Professional Documents

Culture Documents

Tranfer Pricing

Uploaded by

Yash SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tranfer Pricing

Uploaded by

Yash SinghCopyright:

Available Formats

Transfer Pricing

Expectation from Tax Payer And Role of Department in Alternative Dispute Resolution Mechanism

A Presentation By Ms Anuradha Bhatia DIT(TP)-II, Mumbai.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

INDEX

Background The Expectation Gap Our Expectation An Overview The Audited Accounts The Report in Form 3CEB Documentation Requirements and Expectation Bridging the Expectations Gap Alternate Dispute Resolution Mechanism

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

BACKGROUND

Transfer pricing (TP) is a subject of relatively recent origin, in the Indian tax regime. The TP law is evolving.

contd...

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

BACKGROUND Increasing globalization, dismantling of trade barriers and the free movement of capital are the change inducing factors Though TP is a limited subject in the tax code, its horizons being global, are much bigger. Conventionally, TP largely impacted foreign grown MNCs, but now, more and more home grown MNCs, as well as close knit/family run businesses like diamond and jewellery are in the TP net.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

The recent flurry of ITAT TP judgments, indicates the appellate churning out of the law. Its principles will crystallize on an all India basis, in due course of time. The government is sensitive to the dynamic nature of the subject and is open to changes and amendments. TP compliance costs are comparatively high. The government is also sensitive to the TP compliance cost and the fact that even SMEs would tend to be in the TP net, if the threshold bar is not high enough.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

The limited availability of information in public domain has been a hindrance in TP audits. The volume of TP audits is increasing each year. The Income Tax Department is constantly reviewing the TP law and practices, training its staff and learning its lessons, both in India and abroad. There is a lingering gap, between the expectations of the ITD and the tax payers compliance. The expectation gap needs to be bridged to the satisfaction of both parties.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

THE EXPECTATION GAP

Assesses need to pay more attention to TP compliances and maintenance of data/records. The flow of even mandatory information and disclosures, from the assesses, have not been free and forthright, at all times. TP conduct has not been satisfactory and information tends to be shared, when snared.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

There is a general unwillingness to give even routine data, on grounds of confidentiality and secrecy. At times data of even a wholly owned AE is not furnished, citing lack of control over the AE. Even though information is available, direct methods like CUP are avoided and TNMM is preferred.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

THE EXPECTATION GAP

A detailed and focused effort is needed to explain the assessees business and transactions with AEs, particularly for new age/technology businesses. FAR analysis is often deficient and vague. The list of comparables with the tested party, are cherry picked, and result in a biased statistical jugglery. ARs at times do not take the pains to effectively put forward their cases..BUT cases..BUT

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

THE EXPECTATION GAP We find that based on experience, the assessees, and their ARs, are willing to accept, amend and adapt. There has been a willingness to accept our findings, on the part of the assessees and to rearrange their international transactions.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

Assessees have modified their TP practices, on the basis of past TP audits. ARs have been willing to put in the efforts, to match our expectations. ARs have kept pace with changes in the law, which is why I have been invited here

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

OUR EXPECTATIONS AN OVERVIEW

The primary expectation of the ITD from the tax payer, are basic and fundamental, as in any other tax administration matter viz. comply with the TP law. maintain the records as stipulated. the data/documents furnished to the ITD must be correct, complete and forthright.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

suitably explain the TP transactions, with adequate supporting evidence, avoid frivolous litigation and most important. do not arrange your affairs with AEs, such as to deprive India, of its legitimate revenue.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

THE AUDITED ACCOUNTS

The starting point of any tax scrutiny/audit remains the good old audited accounts. Glaring errors and mismatches have been noted between the audited accounts and TP information, even in cases where the auditors have been the transnational accounting firms. Errors of omission and commission in the accounts and mismatches between the audited accounts and the TP reports, obviously lead to suspicion and breakdown of customary trust and dependence on audited statements.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

THE REPORT IN FORM 3CEB

Just as the disclosures in the audited accounts have to be true and fair, so is the case of disclosures in Form 3CEB.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

We thus expect a correct and complete disclosure of information related to the IT of the assesses, with its AEs as prescribed in the said annexure.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

While the Reports of the accountants in Form 3CEB have been by and large satisfactory, we do notice cases of ::Concealment/incomplete disclosure of information. Non reporting of AEs and transactions with them. Mismatches between Form 3CED and the audited accounts. Misclassification of information. ERRORS AND PARTICULARLY DELIBERATE ONES ERODE THE TRUST BETWEEN US AND THE ASSESSEES.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

STATUTORY DOCUMENTATION REQUIREMENTS

The main operating data needed by the ITD for the TP audit of assessees, is clearly stated in Rule 10D of the Income Tax Rules, 1962. Strict and complete complaince of information and contemporaneous document is madatory.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

Unwillingness to furnish information. Such stark unwillingness on the part of assessees portends an attitude to conceal and could be perhaps due to a lack of any punishing penal provision for such non compliance.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

BRIDGING THE EXPECTATIONS GAP

Since tax administration and enforcement, are strictly within the domain of the prescribed law, its requirements are explicit. So is the case of our expectations in the case of TP. The mandatory requirements of TP documentation and disclosures are clearly laid down by the law. The expectations of the ITD are thus an open secret and in public knowledge.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

A fair and proper administration of the tax law is a joint effort between the ITD and the assesses. An open, positive and transparent attitude on the part of the assesses, goes a long way in bridging the expectations gap.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

ALTERNATE DISPUTE RESOLUTION MECHANISM

As the TP law marches ahead, the government is concerned about the rising TP disputes, arising due to increasing cases of adjustments to ALP. The Finance (No. 2) Act, 2009, has thus put in the following amendments ::Safe Harbour rules (Section 92CB) for determining the ALP. The rules would provide the circumstances under which the income tax authorities would automatically accept the TP declared by the assesses. A Dispute Resolution Panel (DRP), (Section 144C) consisting of a collegiums of 3 commissioners of income tax for dealing with complex matters relating to TP or the tax disputes of foreign companies.

contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

An alternate dispute resolution mechanism is a prevailing mode in many other countries and as the TP law develops in India, we have also rightfully adopted it.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

DISPUTE RESOLUTION PANEL AN OVERVIEW

AO to forward a draft of the proposed assessment order to the eligible assessee, if he proposes to make any variation in the income or loss returned, which is prejudicial to the interest of the assessee. Eligible assessee means one in whose case a variation arises as a consequence of the order of the TPO and any foreign company. On receipt of such draft order, the assessee shall within 30 days of its receipt:receipt:contd

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

file his acceptance of the variations to the AO or file his objections if any, to such variations with i) the DRP and ii) the AO. DRP means a collegium consisting of three CITs constituted by the CBDT for this purpose. The AO shall pass the assessment order, within one month from the end of the month, in which, the acceptance is received or the period of filing of objections expires. The DRP shall, in a case where objection is received, issue such directions as it thinks fit, for the guidance of the AO, to enable him to complete the assessment.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

The section prescribes that the DRP shall examine such records and make such enquiry as it thinks fit, before issuing directions to the AO. The DRP may confirm, reduce or enhance the variations proposed in the draft order. It shall however not set aside any proposed variation or issue any direction for further enquiry and passing of the assessment order. In case of any difference of opinion in the DRP, the point will be decided by the opinion of the majority.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

Every direction of the DRP shall be binding on the AO. No directions shall be issued unless an opportunity of being heard is given to the assessee and to the AO. No direction shall be issued after 9 months from the end of the month in which the draft order was forwarded to the assessee. Upon receipt of the directions, the AO shall complete the assessment in conformity with the directions, without providing any further opportunity to the assessee, within one month from the end of the month in which the direction is received.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

DRP A FEW COMMENTS

The newly inserted section 144C has generated a lot of excitement and interest. It will be a path breaking mechanism in dispute resolution for TP and foreign companies. The Hon. Supreme Court, in the recent case of HCL Technologies Ltd. has approvingly taken note of the DRP and has advised the parties to resort to it. It also directed the competent authority DRP, to not reject the application of the assessee. Suitable directions/action to put section 144C into motion are awaited.

TRANSFER PRICING EXPECTATIONS FROM TAX PAYER AND ROLE OF DEPARTMENT IN ALTERNATIVE DISPUTE RESOLUTION MECHANISM

Thank You Very Much

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Child Custody in OhioDocument23 pagesChild Custody in Ohioscott100% (1)

- Ship Stability Notes BS222Document74 pagesShip Stability Notes BS222Ahmed Aboelmagd100% (1)

- Strategic AlliancesDocument26 pagesStrategic AlliancesYash SinghNo ratings yet

- Brand.i Sep 2012Document39 pagesBrand.i Sep 2012Yash SinghNo ratings yet

- Managing Across CulturesDocument24 pagesManaging Across CulturesYash SinghNo ratings yet

- E-CRM CONSOLIDATIONDocument28 pagesE-CRM CONSOLIDATIONYash SinghNo ratings yet

- Cet 13 BR 2 MainDocument143 pagesCet 13 BR 2 MainYash SinghNo ratings yet

- Vishvyapar Jan IssueDocument22 pagesVishvyapar Jan IssueGagandeep PahwaNo ratings yet

- Recekitt BenkiserDocument2 pagesRecekitt BenkiserYash SinghNo ratings yet

- Case DabholDocument12 pagesCase DabholrahulhaldankarNo ratings yet

- Jigyasa'11Document61 pagesJigyasa'11Yash SinghNo ratings yet

- TP 21 2011Document4 pagesTP 21 2011Yash SinghNo ratings yet

- Uday 2012Document48 pagesUday 2012Yash SinghNo ratings yet

- Hall Entrance Ticket-2Document1 pageHall Entrance Ticket-2Tapan KaushikNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentYash SinghNo ratings yet

- Agricultural Outlook Report Sept 2012Document104 pagesAgricultural Outlook Report Sept 2012Yash SinghNo ratings yet

- Hall Entrance Ticket-2Document1 pageHall Entrance Ticket-2Tapan KaushikNo ratings yet

- Questionnaire: Demographic Variables Gender Age (Years) Education OccupationDocument2 pagesQuestionnaire: Demographic Variables Gender Age (Years) Education OccupationYash SinghNo ratings yet

- Imr - Roll No-59Document14 pagesImr - Roll No-59Yash SinghNo ratings yet

- Ykalina vs. Oricio Case DigestDocument1 pageYkalina vs. Oricio Case DigestPauline Mae AranetaNo ratings yet

- ĐẢO NGỮ (Bài tập)Document6 pagesĐẢO NGỮ (Bài tập)Persie YiNo ratings yet

- Constitution of Jammu and KashmirDocument14 pagesConstitution of Jammu and KashmirNawal VermaNo ratings yet

- George Washington - Farewell Address of 1796Document11 pagesGeorge Washington - Farewell Address of 1796John SutherlandNo ratings yet

- CA For Bank Exams Vol 1Document167 pagesCA For Bank Exams Vol 1VenkatesanSelvarajanNo ratings yet

- Case Analysis of The Case of Kihoto HollohonDocument17 pagesCase Analysis of The Case of Kihoto HollohonshrikrishnaNo ratings yet

- Acts Word SearchDocument14 pagesActs Word SearchA. HeraldNo ratings yet

- Valencia V CADocument10 pagesValencia V CApjNo ratings yet

- Bureau of Jail Management and PenologyDocument5 pagesBureau of Jail Management and PenologyChalymie QuinonezNo ratings yet

- Velasco vs. Poizat - DigestDocument3 pagesVelasco vs. Poizat - DigestNympa VillanuevaNo ratings yet

- De Jure: Kottiah Vazha Yrl Devki and Others v. Arya Kandu Kunhi Knnan and OthersDocument25 pagesDe Jure: Kottiah Vazha Yrl Devki and Others v. Arya Kandu Kunhi Knnan and OthersShruti RaiNo ratings yet

- SJPDocument3 pagesSJPapi-304127123No ratings yet

- Tugas Ujian Praktek B.inggris Dania 12 Ips 2 (Movie Review)Document3 pagesTugas Ujian Praktek B.inggris Dania 12 Ips 2 (Movie Review)RaisNo ratings yet

- Gudani v. Senga, Case DigestDocument2 pagesGudani v. Senga, Case DigestChristian100% (1)

- 5.6.a Philippine Duplicators, Inc VS NLRCDocument2 pages5.6.a Philippine Duplicators, Inc VS NLRCRochelle Othin Odsinada Marqueses100% (1)

- Rex Applegate, Chuck Melson - The Close-Combat Files of Colonel Rex Applegate-Paladin Press (1998)Document212 pagesRex Applegate, Chuck Melson - The Close-Combat Files of Colonel Rex Applegate-Paladin Press (1998)PeacefulmanNo ratings yet

- Homeroom Guidance: Quarter 3 - Module 6: I Am Safe!Document16 pagesHomeroom Guidance: Quarter 3 - Module 6: I Am Safe!Gerry Areola Aquino86% (7)

- Civil-Military Relations in BangladeshDocument46 pagesCivil-Military Relations in BangladeshSumon ChakrabortyNo ratings yet

- Appealable Orders in Estate CasesDocument1 pageAppealable Orders in Estate CasesEnzo PerezNo ratings yet

- Pirate+Borg BeccaDocument1 pagePirate+Borg BeccaamamNo ratings yet

- Miami Dade County Request For Hearing Parking TicketDocument1 pageMiami Dade County Request For Hearing Parking TicketRf GoodieNo ratings yet

- Aquino v. Delizo: G.R. No. L-15853, 27 July 1960 FactsDocument6 pagesAquino v. Delizo: G.R. No. L-15853, 27 July 1960 FactsMichelle FajardoNo ratings yet

- Brunsilius v. Sloan, 10th Cir. (2011)Document4 pagesBrunsilius v. Sloan, 10th Cir. (2011)Scribd Government DocsNo ratings yet

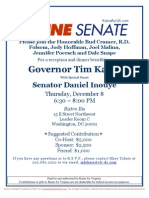

- Reception and DinnerDocument2 pagesReception and DinnerSunlight FoundationNo ratings yet

- Social StudiesDocument15 pagesSocial StudiesRobert AraujoNo ratings yet

- People v Rafael Conviction Upheld for Frustrated Murder and MurderDocument35 pagesPeople v Rafael Conviction Upheld for Frustrated Murder and MurderNigel AlinsugNo ratings yet

- Check Encumberance Certificate To Verify Property TitleDocument2 pagesCheck Encumberance Certificate To Verify Property TitlePVV RAMA RAONo ratings yet

- The Boxer Rebellion PDFDocument120 pagesThe Boxer Rebellion PDFGreg Jackson100% (1)