Professional Documents

Culture Documents

Answer SEVEN (7) Questions: Part A: Structured Questions (60 MARKS)

Uploaded by

navimala85Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer SEVEN (7) Questions: Part A: Structured Questions (60 MARKS)

Uploaded by

navimala85Copyright:

Available Formats

Page 1 of 4

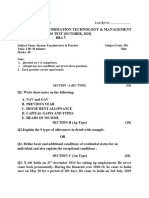

PART A: STRUCTURED QUESTIONS (60 MARKS)

Answer SEVEN (7) questions Question 1 Briefly explain FOUR (4) differences between a resident and a-nonresident individual for tax purposes are as follows. (8 marks)

Question 2 Discuss FOUR (4) situations when the assessments become final and conclusive. (8 marks)

Question 3 Explain the FOUR (4) commencement of an audit. (8 marks) Question 4 Give definition of FOUR (4) types of income. (8 marks) Question 5 Define the term incapacitated persons- section 69 of the Income Tax Act (8 marks)

Question 6 Explain the Five (5) procedures of appeal under the Income Tax Act. (10 marks)

Page 2 of 4

Question 7

Define FIVE (5) types of assessments. (10 marks)

PART B: ESSAY QUESTIONS (40 MARKS) Answer any TWO questions ONLY Question 1 George, an American national, arrived in Malaysia on 11 March 2003 and left Malaysia permanently on 30 September 2008. Details of his stay in Malaysia are as follows:Year 2003 2004 2005 2006 2007 2008 Date Days

11 March to 6 September 180 1 July 31 December 184 1 January to 5 January 5 3 June to 21 August 80 1 September to 10 October 40 1 April to 10 April 10 21 March to 19 May 60 1 June to 29 September 121 Left Malaysia permanently on 30 September at noon.

Required a. State each year which you consider George to be a resident in Malaysia, in each case give reason or quote the relevant sub-section of the Income Tax Act, 1967 (10 marks) b. State the circumstance s in which temporary absence from Malaysia would be accepted as part of the period of at last 182 consecutive days for propose of determining the residence status of an individual. (10 marks)

Page 3 of 4

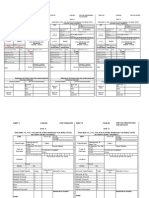

Question 2 Malvern Sdn Bhd makes up its accounts each year to December 31. For the year 31 December 2009 it had the following:Business 1 RM000 Business Income Gross Income Expenditure (Note) Capital allowances Balancing Charge Capital Allowances brought forward Loss brought forward Other income Rental Note: Included in expenditure for the year were the following: Business 1 Rm 000 100 25 Business 11 Rm 000 180 45 2000 2,400 70 100 20 Business 11 RM000 3000 2,400 310 125 RM000 130 70

Non deductible Expenditure Approved Donation Required:

In accordance with section 5 of the Act which provides for the manner in which chargeable income is to be ascertained, you are required to compute chargeable income of Malvern Sdn Bhd in respect of the year of assessment 2009. (20 marks)

Question 3 Explain the responsibility and chargeability of an agent under the Income Tax Act. (20 marks)

Page 4 of 4

End of Exam Questions Paper

You might also like

- TaxationDocument3 pagesTaxationKavish BablaNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesApproximately of 400 Words. Each Question Is Followed by Evaluation SchemeBadder DanbadNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- MF0012Document3 pagesMF0012Rajesh SinghNo ratings yet

- Fundamental of AccountingDocument4 pagesFundamental of AccountingGuruKPONo ratings yet

- 1mba FM 042mbaDocument3 pages1mba FM 042mbaAtindra ShahiNo ratings yet

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibNo ratings yet

- SUNAKSHI Income Taxation Laws & PracticeS - BBA-301Document3 pagesSUNAKSHI Income Taxation Laws & PracticeS - BBA-301Adesh YadavNo ratings yet

- Nov 06Document24 pagesNov 06Vascilly TerentievNo ratings yet

- 3 MarksDocument8 pages3 MarksAaleyahIamarNo ratings yet

- s2 Entrepreneurship ExamDocument2 pagess2 Entrepreneurship ExamyasipifamilychoirNo ratings yet

- Consolidated CsDocument43 pagesConsolidated Cssarathindia22No ratings yet

- AccountingDocument8 pagesAccountingHaniyaAngelNo ratings yet

- GST Revision QuestionsDocument4 pagesGST Revision QuestionsSelvi SNo ratings yet

- Bba 2012Document134 pagesBba 2012gbulani11No ratings yet

- Approved By: Director: Issue No: 02 Issue Date: 1, May 2010Document3 pagesApproved By: Director: Issue No: 02 Issue Date: 1, May 2010Parul BajajNo ratings yet

- 5Document8 pages5Sadhasivan SNo ratings yet

- Taxation - Topics CoveredDocument5 pagesTaxation - Topics CoveredKobir HossainNo ratings yet

- B. B. M. (I.B.) (Semester - I) Examination - 2011: Total No. of Questions: 4) (Total No. of Printed Pages: 2Document103 pagesB. B. M. (I.B.) (Semester - I) Examination - 2011: Total No. of Questions: 4) (Total No. of Printed Pages: 2Smruti Mehta100% (1)

- Dec 2007 PDFDocument9 pagesDec 2007 PDFeric_mdisNo ratings yet

- (Xi) 2023 Target Paper Eco, Poc, Acc & Bmaths by Sir IrfanDocument17 pages(Xi) 2023 Target Paper Eco, Poc, Acc & Bmaths by Sir IrfanMosa AbdullahNo ratings yet

- Taxation EMDocument2 pagesTaxation EMtadepalli patanjaliNo ratings yet

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011No ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- Question Papers Supplementary Exam 2007Document24 pagesQuestion Papers Supplementary Exam 2007ce1978No ratings yet

- MAT112 DOCUMENT ED: 100000 ? - / I 6 V: Universiti Teknologi Mara Final ExaminationDocument8 pagesMAT112 DOCUMENT ED: 100000 ? - / I 6 V: Universiti Teknologi Mara Final ExaminationMuhammad Rifdi50% (2)

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- Business 2012julyDocument6 pagesBusiness 2012julyNavinYattiNo ratings yet

- Com Law MTDocument6 pagesCom Law MTselvavishnuNo ratings yet

- CLG Past YearDocument4 pagesCLG Past YearBeeJu LyeNo ratings yet

- MTR 6 PT Excel FormatDocument5 pagesMTR 6 PT Excel FormatJOYSON NOEL DSOUZANo ratings yet

- Business Laws (70) : Summer Exam-2013Document21 pagesBusiness Laws (70) : Summer Exam-2013Khalid MahmoodNo ratings yet

- BBADocument138 pagesBBAAbhishek AgarwalNo ratings yet

- ST STDocument1 pageST STsaifuliuNo ratings yet

- END Examination:: Ar:: y - . IDocument2 pagesEND Examination:: Ar:: y - . Ivjkapoor1609No ratings yet

- 08MBA14 May - June 2010Document3 pages08MBA14 May - June 2010nitte5768No ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Foundation Examination - January 2015: (52) EconomicsDocument6 pagesFoundation Examination - January 2015: (52) EconomicscthiruvazhmarbanNo ratings yet

- Narsee Monjee College of Comm. & Eco. Oct' 04: BMS (V) - Financial Management (Paper II)Document3 pagesNarsee Monjee College of Comm. & Eco. Oct' 04: BMS (V) - Financial Management (Paper II)Rutuja KhotNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- Module Iii: Various Statutory and Business Registrations: Answer KeyDocument5 pagesModule Iii: Various Statutory and Business Registrations: Answer KeyShelendraSinghNo ratings yet

- IT-BBA IV - 1st Internals 2016Document2 pagesIT-BBA IV - 1st Internals 2016KNRavi KiranNo ratings yet

- 1702q PDFDocument2 pages1702q PDFfloriza binadayNo ratings yet

- Inland Revenue Board Malaysia: Residence Status of IndividualsDocument21 pagesInland Revenue Board Malaysia: Residence Status of IndividualsNurin HadNo ratings yet

- Bba 3 Sem AccountsDocument9 pagesBba 3 Sem Accountsanjali LakshcarNo ratings yet

- Mba (Bank MGT.)Document32 pagesMba (Bank MGT.)Sneha Angre0% (1)

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Acct 381 FinalDocument20 pagesAcct 381 Final342517962No ratings yet

- Taxation MalawiDocument15 pagesTaxation MalawiCean Mhango100% (1)

- Accounting For ManagersDocument6 pagesAccounting For ManagerskartikbhaiNo ratings yet

- MN3002-Financial Accounting (2019-20) - FYBBADocument4 pagesMN3002-Financial Accounting (2019-20) - FYBBAVivek AyreNo ratings yet

- Direct Tax1Document41 pagesDirect Tax1Kunjal Kumar SinghNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- Accounting For Managers GTU Question PaperDocument3 pagesAccounting For Managers GTU Question PaperbhfunNo ratings yet

- L1-Income & Scope (Q)Document1 pageL1-Income & Scope (Q)Jason LingNo ratings yet

- School Tutorials 33Document1 pageSchool Tutorials 33Venkat RamNo ratings yet

- POB Paper 2 June 2010Document4 pagesPOB Paper 2 June 2010Duhguy Marvin CharlesNo ratings yet

- Income Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Document17 pagesIncome Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Prabhakar BhattacharyaNo ratings yet

- 867C1F Personal and Professional Goal Setting WorksheetDocument2 pages867C1F Personal and Professional Goal Setting Worksheetnavimala85No ratings yet

- Decision Making Can Be Viewed As An Eight-Step Process That Involves IdentifyingDocument5 pagesDecision Making Can Be Viewed As An Eight-Step Process That Involves Identifyingnavimala85No ratings yet

- Quiz (10 %)Document1 pageQuiz (10 %)navimala85No ratings yet

- Managing and OrganizationsDocument128 pagesManaging and Organizationsnavimala85100% (1)

- Case StudyDocument3 pagesCase Studynavimala85No ratings yet

- Unintentional Bias (Cain & Detsky, 2008 Moore, Tanlu, & Bazerman, 2010Document2 pagesUnintentional Bias (Cain & Detsky, 2008 Moore, Tanlu, & Bazerman, 2010navimala85No ratings yet

- Notesondecisionsmaking 120301012855 Phpapp01Document6 pagesNotesondecisionsmaking 120301012855 Phpapp01navimala85No ratings yet

- What Is GlobalizationDocument5 pagesWhat Is Globalizationnavimala85No ratings yet

- The Social Responsibility of Business: A ReviewDocument14 pagesThe Social Responsibility of Business: A Reviewnavimala85No ratings yet

- Background of The EntrepreneurDocument5 pagesBackground of The Entrepreneurnavimala85100% (2)

- ABPH Sample Study QuestionsDocument5 pagesABPH Sample Study Questionsnavimala85No ratings yet

- Southern New England Telephone Company: AssignmentDocument1 pageSouthern New England Telephone Company: Assignmentnavimala85No ratings yet

- Communication in OrganizationDocument30 pagesCommunication in Organizationnavimala85No ratings yet

- The Affordable Care ActDocument25 pagesThe Affordable Care ActTania Ballard100% (3)

- Kelkar CommitteeDocument6 pagesKelkar Committeedevika_verma240% (1)

- Benefit Illustration For Your Policy EQuote Number 520040229470Document2 pagesBenefit Illustration For Your Policy EQuote Number 520040229470Shobha RaniNo ratings yet

- Itr2 PreviewDocument38 pagesItr2 PreviewShailjaNo ratings yet

- Examples Transfer PricingDocument15 pagesExamples Transfer PricingRajat RathNo ratings yet

- Assignment 1-Business LawDocument30 pagesAssignment 1-Business Lawhoanggiang4445No ratings yet

- Financial Statements PreparationDocument6 pagesFinancial Statements Preparationana lopezNo ratings yet

- Macroeconomics - Staicu&PopescuDocument155 pagesMacroeconomics - Staicu&PopescuŞtefania Alice100% (1)

- Pre-Week General Principles TaxationDocument6 pagesPre-Week General Principles Taxationjharik23No ratings yet

- Overview of Heads of income-MTS-2022Document197 pagesOverview of Heads of income-MTS-2022GauravNo ratings yet

- PHI 17A-Dec 2018 PAL Fin Statement 2018Document162 pagesPHI 17A-Dec 2018 PAL Fin Statement 2018makane100% (1)

- Principles of Taxation Law Part 8 - IndexDocument32 pagesPrinciples of Taxation Law Part 8 - IndexHan Ny PhamNo ratings yet

- 2000-DST Jan 2018 FinalDocument3 pages2000-DST Jan 2018 FinalClark GuilasNo ratings yet

- The Effect of Local Tax and Retribution On Direct Expenditure With Special Autonomy FundDocument5 pagesThe Effect of Local Tax and Retribution On Direct Expenditure With Special Autonomy FundDR. SYUKRIY ABDULLAH , S.E, M.SINo ratings yet

- Blakemore Freeman Fellowship InformationDocument6 pagesBlakemore Freeman Fellowship InformationTaiwanSummerProgramsNo ratings yet

- National Highways and Infrastructure Development Corporation Ltd. (Ministry of Road Transport & Highways) Government of IndiaDocument214 pagesNational Highways and Infrastructure Development Corporation Ltd. (Ministry of Road Transport & Highways) Government of IndiaHemant OjhaNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Punjab Budget 2020-21 Highlights EnglishDocument47 pagesPunjab Budget 2020-21 Highlights EnglishInsaf.PK100% (1)

- Cao-04-2019 Duty Drawback Refund and AbatementDocument24 pagesCao-04-2019 Duty Drawback Refund and AbatementesdseaborneNo ratings yet

- FICO Module Course ContentsDocument3 pagesFICO Module Course ContentsMohammed Nawaz Shariff100% (1)

- COA Form - EnglishDocument9 pagesCOA Form - EnglishGatras NusantaraNo ratings yet

- PT Aksi Bergerak Cepat ChartOfAccounts 2022-11-23Document16 pagesPT Aksi Bergerak Cepat ChartOfAccounts 2022-11-23adisetNo ratings yet

- Luzon Stevedoring Corp vs. CTADocument2 pagesLuzon Stevedoring Corp vs. CTAmaximum jicaNo ratings yet

- Income TaxDocument30 pagesIncome TaxMohd Hossain Natiqi100% (1)

- Introduction To Agriculture Lecture Notes NewDocument35 pagesIntroduction To Agriculture Lecture Notes NewAnonymous S8YHHo51M86% (7)

- A System Dynamics Model of Capital StrucDocument14 pagesA System Dynamics Model of Capital StrucAbhishek ModakNo ratings yet

- Cash Flow Indirec Metode PD Mitra Revisi Upk 2016Document2 pagesCash Flow Indirec Metode PD Mitra Revisi Upk 2016Faie RifaiNo ratings yet

- Food Waste in Rst. Pakistan PDFDocument21 pagesFood Waste in Rst. Pakistan PDFKaruna DhuttiNo ratings yet

- Elasticity and InelasticityDocument2 pagesElasticity and InelasticityKarl BrattNo ratings yet

- A Project Report: "Equity Analysis"Document103 pagesA Project Report: "Equity Analysis"Sampath SanguNo ratings yet