Professional Documents

Culture Documents

COA reviews legality of GSIS retirement plan

Uploaded by

jerushabrainerdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COA reviews legality of GSIS retirement plan

Uploaded by

jerushabrainerdCopyright:

Available Formats

Republic of the Philippines SUPREME COURT Manila EN BANC G.R. No.

162372 October 19, 2011

GOVERNMENT SERVICE INSURANCE SYSTEM (GSIS), HERMOGENES D. CONCEPCION, JR., WINSTON F. GARCIA, REYNALDO P. PALMIERY, LEOVIGILDO P. ARRELLANO, ELMER T. BAUTISTA, LEONORA V. DE JESUS, FULGENCIO S. FACTORAN, FLORINO O. IBAEZ, AIDA C. NOCETE, AURORA P. MATHAY, ENRIQUETA DISUANCO, AMALIO MALLARI, LOURDES PATAG, RICHARD M. MARTINEZ, ASUNCION C. SINDAC, GLORIA D. CAEDO, ROMEO C. QUILATAN, ESPERANZA FALLORINA, LOLITA BACANI, ARNULFO MADRIAGA, LEOCADIA S. FAJARDO, BENIGNO BULAONG, SHIRLEY D. FLORENTINO, and LEA M. MENDIOLA, Petitioners, vs. COMMISSION ON AUDIT (COA), AMORSONIA B. ESCARDA, MA. CRISTINA D. DIMAGIBA, and REYNALDO P. VENTURA, Respondents. DECISION LEONARDO-DE CASTRO, J.: This is a petition for review on certiorari under Rule 64 in relation to Rule 65 of the 1997 Rules of Court to annul and set aside the Commission on Audits Decision Nos. 2003-062 and 2004-004 dated March 18, 2003 and January 27, 2004, respectively, for having been made without or in excess of jurisdiction, or with grave abuse of discretion amounting to lack or excess of jurisdiction. The Government Service Insurance System (GSIS) is joined by its Board of Trustees and officials, namely: Chairman Hermogenes D. Concepcion, Jr.; Vice-Chairman and President and General Manager Winston F. Garcia (Garcia); Executive Vice President and Chief Operating Officer Reynaldo P. Palmiery; Trustees Leovigildo P. Arrellano, Elmer T. Bautista, Leonora V. de Jesus, Fulgencio S. Factoran, Florino O. Ibaez, and Aida C. Nocete; Senior Vice Presidents Aurora Mathay, Enriqueta Disuangco, Amalio Mallari, Lourdes Patag, and Asuncion C. Sindac; Vice Presidents Richard Martinez, Romeo C. Quilatan, and Gloria D. Caedo; and Managers Esperanza Fallorina, Lolita Bacani, Arnulfo Madriaga, Leocadia S. Fajardo, Benigno Bulaong, Shirley D. Florentino, and Lea M. Mendiola, together with all other officials and employees held liable by the Commission on Audit (COA) as petitioners in this case.1 The respondents in this petition are: the COA; its Director of Corporate Audit Office (CAO) I, Amorsonia B. Escarda (Escarda), who rendered CAO I Decision No. 2002-009 dated May 27, 2002; the former Corporate Auditor of GSIS, Ma. Cristina D. Dimagiba (Dimagiba), who issued the Notices of Disallowance subject of CAO I Decision No. 2002-009; and the incumbent GSIS Corporate Auditor Reynaldo P. Ventura (Ventura).2 The facts are as follows: On May 30, 1997, Republic Act No. 8291, otherwise known as "The Government Service Insurance System Act of 1997" (the GSIS Act) was enacted and approved, amending Presidential Decree No. 1146, as amended, expanding and increasing the coverage and benefits of the GSIS, and instituting reforms therein.

On October 17, 2000, pursuant to the powers granted to it under Section 41(n) of the said law, the GSIS Board of Trustees, upon the recommendation of the Management-Employee Relations Committee (MERCOM), approved Board Resolution No. 326 wherein they adopted the GSIS Employees Loyalty Incentive Plan (ELIP),3 to wit: GSIS EMPLOYEES LOYALTY INCENTIVE PLAN (Pursuant to Sec. 41(n) of R.A. No. 8291) I OBJECTIVE : To motivate and reward employees for meritorious, faithful and satisfactory service II COVERAGE : The GSIS Employees Loyalty Incentive Plan shall cover all present permanent employees and members of the Board and those who may hereafter be appointed. III SPECIFIC BENEFIT : LI = TGS* MULTIPLIED BY HS MINUS 5yLS/BPRCP Where : LI = loyalty incentive TGS = total government service HS = highest monthly salary/benefit received 5yLS = 5 year lump sum under RA 660, RA 910, PD 1146 or RA 8291 BPRCP = retirement benefit previously received plus cash payment for employees no longer qualified to 5yLS *Determined as follows: **For positions salary grade 1-26 For positions SG 27 up 1 - 20 yrs x 1.5 1 - 20 yrs x 1.25 21 - 30 yrs x 2.0 21 - 30 yrs x 1.75 31 yrs above x 2.5 31 yrs above x 2.00 **Subject to review. Applicable only to present salary structure. IV IMPLEMENTING POLICIES: 1. To be entitled to the plan, the employee must be qualified to retire with 5 year lump sum under RA 660 or RA 8291 or had previously retired under applicable retirement laws 2. The loyalty incentive benefit shall be computed based on both total government service and highest monthly salary/benefit received from GSIS 3. Employees with pending administrative and/or criminal case may apply but processing and payment of loyalty incentive shall be held in abeyance until final decision on their cases

4. GSIS loyalty incentive plan can only be availed once and employees who retired under GERSIP97 are no longer qualified 5. There shall be no refund of retirement premiums in all cases 6. Application is subject to approval by the President and General Manager PROCEDURE: 1. Employees availing of the Employee Loyalty Incentive Plan must file his/her application under RA 6604 or RA 8291 for the five (5) year lump sum, with HRS for indorsement to SIG 2. Option 2 under RA 8291 may be allowed but the loyalty incentive shall be computed based on 5 year lump sum 3. The loyalty incentive shall only be paid after deducting the lump sum under RA 660, RA 910,5 PD 11466 or RA 8291 or retirement benefit previously received plus cash payment 4. Government service of previously retired employees shall be considered in computing the loyalty incentive 5. For expediency, the processing of the plan shall be done by the Social Insurance Group EFFECTIVITY DATE: The Plan shall take effect August, 2000. (Emphases supplied.) On November 21, 2000, Board Resolution No. 326 was amended by Board Resolution No. 360,7 which provided for a single rate for all positions, regardless of salary grade, in the computation of creditable service, viz: 1-20 years x 1.5 21-30 years x 2.0 31 years above x 2.5 Except as herein amended, Resolution No. 326 dated October 17, 2000 shall remain to have full force and effect. Dimagiba, the corporate auditor of GSIS, communicated to the President and General Manager of GSIS that the GSIS RFP was contrary to law. However, the GSIS Legal Services Group opined that the GSIS Board was legally authorized to adopt the plan since Section 28(b) of Commonwealth Act No. 186 as amended by Republic Act No. 4968 has been repealed by Sections 3 and 41(n) of Republic Act No. 8291.8 On January 16, 2001, Board Resolution No. 69 was approved, wherein ELIP was renamed GSIS Retirement/Financial Plan (RFP) to conform strictly to the wordings of Section 41(n) of Republic Act No. 8291.

Upon Garcias assumption of office as President and General Manager, Dimagiba requested to again review the GSIS RFP. This was denied by Garcia.10 Believing that the GSIS RFP was "morally indefensible,"11 Dimagiba sought the assistance of COA "in determining the legality and/or morality of the said Plan in so far as it has adopted the best features of the two retirement schemes, the 5year lump sum payment under [Republic Act No.] 1616 and the monthly pension of [Republic Act No.] 660 based on the creditable service computed at 150%."12 On August 7, 2001, COAs General Counsel Santos M. Alquizalas (Alquizalas) issued a Memorandum to COA Commissioner Raul C. Flores regarding the GSIS RFP. Alquizalas opined that the GSIS RFP is a supplementary retirement plan, which is prohibited under Republic Act No. 4968, or the "Teves Retirement Law." He also said that since there is no provision in the new Republic Act No. 8291 expressly repealing the Teves Retirement Law, the two laws must be harmonized absent an irreconcilable inconsistency. Alquizalas pronounced that Board Resolution Nos. 360 and 6 are null and void for being violative of Section 28(b) of Commonwealth Act No. 186 as amended by Republic Act No. 4968, which bars the creation of a supplemental retirement scheme; and Section 41(n) of Republic Act No. 8291, which speaks of an early retirement plan or financial assistance.13 On August 14, 2001,14 Commissioner Flores forwarded this Memorandum to Dimagiba, who in turn forwarded it to Garcia on August 23, 2001. Dimagiba, in her letter attached to Alquizalass Memorandum, added that for lack of legal basis, her office was disallowing in audit the portion of retirement benefits granted under the GSIS RFP, or the excess of the benefits due the retirees. She also said that GSIS could avail of the appeal process provided for under Sections 48 to 50 of Presidential Decree No. 1445 and Section 37.1 of the Manual on Certificate of Settlement and Balances.15 On August 27, 2001, Garcia responded16to Dimagiba, taking exception to the notice of disallowance for being "highly irregular and precipitate" as it was based on a mere opinion of COAs counsel who had no authority to declare the resolution of the GSIS Board of Trustees as null and void. Moreover, Garcia asseverated that COA had neither power nor authority to declare as null and void certain resolutions approved by the Board of Government Corporations, as the power to do so was exclusively lodged before the courts. He also argued that the notice of disallowance was premature, and was tantamount to a pre-audit activity, as it should refer only to a particular or specific disbursement of public funds and not against a general activity or transaction. Garcia averred that the GSIS RFP was part and parcel of the compensation package that GSIS may provide for its personnel, by virtue of the powers granted to its Board of Trustees under Section 41(m) and (n) of Republic Act No. 8291. Garcia said that the appeal process would commence only upon GSISs receipt of the particulars of the disallowances.17 Finally, Garcia requested Dimagiba to withdraw the notices of disallowance "in the interest of industrial peace in the GSIS."18 Without responding to Garcias August 27, 2001 Memorandum, Dimagiba issued the following Notices of Disallowance on the grounds that: Pursuant to legal opinion of the General Counsel dated August 7, 2001, Board Resolution No. 360 dated Nov. 21, 2000 as amended by No. 6 dated Jan. 16, 2001 approving the Employees Loyalty Incentive Plan (ELIP) is null and void for being directly in conflict with Section 28(b) of CA No. 186 as amended by RA 4968 which bars the creation of supplemental retirement scheme and of Section 41 (n) of RA 8291 which speaks of an early retirement plan or financial assistance.19 Notices of Disallowance dated September 19, 200120 Notice of Payee Amount Persons Liable:

Disallowance No./Period covered:

Disallowed Board of Trustees; Lourdes Patag (SVP), Gloria Caedo (VP-SIAMS II), the payee, and the following officers: Marina Santamaria P 6,895,545.84 Richard Martinez Lea M. Mendiola

2001-01-412/ December 2000 2001-02-412/ December 2000 2001-03-412/ January 2001

Rosita N. Lim

P 2,281,005.52

Manuel G. Ojeda

P 1,201,581.29

Daniel Mijares Romeo Quilatan Richard Martinez Benigno Bulaong Winston F. Garcia Esperanza Fallorina Lea M. Mendiola Winston F. Garcia Esperanza Fallorina Lea M. Mendiola Shirley Florentino Enriqueta Disuanco Aurora P. Mathay Lea M. Mendiola

2001-04-412/ March 2001 2001-05-412/ March 2001

Federico Pascual

P 11,444,957.32 P 332,035.79

Juanito Gamier, Sr.

2001-06-412/ May 2001

Vicente Villegas

P 4,792,260.17

Notices of Disallowance dated October 22, 200121 Persons Liable: Board of Trustees; Gloria Caedo (VP-SIAMS II); Asuncion Sindac (VP); Richard M. Martinez (VP & Controller); Lea M. Mendiola (Manager, HRSD); the payee; and the following officers: Reynaldo Palmiery Reynaldo Palmiery Amalio A. Mallari Lolita B. Bacani

Notice of Disallowance No./Period covered: July 24, 2001

Payee

Amount Disallowed

2001-07-412 2001-08-412 2001-09-412

Rustico G. Delos Angeles Lourdes Delos Angeles Gloria L. Anonuevo

P 1,968,516.01 P 4,320,567.99 P 1,308,705.75

2001-10-412 2001-11-412

Elvira J. Agcaoili Segundina S. Dionisio

P 2,313,729.41 P 743,877.21

Reynaldo Palmiery Amalio A. Mallari (except Richard Martinez and Lea M. Mendiola)

Notices of Disallowance dated October 23, 200122 Persons Liable: Board of Trustees; Gloria Caedo (VP-SIAMS II); Asuncion Sindac (VP); Lea M. Mendiola (Manager, HRSD); the payee; and the following officers: Reynaldo Palmiery Richard Martinez Reynaldo Palmiery Richard Martinez Manuel P. Bausa Enriqueta Disuanco Arnulfo Madriaga Reynaldo Palmiery Richard Martinez Lourdes A. Delos Angeles

Notice of Disallowance No./Period covered: July 24, 2001 2001-12-412 2001-13-412

Payee

Amount Disallowed

Daniel N. Mijares Melinda A. Flores

P 7,148,031.17 P 1,459,974.12 P 532,869.65 P 1,955,561.67

2001-14-412 2001-15-412

Democrito M. Silang Manuel P. Bausa

Notices of Disallowance dated November 9, 200123 Persons Liable: Board of Trustees; Winston F. Garcia (PGM); Asuncion Sindac (SVP); Gloria Caedo (VP); the payee; and the following officers: Enriquita Disuanco Lea M. Mendiola Richard Martinez

Notice of Disallowance No./Period covered:

Payee

Amount Disallowed

2001-16-412/ June 28, 2001 2001-17-412/ July 17, 2001

Lourdes G. Patag

P 7,883,629.28 P 5,648,739.26

Elvira U. Geronimo

Notices of Disallowance dated November 13, 200124 Notice of Disallowance No./Period covered:

Payee

Amount Disallowed

You might also like

- Gsis V Coa 2011Document17 pagesGsis V Coa 2011Joy Carmen CastilloNo ratings yet

- GR No 162372 Case DigestDocument29 pagesGR No 162372 Case DigestMark FailogaNo ratings yet

- Today Is Saturday, March 09, 2019Document20 pagesToday Is Saturday, March 09, 2019carmzy_ela24No ratings yet

- G.R. No. 162372Document16 pagesG.R. No. 162372Scrib LawNo ratings yet

- AsdfaDocument3 pagesAsdfaMissy VRBNo ratings yet

- Case 1Document20 pagesCase 1PRCRO1 LEGALNo ratings yet

- GSIS Employees Loyalty Incentive Plan UpheldDocument12 pagesGSIS Employees Loyalty Incentive Plan UpheldabcNo ratings yet

- Supreme Court Rules on GSIS Employees Loyalty Incentive PlanDocument12 pagesSupreme Court Rules on GSIS Employees Loyalty Incentive PlanClee Ayra CarinNo ratings yet

- Gsis VS CoaDocument5 pagesGsis VS CoaJullian UmaliNo ratings yet

- GDocument23 pagesGJovan Ace Kevin DagantaNo ratings yet

- GSIS Employees Loyalty Incentive Plan challenged in Supreme CourtDocument12 pagesGSIS Employees Loyalty Incentive Plan challenged in Supreme CourtClee Ayra CarinNo ratings yet

- Courage vs. CIR, GR No. 213446, 3 July 2018Document63 pagesCourage vs. CIR, GR No. 213446, 3 July 2018gryffindorkNo ratings yet

- COA ruling on 14th month pay for Duty Free employeesDocument13 pagesCOA ruling on 14th month pay for Duty Free employeesDexter CircaNo ratings yet

- Philippine Mining vs. AguinaldoDocument21 pagesPhilippine Mining vs. AguinaldoKey ClamsNo ratings yet

- Aninon v. Gsis 2019Document11 pagesAninon v. Gsis 2019joselle torrechillaNo ratings yet

- Manila TeachersDocument11 pagesManila TeachersEJ SantosNo ratings yet

- PHCP Inc., Case G.R. No 167330Document23 pagesPHCP Inc., Case G.R. No 167330miscaccts incognitoNo ratings yet

- PMDC v. COADocument24 pagesPMDC v. COAAizaLizaNo ratings yet

- GSIS V MARO-ARDocument8 pagesGSIS V MARO-ARjvpvillanuevaNo ratings yet

- Upreme Lcou RT: Epubltc of Tbe FlbilippinegDocument37 pagesUpreme Lcou RT: Epubltc of Tbe FlbilippinegVel June De LeonNo ratings yet

- Philippine Supreme Court Jurisprudence Year 2017 October 2017 DecisionsDocument14 pagesPhilippine Supreme Court Jurisprudence Year 2017 October 2017 DecisionsReynaldo PunzalanNo ratings yet

- GSIS v. COA, G.R. No. 138381, November 10, 2004Document19 pagesGSIS v. COA, G.R. No. 138381, November 10, 2004sunsetsailor85No ratings yet

- Philippine Health Care Providers, Inc. v. Commissioner of Internal Revenue, 600 SCRA 413 (2009)Document15 pagesPhilippine Health Care Providers, Inc. v. Commissioner of Internal Revenue, 600 SCRA 413 (2009)Henri Ana Sofia NicdaoNo ratings yet

- First DivisionDocument13 pagesFirst DivisionReynaldo PunzalanNo ratings yet

- NLRC Rules PNCC Must Pay Mid-Year BonusDocument12 pagesNLRC Rules PNCC Must Pay Mid-Year BonusNympa VillanuevaNo ratings yet

- Petitioner vs. vs. Respondent: Third DivisionDocument10 pagesPetitioner vs. vs. Respondent: Third DivisionyodachanNo ratings yet

- 07 Dimagiba vs. Espartero, 676 SCRA 420, July 16, 2012Document18 pages07 Dimagiba vs. Espartero, 676 SCRA 420, July 16, 2012ElronRayEspinosaNo ratings yet

- Procedural Due Process - MPSTA V. GARCIADocument10 pagesProcedural Due Process - MPSTA V. GARCIAAngel CabanNo ratings yet

- Jurisprudence 2022012 GR - 253127 - 2022Document18 pagesJurisprudence 2022012 GR - 253127 - 2022dyosaNo ratings yet

- PERSONS Cases First SetDocument49 pagesPERSONS Cases First SetJonathan BravaNo ratings yet

- Facts:: Stated: "Pursuant To The Notice of Organization, Staffing and Compensation Action (NOSCA) AllDocument41 pagesFacts:: Stated: "Pursuant To The Notice of Organization, Staffing and Compensation Action (NOSCA) AllAtlas LawOfficeNo ratings yet

- PNCC Vs NLRC, GR 248401, June 23, 2021Document7 pagesPNCC Vs NLRC, GR 248401, June 23, 2021Key ClamsNo ratings yet

- 02 Digested Cases Administrative LawDocument46 pages02 Digested Cases Administrative LawAtlas LawOfficeNo ratings yet

- GSIS Allowances Under Salary Standardization LawDocument17 pagesGSIS Allowances Under Salary Standardization LawJessica Melle GaliasNo ratings yet

- Court Declares Invalid BIR Revenue Order Subjecting Government Allowances to TaxDocument30 pagesCourt Declares Invalid BIR Revenue Order Subjecting Government Allowances to TaxJavieNo ratings yet

- 676 SCRA 420 Dimagiba vs. EsparteroDocument10 pages676 SCRA 420 Dimagiba vs. EsparteroGolden PiaNo ratings yet

- PLDT vs. BelloDocument47 pagesPLDT vs. BelloOnnie LeeNo ratings yet

- MPH MHA Public Health Workers Dissallowance Human ResourceDocument5 pagesMPH MHA Public Health Workers Dissallowance Human ResourceNelson LogronioNo ratings yet

- Case DigestDocument38 pagesCase DigestJerry KhoNo ratings yet

- GSIS v. DaymielDocument9 pagesGSIS v. DaymielJemuel LadabanNo ratings yet

- Cases 1-35Document308 pagesCases 1-35Vienie Ramirez BadangNo ratings yet

- G.R. No. 167330 Philippine Health InsuranceDocument11 pagesG.R. No. 167330 Philippine Health InsuranceTin LicoNo ratings yet

- Phil Health Care Providers Vs CIR (2009)Document15 pagesPhil Health Care Providers Vs CIR (2009)LPPD DLNo ratings yet

- G.R. No. 182574Document6 pagesG.R. No. 182574Victor LimNo ratings yet

- GSIS Exemption from Legal FeesDocument10 pagesGSIS Exemption from Legal FeesKateBarrionEspinosaNo ratings yet

- 80 SSS V COADocument15 pages80 SSS V COAKirsten Denise B. Habawel-VegaNo ratings yet

- Philippine Health Care Providers, Inc., v. CIR, G.R. No. 167330, September 18, 2009Document24 pagesPhilippine Health Care Providers, Inc., v. CIR, G.R. No. 167330, September 18, 2009Gfor FirefoxonlyNo ratings yet

- Manila Public School Teachers Association vs. GarciaDocument17 pagesManila Public School Teachers Association vs. GarciaMark Gennesis Dela CernaNo ratings yet

- PhilHealth regional VP affidavit on admin caseDocument24 pagesPhilHealth regional VP affidavit on admin caseChristian UrbinaNo ratings yet

- NPC Tax Exemption Withdrawn by LGCDocument5 pagesNPC Tax Exemption Withdrawn by LGCEmNo ratings yet

- THE PROVINCE OF NEGROS OCCIDENTAL Vs CommissionersDocument3 pagesTHE PROVINCE OF NEGROS OCCIDENTAL Vs CommissionersJu LanNo ratings yet

- Philippine Health Care Providers, Inc. v. CIRDocument12 pagesPhilippine Health Care Providers, Inc. v. CIRPat EspinozaNo ratings yet

- PHILIPPINE HEALTH CARE PROVIDERS, INC., vs. COMMISSIONER OF INTERNAL REVENUE, G.R. No. 167330 September 18, 2009Document16 pagesPHILIPPINE HEALTH CARE PROVIDERS, INC., vs. COMMISSIONER OF INTERNAL REVENUE, G.R. No. 167330 September 18, 2009Christopher ArellanoNo ratings yet

- 43 Kilusang Mayo Uno v. Aquino III, G.R. No. 210500, (April 2, 2019)Document31 pages43 Kilusang Mayo Uno v. Aquino III, G.R. No. 210500, (April 2, 2019)Jeunice VillanuevaNo ratings yet

- Legislative CasesDocument70 pagesLegislative CasesNiñaNo ratings yet

- DOCTRINESDocument70 pagesDOCTRINESPrincess Erma Ricel EreseNo ratings yet

- Case Digest: Exceptions To The Exception of ProspectivityDocument10 pagesCase Digest: Exceptions To The Exception of Prospectivityejusdem generisNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- 2016 Commercial & Industrial Common Interest Development ActFrom Everand2016 Commercial & Industrial Common Interest Development ActNo ratings yet

- Third report of the United Nations Verification Mission in GuatemalaFrom EverandThird report of the United Nations Verification Mission in GuatemalaNo ratings yet

- 1990 Bar Examination - MercantileDocument11 pages1990 Bar Examination - MercantilejerushabrainerdNo ratings yet

- Due Process Upheld in PNCC Stock Ownership CaseDocument2 pagesDue Process Upheld in PNCC Stock Ownership CasejerushabrainerdNo ratings yet

- Taxicab Operators v. The Board of Transportation (GR L-59234, 30 September 1982) DigestsDocument1 pageTaxicab Operators v. The Board of Transportation (GR L-59234, 30 September 1982) DigestsjerushabrainerdNo ratings yet

- 1987 Bar Examination - MercantileDocument14 pages1987 Bar Examination - MercantilejerushabrainerdNo ratings yet

- 1988 BAR EXAMINATION QUESTIONSDocument18 pages1988 BAR EXAMINATION QUESTIONSjerushabrainerdNo ratings yet

- 1989 BAR EXAMINATION QUESTIONSDocument13 pages1989 BAR EXAMINATION QUESTIONSjerushabrainerdNo ratings yet

- 1989 Labor Bar ExaminationDocument13 pages1989 Labor Bar ExaminationjerushabrainerdNo ratings yet

- 1988 BAR EXAMINATION QUESTIONSDocument15 pages1988 BAR EXAMINATION QUESTIONSjerushabrainerdNo ratings yet

- G.R. No. 180643 Neri Vs SenateDocument38 pagesG.R. No. 180643 Neri Vs SenateBrian BertNo ratings yet

- G.R. No. 180643 Neri Vs SenateDocument38 pagesG.R. No. 180643 Neri Vs SenateBrian BertNo ratings yet

- 1986 Bar Examination - MercantileDocument12 pages1986 Bar Examination - MercantilejerushabrainerdNo ratings yet

- Due Process Upheld in PNCC Stock Ownership CaseDocument2 pagesDue Process Upheld in PNCC Stock Ownership CasejerushabrainerdNo ratings yet

- EVIDENCE BENCHBOOK TRIAL JUDGESDocument19 pagesEVIDENCE BENCHBOOK TRIAL JUDGESjerushabrainerdNo ratings yet

- 1987 Labor Bar ExaminationDocument18 pages1987 Labor Bar ExaminationjerushabrainerdNo ratings yet

- ADR Case 2 LM Engineering V CapitolDocument6 pagesADR Case 2 LM Engineering V CapitoljerushabrainerdNo ratings yet

- ADR Case 2 LM Engineering V CapitolDocument6 pagesADR Case 2 LM Engineering V CapitoljerushabrainerdNo ratings yet

- de Leon v. Esguerra, 153 SCRA 602Document25 pagesde Leon v. Esguerra, 153 SCRA 602Elle VieNo ratings yet

- Businos vs. LegaspiDocument6 pagesBusinos vs. LegaspijerushabrainerdNo ratings yet

- Aquino V ComelecDocument13 pagesAquino V ComelecjerushabrainerdNo ratings yet

- Razon V TagitisDocument65 pagesRazon V TagitisjerushabrainerdNo ratings yet

- Aquino vs. MangaoangDocument1 pageAquino vs. MangaoangjerushabrainerdNo ratings yet

- DOH V Phil PharmaDocument9 pagesDOH V Phil PharmajerushabrainerdNo ratings yet

- Magallano Vs ErmitaDocument35 pagesMagallano Vs ErmitaEnan IntonNo ratings yet

- Insular Savings Bank vs. FEBTCDocument6 pagesInsular Savings Bank vs. FEBTCJune Erik YlananNo ratings yet

- Abakada V Exec SecDocument64 pagesAbakada V Exec SecjerushabrainerdNo ratings yet

- Chavez V JBCDocument24 pagesChavez V JBCjerushabrainerdNo ratings yet

- Buenaseda vs. Flavier Ombudsman power to suspend officials (40Document4 pagesBuenaseda vs. Flavier Ombudsman power to suspend officials (40jerushabrainerdNo ratings yet

- Blanza v. ArcangelDocument2 pagesBlanza v. ArcangelNikki Rose Laraga AgeroNo ratings yet

- Manila Prince Hotel V GSISDocument17 pagesManila Prince Hotel V GSISjerushabrainerdNo ratings yet

- Case 1 - People v. Perfecto, 43 Phil. 887, 10-04-1922 (G.R. No. L-18463)Document5 pagesCase 1 - People v. Perfecto, 43 Phil. 887, 10-04-1922 (G.R. No. L-18463)Faizah Kadon TejeroNo ratings yet

- Search Inside Yourself PDFDocument20 pagesSearch Inside Yourself PDFzeni modjo02No ratings yet

- DRRR STEM 1st Quarter S.Y.2021-2022Document41 pagesDRRR STEM 1st Quarter S.Y.2021-2022Marvin MoreteNo ratings yet

- MVD1000 Series Catalogue PDFDocument20 pagesMVD1000 Series Catalogue PDFEvandro PavesiNo ratings yet

- Poetry Recitation Competition ReportDocument7 pagesPoetry Recitation Competition ReportmohammadNo ratings yet

- Training Effectiveness ISO 9001Document50 pagesTraining Effectiveness ISO 9001jaiswalsk1No ratings yet

- Brain Chip ReportDocument30 pagesBrain Chip Reportsrikanthkalemla100% (3)

- Chronic Pancreatitis - Management - UpToDateDocument22 pagesChronic Pancreatitis - Management - UpToDateJose Miranda ChavezNo ratings yet

- Database Interview QuestionsDocument2 pagesDatabase Interview QuestionsshivaNo ratings yet

- Casey at The BatDocument2 pagesCasey at The BatGab SorianoNo ratings yet

- Compound SentenceDocument31 pagesCompound Sentencerosemarie ricoNo ratings yet

- 2Document5 pages2Frances CiaNo ratings yet

- Supreme Court declares Pork Barrel System unconstitutionalDocument3 pagesSupreme Court declares Pork Barrel System unconstitutionalDom Robinson BaggayanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pravin AwalkondeNo ratings yet

- FPR 10 1.lectDocument638 pagesFPR 10 1.lectshishuNo ratings yet

- Otto F. Kernberg - Transtornos Graves de PersonalidadeDocument58 pagesOtto F. Kernberg - Transtornos Graves de PersonalidadePaulo F. F. Alves0% (2)

- Contract Costing and Operating CostingDocument13 pagesContract Costing and Operating CostingGaurav AggarwalNo ratings yet

- Device Exp 2 Student ManualDocument4 pagesDevice Exp 2 Student Manualgg ezNo ratings yet

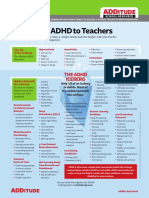

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Developing An Instructional Plan in ArtDocument12 pagesDeveloping An Instructional Plan in ArtEunice FernandezNo ratings yet

- Irony in Language and ThoughtDocument2 pagesIrony in Language and Thoughtsilviapoli2No ratings yet

- Mayflower Compact - WikipediaDocument4 pagesMayflower Compact - WikipediaHeaven2012No ratings yet

- Microeconomics Study Guide for CA-CMA-CS ExamDocument14 pagesMicroeconomics Study Guide for CA-CMA-CS ExamCA Suman Gadamsetti75% (4)

- Bianchi Size Chart for Mountain BikesDocument1 pageBianchi Size Chart for Mountain BikesSyafiq IshakNo ratings yet

- Aladdin and the magical lampDocument4 pagesAladdin and the magical lampMargie Roselle Opay0% (1)

- Prac Research Module 2Document12 pagesPrac Research Module 2Dennis Jade Gascon NumeronNo ratings yet

- Phasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary EssayDocument4 pagesPhasin Ngamthanaphaisarn - Unit 3 - Final Assessment Literary Essayapi-428138727No ratings yet

- Settlement of Piled Foundations Using Equivalent Raft ApproachDocument17 pagesSettlement of Piled Foundations Using Equivalent Raft ApproachSebastian DraghiciNo ratings yet

- Set up pfSense transparent Web proxy with multi-WAN failoverDocument8 pagesSet up pfSense transparent Web proxy with multi-WAN failoverAlicia SmithNo ratings yet

- 2013 Gerber CatalogDocument84 pages2013 Gerber CatalogMario LopezNo ratings yet

- Tennessee Inmate Search Department of Corrections LookupDocument9 pagesTennessee Inmate Search Department of Corrections Lookupinmatesearchinfo50% (2)