Professional Documents

Culture Documents

Solution For Sample Past Year Exam Question

Uploaded by

Fazlin GhazaliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution For Sample Past Year Exam Question

Uploaded by

Fazlin GhazaliCopyright:

Available Formats

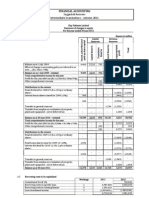

ACT3126 ADVANCED FINANCIAL ACCOUNTING I (SEMESTER 1 2010/2011) QUESTION 1 (40 MARKS) (i) Determine the amount of goodwill on acquisition.

Investment in MUFC Less Share capital of MUFC Sdn Bhd (8,000 x 80%) 6,400 Revaluation Net assets (4,000 x 80%) 3,200 Retained profits brought forward (pre-acquisition) (6,000 x 80%) 4,800 14,400 Goodwill on acquisition 1,600 RM000 16,000

( = 1 mark, Total : 5 marks) (ii) Determine the share of non-controlling interest in the realized profit for the financial year end 2010. Profit for the year Add realization of profit on intercompany inventory brought forward Less unrealized profit in closing inventories Total profit for the year x 20% 5,700,000 400,000 (300,000) 5,800,000 1,160,000

( = 1/2 mark, Total : 3 marks) (iii) for (b). Sales Purchases to eliminate inter-company sales and purchases 300,000 300,000 Debit 4,000,000 Credit 4,000,000 Show all the consolidation entries in relation to the additional information

Closing inventories in comprehensive income Closing inventories in financial position - to eliminate unrealized profit in closing inventories 1 for correct positioning of debit and credit

( = 1 mark, Total : 7 marks) (iv)Present the consolidated financial statements of Kelate Bhd for the year ended 31 December 2010. Kelate Bhd Consolidated Statement of Comprehensive Income For the year ended 31.12.10 1

ACT3126 ADVANCED FINANCIAL ACCOUNTING I (SEMESTER 1 2010/2011) RM000 36,000 (19,900) 16,100 (2,400) 4,280 17,980 (440) 17,540 (2,700) 14,840

Revenue Cost of sales Gross profit Operating expenses Gain on sales of properties Profit from operations Finance cost Profit before taxation Taxation Profit for the year

Kelate Bhd Consolidated Statement of Financial Position As at 31.12.10 RM000 Non-current Assets: Property, plant and equipment Goodwill on combination Current Assets: Inventories Trade receivables Other receivables Bank balances TOTAL ASSETS Share capital of RM1 each Retained profits Equity attributable to owners of the Kelate Bhd Non-controlling interest TOTAL EQUITY Non-current Liabilities: Long term loans Redeemable preference shares of RM1 each Current Liabilities: Trade payables Other payables Taxation Bills payables TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES 1 if there is no mention of Investment in MUFC Sdn Bhd 2 48,280 2,000 50,280 15,700 14,000 2,560 6,960 39,220 89,500 32,000 22,920 55,900 5,460 61,360 15,000 2,000 21,000 6,200 1,270 2,650 2,000 12,120 33,120 94,480

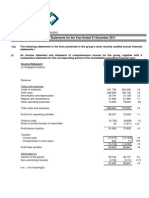

ACT3126 ADVANCED FINANCIAL ACCOUNTING I (SEMESTER 1 2010/2011) ( = 1 mark, Total : 25 marks) QUESTION 2 (20 MARKS) (a) (i) Prepare the consolidated statement of financial position of Ilyas Bhd for the year ended 31 December 2010. Ilyas Bhd Consolidated Statement of Financial Position as at 31.12.10 RM000 RM000 Ordinary shares Consolidated profit and loss (150 + (110 30) x 25%) Liabilities Non-current assets Investment in associate Current assets Loan to associate 50 10 500 170 670 25 695 515 120 635 60 695

Investment in associate Net assets in Associate (200,000 + 30,000) x 25% Goodwill

57,500 62,500 120,000 ( = 1/2 mark, Total : 8 marks)

(ii)

Define the term significant influence as prescribed by FRS 128.

Significant influence is the power to participate in the financial and operating policy decisions of the investee but not control of those policy. ( = 1 mark, Total : 2 marks)

ACT3126 ADVANCED FINANCIAL ACCOUNTING I (SEMESTER 1 2010/2011)

(b) (i) Present the consolidated statement of financial position of Elsa Bhd for the year ended 31 December 2010 using proportionate consolidation. Elsa Bhd Consolidated Statement of Financial Position as at 31.12.10 Ordinary shares of RM1 each Group profit (150 + (110 30) x 25%) Current liabilities (45 + (30 x 25%)) Non-current assets (570+ (330 x 25%)) Goodwill (100 (200 + 30) x 25%) Current assets (25 + (10 x 25%)) RM000 500 170 670 52.5 722.5 652.5 42.5 27.5 722.5 ( = 1/2 mark, Total : 8 marks) (ii) Define the term joint control as prescribed by FRS 131. Joint control is the contractually agreed sharing of control over an economic activity, and exists only when the strategic financial and operating decisions relating to the activity require the unanimous consent of the parties sharing control (the venturers). ( = 1 mark, Total : 2 marks)

ACT3126 ADVANCED FINANCIAL ACCOUNTING I (SEMESTER 1 2010/2011)

Question 4 (a) S$000 Sales Cost of goods sold: Opening inventories Purchases Closing inventories Gross profit Expenses: Depreciation Interest expense Administrative expense Other expenses Profit before taxation Taxation Profit after tax Retained profit b/f Retained profit c/f 3,200 13,000 16,200 (4,800) (11,400) 8,600 680 370 200 660 (1,910) 6,690 (1,338) 5,352 9,600 14,952 2.66 2.66 2.66 2.66 2.66 Note 1 1,809 984 532 1,756 (5,081) 17,795 (3,559) 14,236 S$000 20,000 Rate 2.66 2.66 2.66 2.66 RM000 8,512 34,580 43,092 (12,768) (30,324) 22,876 RM000 53,200

S$000 Non-Current Assets: Land Property, Plant and Equipment (at cost) Less: Accumulated depreciation Current assets: Inventories Monetary current assets 8,680 1,140 4,800 15,680

S$000 6,000 7,540 13,540 20,480 34,020 8,000 4,800 14,952 27,752 5,000

Ordinary share capital of S$1 each Revaluation reserve Retained profits Long term liabilities: Loan Current liabilities: Short term borrowings Bills payable 5

1,000 268

1,268

ACT3126 ADVANCED FINANCIAL ACCOUNTING I (SEMESTER 1 2010/2011) 34,020

You might also like

- Financial Statements, Cash Flow and TaxesDocument44 pagesFinancial Statements, Cash Flow and TaxesAli JumaniNo ratings yet

- Muslim Spain and Portugal A Political History of Al Andalus1Document359 pagesMuslim Spain and Portugal A Political History of Al Andalus1Amira AnitaNo ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Sanctuary Real or Symbolic Samuele BacchiocchiDocument21 pagesSanctuary Real or Symbolic Samuele BacchiocchiErick Jose Rodriguez JimenezNo ratings yet

- Simbisa BrandsDocument2 pagesSimbisa BrandsBusiness Daily Zimbabwe100% (1)

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- GMH 2011 Depot - 14 - 154891Document50 pagesGMH 2011 Depot - 14 - 154891LuxembourgAtaGlanceNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Stockholders of F. Guanzon v. RDDocument1 pageStockholders of F. Guanzon v. RDJL A H-Dimaculangan0% (1)

- The Battle of The TrenchDocument9 pagesThe Battle of The TrenchshuaibyousafNo ratings yet

- JKhoggesDocument6 pagesJKhoggesDegrace NsNo ratings yet

- Keller SME 12e PPT CH01Document19 pagesKeller SME 12e PPT CH01NAM SƠN VÕ TRẦN100% (1)

- A. Express TermsDocument27 pagesA. Express TermscwangheichanNo ratings yet

- Sample Question Paper PMADocument5 pagesSample Question Paper PMAjasminetsoNo ratings yet

- CFA Lecture 4 Examples Suggested SolutionsDocument22 pagesCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- Advanced Accounitng & Financial Reporting: IGL Identifiable Net Assets On Acquisition Date of Oct. 1, 2010 (100+60+35-10)Document6 pagesAdvanced Accounitng & Financial Reporting: IGL Identifiable Net Assets On Acquisition Date of Oct. 1, 2010 (100+60+35-10)Ahmer KhanNo ratings yet

- Sample Past Year Exam QuestionDocument12 pagesSample Past Year Exam QuestionFazlin GhazaliNo ratings yet

- Consolidated Statement of Profit or Loss and Other Comprehensive IncomeDocument40 pagesConsolidated Statement of Profit or Loss and Other Comprehensive IncomeSing YeeNo ratings yet

- Financial Statement Analysis - Illustrative Problem - FOR STUDENTSDocument6 pagesFinancial Statement Analysis - Illustrative Problem - FOR STUDENTShobi stanNo ratings yet

- Consolidations Interim AcqDocument8 pagesConsolidations Interim Acqsikute kamongwaNo ratings yet

- Weida 2011's 4th QTR Return - 31032011Document23 pagesWeida 2011's 4th QTR Return - 31032011Kai Sheng RooraNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- S P SETIA BERHAD Interim Financial Report for Period Ended 31 January 2004Document13 pagesS P SETIA BERHAD Interim Financial Report for Period Ended 31 January 2004Xavier YeohNo ratings yet

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Apollo Food Holdings Berhad Financial StatementsDocument39 pagesApollo Food Holdings Berhad Financial Statementsluchono1No ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Kordia Interim Report 2012Document11 pagesKordia Interim Report 2012kordiaNZNo ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- Solution Far450 UITM - Jan 2013Document8 pagesSolution Far450 UITM - Jan 2013Rosaidy SudinNo ratings yet

- Understanding Balance Sheet and Financial StatementsDocument21 pagesUnderstanding Balance Sheet and Financial StatementsPGNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- Final Grace CorpDocument14 pagesFinal Grace CorpAnonymous 0M5Kw0YBXNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- Hannans Half Year Financial Report 2011Document18 pagesHannans Half Year Financial Report 2011Hannans Reward LtdNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- October 21, 2020 Financial AssetDocument12 pagesOctober 21, 2020 Financial AssetareebNo ratings yet

- Hannans Half Year Financial Report 2010Document18 pagesHannans Half Year Financial Report 2010Hannans Reward LtdNo ratings yet

- KISIAKMDocument1 pageKISIAKMhgoenNo ratings yet

- Unaudited Financial Statements for Year Ended 31 Dec 2011Document18 pagesUnaudited Financial Statements for Year Ended 31 Dec 2011Jennifer JohnsonNo ratings yet

- MU PLC Annual Report 2002 Financial StatementsDocument21 pagesMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNo ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- Chapter 1 Analysing and Interpreting FSDocument15 pagesChapter 1 Analysing and Interpreting FSKE XIN NGNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Institute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesDocument11 pagesInstitute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesColleen BosmanNo ratings yet

- Grace Corporation: Statement of Management's Responsibility For Financial StatementsDocument14 pagesGrace Corporation: Statement of Management's Responsibility For Financial StatementsLaiza Joyce Sales100% (2)

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesreNo ratings yet

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- Merk v2Document19 pagesMerk v2Ardian WidiNo ratings yet

- FAC2602/202/2/2011 SELECTED ACCOUNTING STANDARDS AND SIMPLE GROUP STRUCTURESDocument36 pagesFAC2602/202/2/2011 SELECTED ACCOUNTING STANDARDS AND SIMPLE GROUP STRUCTURESPrince McBossmanNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- PHN 17Q Sep2011Document74 pagesPHN 17Q Sep2011Ryan Samuel C. CervasNo ratings yet

- Problem 36 14Document18 pagesProblem 36 14Janna rae BionganNo ratings yet

- ICAN MAY 2018 DIET FINANCIAL REPORTING SKILLS LEVEL EXAMDocument155 pagesICAN MAY 2018 DIET FINANCIAL REPORTING SKILLS LEVEL EXAMOgunmola femiNo ratings yet

- 3may2011 e-1Q11ResultsDocument13 pages3may2011 e-1Q11ResultsByond ReNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Analyze mission statements using nine componentsDocument1 pageAnalyze mission statements using nine componentsFazlin GhazaliNo ratings yet

- Fraud-Health South CaseDocument4 pagesFraud-Health South CaseKenneth WongNo ratings yet

- Equipped First Aid Kit (M-6)Document1 pageEquipped First Aid Kit (M-6)Fazlin GhazaliNo ratings yet

- Jan 2014Document1 pageJan 2014Fazlin GhazaliNo ratings yet

- Title: Undue Influence in The House of LordsDocument13 pagesTitle: Undue Influence in The House of LordsFazlin GhazaliNo ratings yet

- Suncity, Sunway To Combine? Analysts See A Current Trend of M&AsDocument12 pagesSuncity, Sunway To Combine? Analysts See A Current Trend of M&AsFazlin GhazaliNo ratings yet

- Answer (Ii)Document8 pagesAnswer (Ii)Fazlin GhazaliNo ratings yet

- Budget and Budgetary 0controlDocument43 pagesBudget and Budgetary 0controlFazlin GhazaliNo ratings yet

- Sample Profit CentsDocument12 pagesSample Profit CentsFazlin GhazaliNo ratings yet

- Accg For Liability & OEDocument10 pagesAccg For Liability & OEFazlin GhazaliNo ratings yet

- QS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesDocument36 pagesQS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesSamael AstarothNo ratings yet

- URC 2021 Annual Stockholders' Meeting Agenda and Voting DetailsDocument211 pagesURC 2021 Annual Stockholders' Meeting Agenda and Voting DetailsRenier Palma CruzNo ratings yet

- North Carolina Wing - Jul 2011Document22 pagesNorth Carolina Wing - Jul 2011CAP History LibraryNo ratings yet

- The Humanization of Dogs - Why I Hate DogsDocument1 pageThe Humanization of Dogs - Why I Hate Dogsagentjamesbond007No ratings yet

- Gujarat Technological University: SUBJECT NAME:Professional Ethics Semester IVDocument2 pagesGujarat Technological University: SUBJECT NAME:Professional Ethics Semester IVRISHI YADAVNo ratings yet

- Mapping Active Directory Using Bloodhound: Blue Team EditionDocument26 pagesMapping Active Directory Using Bloodhound: Blue Team EditionFatonNo ratings yet

- Codex Alimentarius Commission: Procedural ManualDocument258 pagesCodex Alimentarius Commission: Procedural ManualRoxanaNo ratings yet

- Chandigarh Shep PDFDocument205 pagesChandigarh Shep PDFAkash ThakurNo ratings yet

- Medical Audit Checklist Active File AuditDocument2 pagesMedical Audit Checklist Active File AuditCOO TOP STARNo ratings yet

- Quarter4 2Document13 pagesQuarter4 2Benedick CruzNo ratings yet

- UBLDocument38 pagesUBLMuhammad Shahroz KafeelNo ratings yet

- Freelance Digital Marketer in Calicut - 2024Document11 pagesFreelance Digital Marketer in Calicut - 2024muhammed.mohd2222No ratings yet

- Vs. AdazaDocument16 pagesVs. AdazawandererkyuNo ratings yet

- Famous Entrepreneur Scavenger HuntDocument4 pagesFamous Entrepreneur Scavenger HuntJia GalanNo ratings yet

- Ilé-Ifè: : The Place Where The Day DawnsDocument41 pagesIlé-Ifè: : The Place Where The Day DawnsAlexNo ratings yet

- Assessment of Diabetes Mellitus Prevalence and Associated Complications Among Patients at Jinja Regional Referral HospitalDocument10 pagesAssessment of Diabetes Mellitus Prevalence and Associated Complications Among Patients at Jinja Regional Referral HospitalKIU PUBLICATION AND EXTENSIONNo ratings yet

- Maricar Te ResumeDocument1 pageMaricar Te ResumeMaricar27100% (3)

- Cracking Sales Management Code Client Case Study 72 82 PDFDocument3 pagesCracking Sales Management Code Client Case Study 72 82 PDFSangamesh UmasankarNo ratings yet

- MoebiusFinal PDFDocument26 pagesMoebiusFinal PDFLéo LacerdaNo ratings yet

- Case StudyDocument2 pagesCase StudyMicaella GalanzaNo ratings yet

- 40 Rabbana DuasDocument3 pages40 Rabbana DuasSean FreemanNo ratings yet

- 4 Rizal's Childhood & 1st TripDocument46 pages4 Rizal's Childhood & 1st TripRain Storm PolgaderaNo ratings yet