Professional Documents

Culture Documents

Dividend

Uploaded by

parulshinyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend

Uploaded by

parulshinyCopyright:

Available Formats

Dividend: The word, Dividend has two meanings, in case of a going concern it means the portion of profits of the

Company which is allocated to holders in the Company; in case of a winding up company it means the division of the realized assets among the creditors and contributions according to their respective rights. Section 205 of the Companies act relates to the former category of dividend. History behind enactment: The evolution began with Lee v, Neuchatel Asphalte Co., (1886-90) All ER Rep 947 where the courts laid down even beyond the expectation of accounts that the reduction in wasting assets need not be taken care for working out divisible profits. In order, however, to appease the commercial world the courts recognized a distinction between fixed and circulating assets and insisted that while fixed capital may be lost or wasted, the circulating capital must be maintained out of revenue. With this should be contrasted the judicial latitude that fixed assets may be revalued on a fair and reasonable basis and the surplus may thus be distributed as Dividend. Now the provisions governing declaration and payment of dividend by a company are provided in the Companies Act, 1956 (referred to as Act) and the Rules made there under including the Companies (Transfer of Profits to Reserve) Rules, 1975, Companies (Declaration of Dividend out of Reserves) Rules, 1975. Determination and Declaration of Dividend: Section 205 of the Act only prescribes that dividend shall be paid out of profits of the company. Further, it has become obligatory for a company to provide for depreciation as required by Section 205(2) of the Act. Depreciation has to be provided for the current year as well as for arrears of depreciation if any. It further states that the depreciation must be provided to the extent specified in the Section 350 of the Act. If we refer this Section, it states that the depreciation is to be calculated at the rate specified in Schedule XIV of the Act. Further, it is to be noted that if the Act makes no provision for a particular kind of asset, then its depreciation may be worked out on a basis approved by the Central Government in this regard. A company has got two choice to arrive at depreciation i.e. either to adopt the above said procedure or to work out depreciation by dividing ninety five percent of the original cost of the depreciable asset by the specified period in respect of such asset.The previous years losses, if any must also be set off against the profits of any subsequent year or years before any dividend can be paid. A company cannot declare dividend in the following circumstances:a) When a Company is not having profit i.e. is a loss making company. b) When a Company fails to redeem its preference shares as per the provisions of Section 80A of the Companies Act. (Sub Section 2B) Further, a Company cannot declare a dividend without the prior approval of Financial Institution, in case if the covenants of the loan agreement stipulates in this regard. Section 205(3) stipulates that no dividend shall be payable except in cash. Dividends cannot be declared out of the Securities Premium Account or the Capital Redemption Reserve Account or Revaluation Reserve or Amalgamation Reserve or out of the Profit on re-issue of forfeited shares or out of profit earned prior to the incorporation of the Company. Compulsory Reserves

Section 205 (2A) of the Act prescribes that before any dividend is declared or paid, certain percentage of profits as may be prescribed by the Central Government, but not exceeding 10% will have to be transferred to the reserves of the Company. The company may, however, voluntarily create more than the prescribed percentage and transfer to the reserves of the Company. If in a particular year, on account of inadequacy of profit, the company has to pay dividends out of the previous years reserves, it should follow such rules as may be made by the Central Government. In case of any deviation from such rules, then the company can do so only with the previous approval of the Central Government. The term Reserve meant in the said Rules means Free Reserves i.e . reserve which are not created or set apart or intended for any special purpose. For e.g. Development Rebate Reserve, Capital Reserve or Special Reserve will not come under the category of free reserves for the purposes of this rule. According to the Companies ( Transfer of Profits to Reserves) Rules 1975, before declaration or payment of dividend, profits shall be compulsorily transferred to reserves at the following rates:Rate of proposed dividend Amount to be transferred to Reserves Not exceeding 10% Exceeding 10% but not exceeding 12.5% Exceeding 12.5% but not exceeding 15% Exceeding 15% but not exceeding 20% Exceeding 20% Nil 2.5% of current profits 5% of current profits 7.5% of current profits 10% of current profits.

Declaration of dividend out of profits earned by earlier years Section 205 of the Act, provides that a company can declare dividend out of the profits of the previous years. It stipulates that if owing to inadequacy or absence of profits in any Financial Year, the Company proposes to declare dividend out of the profits of the previous financial year or years and transferred to its reserves, such declaration shall be passed by a resolution at the Board Meeting with the consent of all the directors and approval of the financial institution whose term loans are subsisting and also to be passed by the shareholders by a special resolution at the Annual General Meeting. The Ministry has received suggestions, stating that the resolution passed by the Board should be approved by all the directors present at the Board Meeting and not by with the consent of all the directors of the company.

Interim Dividend Dividends can be declared only by a resolution of the shareholders in accordance with the Directors recommendation at a general meeting. But, if so permitted by the Articles of Association of the company, the Directors can declare an interim dividend between two Annual General Meetings. Thus, the shareholders do not get any vested right under a Directors resolution declaring an interim dividend. Section 207 of the Companies Act which applies to interim dividend also, stipulates penalty for failure to distribute dividend to the shareholders within 30 days of its declaration. The penalty prescribed under the Act is that the directors shall be punishable with simple imprisonment of three years along with a fine of Rs.1000 for every day during which such default continues and the company shall be liable to pay simple interest at the rate of 18% p.a. during the period for which such default continues. Further, since the penalty prescribed is by way of both fine and imprisonment, the offence is also not compoundable under Section 621A of the Companies Act. Thus, going by the principle, in law one cannot take advantage of his own default, the Board of Directors have got power to rescind th th the payment of dividend only upto the 29 day of its declaration and not thereafter. It is because, after the 30 day, it becomes a statutory default.

When dividend need not be paid

In the following cases, a company need not pay dividend within 30 days from the date of declaration:a) a) Where dividend could not be paid by reason of the operation of any law. b) b) Where a shareholder has given directions to the company regarding payment of dividend and those directions cannot be complied with. c) c) Where there exists a dispute regarding the right to receive the dividend. d) d) Where dividend is lawfully adjusted by the company against any sum due to its from the shareholder. e) e) Where the non-payment of dividend is not due to any default of the company. Disqualification for directors:As per Section 274 (1)(g) of the Companies Act, 1956, if a public company fails to pay dividend and such failure continues for one year or more, then any person who is a director of the company at the time when default is made, shall not be eligible to the appointed a director of any other public company for a period of 5 years. Conclusion The payment of dividend will instil confidence to the shareholders of the company, after all a company can declare and pay dividend only if it makes profit. Further, payment of dividend consistently over a period of time would enhance the image of the company. The company would also stand to benefit as whenever it requires additional funds for expansion, it can very easily tap the capital markets (as investors would be ready and willing to invest) without resorting to huge borrowings from Banks and Financial Institutions. The shareholders can be rewarded by other means i.e. declaring bonus shares, rights shares etc. but since dividend is paid in cash it is considered one of the best reward a company can do to its shareholders for enhancing their wealth. The shareholders also enjoy additional benefit since the dividend which they receive is tax free and need not pay any tax on dividend and the company would be liable to pay Dividend Distribution Tax. Thus, a consistent dividend paying company is considered to be a good investment option to the investors.

You might also like

- NA NA NA: Signing of Annual Return Issued by The Institute On 27Document1 pageNA NA NA: Signing of Annual Return Issued by The Institute On 27parulshinyNo ratings yet

- Form - D Application For The Issue of Certificate of Practice See Reg. 10, 13 & 14Document1 pageForm - D Application For The Issue of Certificate of Practice See Reg. 10, 13 & 14parulshinyNo ratings yet

- Fee Structure For Pride East Entertainments & Rbs RealtorsDocument1 pageFee Structure For Pride East Entertainments & Rbs RealtorsparulshinyNo ratings yet

- N A NA NA: Form - D Application For The IssueDocument1 pageN A NA NA: Form - D Application For The IssueparulshinyNo ratings yet

- Alteration in ArticlesDocument4 pagesAlteration in ArticlesparulshinyNo ratings yet

- Form (See Rule 3) Compliance Certificate Registration No.: . The Members M/S .. Guwahati, AssamDocument2 pagesForm (See Rule 3) Compliance Certificate Registration No.: . The Members M/S .. Guwahati, AssamparulshinyNo ratings yet

- Form 22ashorter Notice - IndividualDocument2 pagesForm 22ashorter Notice - IndividualparulshinyNo ratings yet

- Debt Instruments - FAQ: Personal FinanceDocument12 pagesDebt Instruments - FAQ: Personal FinanceparulshinyNo ratings yet

- Form 22ashorter Notice - IndividualDocument2 pagesForm 22ashorter Notice - IndividualparulshinyNo ratings yet

- Post Merger ActivitiesDocument1 pagePost Merger ActivitiesparulshinyNo ratings yet

- Form-Vii Completion Certificate of Managerial/ Practical TrainingDocument1 pageForm-Vii Completion Certificate of Managerial/ Practical TrainingparulshinyNo ratings yet

- Agreement For Other Than CashDocument2 pagesAgreement For Other Than CashparulshinyNo ratings yet

- Sweat EquityDocument3 pagesSweat EquityparulshinyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction To Financial Statements: Kimmel Weygandt Kieso Accounting, Sixth EditionDocument31 pagesIntroduction To Financial Statements: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasNo ratings yet

- Chapter 1: The Problem: Rationale and BackgroundDocument21 pagesChapter 1: The Problem: Rationale and BackgroundadorableperezNo ratings yet

- S2M. National Income Accounting 0 - 1 PDFDocument66 pagesS2M. National Income Accounting 0 - 1 PDFabcdfNo ratings yet

- (Sales) Medina V Collector of Internal RevenueDocument2 pages(Sales) Medina V Collector of Internal RevenueKristel Angeline Rose P. NacionNo ratings yet

- Chapter 2 Why People CommiDocument18 pagesChapter 2 Why People CommiChristian De Leon100% (1)

- FinManSemis3 UMALIDocument6 pagesFinManSemis3 UMALIJenny Shane UmaliNo ratings yet

- HUMANA INC 10-K (Annual Reports) 2009-02-20Document148 pagesHUMANA INC 10-K (Annual Reports) 2009-02-20http://secwatch.com100% (1)

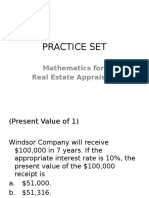

- Practice SetDocument39 pagesPractice SetDionico O. Payo Jr.No ratings yet

- Reward StrategiesDocument35 pagesReward Strategiesamruta.salunke4786100% (6)

- 401 (K) Planner: Growth of InvestmentDocument1 page401 (K) Planner: Growth of Investmentanon-13887100% (1)

- Ko Tak Capital Multiplier PlanDocument2 pagesKo Tak Capital Multiplier PlanemailtotesttestNo ratings yet

- Merged 1Document24 pagesMerged 1api-317193133No ratings yet

- Advanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsDocument12 pagesAdvanced Taxation - Singapore (Atx - SGP) : Strategic Professional - Optionsnivethababu7No ratings yet

- 2017 Coa Aar PDFDocument150 pages2017 Coa Aar PDFJP De La PeñaNo ratings yet

- NTPC LIMITED Ion StudyDocument84 pagesNTPC LIMITED Ion StudyEndabetla PraveenkumarNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- Accounts Code Vol III Classification of Forest Receipt and ExpenditureDocument2 pagesAccounts Code Vol III Classification of Forest Receipt and ExpenditurepahbarpNo ratings yet

- IAS 40 Investment PropertyDocument10 pagesIAS 40 Investment PropertyGvNo ratings yet

- Financial Statement Analysis For MBA StudentsDocument72 pagesFinancial Statement Analysis For MBA StudentsMikaela Seminiano100% (1)

- 3 - Valuation of Equity Shares - Assignment (26-04-19)Document4 pages3 - Valuation of Equity Shares - Assignment (26-04-19)AakashNo ratings yet

- Bajaj AllianzDocument57 pagesBajaj AllianzDIpesh Joshi93% (30)

- Week 10 Books of AcctsDocument6 pagesWeek 10 Books of AcctsKirsten BentingananNo ratings yet

- Test Bank Aa Part 2 2015 EdDocument143 pagesTest Bank Aa Part 2 2015 EdNyang Santos72% (25)

- 9086sdaa2314-And Star Health InsuranceDocument19 pages9086sdaa2314-And Star Health InsuranceMuktikant MishraNo ratings yet

- HBS Private Equity Study PDFDocument66 pagesHBS Private Equity Study PDFanton88be100% (1)

- MANACCDocument12 pagesMANACCAllan Patrick AlsimNo ratings yet

- Encircle The Letter of The Correct AnswerDocument2 pagesEncircle The Letter of The Correct AnswerAnonymous EvbW4o1U7No ratings yet

- Q 13-1 RELEVANT COST: A Cost That Differs BetweenDocument5 pagesQ 13-1 RELEVANT COST: A Cost That Differs Betweensiti nazirahNo ratings yet

- FinMan DLSUD Mid-Term Exam April 11 2019Document4 pagesFinMan DLSUD Mid-Term Exam April 11 2019Raquel ManarpiisNo ratings yet

- Security 12 Jam DealDocument21 pagesSecurity 12 Jam DealBiyan FarabiNo ratings yet