Professional Documents

Culture Documents

CH 6

Uploaded by

Natsu DragneelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 6

Uploaded by

Natsu DragneelCopyright:

Available Formats

CHAPTER SIX ELIMINATION OF UNREALIZED PROFIT ON INTERCOMPANY SALES OF INVENTORY Updates The concepts that are introduced and

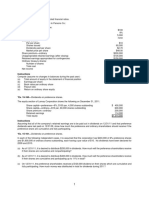

detailed in this chapter are not affected by the changes brought about by SFAS No. 141 and 142. However, several of the homework problems are comprehensive in nature and thus are affected by the elimination of goodwill amortization. The revised homework problems affected are shown here. The revised solutions are available in the solutions manual on the Website and are labeled as 2nd edition solutions. Problem 6-8 Upstream Eliminating Entries and Consolidated Net Income On January 2, 2002, Patten Company purchased a 90% interest in Sterling Company for $1,400,000. At that time Sterling Company had capital stock outstanding of $800,000 and retained earnings of $425,000. The difference between cost and book value was assigned to the following assets: Inventory Plant and equipment (net) Excess of cost over fair value $ 37,500 180,000 80,000

The inventory was sold in 2002. The plant and equipment had a remaining useful life of 12 years on January 2, 2002. During 2002 Sterling sold merchandise with a cost of $950,000 to Patten at a 20% markup above cost. At December 31, 2002, Patten still had merchandise in its inventory that it purchased from Sterling for $576,000. In 2002, Sterling Company reported net income of $410,000 and declared no dividends. Required: A. Prepare in general journal form all entries necessary on the consolidated financial statements workpaper to eliminate the effects of the intercompany sales, to eliminate the investment account, and to assign the difference between cost and book value. B. Assume that Patten Company reports net income of $2,000,000 from its independent operations. Calculate consolidated net income.

C. Calculate noncontrolling interest in combined income.

Problem 6-9 Upstream and Downstream Worksheet On January 1, 2002, Perry Company purchased 80% of Selby Company for $990,000. At that time Selby had capital stock outstanding of $350,000 and retained earnings of $375,000. The fair value of Selby Company's assets and liabilities is equal to their book value except for the following: Inventory Plant and equipment (10-year life) Fair Value $210,000 780,000 Book Value $160,000 630,000

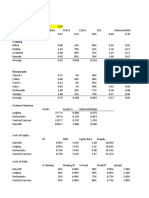

One-half of the inventory was sold in 2002; the remainder was sold in 2003. At the end of 2002, Perry Company had in its ending inventory $60,000 of merchandise it had purchased from Selby Company during the year. Selby Company sold the merchandise at 25% above cost. During 2003, Perry Company sold merchandise to Selby Company for $310,000 at a markup of 20% of the selling price. At December 31, 2003, Selby still had merchandise that it purchased from Perry Company for $82,000 in its inventory. Financial data for 2003 are presented here: Perry Company $1,400,000 20,000 1,420,000 230,000 900,000 1,130,000 450,000 680,000 250,000 930,000 $ 490,000 $1,500,000 490,000 (50,000) $1,940,000 $ 95,000 302,000 450,000 Selby Company $ 800,000 ------800,000 145,000 380,000 525,000 200,000 325,000 195,000 520,000 $ 280,000 $ 480,000 280,000 (25,000) $ 680,000 $ 70,000 90,000 200,000

Sales Dividend income Total revenue Cost of goods sold: Beginning inventory Purchases Cost of Goods Available Less: Ending inventory Cost of goods sold Other expenses Total cost and expense Net Income 1/1 Retained earnings Net income Dividends declared 12/31 Retained earnings Cash Accounts receivable (net) Inventory

Investment in Selby Company Plant and equipment (net) Other assets (net) Total assets Accounts payable Other liabilities Common stock Retained earnings Total liabilities and equity Required:

990,000 850,000 390,000 $3,077,000 $ 75,000 102,000 960,000 1,940,000 $3,077,000

582,000 230,000 $1,175,000 $ 30,000 60,000 350,000 735,000 $1,175,000

A. Prepare the consolidated statements workpaper for the year ended December 31, 2003. B. Calculate consolidated retained earnings on December 31, 2003, using the analytical or T-account approach.

Problem 6-14 Omit the sentence that states that goodwill should be amortized over 40 years.

Problem 6-18 Comprehensive Complete Equity Problem, Cost Greater than Fair Value with Intercompany Sales of Inventory (Note that this is the same problem as Problem 6-14, but assuming the use of the complete equity method.) On January 1, 2003, Perry Company purchased 80% of Selby Company for $960,000. At that time Selby had capital stock outstanding of $400,000 and retained earnings of $400,000. The fair value of Selby Company's assets and liabilities is equal to their book value except for the following:

Inventory Plant and equipment (10-year life) FAIR VALUE $ 230,000 800,000 BOOK VALUE $ 155,000 600,000

One-half of the inventory was sold in 2003; the remainder was sold in 2004. At the end of 2003, Perry Company had in its ending inventory $54,000 of merchandise it had purchased from Selby Company during the year. Selby Company sold the merchandise at 20% above cost. During 2004, Perry Company sold merchandise to Selby Company for $300,000 at a markup of 20% of the selling price. At December 31, 2004, Selby still had merchandise that it purchased from Perry Company for $78,000 in its inventory. Financial data for 2004 are presented here:

PERRY COMPANY $ 1,385,000 153,600 1,538,600 210,000 875,000 1,085,000 400,000 685,000 225,000 910,000 $ 628,600 1,417,000 628,600 (40,000) SELBY COMPANY $ 720,000 720,000 155,000 360,000 515,000 225,000 290,000 170,000 460,000 $ 260,000 450,000 260,000 (30,000)

Sales Equity in subsidiary income Total revenue Cost of goods sold: Beginning inventory Purchases Cost of goods available Less: Ending inventory Cost of goods sold Other expenses Total cost and expense Net income 1/1 Retained earnings Net income Dividends declared

12/31 Retained earnings Cash Accounts receivable Inventory Investment in Selby Company Plant and equipment (net) Other assets Total assets Accounts payable Other current liabilities Common stock Retained earnings Total liabilities and equity

$ $

2,008,100 90,000 297,000 400,000 1,076,400 880,000 384,000 3,127,400 24,300 95,000 1,000,000 2,008,100 3,127,400

$ 680,000 $ 65,000 85,000 225,000 540,000 230,000 $1,145,000 25,000 40,000 400,000 680,000 $1,145,000

Required: A. Prepare the consolidated statements workpaper for the year ended December 31, 2004. B. Calculate consolidated retained earnings on December 31, 2004, using the analytical approach or T-account approach. C. If you completed Problem 6-14, compare the consolidated balances obtained in part (A) with those obtained in that problem.

You might also like

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Quiz CH 9-11 SchoologyDocument8 pagesQuiz CH 9-11 SchoologyperasadanpemerhatiNo ratings yet

- AccountingDocument4 pagesAccountingTk KimNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- What Is The Correct Amount of Inventory?: SolutionDocument3 pagesWhat Is The Correct Amount of Inventory?: SolutionSofia LaoNo ratings yet

- ACSTRAN - Realization and LiquidationDocument4 pagesACSTRAN - Realization and LiquidationDheine MaderazoNo ratings yet

- 08 InvestmentquestfinalDocument13 pages08 InvestmentquestfinalAnonymous l13WpzNo ratings yet

- Test-Bank-Advanced-Accounting-3 By-Jeter-10-ChapterDocument20 pagesTest-Bank-Advanced-Accounting-3 By-Jeter-10-Chapterjhean dabatosNo ratings yet

- Input Error Correction (Accounting Information System)Document14 pagesInput Error Correction (Accounting Information System)Rachel Garcia0% (1)

- 118.2 - Illustrative Examples - IFRS15 Part 1Document3 pages118.2 - Illustrative Examples - IFRS15 Part 1Ian De DiosNo ratings yet

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDocument3 pagesExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.No ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Mahusay-Bsa-315-Module 3-CaseletsDocument15 pagesMahusay-Bsa-315-Module 3-CaseletsJeth MahusayNo ratings yet

- Management Accounting Multiple Choice ExamDocument12 pagesManagement Accounting Multiple Choice ExamMark Lord Morales Bumagat100% (1)

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- Compilation of ProblemsDocument9 pagesCompilation of ProblemsCorina Mamaradlo CaragayNo ratings yet

- Auditing I: Chapter 6 (Internal Control in A Financial Statement Audit)Document16 pagesAuditing I: Chapter 6 (Internal Control in A Financial Statement Audit)CrystalNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- 2.3G Homework (Questionnaire)Document4 pages2.3G Homework (Questionnaire)Bea GarciaNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Individual Business CaseDocument7 pagesIndividual Business CaseKatrina Belarmino100% (1)

- Karma Company Sells Televisions at An Average Price of P7Document1 pageKarma Company Sells Televisions at An Average Price of P7Nicole AguinaldoNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3Sharmaine Rivera MiguelNo ratings yet

- Study ProbesDocument64 pagesStudy ProbesEvan Jordan100% (1)

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Strategic Costing and Management SystemsDocument21 pagesStrategic Costing and Management Systemsambrosia96No ratings yet

- Act13 Orquia-Anndhrea Bsa-32Document3 pagesAct13 Orquia-Anndhrea Bsa-32Clint RoblesNo ratings yet

- Quiz 1 ConsulDocument4 pagesQuiz 1 ConsulJenelyn Pontiveros40% (5)

- Suzette Washington CaseDocument30 pagesSuzette Washington CaseMary Queen Ramos-Umoquit100% (1)

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezNo ratings yet

- #10 Cash and Cash EquivalentsDocument2 pages#10 Cash and Cash Equivalentsmilan100% (3)

- Items 1Document7 pagesItems 1RYANNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- R3 - ARC - AP and ATDocument10 pagesR3 - ARC - AP and ATOliver SalamidaNo ratings yet

- Auditing Multiple ChoiceDocument18 pagesAuditing Multiple ChoiceAken Lieram Ats AnaNo ratings yet

- Absorption vs Variable Costing Activity 2Document2 pagesAbsorption vs Variable Costing Activity 2Gill Riguera100% (1)

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- Activity Based Costing-AssignmentDocument3 pagesActivity Based Costing-Assignmentmamasita25No ratings yet

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Document7 pagesACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Audit of Intangible Assets TitleDocument2 pagesAudit of Intangible Assets TitleJaycee FabriagNo ratings yet

- Applied Auditing ComprehensiveDocument6 pagesApplied Auditing ComprehensiveLEnz AngelNo ratings yet

- CH 13Document19 pagesCH 13pesoload100No ratings yet

- Tugas AKL ANNISA SHABIRA 3111801029Document7 pagesTugas AKL ANNISA SHABIRA 3111801029annisa shabiraNo ratings yet

- T.B - CH09Document17 pagesT.B - CH09MohammadYaqoobNo ratings yet

- Chapter 8 Solutions and ExercisesDocument25 pagesChapter 8 Solutions and ExercisesCliff StewardNo ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- Dissolution LiquidationDocument9 pagesDissolution LiquidationCha FeudoNo ratings yet

- Accounting for Liquidation and Foreign ExchangeDocument8 pagesAccounting for Liquidation and Foreign Exchangeprecious mlb100% (1)

- Exercises Ch05Document3 pagesExercises Ch05Ahmed El KhateebNo ratings yet

- StatementDocument4 pagesStatementAngel Alejo AcobaNo ratings yet

- Job Order Assignment PDFDocument3 pagesJob Order Assignment PDFAnne Marie100% (1)

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Eliminating Unrealized Profit on Intercompany SalesDocument6 pagesEliminating Unrealized Profit on Intercompany SalesYuitaNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysiswahab_pakistan50% (2)

- Financial Statement Analysis Chapter 2Document10 pagesFinancial Statement Analysis Chapter 2Houn Pisey100% (1)

- Advanced Accounting Homework Week 5 ConsolidationDocument5 pagesAdvanced Accounting Homework Week 5 ConsolidationFebrina ClaudyaNo ratings yet

- P1 - Financial Accounting April 07Document23 pagesP1 - Financial Accounting April 07IrfanNo ratings yet

- Exercise 6Document4 pagesExercise 6Tania MaharaniNo ratings yet

- In Partial Fulfillment of The Requirements For The Degree of Bachelor of Science in AccountancyDocument2 pagesIn Partial Fulfillment of The Requirements For The Degree of Bachelor of Science in AccountancyNatsu DragneelNo ratings yet

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- GoodDocument1 pageGoodNatsu DragneelNo ratings yet

- 4 Positive Reasons Credit Cards BibliographyDocument1 page4 Positive Reasons Credit Cards BibliographyNatsu DragneelNo ratings yet

- 2010-10-22 003512 Yan 8Document19 pages2010-10-22 003512 Yan 8Natsu DragneelNo ratings yet

- Chapter 02 - Stock Investment - Investor Accounting and ReportingDocument26 pagesChapter 02 - Stock Investment - Investor Accounting and ReportingTina Lundstrom100% (3)

- According ToDocument1 pageAccording ToNatsu DragneelNo ratings yet

- In Partial Fulfillment of The Requirements For The Degree of Bachelor of Science in AccountancyDocument2 pagesIn Partial Fulfillment of The Requirements For The Degree of Bachelor of Science in AccountancyNatsu DragneelNo ratings yet

- QuestionnaireDocument4 pagesQuestionnaireNatsu DragneelNo ratings yet

- Segment ReportingDocument2 pagesSegment ReportingDhan MarkNo ratings yet

- ProspectsDocument1 pageProspectsNatsu DragneelNo ratings yet

- Chap 6.1Document32 pagesChap 6.1Natsu DragneelNo ratings yet

- OlivaDocument1 pageOlivaNatsu DragneelNo ratings yet

- Advanced Accounting Baker Test Bank - Chap014Document34 pagesAdvanced Accounting Baker Test Bank - Chap014donkazotey100% (1)

- Chapter 02 - Stock Investment - Investor Accounting and ReportingDocument26 pagesChapter 02 - Stock Investment - Investor Accounting and ReportingTina Lundstrom100% (3)

- Accounting for Consolidated StatementsDocument7 pagesAccounting for Consolidated StatementsNatsu DragneelNo ratings yet

- AA2 Chapter 11 SolDocument16 pagesAA2 Chapter 11 SolJoan RomeroNo ratings yet

- 11 Chapter 3Document27 pages11 Chapter 3Natsu DragneelNo ratings yet

- Chapter 17Document4 pagesChapter 17khae123No ratings yet

- Chapter 10Document8 pagesChapter 10Natsu DragneelNo ratings yet

- One PieceDocument1 pageOne PieceNatsu DragneelNo ratings yet

- Effectiveness of Marketing Strategies for Realtors in Lipa CityDocument1 pageEffectiveness of Marketing Strategies for Realtors in Lipa CityNatsu Dragneel89% (9)

- How Bench Clothing Pioneered Affordable FashionDocument8 pagesHow Bench Clothing Pioneered Affordable FashionNatsu Dragneel83% (6)

- 11 Chapter 3Document27 pages11 Chapter 3Natsu DragneelNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterNatsu DragneelNo ratings yet

- Test of Controls Procedure PDFDocument6 pagesTest of Controls Procedure PDFNatsu DragneelNo ratings yet

- IntroDocument2 pagesIntroNatsu DragneelNo ratings yet

- At-030507 - Auditing in A CIS EnvironmentDocument15 pagesAt-030507 - Auditing in A CIS EnvironmentRandy Sioson100% (9)

- IntroDocument2 pagesIntroNatsu DragneelNo ratings yet

- Investor Education in Nepal: Krishna Prasad Ghimire & Suraj Pradhananga Securities Board of NepalDocument16 pagesInvestor Education in Nepal: Krishna Prasad Ghimire & Suraj Pradhananga Securities Board of NepalNoufal AnsariNo ratings yet

- 5 EMA 13 EMA Fibonacci Forex Trading SystemDocument7 pages5 EMA 13 EMA Fibonacci Forex Trading SystemantoniusNo ratings yet

- Post Graduate Diploma in International Business Operations / Master of CommerceDocument4 pagesPost Graduate Diploma in International Business Operations / Master of CommerceKunal SharmaNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- Module4 Dividend PolicyDocument5 pagesModule4 Dividend PolicyShihad Panoor N KNo ratings yet

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- CCI - Amazon OrderDocument310 pagesCCI - Amazon OrderRyan Denver MendesNo ratings yet

- Systematic Risk of Select Banking ScriptsDocument70 pagesSystematic Risk of Select Banking ScriptsHassim KhanNo ratings yet

- Ambit - Strategy - ERr GRP - The Rebooting of IndiaDocument25 pagesAmbit - Strategy - ERr GRP - The Rebooting of Indiaomkarb87No ratings yet

- 1.1 Introduction of Working Capital Management: Chapter - 1Document67 pages1.1 Introduction of Working Capital Management: Chapter - 1raisNo ratings yet

- CHINA HUANENG GROUP CONTROL PERFORMANCE EVALUATIONDocument15 pagesCHINA HUANENG GROUP CONTROL PERFORMANCE EVALUATIONYouJianNo ratings yet

- Exercise 2.2Document18 pagesExercise 2.2Stephanie Xie100% (1)

- HUD HECM Complaint Appendix I Exhibits 1-21Document108 pagesHUD HECM Complaint Appendix I Exhibits 1-21Neil GillespieNo ratings yet

- F & M AccountingDocument6 pagesF & M AccountingCherry PieNo ratings yet

- Source: Annual Accounts of BanksDocument6 pagesSource: Annual Accounts of BanksARVIND YADAVNo ratings yet

- Graded Assignment 2 JCDocument12 pagesGraded Assignment 2 JCJustineNo ratings yet

- Financial Planning ReportDocument75 pagesFinancial Planning ReportAruna Ambastha100% (7)

- Chapter 5Document65 pagesChapter 53ooobd1234No ratings yet

- Marriott Cost of CapitalDocument3 pagesMarriott Cost of Capitalanmolsaini01No ratings yet

- Volatility - Magazine REVISED LAST CHANGESDocument44 pagesVolatility - Magazine REVISED LAST CHANGESbhaskarganeshNo ratings yet

- RJR Nabisco Case ValuationDocument2 pagesRJR Nabisco Case ValuationJorge SmithNo ratings yet

- Introduction to Financial MarketsDocument16 pagesIntroduction to Financial MarketsMick MalickNo ratings yet

- How The Rich Stay Rich - Using A Family Trust Company To Secure ADocument51 pagesHow The Rich Stay Rich - Using A Family Trust Company To Secure Aspcbanking100% (4)

- Investment Consulting Business PlanDocument9 pagesInvestment Consulting Business Planbe_supercoolNo ratings yet

- Handout Classification of TakafulDocument10 pagesHandout Classification of TakafulLail M PimadaNo ratings yet

- UBLDocument104 pagesUBLgreatguy126No ratings yet

- A Short-Term Obligation Can Be Excluded From Current Liabilities If The Company Intends To Refinance It On A Long-Term Basis.Document29 pagesA Short-Term Obligation Can Be Excluded From Current Liabilities If The Company Intends To Refinance It On A Long-Term Basis.cole sprouseNo ratings yet

- WW Alpacas DecisionDocument9 pagesWW Alpacas Decisiondavid5174No ratings yet

- Pulse of Fintech 2018: Blockchain Investment Exceeds 2017 Annual TotalDocument2 pagesPulse of Fintech 2018: Blockchain Investment Exceeds 2017 Annual TotalSergio VinsennauNo ratings yet

- BURMA MYANMAR TELECOM LICENSES Pre-Qualification LIST - ENGLISHDocument70 pagesBURMA MYANMAR TELECOM LICENSES Pre-Qualification LIST - ENGLISHPugh Jutta100% (1)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersFrom EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNo ratings yet

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeFrom EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeRating: 3.5 out of 5 stars3.5/5 (3)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessFrom EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessRating: 4.5 out of 5 stars4.5/5 (17)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASFrom EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNo ratings yet

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2From EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2No ratings yet

- EMT (Emergency Medical Technician) Crash Course Book + OnlineFrom EverandEMT (Emergency Medical Technician) Crash Course Book + OnlineRating: 4.5 out of 5 stars4.5/5 (4)

- Radiographic Testing: Theory, Formulas, Terminology, and Interviews Q&AFrom EverandRadiographic Testing: Theory, Formulas, Terminology, and Interviews Q&ANo ratings yet

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)From Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)No ratings yet

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersFrom EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersRating: 4 out of 5 stars4/5 (14)

- The PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptFrom EverandThe PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptNo ratings yet

- ASE A1 Engine Repair Study Guide: Complete Review & Test Prep For The ASE A1 Engine Repair Exam: With Three Full-Length Practice Tests & AnswersFrom EverandASE A1 Engine Repair Study Guide: Complete Review & Test Prep For The ASE A1 Engine Repair Exam: With Three Full-Length Practice Tests & AnswersNo ratings yet

- Auto Parts Storekeeper: Passbooks Study GuideFrom EverandAuto Parts Storekeeper: Passbooks Study GuideNo ratings yet

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreFrom EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreRating: 5 out of 5 stars5/5 (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- PTCE - Pharmacy Technician Certification Exam Flashcard Book + OnlineFrom EverandPTCE - Pharmacy Technician Certification Exam Flashcard Book + OnlineNo ratings yet

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsFrom EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (76)

- Programmer Aptitude Test (PAT): Passbooks Study GuideFrom EverandProgrammer Aptitude Test (PAT): Passbooks Study GuideNo ratings yet

- Real Property, Law Essentials: Governing Law for Law School and Bar Exam PrepFrom EverandReal Property, Law Essentials: Governing Law for Law School and Bar Exam PrepNo ratings yet

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariFrom EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariRating: 1 out of 5 stars1/5 (3)

- Python Handbook For Beginners. A Hands-On Crash Course For Kids, Newbies and Everybody ElseFrom EverandPython Handbook For Beginners. A Hands-On Crash Course For Kids, Newbies and Everybody ElseNo ratings yet

- Child Protective Services Specialist: Passbooks Study GuideFrom EverandChild Protective Services Specialist: Passbooks Study GuideNo ratings yet

- 2024 – 2025 FAA Drone License Exam Guide: A Simplified Approach to Passing the FAA Part 107 Drone License Exam at a sitting With Test Questions and AnswersFrom Everand2024 – 2025 FAA Drone License Exam Guide: A Simplified Approach to Passing the FAA Part 107 Drone License Exam at a sitting With Test Questions and AnswersNo ratings yet