Professional Documents

Culture Documents

Islamic Financial Institutions

Uploaded by

purple0123Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Islamic Financial Institutions

Uploaded by

purple0123Copyright:

Available Formats

Literature review Islamic financial institutions have made significant progress and achieved steady high growth despite

several obstacles, impediments, and challenges. Growth was led mainly by the initiatives of the private sector Islamic and conventional financial institutions in pursuit of capturing an emerging market. As a result of increased demand for products & compatible with both the Islamic economic and financial system the banking became more popular among Muslim and non-Muslims countries (Archer&Kareem 2007). Today maximum number of products present in the market is in compliant with the Islamic finance. A growing numbers of individuals and companies are now embracing their workings, which are based on Quranic principles (Quinn, 2008). The first modern experiment with Islamic banking can be traced back to the establishment of the Mitghamr saving bank in Egypt in 1963. During the past four decades, however, Islamic banking has grown rapidly in terms of size and the number of players. It is currently practiced in more than 50 countries worldwide (Chong & Lui 2009). Rising petroleum prices, increased attention on the Middle East as a result of politics, and competition between Bahrain and Dubai for the title of Middle Eastern financial centre are other factors contributing to the same (DiMeglio,2007). As argued by Sole (2007) Islamic banking is steadily moving into increasing number of conventional finance systems. It is expanding not only in nations with majority Muslim population but also in other countries where Muslims are minority, such as UK and Japan. Islamic banking and financial institution have a little success in making inroads in to the UK financial market. The scenario, however, dramatically changed over the recent years (Bhatti & Khan 2008). The figure below illustrates the development of Islamic banking in the world. . Figure 1: The Development of Islamic Banking. In august 2004, the Islamic bank of Britain (IBB) became the first bank to be licensed for engagement of Islamic transactions. Over the centuries the worlds financial system has been shaped by many different factors and events. Islamic views of finance and trade are based on the core principles of fairness and trust and have much in common with traditional JudaeoChristian viewpoints. The chart below illustrates the geographic breakdown for Islamic finance Figure: 2 Geographic breakdown of Islamic finance. (Source: International Finance Services London, 2008.) Islamic loans are becoming common among non Muslims, according to Power, (2009); half of HSBCs Islamic mortgages in Malaysia were taken by non Muslims the first year it was launched. Thus, Islamic finance has created an attractive market for non-Muslims and western investors, where in origin it was developed as pure investment for Muslims as alternative to the modern banking.

You might also like

- Project of Consumer AwarenessDocument11 pagesProject of Consumer AwarenessShailesh SharmaNo ratings yet

- Multiplication Table 1 To 30 PDFDocument4 pagesMultiplication Table 1 To 30 PDFpurple012343% (30)

- Apollo OsDocument104 pagesApollo Ospurple0123No ratings yet

- Workshop On Electrical Standards2Document14 pagesWorkshop On Electrical Standards2purple0123No ratings yet

- The Greenhouse Effect On EarthDocument43 pagesThe Greenhouse Effect On EarthsasisNo ratings yet

- Smith 1947 Use Hydrometers EstimateDocument15 pagesSmith 1947 Use Hydrometers Estimatepurple0123No ratings yet

- Project of Market AwarenessDocument1 pageProject of Market Awarenesspurple0123No ratings yet

- PersonalityDocument31 pagesPersonalitypurple0123No ratings yet

- 1323075734Document33 pages1323075734purple0123No ratings yet

- Global Jewelry Retailing: Market Size, Retailer Strategies, and Competitive PerformanceDocument8 pagesGlobal Jewelry Retailing: Market Size, Retailer Strategies, and Competitive PerformanceArati PrabhuNo ratings yet

- PersonalityDocument67 pagesPersonalitypurple0123No ratings yet

- Nelson & Quick: Personality, Perception, and AttributionDocument22 pagesNelson & Quick: Personality, Perception, and AttributionDhanwantikasotiye6No ratings yet

- 4-1 Chapter 8 PersonalityDocument55 pages4-1 Chapter 8 PersonalityRonnel Aldin FernandoNo ratings yet

- Ch14 Rubber Wiley PDFDocument39 pagesCh14 Rubber Wiley PDFPraveen MNo ratings yet

- 18Document35 pages18Sujit MuleNo ratings yet

- Sect 18 Compression Troubleshooting GuideDocument9 pagesSect 18 Compression Troubleshooting Guidepurple0123No ratings yet

- PP 9Document4 pagesPP 9FenDy WaHabNo ratings yet

- Effect of Molding Parameters On Compression Molded Sheet Molding Compounds PartsDocument7 pagesEffect of Molding Parameters On Compression Molded Sheet Molding Compounds Partspurple0123No ratings yet

- 03 Introduction To SHRMDocument87 pages03 Introduction To SHRMpurple0123No ratings yet

- Hydraulic Press PartsDocument20 pagesHydraulic Press Partspurple0123No ratings yet

- Extract 05Document18 pagesExtract 05purple0123No ratings yet

- 18 Compression and Transfer MoldingDocument20 pages18 Compression and Transfer MoldingKamal Krishna KashyapNo ratings yet

- Compression Molding (Matched-Die Molding)Document13 pagesCompression Molding (Matched-Die Molding)Sanjay BaruaNo ratings yet

- By: Ayushi Jain Vijeta SharmaDocument26 pagesBy: Ayushi Jain Vijeta SharmachowmowNo ratings yet

- SHRM Shiksha Urvashi DishaDocument24 pagesSHRM Shiksha Urvashi DishachowmowNo ratings yet

- International Human Resource Management: Managing People in A Multinational ContextDocument16 pagesInternational Human Resource Management: Managing People in A Multinational Contextpurple0123No ratings yet

- Performance Management (SHRM)Document18 pagesPerformance Management (SHRM)purple0123No ratings yet

- Expat N Repat (84, 88)Document36 pagesExpat N Repat (84, 88)purple0123No ratings yet

- Google's HRM Strategies Presentation-Ambesh Govind, MBA-4B - 078Document34 pagesGoogle's HRM Strategies Presentation-Ambesh Govind, MBA-4B - 078purple0123100% (1)

- Islamic Financial InstitutionsDocument1 pageIslamic Financial Institutionspurple0123No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Corporate Finance Current Papers of Final Term PDFDocument35 pagesCorporate Finance Current Papers of Final Term PDFZahid UsmanNo ratings yet

- Corporate Law - Cheat Sheet (Lecture 1) PDFDocument1 pageCorporate Law - Cheat Sheet (Lecture 1) PDFSarah CamilleriNo ratings yet

- Chapter 1: A Simple Market ModelDocument8 pagesChapter 1: A Simple Market ModelblillahNo ratings yet

- Income Tax Study PackDocument68 pagesIncome Tax Study PackKempton MurimiNo ratings yet

- FIN 103 - V. Financial Planning and ForecastingDocument6 pagesFIN 103 - V. Financial Planning and ForecastingJill Roxas100% (1)

- Shariah Pronouncement For Quantum Metal Sdn. Bhd. Gold AdvanceDocument3 pagesShariah Pronouncement For Quantum Metal Sdn. Bhd. Gold AdvanceshahrimanNo ratings yet

- Chapter 13 - Test BankDocument29 pagesChapter 13 - Test Bankjuan100% (4)

- Chapter 3 The Machinery of Government MMLSDocument32 pagesChapter 3 The Machinery of Government MMLSpremsuwaatiiNo ratings yet

- Integrated Case Study Case Study 1 Delaila BoutiqueDocument2 pagesIntegrated Case Study Case Study 1 Delaila BoutiqueNUR AIN BINTI MOHAMMAD MOKHTARNo ratings yet

- Growth Opportunities Abound in Hong Kong's Insurance MarketDocument6 pagesGrowth Opportunities Abound in Hong Kong's Insurance Marketlinru xieNo ratings yet

- Money MarketDocument20 pagesMoney Marketramankaurrinky100% (1)

- DrVijayMalik Company Analyses Vol 5Document349 pagesDrVijayMalik Company Analyses Vol 5THE SCALPERNo ratings yet

- Joint Venture PPT FinalDocument13 pagesJoint Venture PPT FinalKazi Taher SiddiqueeyNo ratings yet

- Unipe-NPF Initiative To Make Education Affordable and Thus AccessibleDocument1 pageUnipe-NPF Initiative To Make Education Affordable and Thus Accessiblemsarma7037No ratings yet

- Declaration For Lost Gold Loan Token: Description of Ornaments Weight Approx. Market Value SI. No. 2278-MDS-134Document1 pageDeclaration For Lost Gold Loan Token: Description of Ornaments Weight Approx. Market Value SI. No. 2278-MDS-134Muthoot Finance100% (3)

- CH 6 13Document148 pagesCH 6 13林韋丞No ratings yet

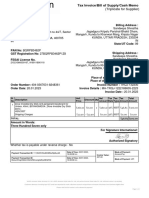

- Invoice DocumentDocument1 pageInvoice DocumentrameshNo ratings yet

- Mock Test AnswersDocument19 pagesMock Test Answerstoll_meNo ratings yet

- Pledge Real Mortgage Chattel Mortgage AntichresisDocument12 pagesPledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANNo ratings yet

- Elvis Products International Common-Size Income Statement For The Year Ended Dec. 31, 1997 ($ 000's)Document5 pagesElvis Products International Common-Size Income Statement For The Year Ended Dec. 31, 1997 ($ 000's)askdgasNo ratings yet

- TK BAI2Document23 pagesTK BAI2saurabh_565No ratings yet

- Electronic Fund TransferDocument15 pagesElectronic Fund Transferjunefourth0614No ratings yet

- MPERS - Section 3 - MASB 1 - MFRS 101 - Financial Statement PresentationDocument8 pagesMPERS - Section 3 - MASB 1 - MFRS 101 - Financial Statement Presentationckin1609No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RehanNo ratings yet

- Daily Report 192 27-08-2021Document176 pagesDaily Report 192 27-08-2021jay ResearchNo ratings yet

- MiFID II - Product GovernanceDocument8 pagesMiFID II - Product GovernanceHoàng Minh ChiếnNo ratings yet

- E) Growth and Survival of FirmsDocument6 pagesE) Growth and Survival of FirmsRACSO elimuNo ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- Lease Accounting Lecture in Power PointDocument22 pagesLease Accounting Lecture in Power PointEjaz AhmadNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 2Document5 pagesINCOME TAX AND GST. JURAZ-Module 2TERZO IncNo ratings yet