Professional Documents

Culture Documents

Preface: Executive Summary

Uploaded by

Ghulam AbbasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preface: Executive Summary

Uploaded by

Ghulam AbbasCopyright:

Available Formats

Preface

etting practical knowledge in one of the major aims of BBA program. Department of Business Administration FAST NATIONAL UNIVERSITY, City Campus, Karachi has followed policy of assigning different practical assignments to its students so a touch of real working environment can be given to the students apart from classroom studies to widen their perspective. In this context, respectable Chairman of Training Division Mr. ABDUL RAFAY QADRI assigned me to do internship in Soneri Bank. This internship report consists of two findings to work in the different departments of bank and gathered useful information from different sources. I hope that the readers of this report will get valuable information about Soneri Bank Karachi.

Author AMNA JAHANGIR

EXECUTIVE SUMMARY

The banking structure in Pakistan comprises of the following types, State Bank of Pakistan, Commercial bank of Pakistan, Exchange Bank, Saving Bank, cooperative banks, specialized credit institutions. In six week internship program, I have worked in almost all departments of General banking. I have learned about the banking from experienced managers running these departments.

This report contains the information about SBL that I have gathered during my six weeks internship period. This report basically deals in General banking departments of SBL Malir branch where I worked as internee . The bank is using SWIFT for transfer of information about imports and exports. SBL Malir branch basically a smaller branch so it does not have particular department for trade and credit. To open an account the customer has to meet account opening officer with an introducer. The introducer must have an account in bank, or introducer might be the employee of the bank. Soneri bank strictly followed the account opening procedure. The bank cant open an account of customer before the verifications comes from NADRA. SBL has different types of account like, Basic Banking A/C. Current account, PLS and Soneri PLS A/C. They store all the information of their customers in data base. After entering data, they assigned customer an ID is known as Customer Relationship Management ID. He told me with the help of this ID their different branches can easily get information about customer account. In clearing and remittances section they have very efficient system. They clear the cheque through NIFT (National Institute of Facilitation Technology) where SBP exits. In remittances they told me about T.T D.D. and pay orders. Now people prefer D.D instead of T.T. D.D is a banker instrument and draft used for outside the city. It is valid for six month. Bank use pay order, when the payment is to be made with in a city.

MISSION STATEMENT

To developed Soneri bank Limited into an aggressive and dynamic financial institution having the capabilities to provide personalized service to the customers with cutting edge technology and a wide range of products, and during the process to ensure maximum return on assets with ultimate goal of serving the economy and society.

We have more time for you

You might also like

- Bank of Punjab: Xecutive SummaryDocument11 pagesBank of Punjab: Xecutive SummaryAnonymous LKbSeDNo ratings yet

- Credit Appraisal3Document99 pagesCredit Appraisal3Bharat AhujaNo ratings yet

- Banking System Analysis of IFIC Bank LimitedDocument28 pagesBanking System Analysis of IFIC Bank LimitedMd Omar FaruqNo ratings yet

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaNo ratings yet

- Bank of India Project ReportDocument102 pagesBank of India Project ReportAbhishek Mittal0% (1)

- NCC Bank ReportDocument65 pagesNCC Bank Reportইফতি ইসলামNo ratings yet

- Credit Management System of Social IslamDocument61 pagesCredit Management System of Social IslamShazidNo ratings yet

- 7'p's of Marketing MixDocument78 pages7'p's of Marketing MixDharmikNo ratings yet

- Bank Internship ReportDocument7 pagesBank Internship ReportWajeeha AslamNo ratings yet

- FINAL Internship Report of Askari BankDocument127 pagesFINAL Internship Report of Askari BankHammad Ahmad100% (1)

- 7 P S of Marketing Mix PDFDocument78 pages7 P S of Marketing Mix PDFanil gondNo ratings yet

- Chapter - 01: Intern Report On Evaluation of Job Satisfication of Social Islami Bank LimitedDocument73 pagesChapter - 01: Intern Report On Evaluation of Job Satisfication of Social Islami Bank LimitedRedwan FerdousNo ratings yet

- National BankDocument60 pagesNational BankMridhaDeAlamNo ratings yet

- Ijaz KhanDocument78 pagesIjaz Khanwaqar ahmadNo ratings yet

- Executive Summary:: The Bank of PunjabDocument40 pagesExecutive Summary:: The Bank of PunjabLucifer Morning starNo ratings yet

- Gunjan Aggarwal Report On Credit AppraisalDocument77 pagesGunjan Aggarwal Report On Credit AppraisalgunjanNo ratings yet

- Axis Bank Financial Overview of Axis Bank Comparative Study of Current Account and Saving AccDocument94 pagesAxis Bank Financial Overview of Axis Bank Comparative Study of Current Account and Saving AccJaiHanumankiNo ratings yet

- Internship Report On MCB Bank LTDDocument66 pagesInternship Report On MCB Bank LTDbbaahmad89No ratings yet

- Internship Report On CreditDocument68 pagesInternship Report On CreditMd Dipu ChowdhuryNo ratings yet

- General Banking Activities of Standard Bank Ltd.Document40 pagesGeneral Banking Activities of Standard Bank Ltd.Moyan HossainNo ratings yet

- Jamuna Bank Recruitment ProcessDocument99 pagesJamuna Bank Recruitment ProcessTanvir80% (5)

- Executive Summary: Table of ContentDocument8 pagesExecutive Summary: Table of ContentAhmad KhanNo ratings yet

- Report On Basic BankDocument16 pagesReport On Basic BankFarhana Mahamud KemiNo ratings yet

- Arun Uco Bank Internship ReportDocument66 pagesArun Uco Bank Internship ReportArun SudhakarNo ratings yet

- HBL Bank Internship Final ReportDocument85 pagesHBL Bank Internship Final ReportMubeen MalikNo ratings yet

- Internship Report 2011Document35 pagesInternship Report 2011Rani BakhtawerNo ratings yet

- Internship Report On Silk BanKDocument31 pagesInternship Report On Silk BanKbbaahmad89100% (1)

- National Bank of PakistanDocument8 pagesNational Bank of PakistanFalaq KhowajaNo ratings yet

- MCB Report For All StudentsDocument50 pagesMCB Report For All Studentsrizwan_hameed786No ratings yet

- Internship ReportDocument85 pagesInternship ReportHassan IkhlaqNo ratings yet

- My Internship ProposalDocument7 pagesMy Internship Proposalsourav4730No ratings yet

- Foreign Exchange and Foreign Trade in Al Arafah Islami Bank LTDDocument51 pagesForeign Exchange and Foreign Trade in Al Arafah Islami Bank LTDZunaid HasanNo ratings yet

- General Banking System On First Security Islami Bank LTDDocument49 pagesGeneral Banking System On First Security Islami Bank LTDJohnathan RiceNo ratings yet

- Credit Risk Management of Sonali BankDocument99 pagesCredit Risk Management of Sonali BankMosiur RahmanNo ratings yet

- CKSBDocument23 pagesCKSBayushiNo ratings yet

- Introduction To The ReportDocument34 pagesIntroduction To The ReportTalha Iftekhar Khan SwatiNo ratings yet

- NCC Bank LTDDocument70 pagesNCC Bank LTDMarjana Khatun100% (1)

- Effectiveness of Core Banking at Corporation Bank Project ReportDocument88 pagesEffectiveness of Core Banking at Corporation Bank Project ReportBabasab Patil (Karrisatte)100% (3)

- SME Products of BRAC Bank LimitedDocument91 pagesSME Products of BRAC Bank LimitedAfroza KhanNo ratings yet

- Working Capital of Axis Bank"Document84 pagesWorking Capital of Axis Bank"Sami Zama100% (2)

- FINAL Internship Report of Askari BankDocument126 pagesFINAL Internship Report of Askari Bankatif aslam29% (7)

- Body of The ReportDocument33 pagesBody of The ReportJehan MahmudNo ratings yet

- Bank of Punjab Internship UOGDocument38 pagesBank of Punjab Internship UOGAhsanNo ratings yet

- Axis BankDocument83 pagesAxis BankSami ZamaNo ratings yet

- Internship Report On Punjab Provincial Bank LTDDocument15 pagesInternship Report On Punjab Provincial Bank LTDaon waqasNo ratings yet

- Final Report On SME and Micro Credit and Micro FinanceDocument65 pagesFinal Report On SME and Micro Credit and Micro FinanceMohammad SumonNo ratings yet

- Economics Board ProjectDocument24 pagesEconomics Board ProjecttashaNo ratings yet

- Bank of IndiaDocument49 pagesBank of IndiaJasmeet Singh100% (1)

- Internship Report On MCB Bank LimitedDocument42 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Retail Banking Activities of CBL..Internship ReportDocument49 pagesRetail Banking Activities of CBL..Internship ReportSuborno AdityaNo ratings yet

- Management AssignmentDocument24 pagesManagement AssignmentsumayaNo ratings yet

- Dubai BankDocument43 pagesDubai BankArslanMehmoodNo ratings yet

- Internship Report On Prime Bank LTD BDDocument87 pagesInternship Report On Prime Bank LTD BDthreeinvestigators0% (2)

- AcknowledgementDocument28 pagesAcknowledgementMd. MizanNo ratings yet

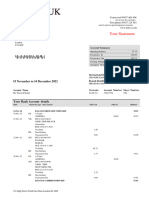

- JK Bank Summer Internship ReportDocument64 pagesJK Bank Summer Internship ReportDevinder Choudhary71% (7)

- Effective Project Financing Essential Principles And Tactics: An Introduction To Finance, Cash Flows, And Project EvaluationFrom EverandEffective Project Financing Essential Principles And Tactics: An Introduction To Finance, Cash Flows, And Project EvaluationNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Pakistan Water and Power Development Authority Revised Prescribed Form For Free Electricity Supply To Wapda Employees Deptt: Code 01641Document1 pagePakistan Water and Power Development Authority Revised Prescribed Form For Free Electricity Supply To Wapda Employees Deptt: Code 01641Ghulam AbbasNo ratings yet

- TagsDocument2 pagesTagsGhulam AbbasNo ratings yet

- AT & C Losses 1Document3 pagesAT & C Losses 1Ghulam AbbasNo ratings yet

- FGEI Job AdvertisementDocument2 pagesFGEI Job AdvertisementGhulam AbbasNo ratings yet

- Form 45: Please Complete in Typescript or in Bold Block CapitalsDocument2 pagesForm 45: Please Complete in Typescript or in Bold Block CapitalsGhulam AbbasNo ratings yet

- Auditing McqsDocument27 pagesAuditing McqsGhulam Abbas100% (5)

- Subject: Service Profile/Transfer/PostingDocument4 pagesSubject: Service Profile/Transfer/PostingGhulam AbbasNo ratings yet

- Annual Report 2013 066Document1 pageAnnual Report 2013 066Ghulam AbbasNo ratings yet

- Annual Report 2013 067Document1 pageAnnual Report 2013 067Ghulam AbbasNo ratings yet

- Accountancy and Auditing-IIDocument3 pagesAccountancy and Auditing-IIamindherNo ratings yet

- Nitish India Banking 00923009001533Document68 pagesNitish India Banking 00923009001533Ghulam AbbasNo ratings yet

- (Rupees in Thousand) Note 2012 2011: (Re-Stated) (Re-Stated)Document1 page(Rupees in Thousand) Note 2012 2011: (Re-Stated) (Re-Stated)Ghulam AbbasNo ratings yet

- Internship Report: "Assessment of Customer Loyalty For Banglalink"Document103 pagesInternship Report: "Assessment of Customer Loyalty For Banglalink"Ghulam AbbasNo ratings yet

- Annual Parking Report 201213Document20 pagesAnnual Parking Report 201213Ghulam AbbasNo ratings yet

- Final SKMH ReportDocument44 pagesFinal SKMH ReportGhulam Abbas0% (1)

- Profit and Loss Account: For The Year Ended June 30, 2013Document1 pageProfit and Loss Account: For The Year Ended June 30, 2013Ghulam AbbasNo ratings yet

- Historical Background of The CompanyDocument3 pagesHistorical Background of The CompanyGhulam AbbasNo ratings yet

- 9704 enDocument86 pages9704 enGhulam AbbasNo ratings yet

- ContentsDocument3 pagesContentsGhulam AbbasNo ratings yet

- Purification ProcessDocument3 pagesPurification ProcessGhulam AbbasNo ratings yet

- EPS Before Tax: 2013 2012 2013 2012 Ratio RatioDocument12 pagesEPS Before Tax: 2013 2012 2013 2012 Ratio RatioGhulam AbbasNo ratings yet

- InternshipDocument6 pagesInternshipGhulam AbbasNo ratings yet

- Viyellatex GroupDocument62 pagesViyellatex GroupGhulam AbbasNo ratings yet

- Significance of Banks and Other Financial InstitutionsDocument18 pagesSignificance of Banks and Other Financial InstitutionsIsshi RomeroNo ratings yet

- Opening of Bank Account - NewDocument2 pagesOpening of Bank Account - NewGanesh medisettiNo ratings yet

- Monthly Digest September 2022 Eng 381663784056463Document37 pagesMonthly Digest September 2022 Eng 381663784056463Rohini KadamNo ratings yet

- July - December 2022Document26 pagesJuly - December 2022Valentin DrăghiciNo ratings yet

- Financial Inclusion: Warm Welcome To AllDocument52 pagesFinancial Inclusion: Warm Welcome To Allkishan_kumar2188No ratings yet

- Chase Bank Statement Template - 1Document2 pagesChase Bank Statement Template - 1Marcus Green64% (11)

- Golden Rules of AccountingDocument5 pagesGolden Rules of AccountingVinay ChintamaneniNo ratings yet

- Crompton +++ Revolut-GBP-Statement-Dec 2020Document2 pagesCrompton +++ Revolut-GBP-Statement-Dec 202013KARATNo ratings yet

- Documento Adicional Natalia - CompressedDocument58 pagesDocumento Adicional Natalia - CompressedAndreaSarmientoNo ratings yet

- Development of Micro, Small and Medium Enterprises Through MUDRA Loans With Special Reference To ManipurDocument8 pagesDevelopment of Micro, Small and Medium Enterprises Through MUDRA Loans With Special Reference To ManipurAditya SharmaNo ratings yet

- Marketing of Bank Services: A Case Study Slovak Banks: Adriana Csikosova Maria Janošková (Antošová)Document16 pagesMarketing of Bank Services: A Case Study Slovak Banks: Adriana Csikosova Maria Janošková (Antošová)Rajan SreedharanNo ratings yet

- Financial Institutions Management A Risk Management Approach 8th Edition Saunders Test BankDocument36 pagesFinancial Institutions Management A Risk Management Approach 8th Edition Saunders Test Banknopalsmuggler8wa100% (25)

- Term Paper On The Topic Monetary Policy of Nepal 2080 - 81 Aadhar Babu KhatiwadaDocument15 pagesTerm Paper On The Topic Monetary Policy of Nepal 2080 - 81 Aadhar Babu KhatiwadaPrashant GautamNo ratings yet

- HKUST Canvas - Quiz 3 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionsDocument10 pagesHKUST Canvas - Quiz 3 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionslauyingsumNo ratings yet

- Kathmandu University School of Law, Kusl BBM, LL.B Semester VII Course SyllabusDocument2 pagesKathmandu University School of Law, Kusl BBM, LL.B Semester VII Course SyllabuspriyansuNo ratings yet

- University of Gondar College of Business and Economics Department of Marketing ManagementDocument14 pagesUniversity of Gondar College of Business and Economics Department of Marketing ManagementMartha GetanehNo ratings yet

- Alternative Sources of FinanceDocument8 pagesAlternative Sources of FinancediahNo ratings yet

- Principles of Managerial Finance Brief 7th Edition Gitman Test BankDocument36 pagesPrinciples of Managerial Finance Brief 7th Edition Gitman Test Bankreniformcalechexcmp100% (21)

- Modernisation in Banking Sector in India Axis Bank VDocument90 pagesModernisation in Banking Sector in India Axis Bank V54 - Akanksha KashyapNo ratings yet

- Book of AccountsDocument8 pagesBook of AccountsJenny SaynoNo ratings yet

- MMS Sample Question Paper For Practice For Semester 4Document16 pagesMMS Sample Question Paper For Practice For Semester 4Shweta SinghNo ratings yet

- Jeffrey Epstein39s Little Black Book Unredacted PDFDocument95 pagesJeffrey Epstein39s Little Black Book Unredacted PDFasdasdasd80% (5)

- Muat TurunDocument3 pagesMuat Turunhadifanna18No ratings yet

- Critical Review - Radhea - 212210Document6 pagesCritical Review - Radhea - 212210Radhea Faradha AmardikaNo ratings yet

- (Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormDocument1 page(Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormSsa ZabalaNo ratings yet

- MathDocument42 pagesMathMamun RashidNo ratings yet

- Micro Finance and Rural BankingDocument7 pagesMicro Finance and Rural Bankingfarhadcse30No ratings yet

- A Study On Customer Awareness Towards e Banking.. B. GopichandDocument11 pagesA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1No ratings yet

- Upi Final Project 2023Document61 pagesUpi Final Project 2023Jay ༄᭄ShahNo ratings yet

- Financial Crisis Literature ReviewDocument6 pagesFinancial Crisis Literature Reviewaflsnoxor100% (1)