Professional Documents

Culture Documents

Monthly Remittance of Excise Duty and Service Tax

Uploaded by

biswajit6864Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Remittance of Excise Duty and Service Tax

Uploaded by

biswajit6864Copyright:

Available Formats

Monthly Remittance of Excise Duty and Service Tax

You use this report to calculate how much excise duty you must remit to the authorities. Legislation requires you to remit excise duty monthly - for all the goods issued and services provided in the given month. In each case, you are allowed five days to remit the excise duty and service tax. Once the report has determined how much you have to pay, it allows you to specify where the money should be paid from - whether it should be deducted from the CENVAT credits that you have accumulated, from the service tax credit accounts, from the personal ledger account (PLA) or from the service tax clearing accounts. If the service tax is to be paid from the service tax credit and CENVAT credit, and the credit available is not sufficient to pay off the service tax, then the amount is pushed to the service tax clearing accounts. NOTE You use the service tax clearing accounts for service payments and personal ledger accounts for CENVAT payments respectively.

Prerequisites

You have: Customized the system so that when you create an excise invoice for a sale, the system automatically debits the excise to a CENVAT clearing account Made the settings in Customizing for Logistics - General, by choosing Movements India Business Transactions Utilization Taxes on Goods

Maintained the various service tax G/L account details in Customizing for Logistics General, under Taxes on Goods Movements India Service Tax Account Assignment .

Features

To access the report, on the SAP Easy Access screen, choose Movements Monthly Utilization . Indirect Taxes Sales/Outbound

On the selection screen of this report, you can no longer maintain the General Ledger (G/L) accounts. To maintain the G/L accounts, do so in Customizing for Logistics General, under Tax on Goods Movements India Service Tax Assign Service Tax Accounts .

Selection

On the selection screen, enter data as required: Organizational data (in the General data group box) Posting date for the CENVAT payment, if it is different from the run date The period to be covered by the report (for example, 1-15 January) NOTE If, for any reason, you want to select an excise invoice individually, you can do so. Any entry in the Period field will be disregarded. NOTE To display a list of all the excise invoices whose excise duty you have not yet remitted, choose Display pend. invoices. To display a list of only the excise invoices for a given period, enter the period in the Period fields, select Select pending inv. for period, and chooseDisplay pend. invoices. You can also print the list of pending invoices.

To display the last date when tax was remitted, choose Display last util. date (Display last utilization date). Payment options You can pay the CENVAT and Service Tax payable amount from CENVAT credit or service tax credit accounts.

Output

For each sort of excise duty, the system shows you: How much you have to remit (Amounts payable group box) How much credit you have at your disposal on the appropriate CENVAT account and Service Tax account(Available balances)

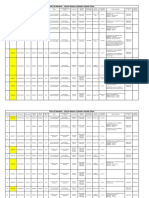

For a list of excise invoices that are considered for the CENVAT payment, choose Display excise invoices. You can print the list and use it as an annexure. You can save the entries only when you have utilized all the duties. The system then: Creates an accounting document that debits the accounts from which the excise duty or the service tax is to be paid. Account CENVAT account Excise duty account Service Tax Debit 250.00 50.00 200.00 Credit

Generates entries in the Part II table for service tax payable. The system assigns a new register type T and also updates the Excise Part II details (J_1IPART2) and the Excise invoice line item details (J_1IEXCDTL) tables with the service tax serial number. Similarly, the system also generates entries in the Part II table for service tax exemption payable and assigns new register type X. The system generates entries in the Part II table for service tax utilization wit

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Business Information Warehouse Reporting & Analysis: Funds Management (FM) & Budget Control Systems (BCS)Document62 pagesBusiness Information Warehouse Reporting & Analysis: Funds Management (FM) & Budget Control Systems (BCS)biswajit6864No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 165 Scen Overview en CNDocument6 pages165 Scen Overview en CNbiswajit6864No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- SAP SD Configuration GuideDocument363 pagesSAP SD Configuration Guiderajendrakumarsahu94% (52)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ABAP DebuggerDocument20 pagesABAP DebuggerHem HemesNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 165 Scen Overview en CNDocument6 pages165 Scen Overview en CNbiswajit6864No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sap Abap - A Step-By-step Guide - Learn SapDocument24 pagesSap Abap - A Step-By-step Guide - Learn SapShahid_ONNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Sap Abap Tutorial PDFDocument179 pagesSap Abap Tutorial PDFasdfNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sap Abap - A Step-By-step Guide - Learn SapDocument24 pagesSap Abap - A Step-By-step Guide - Learn SapShahid_ONNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Sap Abap - A Step-By-step Guide - Learn SapDocument24 pagesSap Abap - A Step-By-step Guide - Learn SapShahid_ONNo ratings yet

- Line Item Display Option For These AccountsDocument1 pageLine Item Display Option For These Accountsbiswajit6864No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Kieron Dowling Proj Sys Ch04Document24 pagesKieron Dowling Proj Sys Ch04nong191No ratings yet

- Additional Duties of ExciseDocument12 pagesAdditional Duties of Excisebiswajit6864No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- FI FM 003 PresentationDocument72 pagesFI FM 003 Presentationbiswajit6864No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Cost CenterDocument47 pagesCost Centerkunaruba89% (9)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- TaxationDocument10 pagesTaxationbiswajit6864No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Step by step tax calculation tableDocument3 pagesStep by step tax calculation tablebiswajit6864No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Risk Management Study of SBI for MSMEsDocument90 pagesRisk Management Study of SBI for MSMEsbiswajit6864No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- T CodesDocument149 pagesT Codesbiswajit6864No ratings yet

- FI MM SDintegration PDFDocument25 pagesFI MM SDintegration PDFGopa Kambagiri SwamyNo ratings yet

- Sap Fico PDFDocument4 pagesSap Fico PDFmsaadnaeemNo ratings yet

- Controlling To BeDocument38 pagesControlling To Bebiswajit6864No ratings yet

- Accounts Payable Invoice Processing Workflows: Process OverviewDocument53 pagesAccounts Payable Invoice Processing Workflows: Process OverviewkammynNo ratings yet

- AdiDocument4 pagesAdirashmitabcetNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manage cash transactionsDocument31 pagesManage cash transactionsbiswajit6864No ratings yet

- Archlinux 之 之 之 之 Lmap 攻 略 ( 攻 略 ( 攻 略 ( 攻 略 ( 1 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 )Document16 pagesArchlinux 之 之 之 之 Lmap 攻 略 ( 攻 略 ( 攻 略 ( 攻 略 ( 1 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 ) 、 环 境 准 备 )Goh Ka WeeNo ratings yet

- IGCSE Chemistry Section 5 Lesson 3Document43 pagesIGCSE Chemistry Section 5 Lesson 3Bhawana SinghNo ratings yet

- DELcraFT Works CleanEra ProjectDocument31 pagesDELcraFT Works CleanEra Projectenrico_britaiNo ratings yet

- Postgraduate Notes in OrthodonticsDocument257 pagesPostgraduate Notes in OrthodonticsSabrina Nitulescu100% (4)

- Important Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMDocument17 pagesImportant Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMC052 Diksha PawarNo ratings yet

- QuickTransit SSLI Release Notes 1.1Document12 pagesQuickTransit SSLI Release Notes 1.1subhrajitm47No ratings yet

- Surgery Lecture - 01 Asepsis, Antisepsis & OperationDocument60 pagesSurgery Lecture - 01 Asepsis, Antisepsis & OperationChris QueiklinNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Iso 9001 CRMDocument6 pagesIso 9001 CRMleovenceNo ratings yet

- STAT100 Fall19 Test 2 ANSWERS Practice Problems PDFDocument23 pagesSTAT100 Fall19 Test 2 ANSWERS Practice Problems PDFabutiNo ratings yet

- Antenna VisualizationDocument4 pagesAntenna Visualizationashok_patil_1No ratings yet

- Family Service and Progress Record: Daughter SeptemberDocument29 pagesFamily Service and Progress Record: Daughter SeptemberKathleen Kae Carmona TanNo ratings yet

- 8dd8 P2 Program Food MFG Final PublicDocument19 pages8dd8 P2 Program Food MFG Final PublicNemanja RadonjicNo ratings yet

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samNo ratings yet

- Last Clean ExceptionDocument24 pagesLast Clean Exceptionbeom choiNo ratings yet

- FR Post-10Document25 pagesFR Post-10kulich545No ratings yet

- Prenatal and Post Natal Growth of MandibleDocument5 pagesPrenatal and Post Natal Growth of MandiblehabeebNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sharp Ar5731 BrochureDocument4 pagesSharp Ar5731 Brochureanakraja11No ratings yet

- Contact and Profile of Anam ShahidDocument1 pageContact and Profile of Anam ShahidSchengen Travel & TourismNo ratings yet

- Quality Management in Digital ImagingDocument71 pagesQuality Management in Digital ImagingKampus Atro Bali0% (1)

- Site Visit Risk Assessment FormDocument3 pagesSite Visit Risk Assessment FormAmanuelGirmaNo ratings yet

- Column Array Loudspeaker: Product HighlightsDocument2 pagesColumn Array Loudspeaker: Product HighlightsTricolor GameplayNo ratings yet

- Trading As A BusinessDocument169 pagesTrading As A Businesspetefader100% (1)

- Numerical Methods Chapter 10 SummaryDocument8 pagesNumerical Methods Chapter 10 SummarynedumpillilNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- Sarvali On DigbalaDocument14 pagesSarvali On DigbalapiyushNo ratings yet

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Document19 pagesMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldNo ratings yet

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocument22 pagesStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNo ratings yet

- Lankeda 3d Printer Filament Catalogue 2019.02 WGDocument7 pagesLankeda 3d Printer Filament Catalogue 2019.02 WGSamuelNo ratings yet

- Decision Maths 1 AlgorithmsDocument7 pagesDecision Maths 1 AlgorithmsNurul HafiqahNo ratings yet

- Analytical Approach To Estimate Feeder AccommodatiDocument16 pagesAnalytical Approach To Estimate Feeder AccommodatiCleberton ReizNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)