Professional Documents

Culture Documents

The Inheritance Tax Heritage of The 18th Century

Uploaded by

root6rabbitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Inheritance Tax Heritage of The 18th Century

Uploaded by

root6rabbitCopyright:

Available Formats

The Inheritance Tax Heritage of the 18th Century

It was actually the Elizabethans in 1597 who first imposed a lawfully binding demand upon individuals with, that which you might call, disposable properties and assets, in aid to provide essential food and refuge for the poorest within the parish. Previous To that it was left for the churches and the richest among the inhabitants to set up non-profit giving. This often manifested in the form of elite women with a faith based inclination taking a basket of food items to their estate laborers. Malnourishment was always a risk for these laborers who endured on minimal wages. The 1760's created yet another transformation which had an indisputable influence on each and every community and most landscapes. So far as work was interested the machine dominated the lives of workers but the very tempo of life sped up because it wasn't any longer controlled because of the horse but became by steam energy. It wasn't however, as thougha dark fog spoiled the once ideal existence of all labourers. Employees, prior to this economic growing market, worked on the land, had little, had no retirement plan to retire on and perished young. Previously they had previously worked really hard and had no work based added benefits as a pension plan or sick pay so that hadn't changed nevertheless the industrialisation of labor had eventually provide them with higher earnings. The population grew and towns expanded quickly and the poor relief, for various reasons, also evolved. The year of 1796 witnessed the taxes move from remaining solely charged on the top classes within their lifetime to becoming obtained from their estates on their demise. These taxations had been called Legacy, Succession and Estate Duties. Wills checked in for probate in England and Wales, if more than a certain worth, were being stamped to indicate liability for any taxes, so beginning the phrase 'Stamp Duty'. These rates of duty changed as the income of the population went up. In 1857 your estate was not tax free above the value of Twenty Pounds however the charges were not generally collected if the value was under fifteen hundred pounds Death Duties were introduced in 1894, progressively ever-increasing so quite a few believe it was the beginning of the breaking apart for the once massive estates. Estate Duty alone only started in 1914 aided by the Liberal Government of Prime Minister Asquith within the recently formed People's Budget. By 2007 most of the populace within the UK, 94 Percent, nevertheless paid out no death duties, just the top 6 Percent paying anything. Inheritance Tax itself only became the final form of earlier levies after 1986. This, even with the entrepreneurial ways found in order to avoid it, still makes up 0.8% of government income, or 3 billion in the year up to April 2013 The big distinction now being that it really is no more collected for the sole advantage the significantly less well off but can be just as prone to benefit everyone.

See information on death duty

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tata Sia MumbaiDocument1 pageTata Sia MumbaiRohitNo ratings yet

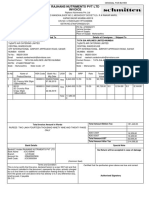

- Tax Invoice: RAJKOT GAS SERVICE (000010176)Document1 pageTax Invoice: RAJKOT GAS SERVICE (000010176)Rahul ShuklaNo ratings yet

- NetbankDocument3 pagesNetbankjambroo100% (1)

- I941 INSTRUCTIONS 2019 PDFDocument12 pagesI941 INSTRUCTIONS 2019 PDFH126 IN5No ratings yet

- Bir Ruling (Da 146 04)Document4 pagesBir Ruling (Da 146 04)cool_peachNo ratings yet

- Kunci Jawaban Lab Chapter 3 OverheadDocument3 pagesKunci Jawaban Lab Chapter 3 OverheadRantiyaniNo ratings yet

- July 2020 E-StatementDocument2 pagesJuly 2020 E-StatementDân TríNo ratings yet

- What Is Real Property TaxDocument7 pagesWhat Is Real Property TaxAnonymous yNGRjeq1hyNo ratings yet

- Sbi Simply SavDocument28 pagesSbi Simply SavkumbharfamilyNo ratings yet

- Tax, Budget, InterstDocument10 pagesTax, Budget, InterstNegese MinaluNo ratings yet

- Policy Statement - U010146572Document1 pagePolicy Statement - U010146572Dipak ChandwaniNo ratings yet

- Receipt - 8 - 13 - 2021 12 - 00 - 00 AMDocument1 pageReceipt - 8 - 13 - 2021 12 - 00 - 00 AMSuhani ChauhanNo ratings yet

- Payment and Settlements in India-ExamPundit FinalDocument8 pagesPayment and Settlements in India-ExamPundit FinalUjjwal MishraNo ratings yet

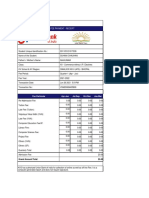

- Account summary and transactionsDocument6 pagesAccount summary and transactionsAbdul HaseebNo ratings yet

- Bank account statement details for Mr. BODA MALLESHDocument5 pagesBank account statement details for Mr. BODA MALLESHSanthosh Naik BhukyaNo ratings yet

- The Following Information Has Been Reported by Laporte Inc On PDFDocument1 pageThe Following Information Has Been Reported by Laporte Inc On PDFLet's Talk With HassanNo ratings yet

- Proposed Adjusting Journal EntriesDocument8 pagesProposed Adjusting Journal EntriesEli Mae Rose Densing100% (1)

- TIN Application ProcedureDocument3 pagesTIN Application ProcedureJuan Dela CruzNo ratings yet

- Vodafone bill details for Rs 638.76 chargesDocument2 pagesVodafone bill details for Rs 638.76 chargesRajneesh JhoradNo ratings yet

- Monese Statement 01 May 2023 - 23 August 2023Document12 pagesMonese Statement 01 May 2023 - 23 August 2023Andrea SarocoNo ratings yet

- 00131369Document5 pages00131369Omprakash PipasaNo ratings yet

- Fauji Cement Manual Hoist QuoteDocument2 pagesFauji Cement Manual Hoist QuoteAdeeb ShahzadaNo ratings yet

- Form - 1040 - Schedule BDocument2 pagesForm - 1040 - Schedule BEl-Sayed FarhanNo ratings yet

- 77Document2 pages77Arian AmuraoNo ratings yet

- 2018 Taxation Law Last Minute TipsDocument15 pages2018 Taxation Law Last Minute TipsMarilynNo ratings yet

- (Resolved) HSBC Credit Card - Recovery After 1 Year of Settlement of Credit CardDocument6 pages(Resolved) HSBC Credit Card - Recovery After 1 Year of Settlement of Credit CardDaniel Smart OdogwuNo ratings yet

- Calculate simple interest rates and amountsDocument9 pagesCalculate simple interest rates and amountsImtiaz AhmedNo ratings yet

- CashDocument7 pagesCashhellohello100% (1)

- Fortunes Redemption FormDocument1 pageFortunes Redemption FormFaiza S. Raja67% (3)

- Payment Receipt: Applicant DetailsDocument1 pagePayment Receipt: Applicant DetailsZakir SzaNo ratings yet