Professional Documents

Culture Documents

Free Trade Zone

Uploaded by

Catherine JohnsonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Free Trade Zone

Uploaded by

Catherine JohnsonCopyright:

Available Formats

FREE TRADE ZONE

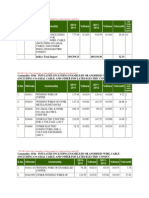

A free trade zone (FTZ) or export processing zone (EPZ) is an area of a country where some normal trade barriers such as tariffs and quotas are eliminated and bureaucratic requirements are lowered in hopes of attracting new business and foreign investments.[1] It is a region where a group of countries has agreed to reduce or eliminate trade barriers.[2] Free trade zones can be defined as labor intensive manufacturing centers that involve the import of raw materials or components and the export of factory products. The world's first Free Trade Zone was established in Shannon, Co. Clare, Ireland Shannon Free Zone. [3] This was an attempt by the Irish Government to promote employment within a rural area, make use of a small regional airport and generate revenue for the Irish economy. It was hugely successful, and is still in operation today. Most FTZs are located in developing countries: Brazil, Indonesia, El Salvador, China, the Philippines, Malaysia, Bangladesh, Pakistan, Mexico, Costa Rica, Honduras, Guatemala, Kenya, and Madagascar have EPZ programs.[4] In 1997, 93 countries had set up export processing zones (EPZs) employing 22.5 million people, and five years later, in 2003, EPZs in 116 countries employed 43 million people.[4] Corporations setting up in a zone may be given tax breaks as an incentive. Usually, these zones are set up in underdeveloped parts of the host country; the rationale is that the zones will attract employers and thus reduce poverty and unemployment, and stimulate the area's economy. These zones are often used by multinational corporations to set up factories to produce goods (such as clothing or shoes). Free trade zones in Latin America date back to the early decades of the 20th century. The first free trade regulations in this region were enacted in Argentina and Uruguay in the 1920s. The Latin American Free Trade Association (LAFTA) was created in the 1960 Treaty of Montevideo by Argentina, Brazil, Chile, Mexico, Paraguay, Peru, and Uruguay. However, the rapid development of free trade zones across the region dates from the late 1960s and the early 1970s. Latin American Integration Association is a Latin American trade integration association, based in Montevideo. Free Trade Zones are also known as Special Economic Zones in some countries. Special Economic Zones (SEZs) have been established in many countries as testing grounds for the implementation of liberal market economy principles. SEZs are viewed as instruments to enhance the acceptability and the credibility of the transformation policies and to attract domestic and foreign investment. In 1999, there were 43 million people working in about 3000 FTZs spanning 116 countries producing clothes, shoes, sneakers, electronics, and toys. The basic objectives of EPZs are to enhance foreign exchange earnings, develop export-oriented industries and to generate employment opportunities.

] Criticism

Free trade zones are domestically[clarification needed] criticized for encouraging businesses to set up operations under the influence of other governments, and for giving foreign corporations more economic liberty than is given indigenous employers who face large and sometimes insurmountable "regulatory" hurdles in developing nations[verification needed]. However, many countries are increasingly allowing local entrepreneurs to locate inside FTZs in order to access export-based incentives.[verification needed]. Because the multinational corporation is able to choose between a wide range of underdeveloped or depressed nations in setting up overseas factories, and most of these countries do not have limited governments, bidding wars (or 'races to the bottom') sometimes erupt between competing governments .[verification needed]. Sometimes the domestic government pays part of the initial cost of factory setup, loosens environmental protections and rules regarding negligence and the treatment of workers, and promises not to ask payment of taxes for the next few years. When the taxation-free years are over, the corporation that set up the factory without fully assuming its costs is often able to set up operations elsewhere for less expense than the taxes to be paid, giving it leverage to take the host government to the bargaining table with more demands, but parent companies in the United States are rarely held accountable.[5] The widespread use of free trade zones by companies such as Nike has received criticism from numerous writers such as Naomi Klein in her book No Logo.

[edit] List of Free Trade Zones

Colon Free Zone Republic of Panama Jebel Ali Free Zone, Dubai Aegean Free Zone, Izmir Turkey Zonamerica Business & Technology Park - Uruguay Aras Free Zone, East Azarbaijan province Iran Bahrain Logistics Zone, Kingdom of Bahrain Bayan Lepas Free Trade Zone, Penang, Malaysia Batam Free Trade Zone], Batam, Indonesia Cavite Export Processing Zone, Rosario, Cavite City, Philippines Zona Franca de Manaus, Brazil Bataguassu - MS, Brazil Freeport, Grand Bahama non [4] Aden, Republic of Yemen Chabahar, Oman Mauritius (the whole island is considered to be a FTZ) Bizerte and Zarzis in Tunisia Directorate for Technological Industrial Development Zones - Macedonia managing four Free Zones: TIDZ Skopje 1 & 2, TIDZ Stip and TIDZ Tetovo] Kandlar Trade Free zone, India

You might also like

- A Free Trade ZoneDocument28 pagesA Free Trade Zone07452222960No ratings yet

- Free Trade Zone / Export Processing Zone: Chandan MukhopadhyayDocument4 pagesFree Trade Zone / Export Processing Zone: Chandan MukhopadhyayChandan MukhopadhyayNo ratings yet

- Free Trade ZoneDocument9 pagesFree Trade ZoneNidhi AgrawalNo ratings yet

- Free Trade ZoneDocument10 pagesFree Trade ZoneAnkit AnandNo ratings yet

- Special Economic ZoneDocument7 pagesSpecial Economic ZoneAnonymous cRMw8feac8No ratings yet

- TAX Haven: A Global Scenario: Aamir AijazDocument3 pagesTAX Haven: A Global Scenario: Aamir AijazSagipul AhyarNo ratings yet

- Criticism: 1 Criticism 2 List of Free Trade Zones 3 See Also 4 ReferencesDocument4 pagesCriticism: 1 Criticism 2 List of Free Trade Zones 3 See Also 4 ReferencesAnusha RameshNo ratings yet

- Regional IntegrationDocument27 pagesRegional Integrationjada romeroNo ratings yet

- Regional IntegrationDocument27 pagesRegional IntegrationAbby miles100% (1)

- Topic4 2WorldEconomicProcessingZonesAssociationDocument34 pagesTopic4 2WorldEconomicProcessingZonesAssociation氏无名No ratings yet

- Special Economic ZonesDocument10 pagesSpecial Economic ZonesPranay Manikanta JainiNo ratings yet

- Report 3Document8 pagesReport 3Manju SreeNo ratings yet

- International Business ManagementDocument6 pagesInternational Business Managementshashi kiranNo ratings yet

- Free-Trade ZoneDocument5 pagesFree-Trade ZoneAmir MehmoodNo ratings yet

- Submitted by Name: N.D.S.K Sruthi Roll No College:: 30: AQJ Centre For PG StudiesDocument15 pagesSubmitted by Name: N.D.S.K Sruthi Roll No College:: 30: AQJ Centre For PG Studiesrswarupini02No ratings yet

- Special Economic Zone: Facts, Roles, and Opportunities of InvestmentDocument5 pagesSpecial Economic Zone: Facts, Roles, and Opportunities of InvestmentAnonymous cRMw8feac8No ratings yet

- Meaning of GlobalizationDocument8 pagesMeaning of GlobalizationDiganta J BaruahNo ratings yet

- Special Economic ZoneDocument2 pagesSpecial Economic ZoneHello NameNo ratings yet

- Assignment No.3: Course Title: Student Name Registration No Class Semester: Date of Submission TutorDocument12 pagesAssignment No.3: Course Title: Student Name Registration No Class Semester: Date of Submission TutorRehman RajpootNo ratings yet

- Specialized Economic ZonesDocument6 pagesSpecialized Economic Zonestony jammerNo ratings yet

- Basic MacroDocument7 pagesBasic MacroAlexis JaneNo ratings yet

- PROJECT REPORT - BEP (1)Document11 pagesPROJECT REPORT - BEP (1)studyy bossNo ratings yet

- International Business Class No 2Document46 pagesInternational Business Class No 2JavidNo ratings yet

- Special Economic Zones (SEZ) : Mr. Rohit Kumar Vishwakarma Assistant Professor UIMDocument17 pagesSpecial Economic Zones (SEZ) : Mr. Rohit Kumar Vishwakarma Assistant Professor UIMPrachi BharadwajNo ratings yet

- GENRALIZED Info For Epz in PakistanDocument6 pagesGENRALIZED Info For Epz in PakistanAli AhmadNo ratings yet

- Presentation ON Trade Bloc: Presented byDocument21 pagesPresentation ON Trade Bloc: Presented byManish MishraNo ratings yet

- Special Economic ZoneDocument44 pagesSpecial Economic Zonedivyesh_varia100% (1)

- Solution Manual For International Business A Managerial Perspective 8 e 8th Edition 0133506290Document26 pagesSolution Manual For International Business A Managerial Perspective 8 e 8th Edition 0133506290BethRowenfed100% (38)

- Role of SEZs in Corporate Social ResponsibilityDocument12 pagesRole of SEZs in Corporate Social ResponsibilitysurindercdluNo ratings yet

- E A L B S: NIT Nternational UsinessDocument42 pagesE A L B S: NIT Nternational UsinessArnieNo ratings yet

- Globalisation and Development in The RegionDocument63 pagesGlobalisation and Development in The RegionSasha FoxNo ratings yet

- Benefits and Criticisms of Free Trade AgreementsDocument9 pagesBenefits and Criticisms of Free Trade AgreementsClaire JOY PascuaNo ratings yet

- Special Economic ZonesDocument4 pagesSpecial Economic ZonesLalithya Sannitha MeesalaNo ratings yet

- 01 - Global and Regional Economic Cooperation and Integration and The United Nations Impact On TradeDocument40 pages01 - Global and Regional Economic Cooperation and Integration and The United Nations Impact On TradeAmaranthine Angel HarpNo ratings yet

- Building New Worlds: China Asia Pacific Europe Africa United States CaribbeanDocument34 pagesBuilding New Worlds: China Asia Pacific Europe Africa United States CaribbeanDavid Paul HensonNo ratings yet

- Indian Sez ModelsDocument24 pagesIndian Sez ModelsAnuja BakareNo ratings yet

- EcoZone TaxationDocument10 pagesEcoZone TaxationjanewightNo ratings yet

- Analysis of Special Economic ZoneDocument7 pagesAnalysis of Special Economic ZoneAyush Kumar SinghNo ratings yet

- Foreign Direct Investment and Free Trade Area: Dr. Sugandh AroraDocument21 pagesForeign Direct Investment and Free Trade Area: Dr. Sugandh AroraMs. Sugandh Arora (SSBS Assistant Professor)No ratings yet

- Advantages of Export-Led GrowthDocument10 pagesAdvantages of Export-Led Growthaman mittalNo ratings yet

- MGMNT ContractDocument3 pagesMGMNT ContractDurgesh AgnihotriNo ratings yet

- U Ooperation Uouncil For The Arab States of The Gulf: ImportsDocument4 pagesU Ooperation Uouncil For The Arab States of The Gulf: ImportsAswathy MenonNo ratings yet

- Imm Work Final 2013Document67 pagesImm Work Final 2013Keyur BhojakNo ratings yet

- A Study On Cash Management Anaiysis in Sri Angalaman Finance Limited Chapter-IDocument61 pagesA Study On Cash Management Anaiysis in Sri Angalaman Finance Limited Chapter-IJayaprabhu PrabhuNo ratings yet

- Presented By: Naval Singh Neha Gupta Nirapjeet BrarDocument33 pagesPresented By: Naval Singh Neha Gupta Nirapjeet BrarNaval SinghNo ratings yet

- UAE Free ZoneDocument4 pagesUAE Free ZoneAshar Sultan KayaniNo ratings yet

- Tax Havens Study MaterialDocument73 pagesTax Havens Study Materialవిజయ్ పిNo ratings yet

- MPIB7103 Assignment 1 (201805)Document12 pagesMPIB7103 Assignment 1 (201805)Masri Abdul LasiNo ratings yet

- Market IntegrationDocument22 pagesMarket IntegrationMario OreoNo ratings yet

- 2 General Concepts: FTZ and Port Hinterland: 2.1 Historical Background and EvolutionDocument22 pages2 General Concepts: FTZ and Port Hinterland: 2.1 Historical Background and EvolutionMunaNo ratings yet

- Humanities-A Comparative Study On Indo-Chinese SEZs-K.G.mallikarjunaDocument8 pagesHumanities-A Comparative Study On Indo-Chinese SEZs-K.G.mallikarjunaImpact JournalsNo ratings yet

- IB FinalDocument6 pagesIB FinalMeaadNo ratings yet

- Globalization of Economic RelationDocument20 pagesGlobalization of Economic RelationKristine OrtizNo ratings yet

- Compentory WorldDocument4 pagesCompentory WorldMary Rose NaboaNo ratings yet

- Comesa Investment OpportunitiesDocument6 pagesComesa Investment OpportunitiesFeisal AhmedNo ratings yet

- Free Trade Zone ArticleDocument18 pagesFree Trade Zone ArticleMbereobongNo ratings yet

- Special Economic ZoneDocument9 pagesSpecial Economic ZoneGïŘï Yadav RasthaNo ratings yet

- Econ Handout IntegrationDocument10 pagesEcon Handout IntegrationOnella GrantNo ratings yet

- UAE SST NotesDocument3 pagesUAE SST Notesiyaan fameebNo ratings yet

- Itc HS (85400Document20 pagesItc HS (85400Catherine JohnsonNo ratings yet

- Present Position in International SubcontractingDocument3 pagesPresent Position in International SubcontractingCatherine JohnsonNo ratings yet

- Multinational CorporationDocument6 pagesMultinational CorporationCatherine JohnsonNo ratings yet

- International SubcontractingDocument2 pagesInternational SubcontractingCatherine JohnsonNo ratings yet

- International StrategyDocument26 pagesInternational StrategyCatherine JohnsonNo ratings yet

- Mergers & Acquisitions: 10 Solid Reasons To Support An Acquisition StrategyDocument2 pagesMergers & Acquisitions: 10 Solid Reasons To Support An Acquisition StrategyCatherine JohnsonNo ratings yet

- Mergers and AcquisitionsDocument12 pagesMergers and AcquisitionsCatherine JohnsonNo ratings yet

- Counter Trade I2Document3 pagesCounter Trade I2Catherine JohnsonNo ratings yet

- International Control SystemDocument5 pagesInternational Control SystemCatherine JohnsonNo ratings yet

- Export of Project & ConsultancyDocument65 pagesExport of Project & ConsultancyCatherine Johnson100% (1)

- Cross Border Business Reorganisation The Indian PerspectiveDocument39 pagesCross Border Business Reorganisation The Indian PerspectiveCatherine JohnsonNo ratings yet

- Overseas Project ConsultancyDocument23 pagesOverseas Project ConsultancyCatherine JohnsonNo ratings yet

- Multinational CorporationDocument8 pagesMultinational CorporationDhananjana JoshiNo ratings yet

- Universe 12 Group 4Document3 pagesUniverse 12 Group 4Arvind SarangiNo ratings yet

- A Strategic Management Review of Pakistan RailwaysDocument28 pagesA Strategic Management Review of Pakistan RailwaysBilal100% (3)

- How Securities Are TradedDocument21 pagesHow Securities Are TradedAriful Haidar MunnaNo ratings yet

- Economics ComDocument121 pagesEconomics ComIqra MughalNo ratings yet

- Assume That You Recently Graduated With A Major in FinanceDocument2 pagesAssume That You Recently Graduated With A Major in FinanceAmit PandeyNo ratings yet

- Public Systems Management - Concept, Nature, Scope and Characteristics - 2Document11 pagesPublic Systems Management - Concept, Nature, Scope and Characteristics - 2abhiijeet070% (1)

- 13 Developing Pricing Strategies and ProgramsDocument34 pages13 Developing Pricing Strategies and ProgramsBahar RoyNo ratings yet

- 1 Semester Assignment Questions: Managerial EconomicsDocument2 pages1 Semester Assignment Questions: Managerial EconomicsSreepadKatlaNo ratings yet

- Ragan 15e PPT ch03Document20 pagesRagan 15e PPT ch03enigmauNo ratings yet

- 11th Economics EM One Mark Questions English Medium PDF DownloadDocument13 pages11th Economics EM One Mark Questions English Medium PDF Downloadthivathiva671No ratings yet

- Economics I 1005Document23 pagesEconomics I 1005meetwithsanjay100% (1)

- The Weekly Profile Guide - VolDocument19 pagesThe Weekly Profile Guide - VolJean TehNo ratings yet

- Company Analysis and Stock ValuationDocument37 pagesCompany Analysis and Stock ValuationHãmèéž MughalNo ratings yet

- Chapter PPT 05Document27 pagesChapter PPT 05Yusi PramandariNo ratings yet

- PESTLE Analysis Ed Tech IndustryDocument3 pagesPESTLE Analysis Ed Tech Industryshashikant prasadNo ratings yet

- IFM Chapter 17 - Class PresentationDocument15 pagesIFM Chapter 17 - Class PresentationCecilia Ooi Shu QingNo ratings yet

- MARKET STRUCTURES CROSSWORDDocument2 pagesMARKET STRUCTURES CROSSWORDSandy SaddlerNo ratings yet

- CH - 10 7-16-11Document58 pagesCH - 10 7-16-11Myla GellicaNo ratings yet

- Englehart Company Sells Two Types of Pumps One Is Large PDFDocument1 pageEnglehart Company Sells Two Types of Pumps One Is Large PDFAnbu jaromiaNo ratings yet

- Product Design and DevelopmentDocument14 pagesProduct Design and Developmentajay3480100% (1)

- Lecture 3 Ratio AnalysisDocument59 pagesLecture 3 Ratio AnalysisJiun Herng LeeNo ratings yet

- Fin701 Module2Document3 pagesFin701 Module2Krista CataldoNo ratings yet

- Fix Af Bab 16 Presentasi Kelompok 6Document19 pagesFix Af Bab 16 Presentasi Kelompok 6Rizky Ananto YandiraNo ratings yet

- To What Extent Can Decentralised Forms of Government Enhance The Development of Pro-Poor Policies and Improve Poverty-Alleviation Outcomes?Document61 pagesTo What Extent Can Decentralised Forms of Government Enhance The Development of Pro-Poor Policies and Improve Poverty-Alleviation Outcomes?Michel Monkam MboueNo ratings yet

- Bill 9500639426Document1 pageBill 9500639426sayys1390No ratings yet

- Maybank GM Daily - 23 May 2013Document5 pagesMaybank GM Daily - 23 May 2013r3iherNo ratings yet

- FIM Chapter 03 Structure of Interest RatesDocument8 pagesFIM Chapter 03 Structure of Interest RatesNiaz MorshedNo ratings yet

- Supply and Demand: Managerial Economics: Economic Tools For Today's Decision Makers, 4/e by Paul Keat and Philip YoungDocument42 pagesSupply and Demand: Managerial Economics: Economic Tools For Today's Decision Makers, 4/e by Paul Keat and Philip YoungGAYLY ANN TOLENTINONo ratings yet

- South Africa EconomyDocument11 pagesSouth Africa EconomyMohammed YunusNo ratings yet

- American Association of Wine EconomistsDocument37 pagesAmerican Association of Wine EconomistspecoraroNo ratings yet