Professional Documents

Culture Documents

Eten CS: Solutions For Budgetary & Contract Costing - 7sep

Uploaded by

Ankur Kulshrestha CA CfaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eten CS: Solutions For Budgetary & Contract Costing - 7sep

Uploaded by

Ankur Kulshrestha CA CfaCopyright:

Available Formats

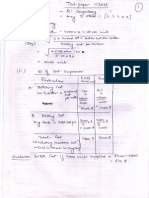

Class Test - Budgetary Costing

7

t h

September

Find out cash collection from Customer for Mis Novan Television & Co. on the

basis of the following information for the first six months of 2008:

(a) Cash sales - 25% and credit sales - 75%.

. (c). 60% of credit sales are collected in the month after sales, 300/0 in the second

. month and 10% in the third. No bad debts are anticipated.

(d) Sales for each month are as follows:

M2> f'Il4

"",

1

""1

...

. \

\ (J(){ea)

htwdwuL

Cl-w""-

45

\''$0' I:

?- 2,.-5

T

' if:: .

r

:J.'

J

-: ..

{.s

\0 df II'

v

JoN\..

, ;l.$';(YCJ[)

4. U>.6l5O

. '$,D,OI5O

c..s-U (2YJ

o

)

.

CAu:L::t

8\o,crcrQ "2:=to ,D150

bO'"

')..,

1Sl{"OU

'30' I' t11>1

\

0

'I 1!1'

B2.-ftm 52-s:.CSD

.

I IS; 2Sl5D \02-0, OOD

fj

, ,

, ,

. -to

'......

-/

'2-1.r 015D

"'STI,61m

'].. 'l...S;-ffiJD

Ltg'Soi>b

. , r'2..f'6t)

4DSC1YD

r3sl.sGO

I I

t (<toe>

/ "

:2-

4

'10

,

rssS':

I I

Ankur Kulshrestha CA (India), CFA (USA), M. Com, B. Com. H (SRCC)

Class Test - Budgetary Costing

7

th

September 2013

If interim cash balance is short by Rs. 2,000 in a particular month. How

much. would be the interest cost for the next month under the following

conditions (Rate of Interest is 18%)

a) Company has surplus investment is Rs. 10,000 and minimum borrowings

is Rs. 5,000 . .

. We- , ..."",hMeut<- 1

4

e"" No. .. <

1Ve;k, :J"-v.L.'"".'"c'{) Ii.

b) Company has surplus Investment IS Rs. 1,500 and mmimum borrowing IS .

Rs. 5,000 r l:o fllict

-? tllAtL- M t'" b I

\S"bb \ f ___

s:. ero 1'1) k VV\cT t5<:r yY\.O)'\. I 8 'l( I". "f. Strm .

. U' .. . ("ib /1 .

b(f- .. =- . I .

c) Company has surplus investment is Rs. 1,000 .

LDW 2- F#eJ o

,

A-"v-.+.

t "It.O vU Cl'Ylt( VI{

d) Company does not have any investment

WId- CJ

/< ')(, 3,b

. \()b . Y,2...

e) Company does not have any investment and minimum borrowing is Rs.

5,000 !--b 6e-

SCSlSb'X ,g \ . 1r s:

x '/" =:.. .> <,

161) /" (2-.

._.._._..__ _.. _.._.. __ -._----_.__ _ -._....._.. _ _--_ _......_ __ ._-_.__ _----_.__..---'--

Ankur Kulshrestha CA (India), CFA (USA), M. Com, B. Com. H (SRCC)

Class Test - Budgetary Costing

7

th

September 2013

Prepare a flexible budget for production at 80 percent and 100

percent activity on the basis of the following information:

-

1')..0 (JV'O

. .

1(IT) ./

So,6U()

.

. 1?-.CJ15D

"3 c. {Sl5O

I

"",--.

V

')..\..{

,

miD

Z- \.I.

,

OTI"D,

'2-YcruD .

S3S',(JOO ''30 bbcsD

\ \SUD

t:-

,

1.o\-c:J....

Gs:J-

--'-.- - ------------------- -------

Ankur Kulshrestha CA (India), CFA (USA), M. Com, B. Com. H (SRCC)

Class Test - Budgetary Costing

7

t h

September 2013

The following are the estimated sales of a company for eight months ending

30.11.2006:

How much is the Opening stock of FG and RM for month of April and closing

stock ofFG and RM for September as per the given stock policy of the firm?

~ ~

RM

6f. '0 Giro '54, DD

el-. bb()O

""=ryem

,

, \>')..CS'O ~ 6 6 " 0

I

I

~ ~

\860

u.. , ' o ~ ~

r

----_.._..__._-_.__._-_.__._-------_.---,----

Ankur Kulshrestha CA (India), CFA (USA), M. Com, B. Com. H (SRCC)

Class Test - Contract Costing

7

th

September 2013

L&T Ltd. undertook a particular, contract on 1st January. During the year, total Material

cost is Rs 30,000. Total inflation has been 15% since the contract was negotiated two

years back. There is an escalation clause providing that should the material prices

increase by more than 12%, the contractee would bear the' increase by 75%. What is '

the extra corripensation that contractee will have to pay due to inflation?

. =..: \'2.;.'1- \ '2.(,0&::+ =-

bO =- - 3 '!-83 C

= ';::.

L&T Ltd. undertook a particular contract on 1st January. During the year, total labour

cost is Rs 20,000. Total inflation has been 20% since the contract was negotiated two

years back. There is an escalation clause providing that should the labour prices increase

, by more than 25%, the contractee would bear the increase by 75%. What is the extra

compensation that contractee will have to pay due to inflation?

o : li--."

k-l. . tD N ll-,,: .::i:lV'otL I f"'b'1lL t'\l\ '

Ankur Kulshrestha CA (India), CFA (USA), M. Com, B. Com. H (SRCC)

Class Test - Contract Costing

7

th

September 2013

A contract started on lJan, 2009. Plant of Rs. 20,000 has been charged to the contract.

Of this amount, plant costing Rs. 5,000 was lost in an accident after 3 months of use. On

31st Dec., 2009, plant costing Rs. 5,000 was returned to the stores. Prepare the working

note for the Plant usage using 20% p.a. as the rate of depreciation.

f \M.J- at- t '( k-

{> \a,.J- loJt-

lol-aL

2-0, o-6D

S;O-UO

\D,aUO $o-BO

,

i0-s;: 0) .3 M

C'3./').5 cj

CJ

,

c:ruu)

.

I?-M

.

- - 1b

,

d ..: By

BDOO

-

i.{ cr0D

A contract started on 1S

t

Jan and ended on 23 Dec of the same year. How much portion

of the profit will you transfer to P/L account? .

J>'IV\LL .\R.- \I.A. ttM. ,(o.vWL

lrro [; WUJ ke.- ro

Spot the mistake in Estimated Profit = Transfer to PIL + Contract Reserve Account

Cavv-et- A.<toJ.e. Me..J- 9 No zz: .., PIL- + NL

P4rt tQM..UW N \ l- I

Nf, + Nf9- 4- \

The contractor estimated that as on 31st March 2009 he had completed 60% of the total

contract spending Rs. 500,000. The Architect issued certificate only for Rs. 8,00,000.

The contractee paid him Rs. 6,40,000. Cash received is Rs. 12,00,000 which is 60% of

the contract price. Calculate the value ofWUC.

. tJ mt- tJ G :::: tod\l.c- tek-cl...

6/0 _ b o /'0 .

2-c -];

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Employee Engagement: The Key To Realizing Competitive AdvantageDocument33 pagesEmployee Engagement: The Key To Realizing Competitive Advantageshivi_kashtiNo ratings yet

- Classical Management TheoryDocument7 pagesClassical Management Theorysimren171100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Citibank Performance EvaluationDocument9 pagesCitibank Performance EvaluationMohit Sharma67% (6)

- Procurement-Management-Plan Doc 1Document10 pagesProcurement-Management-Plan Doc 1api-338883409No ratings yet

- Recruitment AgreementDocument5 pagesRecruitment AgreementTricia GrafiloNo ratings yet

- Hafsa Bookstore Business Plan 1Document3 pagesHafsa Bookstore Business Plan 1Abdi100% (1)

- Acctg 16 - Midterm Exam PDFDocument4 pagesAcctg 16 - Midterm Exam PDFjoan miral0% (1)

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNo ratings yet

- Chapter 7Document15 pagesChapter 7YnaNo ratings yet

- Assignment Case StudyDocument3 pagesAssignment Case StudyMairene CastroNo ratings yet

- SAP Authorization Management GuidelinesDocument3 pagesSAP Authorization Management GuidelinesMohiuddin BabanbhaiNo ratings yet

- Singapore - Oil & Gas Financial JournalDocument11 pagesSingapore - Oil & Gas Financial JournalTimothae ZacharyyNo ratings yet

- Response Sheet 1/2013Document5 pagesResponse Sheet 1/2013Ankur Kulshrestha CA CfaNo ratings yet

- CS Cost A/c New Course: Response Sheet 3/2013Document6 pagesCS Cost A/c New Course: Response Sheet 3/2013Ankur Kulshrestha CA CfaNo ratings yet

- CS Cost A/c New Course: Response Sheet 2/2013Document8 pagesCS Cost A/c New Course: Response Sheet 2/2013Ankur Kulshrestha CA CfaNo ratings yet

- Test-CS Marginal Costing by CA. Ankur Kulshrestha, CFADocument6 pagesTest-CS Marginal Costing by CA. Ankur Kulshrestha, CFAAnkur Kulshrestha CA CfaNo ratings yet

- Test-CS Marginal Costing by CA. Ankur Kulshrestha, CFADocument6 pagesTest-CS Marginal Costing by CA. Ankur Kulshrestha, CFAAnkur Kulshrestha CA CfaNo ratings yet

- AirAsia's Information Systems ResearchDocument20 pagesAirAsia's Information Systems ResearchKarthigeyan SenthanNo ratings yet

- A Marketplace for Smart Learning OnlineDocument10 pagesA Marketplace for Smart Learning OnlineFilza KaziNo ratings yet

- 467 Case 8 1 2Document7 pages467 Case 8 1 2Nguyên NguyễnNo ratings yet

- Chap 5 KaizenDocument9 pagesChap 5 KaizenAnonymous FpRJ8oDdNo ratings yet

- Project Rubrics EconomicsDocument2 pagesProject Rubrics EconomicsYummy Chum23No ratings yet

- Case Chapter 5Document3 pagesCase Chapter 5Laras Dwi ArofatinNo ratings yet

- 5443 - Global Supply Chain Management2.2Document22 pages5443 - Global Supply Chain Management2.2douglas gacheru ngatiiaNo ratings yet

- 0B Implemenation GuideDocument71 pages0B Implemenation GuideSHAURYA TIWARINo ratings yet

- Ch13 Case1 QDocument1 pageCh13 Case1 QalimdtahirNo ratings yet

- MIS of Air India Under Dr. Kinnarry ThakkarDocument84 pagesMIS of Air India Under Dr. Kinnarry ThakkarAshwin Bhagat50% (2)

- July 2021Document14 pagesJuly 2021RkkvanjNo ratings yet

- Angel Broking - Wikipedia Hsushsb Jsis Enthi SunDocument20 pagesAngel Broking - Wikipedia Hsushsb Jsis Enthi SunYuga NayakNo ratings yet

- Problems and challenges facing small scale industriesDocument12 pagesProblems and challenges facing small scale industriesNaruChoudharyNo ratings yet

- Case Studies - ObDocument8 pagesCase Studies - Obsubal2023No ratings yet

- Reports On Audited Financial Statements PDFDocument28 pagesReports On Audited Financial Statements PDFoptimistic070% (1)

- Importance of Performance AppraisalDocument51 pagesImportance of Performance AppraisalRao FarhanNo ratings yet

- All Intermediate ChapterDocument278 pagesAll Intermediate ChapterNigus AyeleNo ratings yet

- RFP For Network Telecom Managed ServicesDocument70 pagesRFP For Network Telecom Managed ServicesRiyad Ismail SaeedNo ratings yet