical Center in Pittsburgh, Pennsylvania, USA which is the largest

light metals research center in the world

Alcoa developed the Global Innovation Network which is an R & D collaboration with leading

universities (Moscow State University, St. Petersburg State Mining Institute), research institutes

(India's Council of Scientific and Industrial Research-CSIR), etc.

Single global model for R & D activities in which the function of mineral exploration and

development cycle of integrated technology to accelerate the discovery of new mineral. Technology

development activity centered in Mineral Development Center (CDM), Minas Gerais, Brazil while

exploration activities focused in five regional locations

Focus in Ni, Vale has integrated R & D center, Vale Technological Center (VTC, ex-Inco) in Ontario,

Canada

Vale also has the Vale Technological Institute (ITV) in Brazil, a non-profit research and graduate

education aimed at supporting R & D companies, especially in the field of mining and sustainable

development.

Activities in the CDM, ITV, and VTC done in conjunction with international research institutions and

universities to enhance their access to the latest technological developments

Antam has a unit that serves to conduct research and technology development.

This unit is under the Directorate of Development.

Some of the research conducted to support the development of the mining business into

downstream

OPPORTUNITIES AND CHALLENGES

TOWARDS INDONESIA ECONOMIC DEVELOPMENT

ACCELERATION AND EXPANSION

Downstream Mining Industry:

Mutual beneficial relationship

TOWARDS INDONESIA ECONOMIC DEVELOPMENT ACCELERATION AND EXPANSION

Wishes for the success of state-owned enterprises (SOE) and private company with the government to promote the

establishment of high economic growth, balanced, equitable and sustainable so that the positive effects of economic

development of Indonesia can be felt by the entire community around the archipelago,

Downstream mining industry toward economic development across Indonesia that create a solid economic independence

and economic competitiveness should be supported from many aspects:

MINERAL AND COAL FOR PEOPLE

WELFARE AND INDONESIA

ECONOMIC DEVT

INTEGRATED COOPERATION BETWEEN SOE + PRIVATE

COMPANY AND LOCAL AUTHORITY

Good mining practice, reclamation and post mining

Corporate social responsibility program

Local employment

Local content

MINING TECHNOLOGY

DEVELOPMENT

COLLABORATION

Industry

Government of Indonesia

International Research

Center/Engineering Design

Consultant

Academic/University

INTEGRATED ONE

ROOF SERVICES

PERMIT ARRANGEMENT

HEALTHY AND PROFITABLE

INVESTMENT ENVIRONMENT

Royalty Policy

Tax Holiday

IUP/Mining Licenses

Forestry Permit

Port Permit

and other permit

DISCLAIMER. This presentation and/or other documents have

been written and presented by Antam. The materials and

information in the presentation and other documents are for

informational purposes only, and are not an offer or

solicitation for the purchase or sale of any securities or

financial instruments or to provide any investment service or

investment advice.

This presentation is for discussion purposes only and is

incomplete without reference to, and should be viewed solely

in conjunction with, the oral briefing provided by Antam.

Neither this presentation nor any of its contents may be

disclosed or used for any other purpose without the prior

written consent of Antam.

The information in this presentation is based upon forecasts

and reflects prevailing conditions and our views as of this date,

all of which are accordingly subject to change. Actual results

could differ materially from forecasts. Antams opinions and

estimates constitute Antams judgment and should be

regarded as indicative, preliminary and for illustrative

purposes only.

PT ANTAM (Persero) Tbk

Gedung Aneka Tambang.

Jl. Letjen TB Simatupang No. Lingkar Selatan, Tanjung Barat.

Jakarta 12530, Indonesia

Tel. : (62-21) 789 1234, 781 2635

Fax. : (62-21) 789 1224

Email: corsec@antam.com

THANK YOU

You might also like

- PT. Anugerah Cahaya Cemerlang Lestari Directur (Zahren Mohamed) Jl. Minangkabau Ruko 6E, Jakarta Selatan 12970Document1 pagePT. Anugerah Cahaya Cemerlang Lestari Directur (Zahren Mohamed) Jl. Minangkabau Ruko 6E, Jakarta Selatan 12970Zamri MahfudzNo ratings yet

- Ota Update Procedure For Zenfone 4 & 5 & 6Document4 pagesOta Update Procedure For Zenfone 4 & 5 & 6Chan Kuan FooNo ratings yet

- Deep ConsumptionDocument2 pagesDeep ConsumptionZamri MahfudzNo ratings yet

- Fco GCV Adb 55-53 Nie-RrpDocument3 pagesFco GCV Adb 55-53 Nie-RrpZamri MahfudzNo ratings yet

- Presidential Regulation No 36 of 2010-1Document101 pagesPresidential Regulation No 36 of 2010-1Andre SimangunsongNo ratings yet

- Peta Perkembangan Izin Penggunaan Kawasan Hutan Provinsi Kalimantan Tengah (S/D September 2012)Document1 pagePeta Perkembangan Izin Penggunaan Kawasan Hutan Provinsi Kalimantan Tengah (S/D September 2012)Zamri MahfudzNo ratings yet

- Quantum Computer Website - SimulasiDocument1 pageQuantum Computer Website - SimulasiZamri MahfudzNo ratings yet

- PT. Anugerah Cahaya Cemerlang Lestari Directur (Zahren Mohamed) Jl. Minangkabau Ruko 6E, Jakarta Selatan 12970Document1 pagePT. Anugerah Cahaya Cemerlang Lestari Directur (Zahren Mohamed) Jl. Minangkabau Ruko 6E, Jakarta Selatan 12970Zamri MahfudzNo ratings yet

- Harga Batubara Acuan April 2012Document6 pagesHarga Batubara Acuan April 2012satuiku100% (1)

- Dzikir Doa Bada Sholat Fardhu FNLDocument10 pagesDzikir Doa Bada Sholat Fardhu FNLSuprianto MasterofArtNo ratings yet

- G-Resources (Martabe Project)Document11 pagesG-Resources (Martabe Project)Zamri MahfudzNo ratings yet

- HASIL EKSPLORASI MINERAL LOGAM KERJASAMA INDONESIA-JEPANG DAN KOREADocument14 pagesHASIL EKSPLORASI MINERAL LOGAM KERJASAMA INDONESIA-JEPANG DAN KOREAZamri MahfudzNo ratings yet

- Manual Del Modem Tl-wr842nd en InglesDocument130 pagesManual Del Modem Tl-wr842nd en InglesEduardito De Villa CrespoNo ratings yet

- PT Damasari Banten July 2013 (Compatibility Mode) - 1Document21 pagesPT Damasari Banten July 2013 (Compatibility Mode) - 1Zamri MahfudzNo ratings yet

- DP822H P.bzafllk MFL67441112Document24 pagesDP822H P.bzafllk MFL67441112Zamri MahfudzNo ratings yet

- HASIL EKSPLORASI MINERAL LOGAM KERJASAMA INDONESIA-JEPANG DAN KOREADocument14 pagesHASIL EKSPLORASI MINERAL LOGAM KERJASAMA INDONESIA-JEPANG DAN KOREAZamri MahfudzNo ratings yet

- Topo Graph IDocument1 pageTopo Graph IZamri MahfudzNo ratings yet

- Ageloc Galvanic Spa FaqDocument8 pagesAgeloc Galvanic Spa FaqZamri MahfudzNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Building A Holistic Capital Management FrameworkDocument16 pagesBuilding A Holistic Capital Management FrameworkCognizantNo ratings yet

- Di OutlineDocument81 pagesDi OutlineRobert E. BrannNo ratings yet

- A Handbook On Private Equity FundingDocument109 pagesA Handbook On Private Equity FundingLakshmi811No ratings yet

- Debt Level and Firm Performance: A Study On Low-Cap Firms Listed On The Kuala Lumpur Stock ExchangeDocument17 pagesDebt Level and Firm Performance: A Study On Low-Cap Firms Listed On The Kuala Lumpur Stock ExchangeMaha Ben BrahimNo ratings yet

- Brahma Et Al. - 2020 - Board Gender Diversity and Firm Performance The UDocument16 pagesBrahma Et Al. - 2020 - Board Gender Diversity and Firm Performance The URMADVNo ratings yet

- Maruti Suzuki India LTDDocument8 pagesMaruti Suzuki India LTDRushikesh PawarNo ratings yet

- Bewakoof Brands - Financial Analysis DataDocument8 pagesBewakoof Brands - Financial Analysis DataDimple SundraniNo ratings yet

- Milestone Gears Private Limited Ratings ReaffirmedDocument4 pagesMilestone Gears Private Limited Ratings ReaffirmedPuneet367No ratings yet

- FOFA RatiosDocument11 pagesFOFA RatiosShilpa RajuNo ratings yet

- Fin 301 - Group Assignment - Group GDocument10 pagesFin 301 - Group Assignment - Group GAvishake SahaNo ratings yet

- Question and Answer - 53Document30 pagesQuestion and Answer - 53acc-expertNo ratings yet

- Chapter 8 - Financial AnalysisDocument36 pagesChapter 8 - Financial AnalysisSameh EldosoukiNo ratings yet

- Chapter 8Document19 pagesChapter 8Benny Khor100% (2)

- Financial Analysis of Ultra Tech CementDocument23 pagesFinancial Analysis of Ultra Tech Cementsanchit1170% (2)

- 16 x11 FinMan DDocument8 pages16 x11 FinMan DErwin Cajucom50% (2)

- Credit Management HandbookDocument48 pagesCredit Management HandbookNauman Rashid67% (6)

- Artha PediaDocument158 pagesArtha Pediagajen_yadavNo ratings yet

- Group 10 - Tata MotorsDocument30 pagesGroup 10 - Tata MotorsSayan MondalNo ratings yet

- Investment Appraisal QsDocument8 pagesInvestment Appraisal Qsnajah madihahNo ratings yet

- Finman Financial Ratio AnalysisDocument26 pagesFinman Financial Ratio AnalysisJoyce Anne SobremonteNo ratings yet

- Petronas Gas AnalysisDocument30 pagesPetronas Gas AnalysisViet Hung70% (10)

- Case Study Hero Cycles - Operating Breakevens - No Profit & No Loss SituationDocument8 pagesCase Study Hero Cycles - Operating Breakevens - No Profit & No Loss SituationRLDK409No ratings yet

- FRA ProjectDocument63 pagesFRA ProjectRisa SahaNo ratings yet

- Acc501 Quiz FileDocument19 pagesAcc501 Quiz Filedaredevil18050% (2)

- FM Project 1Document24 pagesFM Project 1Soumya MohapatraNo ratings yet

- Ratio Analysis: (School) (Course Title)Document14 pagesRatio Analysis: (School) (Course Title)aseni herathNo ratings yet

- Zameer Và C NG S, 2013. Determinants of Dividend Policy A Case of Banking Sector in Pakistan, Middle-East Journal of Scientific Research, ISSN 1990-9233 PDFDocument15 pagesZameer Và C NG S, 2013. Determinants of Dividend Policy A Case of Banking Sector in Pakistan, Middle-East Journal of Scientific Research, ISSN 1990-9233 PDFThi NguyenNo ratings yet

- Introduction To Foreign ExchangeDocument36 pagesIntroduction To Foreign Exchangedhruv_jagtap100% (1)

- Financial Analysis of DG Khan Cement Factory, Ratio AnalysisDocument57 pagesFinancial Analysis of DG Khan Cement Factory, Ratio AnalysisM Fahim Arshed50% (8)

- Accounting Final ProjectDocument21 pagesAccounting Final ProjectKeenNo ratings yet