Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (May 20, 2013

Uploaded by

Manila Standard TodayCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (May 20, 2013

Uploaded by

Manila Standard TodayCopyright:

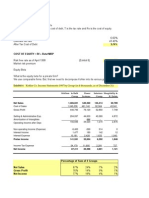

MST Business Daily Stocks Review

M

S

T

Monday, May 20, 2013

52 Weeks

High Low STOCKS

99

58.9

114

65

1.6

0.67

595

48

2.2

1.63

31

18

23.55

17.9

36.2

18.5

0.95

0.62

3.25

2

590

420

39.2

19.08

0.73

0.2

122

81.75

2.37

1.69

107.6

67.4

140

81

515

342

72

40.35

195.5

120.1

1100

879

127

95

2.71

1.71

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

Citystate Savings

COL Financial

Eastwest Bank

First Abacus

I-Remit Inc.

Manulife Fin. Corp.

Maybank ATR KE

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

40.5

31

12.56

6.22

2.26

1.26

48

25

1.59

1.2

50

17.1

5.95

2.12

3.12

2.42

29.3

7.7

7.2

4.32

7.9

5.59

14

5.63

27.45

13.58

113.8

61.5

24.6

16.5

0.027

0.0130

14

11

5.04

3.76

1.88

0.61

131.2

93

12.02

7.18

20.5

3.7

41.4

22.8

8.24

2.3

19.5

13.54

340

218.8

6.88

2.5

15.76

9.7

14

10.16

11.18

8.03

5.18

2.19

7.6

3

125

100

950

239

2.44

1.7

0.220

0.121

2.75

1.59

2.72

1.08

118

57.3

5.5

1.05

2.08

0.560

2.2

0.9

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alphaland Corp.

Alsons Cons.

Asiabest Group

Calapan Venture

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

DNL Industries Inc.

Energy Devt. Corp. (EDC)

EEI

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Lafarge Rep

LT Group

Manila Water Co. Inc.

Mariwasa MFG. Inc.

Megawide

Melco Crown

Mla. Elect. Co `A

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Salcon Power Corp.

San Miguel Corp `A

San MiguelPure Foods `B

Splash Corporation

Swift Foods, Inc.

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vulcan Indl.

1.03

0.64

61

44

23

10.86

2.7

1.88

7.1

4.25

2.98

0.9

608

400.2

64.8

50

3.5

2.35

3.68

1.15

6.32

3.87

805

455.4

8.38

4.02

45.7

30.9

6

3.25

5.7

2.3

7.68

5.04

1.39

0.86

0.74

0.320

3.82

1.680

6

3.85

7.65

4.38

9.66

1.65

0.0620

0.030

2.7

1.02

7.6

3.4

0.420

0.300

1199

557

2.71

1.23

0.425

0.250

0.770

0.330

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anglo Holdings A

Anscor `A

ATN Holdings A

Ayala Corp `A

Cosco Capital

DMCI Holdings

F&J Prince A

F&J Prince B

Filinvest Dev. Corp.

GT Capital

House of Inv.

JG Summit Holdings

Keppel Holdings `A

Keppel Holdings `B

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Mabuhay Holdings `A

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

MJCI Investments Inc.

Pacifica `A

Prime Media Hldg

Seafront `A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

Wellex Industries

Zeus Holdings

48

3.89

2.26

0.239

33.25

6.3

8.35

2.44

3

1.5

0.086

0.92

1.21

0.445

2.76

2.07

3.8

1.65

4.05

0.225

0.870

26.2

7.71

3.87

9.6

20.8

1.35

4.55

0.64

6.24

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

City & Land Dev.

Cityland Dev. `A

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Highlands Prime

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Development `A

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

15

2.39

0.47

0.162

18.8

4.62

3.7

1.35

1.5

1.05

0.060

0.7

0.61

0.155

1.63

1.17

1.31

1.03

1.88

0.105

0.540

15.74

2.35

2.4

5.72

12.1

0.65

3.14

0.49

3.5

3.15

1.62

42

24.1

18.98

1.05

0.95

0.6

16.04

8.3

21.8

8.13

0.1970

0.1010

24

3.1

77.9

52.4

12.5

9.9

7.65

4

1225

915

1374

990

11

8.15

96.95

65.9

10

4.65

6

1.75

0.15

0.019

0.0850

0.040

3.2600

2.000

9.9

6.45

1.06

0.6

4.08

1.44

22.95

13.78

3.47

2.39

130

40

17.88

12.10

3004

2290

43.6

21

22

3.5

4.5

1.14

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Asian Terminals Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Centro Esc. Univ.

DFNN Inc.

FEUI

Globe Telecom

GMA Network Inc.

I.C.T.S.I.

IPeople Inc. `A

IP Converge

IP E-Game Ventures Inc.

Island Info

ISM Communications

Leisure & Resorts

Manila Bulletin

Manila Jockey

MG Holdings

Pacific Online Sys. Corp.

Paxys Inc.

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

Puregold

STI Holdings

Touch Solutions

Yehey

0.0068

6.2

23.35

48

0.315

30.5

1.78

1.68

61.8

1.03

1.52

1.520

0.077

0.081

36.5

12.84

8.4

0.025

0.025

7.24

27.85

48

0.062

295

0.028

0.0039

4.01

16.8

10

0.240

15

0.82

0.91

9.9

0.48

0.8600

0.8600

0.047

0.047

15.78

4.7

3.07

0.016

0.017

5.62

12.52

11.1

0.038

200

0.014

Abra Mining

Apex `A

Atlas Cons. `A

Atok-Big Wedge `A

Basic Energy Corp.

Benguet Corp `B

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Oriental Peninsula Res.

Oriental Pet. `A

Oriental Pet. `B

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

50

578

10.92

116

75.15

79.25

1050

22.65

505

7.99

104.1

74.5

74.5

1000

ABS-CBN Holdings Corp.

Ayala Corp. Pref `A

GMA Holdings Inc.

PCOR-Preferred

SMC Preferred A

SMC Preferred C

SMPFC Preferred

2.93

0.96

Megaworld Corp. Warrants

Previous

Close

High

Low

FINANCIAL

105.5

101.8

96.10

94.50

107.00

106.50

1.38

1.32

77.50

77.00

2.18

2.14

11.98

11.50

20.5

20.3

37.2

36.65

0.82

0.82

2.97

2.70

575.00

575.00

32.1

32.1

0.450

0.425

136.40

133.70

1.86

1.86

34.2

34

112.00

109.50

142.90

139.00

489.8

485

73

72.75

187

182

1065.00

1060.00

156.10

153.80

2.77

2.76

INDUSTRIAL

36.35

36.35

36.1

6.55

6.49

6.4

1.9

1.9

1.83

17.02

17.1

16.7

1.40

1.42

1.40

20

19.96

19.68

6.88

7.38

6.9

3.05

3.10

3.09

16.6

16.6

16.4

8.32

8.470

8.35

6.35

6.40

6.31

15.20

15.72

14.90

22.2

22.8

22.2

106.7

106.7

103.5

17.60

17.50

16.52

0.0180

0.0180

0.0170

15.30

15.40

15.28

3.69

3.69

3.68

0.650

0.650

0.640

139.40

139.40

137.90

12.14

12.14

12.02

25.75

26.6

25.45

40.4

40.95

40.1

2.95

3.05

2.9

22.350

22.450

22.350

13.12

13.2

13.04

384.80

385.60

384.80

6.39

6.48

6.28

15.94

16.10

15.90

15.00

15.00

14.50

7.44

7.51

7.44

5.81

5.99

5.80

5.25

5.41

5.2

115.00

116.80

114.20

301.6

301.8

293

2.03

2.03

1.94

0.140

0.141

0.140

2.98

2.99

2.79

2.79

2.85

2.74

127.90

129.00

126.00

1.79

1.8

1.77

0.93

0.93

0.93

2.03

2.12

2.04

HOLDING FIRMS

0.65

0.66

0.65

56.00

56.50

55.50

26.00

26.10

25.65

2.25

2.26

2.25

6.94

7.00

6.90

1.61

1.45

1.43

668.5

678

669

16.62

17.04

16.62

58.00

59.85

58.00

3.79

3.9

3.72

3.99

3.8

3.8

6.70

6.75

6.66

852

860

854

9.10

9.21

8.93

48.50

48.50

47.10

5.21

5.4

5.2

5.6

5.2

5.2

6.82

6.86

6.78

0.8

0.84

0.8

0.710

0.740

0.680

1.68

1.8

1.66

6.09

6.20

6.08

6.4

6.37

6.3

5.8

5.61

5.58

0.0480

0.0480

0.0440

2.000

2.070

2.000

2.10

2.10

2.10

0.375

0.375

0.370

1179.00

1194.00

1179.00

2.18

2.21

2.17

0.2550

0.2600

0.2450

0.400

0.400

0.395

PROPERTY

24.00

25.00

24.50

2.64

2.68

2.50

1.750

1.790

1.760

0.212

0.219

0.214

33.90

34.90

33.80

6.45

6.59

6.42

6.51

6.5

6.45

2.28

2.31

2.12

2.45

2.50

2.50

1.14

1.21

1.17

0.079

0.078

0.078

0.68

0.70

0.69

1.120

1.110

1.090

0.350

0.350

0.340

2.27

2.29

2.10

2.22

2.27

2.17

2.55

2.50

2.28

1.45

1.45

1.41

4.05

4.08

3.86

0.1160

0.1170

0.1150

0.5400

0.5600

0.5300

24.70

24.75

24.65

3

3

2.94

3.90

3.81

3.81

8.53

8.71

8.54

20.15

20.25

19.86

0.79

0.8

0.77

3.93

3.93

3.92

0.690

0.690

0.640

6.880

6.880

6.770

SERVICES

1.84

1.89

1.84

45.45

46.3

45.45

1.31

1.34

1.34

0.820

0.830

0.820

13.2

13.2

13.2

12.80

13.10

12.86

0.1790

0.1820

0.1780

4.36

4.36

4.13

79.50

80.20

79.60

10.98

11.12

10.98

4.29

4.25

4.25

1290

1280

1280

1564

1599

1562

9.79

9.78

9.75

92.25

93.5

92.2

11.5

11.9

11.5

8.5

8.85

8

0.021

0.021

0.020

0.0540

0.0530

0.0510

2.4900

2.5000

2.3600

8.15

8.17

7.87

0.75

0.77

0.76

2.4

2.4

2.36

0.54

0.59

0.53

15.48

15.5

15.5

2.45

2.45

2.17

92.00

90.20

90.10

15.46

15.50

15.42

3180.00

3184.00

3178.00

39.85

40.40

39.85

1.00

1.00

0.99

19.7

20.3

19.72

1.360

1.360

1.360

MINING & OIL

0.0046

0.0047

0.0047

4.00

4.10

4.10

19.90

19.90

18.60

20.00

20.00

19.98

0.285

0.280

0.275

14.7

14.7

14.6

1.1

1.1

1.02

1.02

1.03

1.02

8.45

8.70

8.35

0.5

0.52

0.500

0.680

0.710

0.670

0.710

0.740

0.700

0.0510

0.0520

0.0500

0.0510

0.0520

0.0510

22

22.3

21.1

3.05

3.06

3

2.270

2.380

2.250

0.0260

0.0260

0.0250

0.0250

0.0260

0.0250

6.91

6.90

6.85

13.80

14.180

13.800

19.76

22

20

0.043

0.044

0.043

280.00

284.60

279.00

0.0150

0.0150

0.0150

PREFERRED

48

49

48

529

529

525

10

10

10

111

111

110.9

79.95

79.95

79.95

83.5

83.75

83.5

1070

1080

1080

WARRANTS & BONDS

2.96

2.96

2.84

104

95.80

106.60

1.32

76.95

2.18

11.50

20.3

36.65

0.83

2.97

575.00

32.25

0.440

136.30

1.88

34.05

109.80

143.00

485

73.5

181

1065.00

153.80

2.76

Close Change Volume

NetForeign(Peso)

Trade/Buying

102

94.85

106.70

1.35

77.20

2.14

11.50

20.4

36.7

0.82

2.71

575.00

32.1

0.440

134.00

1.86

34

110.50

139.00

485

73

184.5

1060.00

154.00

2.77

-1.92

-0.99

0.09

2.27

0.32

-1.83

0.00

0.49

0.14

-1.20

-8.75

0.00

-0.47

0.00

-1.69

-1.06

-0.15

0.64

-2.80

0.00

-0.68

1.93

-0.47

0.13

0.36

4,044,830

3,273,570

2,929,440

183,000

80,500

90,000

12,700

1,600

636,900

11,000

517,000

130

4,100

1,130,000

2,382,420

30,000

376,700

606,410

2,240

10,050

402,670.00

818,810

690

531,520

391,000

-24,761,146.00

19,397,164.00

-1,120,748.00

36.3

6.4

1.84

16.7

1.42

19.68

7.2

3.10

16.4

8.41

6.31

15.04

22.5

103.5

16.80

0.0180

15.30

3.69

0.640

138.00

12.02

25.75

40.4

2.9

22.400

13.08

385.60

6.32

15.96

14.50

7.51

5.84

5.41

114.20

295

1.94

0.140

2.79

2.75

128.00

1.78

0.93

2.10

-0.14

-2.29

-3.16

-1.88

1.43

-1.60

4.65

1.64

-1.20

1.08

-0.63

-1.05

1.35

-3.00

-4.55

0.00

0.00

0.00

-1.54

-1.00

-0.99

0.00

0.00

-1.69

0.22

-0.30

0.21

-1.10

0.13

-3.33

0.94

0.52

3.05

-0.70

-2.19

-4.43

0.00

-6.38

-1.43

0.08

-0.56

0.00

3.45

1,691,300

57,000

2,933,000

11,500

800,000

1,500

113,000

90,000

1,400

3,495,300

7,197,300

4,331,000

2,082,500

1,016,880

22,500

16,300,000

93,600

40,000

256,000

494,060

1,500,200

13,254,100

1,562,200

68,000

830,200

3,561,200

438,060

3,882,300

5,837,600

14,300

317,900

594,300

6,200

408,960

100,450

48,000

2,340,000

836,000

11,379,000

1,448,460

1,337,000

706,000

5,888,000

-294,360.00

0.65

55.50

25.65

2.26

7.00

1.45

675

16.76

59.00

3.9

3.8

6.70

856

9.05

47.10

5.4

5.2

6.82

0.8

0.680

1.79

6.14

6.3

5.58

0.0480

2.000

2.10

0.370

1185.00

2.17

0.2500

0.400

0.00

-0.89

-1.35

0.44

0.86

-9.94

0.97

0.84

1.72

2.90

-4.76

0.00

0.47

-0.55

-2.89

3.65

-7.14

0.00

0.00

-4.23

6.55

0.82

-1.56

-3.79

0.00

0.00

0.00

-1.33

0.51

-0.46

-1.96

0.00

924,000

1,275,100

19,984,500

501,000

403,400

22,000

266,670

1,310,100

1,191,370

40,000

30,000

1,024,600

138,100

1,992,000

6,350,100

10,800

3,000

1,192,100

51,000

6,532,000

2,541,000

64,776,200

19,000

49,900

6,600,000

31,000

242,000

1,210,000

246,935

394,000

290,000

260,000

21,450.00

-7,254,556.50

-7,444,350.00

-114,750.00

-2,078,724.00

24.95

2.65

1.790

0.214

34.55

6.56

6.5

2.15

2.50

1.20

0.078

0.70

1.100

0.345

2.16

2.17

2.50

1.41

3.9

0.1170

0.5600

24.70

2.95

3.81

8.65

20.00

0.79

3.93

0.660

6.800

3.96

0.38

2.29

0.94

1.92

1.71

-0.15

-5.70

2.04

5.26

-1.27

2.94

-1.79

-1.43

-4.85

-2.25

-1.96

-2.76

-3.70

0.86

3.70

0.00

-1.67

-2.31

1.41

-0.74

0.00

0.00

-4.35

-1.16

4,600

82,000

199,000

1,230,000

14,198,500

3,324,000

285,100

38,860,000

18,000

536,000

5,860,000

295,000

9,578,000

1,480,000

4,983,000

32,160,000

6,000

4,564,000

185,850,000

3,260,000

1,454,000

7,262,500

1,045,000

36,000

2,477,900

11,148,800

4,678,000

60,000

462,000

12,672,700

36,950.00

1.85

46

1.34

0.830

13.2

12.90

0.1790

4.2

80.00

10.98

4.25

1280

1580

9.75

92.7

11.9

8.48

0.021

0.0530

2.5000

8.00

0.76

2.4

0.54

15.5

2.17

90.10

15.48

3180.00

40.25

0.99

20

1.360

0.54

1.21

2.29

1.22

0.00

0.78

0.00

-3.67

0.63

0.00

-0.93

-0.78

1.02

-0.41

0.49

3.48

-0.24

0.00

-1.85

0.40

-1.84

1.33

0.00

0.00

0.13

-11.43

-2.07

0.13

0.00

1.00

-1.00

1.52

0.00

187,000

204,000

1,000

3,023,000

102,000

5,480,500

62,040,000

401,000

776,310

5,900

14,000

200

19,500

67,600

1,834,220

308,000

19,800

30,600,000

460,000

610,000

2,322,100

106,000

200,000

575,000

74,000

1,551,000

430

844,900

177,215

1,660,200

22,767,000

193,900

94,000

0.0047

4.10

19.00

20.00

0.275

14.7

1.08

1.02

8.61

0.5

0.680

0.720

0.0500

0.0510

21.1

3.03

2.280

0.0260

0.0250

6.85

14.00

20

0.043

279.00

0.0150

2.17

2.50

-4.52

0.00

-3.51

0.00

-1.82

0.00

1.89

0.00

0.00

1.41

-1.96

0.00

-4.09

-0.66

0.44

0.00

0.00

-0.87

1.45

1.21

0.00

-0.36

0.00

1,000,000

5,000

1,457,800

1,200

1,300,000

7,600

1,084,000

744,000

9,000

5,000

12,402,000

14,027,000

54,890,000

28,920,000

1,370,800

331,000

500,000

85,200,000

63,000,000

3,600

3,145,400

274,200

195,500,000

254,830

17,000,000

48

529

10

110.9

79.95

83.7

1080

0.00

0.00

0.00

-0.09

0.00

0.24

0.93

1,188,600

1,130

1,063,000

587,330

370,110

48,400

170

2.84

-4.05

556,000

-540,660.50

3,487,980.00

9,020.00

-966,010.00

-212,500.00

-143,123,822.00

511,000.00

34,453,460.00

-1,429.00

1,000,094.00

14,440,198.50

-2,365,375.00

28,094,727.00

13,820.00

319,620.00

-167,000.00

-158,100.00

6,788,880.00

-18,094,586.00

-11,601,702.00

6,724,905.00

-54,634,445.00

1,155,148.00

-95,940.00

5,617,253.00

-113,928.00

-2,446,120.00

-8,029,125.00

-2,029,380.00

9,564,306.00

63,156,100.00

20,974,683.00

1,895,586.00

785,943.00

1,985,056.00

-31,368.00

-4,798,386.00

14,345,932.00

140,000.00

-676,400.00

-6,217,160.00

-80,522,208.00

-4,650.00

105,000.00

51,300,630.00

-334,100.00

32,464,125.00

981,550.00

-5,116,190.00

8,198,643.00

-195,209,750.00

5,198,177.00

-142,740.00

-14,240.00

6,101,037.00

22,178,175.00

167,200,060.00

-5,529,343.00

1,826,450.00

3,749,390.00

-85,330.00

9,038,600.00

-457,430.00

-18,859,410.00

1,128,000.00

-280,092,490.00

-70,207,160.00

1,681,200.00

75,477.00

-79,112,054.00

-8,135,830.00

-1,340.00

16,374,752.00

53,700.00

-2,533,043.00

-8,062,165.00

-95,807,431.00

21,000.00

-1,228,431.00

-415,492.00

22,182,710.00

23,926,395.00

136,620.00

-15,221,942.00

-2,002.00

-64,680.00

-937,480.00

-1,020.00

-6,538,300.00

153,000.00

373,630.00

-452,250.00

-1,000,000.00

-2,642,664.00

-126,795.00

-645,000.00

-16,126,400.00

36,394,840.00

10,630,000.00

-8,375.00

You might also like

- Private Equity BookDocument141 pagesPrivate Equity BookBob Li100% (1)

- Marketable SecuritiesDocument18 pagesMarketable Securitiesammaramansoor133% (3)

- RSI Pro The Core Principles PDFDocument34 pagesRSI Pro The Core Principles PDFpankaj thakur100% (11)

- Boeing 777 CaseStudy SolutionDocument3 pagesBoeing 777 CaseStudy SolutionRohit Parnerkar80% (5)

- Corporate Actions PresentationDocument12 pagesCorporate Actions PresentationSheetal LaddhaNo ratings yet

- KohlerDocument10 pagesKohleragarhemant100% (1)

- Monmouth Inc. - SolutionDocument12 pagesMonmouth Inc. - SolutionAnshul Sehgal0% (2)

- H&M ValuationDocument32 pagesH&M Valuationifartunov80% (5)

- CIR Rules on Taxability of Stock Redemptions and DividendsDocument4 pagesCIR Rules on Taxability of Stock Redemptions and DividendsKristian AguilarNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 21, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 28, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 28, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 24, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 24, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 6, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 6, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 13, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 13, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 16, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 16, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 27, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 27, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 25, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (July 25, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (September 16-20, 2013) IssueDocument1 pageManila Standard Today - Business Weekly Stock Review (September 16-20, 2013) IssueManila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 19, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 19, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (October 14-18, 2013) IssueDocument1 pageManila Standard Today - Business Weekly Stock Review (October 14-18, 2013) IssueManila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 2, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 2, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 9, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 9, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 27, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 27, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 23, 2013Document1 pageManila Standard Today - Business Daily Stocks Review (August 23, 2013Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (June 23, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (October 25, 2013) IssueDocument1 pageManila Standard Today - Business Daily Stock Review (October 25, 2013) IssueManila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 7, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 7, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 27, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 27, 2014)Manila Standard TodayNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Document1 pageManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- What Is Meant by Book BuildingDocument2 pagesWhat Is Meant by Book BuildingParul PrasadNo ratings yet

- Making a Killing in the Stock MarketDocument38 pagesMaking a Killing in the Stock MarketVishal ManoriaNo ratings yet

- College of Accountancy & FinanceDocument5 pagesCollege of Accountancy & FinanceCecille GuillermoNo ratings yet

- Vanguard FTSE Canada Index ETF VCE: December 31, 2019Document2 pagesVanguard FTSE Canada Index ETF VCE: December 31, 2019ChrisNo ratings yet

- Capital Restructuring - CholamandalamDocument18 pagesCapital Restructuring - CholamandalamGaurav KumarNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersroukaiya_peerkhanNo ratings yet

- Record Bond TransactionsDocument8 pagesRecord Bond TransactionsVidya IntaniNo ratings yet

- Detail Audit Analysis of Financial StatementsDocument8 pagesDetail Audit Analysis of Financial StatementsAttesam100% (1)

- Euromoney Institutional Investor PLC The Journal of Private EquityDocument11 pagesEuromoney Institutional Investor PLC The Journal of Private EquityJean Pierre BetancourthNo ratings yet

- Need of The Study: Ratio Analysis and Comparative Study of Ratios of HPCL With Its CompetitorsDocument76 pagesNeed of The Study: Ratio Analysis and Comparative Study of Ratios of HPCL With Its Competitorssavita acharekarNo ratings yet

- Accounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500Document6 pagesAccounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500JINKY MARIELLA VERGARA100% (1)

- Intangible Assets Valuation in The Malaysian Capital MarketDocument22 pagesIntangible Assets Valuation in The Malaysian Capital Marketdavidwijaya1986No ratings yet

- Financial Planning and Forecasting Chapter 4 Learning ObjectivesDocument33 pagesFinancial Planning and Forecasting Chapter 4 Learning ObjectivesAL SeneedaNo ratings yet

- PT Krakatau Financial Statements and AccountsDocument19 pagesPT Krakatau Financial Statements and AccountsbajaybbbbgNo ratings yet

- Probability ChapterDocument124 pagesProbability ChapterManish GuptaNo ratings yet

- Financial Analysis of A BankDocument7 pagesFinancial Analysis of A BankLourenz Mae AcainNo ratings yet

- Net Benefits of Leverage for FirmsDocument56 pagesNet Benefits of Leverage for FirmsSajid KhanNo ratings yet

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckFirst Round CapitalNo ratings yet

- Monitor Int'l Stock Portfolio & Analyze PerformanceDocument3 pagesMonitor Int'l Stock Portfolio & Analyze PerformancehermerryNo ratings yet

- Caso Star Appliance CompanyDocument10 pagesCaso Star Appliance CompanyJuan0% (1)

- Myanmar Business Today - Vol 2, Issue 18Document32 pagesMyanmar Business Today - Vol 2, Issue 18Myanmar Business TodayNo ratings yet