Professional Documents

Culture Documents

S021987701100257X PDF

Uploaded by

jimakosjpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S021987701100257X PDF

Uploaded by

jimakosjpCopyright:

Available Formats

International Journal of Innovation and Technology Management Vol. 8, No.

4 (2011) 601613 c World Scientic Publishing Company DOI: 10.1142/S021987701100257X

TOTAL FACTOR PRODUCTIVITY AND R&D IN THE PRODUCTION FUNCTION

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

GORDON REIKARD U.S. Cellular, 8410 West Bryn Mawr Chicago, IL, 60631 Received 1 September 2009 Revised 6 December 2009 Accepted 7 December 2009

A production function is used to estimate total factor productivity and the contribution of R&D to growth. The impact of R&D is found to be higher than in most prior studies, for two reasons. First, the R&D stock is larger, due to the use of a longer time series with base values starting in 1921, and the assumption of no technical depreciation of knowledge. Second, the elasticity of R&D increases over time. In accounting for post-WWII growth, the results for 19481980 are consistent with earlier ndings. Technical advance accelerated dramatically in the 1960s, but collapsed in the mid-1970s. Starting in the early 1980s, however, the production function suggests a new interpretation. There was a stronger rebound in total factor productivity, lasting roughly through 2000. Thereafter, total factor productivity decelerated sharply in 20012007. The contribution of R&D to growth has varied over time. The largest eect occurred in 19481960. The impact of R&D fell o in the 1970s, and picked up to a smaller but still signicant eect starting in the 1980s. Despite the larger stock and the increasing elasticity, R&D is found to have contributed on average less than half of total factor productivity. Keywords : Total factor productivity; R&D; economic growth; production function.

1. Introduction Since the pioneering work of Solow [1957], it has been recognized that a substantial share of economic growth is comprised by technical advance, and that over long periods of time, the rate of technical advance can be approximated by the production function residual. The residual, generally called total factor productivity, is of course not a perfect measure of technology, since at shorter horizons it is extremely variable. Instead, the relationship between technology and the residual can be identied only at lower frequencies, on the order of at least a full business cycle. In the Solow model, technological advance was viewed as labor-augmenting, and was represented as a deterministic trend. As early as the mid-1960s, Jorgenson [1966] pointed out that technology could be capital-augmenting, and embodied in successive vintages of the capital stocks. Solow [1969] later demonstrated that even if technology is capital augmenting, the short-term dynamics could dier but the long-term implications of the model were essentially the same.

601

602

G. Reikard

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

The view that technical advance was deterministic was questioned in two branches of the literature. A wide range of papers, many of which relied on time series models rather than econometrics, demonstrated that the trend in output was more likely to be stochastic [Stock and Watson (1988); Christiano (1992)]. This view gained wide acceptance after the slowdown of the mid-1970s, in which productivity throughout the industrial countries failed to return to earlier growth rates. The second reason to question the deterministic trend emerged from the endogenous growth literature of Romer [1986, 1987, 1990, 1993], which implied that knowledge creation could accelerate or decelerate, depending on current economic conditions. Empirical studies found evidence of low-frequency variations in the rate of technical advance [Evans et al. (1998); Comin and Gertler (2003)]. Another source of support for the stochastic trend is the wide literature on correlating total factor productivity with empirical measures of technology. The extensive work of Griliches [1984] on patents and the work of Adams [1990] on indexes of scientic knowledge both indicate that idea that the rate of technical advance has shifted repeatedly. Yet another branch of the literature has endeavored to measure the share of total factor productivity comprised by R&D [see for instance Griliches (1984, 1988); Eckstein (1983); Verspagen (1995); Coe et al. (1995)]. It is generally recognized that R&D accounts for only a fractional share of total factor productivity. However, the estimates of the magnitude vary widely. They depend on the measurement of the stock of R&D, the rate of depreciation, and the elasticity of R&D in the production function. For a recent review of this literature, see Hall et al. (2009). This paper calculates new estimates for total factor productivity and the contribution of R&D to growth. Section 2 consists of a discussion of the production function. The measurement of the R&D stock is covered in Sec. 3. The production function is estimated in Sec. 4. An analysis of postwar economic growth is presented in Sec. 5. A key nding is that the rate of technical advance accelerated more rapidly from the early 1980s until 2000, but slowed thereafter. Section 6 concludes.

2. R&D and the Production Function The production function is in three factors, capital, labor, and R&D, while the elasticities are stochastic [Reikard (2005)]. Let YPt = potential output, Lt = labor, Kt = the capital stock, Rt = the stock of research and development, and t = residual technical advance. Let t = labors elasticity, t = elasticity of capital, and t = elasticity of R&D. The production function is: ln YPt = ln t + t ln Lt + t ln Kt + t ln Rt , (1)

where the t-subscripts on the elasticities indicate time variation. The stochastic parameters make it possible to capture both labor and capital augmentation. As noted in Granger [2007], any nonlinear model can in principle be approximated by a time-varying parameter model. Certain forms of capital, primarily computer and software capital, show strong evidence of embodied technology. Their elasticities increase sharply starting in the 1980s. The time-varying R&D elasticity also allows research to generate a steadily increasing impact. This can occur because scientic

Total Factor Productivity and R&D in the Production Function

603

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

ideas can lead to breakthroughs, or because R&D can give rise to new technologies with nonlinear impacts on growth. In the literature, there have been several approaches to estimating the impact of R&D. The rst method is to calculate total factor productivity and regress on the R&D stock. The second method is by factor shares [Christensen et al. (1973); Berndt and Christensen (1973)]. Let Yt = real output, Ft = a factor of production, and PFt = cost of the factor. The log marginal product of a factor ( ln Yt / ln Ft ) equates to the input elasticity (Ft ) and to the marginal product multiplied by the share of the factor in total output (Yt /Ft ) (Ft /Yt ). At the asymptotes, the marginal product and marginal cost are equivalent, so that (Yt /Ft ) converges to the ratio of the cost to overall prices (PFt /Pt ). Then, substituting the ratio of prices for the rst term in the expression (Yt /Ft ) (Ft /Yt ) yields the factor shares ratio: ln Yt ln Ft = Yt Ft Ft Yt = PFt Pt Ft Yt = PFt Ft Pt Yt = Ft . (2)

In the cases where payments are directly observed labor and housing the elasticity equates to the factor shares ratio. In the cases where payments are unobserved the other stocks of capital and R&D the elasticity can be estimated by regression of the factor shares ratio on the log of the stock. This method will yield valid estimates if the relationship between the input and output is contemporaneous, and if the factor shares ratio is stationary. In the case of R&D, however, both these assumptions are violated. The relationship between research and output is likely to be characterized by long lags. There can be a period of several years between the initial expenditure and the development of new products. More importantly, the factor shares ratio is nonstationary. In R&D, the ratio trends upward over time. By implication, the elasticity is also upwardly trending. The elasticity derived from a factor shares regression in levels will be downwardly biased. If the factor shares ratio is approximately integrated of order one, or I(1), the elasticity can be estimated by regressing the rst-dierence of the ratio on the log-dierence of the stock. A second idea is to estimate using time-varying parameter regressions, for instance by Kalman lter [Kalman (1960)]. All three methods regression of productivity on the stock, factor shares in rst-dierences, and factor shares in levels by Kalman lter are tested here, and used to calculate a range of estimates. While the methods do not agree completely, they dene the upper and lower boundaries for the impact of R&D.

3. The Measurement of R&D Table 1 summarizes the data sources. The basic source of R&D expenditures is the National Science Foundations National Patterns of R&D Resources, which is available at an annual frequency for the years 19532007 [NSF (2008); www.nsf.gov/statistics/natlpatterns]. This data is divided into basic and applied researches, and development, but is also broken out into sources of funds. From the

604

G. Reikard Table 1. The Data. Data Years of coverage Sources

Part I: R&D R&D funded by industry Billions of current dollars R&D funded by other sources Billions of current dollars R&D Price Indexes

19212007

19532007: National Science Foundation, National Patterns of R&D Resources database: www.nsf.gov/statistics/natlpatterns. 19211953: Bureau of Labor Statistics bulletin 2331 19532007: National Science Foundation, National Patterns of R&D Resources database: www.nsf.gov/statistics/natlpatterns. 19381959: Bureau of Labor Statistics bulletin 2331 19532007: National Science Foundation, National Patterns of R&D Resources database: www.nsf.gov/statistics/natlpatterns. 19211959: Bureau of Labor Statistics bulletin 2331

19382007

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

19212007

Part II: Stocks of physical capital Nominal capital stocks

19292007

National Income Accounts, Table 2.1, current-cost net stock of private xed assets, equipment and software, and structures by type www.bea.gov/national/FA2007 National Income Accounts, Table 2.2, chain-type quantity indexes for the xed assets, equipment and software, and structures by type www.bea.gov/national/FA2007 Calculated from the nominal and real capital stocks National Income Accounts, Table 1.1.5, gross domestic product www.bea.gov/national/nipaweb In the factor shares regressions, output includes R&D National Income Accounts, Table 1.1.6, gross domestic product www.bea.gov/national/nipaweb In the growth accounting tables, output includes R&D

Billions of current dollars Real capital stocks 19292007

Indexes Price Deators Part III: Output Nominal private sector output Billions of current dollars Real private sector output Billions of chained dollars Part IV: Labor National income Billions of current dollars. 19292007 19292007

19292007

19292007

National Income Accounts, Table 1.12, National Income by type. www.bea.gov/national/nipaweb Labors share is dened as wage accruals in the private sector, and one-half of proprietors income. Labors elasticity is dened as the ratio of labor income to national income Bureau of Labor Statistics, Employment, from the current population survey www.bls.gov National Income Accounts, Table 2.3.5, personal consumption expenditure by major type of product www.bea.gov/national/nipaweb The elasticity of residential capital is dened as the ratio of spending on housing, less expenses for operations, to national income

Employment Millions of employees Part V: Residential sector Share of housing in spending Billions of current dollars

19482007

19292007

Total Factor Productivity and R&D in the Production Function

605

standpoint of estimating by factor shares, the sources of funds data are more useful. Consequently, in the tests below, aggregate R&D is broken out into research funded by industry and other sources (the Federal, state, and local governments, Federal laboratories, and universities). For the last few years, the Bureau of Economic Analysis (BEA) at the U.S. Department of Commerce has been calculating R&D expenditures series as part of the satellite national income accounts initiative (www.bea.gov.national.rd.htm). This data is available starting in 1959, and diers marginally from the original NSF source. In order to compute the stocks, data prior to 1953 must be used. The source for these earlier values is Bureau of Labor Statistics [1989]. These prior series are broken out into private sector and government R&D, but not into basic and applied research. Private sector R&D began in 1921, while government R&D began in 1938. Consequently, the series for nominal R&D are calculated by splicing together the BLS data prior to 1953, and the NSF and BEA data from 1953 to 2007. To convert the nominal R&D series to real values, price indexes corresponding to these denitions are obtained from the same sources [see on this issue Jae (1972); Jankowski (1993)]. The next step is to convert the ow data into stocks. The key specication issue here is the rate of depreciation. In the BEA estimates for the R&D stock, 15% geometric depreciation is assumed [Sliker (2007)]. The explanation for this high depreciation rate is that the BEA stocks are designed to measure the value of R&D for the particular rm. However, more recent results published by the BLS are designed to measure the benets that spill over from the original investors to the rest of the economy. These estimates use longer lags and longer rates of depreciation [BLS (2009)]. As a result, the BLS R&D stocks are more than twice as large as the BEA values. The stocks used here are larger than both the BEA and BLS estimates, since they assume no technical depreciation of knowledge. This is based on several considerations. In principle, knowledge should not depreciate at the societal level. Even if particular knowledge becomes obsolete, or if scientic experiments fail, this can become the basis for future knowledge. Moreover, several prior studies have found that research can generate spillovers into the overall industry, the economy as a whole, and the rest of the world [Griliches et al. (1991); Bernstein and Nadiri (1991); Coe and Helpman (1995)]. There are several other reasons to question the assumption of rapid depreciation. If the rate of depreciation is positive, the eect from R&D in the production function could become negative, and returns from R&D would decline. Nevertheless, over periods of time on the order of a business cycle, the rate of technical advance is always observed to be positive. Further, several studies have found that the rate of return to research has increased over time [Lichtenberg and Siegel (1991); Lichtenberg (1995); Brynjolfsson and Kemerer (1996); Brynjolfsson and Yang (1996)]. A more subtle reason is grounded in neo-classical production theory. The equie ), like any private librium nominal stock of industry-funded research, denoted (RIt capital stock, is a negative function of the rental price (RIt ) and a positive function

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

606

G. Reikard

of nominal output: ln

e RIt Yt

= 0 1 ln RIt + 2 ln Yt .

(3)

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

The rental price of R&D is dened in accordance with Hall and Jorgenson [1967]. Let PKt = price of capital, PRt = price of R&D, Pt = aggregate price level, t = marginal tax rate on rms, t = investment tax credit, DAt = present value of depreciation allowances, It = cost of funds to the rm (in this instance, the interest e = expected rate plus a premium), DEt = the rate of economic depreciation, and Kt rate of ination for the particular form of capital [Struckmeyer (1996)]. The rental price is: Kt = PKt

e [(1 t DAt t )(It Kt + DEt )] . (1 t )

(4)

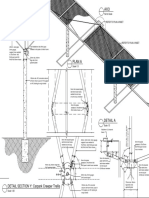

For the rental price of industry-funded R&D, economic depreciation is zero, while rst-year expensing means that DAt = 1. The rental price, therefore, simplies to the actual price and the tax-adjusted cost to the rm. From Eq. (3), the theoretical values of the elasticities are 1 for the rental price and 1 for output. Given this, a reasonable empirical test for the rate of technical depreciation is to estimate the stocks with dierent depreciation rates, and test the restrictions. As noted in Caballero [1994], an issue in regressions of this type is that the equilibrium stock and the adjustment of the actual stock toward its equilibrium value are negatively correlated, resulting in a downward bias in the OLS coecients. The solution is to use distributed lags over several years, on the assumption of gradual adjustment. Equation (3) was estimated for industry-funded R&D, using various rates of depreciation. When zero depreciation was assumed, the elasticity with respect to output was estimated at 1.07. F-tests on the restriction did not reject the theoretical value of unity. The elasticity with respect to the rental price was estimated at 1.09, and again, F -tests did not reject the theoretical restriction of 1.0. By comparison, with positive rates of depreciation, the estimated elasticities bear no resemblance to their theoretical values. Using 15% geometric depreciation, the coecients are 2.17 and 2.39. Even using 5% depreciation, the coecients are estimated at 1.56 and 1.48. By implication, the rate of depreciation of R&D that is most consistent with production theory is zero. To state the case more strongly, the restrictions implied by Eq. (3) reject any nonzero rate of technical depreciation. Accordingly, the R&D stocks for the private and government sectors were calculated by cumulating the nominal ows. The real values of the stocks were calculated by dividing by the deators. Figures 1 and 2 show the real stocks. The total stock of R&D increased rapidly in 19481968, growing by more than 11% annually. The surge was concentrated in the government sector, during the defense boom of the Cold War. Over the next decade, the increase in R&D was minimal: the real stock increased by only 1.9% per year. The R&D stock then picked up again, growing by 4.8% per year in 19792004. While government funding of R&D did not pick up until the Strategic Defense Initiative in the early 1980s, industry-funded R&D began to accelerate around 1979.

Total Factor Productivity and R&D in the Production Function

Natural logs of chain-weighted dollars

9.0 8.5 8.0 7.5 7.0 6.5 6.0

607

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

5.5 5.0 4.5 1948 1953 1958 1963 1968 1973 1978 1983 1988 1993 1998 2003

Fig. 1. The total stock of R&D, 19482007.

Natural logs ofchain-weighted dollars. Line =industry. Dashes = other sources.

8.4

7.2

6.0

4.8

3.6 1948 1953 1958 1963 1968 1973 1978 1983 1988 1993 1998 2003

Fig. 2. The stock of R&D, separate components, 19482007.

4. Estimation of the Production Function The next stage is to estimate the production function. The data denitions and sources are given in Table 1. Output is GDP in the private business sector, including industry-funded R&D. The stocks of capital are the stocks of residential and nonresidential structures, equipment (including machinery, transportation, residential, and other), and information processing (including computers, software, and other). The rates of depreciation and price deators correspond to the denitions of the capital stocks. In the rental price calculations for the capital and R&D stocks, the interest rate is the prime rate, plus two points [see Harper et al. (1989)]. The tax depreciation rates and investment tax credits are set in accordance with their historic values under Federal tax law. Labor inputs are calculated from employment in the private sector, from the BLS. Labors share in income is calculated from BEA

608

G. Reikard

values. One-half of proprietors income is imputed to labor. The housing elasticity is calculated as the ratio of expenditures for housing services, less expenditures for operations, to national income. The elasticities for labor and residential structures are computed using the shares in income and spending. The remaining elasticities are estimated using factor shares regressions. The inclusion of R&D in output is predicated on two considerations. The rst is consistency in the factor shares regressions, which should include research on both the left- and right-hand sides. The second is that there are plans to revise the national income accounts to include R&D in GDP, under business xed investment [Mataloni and Moylan (2007)]. At the current time, there is a discrepancy in the accounts, in that government-performed R&D is included in GDP under government purchases, while private sector R&D is excluded, and treated as an intermediate input. In estimating the factor shares regression for total R&D, the cost can in principle be specied as the weighted average of the rental price and the price index. In eect, for the government and nonprots, the cost is just the acquisition price. The factor shares regressions then yield the elasticities for total (Rt ) and industryfunded research (RIt ). The elasticity for other R&D can be derived as the dierence between the two: RN t = (Rt RIt ). Generally, factor shares regressions have been estimated by 3SLS, in order to deal with simultaneous equation bias. In order to allow for time variation, however, the two stages are carried out independently. The instrumental variables are created using two lags of all the RHS variables in the system. The second stage regressions are then grouped into a simultaneous equation system, and estimated by Kalman lter. On the grounds that the production function elasticities are slowly evolving quantities, the Kalman lter was restricted to allow coecients to vary by only 1% per year. Table 2 presents the elasticities. There is strong evidence for time-variation. The aggregate capital elasticity declines gradually, from 0.36 in 19481960 to 0.31 in 19912000, before increasing to 0.32 in 20002007. The residential elasticity rises gradually from 0.057 in 19481960 to 0.079 in 20002007. The information processing elasticity jumps from 0.016 to 0.028 with the advent of computers. Returns to scale in capital and labor are found to be decreasing, conrming earlier results in Boskin and Lau [1990]. In 19481960, the elasticity for aggregate R&D is estimated at 0.089, but this increases to 0.104 in 19611973. The elasticity declines slightly starting in the early 1970s, but then picks up again in the early 1990s. From this point forward, the elasticity increases continuously, averaging 0.102 in 19912000 and 0.112 in 20002007. By 2007, the elasticity has risen to 0.122. Additional estimates are presented for the disaggregated R&D stocks. The industry-funded stock shows a similar pattern, picking up sharply from the early 1990s onward. The elasticity of other R&D peaks in 19611973, and then gradually declines. The aggregate R&D elasticity was also estimated by direct regression, and by factor shares in dierences. In rst-dierences, the elasticity is nearly 20 basis points higher, 0.125 in 19912000 and reaching 0.14 by 2007 [comparable to Reikard

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

Total Factor Productivity and R&D in the Production Function Table 2. The production function elasticities.

609

19482007 19481960 19611973 19741980 19811990 19912000 20012007 Labor Capital Information processing Computers Software Other 0.620 0.333 0.023 0.006 0.004 0.015 0.080 0.033 0.022 0.021 0.004 0.636 0.378 0.016 0.003 0.002 0.016 0.103 0.038 0.028 0.027 0.010 0.629 0.322 0.023 0.005 0.004 0.015 0.085 0.035 0.023 0.023 0.004 0.629 0.321 0.023 0.005 0.003 0.015 0.083 0.034 0.023 0.022 0.003 0.615 0.323 0.026 0.007 0.004 0.016 0.070 0.030 0.019 0.019 0.002 0.600 0.305 0.027 0.007 0.005 0.014 0.060 0.027 0.016 0.016 0.002 0.620 0.324 0.028 0.007 0.007 0.014 0.065 0.028 0.018 0.017 0.002

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

Equipment Machinery Transportation Other Residential equipment Structures Nonresidential Residential R&D Industrial Other

0.117 0.067 0.098 0.043 0.055

0.127 0.057 0.089 0.039 0.050

0.119 0.066 0.104 0.038 0.066

0.119 0.066 0.096 0.038 0.058

0.115 0.069 0.094 0.041 0.052

0.108 0.074 0.102 0.052 0.051

0.111 0.079 0.112 0.064 0.049

(2005)]. However, in regressions of total factor productivity on the R&D stock, the elasticity is found to be lower, only 0.088 in 19912000. The latter value is closer to the consensus estimates from earlier studies reported in Griliches [1998]. The values reported in Table 2 (i.e., factor shares in levels by Kalman lter) are preferred in that they lie between these extremes, and in this sense capture the central tendency of the estimates.

5. Accounting for Postwar Economic Growth Table 3 presents an accounting for growth over selected periods. For the overall period 19482007, real output grew by 3.43% per year. Labor contributed 0.90 percentage points, and capital contributed 1.09 percentage points. Taken together, labor and capital accounted for 58% of output growth, while total factor productivity made up 42% of growth. On average, total factor productivity grew by 1.45% per year. The ndings for the early part of the Post-WWII period are consistent with earlier ndings. Technical advance accelerated dramatically in 19611973, but collapsed in 19741980 [see Hulten et al. (1989)]. From this point forward, however, the production function suggests a new interpretation. There was a stronger rebound starting in the early 1980s. Total factor productivity accelerated to 1.12% per year in 19811990 and 1.91% per year in 19912000. Technical advance accounted for 35% of growth in 19811990, and fully 52% of growth in 19912000. This has generally been attributed to computers and software [Jorgenson and Stiroh (1995, 2000); Sichel (1997)]. Conversely, total factor productivity decelerated sharply to 1.07% per year in 20012007.

610

G. Reikard

Table 3. Accounting for growth, selected periods. (Annual percent change, unless otherwise indicated). 19482007 19481960 19611973 19741980 19811990 19912000 20012007 Output Labor Capital Information processing Computers Software Other Equipment Machinery Transportation Other Residential equipment Nonresidential structures Residential structures Total factor productivity R&D total eect Industrial R&D Other R&D R&D combined eect Residual technology I Residual technology II Share of TFP in growth Share of R&D in TFP 3.43 0.90 1.09 0.31 0.15 0.07 0.14 0.28 0.11 0.06 0.08 0.03 0.30 0.20 1.45 3.05 0.51 1.14 0.09 0.09 0.50 0.18 0.07 0.14 0.10 0.34 0.21 1.40 4.97 1.07 1.37 0.38 0.15 0.11 0.15 0.37 0.14 0.11 0.10 0.03 0.38 0.23 2.52 2.66 1.34 1.17 0.36 0.14 0.04 0.18 0.31 0.12 0.08 0.10 0.02 0.32 0.17 0.15 3.25 1.17 0.96 0.38 0.17 0.05 0.16 0.09 0.05 0.01 0.02 0.01 0.33 0.17 1.12 3.70 0.87 0.92 0.40 0.18 0.07 0.15 0.16 0.06 0.06 0.03 0.01 0.18 0.18 1.90 2.32 0.57 0.68 0.21 0.09 0.03 0.09 0.09 0.03 0.01 0.04 0.01 0.13 0.23 1.07

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

0.60 0.27 0.35 0.62 0.84 0.82 0.42 0.42

1.10 0.38 0.72 1.10 0.30 0.30 0.46 0.78

0.66 0.25 0.47 0.72 1.86 1.81 0.51 0.26

0.07 0.07 0.05 0.12 0.08 0.03 0.06 0.50

0.50 0.26 0.26 0.52 0.62 0.60 0.35 0.45

0.51 0.33 0.20 0.53 1.39 1.37 0.52 0.27

0.35 0.28 0.11 0.39 0.72 0.68 0.46 0.33

Note: Columns may not add, due to rounding.

Table 3 presents two methods of accounting for the impact of R&D, using the single combined stock, or the separate stocks and elasticities for the two components. Two estimates are also presented for residual technical advance, i.e., total factor productivity less the eect from R&D, using both methods. In 19481960, R&D contributed 1.10 percentage points per year. In 19611973, the eect of R&D slowed to at most 0.72 and in 19741980, the contribution of R&D decreased to a negligibly small eect. From 1981 until 2000, the eect of R&D picked up to over 0.5 percentage points per year, but slackened o again in 20012007. This was due to slower growth in the stocks, which oset the increasing elasticity. Finally, Table 3 also presents the share of total factor productivity accounted for by R&D. This share has gradually declined, due both to the diminishing eect from

Total Factor Productivity and R&D in the Production Function

611

R&D, and to the greater contribution from residual technical advance. Nevertheless, the estimate here is higher than in other sources [BLS (2009)]. 6. Conclusions The contribution of R&D to growth is found to be larger than in most prior studies. The main reason for this is the higher elasticity. The lower values in the earlier work are due to two main factors, lower measures of the R&D stock (due partially to higher rates of depreciation), and failure to take account of the nonstationarity of the R&D factor shares ratio. Despite the fact that the elasticity is higher than the consensus, it is possible that when the eect of international R&D spillovers is taken into account; the true impact of research will be found to be higher [Coe et al. (2008)]. Nonetheless, the conundrum rst identied by Solow [1957] remains. A great deal of technical advance remains an unexplained residual. Despite the increasing higher elasticity, R&D is found to have contributed, on average, less than half of growth in total factor productivity. References

Adams, J. D. (1990). Fundamental stocks of knowledge and productivity growth, Journal of Political Economy, 98: 673702. Baxter, M. and King, R. (1995). Measuring business cycles: approximate band-pass lters for economic time series, Review of Economics and Statistics, 81: 575593. Berndt, E. R. and Christensen, L. R. (1973). The translog function and the substitution of equipment, structures and labor in U.S. manufacturing, 19291968, Journal of Econometrics, 1: 81114. Bernstein, J. and Nadiri, M. I. (1991). Product demand, cost of production, spillovers, and the social rate of return to R&D, National Bureau of Economic Research working paper #3625. Boskin, M. J. and Lau, L. J. (1990). Postwar economic growth in the Group-of-Five countries: a new analysis, Technical paper #217, Stanford University Center for Economic Policy Research, Stanford, CA. Brynjolfsson, E. and Kemerer, C. F. (1996). Network externalities in microcomputer software: an econometric analysis of the spreadsheet market, Management Science, 42: 16271647. Brynjolfsson, E. and Yang, S. (1996). Information technology and productivity: a review of the literature, Advances in Computing, 43: 179214. Bureau of Labor Statistics (2009). Contribution of Research and Development to Private Nonfarm Business Multifactor Productivity, Including Research and Development Stocks. www.bls.gov/Contribution of Research and Development to Private Nonfarm Business Multifactor Productivity including Research and Development stocks. Bureau of Labor Statistics (1989). The Impact of Research and Development on Productivity Growth, Washington, DC: Bureau of Labor Statistics Bulletin 2331. den Butter, F. A. G. and Wollmer, F. J. (1996). An empirical model for endogenous technology in the Netherlands, Economic Modelling, 1: 1540. Caballero, R. J. (1994). Small sample bias and adjustment costs, Review of Economics and Statistics, 76: 5258. Coe, D. T. and Helpman, E. (1995). International R&D spillovers, European Economic Review, 39: 859887. Coe, D. T., Helpman, E. and Homaister, A. W. (2008). International R&D Spillovers and Institutions. National Bureau of Economic Research working paper 14069.

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

612

G. Reikard

Christensen, L. R., Jorgenson, D. W. and Lau, L. J. (1973). Transcendental logarithmic production frontiers, Review of Economics and Statistics, 1: 2845. Christiano, L. J. (1992). Searching for a break in GNP, Journal of Business and Economic Statistics, 10: 237250. Comin, D. and Gertler, M. (2003). Medium-Term Business Cycles, New York University: Manuscript. Eckstein, O. (1983). The DRI Model of the U.S. Economy, New York: McGraw Hill. Evans, G., Honkapohja, S. and Romer, P. (1998). Growth cycles, American Economic Review, 88: 495515. Granger, C. W. J. (2008). Non-linear models: where do we go next Time varying parameter models? Studies in Nonlinear Dynamics and Econometrics, 12: Article 1. http:/ /www.bepress.cxom/snde/vol12/iss3/art1. Griliches, Z. (1984). R&D, Patents, and Productivity, Chicago, IL: University of Chicago Press. Griliches, Z., Hall, B. H. and Pakes, A. (1991). R&D, patents and market value revisited: is there a second technological opportunity factor?, Economics of Innovation and New Technology, 1: 183202. Griliches, Z. (1998). R&D and Productivity: The Econometric Evidence, Chicago, IL: University of Chicago Press. Hall, B. H., Mairesse, J. and Mohnen, P. (2009). Measuring the Returns to R&D, National Bureau of Economic Research working paper #15622. Hall, R. E. and Jorgenson, D. W. (1967). Tax policy and investment behavior, American Economic Review, 57: 391414. Harper, M. J., Berndt, E. R. and Wood, D. O. (1989). Rates of return and capital aggregation using alternative rental prices, in Jorgenson, D. W. and London, R. (eds.), Technology and Capital Formation. Cambridge, MA: MIT Press. Hulten, C. R., Robertson, J. W. and Wyko, F. C. (1989). Energy, obsolescence, and the productivity slowdown, in Jorgenson, D. W. and London, R. (eds.), Technology and Capital Formation, Cambridge, MA: MIT Press. Jankowski, J. (1993). Do we need a price index for industrial R&D?, Research Policy, 22: 195205. Jae, S. (1972). A price index for deation of academic R&D expenditures, National Science Foundation Paper, pp. 72310. Jorgenson, D. W. and Stiroh, K. J. (1995). Computers and growth, Economics of Innovation and New Technology, 3: 295316. Jorgenson, D. W. (1966). The embodiment hypothesis, Journal of Political Economy, 74: 117. Jorgenson, D. W. and Stiroh, K. J. (2000). Raising the speed limit: U.S. economic growth in the information age, Brookings Papers on Economic Activity, pp. 125212. Kalman, R. E. (1960). A new approach to linear ltering and prediction problems. Transactions of the American Society of Mechanical Engineers, Journal of Basic Engineering, 83: 3545. Lichtenberg, F. R. and Siegel, D. (1991). The impact of R&D investment on productivity: new evidence using linked R&D and LRD data, Economic Inquiry, 29: 203228. Lichtenberg, F. R. (1995). The output contributions of computer equipment and personnel: a rm-level analysis, Economics of Innovation and New Technology, 3: 207217. Mataloni, L. and Moylan, C. E. (2007). 2007 R&D satellite account methodologies: current dollar GDP estimates, Bureau of Economic Analysis Research Paper, www.bea.gov/papers.pdf/rdmethods gdp.pdf. National Science Foundation (2008). National Patterns of R&D Resources: 2007 Data Update. NSF 08-318. www.nsf.gov/statistic/nsf083818. Reikard, G. (2005). Endogenous technical advance and the stochastic trend in output: a neoclassical approach, Research Policy, 34: 14761490.

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

Total Factor Productivity and R&D in the Production Function

613

Int. J. Innovation Technol. Management 2011.08:601-613. Downloaded from www.worldscientific.com by 85.74.84.134 on 10/23/12. For personal use only.

Romer, P. M. (1986). Increasing returns and long-run growth, Journal of Political Economy, 94: 10021037. Romer, P. M. (1987). Growth based on increasing returns due to specialization, American Economic Review, 77: 5662. Romer, P. M. (1990). Endogenous technological advance, Journal of Political Economy, 98, S71S102. Romer, P. M. (1993). Idea gaps and object gaps in economic development, Journal of Monetary Economics, 32: 543573. Sichel, D. E. (1997). The Computer Revolution: An Economic Perspective, Washington, DC: Brookings Institution. Sliker, B. K. (2007). R&D Satellite Account Methodologies: R&D Capital Stocks and Net Rates of Return. Bureau of Economic Analysis/National Science Foundation R&D Satellite Account Background Paper. www.bea.gov/papers.pdf/kstocks1221.pdf. Solow, R. M. (1957). Technical change and the aggregate production function, Review of Economics and Statistics, 39: 312320. Solow, R. M. (1969). Investment and technical change, in Arrow, K. J. (ed.), Mathematical Models in the Social Sciences, Palo Alto, CA: Stanford University Press. Stock, J. and Watson, M. (1988). Variable trends in economic time series, Journal of Economic Perspectives, 3: 147174. Reprinted in Engle, R. F. and Granger, C. W. J. (eds.), Long-Run Economic Relationships, Readings in Cointegration. Oxford, Oxford University Press. Struckmeyer, C. S. (1986). The impact of energy price shocks on capital formation and economic growth in a putty-clay technology, Southern Economic Journal, 53: 127140. Verspagen, B. (1995). Endogenous innovation in neo-classical growth models, Journal of Macroeconomics, 14: 631662.

Biography Gordon Reikard is a statistician in industry. He has previously worked for Fortune 100 companies such as Sprint and Intel. His interests include the application of statistics to scientic databases. His papers have been published in journals such as Ocean Engineering, Advances in Space Research, and Wind Energy.

You might also like

- Measuring Total Factor Productivity, Technical Change and The Rate of Returns To Research and DevelopmentDocument31 pagesMeasuring Total Factor Productivity, Technical Change and The Rate of Returns To Research and DevelopmentEduardo QuiñonezNo ratings yet

- R&D, Innovation and The Total FactorDocument35 pagesR&D, Innovation and The Total Factor654501No ratings yet

- Investments in R&D and Business Performance. Evidence From The Greek MarketDocument15 pagesInvestments in R&D and Business Performance. Evidence From The Greek MarketmhldcnNo ratings yet

- Del Gatto ProductividadDocument57 pagesDel Gatto ProductividadAlicia DueñesNo ratings yet

- Pavitt (1984)Document31 pagesPavitt (1984)André Tortato RauenNo ratings yet

- Jones RDBased 1995Document27 pagesJones RDBased 1995shachirai17No ratings yet

- Concentration and Price-Cost Margins in Manufacturing IndustriesFrom EverandConcentration and Price-Cost Margins in Manufacturing IndustriesNo ratings yet

- Explicación Calculo TFPDocument34 pagesExplicación Calculo TFPJorge SalcedoNo ratings yet

- 1994 ProductivityDocument19 pages1994 ProductivityMurdoko RagilNo ratings yet

- 007 - Falk StrotebeckDocument16 pages007 - Falk StrotebeckIzza RNo ratings yet

- Infrastructure Shortage: A Gap ApproachDocument33 pagesInfrastructure Shortage: A Gap ApproachTony BuNo ratings yet

- Chapter No.46Document8 pagesChapter No.46Kamal Singh100% (1)

- The Determinants of Future Economic Growth - 0Document27 pagesThe Determinants of Future Economic Growth - 0Shivam KumarNo ratings yet

- (2006) Total Factor ProductivityDocument5 pages(2006) Total Factor ProductivityDavid SanchezNo ratings yet

- Content ServerDocument46 pagesContent ServerImjusttryingtohelpNo ratings yet

- Increasing Returns and Long-Run GrowthDocument36 pagesIncreasing Returns and Long-Run GrowthFábio Rasche Jr.No ratings yet

- Measuring Productivity Service Sector Sept enDocument17 pagesMeasuring Productivity Service Sector Sept enshashik1007730No ratings yet

- Hasan 2010Document13 pagesHasan 2010fw.priantoNo ratings yet

- Endogenous Growth TheoryDocument16 pagesEndogenous Growth TheoryMaimoona GhaniNo ratings yet

- Labor Productivity Growth: Disentangling Technology and Capital AccumulationDocument33 pagesLabor Productivity Growth: Disentangling Technology and Capital AccumulationCristina CNo ratings yet

- NECA Study - Impact On OvertimeDocument20 pagesNECA Study - Impact On OvertimeNektarios MatheouNo ratings yet

- Unconditional Convergence RevDocument41 pagesUnconditional Convergence Revqjyfzmt8d9No ratings yet

- What Determines Industrial R&D Expenditure in The UKDocument34 pagesWhat Determines Industrial R&D Expenditure in The UKHugo RodriguezNo ratings yet

- Does Domestic Saving Cause Economic GrowthDocument23 pagesDoes Domestic Saving Cause Economic GrowthAparajay SurnamelessNo ratings yet

- 1962 The Economic Implications of Learning by DoingDocument20 pages1962 The Economic Implications of Learning by DoingRodrigo BoufleurNo ratings yet

- NBER Macroeconomics Annual 2014: Volume 29From EverandNBER Macroeconomics Annual 2014: Volume 29Jonathan A. ParkerNo ratings yet

- Data PDFDocument71 pagesData PDFNurul NadiahNo ratings yet

- Long SumersDocument59 pagesLong Sumerswololo7No ratings yet

- The Relative Impact of Government and Private R&D On Productivity Growth: A Quantitative AnalysisDocument8 pagesThe Relative Impact of Government and Private R&D On Productivity Growth: A Quantitative AnalysisJhonatan GrisalesNo ratings yet

- Good OutputDocument24 pagesGood OutputluisNo ratings yet

- The AK Model of New Growth Theory Is The Harrod - Domar Growth EquationDocument10 pagesThe AK Model of New Growth Theory Is The Harrod - Domar Growth EquationAmaru Fernandez OlmedoNo ratings yet

- General Purpose Technologies: Engines of Growth?Document43 pagesGeneral Purpose Technologies: Engines of Growth?josecaceresNo ratings yet

- Endogenous Growth TheoryDocument16 pagesEndogenous Growth TheoryMaimoona GhaniNo ratings yet

- Hausman EconometricModelsCount 1984Document31 pagesHausman EconometricModelsCount 1984ellina syafaNo ratings yet

- Explaining The Broken Link Between R&D and GDP Growth: Preliminary: Do Not Cite Without PermissionDocument19 pagesExplaining The Broken Link Between R&D and GDP Growth: Preliminary: Do Not Cite Without PermissionHoang NguyenNo ratings yet

- Health - and - economic - growth (1) -مفتوحDocument62 pagesHealth - and - economic - growth (1) -مفتوحASSIANo ratings yet

- Romer IncreasingReturnsLongRun 1986Document37 pagesRomer IncreasingReturnsLongRun 1986shachirai17No ratings yet

- Transitional Dynamics in Two-Sector Models of Endogenous Growth.Document36 pagesTransitional Dynamics in Two-Sector Models of Endogenous Growth.skywardsword43No ratings yet

- The Economic Implications of Learning by Doing - ArrowDocument20 pagesThe Economic Implications of Learning by Doing - ArrowjosecaceresNo ratings yet

- Unemployment, Wage Bargaining and Capital-Labour SubstitutionDocument15 pagesUnemployment, Wage Bargaining and Capital-Labour SubstitutionHernanBuenosAiresNo ratings yet

- Li-Liu Modeling Finalpaper2010Document25 pagesLi-Liu Modeling Finalpaper2010Nikolai KondratiefNo ratings yet

- Salter 81Document33 pagesSalter 81sauravjhaNo ratings yet

- 1962, SchmooklerDocument12 pages1962, SchmooklerVictor Julian Paez RiveraNo ratings yet

- Total Factor ProductivityDocument6 pagesTotal Factor ProductivitySarita SamNo ratings yet

- 1.1 Models by CountryDocument18 pages1.1 Models by CountrymhldcnNo ratings yet

- BELL - & - PAVITT - Technological Accumulation and Industrial GrowthDocument54 pagesBELL - & - PAVITT - Technological Accumulation and Industrial GrowthJasar GraçaNo ratings yet

- Glyn, Does Aggregate Profitability Really Matter?Document27 pagesGlyn, Does Aggregate Profitability Really Matter?RyanNo ratings yet

- Romero Britto 2017Document22 pagesRomero Britto 2017Thalita BorgesNo ratings yet

- DP 10472Document31 pagesDP 10472Ron BrownNo ratings yet

- Real Money CycleDocument23 pagesReal Money Cycleanabuitrago843No ratings yet

- A New Empirical Approach To Catching Up or Falling Behind: ArticleDocument23 pagesA New Empirical Approach To Catching Up or Falling Behind: ArticleUjjwal Kumar DasNo ratings yet

- Patterns of Productivity Growth in South Korean Manufacturing Industries, 1963-1979Document19 pagesPatterns of Productivity Growth in South Korean Manufacturing Industries, 1963-1979AniAceNo ratings yet

- 1985 Foss PDFDocument6 pages1985 Foss PDFSantiago J. GahnNo ratings yet

- Arvanitis2008 Article DoSpecificFormsOfUniversity-inDocument30 pagesArvanitis2008 Article DoSpecificFormsOfUniversity-inMiguel MazaNo ratings yet

- 1215 @xyserv1/disk4/CLS - JRNLKZ/GRP - qjec/JOB - qjec113-4/DIV - 031a08 DawnDocument30 pages1215 @xyserv1/disk4/CLS - JRNLKZ/GRP - qjec/JOB - qjec113-4/DIV - 031a08 DawnVinoth HariNo ratings yet

- Technical Change Effective Demand and EmploymentDocument21 pagesTechnical Change Effective Demand and EmploymentKedir YesufNo ratings yet

- Potential of Poka-Yoke Devices To Reduce Variability in ConstructionDocument12 pagesPotential of Poka-Yoke Devices To Reduce Variability in ConstructionAliirshad10No ratings yet

- Growth and Asian ExperienceDocument44 pagesGrowth and Asian ExperiencefabyunaaaNo ratings yet

- Technology and The Dynamics of Industrial Structures: An Empirical Mapping of Dutch ManufacturingDocument26 pagesTechnology and The Dynamics of Industrial Structures: An Empirical Mapping of Dutch ManufacturingFede LongNo ratings yet

- Poincaré Embeddings For Learning Hierarchical RepresentationsDocument29 pagesPoincaré Embeddings For Learning Hierarchical RepresentationsjimakosjpNo ratings yet

- An Emotion-Aware Voice Portal: Felix Burkhardt, Markus Van Ballegooy, Roman Englert, Richard HuberDocument9 pagesAn Emotion-Aware Voice Portal: Felix Burkhardt, Markus Van Ballegooy, Roman Englert, Richard HuberjimakosjpNo ratings yet

- Nogueiras, Moreno, Bonafonte, Mariño - 2001 - Speech Emotion Recognition Using Hidden Markov ModelsDocument4 pagesNogueiras, Moreno, Bonafonte, Mariño - 2001 - Speech Emotion Recognition Using Hidden Markov ModelsjimakosjpNo ratings yet

- Space TechnologyDocument10 pagesSpace TechnologyjimakosjpNo ratings yet

- Geophys. J. Int. 1997 Matthews 526 9Document4 pagesGeophys. J. Int. 1997 Matthews 526 9jimakosjpNo ratings yet

- Elger EdDocument5 pagesElger EdjimakosjpNo ratings yet

- DownloadDocument9 pagesDownloadjimakosjpNo ratings yet

- 646 FullDocument5 pages646 FulljimakosjpNo ratings yet

- 5430 FullDocument4 pages5430 FulljimakosjpNo ratings yet

- IFR CalculationDocument15 pagesIFR CalculationSachin5586No ratings yet

- Lesson: The Averys Have Been Living in New York Since The Late NinetiesDocument1 pageLesson: The Averys Have Been Living in New York Since The Late NinetiesLinea SKDNo ratings yet

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Document9 pagesISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602No ratings yet

- Particle BoardDocument1 pageParticle BoardNamrata RamahNo ratings yet

- 100 20210811 ICOPH 2021 Abstract BookDocument186 pages100 20210811 ICOPH 2021 Abstract Bookwafiq alibabaNo ratings yet

- Lab 2 - Using Wireshark To Examine A UDP DNS Capture Nikola JagustinDocument6 pagesLab 2 - Using Wireshark To Examine A UDP DNS Capture Nikola Jagustinpoiuytrewq lkjhgfdsaNo ratings yet

- T-Tess Six Educator StandardsDocument1 pageT-Tess Six Educator Standardsapi-351054075100% (1)

- OVDT Vs CRT - GeneralDocument24 pagesOVDT Vs CRT - Generaljaiqc100% (1)

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- Homework 1Document8 pagesHomework 1Yooncheul JeungNo ratings yet

- Use of Travelling Waves Principle in Protection Systems and Related AutomationsDocument52 pagesUse of Travelling Waves Principle in Protection Systems and Related AutomationsUtopia BogdanNo ratings yet

- Revit 2023 Architecture FudamentalDocument52 pagesRevit 2023 Architecture FudamentalTrung Kiên TrầnNo ratings yet

- PreviewpdfDocument83 pagesPreviewpdfJohana GavilanesNo ratings yet

- Timetable - Alton - London Timetable May 2019 PDFDocument35 pagesTimetable - Alton - London Timetable May 2019 PDFNicholas TuanNo ratings yet

- Zygosaccharomyces James2011Document11 pagesZygosaccharomyces James2011edson escamillaNo ratings yet

- Baxter - Heraeus Megafuge 1,2 - User ManualDocument13 pagesBaxter - Heraeus Megafuge 1,2 - User ManualMarcos ZanelliNo ratings yet

- Ch06 Allocating Resources To The ProjectDocument55 pagesCh06 Allocating Resources To The ProjectJosh ChamaNo ratings yet

- Eu Schengen Catalogue enDocument54 pagesEu Schengen Catalogue enSorin din ConstanțaNo ratings yet

- Le Chatelier's Principle Virtual LabDocument8 pagesLe Chatelier's Principle Virtual Lab2018dgscmtNo ratings yet

- Formal Letter LPDocument2 pagesFormal Letter LPLow Eng Han100% (1)

- A Review of Mechanism Used in Laparoscopic Surgical InstrumentsDocument15 pagesA Review of Mechanism Used in Laparoscopic Surgical InstrumentswafasahilahNo ratings yet

- Pest of Field Crops and Management PracticalDocument44 pagesPest of Field Crops and Management PracticalNirmala RameshNo ratings yet

- Information Technology Project Management: by Jack T. MarchewkaDocument44 pagesInformation Technology Project Management: by Jack T. Marchewkadeeps0705No ratings yet

- TrellisDocument1 pageTrellisCayenne LightenNo ratings yet

- AstmDocument5 pagesAstmyanurarzaqaNo ratings yet

- #Angles Are in Degrees: EGR2313 HW SOLUTIONS (2021)Document4 pages#Angles Are in Degrees: EGR2313 HW SOLUTIONS (2021)SolomonNo ratings yet

- M.Plan SYLLABUS 2022-24Document54 pagesM.Plan SYLLABUS 2022-24Mili DawsonNo ratings yet

- Building A Pentesting Lab For Wireless Networks - Sample ChapterDocument29 pagesBuilding A Pentesting Lab For Wireless Networks - Sample ChapterPackt PublishingNo ratings yet

- Innovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschDocument28 pagesInnovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschacairalexNo ratings yet

- PCI Bridge ManualDocument34 pagesPCI Bridge ManualEm MarNo ratings yet