Professional Documents

Culture Documents

Fund Account

Uploaded by

rwtrimiewCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fund Account

Uploaded by

rwtrimiewCopyright:

Available Formats

Were here to help. Call your New Client Concierge at 1-877-566-7958.

Well handle all the details of setting up your new account.

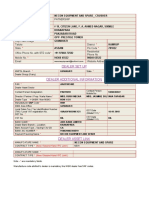

Funding Options for Schwab Brokerage and Individual Retirement Accounts

Funding options Online transfer with Schwab MoneyLink Estimated timing Online enrollment: 12 business days. Subsequent transfers: 12 business days. 7 business days from the date mailed. Same day for branch deposits. Wire transfer Same business day if transfer occurs before daily cutoff time. $0 $0 Schwab fees $0 When funds are available for trading You can trade most stocks and mutual funds as soon as the money is deposited; otherwise, there may be a hold of up to 3 business days. You can trade most stocks and mutual funds as soon as the money is deposited; otherwise, there may be a hold of up to 5 business days.

Check

You can trade most stocks and mutual funds as soon as funds are received in the account. There is (Sending bank a 1-day hold. fees apply.) $0 (Your current firm might charge a transfer fee.) $0 $0 You can trade after a hold of 1 business day. You can trade most stocks and mutual funds as soon as Schwab receives the bill payment you initiate; otherwise, there may be a hold of up to 5 business days. Longer holds (for 5 business days) will be placed on mobile deposits during your first 90 days as a client. You can trade once the transfer is complete.

Account transfer

510 business days after the request is received for stocks, bonds, and acceptable mutual funds held at most brokerage or mutual funds firms. Transfers from trusts, banks, and insurance companies can take longer.

401(k) rollover Online bill pay

Varies depending on the plan administrator. 07 days, depending on your bank. You will need to add your Schwab account number in the Payee Account Number field. If an address is required, use the overnight mailing address below. Application: 03 days. Subsequent deposits: 01 day.

Schwab Mobile Deposit1

$0

Check

Wire transfer

Make your check payable to Charles Schwab & Co., Inc. On the back of the check, write the number for the Schwab brokerage account into which you are making the deposit. For IRAs, please include your contribution year on the check. Mailing Addresses: Standard Mailing Address Charles Schwab & Co., Inc., Phoenix Operations Center P.O. Box 52114 Phoenix, AZ 85072 Overnight Mailing Address Charles Schwab & Co., Inc., Phoenix Operations Center 2423 E. Lincoln Dr. Phoenix, AZ 85016

Brokerage Products: Not FDIC-Insured No Bank Guarantee May Lose Value See important disclosures on the next page.

2012 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. Funding Options | Page 1 of 2

Domestic Transfer (U.S. dollars) To wire funds to your Schwab account, please provide the sending institution with the following information: Make payable to: Citibank NA Citibank address: 111 Wall Street, New York, NY 10005 Citibank ABA number: 021000089 For credit to: Charles Schwab & Co., Inc. Account number: 4055-3953 Include: Your Schwab account title and account number

401(k) Rollover

Request a distribution check from your plan administrator made payable to Charles Schwab & Co., Inc., FBO (your name). Your Rollover IRA account number should be included on the check. If your plan administrator sends you the check, simply forward it to Charles Schwab & Co., Inc., P.O. Box 52114, Phoenix, AZ 85072.

Were here to help. Call your New Client Concierge at 1-877-566-7958. Well handle all the details of setting up your new account.

Funding Options for Schwab Bank Accounts

Funding options Schwab Bank Electronic Funds Transfer (EFT) Check Wire transfer Estimated timing Setup: 1013 business days. Subsequent transfers: 12 business days. 7 business days from the date mailed. Same business day if transfer occurs before daily cutoff time. $0 $0 (Sending bank fees apply.) $0 Same day if request is received prior to 4:00 p.m. PT (7:00 p.m. ET). 1 business day if request is received after 4:00 p.m. PT. After a hold of up to 5 business days. Schwab fees $0 When funds are available After a hold of 4 business days. (Interest is earned immediately after deposit.)

After a hold of 15 business days. (Interest is earned immediately after deposit.) As soon as funds are in the account.

Online transfer from brokerage account Online bill pay

Same business day if transfer occurs before daily cutoff time. 07 days, depending on your bank. You will need to add your Schwab account number in the Payee Account Number field. If an address is required, use the overnight mailing address below. Application: 03 days. Subsequent deposits: 01 day.

$0

Schwab Mobile Deposit1

$0

Longer holds (for 5 business days) will be placed on mobile deposits during your first 90 days as a client.

Check

Wire transfer

Make your check payable to yourself. On the back of the check, write the number for the Schwab Bank account into which you are making the deposit. Mailing Addresses: Standard Mailing Address Charles Schwab Bank P.O. Box 52114 Phoenix, AZ 85072 Overnight Mailing Address Charles Schwab Bank 2423 E. Lincoln Dr. Phoenix, AZ 85016

To wire funds to your Schwab Bank account, please provide the sending institution with the following information: Name on account: Schwab Bank High Yield Investor Checking account number ABA routing and transit number: 121202211 Account type: Checking Name of financial institution: Charles Schwab Bank 5190 Neil Rd., Suite 100 Reno, NV 89502

Mobile Deposit is subject to limitations and other conditions. Standard hold times apply. System availability and response times are subject to mobile connection limitations. Requires a wireless signal or mobile connection. Charles Schwab & Co., Inc. and Charles Schwab Bank are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. Brokerage products are offered by Charles Schwab & Co., Inc., Member SIPC. Deposit and lending products and services are offered by Charles Schwab Bank, Member FDIC and an Equal Housing Lender.

2012 Charles Schwab Bank. All rights reserved. Member FDIC. CS17128-01 (0812-4728) SLS61932-01 (07/12)

Funding Options | Page 2 of 2

You might also like

- Schwab Bank Deposit Account Pricing GuideDocument12 pagesSchwab Bank Deposit Account Pricing GuidecadeadmanNo ratings yet

- Electronic Payment Systems: Presented By: Salman Touheed Tariq Rashid Faizan ZafarDocument45 pagesElectronic Payment Systems: Presented By: Salman Touheed Tariq Rashid Faizan ZafarsalmantouheedNo ratings yet

- Installment Payment Plan Request: No PO Box NumberDocument4 pagesInstallment Payment Plan Request: No PO Box NumberjackNo ratings yet

- Benefits of Using Swift PaymentsDocument6 pagesBenefits of Using Swift PaymentsMidhunNo ratings yet

- E 7009Document4 pagesE 70091399No ratings yet

- What Is Eon Bank Group Mol-Mymode Freedom Mastercard Unembossed Card?Document8 pagesWhat Is Eon Bank Group Mol-Mymode Freedom Mastercard Unembossed Card?wan norizanNo ratings yet

- MPR Grant Application - FinalDocument3 pagesMPR Grant Application - FinalWest Central TribuneNo ratings yet

- Accounting Fundamentals II: Lesson 12Document12 pagesAccounting Fundamentals II: Lesson 12gretatamaraNo ratings yet

- Charles Schwab Cash Features Disclosure Statement For Individual InvestorsDocument32 pagesCharles Schwab Cash Features Disclosure Statement For Individual InvestorscadeadmanNo ratings yet

- Topic ReviewDocument11 pagesTopic ReviewNguyen Thi Bich NgocNo ratings yet

- Us Bank Lien MeDocument6 pagesUs Bank Lien Mefreedom ElNo ratings yet

- RTGSDocument14 pagesRTGSHarshUpadhyayNo ratings yet

- Rules PDFDocument6 pagesRules PDFAshlynNo ratings yet

- Dispute Results PDFDocument28 pagesDispute Results PDFBella AriaNo ratings yet

- Duke Energy PremierNotes ProspectusDocument37 pagesDuke Energy PremierNotes ProspectusshoppingonlyNo ratings yet

- US Internal Revenue Service: p3381Document3 pagesUS Internal Revenue Service: p3381IRSNo ratings yet

- Money Transfer SystemsDocument2 pagesMoney Transfer SystemsMainSqNo ratings yet

- Delaware Corporation Manual 2004Document49 pagesDelaware Corporation Manual 2004documentseeker100% (1)

- Five Star Application FormDocument5 pagesFive Star Application Formkamran1983No ratings yet

- Guarding Against Pandemics 2022 Tax FilingDocument30 pagesGuarding Against Pandemics 2022 Tax FilingTeddy SchleiferNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- Litton FinancialStatementDocument1 pageLitton FinancialStatementZhen WuNo ratings yet

- Faq W2Document5 pagesFaq W2Shyam BabuNo ratings yet

- Public Debt ManagementDocument24 pagesPublic Debt ManagementGenelyn Cabudsan MancolNo ratings yet

- Macn-R000130716 - Ucc1 Dequincy Police DepartmentDocument7 pagesMacn-R000130716 - Ucc1 Dequincy Police Departmenttheodore moses antoine beyNo ratings yet

- E-ZPass NY ApplicationDocument3 pagesE-ZPass NY ApplicationChristopher BrownNo ratings yet

- CFR 2003 Title48 Vol1Document1,093 pagesCFR 2003 Title48 Vol1mptacly9152100% (1)

- Banking Guide For Overseas TravelDocument20 pagesBanking Guide For Overseas TravelLagi Cabe100% (1)

- Group 2 Cash Transfer 701pDocument32 pagesGroup 2 Cash Transfer 701pJesa ClemeniaNo ratings yet

- Us Bank NoteDocument2 pagesUs Bank NoteLamario StillwellNo ratings yet

- E Trade ApplicationDocument4 pagesE Trade Applicationtunlinoo100% (1)

- AIG World Gold FundDocument8 pagesAIG World Gold FundDrashti Investments100% (1)

- 2022 Turbo Tax ReturnDocument53 pages2022 Turbo Tax Returnleachsteven67No ratings yet

- Merchant Cash Factoring Business Cash LoansDocument2 pagesMerchant Cash Factoring Business Cash LoansMerchantCashinAdvanceNo ratings yet

- Credit 3 Pt2Document29 pagesCredit 3 Pt2soojung jungNo ratings yet

- Asterisk-Free Checking Account: 1 Everyday TransactionsDocument3 pagesAsterisk-Free Checking Account: 1 Everyday TransactionsMarcells Danyel JordanNo ratings yet

- By Rupert J. Ward and Seth Weber, KPMG LLP June 20, 2016Document3 pagesBy Rupert J. Ward and Seth Weber, KPMG LLP June 20, 2016Hoa Bồ Công AnhNo ratings yet

- I1099msc DFTDocument11 pagesI1099msc DFTVa KhoNo ratings yet

- Bank of America Matter Banking ConceptsDocument8 pagesBank of America Matter Banking ConceptsJithendar ReddyNo ratings yet

- 1 Eg Custodian Escrow PresentationrevDocument6 pages1 Eg Custodian Escrow PresentationrevGeir HolstadNo ratings yet

- AM - Birth - Form - Rev 1 - 21Document5 pagesAM - Birth - Form - Rev 1 - 21WolfGang4UDeeNo ratings yet

- Coinsource OH Notice of ChargesDocument3 pagesCoinsource OH Notice of ChargesLKNo ratings yet

- Secrecy of Bank DepositsTruth in LendingAMLADocument9 pagesSecrecy of Bank DepositsTruth in LendingAMLAJalod Hadji AmerNo ratings yet

- Law - Trust AccountingDocument2 pagesLaw - Trust AccountingjoanabudNo ratings yet

- Payment Options: Online Banking - Highly RecommendedDocument1 pagePayment Options: Online Banking - Highly RecommendedMEET SHAHNo ratings yet

- Sample Sa: Escrow AgreementDocument4 pagesSample Sa: Escrow AgreementEins BalagtasNo ratings yet

- International Monetary Fund in Globalization: International Organization Bretton Woods ConferenceDocument43 pagesInternational Monetary Fund in Globalization: International Organization Bretton Woods ConferenceYogita BathijaNo ratings yet

- SEC Whistleblower Submission No. TCR1458580189411 - Mar-21-2016Document39 pagesSEC Whistleblower Submission No. TCR1458580189411 - Mar-21-2016Neil GillespieNo ratings yet

- UP Holder Reporting ManualDocument22 pagesUP Holder Reporting ManualJay SingletonNo ratings yet

- Why Banks Don't Need Your Money To Make LoansDocument10 pagesWhy Banks Don't Need Your Money To Make Loansabarnettceo9659No ratings yet

- Chapter-Vi I-Payments - General InstructionsDocument23 pagesChapter-Vi I-Payments - General InstructionsShakeel KhanNo ratings yet

- Tax Credits and Calculation of Tax: What Is Income Tax?Document31 pagesTax Credits and Calculation of Tax: What Is Income Tax?Thulani NdlovuNo ratings yet

- GGDocument7 pagesGGVincent CastilloNo ratings yet

- Top Credit Unions That Pull Equifax PDFDocument1 pageTop Credit Unions That Pull Equifax PDFklg.consultant2366No ratings yet

- Loan Modification: Contract & FormsDocument16 pagesLoan Modification: Contract & FormsjbarreroNo ratings yet

- Christopher Burns WarrantDocument5 pagesChristopher Burns WarrantNick PapadimasNo ratings yet

- BenefitsDocument4 pagesBenefitsrwtrimiewNo ratings yet

- 85 Inspiring Ways To Market Your Small BusinessDocument257 pages85 Inspiring Ways To Market Your Small BusinessSaagar Patil100% (4)

- The Africa Competitiveness Report 2007 Part 5/6Document17 pagesThe Africa Competitiveness Report 2007 Part 5/6World Economic Forum100% (7)

- 85 Inspiring Ways To Market Your Small BusinessDocument257 pages85 Inspiring Ways To Market Your Small BusinessSaagar Patil100% (4)

- DP - Development Planning TemplateDocument1 pageDP - Development Planning TemplaterwtrimiewNo ratings yet

- Necronomicon - The Cipher Manuscript PDFDocument21 pagesNecronomicon - The Cipher Manuscript PDFRoberto BurnNo ratings yet

- Rps 1415 School CalendarDocument2 pagesRps 1415 School CalendarrwtrimiewNo ratings yet

- Review 12Document119 pagesReview 12rwtrimiewNo ratings yet

- Personnel Polices Guide - Enterprise HoldingsDocument44 pagesPersonnel Polices Guide - Enterprise Holdingsrwtrimiew100% (4)

- Rich Dad ScamsDocument26 pagesRich Dad ScamsIustina Haroianu100% (13)

- The RSC Logo: Text Here... As An Introduction Blah BlahDocument1 pageThe RSC Logo: Text Here... As An Introduction Blah BlahrwtrimiewNo ratings yet

- Freelance Industry Report 2012Document71 pagesFreelance Industry Report 2012Ed Gandia100% (3)

- Sketchbook Pro I PadDocument124 pagesSketchbook Pro I PadrwtrimiewNo ratings yet

- B Beesstt R Reessuullttss W Wiitthh C Coolloorr: Image Started in RGBDocument2 pagesB Beesstt R Reessuullttss W Wiitthh C Coolloorr: Image Started in RGBrwtrimiewNo ratings yet

- FedEx Office Ed Asst Claim Form Rev 100709 (2) Recd 01282010Document1 pageFedEx Office Ed Asst Claim Form Rev 100709 (2) Recd 01282010rwtrimiewNo ratings yet

- A Modern English Translation of The Ethiopian Book of Enoch With Introduction and Notes byDocument160 pagesA Modern English Translation of The Ethiopian Book of Enoch With Introduction and Notes byrwtrimiewNo ratings yet

- Transfer Pricing MethodsDocument65 pagesTransfer Pricing Methodsrwtrimiew100% (1)

- Art Blakey FactsDocument2 pagesArt Blakey FactsrwtrimiewNo ratings yet

- Idea VirusDocument197 pagesIdea VirusHannah WardNo ratings yet

- Idea VirusDocument197 pagesIdea VirusHannah WardNo ratings yet

- Alkalize or DietDocument33 pagesAlkalize or Dietinsulated100% (6)

- The Complete Book of Amulets and Talismans - Migene Gonzalez-WipplerDocument309 pagesThe Complete Book of Amulets and Talismans - Migene Gonzalez-Wipplerrwtrimiew100% (3)

- User's Manual: Digital CameraDocument156 pagesUser's Manual: Digital CamerarwtrimiewNo ratings yet

- Microcosmic Orbit and AntahkaranasDocument8 pagesMicrocosmic Orbit and Antahkaranasrwtrimiew100% (4)

- Behold A Pale Horse Chapter SummariesDocument3 pagesBehold A Pale Horse Chapter Summariesrwtrimiew100% (2)

- Strunk White - The Elements of StyleDocument26 pagesStrunk White - The Elements of StyleJack BlaszkiewiczNo ratings yet

- Behold A Pale Horse Chapter SummariesDocument3 pagesBehold A Pale Horse Chapter Summariesrwtrimiew100% (2)

- A Pale Horse Chapter SummariesDocument3 pagesA Pale Horse Chapter SummariesrwtrimiewNo ratings yet

- Circular Motion & Centripetal Force: StarterDocument12 pagesCircular Motion & Centripetal Force: StarterJhezreel MontefalcoNo ratings yet

- Full Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full ChapterDocument36 pagesFull Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full Chapternaturismcarexyn5yo100% (16)

- The Carta de Jamaica 1815. Simon BolivarDocument16 pagesThe Carta de Jamaica 1815. Simon BolivarOmarNo ratings yet

- Csec Physics Study ChecklistDocument10 pagesCsec Physics Study ChecklistBlitz Gaming654100% (1)

- Final Report On The Audit of Peace Corps Panama IG-18-01-ADocument32 pagesFinal Report On The Audit of Peace Corps Panama IG-18-01-AAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Eada Newsletter-May-2015 (Proof3)Document2 pagesEada Newsletter-May-2015 (Proof3)api-254556282No ratings yet

- 5paisa Capital Limited: Account Opening FormDocument11 pages5paisa Capital Limited: Account Opening FormSuman KumarNo ratings yet

- PLM860SAW: Installation and Operation ManualDocument8 pagesPLM860SAW: Installation and Operation Manualjose angel guzman lozanoNo ratings yet

- Sample Balance SheetDocument22 pagesSample Balance SheetMuhammad MohsinNo ratings yet

- United States v. Samuel Roth, 237 F.2d 796, 2d Cir. (1957)Document49 pagesUnited States v. Samuel Roth, 237 F.2d 796, 2d Cir. (1957)Scribd Government DocsNo ratings yet

- Bookkeeping PresentationDocument20 pagesBookkeeping Presentationrose gabonNo ratings yet

- The Forrester Wave PDFDocument15 pagesThe Forrester Wave PDFManish KumarNo ratings yet

- 1 Dealer AddressDocument1 page1 Dealer AddressguneshwwarNo ratings yet

- Aubrey Jaffer: Scheme Implementation Version 5f1Document149 pagesAubrey Jaffer: Scheme Implementation Version 5f1kevinmcguireNo ratings yet

- Sample IPCRF Summary of RatingsDocument2 pagesSample IPCRF Summary of RatingsNandy CamionNo ratings yet

- Family Budget': PSP 3301 Household Financial Management Assignment 4Document2 pagesFamily Budget': PSP 3301 Household Financial Management Assignment 4DenzNishhKaizerNo ratings yet

- Presentation 2Document35 pagesPresentation 2Ma. Elene MagdaraogNo ratings yet

- New Income Tax Provisions On TDS and TCS On GoodsDocument31 pagesNew Income Tax Provisions On TDS and TCS On Goodsऋषिपाल सिंहNo ratings yet

- VergaraDocument13 pagesVergaraAurora Pelagio VallejosNo ratings yet

- Insurance ServicesDocument25 pagesInsurance Servicesjhansi saiNo ratings yet

- Management of TrustsDocument4 pagesManagement of Trustsnikhil jkcNo ratings yet

- UK (Lloyds Bank - Print Friendly Statement1)Document2 pagesUK (Lloyds Bank - Print Friendly Statement1)shahid2opuNo ratings yet

- Ecm Type 5 - 23G00019Document1 pageEcm Type 5 - 23G00019Jezreel FlotildeNo ratings yet

- Model Test 15 - 20Document206 pagesModel Test 15 - 20theabhishekdahalNo ratings yet

- Consti (Taxation)Document2 pagesConsti (Taxation)Mayra MerczNo ratings yet

- Split Payment Cervantes, Edlene B. 01-04-11Document1 pageSplit Payment Cervantes, Edlene B. 01-04-11Ervin Joseph Bato CervantesNo ratings yet

- Introduction Business EthicsDocument24 pagesIntroduction Business EthicsSumit Kumar100% (1)

- The Daily Tar Heel For Nov. 5, 2014Document8 pagesThe Daily Tar Heel For Nov. 5, 2014The Daily Tar HeelNo ratings yet

- Radio CodesDocument1 pageRadio CodeshelpmeguruNo ratings yet

- FortiClient EMSDocument54 pagesFortiClient EMSada ymeriNo ratings yet