Professional Documents

Culture Documents

465655FI AA Integration

Uploaded by

rah300Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

465655FI AA Integration

Uploaded by

rah300Copyright:

Available Formats

SAP-R/3 - Asset Management

Date: 18th Mar2005

Infosys Technologies Limited, Pune

Date 18Th Mar05

Author Manish Garg

Reviewed by Jinal Bipinchandra Shah

Date 11th Apr05

Description Original Document

DECLARATION: I hereby declare that this document is based on my personal experiences and experiences of my project members. To the best of my knowledge, this document does not contain any material that infringes the copyrights of any other individual or organization including the customers of Infosys. Manish Garg TARGET READERS: Functional / Technical Consultants in SAP Practice TABLE OF CONTENTS 1.0 Introduction 2.0 Chart of Depreciation 3.0 Asset Classes 4.0 Account Determination for Assets 5.0 Depreciation Areas 6.0 Depreciation Types 7.0 Depreciation Key 7.1 Valuation Methods 8.0 Fiscal Year and Periods 9.0 Illustrations 1. INTRODUCTION The Asset Accounting is used to manage and supervise Fixed Assets in SAP/3 system where it integrates with other module and provide detailed information on Fixed Assets required for various statutory, tax and management requirement. The R/3 Asset Accounting is intended for international use in many countries, irrespective of the nature of the industry. This means,

for example, that no country-specific valuation rules are hardcoded in the system. You give this component its country-specific and company-specific character with the settings you make in Customizing. The Implementation Guide (IMG) provides the necessary functions for this in Asset Accounting. The Fixed Asset module acts as a subsidiary ledger to the FIGeneral Ledger. This module keeps the detailed records of all the assets purchased, transferred, and disposed of during the year. The Module enables the automatic calculation of depreciation and gives the planned idea as to how the asset is going to be depreciated during its useful life. The Asset Management module maintains each asset with a separate numbers in a particular company and hence identity of that asset is maintained in asset module and simultaneously accounting details are maintained in FI-GL module. This module maintains comprehensive details of asset such as transaction details, location, identification number, inventory number, insurance details, net worth tax, valuation, depreciation details etc.

2. CHART OF DEPRECIATION The Asset accounting starts with defining a Chart of Depreciation. This Chart of Depreciation is designed to incorporate all the statutory requirements of a country. The Chart of Depreciation is country specific and independent of Chart of Accounts. There can be more than one Chart of Depreciation depending on the countries in which a particular company operates. For example if a client operates in two different countries and is having two company codes, it may have two chart of depreciation provided there are different depreciation rules and regulation. The Chart of depreciation is then assigned to a company code which operates in that particular country. Chart of Depreciation in independent of Chart of Accounts. Prerequisites Chart of Accounts created Company code defined.

Path: SPRO

New Chart of Depreciation ZARS is created for Company Code ZARS. Fiscal Year for Co. Code ZARS April 04- March05

T Code OAOB Purpose This T Code is used to assign Chart of Depreciation to company code. As a result the asset valuation for this company code is done as per the chart of depreciation assigned. Here we can see that Chart of Depreciation is assigned to various companies. In our case Chart of Depreciation ZARS is assigned to Company Code ZARS. The next step is to create asset Classes 3. ASSET CLASSES The assets which a company acquires can be classified into certain broad categories on the basis of purpose, functionalities and legal requirement and that broad category can be defined as Asset Class under which any asset purchased is classified. The basic functions of Asset class is to control the screen layout for a particular asset, number ranges and most importantly Account determination which in turn determines the Accounts which will be impacted automatically once the posting is done for any assets. The asset classes are maintained at Client level and can be used by any company irrespective of Chart of Depreciation. An asset class can have more than one chart of depreciation assigned to it and thus can be used by a client for all of its companies. Prerequisites Account determination Key defined.

Screen layout for assets defined. Number ranges for asset class defined

Transaction Code: OAOA Purpose This T Code is used to create new asset class. This controls number range, screen layout and account determination Once a new asset class is created, all asset masters falling within that category can be created in that asset class.

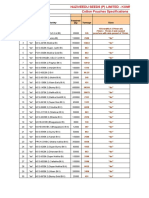

T-Code OAOA Here we can see that various asset classes are being defined for ZARS.

For the asset class 3000, account determination key 30000 is assigned and which controls the GL posting of this particular assets. Screen layout 3000 controls the screen of asset data for this particular asset. This is internal number assigned asset class. However prior to defining asset classes, Account determination key needs to be defined and has to be assigned to asset class. Next step is to define number range for the Company code ZARS T Code- AS08 Purpose This T Code is used for assigning number range to company code. Once this is done, asset class having number range as defined here are available for creation of asset master.

From the above screen we can see that No. ranges are defined for company code. Number range 03 is assigned to asset class 3000 and hence when any asset is created under this asset class for company code ZARS asset number generated will be within the number range interval assigned to this number range. 4. ACCOUNT DETERMINATION FOR ASSETS In this step, you define the account determinations for Asset Accounting (key and description). The key of an account determination must be stored in the asset class. In this way, the account determination links an asset master record to the general ledger accounts to be posted for an accounting transaction using the asset class. You specify the general ledger accounts to be posted for the individual accounting transactions in later implementation activities. You can specify various accounts for each depreciation area to be simultaneously posted to. The account determination key defines the reconciliation account in financial accounting that should be posted in Asset postings. Prerequisites GL Account for depreciation expenses, gains , losses etc already defined in Chart of Accounts GL Account for Balance sheet items for assets defined. Depreciation Area defined.

Company Code ZARS uses ZARS as Chart of Accounts companies .GL accounts are defined for INT and assigned to A/C Determination keys. This helps in automatic updation of accounts in FI-GL T-Code AO90

Purpose This T Code is used determination key. to assign GL Accounts to account

This account determination key is assigned to Asset class, hence works as integration of Asset module with GL

The above screen shows that for Chart of Depreciation ZARS and Chart of Accounts INT there are GL Accounts defined under categories Balance Sheet, Depreciation, and special Reserve for each account determination key for depreciation Area 01. In the later part, there is a detailed description about depreciation area.

T-Code AO90 Here GL accounts categorized under Balance Sheet are assigned to A/C determination Key 3000. Hence in case any purchase of asset is posted to asset classified under the Asset Class 3000 to which a/c determination 30000 is assigned, the amount gets posted to GL Account 21000 automatically and hence there is no need to make separate posting. Once we have configured asset class and account determination, we need to define depreciation areas. This is where Asset Module integrates with G/L module. So depending on companys requirement for asset accounting ,G/L is mapped in Chart of Accounts and which later on is assigned to Account determination Key. 5. DEPRECIATION AREAS Depreciation areas are used to calculate different values in parallel for each fixed asset for different purposes. For example, we can have different depreciation areas for Financial Statement or Cost Accounting or Income tax purpose. One can specify asset specific depreciation terms for every depreciation area. This makes it possible to value assets at straight line method for internal accounting purpose and reducing balance for Balance Sheet purpose. There can be 99 depreciation areas defined for each company depending on requirement. However SAP provides sample depreciation Chart of Depreciation for different countries. So Chart of depreciation can be copied from there and then if required more depreciation areas can be created and those which are not required may be deactivated.

Chart of Depreciation maintains asset values and depreciation in parallel for each depreciation area. Prerequisites Chart of depreciation defined. T Code OADB Purpose This T Code is used to create depreciation area.

Here in the above screen for ZARS, we can see that there are four depreciation areas maintained to meet requirement for Balance Sheet, Taxes, and Cost Accounting and for Group Company accounting purpose. T Code-OADB Purpose Here we define whether Dep. area would be maintained as real dep. area and whether as a derived depreciation area etc.

In above screen we can see that for depreciation area 01, Book Depreciation, GL posting is allowed and only positives values allowed in acquisition which means negatives values cannot be posted and in Net Book value all values allowed is selected which means negative posting can be done. T Code OADX Purpose Here we define which depreciation area. area will be maintained as real

The above screen shows that all G/L posting and accounting entries for assets gets posted to depreciation area 01 while for other areas there wont be any G/L postings. Once we have defined depreciation areas, we need to create some rule so that even if the posting is made for one depreciation area, the values

get carried to other depreciation areas as well. This is known as rules for takeover T Code- OABC Purpose This t-code is helps in defining the takeover rule for depreciation area, as not all depreciation area are maintained as real depreciation area , some rule has to be created so that non-real areas get values from real dep. areas. This is used for takeover of values

The standard system copies the asset balance sheet values from depreciation area 01 to all other depreciation areas during posting. (The only exceptions to this rule are areas for revaluation and for investment support, as well as derived depreciation areas.) Therefore, you only need to carry out this step if you want to copy posting values from a different depreciation area, not depreciation area 01. From the above screen ,we can see that for ZARS, depreciation area 15, 20, 30 copies the Balance sheet values from area 01. Since identical column for area 30 is ticked it wont be possible to make changes in value while creating asset master. Next step is to define rule for taking over depreciation terms from some other already defined depreciation areas. T Code-OABD Purpose This is used for takeover of depreciation terms

For ZARS, in Dep. Area 15 and area 30, a dep term of 01 gets copied. Since for both the areas 15 and 30, identical column is set as checked, it wont allow the dep terms to be changed while creating asset master. Next comes assigning depreciation key to depreciation area Prerequisites Depreciation key defined Asset Class defined. Screen layout rule for depreciation defined.

Here depreciation key, useful life config setting is done which in turn defaults while creating asset master under this asset class. After this we need to define depreciation key. 6. DEPRECIATION TYPES The depreciation types maintained for each depreciation area are Ordinary depreciation, unplanned depreciation, transferred reserves and special depreciation. The purpose of ordinary depreciation is to post the planned depreciation for wear and tear of asset through automatic depreciation run. Unplanned depreciation is required to post certain exceptional postings for damages, permanent decrease in value. This is done manually. Special depreciation is required basically to reconcile the differences between tax and accounts depreciation. We can maintain different depreciation types for depreciation areas defined depending on requirement. Prerequisites Depreciation area defined T Code-OABN Purpose

This T Code is used to define for depreciation areas where ordinary dep. is desired.

In the above screen we can see that for ZARS, ordinary depreciation is maintained for all depreciation Areas. T Code- OABS Purpose This T Code is used to define for depreciation areas where special dep. is desired.

From the above screen it is clear that special depreciation is not maintained in Chart of Depreciation ZARS. T Code OABU Purpose This T Code is used to define for depreciation areas where unplanned dep. is desired.

However unplanned depreciation is maintained for all the dep. areas in Chart of Dep. - ZARS.

This setting allows all values to be posted for ord. dep for ZARS. The next step is to assign GL accounts for ordinary depreciation posting. Since Chart of Accounts for ZARS is INT, GL account is defined under INT and then assigned here. Purpose Assigning GL Accounts for ordinary dep.

In ZARS, unplanned dep is maintained in the following GL Accounts. This transaction provides the flexibility of maintaining unplanned depreciation in different GL Accounts. In our case however same GL account is maintained for ordinary and unplanned depreciation T Code-AO95 Purpose Assigning GL Accounts for unplanned dep.

No GL account assignment for special reserves, as it is not maintained in ZARS.

The above screen shows that no GL Account is maintained for ZARS. In case if there is a requirement we can maintain GL Accounts for special reserves as well. 7. DEPRECIATION KEY Depreciation Key contains value settings which are necessary to determine the depreciation amounts. It represents a combination of calculation rules which are used for automatically calculated depreciation types. Depreciation keys are defined at Chart of Depreciation level, hence available for all company codes within that client.

There are various calculation method assigned to depreciation key which forms the basis for calculation of depreciation. Various methods are: Base method, declining balance method, multiple level methods, period control and changeover method. Prerequisites Valuation method such as base method, declining balance method, and maximum amount method defined Chart of depreciation defined

This is SPRO screen where we can make depreciation key settings

7.1 VALUATION METHODS Below is the base method config setting screen

Purpose This transaction is used to determine whether dep % will be derived from stated % or from the useful life of the asset. Base method provides the features which further control the depreciation percentage. In this particular example dep method set as % from useful life means depreciation calculation needs to done on the basis of useful life and not on the basis of stated %.Also it provides the feature of defining whether you want the depreciation to continue after depreciation period ends. Below is config setting screen for declining balance method T Code-AFAMD Purpose This T Code is used to limit the depreciation % within a particular range.

This method helps in maintaining the depreciation rate within a min and maximum limits of depreciation. This is later on assigned to depreciation key. For example if dep. arrived on the basis of useful life is 5%, but max % set as 3%, the dep will be calculated at 3% and not 5%. Below are the config settings for multiple level methods. T Code AFAMS Purpose This T Code is used in case where asset is depreciated at varying % during its useful life.

Multiple level methods allows asset to be depreciated at different rates in different years. In this example this key allows the asset to be depreciated at 7%for first 4 years , then at 5% for next 6 years , at 2% for another 6 years, and then at the rate of 1.25% for next 24 years. So this allows the asset to be depreciated at different rates during its useful life. Below are the config settings for period control method. T Code- AFAMP Purpose This T Code is used for determining the dep. period depending on acq/transfers/retirements date.

This key helps in determining as to how you would like to depreciate acquisitions, addition, transfers etc.If for example there is a statutory requirements that any asset which is purchased at any time in second half needs to be depreciated for 6 months , this key helps in configuring such settings. T Code- OAVH

Here for each period control key, calendar assignment is made. Below is given the config setting for depreciation key.

T Code- AFAMA Purpose This T Code is depreciation key. used for assigning valuation method to

Here all the calculation methods are assigned to a particular depreciation key which then makes complete parameters for depreciating an asset. Various complex depreciation calculations can be done with the help of this depreciation keys. 8. FISCAL YEAR AND PERIODS Asset accounting used fiscal periods defined in FI and uses the fiscal year variant defined Period Control: Period control in the depreciation key determines the start and end of depreciation when asset transactions are posted Period control determines the relationship between the calendar period in which the asset transaction is posted and the depreciation period. Calendar periods are independent of the posting periods in FI. The only restriction is that the beginnings of the first calendar period and the end of the last calendar period defined in a period control have to match the start date and final date of the fiscal year in FI 9. ILLUSTRATIONS Transaction for Assets Accounting in SAP/3 ASSET - MASTER DATA T Code-AS01 Purpose Creating Asset mater.

The above screen shot shows that a new asset is created in Company code ZARS under asset class 3000. The asset number range is generated automatically. The new asset created is assigned a new number 3000000021.The asset capitalized is on 01/01/2005. There are other screens also where we can fill the details related to controlling, location, asset super number, insurance details, leasing, net worth tax, depreciation parameters etc.

In the above screen, depreciation Keys parameters are assigned to various depreciation areas (01, 15, 20, 30) and useful life of assets is defined .The combination of this will result in automatic calculation of depreciation. POSTINGS The next step is to make posting in the asset no. created. There are various ways in which asset acquired such as In-house acquisition, External acquisitions, Transfers etc. For our case we will take the scenario where there in in-house acquisition ACQUISITION T Code- AFZE (for In-house acq.)

Here the G/L accounts are automatically picked up and we are not assigning GL Accounts to this transaction. This is happening because earlier we have assigned GL Accounts to Asset Class through A/C determ. Key.

The above screen shot shows asset transactions, depreciation calculation for depreciation Area 01. Similarly for other areas also planned depreciation calculated can be displayed. In this case asset was acquired in-house for Rs. 20000 Whenever a posting is made for assets, the transaction gets updated in Asset module and simultaneously it also updates in GL .A/C. The GL Account for the above asset class 3000 is G/L A/C No 21000 (Office Equipment). Hence all acquisition entry for all assets created under the asset class 3000 for Chart of Accounts INT gets updated in the abovementioned a/c. There are other screens also for posted values, depreciation parameters which display depreciation actually posted in Books and depreciation terms. Clicking on the transactions line item will take us to the document posted in FI-GL.

This is a display of accounting document for in-house acquisition from vendor for asset nos. 3000000021 which is posted automatically to GL account 21000, which is assigned to Asset Class 3000 through A/c determ. Key.

From the above screen it is clear that GL A/C No. 21000 is assigned to A/c Determination Key 30000, which in turn is assigned to Asset Class 3000.

Other T Codes for acquisitions: F-90, ABZON, and ABZP In the next step, we would pass a transaction for the retirement of the same asset. RETIREMENT T Code- ABAON

The same asset can be displayed by running through T Code AS02

From this screen it is clear that asset is retired for Rs. 15000.00. Document posted by running transaction No. ABAON is as follows:

From the above screen, it is clear that the same asset is credited to A/C 21000 and losses, and depreciation for 4 months is booked. GL Accounts which are getting affected are GL Accounts assigned to Account determination Key in SPRO. Thus enables automatic posting in GL module when transaction in asset module is run. Other T- Codes: F-92, ABAVN (retirements) Once asset is retired, the asset gets deactivated and no more posting to this asset is allowed.

PARTIAL RETIREMENT An asset can be partially retired also. T Code-ABAON

The above screen shows that the asset is retired for Rs. 9000, as a result the balance amount is carried forward to the next year which is shown in the following screen.

TRANSFERS T Code ABUMN

Document posted by running this transaction is as follows.

Display of Asset No. 3000000022 after transfer

Display of Asset No. 3000000023 after transfer

The above is the example of asset transfer within company. We can also make inter-company transfer of assets; T code for this is ABT1N DEPRECIATION RUN T Code -AFAB

From the above screen we can see that, we can post depreciation as planned, repeat, restart or for unplanned depreciation. Planned depreciation run can be made period wise only. So we cannot skip one period and run it for the subsequent periods. This is possible by making an unplanned depreciation run. In planned depreciation, posting cannot be made asset wise and it has to be made for all the assets within that company code. Repeat option makes adjustment for any changes made in depreciation parameter of any asset. We can limit it to a particular asset. In case any asst posted in previous year and depreciation run for that period is already made then repeat depreciation run can be executed. The document posted will be for that asset only. Restart posting run option is required in case posting run is terminated due to some technical interruptions. The depreciation run can be done only as at the background. Once it is run at the background, we can see the transaction details in T Code SM37.

There is actual posting in assets master and simultaneously document gets generated in FI-GL module. A new Asset 3000000024 is created and acq. Of Rs. 30000.00 is posted to same asset. The depreciation parameter for this asset is useful life -10 years and depreciation period is 6 months. So depreciation for 6 months comes to Rs. 1500.00. The same figure gets posted once dep. run in repeat mode is made. Since planned dep. Run for period 12 is already done, we need to select repeat mode of dep. Run for making posting in this asset.

The above screen shows that dep. posted in this asset is Rs. 1500.00. Display of document no. 400000006 for dep. posting is as follows.

ASSET UNDER CONSTRUCTION A new asset 4000000005 is created for Asset under construction under asset class 4000 (a separate asset class is to be created for AUC Assets). There is no depreciation key assigned to it as AUC assets are nondepreciable assets. In this asset all the expenses incurred are allocated to this asset. In our example we made a posting for Rs. 25000.00 to this asset. Next we need to create settlement rule and post the values to different asset. Example: One AUC (4000000005) is created for a project which when completed leads to creation of 2 or more different assets. The cost so

accumulated in AUC will ultimately settle to the depreciable assets created on some basis. T Code AIAB (for creating settlement rule)

The above screen shows that the cost accumulated in asset will be settled to 2 assets @ 50 % each. Once settlement rule is created we need to execute settlement run. T Code for settlement is AIBU

The above screen shows that cost accumulated in asset 4000000005 is distributed between two assets of Rs. 12500.00 each.

The above screen of AUC asset shows that the entire values are settled. Similarly the other two assets will show the value transfer. LEGACY ASSET DATA TRANSFER SAP provides the facility of creating an asset in current financial year which is already pre-existing at the year beginning. Manually we can create asset in current year and post values for previous year. T code- AS91

A new asset 3000000025 is created as for legacy asset data.

The above screen shows that for asset 3000000025, APC & Accumulated dep. values exist at the beginning of the year. FISCAL YEAR CLOSING FOR ASSET Before we can close a fiscal year in Financial Accounting, we have to carry out preparatory measures in Asset Accounting. Once the fiscal year is closed, we can no longer post or change values within Asset Accounting. The fiscal year that is closed is always the year following the last closed fiscal year. We cannot close the current fiscal year. You have to carry out the year-end closing as background processing for performance reasons. Checks The system only closes a fiscal year in a company code if The system found no errors during the calculation of depreciation Planned depreciation from the automatic posting area has been completely posted to the general ledger. Balances from depreciation areas that are posted periodically have been completely posted to the general ledger. All assets acquired in the fiscal year have already been capitalized. All incomplete assets (master records) have been completed. T Code-AJAB Purpose Close the Fiscal year for company code for assets.

Once this transaction run is made, no posting for assets can be done in closed fiscal year.

Execute it in background

This is the spool generated which can be viewed using T Code-SM37. T Code AJRW Purpose This will open up new fiscal year for asset posting.

In the above screen, we enter the name of company code and the new fiscal year details.

This is the spool created by running the above transaction in background. This can be viewed using Code SM37 USEFUL REPORTS FOR ASSETS Path:

T Code - S_P99_41000192 The screen given below, shows details of posted depreciation, for different depreciation types.

Report on Asset Balances as on date (Asset number wise)This report will give information on assets- APC value, accumulated depreciation and NBV under particular asset class and for the desired dep. area... T Code - S_ALR_87011963

There are other reports on asset balances which are as follows: S_ALR_87011964 - ... by Asset Class S_ALR_87011965 - ... by Business Area S_ALR_87011966 - ... by Cost Center S_ALR_87011967 - ... by Plant S_ALR_87011968 - ... by Location S_ALR_87011969 - ... by Asset Super Number S_ ALR_87011970 - ... by Work list. TABLES ON ASSETS Some of the useful Tables relevant to Asset module are ANLA, ANLB, ANLC, ANLZ, ANLV, ANEP, T095

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Configuring SAP R3 Plant MaintenanceDocument10 pagesConfiguring SAP R3 Plant Maintenancerah300No ratings yet

- 6458465Std. Reports in SAPDocument4 pages6458465Std. Reports in SAPrah300No ratings yet

- Process Analysis: I D I / TH H Introduction / The Three MeasuresDocument39 pagesProcess Analysis: I D I / TH H Introduction / The Three Measuresrah300No ratings yet

- IsaiahDocument7 pagesIsaiahJett Rovee Navarro100% (1)

- Task Performance Valeros Roeul GDocument6 pagesTask Performance Valeros Roeul GAnthony Gili100% (3)

- Cooking Oils and Smoke Points - What To Know and How To Choose The Right Cooking Oil - 2020 - MasterClassDocument7 pagesCooking Oils and Smoke Points - What To Know and How To Choose The Right Cooking Oil - 2020 - MasterClasschumbefredNo ratings yet

- Things in The Classroom WorksheetDocument2 pagesThings in The Classroom WorksheetElizabeth AstaizaNo ratings yet

- Masmud Vs NLRC and Atty Go DigestDocument2 pagesMasmud Vs NLRC and Atty Go DigestMichael Parreño Villagracia100% (1)

- 2011 Innovation & Operations ManagementDocument16 pages2011 Innovation & Operations Managementrah300No ratings yet

- Media For Export ECC6IDESDocument17 pagesMedia For Export ECC6IDESrah300No ratings yet

- Sequential Walk Through SAPDocument7 pagesSequential Walk Through SAPrah300No ratings yet

- JurisprudenceDocument11 pagesJurisprudenceTamojit DasNo ratings yet

- Bon JourDocument15 pagesBon JourNikolinaJamicic0% (1)

- Cotton Pouches SpecificationsDocument2 pagesCotton Pouches SpecificationspunnareddytNo ratings yet

- Industrial Cpmplus Enterprise Connectivity Collaborative Production ManagementDocument8 pagesIndustrial Cpmplus Enterprise Connectivity Collaborative Production ManagementEng Ahmad Bk AlbakheetNo ratings yet

- Divorced Women RightsDocument41 pagesDivorced Women RightsAnindita HajraNo ratings yet

- Anti Dump ch-84Document36 pagesAnti Dump ch-84Tanwar KeshavNo ratings yet

- Event Planning Sample Cover Letter and ItineraryDocument6 pagesEvent Planning Sample Cover Letter and ItineraryWhitney Mae HaddardNo ratings yet

- 6977 - Read and Answer The WorksheetDocument1 page6977 - Read and Answer The Worksheetmohamad aliNo ratings yet

- Boylestad Circan 3ce Ch02Document18 pagesBoylestad Circan 3ce Ch02sherry mughalNo ratings yet

- Total ChangeDocument9 pagesTotal ChangeaurennosNo ratings yet

- DB - Empirically Based TheoriesDocument3 pagesDB - Empirically Based TheoriesKayliah BaskervilleNo ratings yet

- Civil and Environmental EngineeringDocument510 pagesCivil and Environmental EngineeringAhmed KaleemuddinNo ratings yet

- Case 3 GROUP-6Document3 pagesCase 3 GROUP-6Inieco RacheleNo ratings yet

- Solved SSC CHSL 4 March 2018 Evening Shift Paper With Solutions PDFDocument40 pagesSolved SSC CHSL 4 March 2018 Evening Shift Paper With Solutions PDFSumit VermaNo ratings yet

- Snowflake Core Certification Guide Dec 2022Document204 pagesSnowflake Core Certification Guide Dec 2022LalitNo ratings yet

- Succession CasesDocument17 pagesSuccession CasesAmbisyosa PormanesNo ratings yet

- Bakery Management SynopsisDocument13 pagesBakery Management SynopsisSHiVaM KRNo ratings yet

- Neolms Week 1-2,2Document21 pagesNeolms Week 1-2,2Kimberly Quin CanasNo ratings yet

- Send Me An AngelDocument3 pagesSend Me An AngeldeezersamNo ratings yet

- STS INVENTOR - Assignment 3. If I Were An Inventor For StsDocument2 pagesSTS INVENTOR - Assignment 3. If I Were An Inventor For StsAsuna Yuuki100% (3)

- Peptic UlcerDocument48 pagesPeptic Ulcerscribd225No ratings yet

- Part A Questions and AnswersDocument10 pagesPart A Questions and Answerssriparans356No ratings yet

- Problem Based LearningDocument23 pagesProblem Based Learningapi-645777752No ratings yet

- The Rescue Agreement 1968 (Udara Angkasa)Document12 pagesThe Rescue Agreement 1968 (Udara Angkasa)Rika Masirilla Septiari SoedarmoNo ratings yet

- Narrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"Document1 pageNarrative of John 4:7-30 (MSG) : "Would You Give Me A Drink of Water?"AdrianNo ratings yet