Professional Documents

Culture Documents

Cash Management Reconciliations: Foreign Currencies, AP, GL, and Bank Statements</TITLE

Uploaded by

prairnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Management Reconciliations: Foreign Currencies, AP, GL, and Bank Statements</TITLE

Uploaded by

prairnaCopyright:

Available Formats

Cash Management includes: a) Clearing manually or automatically your uncleared transactions lying in Accounts Receivables, Accounts payables, Oracle

Payroll & General Ledger modules. b) It helps the user to reconcile manually or automatically the payments and receipts and then review and correct the unreconciled transactions. c) Enter Bank Statements manually or automatically by importing from Open Interface tables. d) Prepare Cash forecast. e) Cash management also handles Multi Currency Bank Statements and its reconcilation.

Foreign Currency Banks Reconciliations Foreign Currency Transactions

Receipt is in Foreign Currency / Bank is Functional Currency In this case the tolerance amount will be the difference in Converted Amount of Receipt and Statement amount.

Both Receipt and Bank is in foreign Currency In this case the Tolerance amount will first be converted into foreign currency using Rate type and Rate date as specified in System Parameters form.

Note : Rest will remain same as covered till now.

Set ups for Reconciliation with Oracle General Ledger and Oracle Payables

i. Create a Bank Transaction Code for AP and Gl Source Create a Receipt or Payment Type in Bank transaction code screen with Source as Journals Matching Criteria 1 CCID of Bank Account in Journal Line must be same as Cash Account in the Bank Definition 2 Journal Line must be Posted 3 Description field and the Number Field is the Matching Criteria used

Reconciliation of AP to CE

Steps 1 Assign a Payables Document to the bank 2 Define one Supplier 3 Create one Invoice and make payment in full 4 Create Bank Transaction Code with Source as Payables 5 Enter one Bank statement line of Type Payment in Bank Statement. 6 Either Manually Reconcile or Auto 7 For any Stopped Payment line in Bank Statement define bank transaction code for Stopped as type and source payables and then use this code in statement line.

Description Figure 10 Shows Payment created in AP. Navigation Payables- Payments-Payment

Description Figure 11 Shows Payment created in AP. Navigation Payables- Payments-Payment

Cash Management treats Payments as a source of Cash Outflow and Stopped Payments as a source of Cash Inflows. Since the Bank Statement Header has one field for Cash Inflow Sources (Receipts) and one for Outflow sources (Payments), Stopped Payments show up in the Receipts Field. There could be two scenarios, which would affect the Bank Statement Balance: Case 1 The bank records both the original payment and the stopped payment on the same statement. In this case, the two transactions would null out and have no effect on the closing balance. This is the basis for the treatment of stopped payments by the method described above.

Description Figure 12 Shows Reconciliation of Stopped line with AP void payment Navigation : Cash Management Bank Reconciliations-Bank Statements Case 2 The bank records the original payment and the stopped payment on two different statements or just records the stopped payment and not the original payment. In this case, the closing balance would be impacted.

Description Figure 13 Shows bank transaction code for Journal as Source . Navigation : Cash Management Set up- Bank transaction Code

Description Figure 14 Shows the Lines in Cash Management reconciliation with Journals in Oracle General Ledger. Navigation : Cash Management Bank Reconciliations-Bank Statements

Description Figure 15 Shows the Journal Created in oracle general Ledger with Description field populated . Navigation Oracle General Ledger Journals-Enter

Conclusions It is our hope that this paper has helped you understand what Cash Management Reconciliations is , and how to set it up.

You might also like

- 03 - Setting Up Oracle Cash ManagementDocument8 pages03 - Setting Up Oracle Cash ManagementprairnaNo ratings yet

- Balance Sheet: Sources of FundsDocument1 pageBalance Sheet: Sources of FundsprairnaNo ratings yet

- 02 - Cash Management SecurityDocument8 pages02 - Cash Management SecurityprairnaNo ratings yet

- Te040 R12 Cash Management Test ScriptsDocument62 pagesTe040 R12 Cash Management Test ScriptsGrace Ohh100% (2)

- Financial Screening of Residential ProjectsDocument35 pagesFinancial Screening of Residential ProjectsprairnaNo ratings yet

- Cash Management SetupDocument10 pagesCash Management SetupMadhuriSeshadri DevarapalliNo ratings yet

- Cash Management Reconciliations: Foreign Currencies, AP, GL, and Bank Statements</TITLEDocument6 pagesCash Management Reconciliations: Foreign Currencies, AP, GL, and Bank Statements</TITLEprairnaNo ratings yet

- Capital BudgetingDocument219 pagesCapital BudgetingprairnaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Haul Cables and Care For InfrastructureDocument11 pagesHaul Cables and Care For InfrastructureSathiyaseelan VelayuthamNo ratings yet

- 3DS MAX SYLLABUSDocument8 pages3DS MAX SYLLABUSKannan RajaNo ratings yet

- Tata Group's Global Expansion and Business StrategiesDocument23 pagesTata Group's Global Expansion and Business Strategiesvgl tamizhNo ratings yet

- 2JA5K2 FullDocument22 pages2JA5K2 FullLina LacorazzaNo ratings yet

- Q&A Session on Obligations and ContractsDocument15 pagesQ&A Session on Obligations and ContractsAnselmo Rodiel IVNo ratings yet

- Sta A4187876 21425Document2 pagesSta A4187876 21425doud98No ratings yet

- Denial and AR Basic Manual v2Document31 pagesDenial and AR Basic Manual v2Calvin PatrickNo ratings yet

- E2 PTAct 9 7 1 DirectionsDocument4 pagesE2 PTAct 9 7 1 DirectionsEmzy SorianoNo ratings yet

- Civil Aeronautics BoardDocument2 pagesCivil Aeronautics BoardJayson AlvaNo ratings yet

- Broker Name Address SegmentDocument8 pagesBroker Name Address Segmentsoniya_dps2006No ratings yet

- Gates em Ingles 2010Document76 pagesGates em Ingles 2010felipeintegraNo ratings yet

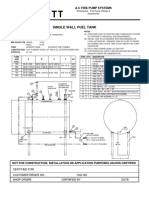

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDocument1 pageSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNo ratings yet

- High Altitude Compensator Manual 10-2011Document4 pagesHigh Altitude Compensator Manual 10-2011Adem NuriyeNo ratings yet

- Ju Complete Face Recovery GAN Unsupervised Joint Face Rotation and De-Occlusion WACV 2022 PaperDocument11 pagesJu Complete Face Recovery GAN Unsupervised Joint Face Rotation and De-Occlusion WACV 2022 PaperBiponjot KaurNo ratings yet

- 1st Exam Practice Scratch (Answer)Document2 pages1st Exam Practice Scratch (Answer)Tang Hing Yiu, SamuelNo ratings yet

- Information Pack For Indonesian Candidate 23.06.2023Document6 pagesInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaNo ratings yet

- Complaint Handling Policy and ProceduresDocument2 pagesComplaint Handling Policy and Proceduresjyoti singhNo ratings yet

- Variable Displacement Closed Circuit: Model 70160 Model 70360Document56 pagesVariable Displacement Closed Circuit: Model 70160 Model 70360michael bossa alisteNo ratings yet

- 01 Automatic English To Braille TranslatorDocument8 pages01 Automatic English To Braille TranslatorShreejith NairNo ratings yet

- Ten Golden Rules of LobbyingDocument1 pageTen Golden Rules of LobbyingChaibde DeNo ratings yet

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFDocument23 pagesPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangNo ratings yet

- MiniQAR MK IIDocument4 pagesMiniQAR MK IIChristina Gray0% (1)

- Pyrometallurgical Refining of Copper in An Anode Furnace: January 2005Document13 pagesPyrometallurgical Refining of Copper in An Anode Furnace: January 2005maxi roaNo ratings yet

- Tutorial 5 HExDocument16 pagesTutorial 5 HExishita.brahmbhattNo ratings yet

- Analytical DataDocument176 pagesAnalytical DataAsep KusnaliNo ratings yet

- Proposed Delivery For PAU/AHU Method Statement SEC/MS/3-25Document4 pagesProposed Delivery For PAU/AHU Method Statement SEC/MS/3-25Zin Ko NaingNo ratings yet

- Bob Wright's Declaration of BeingDocument1 pageBob Wright's Declaration of BeingBZ Riger100% (2)

- Individual Differences: Mental Ability, Personality and DemographicsDocument22 pagesIndividual Differences: Mental Ability, Personality and DemographicsAlera Kim100% (2)

- Tyron Butson (Order #37627400)Document74 pagesTyron Butson (Order #37627400)tyron100% (2)

- Milton Hershey's Sweet StoryDocument10 pagesMilton Hershey's Sweet Storysharlene sandovalNo ratings yet