Professional Documents

Culture Documents

Finergo Episode 29 DT 22june09

Uploaded by

FinergoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finergo Episode 29 DT 22june09

Uploaded by

FinergoCopyright:

Available Formats

04 KALEIDOSCOPE ERGO Monday, June 22, 2009

Numbers that matter

Gold: Rs. 1350 per gram

Silver: Rs. 23,600 per kilogram

Sensex closing: 14521.89 (June 19)

Nifty closing: 4274.05 (June 19)

Dollar: Rs. 48.0103 per USD

(The rates given above are as on June 20)

Quiz

A: State Bank of Pathankot

B: UTI Bank

C: SBI Bank

D: Grindlays Bank

2. NFO stands for:

A: Nationalised Financial Organisations

B: New Fixed Deposits

C: New Fund Offer

D: Nano Fund offers

Send your answers to finergo@goergo.in or SMS

your answers to 92813 98889. For example if you

choose A as the answer to question 1 and B as

the answer to question 2 type it as 1A2B and

send it. Winner will be chosen by lucky draw

from all correct answers.

Answers for last week’s quiz:

Equity Linked Savings Scheme

Capitalisation

News you can use

Guaranteed returns from Bajaj Allianz

Bajaj Allianz Life Insurance has launched

Investplus, a Life Insurance product that guar-

antees a specific return on the investment. It is

Is it housing boom?

a traditional insurance plan in which the in- DIVYA DARSHINI 2. The liquidity situation is improving

vestor is made aware of a guaranteed mini- divya@finerva.com and the cash flow in the market seems

mum investment right at the beginning of the to be getting better. 3. There is also a

year and also a guaranteed maturity value at

T

op CEOs in the housing loan in- strong indication that interest rates on

the end of the term.

The price fall dustry have indicated that the

property prices are expected to go

loans will continue to drop.

This is again an incentive for inves-

New life plan

Future Generalli India Life Insurance Com- in the housing up soon. Reason: There seems to

be an increase in demand for houses.

tors to borrow and spend on their

dream house.

pany has launched Future Anand, a life insur-

ance plan which is a combination of loan industry This is besides other economic indica-

tors. What’s happening

endowment and whole life plan. The plan as-

sures Guaranteed Additions at the rate of 3.5 might be over During the past few months property

prices were showing stagnation and in

Business move by corporates in the

housing finance domain also indicate

per cent of sum assured per annum com-

pounding at the end of each of the first five and one can many cases a downward trend mainly

due to drop in demand for housing.

an upcoming price hike. LIC Housing

Finance has witnessed a 40 per cent rise

policy years and compounded reversionary

bonuses thereafter. expect a rise This forced builders to lower the price

and focus on economically priced pro-

in the number of loan applications

compared to last year. The TATA Group

Fixed deposit from Mahindra in real estate jects. In fact, it looked as if the demand

for expensive or luxurious properties

re-launched the TATA Capital Housing

Finance Ltd, which had stopped its

Mahindra and Mahindra Financial Services

launched a three-year cumulative fixed depos- prices soon, would not go up for a long time. But,

that doesn’t seem to be the trend. The

housing finance business about six

years ago.

it giving returns at the rate of 10 per cent. This

interest is considerably higher than what most say industry demand for housing is slowly but surely

coming back and there seems to be re- What should I do as an investor?

banks and financial institutions are offering.

The FD also has been given a good credit rat- officials newed activity in the housing domain. If you are a prospective buyer and

have been waiting for prices to fall fur-

ing and this backed by the brand of the Ma- Why is demand rising ther, it’s time you start talking to loan

hindras makes this a good investment 1. People probably feel more secure companies.

opportunity. and comfortable to see a stable govern- Any chance of further price drop

ment at the centre. seems minimal. ■

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Himilo University: Direct QuestionsDocument2 pagesHimilo University: Direct QuestionsSabina MaxamedNo ratings yet

- Commercial Transportation Working Analysis HDFC Bank - 2011Document72 pagesCommercial Transportation Working Analysis HDFC Bank - 2011rohitkh28No ratings yet

- Documentary Stamp Taxes: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument3 pagesDocumentary Stamp Taxes: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested Answersrayjoshua12No ratings yet

- Financial Risk Management in BusinessDocument10 pagesFinancial Risk Management in BusinessLuis SeijasNo ratings yet

- Bpi Savings: Mai, Michelle ADocument21 pagesBpi Savings: Mai, Michelle AMimiNo ratings yet

- Account Statement From 1 Apr 2021 To 22 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2021 To 22 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRIDER OF GHOST1No ratings yet

- WaerDocument13 pagesWaerdasmaguero4lgNo ratings yet

- FASW - Consolidated FS - 31 Dec 2021 (Audited)Document70 pagesFASW - Consolidated FS - 31 Dec 2021 (Audited)anon_344878694No ratings yet

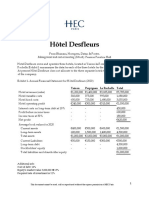

- S07 Desfelurs V3Document2 pagesS07 Desfelurs V3Khushi singhalNo ratings yet

- Lesson 1: Concept and Functions of MoneyDocument31 pagesLesson 1: Concept and Functions of MoneyFind DeviceNo ratings yet

- Financial PlanningDocument18 pagesFinancial PlanningckzeoNo ratings yet

- Credit Risk AnalysisDocument32 pagesCredit Risk AnalysisVishal Suthar100% (1)

- Chapter - Capital BudgetingDocument33 pagesChapter - Capital BudgetingSakshi SharmaNo ratings yet

- Statement of AccountDocument1 pageStatement of Accountsneha1299sharmaNo ratings yet

- Varanasi DCCB Par 31.03.2023Document28 pagesVaranasi DCCB Par 31.03.2023Anuj Kumar SinghNo ratings yet

- Definition of Elements of Financial StatementsDocument1 pageDefinition of Elements of Financial StatementsKc B.No ratings yet

- Project Analysis For Potential InvestorsDocument4 pagesProject Analysis For Potential Investorsjackson priorNo ratings yet

- Globalinvestmentfunds Annualreport 706Document368 pagesGlobalinvestmentfunds Annualreport 706xuhaibimNo ratings yet

- 2023 Outlook Asian CurrenciesDocument13 pages2023 Outlook Asian CurrenciesMaria Pia Rivas LozadaNo ratings yet

- Trefi PresentationDocument16 pagesTrefi PresentationLuis Miguel Garrido MarroquinNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- Homework 1Document3 pagesHomework 1johnny60% (5)

- Econ 100.1 Exercise Set No. 3Document2 pagesEcon 100.1 Exercise Set No. 3Mara RamosNo ratings yet

- Koehl's Doll ShopDocument3 pagesKoehl's Doll Shopmobinil1No ratings yet

- CMA DataDocument36 pagesCMA DataPramod GuptaNo ratings yet

- Kerrisdale Capital Prime Office REIT AG ReportDocument19 pagesKerrisdale Capital Prime Office REIT AG ReportCanadianValueNo ratings yet

- Giannini Final TranscriptDocument32 pagesGiannini Final Transcriptmlieb737No ratings yet

- Bofa Approval LetterDocument3 pagesBofa Approval LetterSteve Mun GroupNo ratings yet

- Investment Banking: Presentation OnDocument56 pagesInvestment Banking: Presentation OnPradeep BandiNo ratings yet

- Lazy Portfolios: Core and SatelliteDocument2 pagesLazy Portfolios: Core and Satellitesan291076No ratings yet