Professional Documents

Culture Documents

Financial Market

Uploaded by

rumahbianglalaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Market

Uploaded by

rumahbianglalaCopyright:

Available Formats

FINANCIAL MARKETS Generally speaking, there is no specific place of location to indicate a financi al market.

Wherever a financial transaction takes place, it is deemed to have t aken place in the financial market. Hence financial markets are pervasive in na ture since financial transactions are themselves very pervasive throughout the e conomic system. For instance, issue of equity shares, granting of loan by term lending institutions, deposit of money into a bank, purchase of debentures, sale of shares and so on. However, financial markets can be referred to as those centers and arrangements which facilitate buying and selling of financial assets, claims and services. S ometimes, we do find the existence of a specific place or location for a financi al market as in the case of stock exchange. Classification of Financial Markets Unorganized Markets In these markets there are a number of money lenders, indigenous bankers, a nd traders etc., who lend money to the public. Indigenous bankers also collect deposits from the public. There are also private finance companies, chit funds etc., whose activities are not controlled by the RBI. Recently the RBI has take n steps to bring private finance companies and chit funds under its strict contr ol by issuing non-banking financial companies (reserve Bank) Directions, 1998. The RBI has already taken some steps to bring the unorganized sector under the o rganized fold. They have not been successful. The regulations concerning their financial dealings are still inadequate and their financial instruments have no t been standardized. Organized Markets In the organized markets, there are standardized rules and regulations governing their financial dealings. There is also a high degree of institutionalization and instrumentalisation. These markets are subject to strict supervision and co ntrol by the RBI or other regulatory bodies. These organized markets can be further classified into two. They are: (i) Capital market (ii) Money market Capital Market The capital market is a market for financial assets which have a long or indefin ite maturity. Generally, it deals with long term securities which have a maturi ty period of above one year. Capital market may be further divided into three n amely: (i) Industrial securities market (ii) Government securities market and (iii) Long term loans market (i) Industrial Securities Market As the very name implies, it is a market for industrial securitie s namely: (i) Equity shares or ordinary shares, (ii) Preference shares and (iii) Debenture s or bonds. It is a market where industrial concerns raise their capital or deb t by issuing appropriate instrumental. It can be further subdivided into two. T hey are: (i) Primary market or New issue market (ii) Secondary market or Stock exchange.

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- (Ebook - PDF - Sex) The Top One Hundred Lovemaking Techniques of All TimeDocument111 pages(Ebook - PDF - Sex) The Top One Hundred Lovemaking Techniques of All Timemani8682% (28)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Accounting in The Golden Age of Singosari KingdomDocument20 pagesAccounting in The Golden Age of Singosari KingdomrumahbianglalaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Business CommunicationDocument0 pagesBusiness CommunicationrumahbianglalaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- History of Science WritingDocument4 pagesHistory of Science WritingrumahbianglalaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Communication Barriers To Distance EducationDocument15 pagesCommunication Barriers To Distance Educationrumahbianglala100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Types of MotivationDocument2 pagesTypes of MotivationrumahbianglalaNo ratings yet

- Lets Laugh Discovering How Laughter Will Make You HealthyDocument192 pagesLets Laugh Discovering How Laughter Will Make You Healthyrpg-120No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Communication Edication RadicalDocument8 pagesCommunication Edication RadicalrumahbianglalaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Sociology of HumorDocument38 pagesSociology of Humorrumahbianglala100% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Features of GlobalizationDocument4 pagesFeatures of Globalizationrumahbianglala50% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Methods For Motivating EmployeesDocument2 pagesMethods For Motivating EmployeesrumahbianglalaNo ratings yet

- Barrier of Communication inDocument1 pageBarrier of Communication inrumahbianglalaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Role of Marketing CommunicationsDocument3 pagesThe Role of Marketing CommunicationsrumahbianglalaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Political Manifestations of GlobalizationDocument2 pagesPolitical Manifestations of Globalizationrumahbianglala100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Types of GlobalizationDocument2 pagesTypes of Globalizationrumahbianglala83% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Impacts of GlobalizationDocument1 pageImpacts of GlobalizationrumahbianglalaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Types of GlobalizationDocument2 pagesTypes of Globalizationrumahbianglala83% (6)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Scribd Positive Framing by TeacherDocument1 pageScribd Positive Framing by TeacherrumahbianglalaNo ratings yet

- International CommunicationDocument1 pageInternational CommunicationrumahbianglalaNo ratings yet

- Old Inspirational StoriesDocument1 pageOld Inspirational StoriesrumahbianglalaNo ratings yet

- How To Deal Bad NewsDocument2 pagesHow To Deal Bad NewsrumahbianglalaNo ratings yet

- Writing Persuasive EssayDocument2 pagesWriting Persuasive EssayrumahbianglalaNo ratings yet

- Stories ScrewDocument1 pageStories ScrewrumahbianglalaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Three Inspirational StoriesDocument2 pagesThree Inspirational StoriesrumahbianglalaNo ratings yet

- Scribd Teachers Need A Positive ClassroomDocument2 pagesScribd Teachers Need A Positive ClassroomrumahbianglalaNo ratings yet

- Stories For PassoverDocument1 pageStories For PassoverrumahbianglalaNo ratings yet

- Good Teacher Is....Document1 pageGood Teacher Is....rumahbianglalaNo ratings yet

- Scribd Great Teacher Is.....Document1 pageScribd Great Teacher Is.....rumahbianglalaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Scribd Great Teacher Is.....Document1 pageScribd Great Teacher Is.....rumahbianglalaNo ratings yet

- International flows assignmentDocument5 pagesInternational flows assignmenttobias stubkjærNo ratings yet

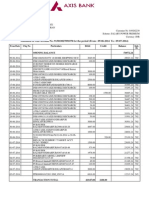

- DSK BankDocument2 pagesDSK BankNoel HCNo ratings yet

- RCB TC 150922enDocument9 pagesRCB TC 150922encsyik123junkNo ratings yet

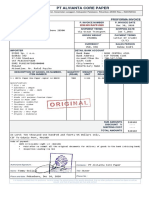

- Invoice 54480Document1 pageInvoice 54480combatgoaNo ratings yet

- Proforma Invoice To Poland PDFDocument1 pageProforma Invoice To Poland PDFTommy DwijayaNo ratings yet

- Funds - Transfer V1 PDFDocument46 pagesFunds - Transfer V1 PDFTanaka MachanaNo ratings yet

- Simple Interest & Simple DiscountDocument32 pagesSimple Interest & Simple DiscountHarold Kian50% (2)

- Credit Card Statement For The Period: MR RH Van Rensburg 13 Oval North Beacon Valley Mitchells Plain 7785Document4 pagesCredit Card Statement For The Period: MR RH Van Rensburg 13 Oval North Beacon Valley Mitchells Plain 7785RyanNo ratings yet

- PRL FORMS Bank FormDocument2 pagesPRL FORMS Bank FormDiana maria RuedaNo ratings yet

- DiscussionDocument5 pagesDiscussionKalaNo ratings yet

- End Chapter Solutions 2 and 3Document18 pagesEnd Chapter Solutions 2 and 3JpzelleNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- American Express Corporate Card StatementDocument3 pagesAmerican Express Corporate Card StatementTheCanadianPress100% (2)

- Time Value of Money NEW FINALDocument38 pagesTime Value of Money NEW FINALAwais A.No ratings yet

- Indian Bank: Jump To Navigation Jump To SearchDocument5 pagesIndian Bank: Jump To Navigation Jump To SearchSakshi BakliwalNo ratings yet

- MITC Registration Form V10Document2 pagesMITC Registration Form V10mcompendioNo ratings yet

- Shahrukh Broadband BillDocument3 pagesShahrukh Broadband BillShah Rukh SNo ratings yet

- Brand Recruitment BrochureDocument11 pagesBrand Recruitment BrochureNeil ArdenNo ratings yet

- Housing Finance 1Document9 pagesHousing Finance 1HimanshiNo ratings yet

- T4 AA Retail PDFDocument481 pagesT4 AA Retail PDFShaqif Hasan Sajib100% (2)

- Account StatementDocument2 pagesAccount StatementgobeyondskyNo ratings yet

- Acquisition of Merrill Lynch by Bank of AmericaDocument26 pagesAcquisition of Merrill Lynch by Bank of AmericaNancy AggarwalNo ratings yet

- EMV Card Architecture OverviewDocument10 pagesEMV Card Architecture Overviewharsha_295725251100% (1)

- Afift Ass1Document5 pagesAfift Ass1Siti Aishah Umairah Naser Binti Abdul RahmanNo ratings yet

- MT760 SBLC Interbank SWIFT Copies - 221201 - 093335Document4 pagesMT760 SBLC Interbank SWIFT Copies - 221201 - 093335tamer abdelhadyNo ratings yet

- SWAP Agreements: Usman AliDocument16 pagesSWAP Agreements: Usman AliomeedjanNo ratings yet

- FAR.3015 Cash and Cash EquivalentsDocument3 pagesFAR.3015 Cash and Cash EquivalentsJoana Tatac100% (1)

- Grameen Bank PDFDocument31 pagesGrameen Bank PDFDodon Yamin100% (2)

- Invoice-Template-Excel-2003Document1 pageInvoice-Template-Excel-2003Bang IpulNo ratings yet

- Candidate's Copy IDBI Bank Cash PayDocument1 pageCandidate's Copy IDBI Bank Cash Payapurv429No ratings yet

- Presentation On "Standard Chartered Bank": Presented By: Avi Udenia Smriti RathiDocument18 pagesPresentation On "Standard Chartered Bank": Presented By: Avi Udenia Smriti RathiAastikUdeniaNo ratings yet

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)