Professional Documents

Culture Documents

OCC Foreclosure Requirements

Uploaded by

Mortgage Compliance InvestigatorsCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

OCC Foreclosure Requirements

Uploaded by

Mortgage Compliance InvestigatorsCopyright:

Minimum Standards Standards for for Prioritization Prioritization and Handling Borrower Files Subject to to Imminent Imminent Foreclosure

Sale

Operating standards standards for for scheduled scheduled foreclosure foreclosure sales sales Operating April19, April 19, 2013

The minimum minimum standards standards set set forth forth in in this this guidance guidancereflect reflectsound sound business business practice practice that should should part of of a a mortgage mortgageservicer's servicer'songoing ongoing collections, collections, loss loss mitigation and and foreclosure foreclosure be part processing functions. Accordingly, the OCC requires that all national banks and federal processing functions. Accordingly, the OCC requires that loans savings savings associations associations(collectively, (collectively,"banks") "banks") that that service service residential residential mortgage loans guidance into into their theirongoing ongoing business business processes. processes. Failure to comply with this incorporate the guidance guidance unsafe and and unsound unsound banking practices, practices, non-compliance non-compliance with guidance may result in unsafe and/or require require rescission rescission of of completed foreclosure related foreclosure related consent orders, as applicable, and/or foreclosures.

Purpose

This standards for for the handling handling and This guidance guidance establishes establishesminimum minimum standards prioritization of prioritization of borrower borrower files filesthat that are are subject subject to to imminent (within 60 days) days) scheduled scheduled foreclosure sales. The foreclosure sales. Thepurpose purpose of of this this guidance is guidance is to to ensure ensure that that borrowers will not lose their files receiving receiving pre-foreclosure sale homes without their their files conducted under the standards listed In reviews conducted in this modifications were guidance, which also help ensure loan modifications considered as considered as appropriate. appropriate. servicers of residential mortgages should use use these review Bank servicers whether a a scheduled scheduled and validation standards standards to determine whether foreclosure foreclosure sale should be postponed, suspended or cancelled due to critical critical foreclosure foreclosuredefects defectsin inthe the borrower's borrower'sfile. file. These intended to ensure ensure a level of minimum review criteria criteria are intended consistency across consistency acrossservicers, servicers, not not to to supplant supplant review and validation procedures that Servicers that procedures that go go beyond beyond these these minimums. minimums. Servicers standards as currently apply apply more than these minimum standards as part of their own own pre-foreclosure pre-foreclosure sale review review and validation validation procedures procedures are continue to do so. expected to continue These standards Intended to incorporate the final final rules rules These standards are are not intended amending Regulation X and Regulation Regulation Z issued issued by by the the CFPB CFPB on January 17, 2013, and and effective effective on on January 10, 2014, 2014,which which govern govern January 17, 2013, mortgage servicers' loss mitigation and foreclosure processing mortgage servicers' loss mitigation and foreclosure processing functions. The The OCC OCC expects expects that that all all servicers servicers will undertake functions. appropriate action manner to to ensure ensure their theirpractices practices will action in in a timely manner be compliant with the new rules by the effective date. compliant with the rules by the

Overview

servicers of residential Bank servicers residential mortgages should monitor all borrower foreclosure process files files in in the foreclosure processat at least least weekly weekly to to determine if foreclosure sales are scheduled within the next foreclosure sales are scheduled within the next60 60 days. days. The

perform and servicer should implement procedures to perform and document a timely pre-foreclosure pre-foreclosure sale review according criteria set in according to to the criteria set out in this guidance and appropriately appropriately postpone, postpone, suspend or cancel t.he the scheduled foreclosure sale when when warranted. warranted. will promptly borrower is The servicer will promptly determine determine whether the borrower currently mitigation program program or currently in in an an active active loss mitigation or is being being actively for or has has requested requested consideration consideration under underthe theMaking Making considered for Home Affordable Modification Modification Program (HAMP) or other modification Program (HAMP) or other or loss mitigation mitigation program defined inin standard programas asfurther further defined standardnumber number 9 below,and andwhether whetherfurther further foreclosure foreclosure proceedings proceedings and/or the below, the scheduled scheduled foreclosure foreclosure sale sale should should be be postponed, suspended or cancelled as as required required by program program standards as as applicable. applicable. of criteria criteria for The following non-exhaustive list list of following standards standards are are a a non-exhaustive which would warrant which an an exception would warrant postponement, postponement, suspension or cancellation of a foreclosure foreclosure sale sale until until the theMinimum Minimum PrePre cancellation Foreclosure Foreclosure Sale Sale Review ReviewStandards Standardsare aresatisfied. satisfied. As As noted above, individual servicers individual servicers may apply additional additional standards/criteria standards/criteria to or cancel a foreclosure foreclosure sale. postpone, suspend or Any negative to the the minimum minimum standards standards detailed detailed in this Any negative response to guidance will critical defect (except for for standard standard will be be considered a critical defect (except number 7 number 7 where where a a positive positive response response is is a a defect) defect) and and cause cause to postpone, suspend suspend or or cancel cancel a a scheduled scheduled foreclosure foreclosure sale. Independent control control functions audit, compliance, compliance, and and risk risk functions (such (such as audit, management) should should confirm confirm and and document servicer adherence to their own standards/criteria and the standards standards described described in in own servicing standards/criteria this document document through through a a program program of of monitoring, monitoring, sampling and testing of of scheduled and and completed foreclosure foreclosure sales.

Minimum Pre PreForeclosure Sale Sale Review Standards

scheduled foreclosure foreclosure sale: Date Date of of the the scheduled sale: _ _ _ _ _ __ Once foreclosure is Once the the date of foreclosure is established, established, the servicer servicer needs to confirm following information confirm the the following information before before foreclosing: 1. Is the loan's loan's default default status accurate? accurate? 2. servicer have have and and can can demonstrate demonstrate the the appropriate appropriate

2. Does Does the servicer legal legal authority authority to to foreclose foreclose (documented (documented assignments, assignments, note

endorsements, and other other necessary legal legal documentation, documentation, as

endorsements, and applicable)?

3. Have other required required

Have required required foreclosure foreclosure notices or other borrower or applicable, been

communications communications to the borrower or others, others, as applicable, provided manner?

provided in in a a timely manner? toconfirm confirm whether the 4. Has the the servicer servicer taken taken all all steps steps necessary necessaryto Has borrower, borrower, co-borrower, co-borrower, and and all alloblig_ors obligorson on the the mortgage, trust

deed, or other security security in entitled to in the the nature of a mortgage are entitled protections under the Servicemembers Civil Relief Act (SCRA), protections including running of Defense Defense including running queries queriesthrough through the the Department of database? If the borrower, co-borrower, or other obligor is database? If the borrower, co-borrower, or other obligor is subject to SCRA SCRA protections, protections, has the servicer complied with all applicable legal legal requirements to to foreclose? foreclose? 5. Determine whether whether the the borrower borrower is isin inan anactive activebankruptcy. bankruptcy. If If so, does the servicer have documented documented legal legal authority authority to foreclose? whether the the loan loan is is currently currently under under loss loss mitigation or 6. Determine whether other retention review review or or such such review has been requested requested by the borrower as as part of the foreclosure foreclosure process. process. If If so, did the borrower that that all all conditions conditions necessary to effect servicer notify the borrower the loss loss mitigation is mitigation or or retention retention action action have have not been been met, what is meet those those conditions, conditions, and the date date necessary necessary to cure cure needed to meet borrower the deficiencies deficiencies to to avoid avoid further further foreclosure foreclosureaction? action? If If a borrower submitted a complete loan modification modification application application after after the foreclosure servicer comply comply with any any applicable applicable foreclosure referral, did the servicer dual track track restrictions? restrictions? 7. Is the borrower borrower currently currently in in an an active active trial trial loss loss mitigation mitigation plan? plan? Is the 8. Determine whether whether the servicer servicer accepted any payment from from the borrower in borrower in the the preceding preceding 60 60 days days (that (that is, were borrower payments, including including interest, principal, principal, fees, escrow payments, applied borrower's account account or retained in in a a suspense suspense applied to the borrower's account). If so,did didthe theservicer servicerclearly clearly communicate communicate to the account). If so, borrower that he he or or she she is is neither neither in in nor nor being being considered considered for a loss mitigation bank's acceptance acceptance of the loss mitigation program, program, and and that the bank's payment in no way affected the the status status of of the the foreclosure foreclosure that is proceeding? 9. As applicable, borrower solicited solicited for and offered a a loss loss applicable, was the borrower HAMP, government such as, those required required by by HAMP, mitigation option, such Housing Administration, sponsored sponsored enterprise, enterprise, the Federal Housing Administration, the the U.S. Veterans Administration, Administration, state-level government programs programs under Department of of Treasury, Treasury, other third party investor, or the U.S. Department servicer's servicer's loss loss mitigation mitigation and and modification modification programs? programs? To the extent applicable, has the servicer complied its loss loss extent applicable, has the servicer complied with its National Mortgage obligations detailed mitigation obligations detailed in in the National Settlement? Have any borrower borrower complaints, complaints, appeals, appeals, or escalations been considered considered and addressed? fully executed executed loan loan modification modification application application submitted by 10. Was the fully the borrower, borrower, as as defined defined by by the the applicable applicable modification modification program, reviewed by the servicer servicer as required, required, including including any timeline or notice requirements?

11. modification decision correct and validated as as required required 11. Was Was the modification by the applicable applicable modification modification program applicable, program (to (to include, as applicable, with program compliance with program requirements and accuracy of calculations and NPV test) with and application application of the NPV test) along with of any any borrower borrower appropriate appropriate resolution resolution and communication of complaint, complaint, appeal, or escalation? 12. borrower or the borrower's borrower's representative (housing 12. Was the borrower loan modification modification decision counselor or attorney) notified of the loan program or policy and rationale rationale as required required by program policy guidelines? the servicer servicer certified certified 13. If required 13. required by by a a GSE GSE or or other other investor, investor, has the to the the attorney attorney conducting conducting the the foreclosure foreclosure that that all all delinquency delinquency management requirements requirements have been met, met, including including that there there is neither an approved approved payment plan plan arrangement nor nor a foreclosure alternative offer pending pending or accepted?

You might also like

- Credit Monitoring and Follow-Up: MeaningDocument23 pagesCredit Monitoring and Follow-Up: Meaningpuran1234567890100% (2)

- Standards of Lending Practice July 16Document12 pagesStandards of Lending Practice July 16nuwany2kNo ratings yet

- Moore Stephens International Audit Manual: Chapters 2Document7 pagesMoore Stephens International Audit Manual: Chapters 2Pilar LozanoNo ratings yet

- Loan Modification Program InfoDocument3 pagesLoan Modification Program InfoDeborah Tarpley HicksNo ratings yet

- NBFC OutsourcingDocument13 pagesNBFC OutsourcingAbin MukhopadhyayNo ratings yet

- Decommissioning Guidance 0Document22 pagesDecommissioning Guidance 0Bilal AhmadNo ratings yet

- CFPB Foreclosure Avoidance ProceduresDocument2 pagesCFPB Foreclosure Avoidance ProceduresunapantherNo ratings yet

- 4 Steps Manage VendorsDocument5 pages4 Steps Manage VendorsJogi ShuklaNo ratings yet

- American Securitization Forum - Streamlined ForeclosureDocument43 pagesAmerican Securitization Forum - Streamlined ForeclosureMaster ChiefNo ratings yet

- Focus Notes Philippine Framework For Assurance EngagementsDocument6 pagesFocus Notes Philippine Framework For Assurance EngagementsThomas_Godric100% (1)

- Philippine Framework For Assurance EngagementsDocument12 pagesPhilippine Framework For Assurance Engagementsjamaira haridNo ratings yet

- Bulletin: NUMBER: 2012-27 TO: Freddie Mac Servicers SubjectsDocument5 pagesBulletin: NUMBER: 2012-27 TO: Freddie Mac Servicers SubjectsDinSFLANo ratings yet

- Fannie Mae Servicer Guidelines As of 6.22.11Document29 pagesFannie Mae Servicer Guidelines As of 6.22.11Ava StamperNo ratings yet

- DRE Broker Compliance Short GuideDocument28 pagesDRE Broker Compliance Short GuideScott RoyvalNo ratings yet

- Philippine Framework For Assurance EngagementsDocument6 pagesPhilippine Framework For Assurance Engagementsjoyce KimNo ratings yet

- Consumer Lending Audit Program For ACUIADocument8 pagesConsumer Lending Audit Program For ACUIAMisc EllaneousNo ratings yet

- Strategic Credit Management - IntroductionDocument14 pagesStrategic Credit Management - IntroductionDr VIRUPAKSHA GOUD G50% (2)

- SuperCPD Article - Anti-Hawking - FinalDocument12 pagesSuperCPD Article - Anti-Hawking - FinalAnthony SmolićNo ratings yet

- Client A&C PolicyDocument20 pagesClient A&C PolicyMustafa AroNo ratings yet

- Trupay Lending Policy July 2023Document47 pagesTrupay Lending Policy July 2023jovinesmNo ratings yet

- Sample Supervision Contract Within Agency 21Document5 pagesSample Supervision Contract Within Agency 21Smart TvNo ratings yet

- Ra 9298Document7 pagesRa 9298Monica Allarrey BalacaniaNo ratings yet

- Unit III MBF22408T Credit Risk and Recovery ManagementDocument22 pagesUnit III MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNo ratings yet

- ISA 210 SummaryDocument8 pagesISA 210 SummaryJawadNo ratings yet

- Auditing and Assurance PrincipleDocument3 pagesAuditing and Assurance PrincipleMichelle ValeNo ratings yet

- Auditing Assignment 1 #14526Document15 pagesAuditing Assignment 1 #14526Mahiana MillieNo ratings yet

- Remote Mortgage Underwriter JobDocument2 pagesRemote Mortgage Underwriter JobDaniel Sands0% (1)

- Philippine Framework For Assurance EngagementsDocument9 pagesPhilippine Framework For Assurance EngagementsKlo MonNo ratings yet

- Aicpa Competency Framework Govt Accnt and Auditing - FinalDocument42 pagesAicpa Competency Framework Govt Accnt and Auditing - FinaldsfdsfsdfNo ratings yet

- S P New Guidelines Rmbs ModificationsDocument9 pagesS P New Guidelines Rmbs ModificationsCindy PeriniNo ratings yet

- Quality Control PolicyDocument11 pagesQuality Control PolicyReah Bello SominoNo ratings yet

- Supplemental Directive 09-09 Revised March 26, 2010: BackgroundDocument45 pagesSupplemental Directive 09-09 Revised March 26, 2010: BackgroundPietroLazoNo ratings yet

- CPA AUDITING NOTES - Philippine Framework For Assurance EngagementsDocument5 pagesCPA AUDITING NOTES - Philippine Framework For Assurance EngagementsJohn OriondoNo ratings yet

- Regulatory Compliance Merger ChecklistDocument5 pagesRegulatory Compliance Merger ChecklistThaddeus J. CulpepperNo ratings yet

- Vendor Due Diligence Audit ProgramDocument4 pagesVendor Due Diligence Audit ProgramElla FlavierNo ratings yet

- Servicing Alignment Initiative - Overview For Fannie Mae ServicersDocument5 pagesServicing Alignment Initiative - Overview For Fannie Mae Servicersmoses_wong_2No ratings yet

- Written Report-Loan FunctionDocument8 pagesWritten Report-Loan FunctionCristina NamuagNo ratings yet

- Professional Fees, Contingent Fees & Independence RulesDocument10 pagesProfessional Fees, Contingent Fees & Independence RulesGeralyn MiralNo ratings yet

- PolicyProcedure WorkbookDocument25 pagesPolicyProcedure WorkbookMistor WilliamsNo ratings yet

- Practical Ifrs 09Document10 pagesPractical Ifrs 09Farooq HaiderNo ratings yet

- 5.1.10 SubcontractingDocument6 pages5.1.10 SubcontractingAhmed AbdallahNo ratings yet

- Credit Operational Manual PDFDocument183 pagesCredit Operational Manual PDFAwais Alvi92% (13)

- 20190212092028-DLT Application Process and Fee Structure PublicDocument8 pages20190212092028-DLT Application Process and Fee Structure PublicAbdullah MutaharNo ratings yet

- Program: Home Affordable Foreclosure AlternativesDocument5 pagesProgram: Home Affordable Foreclosure AlternativesJim LouisNo ratings yet

- Recent Developments in Fair Lending ExaminationsDocument9 pagesRecent Developments in Fair Lending ExaminationsCairo AnubissNo ratings yet

- Loan Management in 40 CharactersDocument28 pagesLoan Management in 40 CharactersSrihari Prasad100% (1)

- Policy Guidelines On Fair Practice Code - July 2016 PDFDocument7 pagesPolicy Guidelines On Fair Practice Code - July 2016 PDFDeepNo ratings yet

- Module 1 Topic 2 in Service MarketingDocument19 pagesModule 1 Topic 2 in Service MarketingSabillon JennivelNo ratings yet

- Real Property Evaluations GuideDocument6 pagesReal Property Evaluations GuideIchi MendozaNo ratings yet

- MS Environment KeysDocument4 pagesMS Environment KeysJoen SinamagNo ratings yet

- PSA 100 - Philippine Framework For Assurance EngagementDocument26 pagesPSA 100 - Philippine Framework For Assurance EngagementHezekiah Reginalde Recta100% (1)

- Unit 8Document8 pagesUnit 8rtrsujaladhikariNo ratings yet

- Offices of Thrift Services and Aurora Loan ServicingDocument29 pagesOffices of Thrift Services and Aurora Loan ServicingKelloggmanNo ratings yet

- Credit Policy: The Exact Payment Terms, The Limits Set On Outstanding Balances and How To Deal With Delinquent AccountsDocument4 pagesCredit Policy: The Exact Payment Terms, The Limits Set On Outstanding Balances and How To Deal With Delinquent AccountsUmair AliNo ratings yet

- Summary AuditDocument8 pagesSummary AuditMarie Joy ButilNo ratings yet

- Shikhar Microfinance Private Limited: Interest RateDocument3 pagesShikhar Microfinance Private Limited: Interest RatesagarNo ratings yet

- IFRS For Insurance Contracts A Complete Guide - 2020 EditionFrom EverandIFRS For Insurance Contracts A Complete Guide - 2020 EditionNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Szymoniak V Banks Qui Tam Unsealed 8 13Document145 pagesSzymoniak V Banks Qui Tam Unsealed 8 13Mortgage Compliance Investigators100% (1)

- Kalicki V Chase Positive Ruling 06-14-2014Document8 pagesKalicki V Chase Positive Ruling 06-14-2014Mortgage Compliance InvestigatorsNo ratings yet

- 118 - Memorandum and Order Dated 6-30-14 (00122979)Document45 pages118 - Memorandum and Order Dated 6-30-14 (00122979)Mortgage Compliance Investigators100% (1)

- Yvanova V New Century Depublication Request To California State Supreme CourtDocument12 pagesYvanova V New Century Depublication Request To California State Supreme CourtMike MaunuNo ratings yet

- CaseLaw Voidjudgment VoidJudgments-CaseListDocument7 pagesCaseLaw Voidjudgment VoidJudgments-CaseListMortgage Compliance Investigators100% (1)

- 23 - Res Judicata - A Double Edged SwordDocument2 pages23 - Res Judicata - A Double Edged SwordMortgage Compliance Investigators100% (1)

- Instructions On How To Register For WebinarDocument1 pageInstructions On How To Register For WebinarMortgage Compliance InvestigatorsNo ratings yet

- 119 - Order Re. Summary Judgment 6-30-14 (00122980)Document2 pages119 - Order Re. Summary Judgment 6-30-14 (00122980)Mortgage Compliance InvestigatorsNo ratings yet

- 25-The 2 Faces of Quiet Title FinalDocument1 page25-The 2 Faces of Quiet Title FinalMortgage Compliance InvestigatorsNo ratings yet

- In-Re-MERS V Robinson 12 June 2014Document31 pagesIn-Re-MERS V Robinson 12 June 2014Mortgage Compliance InvestigatorsNo ratings yet

- 22 - Quieting A Cloud On Title TF EditDocument3 pages22 - Quieting A Cloud On Title TF EditMortgage Compliance InvestigatorsNo ratings yet

- U S V LovascoDocument86 pagesU S V LovascoMortgage Compliance InvestigatorsNo ratings yet

- Top Secret Banker's ManualDocument75 pagesTop Secret Banker's Manualmelanie50% (2)

- "Quieting A Cloud On Title" - Webinar SyllabusDocument4 pages"Quieting A Cloud On Title" - Webinar SyllabusMortgage Compliance Investigators100% (1)

- MCInvestigators MVPackage Chain of Title CollectionDocument6 pagesMCInvestigators MVPackage Chain of Title CollectionMortgage Compliance Investigators100% (3)

- 20 - House Built of Straw or A House Built of BricksDocument1 page20 - House Built of Straw or A House Built of BricksMortgage Compliance InvestigatorsNo ratings yet

- When Should I Invite You To My Quiet Title Party?Document2 pagesWhen Should I Invite You To My Quiet Title Party?Mortgage Compliance InvestigatorsNo ratings yet

- What Are You Asking The Courts To DeclareDocument2 pagesWhat Are You Asking The Courts To DeclareMortgage Compliance InvestigatorsNo ratings yet

- Bricks or Straw?Document2 pagesBricks or Straw?Mortgage Compliance Investigators100% (1)

- BAC Home Loans Servicing L.P. v. BlytheDocument13 pagesBAC Home Loans Servicing L.P. v. BlytheGlenn AugensteinNo ratings yet

- MERScorp V. Carlton DittoDocument9 pagesMERScorp V. Carlton DittoMortgage Compliance InvestigatorsNo ratings yet

- Bank of New York V RomeroDocument19 pagesBank of New York V RomeroMortgage Compliance InvestigatorsNo ratings yet

- FDIC v. BankstersDocument13 pagesFDIC v. BankstersMortgage Compliance InvestigatorsNo ratings yet

- Federal V StateDocument2 pagesFederal V StateMortgage Compliance Investigators100% (1)

- HOT NEWS IN JULY!! MERS NOT THE REAL BENEFICIARY-NO STANDING TO FORECLOSE-Niday V GMAC Oregon Appeal Court Decision On MERSDocument28 pagesHOT NEWS IN JULY!! MERS NOT THE REAL BENEFICIARY-NO STANDING TO FORECLOSE-Niday V GMAC Oregon Appeal Court Decision On MERS83jjmackNo ratings yet

- Michigan Court of Appeals Rules Against MERSDocument11 pagesMichigan Court of Appeals Rules Against MERSStephen DibertNo ratings yet

- Schwartzwald v. FHLMCDocument15 pagesSchwartzwald v. FHLMCMortgage Compliance Investigators100% (1)

- William Squires v. BAC Home Loans Servicing, LPDocument10 pagesWilliam Squires v. BAC Home Loans Servicing, LPMortgage Compliance InvestigatorsNo ratings yet

- Glenn D. Augenstein Vs Deutsche Bank National Trust Company, As TrusteeDocument5 pagesGlenn D. Augenstein Vs Deutsche Bank National Trust Company, As TrusteeForeclosure FraudNo ratings yet

- Jane McCarthy v. Bank of America, NADocument11 pagesJane McCarthy v. Bank of America, NAMortgage Compliance Investigators0% (1)

- Case DigestDocument22 pagesCase DigestPheobelyn EndingNo ratings yet

- Ronald Augustus Dipaola v. Walter Riddle, Superintendent, Virginia State Penitentiary, James D. Swinson, Sheriff, Fairfax County, William J. Powell, Sheriff, Sussex County, 581 F.2d 1111, 4th Cir. (1978)Document4 pagesRonald Augustus Dipaola v. Walter Riddle, Superintendent, Virginia State Penitentiary, James D. Swinson, Sheriff, Fairfax County, William J. Powell, Sheriff, Sussex County, 581 F.2d 1111, 4th Cir. (1978)Scribd Government DocsNo ratings yet

- By-Laws of Purok SambagDocument5 pagesBy-Laws of Purok SambagMelvin Miscala100% (4)

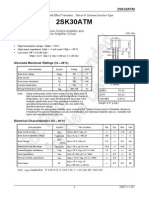

- 2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsDocument4 pages2SK30ATM: Low Noise Pre-Amplifier, Tone Control Amplifier and DC-AC High Input Impedance Amplifier Circuit ApplicationsIee Jimmy Zambrano LNo ratings yet

- DTC Agreement Between Albania and AustriaDocument21 pagesDTC Agreement Between Albania and AustriaOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Gazette Notification (Extraordinary) of Prasar BharatiDocument11 pagesGazette Notification (Extraordinary) of Prasar BharativadrevusriNo ratings yet

- Sport Development The Nigerian Way: A ReviewDocument5 pagesSport Development The Nigerian Way: A ReviewOlohuntoyin Olamide YusufNo ratings yet

- 09 Peoples Bank Trust V Dahican LumberDocument2 pages09 Peoples Bank Trust V Dahican LumberSherwin Anoba Cabutija100% (2)

- Supreme Court Philippines ruling vehicle accident damagesDocument10 pagesSupreme Court Philippines ruling vehicle accident damagesruss8dikoNo ratings yet

- Salient Points CybercrimeDocument6 pagesSalient Points CybercrimeMary Cj PorgatorioNo ratings yet

- Supreme CourtDocument8 pagesSupreme CourtAndrew BelgicaNo ratings yet

- Introduction To Labour Markets & Labour Market InstitutionDocument40 pagesIntroduction To Labour Markets & Labour Market InstitutionakashdeepjoshiNo ratings yet

- Appointment Letter FormateDocument3 pagesAppointment Letter FormateVaghasiyaBipin100% (1)

- Coparcenary Nature of PropertyDocument2 pagesCoparcenary Nature of PropertyAlok DwivediNo ratings yet

- Philippine Law On Sales Art 1544-1623Document15 pagesPhilippine Law On Sales Art 1544-1623Justine Aaron Quiamco78% (27)

- 4th KIIT National Moot Court Competition 2016Document30 pages4th KIIT National Moot Court Competition 2016Pallavi SupehiaNo ratings yet

- Reviewer On Rules On Notarial PracticeDocument3 pagesReviewer On Rules On Notarial PracticeEunice MalayoNo ratings yet

- Causes of French Rev 2Document2 pagesCauses of French Rev 2margajavi2No ratings yet

- Sameer Overseas Placement v. Cabiles (2014)Document11 pagesSameer Overseas Placement v. Cabiles (2014)delayinggratificationNo ratings yet

- AMPLA Model Deed of Assignment Assumption Multi-Party - VERSION 1Document14 pagesAMPLA Model Deed of Assignment Assumption Multi-Party - VERSION 1Toàn PhạmNo ratings yet

- Report AM Mission FinalDocument24 pagesReport AM Mission FinalEaP CSFNo ratings yet

- 6500016884Document7 pages6500016884hfewkorbaNo ratings yet

- Court upholds personal liabilityDocument8 pagesCourt upholds personal liabilityinno KalNo ratings yet

- United States v. John Brannon, 91 F.3d 134, 4th Cir. (1996)Document4 pagesUnited States v. John Brannon, 91 F.3d 134, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- Consti - Montejo LecturesDocument119 pagesConsti - Montejo LecturesAngel Deiparine100% (1)

- IAAF Track & Field RulesDocument229 pagesIAAF Track & Field Rulesjlpark20100% (6)

- ICC International Criminal CourtDocument82 pagesICC International Criminal Courtarsfilosofo100% (1)

- Constitution of Azad Kashmir Football Association (AKFA) by Wasim TahirDocument13 pagesConstitution of Azad Kashmir Football Association (AKFA) by Wasim TahirWasim TahirNo ratings yet

- Mid PioneerDocument1 pageMid PioneerVishnu VNo ratings yet

- League of Cities v. COMELEC (G.R. No. 176951)Document3 pagesLeague of Cities v. COMELEC (G.R. No. 176951)Roward100% (1)