Professional Documents

Culture Documents

Usl Q3 Fy12

Uploaded by

Varun AmritwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Usl Q3 Fy12

Uploaded by

Varun AmritwarCopyright:

Available Formats

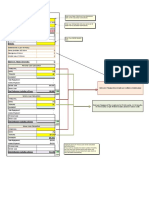

USL Q-3 FY12

Segment-Line-wise Performance

Volume in Mio. Cases

Segment

Act

10-11

Act

11-12

Growth %

Act

11-12

Growth

W/o

TN

Growth

W/o

TN &

WB

Scotch

0.07

0.08

23%

22%

20%

Premium Whisky

0.94

1.09

16%

19%

18%

Premium Others

0.25

0.16

(35%)

87%

87%

Prestige

5.26

5.62

7%

9%

15%

6.51

6.95

7%

12%

16%

Regular

21.36

20.62

(3%)

2%

6%

II Line

1.93

2.40

24%

33%

37%

Franchise

0.49

0.53

8%

8%

8%

30.30

30.51

1%

6%

10%

Prestige & Above

All India

USL - Line Segment wise Performance

Apr-Dec'11

Volume in

Million Cases

Growth

Apr'11 - Dec'11

Act

1011

Act

11-12

>Yr 11

Gth

Growth

W/o TN

W/o

TN & WB

Scotch

0.16

0.20

27%

27%

27%

Premium Whisky

2.43

2.96

22%

25%

25%

Premium Others

0.82

0.54

(34%)

83%

83%

Prestige

14.25

16.53

16%

15%

17%

Prestige & Above

17.65

20.22

15%

18%

19%

Regular

58.54

60.67

4%

8%

10%

II Line

5.91

7.31

24%

34%

33%

Franchise

1.39

1.74

25%

25%

25%

83.49

89.94

8%

12%

14%

USL

ENA Price Movement

180

170

Rs Per Case

160

154.75

151.18

150

140

141.33

130

120

110

100

90

80

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

YTD

Dec Avg

FY 09.

104.52 112.02 116.21 121.28 130.68 147.75 160.66 160.48 147.96 135.71 135.75 143.39

FY 10.

148.37 152.74 150.86 150.68 150.74 150.50 152.34 151.66 151.78 154.98 152.55 149.28

151.18

FY 11. Act 144.49 144.11 140.19 136.97 138.67 138.49 140.03 143.68 144.83 150.01 150.14 150.48

FY 12 Act 146.85 147.38 145.98 148.69 155.14 155.45 162.38 163.51 165.75

Q1

Q2

Q3

Q4

Avg. FY 11

142.83

137.95

142.98

150.20

Avg. FY 12

146.73

153.09

163.97

141.33

154.75

Annual

143.64

154.75

USL Q3 Unaudited Financial results

Three months Ended (UnAudited)

` Crore

31-Dec-11

Net Sales /Income

% NSR

1,967.3

Growth

COGS

30-Sep-11

% NSR

1,866.3

0%

2010

% NSR

1,969.4

37%

1,189.4

60%

1,044.2

56%

1,157.1

59%

Gross Margin

777.9

40%

822.1

44%

812.3

41%

Staff Cost

119.2

6%

104.6

6%

107.4

5%

Advertising & Sales Promotion

216.7

11%

168.6

9%

194.0

10%

Other Overheads

241.8

12%

217.2

12%

225.5

11%

200.3

10%

331.7

18%

285.4

14%

EBITDA

Growth

Exch. Diff Gain/(Loss) / Oth. Income

Interest

Depreciation

PBT before exceptional item

Exceptional items

PBT

Growth

Tax

PAT

Growth

-30%

44%

27.0

1%

39.5

2%

(10.9)

-1%

139.2

7%

124.1

7%

103.8

5%

15.5

1%

15.2

1%

12.6

1%

72.54

4%

231.9

12%

158.1

8%

(2.0)

0%

(10.9)

-1%

36.8

2%

70.57

4%

220.9

12%

194.9

10%

-64%

95%

23.01

1%

72.9

4%

65.0

3%

47.56

2%

148.0

8%

130.0

7%

-63%

98%

USL April -December Unaudited Financial results

Nine Month Ended 31st December

` Crore

2011

Net Sales /Income

% NSR

5,778.1

Growth

COGS

2010

% NSR

4,805.5

Audited Year ended

Mar11

% NSR

6,418.1

20%

3,388.7

59%

2,676.9

56%

3,594.5

56%

2,389.5

41%

2,128.7

44%

2,823.5

44%

Staff Cost

320.3

6%

266.2

6%

364.7

6%

Advertising & Sales Promotion

535.7

9%

488.8

10%

670.5

10%

Other Overheads

662.2

11%

569.1

12%

775.7

12%

871.3

15%

804.6

17%

1,012.7

16%

67.3

1%

(20.2)

0%

(17.3)

0%

386.1

7%

298.6

6%

402.8

6%

43.4

1%

32.1

1%

47.7

1%

509.2

9%

453.6

9%

544.8

8%

(12.9)

0%

36.8

1%

(36.8)

-1%

496.3

9%

490.5

10%

581.6

9%

163

3%

164.88

3%

196.1

3%

333.3

6%

325.6

7%

385.5

6%

Gross Margin

EBITDA

Growth

Exch. Diff Gain/(Loss) / Oth. Income

Interest

Depreciation

PBT before exceptional item

Exceptional items

PBT

8%

Growth

Tax

PAT

Growth

1%

2%

USL Profit Statement (Consolidated)

April December

` Crore

Unaudited

Dec-11

%NSR

Dec-10

Audited

%NSR

%NSR

Sales

6,915.6

COGS

3,766.1

54%

2,930.8

53%

3,852.7

52%

Gross Margin

3,149.5

46%

2,607.0

47%

3,523.5

48%

Other Income

5,537.8

Mar-11

134.8

7,376.2

51.9

3,284.3

90.4

2,658.9

3,613.9

Staff Cost

480.2

7%

399.5

7%

550.2

7%

Advertisement & Sales Promotion

752.1

11%

645.6

12%

869.7

12%

Other Overheads

985.2

14%

742.8

13%

1,038.9

14%

1,066.8

15%

870.9

16%

1,155.1

16%

Exch. Diff Gain / ( Loss )

(41.5)

-1%

5.7

0%

101.5

Pension/Onerous Lease

23.0

0%

23.2

0%

140.9

Interest

565.2

8%

362.5

7%

498.5

7%

Depreciation

100.3

1%

69.9

1%

102.3

1%

382.8

6%

467.4

8%

796.7

11%

(12.9)

0%

36.8

1%

36.8

0%

369.9

504.2

186.6

9%

3%

833.6

184.6

5%

3%

265.2

11%

4%

185.3

3%

317.5

6%

568.3

8%

EBIDTA

PBT before exceptional item

Exceptional items

PBT

Tax

PAT

1%

USL Balance Sheet (Consolidated)

As at 31st December 2011

Dec 2011

` Crore

March 2011

SOURCE

Share Capital

Reserves and Surplus

Minority Interest

Secured Loans

Unsecured Loans

Term Liability towards Franchisee Rights

Total

125.9

4,710.7

14.3

7,130.2

1,274.1

125.9

4,052.7

17.5

5,284.4

1,096.7

295.2

329.6

13,550.2

10,906.8

3,023.3

4,979.7

153.9

690.9

40.1

4,400.7

2,069.0

4,432.0

154.4

637.0

32.5

3,537.1

261.8

44.8

13,550.2

10,906.8

APPLICATION

Fixed Assets - Net

Goodwill on Consolidation

Investments

Cash and Bank Balances

Deferred Tax Asset

Net Current Assets

Misc Exp (to the extent not written off)

Total

USL Debt Position

(Consolidated)

As at 31st December 2011

` Crore

Dec-11

Mar-11

Secured Loans :

Capex Loans

Term Loans : Acquisition of SWCL & HL

Term Loans : Acquisition of W & M

Term Loans : FMS Stock Maturation

Working Capital

Term Loans of SDL, PDL & Others

595

17

1,140

226

1,877

235

4,089

521

83

1,252

211

918

0

2,985

583

676

15

547

536

14

5.363

4,082

2,299

3,041

3,041

2,299

8,404

6,381

USL - Consolidated : (Including W & M)

Total Gross debt ( consolidated)

8,404

Cash & Bank Balance

691

6,381

637

Unsecured Loans

Unsecured Loans

Fixed Deposits

From Others

Sub -Total

W & M Acquisition Loan - Without recourse

USL Holdings (UK) Ltd - With recourse (GBP 370

Mio)

Sub -Total

Total Debt

Total Net Debt

7,713

5,744

W & M Profit Statement

9 Months Apr-Dec

2011

Net Sales

In Million Pounds

9 Months Apr-Dec

2010

128.50

97.78

Gross Profit

64.03

48.64

Marketing expenses

26.86

18.97

Contribution

37.16

29.67

9.13

7.14

28.04

22.53

Depreciation

3.14

3.18

Restructuring costs & Goodwill

0.73

0.63

10.71

7.21

PBT

13.46

11.51

Contribution Margin

28.91%

30.34%

EBITDA Margin

21.82%

23.04%

Overheads

EBITDA

Interest and Fin Costs

W & M Balance Sheet

In Million Pounds

As at Dec 2011

As at Mar 2011

SOURCES

Share Capital

62.31

62.31

Reserves & Surplus

47.59

34.14

138.16

112.76

248.06

209.21

Fixed Assets

59.75

58.81

Goodwill

52.81

26.36

119.37

111.63

Other Net Current Assets

15.01

13.41

Net Pension (Deficit)/Gain

1.12

(1.01)

248.06

209.21

Net Debt

Total Sources

APPLICATION

Bulk Stock

Total Application

You might also like

- What Is Administrative Model of Curriculum?Document9 pagesWhat Is Administrative Model of Curriculum?Varun AmritwarNo ratings yet

- UBHL Annual Report 2011Document89 pagesUBHL Annual Report 2011Varun AmritwarNo ratings yet

- Resume 1Document1 pageResume 1Varun AmritwarNo ratings yet

- DiageoDocument31 pagesDiageoVarun AmritwarNo ratings yet

- Brand Solutions From: India's Pioneer and Stickiest Bollywood PortalDocument36 pagesBrand Solutions From: India's Pioneer and Stickiest Bollywood PortalVarun AmritwarNo ratings yet

- TradeDocument1 pageTradeVarun AmritwarNo ratings yet

- Calgary An Over View - New Destination: Eographic Ocation OF Algary CityDocument4 pagesCalgary An Over View - New Destination: Eographic Ocation OF Algary CityVarun AmritwarNo ratings yet

- Ek 2007 ArDocument215 pagesEk 2007 ArVarun AmritwarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Math 1030Document5 pagesMath 1030api-442263040No ratings yet

- ASM Supple TekDocument16 pagesASM Supple TekRajendra JoshiNo ratings yet

- Internship Report On BRAC Bank Ltd.Document93 pagesInternship Report On BRAC Bank Ltd.Md. Likhon82% (17)

- Women 1501Document41 pagesWomen 1501MeherunnesaNo ratings yet

- Community Learning Center Program A & E Learning Facilitator Literacy Level Month and Quarter Learning Strand LS4 Life and Career SkillsDocument3 pagesCommunity Learning Center Program A & E Learning Facilitator Literacy Level Month and Quarter Learning Strand LS4 Life and Career SkillsMary Joyce Ariem100% (2)

- P ROPOSALDocument14 pagesP ROPOSALabceritreaNo ratings yet

- ICICI BANK AND ITS PARTNERSHIP LINKAGES IN INDIA1 A Case StudyDocument8 pagesICICI BANK AND ITS PARTNERSHIP LINKAGES IN INDIA1 A Case StudyRazel Tercino0% (1)

- Appraised Value Is The Financial Worth Placed On A Real Property Based On A Report by An Appraiser, Who Is ADocument4 pagesAppraised Value Is The Financial Worth Placed On A Real Property Based On A Report by An Appraiser, Who Is AMichelle GozonNo ratings yet

- Banking Awareness Ebook 1 PDFDocument18 pagesBanking Awareness Ebook 1 PDFThakur Rashttra BhushanNo ratings yet

- Agricultural Bank of China Hold: Asset Restructuring Takes TimeDocument17 pagesAgricultural Bank of China Hold: Asset Restructuring Takes TimeShi HuangaoNo ratings yet

- Company Law PsdaDocument15 pagesCompany Law PsdaRamey Krishan RanaNo ratings yet

- CIBIL Score 754: Poonam TiwariDocument3 pagesCIBIL Score 754: Poonam Tiwaripoonamtiwari1586No ratings yet

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument46 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsyeehawwwwNo ratings yet

- G. Edward Griffin: A Second Look at The Federal ReserveDocument11 pagesG. Edward Griffin: A Second Look at The Federal ReserveKirsten NicoleNo ratings yet

- Competition in Ethiopian Banking IndustryDocument16 pagesCompetition in Ethiopian Banking IndustryTsegaye TamratNo ratings yet

- Theoretical FrameworkDocument2 pagesTheoretical FrameworkIvan Clojen Nahilat50% (2)

- OBLICON (Art. 1315-1319)Document2 pagesOBLICON (Art. 1315-1319)Karen Joy MasapolNo ratings yet

- Bullet Points For LocDocument2 pagesBullet Points For Locapi-24643888No ratings yet

- True / False Questions: Risks of Financial InstitutionsDocument27 pagesTrue / False Questions: Risks of Financial Institutions姚依雯No ratings yet

- Lect 13 & 14 EntrepreneurshipDocument29 pagesLect 13 & 14 EntrepreneurshipHaseeb Ur RehmanNo ratings yet

- 2020 Affinity 20hr SAFE Act Manual BookDocument232 pages2020 Affinity 20hr SAFE Act Manual BookRenee NasserNo ratings yet

- CoreLogic - Investor Day May 2010Document109 pagesCoreLogic - Investor Day May 2010as3122No ratings yet

- Registration Guide: Office of The RegistrarDocument11 pagesRegistration Guide: Office of The RegistrarMartin NaukukutuNo ratings yet

- Companies (Acceptance of Deposits) Rules 2014Document14 pagesCompanies (Acceptance of Deposits) Rules 2014PratyakshaNo ratings yet

- Sample ExamDocument5 pagesSample Exam范明奎No ratings yet

- Avopa NW May2014Document8 pagesAvopa NW May2014Prakash VadavadagiNo ratings yet

- Law of Financial Institutions and Securities BLO3405: Vu - Edu.auDocument35 pagesLaw of Financial Institutions and Securities BLO3405: Vu - Edu.auYuting WangNo ratings yet

- Almeda vs. CADocument2 pagesAlmeda vs. CAAlexis Von TeNo ratings yet

- Personal Loan - CalculaterDocument3 pagesPersonal Loan - CalculaterSalman Fateh AliNo ratings yet

- E BankingDocument87 pagesE BankingMailaram BheemreddyNo ratings yet