Professional Documents

Culture Documents

Certificate

Uploaded by

Malik JeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate

Uploaded by

Malik JeeCopyright:

Available Formats

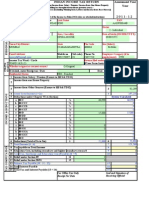

Certificate of Collection or Deduction of Income Tax (including salary)

(under rule 42)

S.No. Certified that the sum of Rupees Duplicate Date of issue.

(Amount of tax collected/deducted in figures)

(amount in words)

on account of income tax has been deducted/collected from (Name and Address of the person from whom tax collected/deducted)

in case of an individual, his/her name in full and in case of an association of persons / company, name and style of the association of persons/company

having National Tax Number holder of CNIC No. on Or during the period under section On account of vide on the value/amount of Rupees From

1391493-6 35202-3039106-7

st th

(if any) and (In case of an individual) (Date of collection/ deduction)

1 July 2012

To

30 June 2013

(Period of collection/deduction) (specify the Section of Income Tax Ordinance,2001) (specify nature) (particulars of LC, Contract etc.)

(Gross amount on which tax deducted/collected in figures)

This is to further certify that the tax collected/deducted has been deposited in the Fedral Government Account as per the following details:

Date of deposit. SBP/NBP/ Treasury. Branch/City. Account (Rupees) Challan/ Treasury No/CPR No.

31-07-2012

SBP SBP SBP SBP SBP SBP SBP SBP SBP SBP SBP SBP

Lahore Lahore Lahore Lahore Lahore Lahore Lahore Lahore Lahore Lahore Lahore Lahore Total 0

Company / office etc. collecting/deducting the tax: Name. Signature Name Address. Designation NTN (if any) Date. Seal

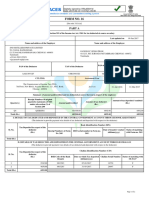

Certificate of Collection or Deduction of Income Tax (including salary)

(under rule 42)

S.No. Certified that the sum of Rupees Duplicate 4,816 Date of issue. 22.12.2010

(Amount of tax collected/deducted in figures)

(Rupees Four Thousand Eight Hundred and Sixteen Only.) on account of income tax has been deducted/collected from (Name and Address of the person from whom tax collected/deducted) AVERY SCALES (PVT) LTD

165-G BLOCK-3, P.E.C.H.S, KARACHI.

(amount in words)

in case of an individual, his/her name in full and in case of an association of persons / company, name and style of the association of persons/company

having National Tax Number holder of CNIC No. on Or during the period under section On account of vide on the value/amount of Rupees From

0700023-5

(if any) and (In case of an individual) (Date of collection/ deduction)

01.07.2007 153(1) (a) & (b)

To

30.06.2008

(Period of collection/deduction) (specify the Section of Income Tax Ordinance,2001) (specify nature) (particulars of LC, Contract etc.)

Supplies and Services

126,880

(Gross amount on which tax deducted/collected in figures)

This is to further certify that the tax collected/deducted has been deposited in the Fedral Government Account as per the following details:

Date of deposit. SBP/NBP/ Treasury. Branch/City. Account (Rupees) Challan/ Treasury No/CPR No.

20.08.2007 14.04.2008 22.05.2008

SBP SBP SBP

LAHORE LAHORE LAHORE

1,866 900 2,050

Total Company / office etc. collecting/deducting the tax: Name. FAZAL SONS MATCH INDUSTRIES (PVT) LTD Signature Name Address. 15 K.M. LAHORE SHEIKHUPURA ROAD,SKP Designation NTN (if any) Date. 2485700-9 22.12.2010 Seal

4,816

Muhammad Ramzan

Manger Accounts

Certificate of Collection or Deduction of Income Tax (including salary)

(under rule 42)

S.No. Certified that the sum of Rupees Duplicate 1,050 (Rupees One Thousand and Fifty Only.) on account of income tax has been deducted/collected from (Name and Address of the person from whom tax collected/deducted) AVERY SCALES (PVT) LTD

165-G BLOCK-3, P.E.C.H.S, KARACHI.

in case of an individual, his/her name in full and in case of an association of persons / company, name and style of the association of persons/company

Date of issue.

22.12.2010

(Amount of tax collected/deducted in figures)

(amount in words)

having National Tax Number holder of CNIC No. on Or during the period under section On account of vide on the value/amount of Rupees From

0700023-5

(if any) and (In case of an individual) (Date of collection/ deduction)

01.07.2008 153(1)(b) Services

To

30.06.2009

(Period of collection/deduction) (specify the Section of Income Tax Ordinance,2001) (specify nature) (particulars of LC, Contract etc.)

17,500

(Gross amount on which tax deducted/collected in figures)

This is to further certify that the tax collected/deducted has been deposited in the Fedral Government Account as per the following details:

Date of deposit. SBP/NBP/ Treasury. Branch/City. Account (Rupees) Challan/ Treasury No/CPR No.

28.10.2008

SBP

LAHORE

1,050

Total Company / office etc. collecting/deducting the tax: Name. FAZAL SONS MATCH INDUSTRIES (PVT) LTD Signature Name Address. 15 K.M. LAHORE SHEIKHUPURA ROAD,SKP Designation NTN (if any) Date. 2485700-9 22.12.2010 Seal

1,050

Muhammad Ramzan

Manger Accounts

You might also like

- Certificate of Tax Deduction 42Document1 pageCertificate of Tax Deduction 42frazwahlah75% (4)

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Metocean Design and Operating ConsiderationsDocument7 pagesMetocean Design and Operating ConsiderationsNat Thana AnanNo ratings yet

- Certificate of Collection or Deduction of Tax-2018-19Document2 pagesCertificate of Collection or Deduction of Tax-2018-19Sarfraz Ali100% (1)

- Certificate of Collection or Deduction of TaxDocument1 pageCertificate of Collection or Deduction of TaxAnonymous BHZsqRcdGRNo ratings yet

- Migration CertificateDocument2 pagesMigration CertificateDua Ashraf100% (1)

- Certificate collection deduction taxDocument1 pageCertificate collection deduction taxdebugger911No ratings yet

- Tax Form-22.Document27 pagesTax Form-22.Masroor RasoolNo ratings yet

- Certificate of Collection or Deduction of Income Tax (Including Salary) (Under Rule 42)Document1 pageCertificate of Collection or Deduction of Income Tax (Including Salary) (Under Rule 42)muhammad mustafa iqbalNo ratings yet

- S4Q0000023905 1 PDFDocument16 pagesS4Q0000023905 1 PDFAli Azhar KhanNo ratings yet

- Ali HaiderDocument2 pagesAli Haiderlalo abbasNo ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Form27d Applicable From 01.04Document2 pagesForm27d Applicable From 01.04sudhrengeNo ratings yet

- Seventy-Five Thousand Four Hundred Ninety-EightDocument1 pageSeventy-Five Thousand Four Hundred Ninety-Eightkhuram MehmoodNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- KJF Tax CertificateDocument1 pageKJF Tax Certificatesyh.zeeshanNo ratings yet

- (See Rule 31 (1) (B) ) : Form No. 16ADocument38 pages(See Rule 31 (1) (B) ) : Form No. 16AsamNo ratings yet

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDocument34 pagesI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- File ITR-1 online in minutes with pre-filled dataDocument3 pagesFile ITR-1 online in minutes with pre-filled datathakurrobinNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Cit 50 PDFDocument8 pagesCit 50 PDFMook Kitty BerryNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Document2 pagesRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688No ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Form 16Document6 pagesForm 16Ravi DesaiNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Form 16 and Salary DetailsDocument22 pagesForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryNo ratings yet

- Form 16 - Fy 2019-20Document4 pagesForm 16 - Fy 2019-20CA SHOBHIT GoelNo ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- Certificate of Collection or Deduction of Income Tax On Salary (Under Rule 42)Document1 pageCertificate of Collection or Deduction of Income Tax On Salary (Under Rule 42)Khusru ShahbazNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- Form 16A TDS Certificate DetailsDocument2 pagesForm 16A TDS Certificate DetailsKovidh GoyalNo ratings yet

- G.A.R.-7 Proforma For Service Tax Payments: Full Name Complete AddressDocument3 pagesG.A.R.-7 Proforma For Service Tax Payments: Full Name Complete AddressRam GuptaNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument3 pagesFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNo ratings yet

- TDS Certificate DetailsDocument2 pagesTDS Certificate DetailsAnonymous SMqp9rZuNo ratings yet

- INDIAN INCOME TAX RETURN FOR INDIVIDUALS WITH INCOME FROM SALARY, HOUSE PROPERTY AND OTHER SOURCES (ITR-1 FORMDocument3 pagesINDIAN INCOME TAX RETURN FOR INDIVIDUALS WITH INCOME FROM SALARY, HOUSE PROPERTY AND OTHER SOURCES (ITR-1 FORMDHARAMSONINo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Babu Form 16Document4 pagesBabu Form 16sundar1111No ratings yet

- Pay TDS and TCS via Challan FormDocument2 pagesPay TDS and TCS via Challan Formbrayan uyNo ratings yet

- Annual Information Return (AIRDocument8 pagesAnnual Information Return (AIRmamasita25No ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- N/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesN/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryZUHAIB ASHFAQNo ratings yet

- 82255BIR Form 1701Document12 pages82255BIR Form 1701Leowell John G. RapaconNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- Issuing Tax Invoices: Simplified Tax InvoiceDocument2 pagesIssuing Tax Invoices: Simplified Tax InvoicehisyamstarkNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS CertificateKesava KesNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- AmirDocument6 pagesAmirMalik JeeNo ratings yet

- CorporateDocument30 pagesCorporateMalik JeeNo ratings yet

- SR - No Asset Description Assets CodeDocument4 pagesSR - No Asset Description Assets CodeMalik JeeNo ratings yet

- Accounts Payable Basic TrainingDocument4 pagesAccounts Payable Basic Trainingengr_amirNo ratings yet

- Importance of Cash Flow StatementDocument2 pagesImportance of Cash Flow StatementMalik JeeNo ratings yet

- Calculation of RatiosDocument5 pagesCalculation of RatiosMalik JeeNo ratings yet

- Return On Investment Return On Capital Employed Cash Return On Capital InvestedDocument1 pageReturn On Investment Return On Capital Employed Cash Return On Capital InvestedMalik JeeNo ratings yet

- Understanding the Structure and Accounting of Cash Flow StatementsDocument4 pagesUnderstanding the Structure and Accounting of Cash Flow StatementsMalik JeeNo ratings yet

- 2012 Tax Refund Report for EmployeesDocument2 pages2012 Tax Refund Report for EmployeesMalik JeeNo ratings yet

- Income TaxDocument2 pagesIncome TaxMalik JeeNo ratings yet

- Service Level AgreementDocument1 pageService Level AgreementMalik JeeNo ratings yet

- Taylor Swift Tagalig MemesDocument34 pagesTaylor Swift Tagalig MemesAsa Zetterstrom McFly SwiftNo ratings yet

- Vodafone service grievance unresolvedDocument2 pagesVodafone service grievance unresolvedSojan PaulNo ratings yet

- Website Vulnerability Scanner Report (Light)Document6 pagesWebsite Vulnerability Scanner Report (Light)Stevi NangonNo ratings yet

- Sweetlines v. TevesDocument6 pagesSweetlines v. TevesSar FifthNo ratings yet

- How To Configure User Accounts To Never ExpireDocument2 pagesHow To Configure User Accounts To Never ExpireAshutosh MayankNo ratings yet

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDocument5 pagesĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiNo ratings yet

- IEC 60050-151-2001 Amd2-2014Document8 pagesIEC 60050-151-2001 Amd2-2014mameri malekNo ratings yet

- Six Sigma and Total Quality Management (TQM) : Similarities, Differences and RelationshipDocument15 pagesSix Sigma and Total Quality Management (TQM) : Similarities, Differences and RelationshipSAKTHIVELNo ratings yet

- 79.1 Enrico vs. Heirs of Sps. Medinaceli DigestDocument2 pages79.1 Enrico vs. Heirs of Sps. Medinaceli DigestEstel Tabumfama100% (1)

- Chapter 16 Study GuideDocument2 pagesChapter 16 Study GuideChang Ho LeeNo ratings yet

- Hwa Tai AR2015 (Bursa)Document104 pagesHwa Tai AR2015 (Bursa)Muhammad AzmanNo ratings yet

- Pharma: Conclave 2018Document4 pagesPharma: Conclave 2018Abhinav SahaniNo ratings yet

- History of Cisco and IBMDocument1 pageHistory of Cisco and IBMSven SpenceNo ratings yet

- Pooling Harness Sets: For Blood and Blood ComponentsDocument1 pagePooling Harness Sets: For Blood and Blood ComponentsCampaign MediaNo ratings yet

- MUN Resolution For The North Korean Missile CrisisDocument2 pagesMUN Resolution For The North Korean Missile CrisissujalachamNo ratings yet

- Lesson 2 The Chinese AlphabetDocument12 pagesLesson 2 The Chinese AlphabetJayrold Balageo MadarangNo ratings yet

- Learn Jèrriais - Lesson 1 2Document19 pagesLearn Jèrriais - Lesson 1 2Sara DavisNo ratings yet

- Intermediate Macro 1st Edition Barro Solutions ManualDocument8 pagesIntermediate Macro 1st Edition Barro Solutions Manualkietcuongxm5100% (22)

- Family Law Final Exam ReviewDocument2 pagesFamily Law Final Exam ReviewArielleNo ratings yet

- Sabbia Food MenuDocument2 pagesSabbia Food MenuNell CaseyNo ratings yet

- 5 8 Pe Ola) CSL, E Quranic WondersDocument280 pages5 8 Pe Ola) CSL, E Quranic WondersMuhammad Faizan Raza Attari QadriNo ratings yet

- WADVDocument2 pagesWADVANNA MARY GINTORONo ratings yet

- Retail investment: Addressing timing and pricing issues through SIPsDocument52 pagesRetail investment: Addressing timing and pricing issues through SIPsMauryanNo ratings yet

- RIZAL Childhood ScriptDocument3 pagesRIZAL Childhood ScriptCarla Pauline Venturina Guinid100% (2)

- Science Club-6Document2 pagesScience Club-6Nguyễn Huyền Trang100% (1)

- EAR Policy KhedaDocument40 pagesEAR Policy KhedaArvind SahaniNo ratings yet

- Woman EmpowermentDocument17 pagesWoman EmpowermentAditya SinghaiNo ratings yet

- Biffa Annual Report and Accounts 2022 InteractiveDocument232 pagesBiffa Annual Report and Accounts 2022 InteractivepeachyceriNo ratings yet