Professional Documents

Culture Documents

M3 Additional Practice Questions

Uploaded by

Ria Trias-MarquezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M3 Additional Practice Questions

Uploaded by

Ria Trias-MarquezCopyright:

Available Formats

Module 3 Additional Questions

Past Exam Question The Statement of Profit or Loss for Bailey Ltd for the year ended 30 June 2012, resulted in a profit before tax of $225,000. This profit amount included the following revenues and expenses: Revenues and Expenses included in profit Rent Revenue 15,000 Government Grant received 5,000 Bad Debts Expense 30,000 Depreciation of PPE 25,000 Annual Leave Expense 20,000 Entertainment costs 9,000 The draft Statements of Financial Position for Bailey Ltd for the years ended 30 June 2011 and 2012 showed the following assets and liabilities: Assets Cash Inventory Accounts Receivable Allowance for Doubtful Debts Property, Plant and Equipment (PPE) Accumulated Depreciation - PPE Deferred Tax Asset Liabilities Accounts Payable Provision for Annual Leave Rent Received in Advance Deferred Tax Liability 2012 40,000 85,000 250,000 (35,000) 300,000 (130,000) ? 2011 42,500 75,000 240,000 (15,000) 300,000 (105,000) 21,000

145,000 27,500 15,000 ?

130,000 15,000 10,000 19,500

Additional information: a) The government grant revenue is not assessable for tax purposes. Entertainment costs are not an allowable tax deduction. b) Accumulated depreciation of property, plant and equipment (PPE) for tax purposes was $150,000 at 30 June 2011, and depreciation for tax purposes for the year ended 30 June 2012 was $50,000. c) Assume a tax rate of 30% for the year ended 30 June 2012. Required: A. Complete the attached worksheet to calculate taxable income and the current tax liability for Bailey Ltd as at 30 June 2012, and prepare the appropriate journal entry for the endof-period current tax adjustment. B. Complete the attached worksheet to calculate the end-of-period adjustments to the deferred tax asset and deferred tax liability accounts as at 30 June 2012, and show the appropriate journal entry to record these adjustments.

Additional Questions Using the attached templates, students can complete the following two questions for additional practice. o Question 6.5 o Question 6.10 (templates provided on following pages)

Template for Question 6.5

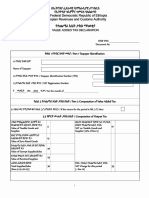

TAMBORINE LTD Determination of Taxable Income (for the year ended 30 June 2014)

Accounting profit (loss) before income tax Add:

Deduct:

Taxable Income (Tax Loss) Current tax liability @ 30%

Template for Question 6.10

WELLINGTON LTD Calculation of deferred tax as at 30 June 2013 DTL Taxable Temp.Diff. DTA Deductible Temp.Diff.

Carrying Amount Assets Cash Receivables (net) Prepaid Insurance Plant (net) Goodwill Liabilities A/cs Payable Revenue in Advance Annual Leave Payable Temporary Differences Excluded Differences Net Temporary Differences Deferred tax liability Deferred tax asset Beginning balances Movement during year (tax losses recouped) Adjustment

Taxable Amount

Deductible Amount

Tax Base

You might also like

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- Company Accounting 9th Edition Solutions PDFDocument37 pagesCompany Accounting 9th Edition Solutions PDFatup12367% (9)

- Sample Past Exam Questions RevisedDocument23 pagesSample Past Exam Questions RevisedAngie100% (2)

- AC100 Exam 2012Document17 pagesAC100 Exam 2012Ruby TangNo ratings yet

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionsReina Erasmo SulleraNo ratings yet

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionszeyyahjiNo ratings yet

- Deferred TaxDocument6 pagesDeferred TaxJayson Manalo GañaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- HUL EthicsDocument29 pagesHUL EthicsRimci KalyanNo ratings yet

- ACCT557 W2 AnswersDocument5 pagesACCT557 W2 AnswersDominickdad86% (7)

- Deferred Tax Asset and LiabilityDocument10 pagesDeferred Tax Asset and LiabilityCamille GarciaNo ratings yet

- Tutorial tax questionsDocument3 pagesTutorial tax questionsPardeep Ramesh AgarvalNo ratings yet

- Chapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Financial Accounting Part 2 Exam: Calculating Tax, Defined Benefit Plans, and SuperannuationDocument3 pagesFinancial Accounting Part 2 Exam: Calculating Tax, Defined Benefit Plans, and SuperannuationEumell Alexis PaleNo ratings yet

- Jasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentDocument5 pagesJasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentSiRo WangNo ratings yet

- Trimester 1, 2023 HI5020Document5 pagesTrimester 1, 2023 HI5020aminbayevbNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- Chapter 6: Accounting For Income Tax: Review QuestionsDocument10 pagesChapter 6: Accounting For Income Tax: Review QuestionsShek Kwun HeiNo ratings yet

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsDocument14 pagesAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document25 pagesChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- IAS 12 Income Tax GuideDocument18 pagesIAS 12 Income Tax GuideTawanda Tatenda HerbertNo ratings yet

- AC1025 ZB d1Document15 pagesAC1025 ZB d1Amna AnwarNo ratings yet

- AC1025 ZA d1Document12 pagesAC1025 ZA d1Amna AnwarNo ratings yet

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganNo ratings yet

- ACC 290 Week 3 Individual Assignment Exercise BE4-1, Problems 4-2A and 4-3ADocument18 pagesACC 290 Week 3 Individual Assignment Exercise BE4-1, Problems 4-2A and 4-3ADebora ElenoirNo ratings yet

- Chapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document15 pagesChapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- KPMBM - Bad Debts and Doubtful DebtsDocument51 pagesKPMBM - Bad Debts and Doubtful DebtsAhmad Hafiz50% (2)

- Practice Problems-Income Tax AccountingDocument3 pagesPractice Problems-Income Tax Accountingjsonnchun75% (4)

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- Taxable Income Calculation for ABC Partnership FirmDocument1 pageTaxable Income Calculation for ABC Partnership FirmSaad HassanNo ratings yet

- Unit 7 Tutorial HK Partnership TaxDocument4 pagesUnit 7 Tutorial HK Partnership TaxCkit1990No ratings yet

- 2012 Dec QCF QDocument3 pages2012 Dec QCF QMohamedNo ratings yet

- Acct 557Document5 pagesAcct 557kihumbae100% (4)

- Quiz 14P - Income TaxDocument5 pagesQuiz 14P - Income TaxDolaypanNo ratings yet

- Acct557 Quiz 2Document3 pagesAcct557 Quiz 2Natasha DeclanNo ratings yet

- CPGA QP May 2010 For PrintDocument20 pagesCPGA QP May 2010 For PrintfaizthemeNo ratings yet

- ACCO1115 - 2021 - JULY - EXAM - OnlineDocument11 pagesACCO1115 - 2021 - JULY - EXAM - OnlineSarah RanduNo ratings yet

- Workshop 6 SOL Additional QuestionDocument5 pagesWorkshop 6 SOL Additional Questiontimlee38100% (1)

- Aud Theo Part 2Document10 pagesAud Theo Part 2Naia Gonzales0% (2)

- CHAPTER - 5 - Exercise & ProblemsDocument6 pagesCHAPTER - 5 - Exercise & ProblemsFahad Mushtaq20% (5)

- Accounting For TaxDocument4 pagesAccounting For Taxhcw49539No ratings yet

- Income Tax 2Document12 pagesIncome Tax 2You're WelcomeNo ratings yet

- Chapter 18Document12 pagesChapter 18ks1043210No ratings yet

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- Financial Evaluation of Debenhams PLCDocument16 pagesFinancial Evaluation of Debenhams PLCMuhammad Sajid SaeedNo ratings yet

- Problem 1Document2 pagesProblem 1Shaira BugayongNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Number Maximum Mark Student Mark 1 17 2 11 3 18 4 10 5 12 6 10 7 12Document5 pagesNumber Maximum Mark Student Mark 1 17 2 11 3 18 4 10 5 12 6 10 7 12pinkyNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet

- Employee BenefitsDocument4 pagesEmployee BenefitsJiberlen MoralesNo ratings yet

- Mock E Exam Pap ERDocument19 pagesMock E Exam Pap ERtim_rattanaNo ratings yet

- Accounting IIIDocument5 pagesAccounting IIIJonathan SmokoNo ratings yet

- Ac557 W3 HW HBDocument2 pagesAc557 W3 HW HBHasan Barakat100% (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 4 AE AutomotionDocument1 page4 AE AutomotionKarthikeyan MallikaNo ratings yet

- Unit 6 Mutual FundDocument46 pagesUnit 6 Mutual Fundpadmakar_rajNo ratings yet

- How High Would My Net-Worth Have To Be. - QuoraDocument1 pageHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerNo ratings yet

- Selected Bibliography On The Right To Development PDFDocument32 pagesSelected Bibliography On The Right To Development PDFMatheus GobbatoNo ratings yet

- PPLCDocument5 pagesPPLCarjun SinghNo ratings yet

- Global Hotels and ResortsDocument32 pagesGlobal Hotels and Resortsgkinvestment0% (1)

- Bahco Chile 2021Document160 pagesBahco Chile 2021victor guajardoNo ratings yet

- Đề HSG Anh Nhóm 2Document4 pagesĐề HSG Anh Nhóm 2Ngọc Minh LêNo ratings yet

- Managing DifferencesDocument15 pagesManaging DifferencesAnonymous mAB7MfNo ratings yet

- Liquidity RatioDocument3 pagesLiquidity RatioJodette Karyl NuyadNo ratings yet

- Social ResponsibilityDocument2 pagesSocial ResponsibilityAneeq Raheem100% (1)

- No Plastic Packaging: Tax InvoiceDocument12 pagesNo Plastic Packaging: Tax Invoicehiteshmohakar15No ratings yet

- Part 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetDocument50 pagesPart 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetMary Rose De TorresNo ratings yet

- Labor Law - Durabuilt Vs NLRCDocument1 pageLabor Law - Durabuilt Vs NLRCEmily LeahNo ratings yet

- VAT Declaration FormDocument2 pagesVAT Declaration FormWedaje Alemayehu67% (3)

- Annual Report 2019 Final TCM 83-498650 PDFDocument153 pagesAnnual Report 2019 Final TCM 83-498650 PDFzain ansariNo ratings yet

- Bajaj Chetak PLCDocument13 pagesBajaj Chetak PLCVinay Tripathi0% (1)

- List of Companies: Group - 1 (1-22)Document7 pagesList of Companies: Group - 1 (1-22)Mohammad ShuaibNo ratings yet

- Mortgage 2 PDFDocument5 pagesMortgage 2 PDFClerry SamuelNo ratings yet

- Lead Dev Talk (Fork) PDFDocument45 pagesLead Dev Talk (Fork) PDFyosiamanurunNo ratings yet

- Sharma Industries (SI) : Structural Dilemma: Group No - 2Document5 pagesSharma Industries (SI) : Structural Dilemma: Group No - 2PRATIK RUNGTANo ratings yet

- Reference BikashDocument15 pagesReference Bikashroman0% (1)

- Balance StatementDocument5 pagesBalance Statementmichael anthonyNo ratings yet

- Nicl Exam GK Capsule: 25 March, 2015Document69 pagesNicl Exam GK Capsule: 25 March, 2015Jatin YadavNo ratings yet

- Agricultural Mechanisation Investment Potential in TanzaniaDocument2 pagesAgricultural Mechanisation Investment Potential in Tanzaniaavinashmunnu100% (3)

- Chapter 2 Consumer's BehaviourDocument14 pagesChapter 2 Consumer's BehaviourAdnan KanwalNo ratings yet

- Oxylane Supplier Information FormDocument4 pagesOxylane Supplier Information Formkiss_naaNo ratings yet

- Bilateral Trade Between Bangladesh and IndiaDocument30 pagesBilateral Trade Between Bangladesh and IndiaAnika ParvinNo ratings yet

- Geography Repeated Topics CSSDocument12 pagesGeography Repeated Topics CSSAslam RehmanNo ratings yet