Professional Documents

Culture Documents

Go Ahead For Equity Morning Note 14 June 2013-Mansukh Investment and Trading Solution

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Go Ahead For Equity Morning Note 14 June 2013-Mansukh Investment and Trading Solution

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

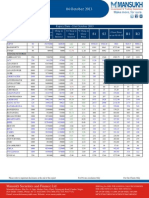

Morning Note 14 JUNE 2013

make more, for sure.

DATA MATRIX OF LAST SESSION FIRST LIGHT HEADINGS

INDEX Close %Chg

Sensex 18827 -1.12

Nifty 5699 -1.06

Midcap 6108 -1.37

Smallcap 5714 -1.06

VALUE TRADED (Rs Crs) %Chg MARKET INSIGHT

BSE 1841 -4.86

On Thursday 14 June 2013, Markets across Asia suffered another bruising day as investors

NSE 9999 -14.02

scrambled for the exits, with Japanese stocks falling into bear market territory, almost 5%, along

F& O Total 139864 -4.60

with heavy losses in China and across Southeast Asia. Meanwhile, European shares sold off

Total Volume 151704 -5.29

again on Thursday with banks and commodity stocks - two of the sectors most exposed to

NET INFLOWS (Rs Crs) %Chg broader economic fortunes remaining the top losers on concerns about stimulus unwinding

and Greek political turbulence. Closer home, the downtrend of Indian equity markets was

FIIs (558.0) -47.37

capped to some extent on account of Fitch's upgrade on Indian's outlook. Fitch returned India's

DIIs 713.8 -0.57

sovereign ratings outlook to 'stable' from 'negative' a year after its initial downgrade, citing

FII OPEN INTEREST (Crs) %Chg government measures to contain the budget deficit and the progress made in improving

FII Index Futures 10086.34 10.56 investment and economic growth. Nevertheless, to add to the positives, Government revised

FII Index Options 56297.26 2.32 the April IIP to 2.3% against 2% reported yesterday.Further, amidst across the board selling

FII Stock Futures 28581.18 -0.75 pressure, only stocks from Consumer Durable counters showed resilience. Prominent losers

FII Stock Options 1916.66 1.48 amongst the sectoral space were stocks from Auto, Realty and Health Care counters. The

market breadth on the BSE ended negative; advances and declining stocks were in a ratio of 760:

World Indices %Chg 1563, while 133 scrips remained unchanged..

Dow Jones 15176 1.21 The BSE Sensex lost 233.95 points or 1.23% to settle at 18807.18.The index touched a high and

Nasdaq 3445 1.32 a low of 18914.13 and 18765.53 respectively. Among the 30-share Sensex pack, 5 stocks gained,

FTSE 100 6305 0.10 while rest of 25 declined. Broader indices concluded in red; BSE Mid cap and Small cap indices

Commodity %Chg were down by 1.47% and 1.06% respectively. (Provisional) On the BSE Sectoral front, Auto

down by 2.59%, Realty down by 2.22%, Health Care down by 1.92%, IT down by 1.87% and PSU

Crude (US$/bl) 96.7 1.16

down by 1.86%, were the top losers, while Consumer Durables up by 7.48 was the sole gainer in

Gold (US$/oz) 1383.9 -0.50

the space. (Provisional)

Top 5 Movers Close Price %Chg

India VIX, a gauge for markets short term expectation of volatility gained 3.12% at 19.44 from

HINDALCO 96.65 4.71 its previous close of 18.85 on Wednesday. The CNX Nifty lost 64.05 points or 1.11% to settle at

BHARTIARTL 286.95 3.31 5,696.15. The index touched high and low of 5,729.85 and 5,683.10 respectively. 9 stocks

JINDALSTEL 237 0.62 advanced against 41 declining on the index. (Provisional)

SBIN 2,017.00 0.55

Asian stocks closed shop on a weak note, with Japanese shares leading the losses as dollar hits

AMBUJACEM 175.1 0.46

a two-month low against the yen, on expectations that central bank's easing measures will soon

Top 5 Loser Close Price %Chg come to an end. Shanghai markets ended lower in its first session of trade this week, as

PNB 718.55 -4.73 investment data at the weekend reinforced fears about a slowdown in the world's number two

BANKBARODA 624.35 -4.2 economy. Hong Kong market went home with red mark after touching lowest level since

GAIL 293 -3.92 September.

TATAMOTORS 282.1 -3.9

NMDC 108.25 -3.69

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd SEBI RegnBSE:

SEBI Reg.No: No.INB

BSE: INB010985834

010985834, / NSE:

F&O: INF INB230781431

010985834

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, PMS Regn No. INP000002387

NSE: INB 230781431, F&O: INF 230781431,

New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000

Email: research@moneysukh.com, Website: www.moneysukh.com MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Morning Note

make more, for sure.

MARKET OUTLOOK- CAUTIOUSLY OPTIMISTIC

QUANTITATIVE ANALYSIS: It was an another nerve-racking session of performance at D-street, where benchmark equity indices

continuously kept their head below water and not even for once did attempt to enter the green zone. Desistance of Finance Minister from

announcing any big-bang announcement for stemming rupee's slide mainly weighed on investors sentiment, coupled with daunting global set-

up. However, Finance Minister P Chidambaram said that the government will soon take a call on further reforms in foreign direct investment

(FDI), a move which on implementation could bring back some cheers into equity markets. Nevertheless, by the close of trade benchmark

indexes, Sensex and Nifty, taking a knock of over a percent settled near their two month low level, below the crucial 19,000 and 5700 mark

respectively. For the upcoming sessions we believe spot index may shown some bounce back in near term however 5950-6030 could be the

resistance zone. On the flip side any negative outcome will further create some more panic among traders and we might see 5600-5550 in a short

span of time where consolidation can’t be rule out. Happy trading.................

TODAY'S MARKET LEVELS

Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend

SENSEX 18590 18805 19041 19388 19522 Rangebound

NIFTY 5712 5752 5760 5844 5892 Rangebound

BANKNIFTY 11144 11605 11842 12190 12410 Rangebound

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd SEBI RegnBSE:

SEBI Reg.No: No.INB

BSE: INB010985834

010985834, / NSE:

F&O: INF INB230781431

010985834

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, PMS Regn No. INP000002387

NSE: INB 230781431, F&O: INF 230781431,

New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000

Email: research@moneysukh.com, Website: www.moneysukh.com MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Morning Note

make more, for sure.

NAME DESIGNATION E-MAIL

Varun Gupta Head - Research varungupta@moneysukh.com

Mohit Taneja Research Analyst mohit.t@moneysukh.com

Vikram Singh Research Analyst vikram_research@moneysukh.com

For more copies or other information, please send your query at research@moneysukh.com

Note: Please refer our Derivative Report for recommendation on OPTION STRATEGIES.

Additional Information with respect to the securities referred in our derivative calls is uploaded on our website.

Please note that our technical calls are totally independent of our fundamental calls. Technical Trends calls are based on momentum,

Investors/Traders are requested to observe following discipline to take maximum advantage of the products.

-Entry/exit will be on the basis of price or time priority

-Use strict stop loss at 15% from your average acquisition price

This report is prepared for the exclusive use of Mansukh Group clients only and should not be reproduced, recirculated, published in any

media, website or otherwise, in any form or manner, in part or as a whole, without the express consent in writing of Mansukh Securities and

Finance Ltd. Any unauthorized use, disclosure or public dissemination of information contained herein is prohibited.

This data sheet is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herein.

While utmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct or

indirect losses arising from the use thereof and the investors are requested to use the information contained herein at their own risk.

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd SEBI RegnBSE:

SEBI Reg.No: No.INB

BSE: INB010985834

010985834, / NSE:

F&O: INF INB230781431

010985834

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, PMS Regn No. INP000002387

NSE: INB 230781431, F&O: INF 230781431,

New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000

Email: research@moneysukh.com, Website: www.moneysukh.com MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

You might also like

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Reading 25 Non-Current (Long-Term) LiabilitiesDocument31 pagesReading 25 Non-Current (Long-Term) LiabilitiesNeerajNo ratings yet

- Check AccountabilityDocument12 pagesCheck Accountabilityjoy elizondoNo ratings yet

- Ekonomi Paint SectorDocument4 pagesEkonomi Paint SectorDilansu KahramanNo ratings yet

- Chapter 5Document19 pagesChapter 5Flordeliza HalogNo ratings yet

- 2.theory of Demand and SupplyDocument39 pages2.theory of Demand and SupplyMuhammad TarmiziNo ratings yet

- ThreadReader 0 MSSR Le Baron 1400636267499454465Document13 pagesThreadReader 0 MSSR Le Baron 1400636267499454465poheiNo ratings yet

- Problem 29.2Document2 pagesProblem 29.2Arian AmuraoNo ratings yet

- Integrating SDGsDocument24 pagesIntegrating SDGsRuwandi KuruwitaNo ratings yet

- Competition Law LLMDocument17 pagesCompetition Law LLMritu kumarNo ratings yet

- Specialty Toys Case ProblemDocument5 pagesSpecialty Toys Case ProblemHope Trinity EnriquezNo ratings yet

- Abrams Company Case Study - MADocument2 pagesAbrams Company Case Study - MAMuhammad Zakky AlifNo ratings yet

- Online Inventory Management at REWEDocument4 pagesOnline Inventory Management at REWEJa NiceNo ratings yet

- Business Cycles (BBA BI)Document19 pagesBusiness Cycles (BBA BI)Yograj PandeyaNo ratings yet

- 79MW Solar Cash Flow enDocument1 page79MW Solar Cash Flow enBrian Moyo100% (1)

- Written Assignment 1Document3 pagesWritten Assignment 1modar KhNo ratings yet

- ACCA P5 - Advanced Performance Management Passcards 2013-1Document177 pagesACCA P5 - Advanced Performance Management Passcards 2013-1allenchi100% (3)

- Economic Analysis For ManagersDocument6 pagesEconomic Analysis For ManagersSaad NiaziNo ratings yet

- Jaipur National University: Dainik Bhaskar Jid Karo Duniya BadloDocument33 pagesJaipur National University: Dainik Bhaskar Jid Karo Duniya BadloAkkivjNo ratings yet

- Case Study (Capital Conundrum) (19!07!11)Document4 pagesCase Study (Capital Conundrum) (19!07!11)sanhack10050% (2)

- Alinma BankDocument4 pagesAlinma BankAnonymous bwQj7OgNo ratings yet

- SAP New GL # 1 Overview of New GL Document Splitting Process PDFDocument8 pagesSAP New GL # 1 Overview of New GL Document Splitting Process PDFspani92100% (1)

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Document27 pagesFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsNo ratings yet

- Forms of Business Organization in NepalDocument10 pagesForms of Business Organization in Nepalsuraj banNo ratings yet

- Positioning ASDocument2 pagesPositioning ASSheila Mae MalesidoNo ratings yet

- An Introduction To The Supply Chain Council's SCOR MethodologyDocument17 pagesAn Introduction To The Supply Chain Council's SCOR MethodologyLuis Andres Clavel Diaz100% (1)

- Chapter - 6 Findings, Suggestions Andconclusion Findings From Financial AnalysisDocument2 pagesChapter - 6 Findings, Suggestions Andconclusion Findings From Financial AnalysisTinku KumarNo ratings yet

- Capstone - Upgrad - Himani SoniDocument21 pagesCapstone - Upgrad - Himani Sonihimani soni100% (1)

- Dcom307 - DMGT405 - Dcom406 - Financial Management PDFDocument318 pagesDcom307 - DMGT405 - Dcom406 - Financial Management PDFBaltej singhNo ratings yet

- WG O1 Culinarian Cookware Case SubmissionDocument7 pagesWG O1 Culinarian Cookware Case SubmissionAnand JanardhananNo ratings yet

- Millennium Development Goals - Wikipedia, The Free EncyclopediaDocument15 pagesMillennium Development Goals - Wikipedia, The Free Encyclopediagvk123No ratings yet