Professional Documents

Culture Documents

Investment Management

Uploaded by

Martin KukovskiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Management

Uploaded by

Martin KukovskiCopyright:

Available Formats

Investment

Question 1 - Risky

securities

The equity securities under your consideration are: Sainsbury is J Sainsbury PLC (Reg. no: 00185647). The principal activities of this company are grocery and related retailing. BAT is British American Tobacco PLC (Reg. no: 03407696). The company involves in the manufacture, distribution and sale of tobacco products. GSK is Glaxosmithkline PLC (Reg. no: 03888792). It is a research-based pharmaceutical group engaged in anti-infectives, central nervous system (CNS), respiratory & gastro-intestinal/metabolic areas, vaccines, oncology products, medicines, oral care products and nutritional healthcare drinks. (Source: FAME) Required: In preparing the report, you should consider both the risk and return of each security. Therefore, your report should include the following: a) Calculations of the monthly rate of returns for each security, namely, Sainsbury, BAT and GSK Your calculations should be using the monthly closing stock prices from August 2004 to July 2011 published in FAME. The figures in FAME have been adjusted based on the stock split/dividend ratio. The formula for monthly rate of return is given by Where r is the rate of return, P is the closing price, t denotes the current month and t-1 denotes the previous month. You can use Microsoft Excel functions to expedite your calculations. Please show answers up to three decimal places only.

(25 marks)

Investment Management Trimester1, 2012/13

b) Based on your calculations in (a), calculate for each security: i. Average monthly rate of returns (Note: You can assume each monthly return for each security has equal chance of occurring). ii. Standard deviation of monthly returns. (You can use Microsoft Excel functions to expedite your calculations. Please show answers up to three decimal places only). (24 marks) c) By referring to reliable sources (e.g. historical data, annual reports, financial press or journal articles), identify and critically discuss: i. ii. One major source of risk facing each security. One major upside potential of each security. (51 marks) (Total: 100 marks)

Investment Management Trimester1, 2012/13

Question 2 Hedging with gold Gold is a commodity which is widely recognised as safe-haven. You would like to assess the impact of incorporating gold into your clients investment portfolios. Your research assistant has provided you with the following monthly returns on gold: January February March April May June July August Septemb er October Novembe r Decembe r 2011 2010 2009 0.052 0.098 (0.020) 2008 0.108 0.037 0.050 2007 0.002 0.053 (0.015) 0.037 2006 0.078 0.009 0.004 0.096 0.106 2005 (0.041) (0.002) 0.026 (0.012) (0.017) 0.021 2004

(0.025) (0.015) 0.012 0.037 0.035 0.025 0.012 0.029 (0.020) 0.016 0.032 0.049 0.023

(0.037) (0.061) 0.043 0.018

(0.023) (0.018) 0.001 0.057 (0.107) (0.011) (0.028) (0.057)

(0.017) (0.117) 0.015 0.000 0.071 0.059 0.068

(0.032) (0.012) 0.019 0.045 0.056 0.021 0.016 0.050 0.047 0.080

0.063 (0.014) (0.002 ) 0.032 (0.054 ) (0.021 ) 0.072 0.041 0.030 0.014 0.012 0.037 0.045 0.006

0.015 0.007 0.073 (0.004) 0.003 0.070 You are also provided with the following monthly returns on FTSE100 index: 2011 2010 0.032 0.061 (0.022) 2009 (0.077) 0.025 0.081 0.041 2008 0.001 (0.031) 0.068 (0.006) 2007 (0.005) 0.022 0.022 0.027 2006 0.005 0.030 2005 0.024 (0.015)

2004

January February March April May June July August Septemb er

0.022 (0.014) 0.027

(0.013) (0.066)

0.010 (0.019) (0.050 ) 0.034 0.019 0.016 (0.004 ) 0.009 0.028 0.030 0.033 0.003 0.034 (0.029) 0.012

(0.007) (0.052) (0.038) (0.071) (0.002) (0.022) 0.069 0.085 0.065 0.046 (0.038) (0.037) 0.042 (0.130) (0.009) 0.026 0.039

(0.072) (0.006) 0.062 0.023

(0.017) (0.107)

October Novembe r Decembe r Required: (0.026) 0.067 0.029 0.043 (0.020) (0.043) 0.034 0.004

(0.013 ) 0.028 (0.003 )

0.020 0.036 0.025

0.017 0.024 0.008

(0.006) (0.041) (0.064) (0.089)

a) Using the same formula you have used in Q1 (b), calculate the average monthly rate of returns and standard deviation of monthly returns for gold. (10 marks)

Investment Management Trimester1, 2012/13

b) Calculate the beta for gold by using a regression technique as follows: From the Microsoft Excel menu, go to Data and click on Data Analysis, then this Analysis Tools box will pop up:

Choose the Regression tool and the following Regression box will appear:

Select all the monthly returns for gold as input Y range Select all the monthly returns for FTSE100 as input X range

Investment Management Trimester1, 2012/13

Click on OK and you should then be able to see the regression output in the following format:

SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations ANOVA df Regression Residual Total Standard Error t Stat Upper 95% Lower 95.0% Upper 95.0% SS MS F Significance F

Coefficient s Intercept

X Variable 1 (Beta)

Pvalue

Lower 95%

(Note: Beta is the coefficient on the variable X or FTSE100) (40 marks) c) Justify why gold should be considered in an equity investment portfolio. The following items should be included in your answers: Comparison of the information you have gathered in (b) with those from Question 1(b) above, Your interpretation of the beta for gold calculated in (b) above, and Citation and explanation from, at least, one academic journal article to further support your opinion. (50 marks) (Total: 100 marks)

Investment Management Trimester1, 2012/13

Question 3 Minimum-variance portfolios Instead of investing in a single security portfolio, you will also propose your risk-averse clients to invest in a minimum-variance portfolio. Required: a) Calculate the weighted average rate of return and standard deviation of returns for each combination of securities containing different weight of each: i. Sainsbury BAT ii. Sainsbury GSK iii. Sainsbury-Gold iv. BAT GSK v. BAT Gold vi. GSK Gold For example, for Sainsbury BAT portfolio: Weig ht Sainsbury Weighted average rate of return 1 2 3 4 5 6 7 8 9 10 11 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 Standar d Tick the deviation portfolio of returns with the lowest risk

Portfolio

BAT

(Note: You can use Microsoft Excel functions to expedite your calculations. Please show answers up to three decimal places only) (30 marks) b) (i) For each of the portfolio (i.e. i to vi), plot the portfolio risk-return for different weights of assets (Note: For the risk-return plots, return is on Y axis and risk is on X axis). (30 marks)

10

Investment Management Trimester1, 2012/13

(ii) Show a two-asset portfolio that has lower risk than the risk of either single asset. Summarize your answers in the following table: Sainsbur y Sainsbury BAT GSK Gold Return Stdev Return Stdev Return Stdev Return Stdev (20 marks) (iii) Explain why the two-asset portfolio can have lower risk than the risk of either single asset. (5 marks) c) Based on the calculations you have done so far, propose and justify the best portfolio that meets your clients needs and risk tolerance. (15 marks) (Total: 100 marks) END OF QUESTION BOOKLET BAT GSK Gold

11

Investment Management

Trimester1, 2012/13

REPORT FORMAT [Title of Report] Introduction (You should mention the background and objective of this report) Risky securities (a) [Name of security e.g., Sainsbury] (1 mark for headings) Monthly closing prices (GBP): 2011 2010 January February March April May June July August September October November December 2009 2008 2007 2006 2005 2004

Monthly rate of returns (to three decimal points): 2011 2010 2009 2008 2007 January February March April May June July August September October November December

2006

2005

2004

Investment Management Trimester1, 2012/13

(b) G S K

Sainsbury Average monthly stock returns Standard deviation of monthly returns

BAT

(c) (Your critically discussion on one major source of risk and one upside potential for each security. Support your opinions by citing from reliable sources). Hedging with gold a) (Report the average monthly gold returns and standard deviation of its monthly returns here) b) Present your regression output as follows and mention indicate the beta:

SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations ANOVA df Regression Residual Total Standard Error Upper 95% Lower 95.0% Upper 95.0% SS MS F Significance F

Coefficient s Intercept X Variable 1

t Stat

Pvalue

Lower 95%

c) (Your answers should include the following: Comparison of the information gathered in (b) with those from Question 1(b) above Correct interpretation of the beta for gold calculated in (b) above Citation and explanation from, at least, one academic journal article to further support your opinion)

Investment Management Trimester1, 2012/13

Minimum-variance portfolios a) [Name of portfolio e.g., Sainsbury-BAT] (1 mark for headings) (Note: Refer to spreadsheets for answers) Weig ht Sainsbury Weighted average rate of return 1 2 3 4 5 6 7 8 9 10 11 b) i. ii. Plot the portfolio risk-return graph for each table Minimum-variance portfolios Sainsbur y Sainsbury BAT GSK Gold Return Stdev Return Stdev Return Stdev Return Stdev (Your explanation) BAT GSK Gold 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 Standar d Tick the deviation portfolio of returns with the lowest risk

Portfolio

BAT

iii.

c) (Provide a recommendation on the portfolio that best suits your clients risk tolerance and investment horizon by including: A recommendation on the best minimum-variance portfolio Justification by reflecting on the analysis performed earlier (End the report with list of references in alphabetical order and consistent format).

You might also like

- SMM200 Derivatives and Risk Management 2021 QuestionsDocument5 pagesSMM200 Derivatives and Risk Management 2021 Questionsminh daoNo ratings yet

- Credit Suisse (Incl. NPV Build Up)Document23 pagesCredit Suisse (Incl. NPV Build Up)rodskogjNo ratings yet

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHANo ratings yet

- Instructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Document8 pagesInstructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Mathew SawyerNo ratings yet

- Global Financial Managemnt Project Report ON: Beyond CAPM Beta: Measures of Risk in Portfolio Risk-Return AnalysisDocument10 pagesGlobal Financial Managemnt Project Report ON: Beyond CAPM Beta: Measures of Risk in Portfolio Risk-Return Analysissayandas87No ratings yet

- Questions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyDocument22 pagesQuestions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyNoura ShamseddineNo ratings yet

- Session 5 - Cost of CapitalDocument49 pagesSession 5 - Cost of CapitalMuhammad HanafiNo ratings yet

- Theory of Finance Questions Jan 2019Document5 pagesTheory of Finance Questions Jan 2019minh daoNo ratings yet

- FIN5203 Homework 5 FL22Document2 pagesFIN5203 Homework 5 FL22merly chermonNo ratings yet

- Reasons For Market Risk MeasurementDocument13 pagesReasons For Market Risk MeasurementTran LongNo ratings yet

- #1 - Midterm Self Evaluation SolutionsDocument6 pages#1 - Midterm Self Evaluation SolutionsDionizioNo ratings yet

- Jun18l1equ-C01 QaDocument5 pagesJun18l1equ-C01 Qarafav10No ratings yet

- P1 - Financial Accounting April 07Document23 pagesP1 - Financial Accounting April 07IrfanNo ratings yet

- RTP Group3 Paper 11 June2012Document48 pagesRTP Group3 Paper 11 June2012Sudha SatishNo ratings yet

- You Have To Answer in The Question PaperDocument6 pagesYou Have To Answer in The Question PaperDavid ViksarNo ratings yet

- Assignment-1:Investment Management 2020Document2 pagesAssignment-1:Investment Management 2020Rajkumar RakhraNo ratings yet

- Tutorial-2 212 Mba 680 SolutionsDocument9 pagesTutorial-2 212 Mba 680 SolutionsbillyNo ratings yet

- Excel MPTDocument23 pagesExcel MPTBokonon22No ratings yet

- Class NotesDocument16 pagesClass NotesAnika Tabassum RodelaNo ratings yet

- RB Answers CH13Document4 pagesRB Answers CH13Nayden GeorgievNo ratings yet

- Revision Questions and Classwork 5Document4 pagesRevision Questions and Classwork 5Sams HaiderNo ratings yet

- Derivatives Mock ExamDocument5 pagesDerivatives Mock ExamMatthew FlemingNo ratings yet

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- Final TestDocument9 pagesFinal TestIqtidar KhanNo ratings yet

- Finance Homework 3Document5 pagesFinance Homework 3LâmViênNo ratings yet

- TutorialsDocument28 pagesTutorialsmupiwamasimbaNo ratings yet

- Chapter 10Document14 pagesChapter 10Vidyasagar Ayyappan100% (1)

- Assignment Business Finance Fina 321 Fall 2016Document4 pagesAssignment Business Finance Fina 321 Fall 2016Aboubakr SoultanNo ratings yet

- Chinhoyi University of Technology: School of Business Sciences and ManagementDocument8 pagesChinhoyi University of Technology: School of Business Sciences and ManagementDanisa NdhlovuNo ratings yet

- 100971-Capital IQ Quant Research-January2011 - MinVariancePortfoliosDocument15 pages100971-Capital IQ Quant Research-January2011 - MinVariancePortfoliosAnonymous 2rtrIS90% (1)

- Edu 2008 11 Fete ExamDocument22 pagesEdu 2008 11 Fete ExamcalvinkaiNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- Final P 11 Sugge Dec 12Document17 pagesFinal P 11 Sugge Dec 12Aditya PakalaNo ratings yet

- Libyan InvestmentsDocument20 pagesLibyan InvestmentsAyam ZebossNo ratings yet

- 6007LBSAF - Coursework - 2021Document3 pages6007LBSAF - Coursework - 2021Daniyal AsifNo ratings yet

- SMM148 Theory of Finance Questions Jan 2020Document5 pagesSMM148 Theory of Finance Questions Jan 2020minh daoNo ratings yet

- Econ161A Winter2015 ExamFinalDocument16 pagesEcon161A Winter2015 ExamFinalKensan Flipmagic Jr.No ratings yet

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- Stock Evaluation PDFDocument11 pagesStock Evaluation PDFmaxmunirNo ratings yet

- Risk ReturnDocument6 pagesRisk ReturnDamian Lee-Gomez0% (1)

- Problem Set 4Document3 pagesProblem Set 4Kevin VerhagenNo ratings yet

- Business Optimization and Simulation: Computer Lab Module 4 Portfolio OptimizationDocument6 pagesBusiness Optimization and Simulation: Computer Lab Module 4 Portfolio OptimizationM.MSZNo ratings yet

- Investment Appraisal QampaDocument62 pagesInvestment Appraisal QampaKamil SanifNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- DAT565 Data Analysis and Business AnalyticsDocument8 pagesDAT565 Data Analysis and Business AnalyticsG Jha0% (1)

- FRM Sample Questions 2011Document9 pagesFRM Sample Questions 2011Shuvo Hasan100% (1)

- BFC5935 - Tutorial 1 Solutions PDFDocument7 pagesBFC5935 - Tutorial 1 Solutions PDFXue Xu100% (1)

- Financial RatiosDocument78 pagesFinancial Ratiospun33tNo ratings yet

- Financial Markets Past Exam QuestionsDocument5 pagesFinancial Markets Past Exam QuestionsDaniel MarinhoNo ratings yet

- Derivatives Jan 11Document5 pagesDerivatives Jan 11Matthew FlemingNo ratings yet

- Mark Scheme (Provisional)Document24 pagesMark Scheme (Provisional)new yearNo ratings yet

- WAC11 01 MSC 20210517Document24 pagesWAC11 01 MSC 20210517Mashhood Babar ButtNo ratings yet

- Sample Midterm For Risk Management (MGFD30)Document21 pagesSample Midterm For Risk Management (MGFD30)somebodyNo ratings yet

- Fin622 Midterm Solved Subjective With Reference by DuaDocument15 pagesFin622 Midterm Solved Subjective With Reference by DuaShrgeel HussainNo ratings yet

- IM FInal Exam Practice Test 3Document13 pagesIM FInal Exam Practice Test 3Ngoc Hoang Ngan NgoNo ratings yet

- Test Bank For Financial Statement Analysis and Valuation 2nd Edition by EastonDocument29 pagesTest Bank For Financial Statement Analysis and Valuation 2nd Edition by EastonRandyNo ratings yet

- Reading 1 Estimating Market Risk Measures - An Introduction and Overview - AnswersDocument22 pagesReading 1 Estimating Market Risk Measures - An Introduction and Overview - AnswersDivyansh ChandakNo ratings yet

- Practice Questions: Set #1: International Finance Professor Michel A. RobeDocument9 pagesPractice Questions: Set #1: International Finance Professor Michel A. RobeSchelter Cuteness MiserableNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- The Risk Premium Factor: A New Model for Understanding the Volatile Forces that Drive Stock PricesFrom EverandThe Risk Premium Factor: A New Model for Understanding the Volatile Forces that Drive Stock PricesNo ratings yet

- Unit I - Working Capital PolicyDocument16 pagesUnit I - Working Capital Policyjaskahlon92No ratings yet

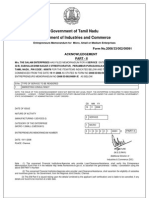

- Government of Tamil Nadu Department of Industries and CommerceDocument6 pagesGovernment of Tamil Nadu Department of Industries and Commercesalam20064909100% (3)

- The Effect of Public Expenditure On Economic Growth in The East African Community PDFDocument5 pagesThe Effect of Public Expenditure On Economic Growth in The East African Community PDFwmmahrousNo ratings yet

- Six Merger Waves in The Historical MergersDocument6 pagesSix Merger Waves in The Historical MergersMei YunNo ratings yet

- Capital Market in Bangladesh AssignmentDocument16 pagesCapital Market in Bangladesh AssignmentTushar Lal SahaNo ratings yet

- Rotissa FO SummitDocument17 pagesRotissa FO SummitKevin G. DavisNo ratings yet

- First Resources Initiating Coverage CIMBDocument27 pagesFirst Resources Initiating Coverage CIMBLee Jie YangNo ratings yet

- Jurnal Akuntansi Dan Auditing Indonesia: WWW - Journal.uii - Ac.id/index - Php/jaaiDocument13 pagesJurnal Akuntansi Dan Auditing Indonesia: WWW - Journal.uii - Ac.id/index - Php/jaaiAnis Anjala WidyantiNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseMultiplan RINo ratings yet

- Asahi Glass OcrDocument29 pagesAsahi Glass OcrHernâni Rodrigues VazNo ratings yet

- Case AnalysisDocument6 pagesCase AnalysisAJ LayugNo ratings yet

- Investment BooksDocument2 pagesInvestment Bookssreekanth reddyNo ratings yet

- Art of Selling by Chris MayerDocument2 pagesArt of Selling by Chris MayerjesprileNo ratings yet

- Week 4 PDFDocument30 pagesWeek 4 PDFJohnLuceNo ratings yet

- MMX Annual Report 2018 Version 821Document78 pagesMMX Annual Report 2018 Version 821clouso100No ratings yet

- Change Bank Details FormDocument2 pagesChange Bank Details FormMustafa Bapai100% (1)

- Cee 10Document58 pagesCee 10Muhammad Irfan MalikNo ratings yet

- Financial Reporting QuestionDocument5 pagesFinancial Reporting QuestionAVNEET SinghNo ratings yet

- Feasibility StudyDocument35 pagesFeasibility StudyJaja TeukieNo ratings yet

- Basis of Difference Balance of Trade (BOT)Document3 pagesBasis of Difference Balance of Trade (BOT)johann_747No ratings yet

- Strong Vs Repide Case DigestDocument3 pagesStrong Vs Repide Case DigestHariette Kim TiongsonNo ratings yet

- Uganda PDFDocument114 pagesUganda PDFMadhu KumarNo ratings yet

- Chapter 1: IntroductionDocument48 pagesChapter 1: IntroductionnemchandNo ratings yet

- Accounting Policies Changes in Accounting Estimates and Errors - IAS 8Document6 pagesAccounting Policies Changes in Accounting Estimates and Errors - IAS 8Anonymous P1xUTHstHTNo ratings yet

- Subprime Mortgage CrisisDocument35 pagesSubprime Mortgage CrisisParaggNo ratings yet

- The Impact of Starting A Business or Buying A Franchise On The Profitability of A BusinessDocument2 pagesThe Impact of Starting A Business or Buying A Franchise On The Profitability of A BusinessAngelo AlcantaraNo ratings yet

- Topic 3 - Todaro, Economic Development - Ch.3 (Wiscana AP)Document4 pagesTopic 3 - Todaro, Economic Development - Ch.3 (Wiscana AP)Wiscana Chacha100% (1)

- Chap - 4 ProblemsDocument2 pagesChap - 4 Problemspartha_biswas_uiuNo ratings yet

- Strategic Analysis of Indian Life Insurance IndustryDocument40 pagesStrategic Analysis of Indian Life Insurance IndustryPunit RaithathaNo ratings yet

- Joint Venture Tax ExemptionsDocument3 pagesJoint Venture Tax ExemptionsalexjalecoNo ratings yet