Professional Documents

Culture Documents

Summary - Deregulation of Sugar Sector - Final

Uploaded by

Sreekanth ReddyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary - Deregulation of Sugar Sector - Final

Uploaded by

Sreekanth ReddyCopyright:

Available Formats

Report Summary

Report of the Committee on the Regulation of Sugar Sector in India: The Way Forward

The Economic Advisory Council to the Prime Minister (Chairperson: C. Rangarajan) submitted a Report on the Regulation of Sugar Sector in India: The Way Forward on October 5, 2012. The Report examines the issues related to the regulation of the sugar sector, and suggests ways to promote efficiency and investments in the sector. However, this arrangement reduces the bargaining power of the farmer. He is forced to sell to a mill even if there are cane arrears (occurs when sugar mill owners delay payment to farmers for the sugarcane supplied). Mills, on their part, lose flexibility in augmenting cane supplies, especially when there is a shortfall in sugarcane production in the cane reservation area. Mills are also restricted to the quality of cane that is supplied by farmers in the area. The Committee recommended that over a period of time, states should encourage development of marketbased long-term contractual arrangements, and phase out cane reservation area and bonding. Such individual contracts with farmers would give them the flexibility to decide which mill they want to sell their produce to. ii. Minimum distance criterion- Under the Sugarcane Control Order, the central government has prescribed a minimum radial distance of 15 km between any two sugar mills. This regulation is expected to ensure a minimum availability of cane for all mills. However, this criterion often causes distortion in the market. The virtual monopoly over a large area can give the mills power over farmers, especially where landholdings are smaller. In addition to restricting competition, the regulation inhibits entry and further investment by entrepreneurs. In order to increase competition and ensure a better price for farmers, the Committee recommended that the distance norm be reviewed. Removing the regulation will ensure better prices for farmers and force existing mills to pay them the cane price on time. iii. Price of sugarcane- The central government fixes a minimum price, the Fair and Remunerative Price (FRP) that is paid by mills to farmers. States can also intervene in sugarcane pricing with a State Advised Price (SAP) to strengthen farmers interests. Typically, SAP is higher than FRP. There have been divergent views on which is a fair price to both farmers and millers.

Current regulations in the sugar sector and recommendations

A major step to liberate the sugar sector from controls was taken in 1998 when the licensing requirement for new sugar mills was abolished. Delicensing caused the installed capacity in the sugar sector to grow at almost 7% annually between 1998-99 to 2011-12 compared to 3.3% annually between 1990-91 to 1997-98. Delicensing also contributed significantly to a structural transformation in the sugar industry. Till 1997-98, sugar cooperatives dominated the sugar industry but by 2011-12 this changed significantly with the private sector contributing the largest share of total installed capacity. Although delicensing removed some regulations in the sugar sector, other regulations persisted. The drivers for regulations were: (i) the highly perishable nature of sugarcane; (ii) the small land holdings of sugarcane farmers; and (iii) the need to keep the price of sugar at reasonably affordable levels while making it available through the Public Distribution System (PDS). However, the Committee found that existing regulations were stunting the growth of the industry and recommended that the sector be deregulated. Deregulation would enable the industry to leverage the expanding opportunities created by the rising demand of sugar and sugarcane as a source of renewable energy. The principal aspects regulated in the sugar sector, the issues that arise due to such regulations, and the Committees recommendations, are as follows: i. Cane reservation area and bonding- Every designated mill is obligated to purchase from cane farmers within the cane reservation area, and conversely, farmers are bound to sell to the mill. This ensures a minimum supply of cane to a mill, while committing the mill to procure at a minimum price.

Sakshi Balani sakshi@prsindia.org

PRS Legislative Research

November 1, 2012

Centre for Policy Research Dharma Marg Chanakyapuri Tel: (011) 2611 5273-76, Fax: 2687 2746 www.prsindia.org

New Delhi 110021

Report Summary

PRS Legislative Research

The Committee recommended that states should not declare an SAP. It suggested determining cane prices according to scientifically sound and economically fair principles. The committee agreed that sharing of the revenues/value created in the sugarcane production chain should be in a ratio of 70:30 between farmers and millers. This ratio should also apply to the revenue generated from sale of primary by-products of sugar. Thus, actual payment for cane dues would happen in two steps. The first would be a payment of a floor price (FRP) from mills to farmers. Balance payment of cane dues will depend on the final sugar price that mills sell at. These dues will be split between farmers and millers on the lines indicated above. iv. Levy sugar obligation- Every sugar mill mandatorily surrenders 10% of its production to the central government at a price lower than the market price this is known as levy sugar. This enables the central government to get access to low cost sugar stocks for distribution through PDS. At present prices, the centre saves about Rs 3,000 crore on account of this policy, the burden of which is borne by the sugar sector. The policy of levy sugar puts the burden of a government social welfare programme (PDS) on the industry. A price lower than the open market price implies lower returns for mills, which eventually impacts cane payments to farmers. The Committee recommended dispensing with levy sugar and doing away with a centralized arrangement for PDS sugar. States that want to provide sugar under PDS may henceforth procure it directly from the market. v. Regulated release of non-levy sugar- The central government allows the release of non-levy sugar into the market on a periodic basis. Currently, release orders are on a quarterly basis. Thus, sugar produced over the four-to-six month sugar season is sold throughout the year by distributing the release of stock evenly across the year. The mechanism of regulated release imposes costs directly on mills (and hence indirectly on farmers). Mills can neither take advantage of high prices to sell the maximum possible stock, nor dispose of their stock to raise cash for meeting various obligations. This adversely impacts the ability of mills to pay sugarcane farmers in time. The Committee recommended removing the regulations on release of non-levy sugar. Removal of

these controls will improve the financial health of the sugar mills. This, in turn, will lead to timely payments to farmers and a reduction in cane arrears. vi. Trade policy for sugar- The government has set controls on both exports and imports. These controls are imposed after taking into account the domestic availability, demand and price of sugarcane. A number of cascading import controls and export permits are used to achieve this. As a result, Indias trade in the world trade of sugar is small. Even though India contributes 17% to global sugar production (second largest producer in the world), its share in exports is only 4%. This has been at the cost of considerable instability for the sugar cane industry and its production. All existing quantitative restrictions on trade in sugar should be removed and converted into tariffs. Appropriate tariff in the form of a moderate duty on imports and exports, not exceeding 5-10%, should be applied. Such a trade policy will be neutral to consumers and producers. The tariff can be changed when world prices are very high or low. vii. Regulations relating to by-products- Certain restrictions have been placed on by-products of sugarcane such as molasses and bagasse. State governments fix quotas for different end uses of molasses and restrict their movement, particularly across state boundaries. Some states have also imposed restrictions on the mills that can sell power generated from bagasse to users other than the local power utility. Mills are also restricted from selling power generated from bagasse to other states. Such restrictions impede the revenue realization from cogeneration and reduce economic efficiency. The committee recommended that there should be no restrictions on sale of by-products and prices should be market determined. States should also undertake policy reform to allow mills to harness power generated from bagasse. viii. Other issues- The Jute Packaging Materials (Compulsory use in Packing Commodities) Act, 1987 (JPMA) mandates that sugar be packed only in jute bags. The sugar industry estimates that this leads to an increase in cost by about 40 paise per kg of sugar besides adversely impacting quality. The committee recommended removing the sugar industry from the purview of the JPMA.

DISCLAIMER: This document is being furnished to you for your information. You may choose to reproduce or redistribute this report for noncommercial purposes in part or in full to any other person with due acknowledgement of PRS Legislative Research (PRS). The opinions expressed herein are entirely those of the author(s). PRS makes every effort to use reliable and comprehensive information, but PRS does not represent that the contents of the report are accurate or complete. PRS is an independent, not-for-profit group. This document has been prepared without regard to the objectives or opinions of those who may receive it.

November 1, 2012

You might also like

- Service Allocation of 2013 Batch Civil ServantsDocument89 pagesService Allocation of 2013 Batch Civil ServantsSreekanth Reddy100% (3)

- Sino-Indian Relations Contours Across The PLA Intrusion CrisesDocument6 pagesSino-Indian Relations Contours Across The PLA Intrusion CrisesSreekanth ReddyNo ratings yet

- Service Allocation of 2013 Batch Civil ServantsDocument89 pagesService Allocation of 2013 Batch Civil ServantsSreekanth Reddy100% (3)

- Gatt 1994Document2 pagesGatt 1994anirudhsingh0330No ratings yet

- New Scheme IFSE2013Document1 pageNew Scheme IFSE2013Sreekanth ReddyNo ratings yet

- 11 13 EngDocument9 pages11 13 EngPushan Kumar DattaNo ratings yet

- Ultra Mega ProjectDocument8 pagesUltra Mega ProjectSiddharth ManiNo ratings yet

- Social Reform MovementsDocument8 pagesSocial Reform MovementsSreekanth ReddyNo ratings yet

- 2668Document2 pages2668Imelda RozaNo ratings yet

- Foreign Trade Policy 2009-2014Document112 pagesForeign Trade Policy 2009-2014shruti_siNo ratings yet

- Direct and Indirect Effects of Fdi On Current Account: Jože Mencinger EIPF and University of LjubljanaDocument19 pagesDirect and Indirect Effects of Fdi On Current Account: Jože Mencinger EIPF and University of LjubljanaSreekanth ReddyNo ratings yet

- Importance and Challenges of Ethics PDFDocument10 pagesImportance and Challenges of Ethics PDFDinesh KumarNo ratings yet

- IB DefenceOffsetGuidelines 050813Document6 pagesIB DefenceOffsetGuidelines 050813Sreekanth ReddyNo ratings yet

- Handbook of Climate Change and India OUPDocument1 pageHandbook of Climate Change and India OUPSreekanth ReddyNo ratings yet

- Y V Reddy: Indian Economy - Current Status and Select IssuesDocument3 pagesY V Reddy: Indian Economy - Current Status and Select IssuesSreekanth ReddyNo ratings yet

- India's Gold Economy and Policy ReviewDocument11 pagesIndia's Gold Economy and Policy ReviewSreekanth ReddyNo ratings yet

- Sample Paper of Upsc EthicsDocument2 pagesSample Paper of Upsc EthicsKarakorammKaraNo ratings yet

- Media EthicsDocument11 pagesMedia EthicsSreekanth Reddy100% (2)

- Importance and Challenges of Ethics PDFDocument10 pagesImportance and Challenges of Ethics PDFDinesh KumarNo ratings yet

- Ethics in The History of Indian PhilosophyDocument12 pagesEthics in The History of Indian PhilosophySreekanth ReddyNo ratings yet

- Seabuckthorn @sandeepDocument3 pagesSeabuckthorn @sandeepSreekanth ReddyNo ratings yet

- Union Budget 2011-12: HighlightsDocument14 pagesUnion Budget 2011-12: HighlightsNDTVNo ratings yet

- Nature and Scope of EthicsDocument10 pagesNature and Scope of EthicsSreekanth ReddyNo ratings yet

- Indian ReformDocument34 pagesIndian ReformSreekanth ReddyNo ratings yet

- CH 05 PDFDocument17 pagesCH 05 PDFDrRaanu SharmaNo ratings yet

- Cyber Security PolicyDocument21 pagesCyber Security PolicyashokndceNo ratings yet

- WHO - Climate Change and Human Health - Risks and Responses - SummaryDocument28 pagesWHO - Climate Change and Human Health - Risks and Responses - SummarySreekanth ReddyNo ratings yet

- Nonalignment 2Document70 pagesNonalignment 2Ravdeep SinghNo ratings yet

- Disaster Management VIII Together Towards A Safer India Part-I @sina @maxiDocument63 pagesDisaster Management VIII Together Towards A Safer India Part-I @sina @maxiblu_diamond2450% (8)

- Bt Brinjal Consultations Primer Issues ProspectsDocument26 pagesBt Brinjal Consultations Primer Issues ProspectsVeerendra Singh NagoriaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Formed Police Units in United Nations Peacekeeping OperationsDocument26 pagesFormed Police Units in United Nations Peacekeeping OperationsparapoliticalNo ratings yet

- Executive Order No. 292 (BOOK IV/Chapter 2-Secretaries, Undersecretaries, and Assistant Secretaries)Document2 pagesExecutive Order No. 292 (BOOK IV/Chapter 2-Secretaries, Undersecretaries, and Assistant Secretaries)Carmela LopezNo ratings yet

- Cunningham Priors On April Motion To EnhanceDocument1 pageCunningham Priors On April Motion To EnhanceJohn S KeppyNo ratings yet

- Philippine Politics and Governance PretestDocument2 pagesPhilippine Politics and Governance PretestAnnabel MarianasNo ratings yet

- Guide To OK Corral NewDocument16 pagesGuide To OK Corral NewCarlos OjedaNo ratings yet

- CryDocument6 pagesCryGrasya CatacutanNo ratings yet

- Basque and Catalan nationalism before the Spanish Civil War: Explaining differences in programmatic characterDocument30 pagesBasque and Catalan nationalism before the Spanish Civil War: Explaining differences in programmatic charactergerardglledaNo ratings yet

- IICS ConnectionDocument29 pagesIICS ConnectionsahilNo ratings yet

- Article 1341-1355 ObliconDocument2 pagesArticle 1341-1355 Obliconporeoticsarmy0% (1)

- Sample Accounting Issues Memo 1 - Gross Vs NetDocument4 pagesSample Accounting Issues Memo 1 - Gross Vs NetAnkit MrCub Patel100% (1)

- التحفيزات الجبائيةDocument18 pagesالتحفيزات الجبائيةbouamama bNo ratings yet

- People V GoDocument33 pagesPeople V GoaratanjalaineNo ratings yet

- Cordero Vs CabralDocument11 pagesCordero Vs CabralPatrick RamosNo ratings yet

- Parallel Lines and Transversals PDFDocument2 pagesParallel Lines and Transversals PDFRonnieMaeMaullionNo ratings yet

- Bulletin Publishing Corp. v. NoelDocument2 pagesBulletin Publishing Corp. v. NoelRhea CalabinesNo ratings yet

- GR No 202789 Cir VS PuregoldDocument11 pagesGR No 202789 Cir VS PuregoldSERVICES SUBNo ratings yet

- Thursday, May 29, 2014 EditionDocument20 pagesThursday, May 29, 2014 EditionFrontPageAfricaNo ratings yet

- PAN Change Request FormDocument6 pagesPAN Change Request FormAlok ShahNo ratings yet

- Pharmaceutical Deviation Report System QMS-035 SampleDocument9 pagesPharmaceutical Deviation Report System QMS-035 SampleMostafa FawzyNo ratings yet

- 4 - Cir Vs San Roque Power CorpDocument15 pages4 - Cir Vs San Roque Power CorpcloudNo ratings yet

- Crim Prac - Proc - Unit 9Document36 pagesCrim Prac - Proc - Unit 9Devon ButeNo ratings yet

- 01.yau Chu Vs CA G.R. No. L-78519Document2 pages01.yau Chu Vs CA G.R. No. L-78519Anasor GoNo ratings yet

- LAW305: Understanding Media and LawDocument1 pageLAW305: Understanding Media and LawMansi MalikNo ratings yet

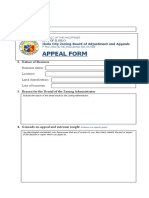

- Appeal or Petition Form for Iloilo City Zoning BoardDocument6 pagesAppeal or Petition Form for Iloilo City Zoning BoardRudiver Jungco JrNo ratings yet

- Garcia v. Philippine Airlines, GR 164856, Jan. 20, 2009Document8 pagesGarcia v. Philippine Airlines, GR 164856, Jan. 20, 2009Noela Glaze Abanilla DivinoNo ratings yet

- Phys 1 PracDocument17 pagesPhys 1 PracJoseph AzrakNo ratings yet

- Report in Philo 1Document2 pagesReport in Philo 1XXXXXNo ratings yet

- United Polyresins v. PinuelaDocument3 pagesUnited Polyresins v. PinuelaIge OrtegaNo ratings yet

- World Mission Conferences 1910-2010Document4 pagesWorld Mission Conferences 1910-2010P Cristhian HolguínNo ratings yet

- Easergy P3: Quick Start - IECDocument46 pagesEasergy P3: Quick Start - IECdaniela sayuriNo ratings yet