Professional Documents

Culture Documents

Principles OF TAXATION

Uploaded by

tilahunthmCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles OF TAXATION

Uploaded by

tilahunthmCopyright:

Available Formats

Ten Principles of Sound Tax Policy

1. Transparency is a must. A good tax system requires informed taxpayers who understand how taxes are assessed, collected and complied with. It should be clear to taxpayers who and what is being taxed, and how tax burdens affect them and the economy. 2. Be neutral. The fundamental purpose of taxes is to raise necessary revenue for programs, not micromanage a complex market economy with subsidies and penalties. The tax systems central aim should be to minimize distortions in the economy, and to interfere as little as possible with the decisions of free people in the marketplace. 3. Maintain a broad base. Taxes should be broadly based, allowing tax rates to be as low as possible at all points. 4. Keep it simple. The tax system should be as simple as possible, and should minimize gratuitous complexity. The cost of tax compliance is a real cost to society, and complex taxes create perverse incentives to shelter and disguise legitimately earned income. 5. Stability matters. Tax law should not change continuously, and tax changes should be permanent and not temporary. Instability in the tax system makes long-term planning difficult, and increases uncertainty in the economy. 6. No retroactivity. Changes in tax law should not be retroactive. As a matter of fairness, taxpayers should rely with confidence on the law as it exists when contracts are signed and transactions are made. 7. Keep tax burdens low. It makes a difference how large a share of national income is taken by government in taxes. The private sector is the source of all wealth, and is what drives increases in the standard of living in a market-based economy. Taxes should consume as small a portion of national income as possible, and should not interfere with economic growth and investment. 8. Don't inhibit trade. In our increasingly global marketplace, the U.S. tax system must be competitive with those of other developed countries. Our tax system should not penalize or subsidize imports, exports, U.S. investment abroad or foreign investment in the U.S. Taxes on corporations, individuals, and goods and services should be competitive with other nations. 9. Ensure an open process. Tax legislation should be based on careful economic analysis and transparent legislative procedures. Tax legislation should be subject to open hearings with full opportunity to comment on legislation and regulatory proposals. 10. State and local taxes matter. The same general principles that apply to federal taxes also apply at the state and local level. Local, state and federal tax systems should be harmonized to the extent possible, including consistent definitions, procedures and rules.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Leadership Traits and BehaviorsAdv. OB & Analysis(MBA- 532Document33 pagesLeadership Traits and BehaviorsAdv. OB & Analysis(MBA- 532tilahunthmNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- BSC 2Document28 pagesBSC 2tilahunthmNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- CamScanner 09-09-2022 11.09Document2 pagesCamScanner 09-09-2022 11.09tilahunthmNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 7: Designing Effective Organizations: By: Girma Tadesse, PH .DDocument28 pagesChapter 7: Designing Effective Organizations: By: Girma Tadesse, PH .DtilahunthmNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- BSC 1 PDFDocument17 pagesBSC 1 PDFNaod FishNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ACM CH 1Document5 pagesACM CH 1tilahunthmNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Printout: Wednesday, July 20, 2022 11:23 PMDocument45 pagesPrintout: Wednesday, July 20, 2022 11:23 PMtilahunthmNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Wollo University, College of Business & Economics Department of Management: MBA Extension Program Course: Advanced Financial Management (MBA611)Document1 pageWollo University, College of Business & Economics Department of Management: MBA Extension Program Course: Advanced Financial Management (MBA611)tilahunthmNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 2.1.1. Summary of Income StatementDocument2 pages2.1.1. Summary of Income StatementtilahunthmNo ratings yet

- Understanding Phase IinDocument35 pagesUnderstanding Phase IintilahunthmNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Ration Analysis Tilahun HailuDocument3 pagesRation Analysis Tilahun HailutilahunthmNo ratings yet

- BSC 4Document4 pagesBSC 4tilahunthmNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Wollo University, College of Business & Economics Department of Management: MBA Extension Program Course: Advanced Financial Management (MBA611)Document1 pageWollo University, College of Business & Economics Department of Management: MBA Extension Program Course: Advanced Financial Management (MBA611)tilahunthmNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- ACM CH 2Document3 pagesACM CH 2tilahunthmNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Business Process ReengineeringDocument33 pagesBusiness Process ReengineeringtilahunthmNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- BSC 5Document10 pagesBSC 5tilahunthmNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

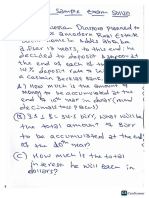

- Exam QuestionsDocument13 pagesExam QuestionstilahunthmNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- BSC 3Document14 pagesBSC 3tilahunthmNo ratings yet

- What Is Money LaunderingDocument2 pagesWhat Is Money LaunderingtilahunthmNo ratings yet

- Note For ExamDocument38 pagesNote For ExamtilahunthmNo ratings yet

- Introduction To ManagementDocument98 pagesIntroduction To ManagementtilahunthmNo ratings yet

- BSC 1 PDFDocument17 pagesBSC 1 PDFNaod FishNo ratings yet

- Fundamentals Strategic Management 2nd Edition 2018 PDFDocument18 pagesFundamentals Strategic Management 2nd Edition 2018 PDFIbrahim Salahudin0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Internatinal MarketingDocument9 pagesInternatinal MarketingtilahunthmNo ratings yet

- E MailDocument84 pagesE MailtilahunthmNo ratings yet

- Woldia UniversityDocument1 pageWoldia UniversitytilahunthmNo ratings yet

- Ethiopian Law of PersonsDocument278 pagesEthiopian Law of Personstilahunthm89% (9)

- Excel 2013 Training Manual SEODocument257 pagesExcel 2013 Training Manual SEOtilahunthm94% (16)

- Module Public Asset PADocument125 pagesModule Public Asset PAtilahunthmNo ratings yet

- Econ Exam 3 PracticeDocument17 pagesEcon Exam 3 PracticeNickArnoukNo ratings yet

- 04 Task Performance 1Document6 pages04 Task Performance 1Hanna LyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Effects On Textile Industry Due To Energy CrisisDocument8 pagesEffects On Textile Industry Due To Energy Crisismudassar jamil100% (2)

- Ananya Mukherjee-Reed - Perspectives On The Indian Corporate Economy - Exploring The Paradox of Profits (International Political Economy) (2001)Document249 pagesAnanya Mukherjee-Reed - Perspectives On The Indian Corporate Economy - Exploring The Paradox of Profits (International Political Economy) (2001)VENKY KRISHNANo ratings yet

- Economic Reforms in India Since 1991: An AppraisalDocument21 pagesEconomic Reforms in India Since 1991: An AppraisalShem W LyngdohNo ratings yet

- PublicEducationFunding ReportDocument118 pagesPublicEducationFunding ReportOKCFOXNo ratings yet

- ST Helena Tariff - Review - and - Justification - Paper - 2022-23Document18 pagesST Helena Tariff - Review - and - Justification - Paper - 2022-23Mark NabongNo ratings yet

- Ch.17 ENG-market FailureDocument35 pagesCh.17 ENG-market FailureCUBEC CHANGNo ratings yet

- A Discussion On The Roadmap For Public Higher Education Reform (RPHER)Document31 pagesA Discussion On The Roadmap For Public Higher Education Reform (RPHER)Angel Rose Trocio100% (2)

- What is a Central Bank in 40 CharactersDocument9 pagesWhat is a Central Bank in 40 CharactersJabree 3DNo ratings yet

- Alternatives To SprawlDocument36 pagesAlternatives To SprawlCallejasAlbinNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 2Document124 pagesChapter 2Cha Boon KitNo ratings yet

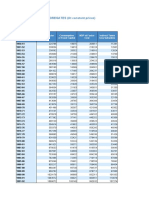

- HBS Table No. 02 - Macro Economic Aggregates (At Constant Prices)Document35 pagesHBS Table No. 02 - Macro Economic Aggregates (At Constant Prices)Anuj VermaNo ratings yet

- The Multifibre AgreementDocument40 pagesThe Multifibre AgreementVarun MehrotraNo ratings yet

- ISS22 PronelloDocument74 pagesISS22 PronelloAderito Raimundo MazuzeNo ratings yet

- Adda Leaf PlatesDocument5 pagesAdda Leaf PlatesSenkatuuka LukeNo ratings yet

- Reading 7 Economics of Regulation - AnswersDocument15 pagesReading 7 Economics of Regulation - Answerstristan.riolsNo ratings yet

- Agricultural FinanceDocument8 pagesAgricultural FinanceYayah Koroma100% (1)

- Marcopper Mining: Dealing with CSRDocument14 pagesMarcopper Mining: Dealing with CSRJose Mari DichosonNo ratings yet

- Introduction of International BusinessDocument42 pagesIntroduction of International Businesstrustme77100% (1)

- Karnataka MissionDocument67 pagesKarnataka MissionjalpathprathyuNo ratings yet

- Chapter 2 Theory of Demand and SupplyDocument25 pagesChapter 2 Theory of Demand and Supplyhidayatul raihanNo ratings yet

- The Cullman Times: Tornado Papers From Days Following April 27, 2011Document72 pagesThe Cullman Times: Tornado Papers From Days Following April 27, 2011Trent MooreNo ratings yet

- International BusinessDocument59 pagesInternational BusinessRizwan ZisanNo ratings yet

- Bçì Êçç QK Dçåò Äéò Åç Oçë Êáç Dêéöçêáç J Å Ë ÅDocument60 pagesBçì Êçç QK Dçåò Äéò Åç Oçë Êáç Dêéöçêáç J Å Ë ÅmarielNo ratings yet

- Quieter Homes: Reducing Aircraft Noise at Your PlaceDocument8 pagesQuieter Homes: Reducing Aircraft Noise at Your Placepauline_pabelloNo ratings yet

- Assam Development ReportDocument216 pagesAssam Development ReportnipjoyNo ratings yet

- Energy Transition and Renewable Energies: Challenges For Peru - Humberto Campodónico, Cesar CarreraDocument11 pagesEnergy Transition and Renewable Energies: Challenges For Peru - Humberto Campodónico, Cesar CarreratochisitoNo ratings yet

- CIR V SONY Case DigestDocument2 pagesCIR V SONY Case DigestAndrea TiuNo ratings yet

- Ib Economics - 1.10 Exam Practice Questions - SubsidiesDocument3 pagesIb Economics - 1.10 Exam Practice Questions - SubsidiesSOURAV MONDALNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)