Professional Documents

Culture Documents

A Study of Financial Working and Operational Performance of Urban

Uploaded by

Srikara AcharyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Financial Working and Operational Performance of Urban

Uploaded by

Srikara AcharyaCopyright:

Available Formats

Indian Streams Research Journal

Vol.1,Issue.V/June; 12pp.1-4

Dr.R.S.Shirasi Research Papers

ISSN:-2230-7850

A Study of Financial Working and Operational Performance of Urban Co-operative Banks in Pune District

Dr.R.S.Shirasi Hutatma Rajguru Mahavidyalaya Rajgurunagar, Tal.Khed, Dist.Pune- 410505

ABSTRACT

Due to liberalization and globalization the UCBs are facing the problems of competition from public sector banks, private banks, foreign banks and other UCBs as well. To study the financial working and operational performance of UCBs in Pune district is the main purpose of the research work.

OBJECTIVES : 1. To examine the financial working of the UCBs in Pune district with regards to banking parameters viz., membership, paid up capital, deposits, advances, NPAs and CD ratio. 2. To analyze the operational performance with regards to cost efficiency parameters viz, income analysis, expenses analysis and profit analysis. 3. To examine the experiences and expectations of the customers of the UCBs. 4. To analyze the strength of the customer service of selected UCBs. 5. To analyze the conditions of selected UCBs and identify their problems. 6. On the basis of analysis of financial working and operational performance, to suggest some preventive and remedial measures to UCBs in Pune district. HYPOTHESIS : Due to liberalization and globalization the financial and operational performance of UCBs are adversely affected. However, in a competition environment the UCBs have to increase their efficiency. SCOPE OF THE STUDY : 60 Urban Co-operative banks registered in Pune district Out of 60 UCBs, 10% UCBs i.e. 6 UCBs were selected by the random sampling procedure

Please cite this Article as : Dr.R.S.Shirasi, A STUDY OF FINANCIAL WORKING AND OPERATIONAL PERFORMANCE OF (1), ISRJ URBAN CO-OPERATIVE BANKS IN PUNE DISTRICT : Indian Streams Research Journal (June ; 2012)

A Study of Financial Working and Operational Performance of Urban

Indian Streams Research Journal

Vol.1,Issue.V/June; 2012

Sr. No. 1 2 3 4 5 6

Name of UCBs Baramati Sahakari Bank Ltd. Janaseva Sahakari Bank Ltd. Jijamata Mahila Sahakari Bank Ltd. Rajgurunagar Sahakari Bank Ltd. Sharad Sahakari Bank Ltd. Sopankaka Sahakari Bank Ltd.

Date of Registration 23/09/1961 24/10/1972 25/04/1974 19/06/1931 25/04/1974 08/04/1997

SELECTION OF CUSTOMERS : To examine the experiences and expectations of the customers of UCBs, 20 customers in each bank were selected by following the simple random procedure. In all 120 customers from 6 UCBs were selected for the study PERIOD OF STUDY : The study covers a period of 10 years as from 1998-99 to 2007-08. The accounting year of the bank commences on 1st April of every year and ends on 31st March of next year. METHODOLOGY : The present research study is an imperical research based on survey method. The data required for this study has been both from primary and secondary sources. PRIMARY DATA : The questionnaire, interviews, observations techniques are adopted for the research. Detailed and comprehensive questionnaire of two types were prepared. Questionnaire for CEO/Manager of UCBs. Questionnaire for customers of UCBs. SECONDARY DATA The secondary data and other relevant particulars were collected from the annual reports of these banks, journals, periodicals and published books. CONCLUSIONS : 1.It is observed that there is regional imbalance in the growth of UCBs in India. Five states viz. Maharashtra, Gujarat, Karanataka, Andhra Pradesh and Tamil Nadu account for 1661 UCBs out of 2104 in the country as at end March 2003. In 2008, out of total UCBs; 603 UCBs were registered in Maharashtra state. 2.It is observed that there is regional imbalance in the growth of UCBs in Maharashtra and in Pune district as well. There are 14 blocks in Pune district. The total number of UCBs registered in Pune district was 60 as on 31/03/2008. Out of these 60 UCBs, 47 UCBs were concentrated in Pune city, whereas 13 UCBs were scattered in 13 blocks of the district as on 31/03/2008. The number of UCBs registered in Velhe and Mulshi blocks was nil. 3.The UCBs are regulated and supervised by State Registrars of Co-operative Societies, Central Registrar of Co-operative societies in case of multi-state co-operative banks and by the RBI. The registrars of co-operative societies of the states exercise powers under the respective co-operative societies act of the states in regard to incorporation, registration, management, amalgamation, reconstruction or liquidation. In case of the UCBs having multi-state presence, the Central Registrar of

Please cite this Article as : Dr.R.S.Shirasi, A STUDY OF FINANCIAL WORKING AND OPERATIONAL PERFORMANCE OF (2), ISRJ URBAN CO-OPERATIVE BANKS IN PUNE DISTRICT : Indian Streams Research Journal (June ; 2012)

A Study of Financial Working and Operational Performance of Urban

Indian Streams Research Journal

Vol.1,Issue.V/June; 2012

Co-operative societies, New Delhi, exercises such powers. All UCBs are required to maintain the minimum 9% CRAR akin to commercial banks. The sample UCBs maintained the minimum CRAR. 4.It is observed that number of branches of the sample UCBs increased from 32 to 59 during the period of 1998-99 to 2003-04. But later on the number of branches increased by just 01. The average growth of branch expansion of these sample UCBs shows 1.69% in 2008 over 2004. 5.It is observed that the membership of these banks increased from 41566 to 80009 during the period of 1998-99 to 2007-08, registering a growth rate of 92.49%. It is observed that out of the total sample UCBs, the highest membership of 20968 was of Janaseva Sahakari Bank Ltd. as on 31/03/2008. The lowest membership of 6697 was Sopankaka Sahakari Bank Ltd. as on 31/03/2008. 6.It may be observed that the share capital of these UCBs increased from Rs. 1015.12 lakhs in 1999-2000 to Rs. 4666 lakhs in 2007-08. Out of the total sample UCBs the highest paid up capital of Rs. 1444 lakhs was of Janaseva Sahakari Bank Ltd., while the lowest paid up capital o Rs. 405 lakhs was of Sopankaka Sahakari Bank Ltd. as on 31/03/2008. However, the highest growth rate of share capital of 1483% was of Sopankaka Sahakari Bank Ltd. and the lowest growth rate of share capital of 203% was of Sharad Sahakari Bank Ltd. in 2008 over 2000. 7.It is observed that out of the total sample UCBs, the highest share capital per member of Rs. 7300 was of Baramati Sahakari Bank Ltd. and the lowest share capital per of Rs. 4300 was of Jijamata Mahila Sahakari Bank Ltd. as on 31/03/2008. 8.It is observed that the total deposits of the sample UCBs increased from Rs. 33107 lakhs to Rs. 152675 lakhs in 2008 over 1999, showing the growth rate of 361%. Out of these sample UCBs, the highest deposits of Rs. 59169 lakhs was of Janaseva Sahakari Bank Ltd. and the lowest deposits of Rs. 9997 lakhs was of Sopankaka Sahakari Bank Ltd. as on 31/03/2008. 9.It may be observed that out of these sample UCBs, the highest amount of loans and advances granted of Rs. 37787 lakhs was of Janaseva Sahakari Bank Ltd. and the lowest amount of Rs. 6812 lakhs of Sopankaka Sahakari Bank Ltd. as on 31/03/2008. 10.It may be observed that the deposits of these sample UCBs increased by 361% from Rs. 33107 lakhs to Rs. 152675 lakhs during the period of study, but the loans and advances increased by 218% only from Rs. 31346 lakhs to Rs. 99931 lakhs. 11.The total Credit-Deposit Ratio of all these sample UCBs was between 60% and 70% during the period of 1999-2000 to 2007-08. Out of the total sample UCBs Jijamata Mahila Sahakari Bank Ltd. and Sharad Sahakari Bank Ltd. was unable to maintain an ideal CD Ratio i.e. 60% to 70% as on 31/03/2008.It is also observed that the CD Ratio of all these sample UCBs was maximum in the year 1998-99 and was minimum in 2003-04. 12.The RBI has developed a rating model for UCBs based on 'CAMELS' factors. Performance of a bank will be rated on a scale of 1 to 100 in ascending order of performance. This will be done for each of the six component of the CAMELS factors viz, Capital adequacy, Asset quality, Management, Earnings, Liquidity and System and controls. 13.Co-operatives are organized not with profit motive but with service motive. It does not mean that cooperative run on 'No Profit No Loss basis'. Efficiently managed co-operative will run on profits. Though all these sample UCBs were running with net profit, there were fluctuations in the growth rate of net profit of these sample UCBs. 14. At present all UCBs are required to comply with 9% Capital to Risk Asset Ratio (CRAR) akin to commercial banks. It is observed that all these sample UCBs were able to maintain minimum CRAR. Out of these sample UCBs; Rajgurunagar Sahakari Bank Ltd. maintain the maximum CRAR; while Baramati Sahakari Bank Ltd. maintain the minimum CRAR during the period of 2005-06 to 2007-08. 15.The productivity of employees is the most common productivity indicators used by the banks. For this analysis the researcher has used, Business Volume (Deposits + Advances)/No. of Employees as a measure of the productivity of employees. 16.The productivity of branches is also the important indicators used by the banks. For this analysis Business Volume (Deposits + Advances)/No. of Branches used as a measure of the productivity of branches. 17.For the analysis of profitability per employee, Net Profit/No. of Employee used as a measure. The profitability per employee of Sharad Sahakari Bank Ltd. was the maximum of Rs. 3.09 lakhs during the

Please cite this Article as : Dr.R.S.Shirasi, A STUDY OF FINANCIAL WORKING AND OPERATIONAL PERFORMANCE OF (3), ISRJ URBAN CO-OPERATIVE BANKS IN PUNE DISTRICT : Indian Streams Research Journal (June ; 2012)

A Study of Financial Working and Operational Performance of Urban

Indian Streams Research Journal

Vol.1,Issue.V/June; 2012

period of 2007-08. The profitability per employee of Baramati Sahakari Bank Ltd. decreased from Rs. 1.26 lakhs to Rs. 0.62 lakhs during the period of 1999-2000 to 2007-08. 18. For the analysis of profitability per branch, Net Profit/No. of the Branches used as a measure. 19.For the analysis of Business per Employee, the researcher has used The amount of deposits mobilized per employee as a measure.It can be observed that out of the total sample UCBs, the business per employee of Sharad Sahakari Bank Ltd. was the maximum of Rs. 242.77 lakhs as on 31/03/2008. It was followed by Sopankaka Sahakari Bank Ltd. with Rs. 199.94 lakhs and Rajgurunagar Sahakari Bank Ltd. Rs. 167.76 lakhs during the period of 2007-08.The business per employee of Jijamata Mahila Sahakari Bank Ltd. was the minimum of Rs. 130.01 lakhs as on 31/03/2008. 20.For the analysis of Business per Branch the researcher has used Deposits mobilization per Branch as a measure. 21.It is observed that out of the total sample customers, 92.5% customers (111) expressed that time required to deposits cash was less than 10 minutes, while 7.2% customers (09) replied that time required to deposits cash was between 10 and 20 minutes. 22.It is observed that out of the total sample customers 35.83% customers (43) replied that time required to withdraw cash was less than 10 minutes, while 58.33% customers (70) expressed that time required to withdraw was between 10 and 20 minutes. It can also observed that out of these customers, 5.84% customers (07) replied that time required to withdraw was between 20 and 30 minutes. 23.Out of the total sample customers, 73.33% customers (88) replied that time required for the collection of local cheques was less than 2 days, while 20% customers (24) expressed that time required for the collection of local cheques was between 3 and 4 days. It can be observed that 6.67% customers (08) replied that time required for the collection of local cheques was between 5 to 6 days. 24.Out of the total sample customers, 3.33% customers (04) expressed that time required for the collection of outstation cheques was less than 4 days, while 60% customers (72) opined that time required for the collection of outstation cheques was between 5 and 7 days. It is also observed that 26.67% customers (32) expressed that time required for these purpose was between 8 to 12 days, whereas 10% customers (12) replied that time required these reasons was over 12 days. 25.It is observed that out of the total sample customers, 70% customers (84) expressed that they received polite treatment from the bank employees.It is also observed that out of these customers, 26.67% customers (32) stated that they received impersonal but helpful treatment, while 3.33% customers (04) expressed that they received impersonal but not helpful treatment from the bank employees. 26.The present study reveals that depositing of cash, collection of local cheques, treatment of bank employees are the area of customers satisfaction, while withdrawal of cash, collection of outstation cheques can be identified as the areas of customer dissatisfaction as the time taken was much more than the customer expectations. It is observed that these sample UCBs have their inter alia following weakness as compared to other commercial banks. Meager resources High level percentage of NPAs Absence of Modern Technology in banking business Poor professional management Narrow spread of interest and thereby unsatisfactory level of profits Inefficient services to the customers as compared to their competitors Due to liberalization and globalization, the UCBs are unable to improve their efficiency as they failed to compete successfully with their competitors. RECOMMENDATIONS : 1.In terms of geographical spread, UCBs are unevenly distributed across the country. There is need for extending the banking facilities in different regions of the country. As yet the spread of UCBs is found only in a few states, other states, in particular those in the North Eastern Region, are lagging far behind. It is necessary to accelerate the pace of its growth especially in the backward regions. In Pune district itself, there is a great need for extending banking facilities to the semi Urban areas like Velhe and Mulshi blocks. It is suggested that a few more UCBs can be organized in these semi Urban areas. 2.The UCBs are under the dual control of the RBI and co-operative departments. This duality of

Please cite this Article as : Dr.R.S.Shirasi, A STUDY OF FINANCIAL WORKING AND OPERATIONAL PERFORMANCE OF (4), ISRJ URBAN CO-OPERATIVE BANKS IN PUNE DISTRICT : Indian Streams Research Journal (June ; 2012)

A Study of Financial Working and Operational Performance of Urban

Indian Streams Research Journal

Vol.1,Issue.V/June; 2012

command is largely responsible for most of the difficulties in implementing regulatory measures with the required speed and urgency and impedes effective supervision. 3.The state and central Governments could recognize that the UCBs are not just co-operative societies but they are essentially banking entities whose management structure is based on co-operative principles. They should support, facilitate and empower the RBI to put in place mechanisms and systems that enable these UCBs to perform their banking functions. Paid up share capital and reserve funds constitute owned funds of the UCBs. Though these sample UCBs had satisfactory minimum owned funds, these funds ought to be increased to maintain CRAR. In order to increase the owned funds, these UCBs must increase their share capital by increasing the value of shares and by attracting more members. 4. The present study reveals that all these sample UCBs have shown more dependence on deposits as compared to other sources. Since deposits involve interest cost, it is therefore, suggested that all these sample UCBs should make concerted efforts to augment their owned funds component, particularly share capital base at a faster pace by enrolling more and more members in their folds. 5.Shares of UCBs should be treated at par with the shares of the joint stock companies and their shares should be allowed to be traded. 6.The present research study reveals that these sample UCBs were largely satisfied with the deposits that were made with banks out of the individual efforts of the customers. In other words, the banks were satisfied with their limited operation. In a highly competitive field of banking, this approach may ultimately land the UCBs in stagnation and in the long run the banks may face serious problems. 7.The UCBs have been collecting and accumulating more deposits than the deployment and dispensation of the funds which have led to an increase idle resources. Hence, it is suggested that CD ratio of these sample UCBs should be increased to desired level of 70%. 8.The NPAs may be high on account of defective loan policies and procedures of the bank. The NPAs may also be high on account of lack of timely action and adequate efforts for recovery. 9.In the era of the competition, the UCBs are unable to expand the volume of the business. To improve the productivity of employees the UCBs should increase the volume of deposits and advances on the one hand and to curtail the number of employees at the optimum level on the other hand. 10.The study reveals that the UCBs are unable to expand the business as they expanded their branches. Hence, the productivity of branches of the UCBs is much lower as compared to other commercial banks. To improve the productivity of branches the UCBs has to raise the volume of deposits and loans and advances. 11.Under the new economic policy and also for the deregulation of interest rates, there is an urgent need for the UCBs to have a review and examination of the resources and uses of funds to optimize returns. Hence, a faster rotation of funds, modified lending policies and procedures and selection of proper clientele are the needs of the day for efficient fund management to make the UCBs more and more successful. 12.The success of a bank depends upon the range and quality of services offered to its customers. The range of service covers: Mobilization of deposits, Remittances and Transfers, Collections NRI Account operations, Safety locker facility, Teller system, ATM etc. 13.In order to take advantages of new opportunities created by liberalization and globalization, the UCBs should work towards improving their position. For this purpose, the UCBs have to formulate a strategy. The following would be the main elements in the strategic plan:Introduction of professionalization in the management. Introduction of modern technology. A continuous process of human resource development. Toning up the customer service Review of the income and expenditure pattern.

Please cite this Article as : Dr.R.S.Shirasi, A STUDY OF FINANCIAL WORKING AND OPERATIONAL PERFORMANCE OF (5), ISRJ URBAN CO-OPERATIVE BANKS IN PUNE DISTRICT : Indian Streams Research Journal (June ; 2012)

You might also like

- SBI and Associate Bank Performance StudyDocument11 pagesSBI and Associate Bank Performance StudyAnjum Ansh KhanNo ratings yet

- 20150827161213912.12.prof. Bharati R. HiremathDocument23 pages20150827161213912.12.prof. Bharati R. HiremathMuhammed Rafee100% (1)

- A Comparative Study of Regional Rural Banks in Chhattisgarh StateDocument9 pagesA Comparative Study of Regional Rural Banks in Chhattisgarh StateMohmmedKhayyumNo ratings yet

- IJMSS2273Jan31 PDFDocument12 pagesIJMSS2273Jan31 PDFdsfgNo ratings yet

- 16-RRBCompDocument9 pages16-RRBCompHarivenkatsai SaiNo ratings yet

- Non-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Document7 pagesNon-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017jassNo ratings yet

- Non-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Document8 pagesNon-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Shubham RautNo ratings yet

- 07 AbstractDocument14 pages07 Abstractchavdavijaysinh481No ratings yet

- Analyzing the Financial Performance of Andhra Bank from 2006-2010Document21 pagesAnalyzing the Financial Performance of Andhra Bank from 2006-2010Mane DaralNo ratings yet

- Raki RakiDocument63 pagesRaki RakiRAJA SHEKHARNo ratings yet

- A Relative Comparison of Financial Performance of State Bank of India and Axis BankDocument8 pagesA Relative Comparison of Financial Performance of State Bank of India and Axis BankAxE GhostNo ratings yet

- Punjab Political Reseach For The Water PlantDocument11 pagesPunjab Political Reseach For The Water PlantPerfect waaleNo ratings yet

- Cash FlowsDocument67 pagesCash FlowsUsman MohammedNo ratings yet

- A Study of Operational and Financial Performance of Public and Private Sector Bank in Chandrapur CityDocument5 pagesA Study of Operational and Financial Performance of Public and Private Sector Bank in Chandrapur Cityप्रेम हेNo ratings yet

- Review of Literature on Cooperative BanksDocument9 pagesReview of Literature on Cooperative BanksPooja HarhareNo ratings yet

- Role of Lok Adalat in Managing Non-Performing Assets in Scheduled Commercial BanksDocument5 pagesRole of Lok Adalat in Managing Non-Performing Assets in Scheduled Commercial BanksJitendra KumarNo ratings yet

- Urban Cooperative Banks: A Case Study of Karnataka: Munich Personal Repec ArchiveDocument7 pagesUrban Cooperative Banks: A Case Study of Karnataka: Munich Personal Repec ArchiveAmrita SahaNo ratings yet

- Review of The Literature: Chapter - IIIDocument10 pagesReview of The Literature: Chapter - IIIVįňäý Ğøwđã VįñîNo ratings yet

- k1 PDFDocument7 pagesk1 PDFMegan WillisNo ratings yet

- A Study On The Working Performance of THDocument12 pagesA Study On The Working Performance of THgayathriNo ratings yet

- Abhinandan Loans and AdvancesDocument72 pagesAbhinandan Loans and AdvancesPraveen KambleNo ratings yet

- Shewta - Final SynopsisDocument6 pagesShewta - Final SynopsisShilpi NairNo ratings yet

- Performance of Regional Rural Banks in Punjab-A Financial PerspectiveDocument14 pagesPerformance of Regional Rural Banks in Punjab-A Financial PerspectiveLevi AckermanNo ratings yet

- DisseratationDocument78 pagesDisseratationPankaj GuptaNo ratings yet

- Financial Performance of Scheduled Commmercial Banks in India: An AnalysisDocument8 pagesFinancial Performance of Scheduled Commmercial Banks in India: An AnalysisRamanarayana BharadwajNo ratings yet

- A Study of Financial Performance Evaluation of Banks in IndiaDocument11 pagesA Study of Financial Performance Evaluation of Banks in IndiaRaghav AryaNo ratings yet

- .. Current 2018 Feb BDj0Gy8teJzklCWDocument14 pages.. Current 2018 Feb BDj0Gy8teJzklCWRAHUL KUMARNo ratings yet

- Analyzing NPA Management of Co-operative BanksDocument16 pagesAnalyzing NPA Management of Co-operative BanksSandesh RaoNo ratings yet

- A Study On Financial Performance of Sbi Bank: AbstractDocument7 pagesA Study On Financial Performance of Sbi Bank: AbstractMohini PashilkarNo ratings yet

- Financial Performance of State Bank of India and Icici Bank - A Comparative StudyDocument9 pagesFinancial Performance of State Bank of India and Icici Bank - A Comparative StudyMrinali MahajanNo ratings yet

- An Analysis of The Performance of Select Public Sector Banks Using Camel ApproachDocument17 pagesAn Analysis of The Performance of Select Public Sector Banks Using Camel Approachmithunraj packiyanathanNo ratings yet

- Performance Evaluation of Regional Rural Banks in IndiaDocument13 pagesPerformance Evaluation of Regional Rural Banks in IndiaNeelam DeshpandeNo ratings yet

- Evaluating The Performances of Select Nationalized Banks Using Camel ApproachDocument15 pagesEvaluating The Performances of Select Nationalized Banks Using Camel Approachharshita khadayteNo ratings yet

- Financial Performance Comparison of SBI and ICICI BankDocument12 pagesFinancial Performance Comparison of SBI and ICICI BankKuldeep KaushikNo ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of India PDFDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of India PDFPravin RnsNo ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of IndiaDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of IndiaarcherselevatorsNo ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of India Dr. Veena K.P. Ms. Pragathi K.MDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of India Dr. Veena K.P. Ms. Pragathi K.MMane DaralNo ratings yet

- 135Dr VijayLaxmiSharmaShodhsamitaDocument13 pages135Dr VijayLaxmiSharmaShodhsamitaHarsh ModiNo ratings yet

- Npa 2Document22 pagesNpa 2rahul singhNo ratings yet

- Literature ReviewDocument9 pagesLiterature ReviewRiyas Parakkattil67% (3)

- Financial Statement Analysis of State Bank of India 2013 by AKASH DIXIT NIILM CMS Greater NoidaDocument18 pagesFinancial Statement Analysis of State Bank of India 2013 by AKASH DIXIT NIILM CMS Greater NoidaAkash Dixit43% (7)

- Study On Performance of Foreign Banks in India: SSRN Electronic Journal January 2016Document8 pagesStudy On Performance of Foreign Banks in India: SSRN Electronic Journal January 2016Harsha HaridasNo ratings yet

- A STRATEGY TO MANAGE THE NPAs OF PUBLIC PDFDocument7 pagesA STRATEGY TO MANAGE THE NPAs OF PUBLIC PDFDeepakNo ratings yet

- Non-Performing Assets: A Study of State Bank of India: Dr.D.Ganesan R.SanthanakrishnanDocument8 pagesNon-Performing Assets: A Study of State Bank of India: Dr.D.Ganesan R.SanthanakrishnansusheelNo ratings yet

- Non-Performing Assets: A Comparative Study of SBI & ICICI Bank From (2014-2017)Document32 pagesNon-Performing Assets: A Comparative Study of SBI & ICICI Bank From (2014-2017)Alok NayakNo ratings yet

- ALM Techniques for Managing RisksDocument46 pagesALM Techniques for Managing RisksNagarajuNo ratings yet

- Non-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Document22 pagesNon-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Alok NayakNo ratings yet

- A Comparative Study of Financial Permormance of State Bank of India and ICICI BankDocument10 pagesA Comparative Study of Financial Permormance of State Bank of India and ICICI Bankprteek kumarNo ratings yet

- Sir Research Paper On BankingDocument17 pagesSir Research Paper On BankingAratiPatelNo ratings yet

- A Descriptive Study On Financial Performance of Nagaland State Co Operative Bank LTDDocument8 pagesA Descriptive Study On Financial Performance of Nagaland State Co Operative Bank LTDEditor IJTSRDNo ratings yet

- 10 Chapter 2Document8 pages10 Chapter 2Y.durgadeviNo ratings yet

- Ijrfm Volume 2, Issue 1 (January 2012) (ISSN 2231-5985) To Study The Financial Performance of Bank: A Case Study of SbiDocument17 pagesIjrfm Volume 2, Issue 1 (January 2012) (ISSN 2231-5985) To Study The Financial Performance of Bank: A Case Study of SbiMonika DhakaNo ratings yet

- 05 - Chapter 2Document24 pages05 - Chapter 2shantishree04No ratings yet

- Review of Research: A Review of Literature On Performance of Regional Rural Banks in IndiaDocument12 pagesReview of Research: A Review of Literature On Performance of Regional Rural Banks in IndiaaakritiNo ratings yet

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocument9 pagesA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNo ratings yet

- Financial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelDocument34 pagesFinancial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelIjbemrJournalNo ratings yet

- Final Project 0108Document56 pagesFinal Project 0108Shubham DanielNo ratings yet

- A Study On Cooperative Banks in India With Special Reference To Lending PracticesDocument6 pagesA Study On Cooperative Banks in India With Special Reference To Lending PracticesSrikara Acharya100% (1)

- Pavan Cs Synopsis....Document9 pagesPavan Cs Synopsis....Pavan PaviNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- SSRN-id3124109 PDFDocument56 pagesSSRN-id3124109 PDFSrikara AcharyaNo ratings yet

- Activist Directors: Determinants and Consequences: Ian D. Gow Sa-Pyung Sean Shin Suraj SrinivasanDocument46 pagesActivist Directors: Determinants and Consequences: Ian D. Gow Sa-Pyung Sean Shin Suraj SrinivasanSrikara AcharyaNo ratings yet

- Brahma Yagnam PDFDocument3 pagesBrahma Yagnam PDFrogerio sanfer100% (1)

- Audit Quality and Auditor Reputation: Evidence From Japan: John P. and Lillian A. Gould Professor of AccountingDocument49 pagesAudit Quality and Auditor Reputation: Evidence From Japan: John P. and Lillian A. Gould Professor of AccountingSrikara AcharyaNo ratings yet

- Fake Discounts Drive Real Revenues in Retail: Donald NgweDocument47 pagesFake Discounts Drive Real Revenues in Retail: Donald NgweSrikara AcharyaNo ratings yet

- 11-036Document29 pages11-036andree sebastianNo ratings yet

- Multinational Firms, FDI Flows and Imperfect Capital MarketsDocument48 pagesMultinational Firms, FDI Flows and Imperfect Capital MarketsSrikara AcharyaNo ratings yet

- The Impact of Forward-Looking Metrics On Employee Decision MakingDocument45 pagesThe Impact of Forward-Looking Metrics On Employee Decision MakingSrikara AcharyaNo ratings yet

- Corporate Social Responsibility and Taxation: The Missing LinkDocument3 pagesCorporate Social Responsibility and Taxation: The Missing LinkSrikara AcharyaNo ratings yet

- A Study On The Urban Cooperative Banks Success and Growth in Vellore DistrictDocument4 pagesA Study On The Urban Cooperative Banks Success and Growth in Vellore DistrictSrikara AcharyaNo ratings yet

- Financial Patent Quality: Finance Patents After State StreetDocument55 pagesFinancial Patent Quality: Finance Patents After State StreetSrikara AcharyaNo ratings yet

- Why Every Company Needs A CSR Strategy and How To Build ItDocument31 pagesWhy Every Company Needs A CSR Strategy and How To Build ItpauldupuisNo ratings yet

- Understanding consolidation adjustments when a subsidiary is acquiredDocument3 pagesUnderstanding consolidation adjustments when a subsidiary is acquiredSrikara AcharyaNo ratings yet

- Bhaja GovindamDocument10 pagesBhaja GovindamSrikara AcharyaNo ratings yet

- A Study On Cooperative Banks in India With Special Reference To Lending PracticesDocument6 pagesA Study On Cooperative Banks in India With Special Reference To Lending PracticesSrikara Acharya100% (1)

- IS at the strategic levelDocument3 pagesIS at the strategic levelSrikara AcharyaNo ratings yet

- W 24529Document55 pagesW 24529Srikara AcharyaNo ratings yet

- Brand Marketing MerchandisingDocument27 pagesBrand Marketing MerchandisingSrikara AcharyaNo ratings yet

- A Study of The Profitability of Urban Cooperative BanksDocument11 pagesA Study of The Profitability of Urban Cooperative BanksSrikara AcharyaNo ratings yet

- Sustainable Procurement Wood Paper Based Products v3 IntroDocument40 pagesSustainable Procurement Wood Paper Based Products v3 IntroSrikara AcharyaNo ratings yet

- Apr 2012 1Document2 pagesApr 2012 1Srikara AcharyaNo ratings yet

- From Up-Start To Start-Up - Lessons From A Serial Entrepreneur - The Economic TimesDocument5 pagesFrom Up-Start To Start-Up - Lessons From A Serial Entrepreneur - The Economic TimesSrikara AcharyaNo ratings yet

- Tata CoffeeDocument6 pagesTata CoffeeSrikara AcharyaNo ratings yet

- Sustainable DevelopmentDocument10 pagesSustainable DevelopmentSrikara AcharyaNo ratings yet

- Eligibility-Of-urban Cooperative Banks To Engage BCDocument72 pagesEligibility-Of-urban Cooperative Banks To Engage BCviveksharma51No ratings yet

- India: Certain Indian SymbolsDocument4 pagesIndia: Certain Indian SymbolsSrikara AcharyaNo ratings yet

- How To Do A Paper PresentationDocument19 pagesHow To Do A Paper Presentationbalak88100% (1)

- Olasanmi JibcDocument10 pagesOlasanmi JibcSrikara AcharyaNo ratings yet

- CURRICULUM VITAE SUMMARYDocument3 pagesCURRICULUM VITAE SUMMARYSrikara AcharyaNo ratings yet

- Organic Farming Conference InvitationDocument3 pagesOrganic Farming Conference InvitationJudy Panguito AralarNo ratings yet

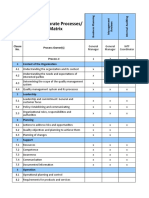

- IATF 16949 Corporate Processes/ Clause Matrix: Process Owner(s) Process # Context of The Organization Clause NoDocument6 pagesIATF 16949 Corporate Processes/ Clause Matrix: Process Owner(s) Process # Context of The Organization Clause NoshekarNo ratings yet

- 36.10 Cakkavatti Sihanada S d26 PiyaDocument50 pages36.10 Cakkavatti Sihanada S d26 PiyaNo SelfNo ratings yet

- Project CostingDocument10 pagesProject CostingDanish JamaliNo ratings yet

- Philippine Corporate Law SyllabusDocument102 pagesPhilippine Corporate Law SyllabusRoa Emetrio NicoNo ratings yet

- Summer DessertsDocument17 pagesSummer DessertstallisroNo ratings yet

- WHT Rates Tax Year 2023-24 - 230630 - 222611Document2 pagesWHT Rates Tax Year 2023-24 - 230630 - 222611Ammad ArifNo ratings yet

- Team 12 Moot CourtDocument19 pagesTeam 12 Moot CourtShailesh PandeyNo ratings yet

- Un Plan D'urgence en Cas de Marée Noire À Maurice Élaboré Depuis Plus de 30 AnsDocument99 pagesUn Plan D'urgence en Cas de Marée Noire À Maurice Élaboré Depuis Plus de 30 AnsDefimedia100% (1)

- Jet Blue Case SummaryDocument1 pageJet Blue Case Summarynadya leeNo ratings yet

- Lighting Plan Layout and ScheduleDocument1 pageLighting Plan Layout and ScheduleMuhammad AbuBakarNo ratings yet

- (Aries Book Series 17) Staudenmaier - Between Occultism and Nazism 2014Document420 pages(Aries Book Series 17) Staudenmaier - Between Occultism and Nazism 2014Esotericist Ignotus100% (1)

- Is648.2006 Crno SteelDocument30 pagesIs648.2006 Crno SteelAnonymous qfwuy3HWVNo ratings yet

- 15 Terrifying Books Jordan Peterson Urges All Smart People To Read - High ExistenceDocument14 pages15 Terrifying Books Jordan Peterson Urges All Smart People To Read - High Existencegorankos9889889% (35)

- As 4467-1998 Hygienic Production of Crocodile Meat For Human ConsumptionDocument12 pagesAs 4467-1998 Hygienic Production of Crocodile Meat For Human ConsumptionSAI Global - APACNo ratings yet

- Ankur Final Dissertation 1Document99 pagesAnkur Final Dissertation 1pratham singhviNo ratings yet

- Seylan Bank Annual Report 2016Document302 pagesSeylan Bank Annual Report 2016yohanmataleNo ratings yet

- Virtues of a Long Life, Reaching Times of Goodness and Righteous DeedsDocument2 pagesVirtues of a Long Life, Reaching Times of Goodness and Righteous DeedsDede RahmatNo ratings yet

- Operator's Manual M224 D00011Document206 pagesOperator's Manual M224 D00011czud50% (2)

- Psikopatologi (Week 1)Document50 pagesPsikopatologi (Week 1)SyidaBestNo ratings yet

- WTP WI Stick Diagram R4Document3 pagesWTP WI Stick Diagram R4setyaNo ratings yet

- List of Countries and Dependencies by AreaDocument16 pagesList of Countries and Dependencies by Arearpraj3135No ratings yet

- Accounting Costing and Pricing ProblemsDocument2 pagesAccounting Costing and Pricing ProblemsVivian Loraine BorresNo ratings yet

- 1.SPA SSS Death BenefitsDocument1 page1.SPA SSS Death BenefitsTroy Suello0% (1)

- GUIDANCE AND COUNSELLING FUNDAMENTALSDocument8 pagesGUIDANCE AND COUNSELLING FUNDAMENTALSDante MutzNo ratings yet

- 13-Arciga v. Maniwag A.M. No. 1608 August 14, 1981Document4 pages13-Arciga v. Maniwag A.M. No. 1608 August 14, 1981Jopan SJNo ratings yet

- 80-100Tph Tin Stone Crushing LineDocument3 pages80-100Tph Tin Stone Crushing LineМаксим СтратилаNo ratings yet

- HKMA's Approach to Derivatives RegulationDocument172 pagesHKMA's Approach to Derivatives RegulationHoangdhNo ratings yet

- CAPS AND FLOORS: Hedging Interest Rate RiskDocument4 pagesCAPS AND FLOORS: Hedging Interest Rate RiskSanya rajNo ratings yet

- Audit of Property Plant and EquipmentDocument22 pagesAudit of Property Plant and EquipmentLenyBarroga0% (1)