Professional Documents

Culture Documents

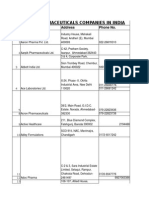

Pharma Companies List

Uploaded by

Deepshikha ChauhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pharma Companies List

Uploaded by

Deepshikha ChauhanCopyright:

Available Formats

PT Kalbe Farma Tbk, PT Merck Tbk, and PT Kimia Farma (Persero) Tbk.

1.

Behn Meyer Kimia, PT 2. PT. Anugerah Pharmindo Lestari 3. PT. Ciubros Farma 4. Kimia Farma, PT 5. Kalbe Farma Tbk, PT 4 6. Pyridam Farma Tbk, PT 7. Saka Farma Laboratories, PT 8. Rias Sukses Dinamika, PT 9. PT. Songgolangit Herbal Indonesia, 10. PT. Sido Muncul 11. PT. Nyonya Meneer 12. Abbott Indonesia, PT 13. PT. Afiat Industri Farmasi 14. PT. Combiphar 15. PT. Errita Pharma 16. PT. Gracia Pharmindo 17. PT. Medion Indonesia 18. PT. Otto Pharmaceutical Industries 19. PT. Rohto Laboratories Indonesia 20. PT Bayer Indonesia Tbk 21. PT Dipa Pharmalab Intersains 22. Darya-Varia Group 23. PT Boehringer Ingelheim Indonesia 24. PT Phapros 25. PT Erela 26. PT Bernofarma 27. PT. Bio Farma (Persero) 28. Dexa Medica, PT 29. Eisai Indonesia, PT 30. Ethica, PT (Industri Farmasi) 31. Graha Farma, PT 32. Gratia Husada Farma, PT 33. Guardian Pharmatama, PT 34. Hexpharm Jaya, PT 35. Ikapharmindo Putramas, PT 36. P.T. Distriversa Buanamas 37. PT Soho Industri Pharmasi 38. Indofarma PT 39. Interbat, PT 40. Konimex Pharm. Laboratories, PT 41. Landson, Pertiwiagung, PT 42. PT. Lapi Laboratories 43. PT. Mahakam Beta Farma 44. Mecosin Indonesia, PT 45. PT Meprofarm Pharmaceutical Industries 46. Merck Indonesia, PT 47. Molex Ayus, PT 48. Novartis Biochemie, PT 49. PT. Otsuka Indonesia 50. PT Pfizer Indonesia 51. Pharos Indonesia, PT 52. PT. Phytokemo Agung Farma 53. Pyridam, PT 54. PT. Roche Indonesia 55. Saka Farma Laboratories, PT 56. PT. Takeda Indonesia 57. Tempo Group 58. PT. Supra Ferbindo Farma 59. PT Triyasa Nagamas Farma 60. Tunggal Idaman Abdi Pharmaceutical

Enterprises, PT 61. Universal Pharm Industries, PT 62. PT. Bima Mitra Farma

Kalbe Pharma Indonesias largest domestic drug manufacturer holds 15 percent of market share. Together, Bayer, Pfizer and GlaxoSmithKline hold 8 percent of market share.

Indonesias industry association for foreign drug manufacturers the International Pharmaceutical Manufacturers Group (IPMG)

Entering the market According to Indonesias 2008 Ministry of Health Decree on the Registration of Drugs, the following regulations became offi cial at the end of 2010: Almost all pharmaceutical products registered in In donesia must be manufactured in country. The only exceptions are patented products and drugs that cannot be manufactured in Indonesia. Foreign applicants for product registration must have an Indonesian manufacturing facility or appoint an intermediary. Product registration In order to register a drug in Indonesia, applicants must submit their materials to the National Agency of Drug and Food Control (NADFC). The NADFC is responsible for pre-market evaluation of pharmaceutical products, regulations, standardization and GMP certification. Drugs are evaluated based on their risk, quality, safety and efficacy, as well as the needs of the Indonesian public. All drugs are divided into four classes: Narcotics (Category O) Prescription medicines (Category G) OTC medicines with warning labels (Category W) General OTC products (Category F) If the applicant is not the product license holder (for example, if the applicant is an Indonesian drug manufacturer filing on behalf of a foreign pharmaceutical company), they must provide written authorization from the foreign manufacturer. In addition, applicants must provide: A manufacturing license A valid GMP certificate Data from the last GMP inspection A drug master file (in the case of new chemical entiti es, first generic drugs and generics for serious illnesses such as cancer or cardiovascular disease) A manufacturing site master file Other documentation, as required Applicants are required to follow the ASEAN Common Technical Documents (CTD) format in order to be certified. They must also adhere to ASEAN standards in the case of non-clinical and clinical studies, product specification, stability studies, bioequivalent studies and GMP standards.

, "More and more foreign drug companies are looking to Indonesia for future profits." , Drug registration can take anywhere from one to three years. According to the NADFC, the evaluation of export-only drugs and me-too drugs takes 40 working days. It takes 100 working days for NADFC to evaluate orphan drugs and drugs that require local clinical trials. It takes 150 working days to evaluate drugs with new indications and drugs that have already been marketed in other ASEAN countries. Finally, it takes NADFC 300 working days to evaluate new drugs, biological and biotherapeutic products not covered in the other categories. Labeling and advertising All pharmaceutical products sold in Indonesia must state their chemical or generic name along with their brand name on the packaging. In addition, they must bear labels declaring whether they contain non-halal (non-porcine) materials or have undergone processes that encounter nonhalal materials. OTC medicines must be labeled in Indonesian. The NADFC regulates all drug advertising and approves all advertising materials. While general OTC medicines can be advertised (as long as they include required warning labels), there is a ban on direct to customer advertising for prescription medicines. Further, the NADFC regulates spending limits on the promotion of pharmaceutical products. Distribution and pricing The distribution of drugs takes place through wholesalers, who sell to both pharmacies and hospitals. Wholesalers distribute their products through Indonesias 11,000 pharmacies and 7,000 registered outlets. In addition, they also distribute OTC medications through Indonesias 1.9 million retail outlets. Currently, wholesale licenses in Indonesia do not expire. After June 28, 2013, they will be valid for only five years. Wholesalers in Indonesia typically mark up factory prices by about 10 percent. Retail outlets then raise drug prices another 2030 percent over wholesale prices. Most generic pricing is controlled by a series of national regulations. Drugs on Indonesias Essential Drug List have a maxim um retail margin of 50 percent. Special, quality assured generics (called OGB generics) have regulated retail prices. Prices are set at the same low levels throughout Indonesia, irrespective of transport and inventory holding costs. To further curb rising healthcare costs, the Indonesian government passed a law in January 2010 that requires doctors at all state run medical facilities to prescribe unbranded generics whenever possible. Foreign companies in Indonesia More and more foreign drug companies are looking to Indonesia for future profits. Despite restrictions on manufacturing and ownership, more than 50 international pharmaceutical companies have business in Indonesia. Wyeth, Sanofi and Merck all have a considerable presence in the country. In October 2012, Merck opened a $21 million packaging plant in Indonesia. It expects annual sales in the country to go up 13 18 percent in 2013. Other Western companies, like Novo Nordisk and Novartis, are heavily engaged in community outreach and education activities. For example, Novo Nordisk recently launched an extensive diabetes education campaign for doctors, healthcare professionals and the public. Novartis is running a similar program for communicable diseases. But if restrictions on foreign ownership are lifted, many foreign pharmaceutical executives have said they would like to expand their Indonesian operations. Novartis president recently revealed that the company would be interested in opening R&,D facilities in Indonesi a, as long as they do not have to worry about Indonesian ownership requirements. Currently, foreign ownership in domestic drug companies is limited to 75 percent. The other 25 percent of a company must be owned by an Indonesian national. Since early 2009, Indonesias MOH has hinted that it wants to drop restric tions on foreign ownership of Indonesian pharmaceutical firms. This has not yet taken place, but it is expected to within the next several years.

http://www.pharmaphorum.com/articles/indonesia-pharmaceutical-market-update-2013

http://india.nydailynews.com/business/9ec13c7b70fb20b34c0c70d768b13604/indian-pharma-industryseeks-policy-reforms-in-indonesia

Indian pharma industry seeks policy reforms in Indonesia

Monday Mar 25, 2013

StumbleUpon Tumblr Digg Reddit Email

Jakarta, March 25 India hopes the Indonesian government will undertake policy reforms that will enable Indian companies to invest in the South-East Asian nation's pharmaceutical sector. Since Indian pharmaceutical products are affordable and of high standards, India can contribute immensely to the growth of Indonesia's pharmaceutical industry, an Indian embassy release here said. Speaking during a pharmaceutical exhibition, participated by 39 Indian small and medium enterprises (SMEs) between March 20-22, Indian Ambassador Gurjit Singh expressed optimism of "early policy reforms by the Indonesian government". Singh said this would result in "meeting the increasing demand of pharmaceuticals at competitive prices once the Indonesian Government initiates the social insurance cover for its population". Indian exports of pharmaceuticals to Indonesia reached about $75 million in 2011-12 from $44 million in 2008-09. The Indian pharmaceutical industry, valued presently at over $25 billion, has gained recognition as the global pharmacy of the world on account of being able to prove quality generic medicines at affordable price. It has been recognised as a reliable source for bulk drugs (APIs), drug intermediates and formulations (generics), pharmaceutical machinery and packaging. This year major Indian companies in the CPhI-SEA included Morepen Labs, SG Pharma, ACG Group, Sterile India, Thermolab Scientific Equipments, Borosil Glass Works Brothers Pharmamach, and Healthcaps.

Read more: http://india.nydailynews.com/business/9ec13c7b70fb20b34c0c70d768b13604/indian-pharma-industry-seeks-policy-reforms-inindonesia#ixzz2WU49vxvo

http://www.slideshare.net/ErwinEAnanto/overview-of-indonesia-economic-and-pharmaindustry#btnNext

http://xa.yimg.com/kq/groups/18751725/3555163/name/Indonesia+Pharmaceutical+and+Healthcare+r eport+2009.pdf

You might also like

- Distributor ListDocument67 pagesDistributor ListJudith Johnson Greer100% (1)

- Alkem Trade Data Jan Jun 2019Document192 pagesAlkem Trade Data Jan Jun 2019AniketNo ratings yet

- Cphi Worldwide Exhibitor List 2016 0Document28 pagesCphi Worldwide Exhibitor List 2016 0sanjay_gawaliNo ratings yet

- Pharma Companies DetailsDocument5 pagesPharma Companies DetailsFuture InnovationsNo ratings yet

- Cphi China-Apis Intermediates Fine ChemicalsDocument271 pagesCphi China-Apis Intermediates Fine Chemicalsমোঃ এমদাদুল হকNo ratings yet

- Biotechnology Industry DatabaseDocument150 pagesBiotechnology Industry Databasebrindatamma100% (2)

- List of African Country DelegatesDocument2 pagesList of African Country DelegatesAditya JogNo ratings yet

- Database For Trade InquiryDocument75 pagesDatabase For Trade InquiryAnna LaClair100% (2)

- Company Contact ListDocument27 pagesCompany Contact ListKusumNo ratings yet

- Marine Exporters List India-DirectoryDocument408 pagesMarine Exporters List India-Directorygeorgejoseph80% (5)

- Ashco Contract Research Center and Other Top Pharma Companies in MumbaiDocument48 pagesAshco Contract Research Center and Other Top Pharma Companies in MumbaiNarendra Vaidya50% (2)

- List of Pharmaceutical Companies in PuneDocument5 pagesList of Pharmaceutical Companies in PuneMain Sanatani HunNo ratings yet

- Export of GujaratDocument35 pagesExport of GujaratAshish MittalNo ratings yet

- GMP Manual - Version Feb 2014 - 24 Chapter PDFDocument1,678 pagesGMP Manual - Version Feb 2014 - 24 Chapter PDFMeram Ahmed100% (7)

- Geeta Chemical Directories & Association - Updated StatusDocument9 pagesGeeta Chemical Directories & Association - Updated StatusREACHLaw Chemical Regulatory Training ServicesNo ratings yet

- Aajonus ChocolateDocument5 pagesAajonus ChocolateGemma EspartNo ratings yet

- List of Members of SMPIC PharmaDocument7 pagesList of Members of SMPIC PharmaMeghana VyasNo ratings yet

- Iran 1Document92 pagesIran 1somen79No ratings yet

- Exhibitor Listing Pharma Expo 2022Document5 pagesExhibitor Listing Pharma Expo 2022Richard OrtizNo ratings yet

- Biotech Companies PDFDocument22 pagesBiotech Companies PDFPunu Mayekar100% (1)

- Ibis Chemical Directory 2020 SampleDocument9 pagesIbis Chemical Directory 2020 SampleDINKER MAHAJANNo ratings yet

- BtcompaniesDocument15 pagesBtcompaniesjishavenugopalNo ratings yet

- Pharma Directory PDFDocument83 pagesPharma Directory PDFchirag100% (1)

- Global Pharmaceutical Industry-OverviewDocument6 pagesGlobal Pharmaceutical Industry-OverviewNaveen Reddy50% (4)

- 1522840355trade Enquiries From India For March 2018Document42 pages1522840355trade Enquiries From India For March 2018Vishal MalikNo ratings yet

- Pharma Companies ListDocument4 pagesPharma Companies ListDeepshikha Chauhan100% (5)

- Top 100 Indian Pharmaceutical Companies ListDocument22 pagesTop 100 Indian Pharmaceutical Companies ListJoseph Devasia50% (2)

- Chemical Companies Directory PDFDocument268 pagesChemical Companies Directory PDFKumar Anudeep100% (4)

- Iphex 2014Document17 pagesIphex 2014Sadik ShaikhNo ratings yet

- Consulting AgreementDocument5 pagesConsulting AgreementDeepshikha ChauhanNo ratings yet

- Consulting AgreementDocument5 pagesConsulting AgreementDeepshikha ChauhanNo ratings yet

- Consulting AgreementDocument5 pagesConsulting AgreementDeepshikha ChauhanNo ratings yet

- Consulting AgreementDocument5 pagesConsulting AgreementDeepshikha ChauhanNo ratings yet

- Consulting AgreementDocument5 pagesConsulting AgreementDeepshikha ChauhanNo ratings yet

- 04 Beverages Alcohols ExpDocument99 pages04 Beverages Alcohols ExpAndrea GallianoNo ratings yet

- List N Contact Details of Pharma Companies in IndaDocument19 pagesList N Contact Details of Pharma Companies in IndaAjita Chandra100% (1)

- List of Pharmaceutical Companies in - HTMLDocument12 pagesList of Pharmaceutical Companies in - HTMLBohluwahtyfe FahshinahNo ratings yet

- Manufacturing Units Having Who GMP CertificationDocument34 pagesManufacturing Units Having Who GMP Certificationchirag100% (2)

- Companies ListDocument3 pagesCompanies ListTanmay Agnani0% (1)

- Apteka Participants Profile1Document26 pagesApteka Participants Profile1satyam pathakNo ratings yet

- Goa Industrial EstatesDocument11 pagesGoa Industrial EstatesJithin Kader0% (1)

- Exhibitors Listing for BioFach India 2022 Trade ShowDocument6 pagesExhibitors Listing for BioFach India 2022 Trade ShowRohit_1987100% (1)

- FMCG Companies in India Cadbury Banglore Mumbai ChennaiDocument6 pagesFMCG Companies in India Cadbury Banglore Mumbai ChennaiMarketing AdminNo ratings yet

- Final Profile For Distributor 2018Document17 pagesFinal Profile For Distributor 2018Md Enamul HaqueNo ratings yet

- Pharma DirectoryDocument208 pagesPharma Directoryajmal_2kNo ratings yet

- Fertilizer-companies-in-Sri-lanka 2Document1 pageFertilizer-companies-in-Sri-lanka 2Senthil KumarNo ratings yet

- 40 Leading Pharmaceutical CompaniesDocument39 pages40 Leading Pharmaceutical CompaniesArul Devan0% (1)

- Corporate List Along With ForcastDocument40 pagesCorporate List Along With ForcastHotel EkasNo ratings yet

- Alphabetical List of Pharma CompaniesDocument4 pagesAlphabetical List of Pharma Companiesvipinbhai100% (1)

- Pharma ExportersDocument31 pagesPharma ExportersSanath Suvarna100% (2)

- List of FMCG Companies in IndiaDocument3 pagesList of FMCG Companies in IndiadhirajthegreatNo ratings yet

- Approved WHO PlantsDocument106 pagesApproved WHO PlantsKsusha Chernobrova100% (1)

- Database Directory of Pharmaceutical ManufacturersDocument73 pagesDatabase Directory of Pharmaceutical ManufacturersVaibhav Bacchav50% (2)

- Pharma Co List 1000Document90 pagesPharma Co List 1000Naveenbabu Soundararajan100% (1)

- Indian ImportersDocument18 pagesIndian ImportersSarika YadavNo ratings yet

- Top Pharmaceutical Companies in IndiaDocument84 pagesTop Pharmaceutical Companies in IndiaVandana TyagiNo ratings yet

- State-Wise Pharmaceutical Manufacturing Units Ini Ndi ADocument83 pagesState-Wise Pharmaceutical Manufacturing Units Ini Ndi AJammieNo ratings yet

- Zoomark Exhibitor ListDocument30 pagesZoomark Exhibitor ListSunny Rocky100% (2)

- Pharma Conpanies in Africa RegionDocument25 pagesPharma Conpanies in Africa RegionSiddhesh LawandeNo ratings yet

- Pharma Web AtulDocument1 pagePharma Web Atulapi-19786321100% (1)

- Pharma - Manu.Document15 pagesPharma - Manu.Anagha KiniNo ratings yet

- Medplus Internship Report on Competitor Study & Brand PromotionDocument85 pagesMedplus Internship Report on Competitor Study & Brand PromotionNeog Rupak71% (14)

- Apteka - Participants - Profile1 PDFDocument21 pagesApteka - Participants - Profile1 PDFVandana TyagiNo ratings yet

- Pharmexcil DataDocument86 pagesPharmexcil DataRandoNo ratings yet

- Deepika SheetDocument80 pagesDeepika Sheetsunildubey02No ratings yet

- Exhibitor ListDocument24 pagesExhibitor ListOmer JahangirNo ratings yet

- Indo-Latam Connect Virtual Pharma BSM CompaniesDocument45 pagesIndo-Latam Connect Virtual Pharma BSM CompaniesvishalNo ratings yet

- Biologic Ale e Chapter 1Document8 pagesBiologic Ale e Chapter 1geeta reddyNo ratings yet

- Pharmaceutical IndustryDocument4 pagesPharmaceutical IndustryHilal LoneNo ratings yet

- 2351 The Indian Pharmaceutical MarketDocument6 pages2351 The Indian Pharmaceutical MarketAaditya SrivastavaNo ratings yet

- The Study On To Identify The Effectiveness of Product Promotion by Sangrose Laboratories Pvt. LTDDocument76 pagesThe Study On To Identify The Effectiveness of Product Promotion by Sangrose Laboratories Pvt. LTDAmeen MtNo ratings yet

- Pharmacovigilance Outsourcing and Career Advantages For Indian ProfessionalsDocument3 pagesPharmacovigilance Outsourcing and Career Advantages For Indian ProfessionalsVijay Venkatraman JanarthananNo ratings yet

- ChatLog Data Science Training - 20160619 - 2016-08-20 15 - 30Document10 pagesChatLog Data Science Training - 20160619 - 2016-08-20 15 - 30Deepshikha ChauhanNo ratings yet

- WLHDocument2 pagesWLHDeepshikha ChauhanNo ratings yet

- SAP Growth StrategyDocument2 pagesSAP Growth StrategyDeepshikha ChauhanNo ratings yet

- A Case Study On Nike: Student's Name: Student Number: 089106383 Degree Programme: Module CodeDocument5 pagesA Case Study On Nike: Student's Name: Student Number: 089106383 Degree Programme: Module CodeDeepshikha ChauhanNo ratings yet

- Growing Demand For AnalyticsDocument3 pagesGrowing Demand For AnalyticsDeepshikha ChauhanNo ratings yet

- SAP Buys Data Integration DeveloperDocument2 pagesSAP Buys Data Integration DeveloperDeepshikha ChauhanNo ratings yet

- NikeDocument11 pagesNikeDeepshikha ChauhanNo ratings yet

- HaryanaDocument2 pagesHaryanaUsman DarNo ratings yet

- Logistik Farmasi Saldo Awal Nama Bentuk/Satuan Hna+Ppn QTT JumlahDocument122 pagesLogistik Farmasi Saldo Awal Nama Bentuk/Satuan Hna+Ppn QTT JumlahListya HasanahNo ratings yet

- Sales Forecasting in Pharmaceutical Industry - Challenges & Opportunities - Pharma Mirror Magazine PDFDocument6 pagesSales Forecasting in Pharmaceutical Industry - Challenges & Opportunities - Pharma Mirror Magazine PDFMohammed Shamiul ShahidNo ratings yet

- Trends in Oncology Business DevelopmentDocument25 pagesTrends in Oncology Business DevelopmentSheltie ForeverNo ratings yet

- Sun Pharma: Leading Pharma CompanyDocument43 pagesSun Pharma: Leading Pharma CompanyRishabhJaysawal100% (1)

- Cannes Lions 2018 Pharma Lions ShortlistDocument8 pagesCannes Lions 2018 Pharma Lions Shortlistadobo magazineNo ratings yet

- Zimbabwe - Pharma Sector Profile - 032011 - Ebook PDFDocument64 pagesZimbabwe - Pharma Sector Profile - 032011 - Ebook PDFgizzarNo ratings yet

- PM Case StudyDocument1 pagePM Case StudyTinersNo ratings yet

- Sun Pharma Reports Strong Q3 PerformanceDocument2 pagesSun Pharma Reports Strong Q3 Performancebhavesh25jadavNo ratings yet

- Book 1Document18 pagesBook 1Syed Ali ShahNo ratings yet

- Drug Price TNMSCDocument13 pagesDrug Price TNMSCdrtpkNo ratings yet

- Eli Lilly's Development of Cymbalta to Replace ProzacDocument11 pagesEli Lilly's Development of Cymbalta to Replace ProzacemanuelariobimoNo ratings yet

- Accenture Five Branded Generics Strategies Pharmaceuticals in Emerging MarketsDocument16 pagesAccenture Five Branded Generics Strategies Pharmaceuticals in Emerging MarketsAnonymous 75aETJ8ONo ratings yet

- USFDA - Pre-Approval InspectionDocument53 pagesUSFDA - Pre-Approval Inspectionvg_vvgNo ratings yet

- A Annual Report 2009Document38 pagesA Annual Report 2009dmittal4uNo ratings yet

- PharmaDocument64 pagesPharmaaasimshaikh111No ratings yet

- Data ResepDocument26 pagesData ResepFACHRIZAL AMRIENo ratings yet

- Company NameDocument50 pagesCompany NameB. SrivastavaNo ratings yet

- Data Driven Digital Transformation Pharma Sales and Marketing - Executive Brief - 3554enDocument3 pagesData Driven Digital Transformation Pharma Sales and Marketing - Executive Brief - 3554enSanchan KumarNo ratings yet

- E Pharmacies Gaining Momentum 1571322075Document21 pagesE Pharmacies Gaining Momentum 1571322075Md Javid Gen DxNo ratings yet

- The Ethical Issues Involved in Medical Sales RepresentationDocument2 pagesThe Ethical Issues Involved in Medical Sales RepresentationMatthew Kofi Oppong Ackah0% (1)

- Drug Rep Chronicle: June 2010 (Canada)Document16 pagesDrug Rep Chronicle: June 2010 (Canada)shannon3458No ratings yet

- Dicalcium Phospate Dihidrat - DiCaFos (p.96-99) 125-128Document4 pagesDicalcium Phospate Dihidrat - DiCaFos (p.96-99) 125-128Marsha Fendria PrastikaNo ratings yet

- List of Homoeopathic Medicine ManufacturerDocument3 pagesList of Homoeopathic Medicine ManufacturerRehan AliNo ratings yet