Professional Documents

Culture Documents

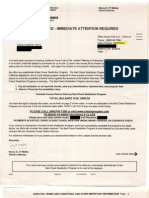

Letter From NIF Re Sale of Shares (130913)

Uploaded by

Investors of NSELCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter From NIF Re Sale of Shares (130913)

Uploaded by

Investors of NSELCopyright:

Available Formats

(BY PERSONAL DELIVERY & COURIER) September 13, 2013 To Mr Jignesh Shah, Director and Vice-Chairman National Spot

t Exchange Limited (NSEL), FT Tower, CTS No. 256 & 257, 4th Floor, Suren Road, Chakala, Andheri (East), Mumbai - 400 093 Dear Sir, Re: Disposal and/or creation of rights and/or interest over assets of Mr. Jignesh Shah and/or Financial Technologies (India) Limited (FTIL) 1. We have reliably learnt that Mr. Jignesh Shah is presently in advanced discussions with a prospective investor for sale of substantial part of his shareholding in Financial Technologies (India) Limited (FTIL). Further, we understand that as part of the proposed commercial arrangement, Mr. Jignesh Shah is also likely to grant the prospective investor a preemptive right over the assets of FTIL including the shareholding and interest of FTIL in its subsidiary companies. 2. It is now clear that a well scripted fraud has been perpetrated by FTIL along with the board of directors and senior management of National Spot Exchange Limited (NSEL) in complicity with the defaulting members. 3. The press release issued by NSEL on September 10, 2013 confirms the position of the stock and expressly states that as per the audit of the NSEL warehouses conducted by SGS, significant stock shortage has been found in 9 so-called NSEL accredited warehouses relating to 7 defaulters and SGS audit team was not even allowed inside the premises of the majority of the NSEL warehouses, i.e. 29 warehouses relating to 11 defaulters. Accordingly, it is now clear that NSEL, a commodities exchange, in fact operated without any underlying commodities. The widespread shortage of goods in the NSEL designated warehouses confirms that a large scale fraud has been committed. 4. The fraud perpetrated in the present instance percolates to the very root of the transaction, the first step of the entire trade on NSEL being the deposit of the commodities in the socalled NSEL accredited warehouses. It is now clear that the NSEL accredited warehouses did not have the requisite storage capacity to hold the quantity of the stock collateral for the trades on NSEL to begin with. Therefore, it would be an irrefutable conclusion that such a basic, schematic and systemic fraud was within the knowledge of Mr. Jignesh Shah. 5. Further, the fact that (a) majority of the NSEL accredited warehouses were not independent properties but merely designated areas within the premises of the defaulting members; (b) in majority of the trades, the seller or a group company of the seller in the first settlement cycle was the buyer in the second settlement cycle and thus, the same entity was trading in

both positions; and (c) the 24 defaulters are themselves registered as members of NSEL and therefore, Mr. Jignesh Shah, the board of directors and senior officials of NSEL were well aware that these thinly capitalized entities would have a limited ability to honour their settlement obligations; points to a premeditated and well-planned scam to dupe unsuspecting investors. 6. We are also certain that M/s Mukesh P. Shah, Chartered Accountants, Mumbai, a related party, was deliberately appointed by Mr. Jignesh Shah as the statutory auditors of NSEL to ensure that the fraudulent activities of NSEL do not come to light. 7. As the Chairman and Chief Executive Officer of the Financial Technologies Group, Chairman and Managing Director of FTIL and the Vice-Chairman and Director of NSEL, Mr. Jignesh Shah has been the moving force and directing mind behind NSEL. NSEL is nothing but the alter ego of Mr. Jignesh Shah. Mr. Jignesh Shah has been responsible for evolving several products which were marketed by NSEL through the NSEL officers and he was a substantial benefactor of NSEL. Therefore, it was within the knowledge and with the consent of Mr. Jignesh Shah that all aspects of the execution and subsequent follow-up were implemented. 8. Mr. Jignesh Shah has also actively promoted and marketed the NSEL as a commodities exchange and made several assurances to investors and members on the basis of which they participated in the NSEL Exchange. In fact, the NSEL brochure entitled The new Face of Commodity Market (NSEL Brochure) contains the photograph of Mr. Jignesh Shah and it is touted that Mr. Shah is often credited as the Innovator of Modern Financial Markets for his role in creating successful public-private partnership (PPP) model for building worldclass financial institutions in emerging economies. Therefore, it is irrefutable that Mr. Jignesh Shah was a key functionary and key member of the NSEL management team and it is inconceivable that he was not aware of the manner in which the affairs of NSEL were being conducted. In fact, given the all pervasive control exercised by Mr. Jignesh Shah, it is an inescapable conclusion that he designed, executed and perpetrated the fraud. 9. FTIL is the promoter of NSEL, holding a controlling stake of 99.99% in NSEL. FTILs track record in domestic as well as foreign exchanges was marketed by FTIL and Mr. Jignesh Shah, as the basis for obtaining more investors for NSEL. In the NSEL brochure entitled The new Face of Commodity Market , NSEL has claimed that FTIL was a global leader in creating and operating technology centric next generation financial markets that are transparent, efficient and, most importantly, liquid. Further, the experience of the Financial Technologies Group in operating a network of 9 exchanges connecting Africa, Middle East and South East Asia, as well as India is also trumpeted in the NSEL Brochure. Mr. Jignesh Shah is the promoter, Chairman and Managing Director of FTIL. FTIL and NSEL also had common directors at the relevant time, namely Mr. Jignesh Shah and Mr. R. Devarajan. Given that NSEL contributes to approximately 50-60% of the overall profits of FTIL and is a material and profitable subsidiary of FTIL, it is only natural that its affairs were closely monitored by FTIL. Therefore, it is an inescapable conclusion that FTIL was knowingly a party to the carrying on of the business of NSEL in a fraudulent manner. 10. The inaction of the board of directors of FTIL in supervising and directing the affairs of FTIL appropriately has resulted in FTIL directing NSEL to operate through misrepresentations, acts of cheating, criminal mis-appropriation of assets, issuance of warehouse receipts without ensuring their being underlying goods, forgery in issuance of false warehouse receipts. The board of directors of FTIL, was in fact the custodian of the

assets of FTIL, which included NSEL, and there has been complete failure by the FTIL board to manage such assets commensurate with its fiduciary duties. We strongly hold FTIL liable for the fraud perpetrated in the operations of NSEL. 11. Ever since the present crisis has arisen, Mr. Jignesh Shah has deliberately misstated, misrepresented and given contradictory details of the stock lying in the exchange certified warehouses and have engaged in and continued with deception and trickery. 12. In light of the above, it is clear that offences have been committed by FTIL, Mr. Jignesh Shah, the board of directors and senior management of NSEL, inter alia under the Indian Penal Code of 1860, the Companies Act of 1956, the Forward Contracts (Regulation) Act of 1952, Warehousing (Development and Regulation) Act, 2007 and the Prevention of Money Laundering Act, 2002. 13. The present attempt by Mr. Jignesh Shah to dispose part of his shareholding in FTIL while the default continues is very evidently an attempt to intentionally distance himself from the on going crisis and absolve liability for the systematic fraud perpetrated by NSEL. In fact, we strongly apprehend that such a proposed sale of shares of FTIL and creation of interest over the assets of FTIL, is not a genuine transaction and is merely a clever ruse to deflect attention from the liability for the present fraud. Given the consistent failure by NSEL in satisfying the first, second and third pay-out as per the payment schedule, the magnitude of the amounts involved and the seriousness of the issues, it is imperative that the assets of Mr. Jignesh Shah are not frittered away so as to frustrate recovery of outstanding amounts. 14. Any disposition of assets by FTIL, as the promoter of NSEL, or Mr. Jignesh Shah, the key functionary of NSEL, in the present circumstances will seriously put at peril recovery of investor funds of over Rs. 5,500 crores. Given that the amount involved is large, it is absolutely necessary to safeguard and preserve these assets till such time as the outstanding amounts are not paid to the investors. 15. Accordingly, you are hereby directed to take notice that pending settlement of the outstanding contracts and fulfilment of the outstanding payment obligations, you are precluded from undertaking any of the following: i. dispose off, directly or indirectly, any assets of Mr. Jignesh Shah and/or FTIL, whether pursuant to an agreement or otherwise, which would result in frustration of any recourse by the investors to the assets of FTIL and Mr. Jignesh Shah; offering or creating any rights or interest, whether directly or indirectly, over the assets of Mr. Jignesh Shah and FTIL, including specifically the shareholding or interest of FTIL in its subsidiaries, whether pursuant to an agreement or otherwise.

ii.

16. We will be compelled to take appropriate legal action, including criminal action, against you if you proceed to dispose off or create any rights/interest in any assets owned by Mr. Jignesh Shah and/or FTIL, whether pursuant to an agreement or otherwise, pending the settlement of the outstanding defaults.

17. We are also by this letter putting the entire Board of Directors of FTIL on notice. We reserve our rights to proceed against other Board members in accordance with law. Please note that this letter is without prejudice to the other rights available to us under law, equity or otherwise. Yours faithfully, For and on behalf of NSEL Investors Forum Sd/Arun Dalmia Secretary Mobile: 9821013308 Email:arundalmia2000@yahoo.com

You might also like

- BHAVCOPY Data From The NSE Data For Jyuly Aug 2013Document7 pagesBHAVCOPY Data From The NSE Data For Jyuly Aug 2013Investors of NSELNo ratings yet

- FTIL EQ Analysis July Aug 2013Document1 pageFTIL EQ Analysis July Aug 2013Investors of NSELNo ratings yet

- FTIL Open Interest F&O July Aug 2013Document1 pageFTIL Open Interest F&O July Aug 2013Investors of NSELNo ratings yet

- BS: NSEL Owes Rs 253 Crore To Motilal Oswal GroupDocument1 pageBS: NSEL Owes Rs 253 Crore To Motilal Oswal GroupInvestors of NSELNo ratings yet

- SGS Audit Progress Report As On 17 Sept 2013Document3 pagesSGS Audit Progress Report As On 17 Sept 2013Investors of NSELNo ratings yet

- HBL - Investors Take NSEL Issue To Mumbai Police's Economic Offences Wing - 2013 09 19Document1 pageHBL - Investors Take NSEL Issue To Mumbai Police's Economic Offences Wing - 2013 09 19Investors of NSELNo ratings yet

- ET - I'm A Victim, Pleads Shah, But FMC'LL Have None of It - 2013 09 19Document1 pageET - I'm A Victim, Pleads Shah, But FMC'LL Have None of It - 2013 09 19Investors of NSELNo ratings yet

- NAFED A Background PresentationDocument20 pagesNAFED A Background PresentationInvestors of NSELNo ratings yet

- NSEL Fiasco Looks Like Another Satyam Scam - ET Guest Article by MR Motilal OswalDocument2 pagesNSEL Fiasco Looks Like Another Satyam Scam - ET Guest Article by MR Motilal OswalInvestors of NSELNo ratings yet

- BS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Document1 pageBS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Investors of NSELNo ratings yet

- Jignesh Shah Knew A Crisis Was Brewing?Document2 pagesJignesh Shah Knew A Crisis Was Brewing?Investors of NSELNo ratings yet

- JSA Letter Dated 16 September 2013 PDFDocument4 pagesJSA Letter Dated 16 September 2013 PDFInvestors of NSELNo ratings yet

- BS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Document1 pageBS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Investors of NSELNo ratings yet

- Rajnikant Patel - The NSEL Effect - A Case For 'Indocom' - BSDocument3 pagesRajnikant Patel - The NSEL Effect - A Case For 'Indocom' - BSInvestors of NSELNo ratings yet

- Affidavit Anjani Sinha 2013 09 11Document13 pagesAffidavit Anjani Sinha 2013 09 11Investors of NSELNo ratings yet

- NSEL Saga Audit by Swiss Firm SGSDocument3 pagesNSEL Saga Audit by Swiss Firm SGSInvestors of NSELNo ratings yet

- HBL - NSEL Defaults Yet Again, Pays Only Rs.7.77 Crore - 2013 09 11Document1 pageHBL - NSEL Defaults Yet Again, Pays Only Rs.7.77 Crore - 2013 09 11Investors of NSELNo ratings yet

- Mint - Jharkhand Scam Accused Stakeholder in NSEL Firm - 2013 09 06Document4 pagesMint - Jharkhand Scam Accused Stakeholder in NSEL Firm - 2013 09 06Investors of NSELNo ratings yet

- Letter - Chairman WDRA From NIFDocument3 pagesLetter - Chairman WDRA From NIFInvestors of NSELNo ratings yet

- Letter - FMC Chairman From NIFDocument4 pagesLetter - FMC Chairman From NIFInvestors of NSELNo ratings yet

- WSJ Suit Claims Merkin Knew Madoff's Business Was A FraudDocument2 pagesWSJ Suit Claims Merkin Knew Madoff's Business Was A FraudInvestors of NSELNo ratings yet

- BS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Document1 pageBS - LOIL Promoter Says He Doesn't Owe NSEL - 2013 09 12Investors of NSELNo ratings yet

- HBL - Forward Markets Commission Brought Under FinMin Control - 2013 09 11Document1 pageHBL - Forward Markets Commission Brought Under FinMin Control - 2013 09 11Investors of NSELNo ratings yet

- Letter - Uday KotakDocument1 pageLetter - Uday KotakInvestors of NSELNo ratings yet

- ET - FMC To Move Next Week On MCX 'Fit Test 2013 09 13Document1 pageET - FMC To Move Next Week On MCX 'Fit Test 2013 09 13Investors of NSELNo ratings yet

- ET - NSEL Borrower Used Dummy To Divert Funds - 2013 09 11Document1 pageET - NSEL Borrower Used Dummy To Divert Funds - 2013 09 11Investors of NSELNo ratings yet

- Marriott Rewards Silver Elite Card - Uday Punj.-0215Document1 pageMarriott Rewards Silver Elite Card - Uday Punj.-0215Investors of NSELNo ratings yet

- HBL - Steps Taken To Protect Investors, NSEL Assures High Court - 2013 09 06Document1 pageHBL - Steps Taken To Protect Investors, NSEL Assures High Court - 2013 09 06Investors of NSELNo ratings yet

- BS - Chronicles of An NSEL Investor - 2013 09 06Document1 pageBS - Chronicles of An NSEL Investor - 2013 09 06Investors of NSELNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CG Theories, Board Structure, CommitteesDocument40 pagesCG Theories, Board Structure, CommitteesMohd ThahzinNo ratings yet

- NFA Citizen's CharterDocument53 pagesNFA Citizen's CharterpastorjeffgatdulaNo ratings yet

- 2 5 Kathy Ngs Ethics Case StudyDocument6 pages2 5 Kathy Ngs Ethics Case Studyapi-249275570No ratings yet

- Removal From Service (Special Powers) Sindh Ordinance, 2000Document11 pagesRemoval From Service (Special Powers) Sindh Ordinance, 2000Ahmed GopangNo ratings yet

- XYZ Cement Co nuisance case analyzedDocument4 pagesXYZ Cement Co nuisance case analyzedKershey Salac50% (2)

- Letter From Bad Check Restitution ProgramDocument5 pagesLetter From Bad Check Restitution Programnoahclements1877No ratings yet

- SUNSHINE SLATE - in Florida, Ex-Felons Like Vikki Hankins Fight For Their Civil Rights PDFDocument35 pagesSUNSHINE SLATE - in Florida, Ex-Felons Like Vikki Hankins Fight For Their Civil Rights PDFAdam RoussoNo ratings yet

- Agreement Between Author and Publisher MJSDocument4 pagesAgreement Between Author and Publisher MJSmadhuchikkakall7113No ratings yet

- World Armwrestling Federation (WAF) Rules of Armwrestling Sitdown and StandingDocument13 pagesWorld Armwrestling Federation (WAF) Rules of Armwrestling Sitdown and StandingZil FadliNo ratings yet

- Bs-En Iso 544 2003 PDFDocument16 pagesBs-En Iso 544 2003 PDFPacoNo ratings yet

- Chiquita ATA Witness & Exhibit ListsDocument330 pagesChiquita ATA Witness & Exhibit ListsPaulWolf0% (1)

- DigestDocument3 pagesDigestKrisha FayeNo ratings yet

- Padgett v. STB, 1st Cir. (2015)Document14 pagesPadgett v. STB, 1st Cir. (2015)Scribd Government DocsNo ratings yet

- Southampton ShowDocumentaspPKID10833Document4 pagesSouthampton ShowDocumentaspPKID10833parkingeconomicsNo ratings yet

- Criminal Procedure On Rights of Arrested PersonDocument9 pagesCriminal Procedure On Rights of Arrested PersonGrace Lim OverNo ratings yet

- Indian Contract ActDocument18 pagesIndian Contract ActanupraipurNo ratings yet

- SPL Meeting 5Document38 pagesSPL Meeting 5doraemoanNo ratings yet

- Jeevan Shanti: Proposal Form LIC's New Jeevan Shanti Page 1 of 9Document9 pagesJeevan Shanti: Proposal Form LIC's New Jeevan Shanti Page 1 of 9withrjNo ratings yet

- Renew Notary Commission CebuDocument13 pagesRenew Notary Commission CebuEdsoul Melecio Estorba100% (1)

- Revocable Living TrustDocument14 pagesRevocable Living TrustJack100% (7)

- Psychological Incapacity in Lim vs Sta. Cruz-LimDocument3 pagesPsychological Incapacity in Lim vs Sta. Cruz-LimMonica SalvadorNo ratings yet

- Fabricator Phil v. EstolasDocument5 pagesFabricator Phil v. EstolasGilbertNo ratings yet

- Revised Rules On Summary Procedure and Judicial Affidavit RuleDocument12 pagesRevised Rules On Summary Procedure and Judicial Affidavit RuleDis Cat100% (1)

- Statutes and Its PartsDocument24 pagesStatutes and Its PartsShahriar ShaonNo ratings yet

- Smietanka v. First Trust & Savings Bank: 257 U.S. 602 (1922) : Justia US Supreme Court CenterDocument1 pageSmietanka v. First Trust & Savings Bank: 257 U.S. 602 (1922) : Justia US Supreme Court CenterChou TakahiroNo ratings yet

- Tax Midterm ReviewerDocument32 pagesTax Midterm ReviewerJunivenReyUmadhayNo ratings yet

- Office of The Court Administrator Vs IndarDocument12 pagesOffice of The Court Administrator Vs IndarkitakatttNo ratings yet

- 4 - The Iloilo Ice and Cold Storage Company V, Publc Utility Board G.R. No. L-19857 (March 2, 1923)Document13 pages4 - The Iloilo Ice and Cold Storage Company V, Publc Utility Board G.R. No. L-19857 (March 2, 1923)Lemuel Montes Jr.No ratings yet

- Million Dollar Money DropDocument19 pagesMillion Dollar Money DropAdam GohNo ratings yet

- Melbourne Storm Deloitte InvestigationDocument6 pagesMelbourne Storm Deloitte InvestigationABC News Online100% (1)