Professional Documents

Culture Documents

The Application of Ifrs Oil and Gas PDF

Uploaded by

SahilJainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Application of Ifrs Oil and Gas PDF

Uploaded by

SahilJainCopyright:

Available Formats

The Application of IFRS: Oil and Gas

Executive Summary October 2008

Foreword

The global adoption of International Financial Reporting Standards (IFRSs) gained tremendous momentum in 2005 with the adoption of these standards by a number of countries, including in the European Union and Australia. That trend has continued with the decision of the U.S. Securities and Exchange Commission (SEC) to drop the requirement for the reconciliation to U.S. GAAP for foreign private issuers reporting under IFRSs as issued by the International Accounting Standards Board. And there is the prospect of further SEC acceptance of IFRSs indicated by its decision in August 2008 to propose a roadmap for IFRS adoption by U.S. issuers. The oil and gas industry is one of the most international and so stands to gain significantly. However, there is relatively little IFRS guidance specifically tailored to some of the industrys particular features: the significant uncertainties around exploration activity; the long lead times between initial investment and first production; the very significant disconnect between the amount spent to explore for, evaluate and develop an oil or gas field and its value; the complex risk-sharing arrangements often involving resource-owning countries and national oil companies; the many and varied ways in which resource-owning countries take their share of the economic benefits (through royalties, taxes or production and risk sharing contracts); and the environmental challenges. It is not surprising then that transitioning to IFRSs has involved oil and gas companies making some complex judgements. IFRSs took a significant step forward in 2005 with the first wave of countries adopting the standards, and after three years of wide experience, now seems an opportune time to take stock of how oil and gas companies around the world are applying IFRSs in practice. The survey highlights areas in which IFRSs have been applied with reasonable consistency by the industry; it also highlights areas in which nuances of companies previous GAAPs have been carried through to their IFRS accounting policies and disclosures. While some of these nuances manifest themselves in the use of different terminology and minor differences of accounting, others highlight the need to read the financial statements closely when the objective is to make accurate comparisons between companies in the sector. Improvements in financial reporting are not achieved by mere compliance but through concerted efforts to communicate financial performance with clarity and consistency. The oil and gas industry is making progress in this direction and the outcome of the IASBs Extractive Activities project, which currently is underway, is eagerly anticipated.

Jimmy Daboo Global Head of Energy & Natural Resources Auditing and Accounting KPMG in the UK

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

This executive summary has been drawn from The Application of IFRS: Oil and Gas, published in October 2008, and focuses on the results of a survey of the IFRS financial statements of 33 companies in the oil and gas sector across 14 countries. That publication was produced by the KPMG International Financial Reporting Group, in collaboration with KPMG in the UK. To order a copy, go to www.kpmgifrg.com or www.kpmgglobalenergyinstitute.com. This executive summary should be read in conjunction with that publication in order to understand more fully the findings from the survey. In addition, that publication includes disclosures made by companies in their consolidated financial statements that we believe may be useful in assessing the type of information being disclosed in practice. KPMGs Global Energy & Natural Resources (ENR) practice is dedicated to assisting all organisations operating in the Oil & Gas, Power & Utilities, Mining and Forestry Industries in dealing with industry trends and business issues. We have a range of publications that can assist you further, including IFRS 6: Exploration for and Evaluation of Mineral Resources by Oil and Gas companies (by KPMG in the UK), Insights into IFRS, IFRS: An overview, Disclosure checklist, illustrative financial statements, and illustrative condensed interim financial statements. Technical information is available at www.kpmgifrg.com and www.kpmgglobalenergyinstitute.com. For access to an extensive range of accounting, auditing and financial reporting guidance and literature, visit KPMGs Accounting Research Online. This Web-based subscription service can be a valuable tool for anyone who wants to stay informed in todays dynamic environment. For a free 15-day trial, go to www.aro.kpmg.com and register today.

KPMG International Financial Reporting Group is part of KPMG IFRG Limited. KPMG International is a Swiss cooperative. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis--vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

The Application of IFRS: Oil and Gas Executive Summary

Contents

1. 2. 3. 4. 5. 6. 7 . 8. 9.

Exploration and evaluation (E&E) and development expenditure Depletion, depreciation and amortisation (DD&A) Decommissioning and environmental provisions Interests in joint ventures Business combinations Farm-ins and farm-outs Reserves reporting Critical judgements and key sources of estimation uncertainty Revenue

4

5

6

7

8

9

10

11

12

13

14

15

16

10. Taxation and other fiscal features 11. Derivatives and commodity price risk 12. Functional and presentation currencies 13. Segment reporting

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

1.

Exploration and evaluation (E&E) and development

expenditure

The costs involved in E&E and development activities are considerable, and often there are years between the start of exploration and the commencement of production; and even with todays advanced technology, exploration is a risky and complex activity. Additionally, there is no direct correlation between the cost incurred and the value this creates. Accounting for E&E expenditure therefore is a critical element of ensuring that the financial statements of oil and gas companies fairly represent their business activities. There was no IFRS that addressed specifically E&E activities until IFRS 6 Exploration for and Evaluation of Mineral Resources was approved by the IASB in 2005, effective for annual periods beginning on or after 1 January 2006. IFRS 6 was intended to be a temporary standard while the International Accounting Standards Board undertook an in-depth project on extractive activities, aimed at bringing some discipline to the accounting for E&E activities. With that in mind, the standard was written with a view to allowing companies to carry over to IFRSs their previous GAAP practices to a large extent.

Key messages from our survey group

The introduction of IFRS 6 has not made the use of the terms successful efforts accounting and full cost accounting redundant, despite neither term being referred to in IFRS 6. Even though full cost accounting in its pure form is not consistent with IFRS 6, companies either had changed the term subtly to modified full cost accounting, or had continued to use the term in conjunction with a change in accounting policies in order to comply with IFRS 6. All companies capitalised at least some E&E expenditure, the majority classifying the resulting E&E asset as an intangible asset. A majority of companies included a specific accounting policy for the impairment of E&E assets. However, most companies did not disclose how E&E assets were allocated to cash-generating units. It was not common for companies to present an accounting policy for pre-E&E (pre-licence) expenditure, but most companies presented an accounting policy for development expenditure. Most companies classified development assets as property, plant and equipment. Few companies differentiated between development assets and production assets, with most companies combining these into one class for the purpose of disclosure.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

2. Depletion, depreciation and amortisation (DD&A)

Oil and gas companies invest large amounts of time, money and experience in exploring and evaluating potential reserves and resources. The success of many of these companies is measured by the returns that these investments produce. For many oil and gas companies the commencement of production is cause for celebration, as it represents the success of the exploration and evaluation process. With the current price of oil and gas products reaching record highs, and showing a significant rise in prices compared to previous years, companies that may have decided previously that the extraction of identified resources was uneconomic are reassessing their position. For some companies, as the cost of oil and gas remains high, the field life will be extended as unexploited resources become economic and commercial reserve estimates increase. As DD&A is an estimate, this will change in response to the strategic and operational decisions made by the business to best reflect the consumption of the benefits of the reserves.

Key messages from our survey group

Almost all companies used the unit-of-production method to deplete upstream oil and gas assets. The basis of calculation of the underlying reserves in applying the unit-of production method varied. The most common bases were proved and probable reserves, and proved developed reserves. Most companies with midstream and downstream oil and gas assets depreciated them on a straight-line basis.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

3. Decommissioning and environmental provisions

Oil and gas companies often are exposed to legal, contractual and / or constructive obligations to meet the costs of decommissioning and dismantling assets at the end of their production life, in addition to restoring the site. These costs are likely to be a significant item of expenditure for most oil and gas companies. Specific decommissioning activities can include the plugging and abandonment of wells; the dismantlement of wellheads, production and transportation activities; and the physical restoration of an area of activity to its original, or better than its original, condition.

Key messages from the survey group

Almost all companies recognised a provision for decommissioning, but none of the companies mentioned a separate provision for decommissioning in respect of midstream and downstream facilities. Approximately a third of companies disclosed the rate used to discount future cash flows in determining the amount of the provision. Amongst those companies that did include disclosure, the basis of discount rate showed significant variation, making comparison difficult. The general level of disclosure in respect of decommissioning and environmental provisions varied significantly.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

4. Interests in joint ventures

Joint ventures are common arrangements in the oil and gas industry, and come in a variety of forms. Companies historically have used joint ventures as a means of sharing the risks and costs of exploration and production activities, and as a practical way of entering new countries and areas of operation.

Key messages from our survey group

The term joint venture is widely used as an all-encompassing operational expression to describe shared working arrangements between oil and gas companies. However, this does not mean that such arrangements are joint ventures for accounting purposes. A lack of disclosure sometimes made it difficult to understand the nature of the companys interests in joint ventures from an accounting point of view. There also appeared to be some confusion regarding the accounting difference between jointly controlled assets and jointly controlled operations. Just over half of companies accounted for jointly controlled entities using the equity method, with the remainder applying proportionate consolidation.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

5. Business combinations

As the price of oil and gas has continued to reach record highs, the level of corporate activity in the oil and gas industry remains strong and continues to accelerate. Transactions that were less attractive at lower oil prices have become more economic in the present climate, and further investment in less traditional sources of oil and gas, such as mineral sands and coal seam gas, are becoming more popular. Companies also are exploring new markets that may have previously been restricted due to foreign investment or ownership requirements, such as in Kazakhstan, China and India. Companies are using the profits that they are making from the higher oil and gas prices to fund expansion and new investments in companies, particularly those that have proven reserves, or in new exploration areas. Consequently, the accounting for acquisitions is a subject that is relevant for most oil and gas companies.

Key messages from our survey group

The most common fair value adjustments in respect of oil and gas activities were to oil and gas assets, and deferred tax balances. Fair value adjustments to decommissioning provisions were not common. It appeared that goodwill was recognised on less than half of the business combinations reported in the latest financial year; and only limited disclosure of the factors giving rise to goodwill was provided. In a number of cases it appeared that any excess value was allocated to oil and gas assets.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

6. Farm-ins and farm-outs

A farm-in is the industry term commonly used to describe the investment process by which a company (farmee) purchases an interest in an exploration licence. In our experience, the consideration paid for a farm-in investment often takes the form of a commitment by the farmee to meet future exploration or development costs that otherwise would be met by the owner (farmor), and may also involve reimbursement to the farmor of a portion of the capital expenditure incurred to date.

Key messages from our survey group

Numerous examples of farm-ins and farm-outs were mentioned in the annual reports, but commonly were confined to sections of the annual report such as the chairmans statement or the operating review. There was little information about farm-in and farm-out transactions within the financial statements.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

10

The Application of IFRS: Oil and Gas Executive Summary

7 .

Reserves reporting

Over the past five years there has been significant debate regarding reserves reporting, with further focus due to a number of well-publicised restatements of published proved reserves estimates. A significant part of the ongoing debate is focused on the U.S. requirements. The SECs rules were introduced in 1978 and focus on proved reserves , which are a small part of the total reserves controlled by companies. The definitions forming the basis of the SECs rules were derived from definitions established by the Society of Petroleum Engineers. One of the most important restrictions on published information that arises from the current SEC rules is the prohibition on allowing probable and possible reserves (or other even less certain estimates of reserves) to be reported in U.S. filings. Similarly, oil recoverable from oil-sands operations also must be excluded from disclosures about oil and gas producing activities. The SEC has to date considered oil-sands extraction to be a mining activity, although most companies describe oil-sand reserves separately. This is becoming increasingly significant as large oilsands basins such as those in Canada are being developed. Reporting requirements in other jurisdictions allow or even require broader measures of reserves and resources to be published. For example, Canadas NI 51-101 Standards of Disclosure for Oil and Gas Activities requires a statement of probable reserves and permits a statement of possible reserves. In June 2008 the SEC published its Proposed Rule on Modernization of the Oil and Gas Reserve Reporting Requirements, which addresses many of the above concerns.

Key messages from our survey group

The reporting of oil and gas reserves was a common feature of the annual reports. The most commonly used convention for measuring and presenting reserves estimates was proven and probable (also known as 2P) reserves. A majority of companies disclosed their process for the preparation and / or audit of the reserves report. A range of presentational styles and measurement methodologies was applied to reserves reporting, making comparisons between companies difficult.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

11

8. Critical judgements and key sources of estimation uncertainty

Oil and gas companies make a number of key estimates and judgements that are industry-specific. One of the most important estimates, from both an operational and an accounting perspective, is the estimate of reserves (see section 7). Oil and gas companies rely on this measure to assist them in setting the strategic direction of the company as the reserve estimate drives the selection of which fields to develop, which to focus exploration activities on, and how long the field life is. Another key estimate relates to the cost of decommissioning (see section 3). One of the assumptions that make this estimate so difficult to assess is the impact of future technological developments on the costs of decommissioning a site. In our experience, over the last 12 months any savings from the expectation that future costs will be reduced due to technological advances have been offset by the shortage of skilled labour and materials, resulting in increased cost estimates.

Key messages from our survey group

The most common areas of disclosure in respect of critical judgements and estimation uncertainty were reserves estimates, decommissioning liabilities, and the impairment testing of oil and gas assets.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

12

The Application of IFRS: Oil and Gas Executive Summary

9. Revenue

The increasing global price of oil and gas has meant that many oil and gas companies are focusing their operations on extracting reserves that may have been previously uneconomic. In our experience, companies also are looking to renegotiate production-sharing agreements to ensure that as much resource as possible is being extracted while the prices of oil and gas remain at record levels. Companies also are focusing on the timing of operations, especially when contracts are denominated by reference to spot prices. Oil and gas companies want to ensure that they are obtaining the best price for their product, and this is made difficult by operational issues such as production having to be transported long distances or using third-party infrastructure that may absorb some, but not all, of the delivery risk.

Key messages from our survey group

While all companies disclosed an accounting policy for revenue, a varying range of detail was provided. Only a small number of companies explained the timing of the transfer of risks and rewards of ownership. A majority of companies disclosed a detailed breakdown of revenue that went beyond the strict disclosure requirements of IAS 18 Revenue.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

13

10. Taxation and other fiscal features

Oil and gas production is the most important industry in many resourcerich countries. Therefore it is inevitable that the fiscal regimes applying to oil companies have a high public profile, and are scrutinised closely by many interest groups. Governments are under pressure to show that, as the ultimate resource owners, the people of the producing country benefit appropriately from the exploitation of the countrys natural resources, which often is carried out by international oil and gas companies. The fiscal regime in a particular country, and importantly investing companies views on the stability of that regime, critically affect investment decisions and the allocation of capital. Overall the government can receive more than 90 percent of the price ultimately charged to consumers for fuel, and the upstream sector often is subject to significantly higher taxes than tax charged on the profits of other businesses.

Key messages from our survey group

Just over half of companies disclosed information on the classification in the financial statements, as income tax or operating expense, of taxation and other fiscal features. There appeared to be limited consistency in the classification of specific taxes on oil and gas production activities.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

14

The Application of IFRS: Oil and Gas Executive Summary

11. Derivatives and commodity price risk

Oil and gas activities typically are exposed mainly to commodity price risk, which was the focus of our survey. Other exposures include foreign exchange risk, and to a lesser extent interest rate risk. Derivatives are used frequently within the industry to manage these risks. Larger oil and gas companies often have an energy trading division through which risks are managed and energy trading conducted. However, in our experience, relatively few companies take arbitrage trading positions.

Key messages from our survey group

Most companies used derivatives in risk management activities. For companies that disclosed a sensitivity analysis in respect of commodity price risk, a value at risk analysis was not the preferred disclosure. All companies that disclosed a sensitivity analysis considered oil price to be a significant risk.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The Application of IFRS: Oil and Gas Executive Summary

15

12. Functional and presentation currencies

An entity measures its assets, liabilities, equity, revenues and expenses in its functional currency, and all transactions in currencies other than the functional currency are foreign currency transactions. Each entity in a group has its own functional currency; there is no concept of a group-wide functional currency under IFRSs. Functional currency is determined by reference to the primary economic environment in which an entity operates. Oil and gas prices are routinely denominated in U.S. dollars, while costs often are incurred in local currency. However, the influence on supply and demand from countries like Russia, China and India makes it increasingly complex to determine the key factors that are influencing the primary economic environment of an oil and gas company.

Key messages from our survey group

Outside of the currency of the country in which the groups parent was based, the U.S. dollar was the most influential currency in determining functional currency. A majority of companies chose as their presentation currency the currency of the country in which the groups parent was based.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

16

The Application of IFRS: Oil and Gas Executive Summary

13. Segment reporting

Oil and gas companies typically have diverse operations, either from a geographic area or from an integrated business model perspective. Smaller explorationfocused companies typically will have fields in a range of geographic locations in order to spread operational risks and to enhance their chances of success. In contrast, larger companies tend to be more integrated and have exploration, as well as midstream and downstream operations. These companies may place less importance on the geographic location of their assets and operations, and more importance on the different lines of business or markets in which they operate. Many oil and gas companies manage their operations by grouping together risks, based either on geography or the nature of operations. In our experience, oil and gas companies tend to disclose extensive information by either field or main revenue stream. This discussion, which may not be included in the financial statements, typically includes managements assessment of the risks specific to that location or business. The discussion might cover, for example, the complex system of land title and access to permits that operate in emerging markets, and the political environment and potential risks that arise from unrest in various countries.

Key messages from our survey group

The most common primary segment reporting format was business segments. Most companies that presented geographical segments as the primary segment reporting format did not have multiple business segments. Two companies had adopted IFRS 8 Operating Segments before its effective date of 1 January 2009.

2008 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

kpmgifrg.com

Contacts

Roger Munnings Global Energy and Natural Resources (ENR) Chairman KPMG in Russia / CIS Tel: +7 (495) 937 2501 e-Mail: rmunnings@kpmg.ru Jimmy Daboo Global Head of ENR - Auditing and Accounting KPMG in the UK Tel: +44 (0) 20 7311 8350 e-Mail: jimmy.daboo@kpmg.co.uk Wayne Chodzicki Global Head of Oil and Gas KPMG in Canada Tel: +1 403 691 8004 e-Mail: wchodzicki@kpmg.ca Tim Rockell Global ENR Executive Director KPMG in Saudi Arabia Tel: +966 (3) 887 7241 ext 224 e-Mail: timrockell@kpmg.com

Regional ENR Leaders Europe, Middle East and Africa Chris Jenkins KPMG in the UK Tel: +44 (0) 20 7311 8368 e-Mail: chris.jenkins@kpmg.co.uk The Americas Bill Kimble KPMG in the U.S. Tel: +1 713 319 2148 e-Mail: wkimble@kpmg.com China Peter Fung KPMG in China Tel: +86 (10) 8508 7017 e-Mail: peter.fung@kpmg.com.cn Japan Osamu Nakai KPMG in Japan Tel: +81 (3) 3548 5301 e-Mail: osamu.nakai@jp.kpmg.com Australia Antony Cohen KPMG in Australia Tel: +61 (3) 9288 5030 e-Mail: antonycohen@kpmg.com.au

You might also like

- Letter of CreditDocument4 pagesLetter of CreditRahul Mehrotra67% (3)

- OPM Actual CostingDocument12 pagesOPM Actual Costingsan_bit2002100% (1)

- Wacc MisconceptionsDocument27 pagesWacc MisconceptionsstariccoNo ratings yet

- Offer and Acceptance NotesDocument24 pagesOffer and Acceptance NotesvijiNo ratings yet

- What Is The Difference Between Book Value and Market ValueDocument12 pagesWhat Is The Difference Between Book Value and Market ValueAinie Intwines100% (1)

- Understanding antitrust laws and how they protect consumersDocument10 pagesUnderstanding antitrust laws and how they protect consumersselozok1No ratings yet

- Ac 1Document39 pagesAc 1taajNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Codification Reference Guide (KPMG) (00663376)Document3 pagesCodification Reference Guide (KPMG) (00663376)bencho10150% (2)

- Fertiliser Sector Report - PINC ResearchDocument72 pagesFertiliser Sector Report - PINC Researchsatish_xpNo ratings yet

- PWC Codification Quick Reference Guide PDFDocument2 pagesPWC Codification Quick Reference Guide PDFkaseNo ratings yet

- Key Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - InvestopediaDocument3 pagesKey Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - Investopediapolobook3782No ratings yet

- Tax Motivated Film Financing at Rexford StudiosDocument13 pagesTax Motivated Film Financing at Rexford StudiosNiketPaithankarNo ratings yet

- Accounting AnalysisDocument15 pagesAccounting AnalysisMonoarul IslamNo ratings yet

- CLSAU Mining0615Document40 pagesCLSAU Mining0615pokygangNo ratings yet

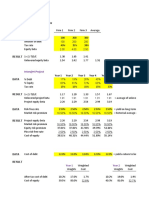

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- Learn deferred tax and accounting for timing differencesDocument10 pagesLearn deferred tax and accounting for timing differencesteddy matendawafaNo ratings yet

- Back To Basics: Period End Monthly/Yearly ClosingDocument128 pagesBack To Basics: Period End Monthly/Yearly ClosingAtish Muttha GNo ratings yet

- E Accounting in The Oil and Gas Industry PDFDocument20 pagesE Accounting in The Oil and Gas Industry PDFShynara MuzapbarovaNo ratings yet

- IFRS Functional Currency CaseDocument23 pagesIFRS Functional Currency CaseDan SimpsonNo ratings yet

- Fernandez Corporation Financial StatementsDocument20 pagesFernandez Corporation Financial StatementsKhánh Huyền0% (2)

- Cost Volume ProfitDocument4 pagesCost Volume ProfitProf_RamanaNo ratings yet

- WACC CALCULATIONSDocument4 pagesWACC CALCULATIONSshan50% (2)

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- 2 Risk&ReturnDocument23 pages2 Risk&ReturnFebson Lee MathewNo ratings yet

- Tutorial 3 Cost of CapitalDocument1 pageTutorial 3 Cost of Capitaltai kianhongNo ratings yet

- Case Study: Calculating CAPM Beta in ExcelDocument18 pagesCase Study: Calculating CAPM Beta in ExcelNumXL Pro100% (1)

- Investment Analysis and Portfolio Management Christmas Worksheet 2009Document2 pagesInvestment Analysis and Portfolio Management Christmas Worksheet 2009farrukhazeemNo ratings yet

- Ch01 SMDocument33 pagesCh01 SMcalz_ccccssssdddd_550% (1)

- Comprehensive Investment Analysis On Summit Power LimitedDocument69 pagesComprehensive Investment Analysis On Summit Power LimitedMD Rakibul Hassan RiponNo ratings yet

- Fauji Fertilizer Company (FFC) : Target Price StanceDocument17 pagesFauji Fertilizer Company (FFC) : Target Price StanceAli CheenahNo ratings yet

- Balance Sheet Statement of Financial PositionDocument17 pagesBalance Sheet Statement of Financial PositionAhmed FawzyNo ratings yet

- Applying IFRS Revenue From Contracts With CustomersDocument76 pagesApplying IFRS Revenue From Contracts With CustomersDhe SagalaNo ratings yet

- FMDocument77 pagesFMYawar Khan KhiljiNo ratings yet

- Introduction To Management AccountingDocument55 pagesIntroduction To Management AccountingUsama250100% (1)

- Adjusted Present Value Method of Project AppraisalDocument7 pagesAdjusted Present Value Method of Project AppraisalAhmed RazaNo ratings yet

- Calculate FCFE XYZDocument4 pagesCalculate FCFE XYZaks171No ratings yet

- Corporate Finance PDFDocument185 pagesCorporate Finance PDFrodgington duneNo ratings yet

- Fitch RatingsDocument7 pagesFitch RatingsTareqNo ratings yet

- Expected Returns, Variance, and Portfolio DiversificationDocument7 pagesExpected Returns, Variance, and Portfolio DiversificationLavanya KosuriNo ratings yet

- SMCH 12Document101 pagesSMCH 12FratFool33% (3)

- Organizational Structures of Major CompaniesDocument10 pagesOrganizational Structures of Major CompaniesShimaa MohamedNo ratings yet

- Vadeo Inc Exercise: Strictly ConfidentialDocument3 pagesVadeo Inc Exercise: Strictly ConfidentialRaja ShahabNo ratings yet

- Consolidated Financial Statements and Outside Ownership: Chapter OutlineDocument44 pagesConsolidated Financial Statements and Outside Ownership: Chapter OutlineJordan Young100% (2)

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaNo ratings yet

- 2017 02 Ifrs 15 Revenue From Contracts With CustomersDocument65 pages2017 02 Ifrs 15 Revenue From Contracts With Customerssuruth242No ratings yet

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- Cash Flow Analysis: Glim Dr. Manaswee K SamalDocument29 pagesCash Flow Analysis: Glim Dr. Manaswee K SamalAnirbanRoychowdhuryNo ratings yet

- Comparable Companies: Inter@rt ProjectDocument9 pagesComparable Companies: Inter@rt ProjectVincenzo AlterioNo ratings yet

- Dipifr 2004 Dec QDocument8 pagesDipifr 2004 Dec QAhmed Raza MirNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- Financial Statement Analysis ControlDocument7 pagesFinancial Statement Analysis ControlTareq MahmoodNo ratings yet

- Financial Study On Public Listed CorporationDocument17 pagesFinancial Study On Public Listed CorporationvinyspNo ratings yet

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1No ratings yet

- Dummy Financial ModelDocument17 pagesDummy Financial ModelarhawnnNo ratings yet

- Financial Analysis in Mergers AcquisitionsDocument27 pagesFinancial Analysis in Mergers AcquisitionsJas KainthNo ratings yet

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- Chapter 9Document33 pagesChapter 9Annalyn Molina0% (1)

- HW8 AnswersDocument6 pagesHW8 AnswersPushkar Singh100% (1)

- NBS Non Performing LoansDocument28 pagesNBS Non Performing LoansGreg ZuccariniNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Case 42 West Coast DirectedDocument6 pagesCase 42 West Coast DirectedHaidar IsmailNo ratings yet

- Corporate RestructuringDocument46 pagesCorporate RestructuringMilu Mathew MoorkkattilNo ratings yet

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- 19 SummaryDocument7 pages19 SummarySahilJainNo ratings yet

- SpaDocument4 pagesSpaSahilJainNo ratings yet

- Brand Indent - Cafe BasilicoDocument1 pageBrand Indent - Cafe BasilicoSahilJainNo ratings yet

- Moh SpaDocument4 pagesMoh SpaSahilJainNo ratings yet

- DateDocument2 pagesDateSahilJainNo ratings yet

- Globalization and Economic Justice (Graduate Seminar) Meets: Thursdays 4:40-7:30 Location: Wilson Hall 255Document14 pagesGlobalization and Economic Justice (Graduate Seminar) Meets: Thursdays 4:40-7:30 Location: Wilson Hall 255SahilJainNo ratings yet

- Basic Concepts On Cyber WarfareDocument18 pagesBasic Concepts On Cyber WarfareMartín LuzuriagaNo ratings yet

- India CyberDocument201 pagesIndia CyberSahilJainNo ratings yet

- CYBER LAW Case StudiesDocument15 pagesCYBER LAW Case StudiesManish DhaneNo ratings yet

- MITESD 273JF09 Lec06Document10 pagesMITESD 273JF09 Lec06SahilJainNo ratings yet

- Report SummaryDocument2 pagesReport SummarySahilJainNo ratings yet

- 3978Document7 pages3978SahilJainNo ratings yet

- HPCL internship certificatesDocument5 pagesHPCL internship certificatesVivek MehtaNo ratings yet

- CompetitionDocument8 pagesCompetitionSahilJainNo ratings yet

- Brand Ambassadors Role in MarketingDocument36 pagesBrand Ambassadors Role in MarketingSahilJainNo ratings yet

- eScholarship Provides Open Access ResearchDocument25 pageseScholarship Provides Open Access ResearchSahilJainNo ratings yet

- HRM ReportDocument107 pagesHRM ReportSahilJainNo ratings yet

- Eco All NotesDocument14 pagesEco All NotesSahilJainNo ratings yet

- Sundri ReportDocument6 pagesSundri ReportSahilJainNo ratings yet

- Operations in A Retail Store - Value Analysis: Allana Institute of Management Sciences, PuneDocument8 pagesOperations in A Retail Store - Value Analysis: Allana Institute of Management Sciences, PuneSahilJainNo ratings yet

- F10 MCS 1000 Adlam NotesDocument56 pagesF10 MCS 1000 Adlam NotesSanjiv GautamNo ratings yet

- Premium Investor Registration FormDocument4 pagesPremium Investor Registration FormSahilJainNo ratings yet

- Name Reliance Industries LimitedDocument4 pagesName Reliance Industries LimitedSahilJainNo ratings yet

- HRM (RecruitmentCaseTESCO)Document7 pagesHRM (RecruitmentCaseTESCO)SahilJainNo ratings yet

- Indian Government DataDocument9 pagesIndian Government DataSahilJainNo ratings yet

- Summer Report FormatDocument8 pagesSummer Report FormatSahilJainNo ratings yet

- Summer Report FormatDocument8 pagesSummer Report FormatSahilJainNo ratings yet

- PremNarayan FoodSafety PDFDocument6 pagesPremNarayan FoodSafety PDFSahilJainNo ratings yet

- Computer Profile Summary: Plan For Your Next Computer Refresh... Click For Belarc's System Management ProductsDocument6 pagesComputer Profile Summary: Plan For Your Next Computer Refresh... Click For Belarc's System Management ProductsSahilJain0% (1)

- Information Technology: Sem IDocument9 pagesInformation Technology: Sem ISahilJainNo ratings yet

- Report European Retail in 2018 GFK Study On Key Retail Indicators 2017 Review and 2018 Forecast GFK Across - 293 PDFDocument23 pagesReport European Retail in 2018 GFK Study On Key Retail Indicators 2017 Review and 2018 Forecast GFK Across - 293 PDFJoão MartinsNo ratings yet

- Economics Chapter 4Document14 pagesEconomics Chapter 4Sharif HassanNo ratings yet

- Chapter 1: Financial Management and Financial ObjectivesDocument15 pagesChapter 1: Financial Management and Financial ObjectivesAmir ArifNo ratings yet

- Case 13C - Spring Water Spa CompanyDocument1 pageCase 13C - Spring Water Spa Companyariani fNo ratings yet

- Maternity Newborn AgreementDocument3 pagesMaternity Newborn Agreementmjrose514No ratings yet

- MMS Derivatives Lec 1Document85 pagesMMS Derivatives Lec 1AzharNo ratings yet

- National Highways Authority of ... Vs Patel KNR (JV) On 14 May, 2018Document14 pagesNational Highways Authority of ... Vs Patel KNR (JV) On 14 May, 2018SarinNo ratings yet

- CH 12Document49 pagesCH 12Natasya SherllyanaNo ratings yet

- q17 Iaetrfcnrfc AnsDocument2 pagesq17 Iaetrfcnrfc AnsIan De DiosNo ratings yet

- Chapter 9 SolutionsDocument4 pagesChapter 9 SolutionsVaibhav MehtaNo ratings yet

- Cost Acctg - Chapter 2 & 3Document4 pagesCost Acctg - Chapter 2 & 3Hamoudy DianalanNo ratings yet

- Prospects and Challenges of The Ethiopian Commodity ExchangeDocument83 pagesProspects and Challenges of The Ethiopian Commodity Exchangeggmanche100% (5)

- Final Project of Working CapitalDocument118 pagesFinal Project of Working CapitalVishal Keshri0% (1)

- IAS 33 - Earning Per ShareDocument30 pagesIAS 33 - Earning Per ShareSelemani KinyunyuNo ratings yet

- Biotech Sunglasses Break-Even AnalysisDocument8 pagesBiotech Sunglasses Break-Even AnalysisKuralay TilegenNo ratings yet

- Assignment Managerial FinanceDocument29 pagesAssignment Managerial FinancesdfdsfNo ratings yet

- Food InflationDocument34 pagesFood Inflationshwetamohan88No ratings yet

- RRL - DraftDocument2 pagesRRL - DraftJp CombisNo ratings yet

- Understanding the Difference Between Positive and Normative EconomicsDocument21 pagesUnderstanding the Difference Between Positive and Normative EconomicsKevin Fernandez MendioroNo ratings yet

- Inventory KPI - SAP TransactionsDocument3 pagesInventory KPI - SAP TransactionsGabrielNo ratings yet

- Econ 3024 Assignment 1 (Final Version)Document2 pagesEcon 3024 Assignment 1 (Final Version)Van Law Wai LunNo ratings yet

- Part 1Document8 pagesPart 1Ahmed Mostafa ElmowafyNo ratings yet

- Chapter 4 Investment EfficiencyDocument70 pagesChapter 4 Investment Efficiency10-12A1- Nguyễn Chí HiếuNo ratings yet

- TCS Recruitment Previous Year Pattern Questions Set-9Document2 pagesTCS Recruitment Previous Year Pattern Questions Set-9QUANT ADDANo ratings yet