Professional Documents

Culture Documents

Hot Topic: XBRL-A New Era in The Delivery of Financial Information?

Uploaded by

urkerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hot Topic: XBRL-A New Era in The Delivery of Financial Information?

Uploaded by

urkerCopyright:

Available Formats

Hot Topic

XBRLA New Era in the Delivery of Financial Information?

A Publication Prepared by Ernst & Youngs Professional Practice Group March 7, 2008

Overview .......................................................1 XBRL Background .......................................2 SEC Initiatives .............................................2 CIFiR Proposal .............................................2 Ernst & Young Insights ..............................3 Summary.......................................................4

Overview

For several years, momentum has been building for a single electronic financial reporting standard to allow efficient retrieval and analysis of financial information. The goal of electronic financial reporting is to provide better, faster, cheaper, and more consistent financial information that will support more informed business and investing decisions.

In December 2007, an SEC funded

XBRL taxonomy for US GAAP was released for public comment.

The February 14, 2008 Progress

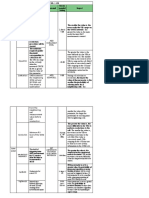

Report of the SEC Advisory Committee on Improvements to Financial Reporting (CIFiR) includes a proposal that the SEC ultimately require XBRL formatted financial statements in SEC filings. The CIFiR Progress Report, on which the SEC has solicited public comment, also proposes a phase-in for SEC mandated XBRL tagging. Later this year, the SEC is expected to consider proposing a rule that would mandate the use of XBRL by certain large accelerated filers, perhaps by as early as the end of 2008.

Several recent developments have heightened awareness of Interactive Data (eXtensible Business Reporting Language XBRL) as the potential electronic financial reporting standard for SEC registrants:

These developments have led to increased interest about XBRL among public companies. In this publication, we review the history and current status of XBRL, as well as its potential future in financial reporting.

XBRLA NEW ERA IN THE DELIVERY OF FINANCIAL INFORMATION

XBRL Background

Eight years ago, XBRL International (a not-for-profit consortium) began developing the XBRL standard for the electronic communication of business and financial information. Its supporters envision XBRL as the successor to current paper-based and electronic financial reporting formats. XBRL is based on XML (Extensible Markup Language), which allows for the exchange of data by encoding information in a meaningful way. Computer applications can use XBRL data intelligently in that those applications can recognize the information in an XBRL document, select it, analyze it, store it, exchange it with other computers, and present it in a variety of ways for users. The idea behind XBRL is simple. Instead of treating financial information as a block of text - as in a standard internet page or a printed document, XBRL provides an identifying tag for each individual item of data, whether numeric or textual. This tag is computer readable. For example, cash, as reported on a companys balance sheet, has its own unique tag. XBRL uses these tags for the presentation and definition of information. Tags are defined and maintained in taxonomies which contain meta-data (data about data) such as labels, data types, balance and period type. In effect, taxonomies are the dictionaries that XBRL uses to identify information included in electronic documents. XBRL is extensible in that preparers are able to customize and extend the standard taxonomies. That is, a preparer can create, define and describe new tags

unique to its particular circumstances, while otherwise maintaining the comparability of its other information tagged using the standard taxonomy. XBRL was designed to be flexible and is intended to support all current aspects of financial reporting across countries and industries. Its extensible nature means that it can be adjusted to meet particular business requirements, including internal reporting needs within an organization. The worldwide use of XBRL has increased during the past few years. Government regulators in at least ten European countries have adopted, or are in process of adopting, XBRL as the standard for filing financial reports. Also, in Australia, Canada, Israel, Japan, and Korea, various projects are underway or in development to use XBRL to satisfy regulatory filing requirements.

member of XBRL International) to develop such a taxonomy. This effort took place over the following year with the help of various industry groups, public accounting firms and regulatory agencies. On December 5, 2007, the SEC announced that the US GAAP Taxonomy was available for public review and comment. The SEC encourages users and preparers of financial reports to review the taxonomy and provide comments. Those wishing to do so may access the taxonomy at http://usgaap.xbrl.us. Comments are due by April 4, 2008. Thus, companies now can familiarize themselves with the XBRL US GAAP Taxonomy that ultimately could be used for XBRL filings with the SEC. Companies can see how well the taxonomy supports their financial characteristics and terminology. Companies also can identify any gaps that otherwise might require them to develop their own extensions.

SEC Initiatives

The SEC has become very interested in the potential of XBRL. In April 2005, the SEC launched its Interactive Data voluntary filing program to evaluate potential benefits, including whether interactive data could make filings more accessible and understandable to the average investor. To date, participation in the SECs XBRL voluntary filing program has been limited to a relatively small number of registrants, and the general usefulness and consistency of their filings have varied. Variability in quality and consistency of voluntary XBRL filings has been due, at least in part, to the lack of a robust XBRL taxonomy for US GAAP financial reporting. Accordingly, in late 2006, the SEC contracted XBRL US (a not-for-profit

HOT TOPIC MARCH 7, 2008

CIFiR Proposal

The February 14, 2008 Progress Report of CIFiR, a federal advisory committee charged with examining the U.S. financial reporting system, includes a proposal that the SEC ultimately require XBRL in financial statements in SEC filings. CIFiR proposes that the SEC should, over the long-term, mandate use of XBRL, once certain preconditions are met. The preconditions relate to the successful testing of the XBRL US GAAP Taxonomy, the ability of the SECs EDGAR filing system to accept and accurately render XBRL tagged filings, and the readiness of SEC reporting companies to make XBRL filings.

XBRLA NEW ERA IN THE DELIVERY OF FINANCIAL INFORMATION

The CIFiR Progress Report also proposes a phase-in for SEC mandated XBRL tagging. As proposed, in Phase I, the 500 largest domestic public companies would be required to furnish, through the SECs EDGAR filing system, XBRL tagged financial statements, with the financial statement notes each tagged only as block text (e.g., one tag per note). In Phase II, after one year, all domestic large accelerated filers would join the mandatory XBRL tagging group. Then, CIFiR proposes that the SEC evaluate whether and when to (1) require the XBRL tagged financial information to be filed rather than furnished, and (2) extend XBRL tagging to all SEC reporting companies. The CIFiR Progress Report also notes that an important issue related to tagging public company financial statements using XBRL involves whether assurance should be provided by a third party. While independent assurance could increase public confidence in XBRL documents, CIFiR is concerned that the cost and time incurred to obtain such assurance might outweigh the benefits to preparers and users. Therefore, CIFiR has not proposed that the SEC mandate assurance during the initial two XBRL phase-in periods discussed above. Instead, CIFiR suggests that the SEC and PCAOB seek input from companies, investors, and other market participants as to the type, timing, and extent of assurance, if any, during the phase-in periods and thereafter. The SEC has requested public comment on the CIFiR Progress Report by March 31, 2008. The CIFiR Progress Report is available on the SEC website and in the February 28, 2008 edition of the Federal Register.

Ernst & Young Insights

Considering recent developments, including CIFiRs proposal, we believe the likely next step will be SEC proposed rulemaking in the spring or summer of 2008 to mandate the use of XBRL by a select group of the largest public companies. It is possible that the SEC could adopt a final rule this year that might require the largest public companies to furnish XBRL formatted financial statements as soon as December 31, 2008.

Although there are benefits, there also will be costs associated with the implementation of XBRL. Preparing filings using XBRL likely will require additional efforts on the part of registrants. This could be particularly true with respect to tagging the various elements of information included in notes to the financial statements. However, the incremental effort associated with XBRL might decline over time based on the learning curve. Other potential costs could relate to auditor involvement with XBRL filings, although it seems unlikely that the SEC will mandate auditor reporting, at least initially. Nevertheless, some issuers still might engage their auditor to provide assurance in order to enhance confidence in the quality of their XBRL submissions.

Benefits and Costs of XBRL

Those that stand to benefit the most from XBRL are the users of financial data, including governments, regulators, economic agencies, stock exchanges, financial information companies, company managers, financial analysts, investors and creditors. Supporters believe XBRL offers major benefits at all stages of business reporting and analysis. The benefits might be seen in the form of increased automation; cost saving; and faster, more reliable and more accurate handling of data. XBRL might enable consumers of financial data to reallocate resources from costly manual processes, often involving timeconsuming comparison, assembly and reentry of data. Those users will be able to concentrate their efforts on analysis, aided by software that can validate and compare XBRL information. This could result in improved analysis and better quality information for decision-making.

Maturity of XBRL Tools

Consistent with the implementation of other new technologies and standards, there will be certain challenges associated with implementing and using XBRL for financial reporting. In developing the XBRL US GAAP Taxonomy, XBRL US is trying to address many, if not all, of the issues and unique features of US GAAP financial reporting; as a result, the extent and content of the taxonomy have become complex. Although XBRL applications and support for XBRL will likely develop and improve in the coming years, they are relatively immature today. Accordingly, the initial implementation and use of XBRL for financial reporting might not be as effective and efficient as it will likely become in the future.

HOT TOPIC MARCH 7, 2008

XBRLA NEW ERA IN THE DELIVERY OF FINANCIAL INFORMATION

Quality

As mentioned above, the quality of the information provided in XBRL filings has varied to date. Inconsistent quality could involve a misunderstanding of how best to apply the XBRL US GAAP Taxonomy, or a lack of clarity about the respective roles and responsibilities of preparers, service providers and software vendors. In addition, factors contributing to diverse quality could include:

Test available XBRL tagging tools and

understand how the XBRL US GAAP Taxonomy maps to its financial statements.

Participate in the SECs XBRL

Voluntary Filing Program.

Plan to comment to the SEC on its

expected XBRL rule proposal.

Summary

The release of the US GAAP Taxonomy and the CIFiR proposals are important milestones toward widespread acceptance of XBRL as the standard for electronic financial reporting, and could signal the dawn of a new era in the delivery of financial information in the United States. CIFiR is expected to issue its final report this summer with recommendations for a mandatory phase-in of XBRL. It appears likely that the SEC will propose a rule in 2008 that would begin to mandate the use of XBRL financial reporting. XBRL filings could be required as soon as December 31, 2008 for certain large accelerated filers, with its use by other companies being phased in over time. We urge companies to monitor these developments, and to begin to prepare to use XBRL. Additional information on XBRL and its use can be found at www.ey.com/xbrl and www.sec.gov/spotlight/xbrl.htm.

The fact that XBRL creation tools are

relatively immature, and the market has been relatively small.

XBRL rendering tools also are

immature (i.e., it is hard to see the content of an XBRL file in a familiar way).

The XBRL US GAAP Taxonomy is

evolving and voluminous.

There is a lack of clear and succinct

preparer guidance, and preparers cannot refer to practical examples to address implementation questions.

The XBRL standard is technically

complex.

Steps to Consider

There are several immediate steps that a company could currently undertake to begin its preparation for XBRL filings, including:

Review the draft of the XBRL U.S.

GAAP Taxonomy, and comment by April 4, 2008.

HOT TOPIC MARCH 7, 2008

ERNST & YOUNG LLP

www.ey.com

2008 Ernst & Young LLP All Rights Reserved. Ernst & Young is a registered trademark. SCORE No. BB1495

This publication has been carefully prepared but it necessarily contains information in summary form and is therefore intended for general guidance only; it is not intended to be a substitute for detailed research or the exercise of professional judgment. The information presented in this publication should not be construed as legal, tax, accounting, or any other professional advice or service. Ernst & Young LLP can accept no responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication. You should consult with Ernst & Young LLP or other professional advisors familiar with your particular factual situation for advice concerning specific audit, tax or other matters before making any decision.

Accounting & Auditing News & Developments on Ernst & Young Online

Keep current with U.S. and International accounting, audit, financial reporting and regulatory developments. These digests and other materials are available free of charge for Ernst & Young clients and friends. Please contact your Ernst & Young client service team to learn more about obtaining a password to Ernst & Young Online. ACCOUNTING & REPORTING DIGESTProvides thorough coverage of accounting and financial reporting developments from the FASB, the SEC, the PCAOB and the EITF. The digest includes: Client WeeklyNews update on meetings, pronouncements, commentary, and other developments. Hot TopicsBrief publications that spotlight important new technical issues or developments. Financial Reporting DevelopmentsIn-depth booklets providing analysis and implementation guidelines on important financial reporting matters. Periodicals such as the SEC in Review, E&Y on the EITF, and Quarterly Standard Setter Update. SEC Reporting SeriesIncludes our Annual Guide to Quarterly Financial Reporting, our Overview of Proxy Statement Requirements, and our SEC Annual Reports publication. Accounting & Auditing Developments Database Provides an archive of developments relating to U.S. Standard Setter projects and more. AUDIT COMMITTEE DIGESTInformation that helps audit committee members fulfill their responsibilities in the areas of independence, internal controls and financial reporting. The digest includes: BoardMatters Quarterly newsletter. Trends and articles on audit committee developments INTERNATIONAL GAAP & GAAS DIGESTProvides thorough coverage of IFRS-related developments, including: Developments in U.S. GAAP/IFRS convergence Ernst & Youngs Good Group illustrative financial statements Global EYe on IFRS (quarterly newsletter) Exposure Drafts and other materials issued by the International Accounting Standards Board (IASB) and the International Federation of Accountants (IFAC). ERNST & YOUNG GAAP CHECKLISTSDownload library includes: Primary U.S. GAAP Disclosure Checklist Interim U.S. Financial Reporting Checklist U.S. Form 10K Registration Statement Checklist International GAAP Disclosure Checklist EMAIL ALERTS Email alerts are available for all Ernst & Young Online digests and features. WEBCASTS Online panel discussions addressing accounting, financial reporting, internal controls and other issues.

GAAIT-Client Edition

GAAIT, Ernst & Youngs Global Accounting & Auditing Information Tool, is available exclusively through the Ernst & Young Online portal website. GAAIT-Client Edition is the Internet version of the A&A research tool used by Ernst & Young practitioners worldwide. Although Ernst & Young Onlines digests, email alerts, and webcasts are available to clients free of charge, GAAIT-Client Edition is available on a paid subscription basis. The following channels are available in GAAITClient Edition: United StatesIncludes authoritative literature from the FASB, the AICPA, and the SEC, as well as Ernst & Youngs Accounting Manual, SEC Manual and more. Also includes customized online GAAP checklists. International GAAP OnlineThe authority on the theory and practice of financial reporting under IFRS, International GAAPonline includes the full text of our International GAAP book; all IFRS Standards, IFRIC Interpretations, SICs and Implementation Guidance, E&Ys IFRS Illustrative Financial Statements (Good Group series); and 11 full sets of IFRS reporting companies annual reports and financial statements. International GAAP & GAASIncludes standards and guidance issued by the IASB and the IFAC. This channel includes interpretations, exposure drafts, and implementation guidance, as well as a wide range of E&Y commentary and tools. CanadaIncludes the complete CICA Standards and Guidance Collection, the Canadian Securities Reporter, as well as E&Y guidance and our interactive Online GAAP Checklist. These GAAIT-Client channels are available on 30 day free-trial or annual subscription basis. Bulk rate discounts apply.

HOT TOPIC MARCH 7, 2008

You might also like

- Boritz and No 2008 ABS 2 XBRL AuditingDocument16 pagesBoritz and No 2008 ABS 2 XBRL AuditingEsraa S AlkhatibNo ratings yet

- Financial Reporting and Management Reporting SystemsDocument71 pagesFinancial Reporting and Management Reporting SystemscamsNo ratings yet

- Business Wire White Paper - XBRL Next Steps: What You Need To Know For 2010 and BeyondDocument9 pagesBusiness Wire White Paper - XBRL Next Steps: What You Need To Know For 2010 and BeyondIR Global RankingsNo ratings yet

- Study On XBRL Implementation For Financial Reporting.Document41 pagesStudy On XBRL Implementation For Financial Reporting.sa281289100% (1)

- XBRL: Enabling Faster, More Transparent Financial ReportingDocument12 pagesXBRL: Enabling Faster, More Transparent Financial ReportingPrasad VeeraNo ratings yet

- 5 XBRL: A New Tool For Electronic Financial Reporting: January 2004Document21 pages5 XBRL: A New Tool For Electronic Financial Reporting: January 2004Voiceover SpotNo ratings yet

- XBRL TechnologyDocument2 pagesXBRL TechnologyCris R. HatterNo ratings yet

- XBRL in IndiaDocument23 pagesXBRL in Indiaksmuthupandian2098No ratings yet

- XBRL Reference GuideDocument86 pagesXBRL Reference GuideAri Tata AdiantaNo ratings yet

- C15. XBRL New ToolDocument20 pagesC15. XBRL New ToolHayderAlTamimiNo ratings yet

- Accounting Information Systems 2nd Edition Richardson Solutions Manual Full Chapter PDFDocument36 pagesAccounting Information Systems 2nd Edition Richardson Solutions Manual Full Chapter PDFletitiaesperanzavedhd100% (14)

- Referencer On XBRLDocument19 pagesReferencer On XBRLasksubirNo ratings yet

- ICAI Guidance Note On XBRLDocument64 pagesICAI Guidance Note On XBRLSHIV KUMAR KAULNo ratings yet

- MCA Circular - 31.3.2011Document8 pagesMCA Circular - 31.3.2011Karishma ThakkarNo ratings yet

- Faqs On XBRLDocument5 pagesFaqs On XBRLDarshan ShahNo ratings yet

- XBRL and AccaDocument76 pagesXBRL and AccaValentin BurcaNo ratings yet

- All About XBRL: 2. What Are The Potential Uses of XBRL?Document9 pagesAll About XBRL: 2. What Are The Potential Uses of XBRL?Rohit AggarwalNo ratings yet

- 3.3. Initial Evidence On The Market Impact of The XBRL Mandate (Blankespoor) - RAS 2014Document36 pages3.3. Initial Evidence On The Market Impact of The XBRL Mandate (Blankespoor) - RAS 2014Eva WinartoNo ratings yet

- Nel & Steenkamp (7.08) - Meditari Vol 16 No 1 2008Document15 pagesNel & Steenkamp (7.08) - Meditari Vol 16 No 1 2008Essam AminNo ratings yet

- Class of Companies: WWW - Mca.gov - inDocument5 pagesClass of Companies: WWW - Mca.gov - inParvathalu NeelaNo ratings yet

- Addressing XBRLDocument36 pagesAddressing XBRLBooksyBNo ratings yet

- Vaibhavdwivedi Bcom2e CADocument4 pagesVaibhavdwivedi Bcom2e CAPsyc GamingNo ratings yet

- XBRLDocument33 pagesXBRLShi SyngeNo ratings yet

- Article 2 PDFDocument4 pagesArticle 2 PDFAllan CintronNo ratings yet

- 2 Debreceny XBRL Ratios 20101213Document31 pages2 Debreceny XBRL Ratios 20101213Ardi PrawiroNo ratings yet

- The Impact of XBRL On Financial Reporting: A Conceptual AnalysisDocument8 pagesThe Impact of XBRL On Financial Reporting: A Conceptual AnalysisChima EmmanuelNo ratings yet

- CA XBRL Preparers GuideDocument98 pagesCA XBRL Preparers GuideGaurav RamrakhyaNo ratings yet

- XBRL FaqDocument6 pagesXBRL FaqaauchityaNo ratings yet

- CG CHP 12 PDFDocument12 pagesCG CHP 12 PDFlani anggrainiNo ratings yet

- Basonglu and White 2015 ABS 1 XBRL AuditingDocument12 pagesBasonglu and White 2015 ABS 1 XBRL AuditingEsraa S AlkhatibNo ratings yet

- What Is XBRLDocument3 pagesWhat Is XBRLpawan kumar dubeyNo ratings yet

- Critical Reflection On XBRLDocument23 pagesCritical Reflection On XBRLSudershan ThaibaNo ratings yet

- Lecture Corporate Governance and Ethics Chapter 12 - Rezaee (Download Tai Tailieutuoi - Com)Document13 pagesLecture Corporate Governance and Ethics Chapter 12 - Rezaee (Download Tai Tailieutuoi - Com)hieuvu2000No ratings yet

- Atg XBRL BB1710Document20 pagesAtg XBRL BB1710Namit KewatNo ratings yet

- FN 307 FinalDocument8 pagesFN 307 FinalJasco JohnNo ratings yet

- An XBRL Starter GuideDocument4 pagesAn XBRL Starter GuideJill Edmonds, Communications DirectorNo ratings yet

- XBRL Mandate and Timeliness of Financial Reporting: The Effect of Internal Control ProblemsDocument27 pagesXBRL Mandate and Timeliness of Financial Reporting: The Effect of Internal Control ProblemsPablo LunaNo ratings yet

- Markit Response IOSCO Financial BenchmarksDocument23 pagesMarkit Response IOSCO Financial BenchmarksMarketsWikiNo ratings yet

- TECH-CDR-1961 - FRC - Future - of - Corporate - Reporting - ACCA FinalDocument11 pagesTECH-CDR-1961 - FRC - Future - of - Corporate - Reporting - ACCA FinalCharles SantosNo ratings yet

- Chapter 14 Tak Godfrey (Lo 1 Dan 2)Document2 pagesChapter 14 Tak Godfrey (Lo 1 Dan 2)Sapri JoeriNo ratings yet

- XBRL All Case StudiesDocument13 pagesXBRL All Case StudiesSadar CmNo ratings yet

- Alles and Gray 2012 ABS 1 XBRL AuditingDocument25 pagesAlles and Gray 2012 ABS 1 XBRL AuditingEsraa S AlkhatibNo ratings yet

- The Clearing Corporation of India LTDDocument20 pagesThe Clearing Corporation of India LTDabhabhalla53No ratings yet

- Tax & Accounting Update: FASB NewsDocument6 pagesTax & Accounting Update: FASB NewsAlta SophiaNo ratings yet

- Special Report Corporate Actions DTCCDocument2 pagesSpecial Report Corporate Actions DTCCcoolmint9999No ratings yet

- 3.1. Exec Team IS and Financial Competencies and Voluntary XBRL ReportingDocument54 pages3.1. Exec Team IS and Financial Competencies and Voluntary XBRL ReportingEva WinartoNo ratings yet

- 11 12 13 15Document8 pages11 12 13 15Vanilla GirlNo ratings yet

- Vuran, B (Growth)Document13 pagesVuran, B (Growth)fitri andiyaniNo ratings yet

- Aeb1 11801196 PDFDocument8 pagesAeb1 11801196 PDFHayderAlTamimiNo ratings yet

- Principles For Financial: BenchmarksDocument42 pagesPrinciples For Financial: BenchmarksMarketsWikiNo ratings yet

- International Differences in AccountingDocument4 pagesInternational Differences in AccountingHadeel Abdul SalamNo ratings yet

- US GAAP Convergence and IFRS (1) .PDF - Adobe ReaderDocument816 pagesUS GAAP Convergence and IFRS (1) .PDF - Adobe ReaderRufina Yagudina100% (1)

- Csit5 13501416 PDFDocument10 pagesCsit5 13501416 PDFHayderAlTamimiNo ratings yet

- COMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BankDocument29 pagesCOMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BanknigusNo ratings yet

- 0905 XBRLDocument2 pages0905 XBRLshrikantgarudNo ratings yet

- Investor Protection in AustraliaDocument33 pagesInvestor Protection in AustraliaAabhas KshetarpalNo ratings yet

- Research Paper On Accounting Information SystemsDocument6 pagesResearch Paper On Accounting Information Systemsfvffv0x7No ratings yet

- Baldwin Et Al 2006 ABS1 XBRL IntermediariesDocument21 pagesBaldwin Et Al 2006 ABS1 XBRL IntermediariesEsraa S AlkhatibNo ratings yet

- Global Filing Manual 20110419Document81 pagesGlobal Filing Manual 20110419ted5864No ratings yet

- GAAP ACCOUNTING Conservatism in Accounting PART 1 SSRN-Id414522Document35 pagesGAAP ACCOUNTING Conservatism in Accounting PART 1 SSRN-Id414522urkerNo ratings yet

- PacterDocument81 pagesPacterurkerNo ratings yet

- Exposure Draft: Amendments To IAS 1 Presentation of Financial Statements: A RevisedDocument3 pagesExposure Draft: Amendments To IAS 1 Presentation of Financial Statements: A RevisedurkerNo ratings yet

- Don't Forget The Audience: Topic: Business, IASDocument3 pagesDon't Forget The Audience: Topic: Business, IASurkerNo ratings yet

- M 19 Incorporation of PBR Into SapDocument6 pagesM 19 Incorporation of PBR Into SapurkerNo ratings yet

- European ComissionDocument14 pagesEuropean ComissionurkerNo ratings yet

- Basic Vocabulary List Instructions: Agricultor, La Agricultora) Estudiante, La Estudiante)Document22 pagesBasic Vocabulary List Instructions: Agricultor, La Agricultora) Estudiante, La Estudiante)May AbiaNo ratings yet

- MATH PROBABILITY Book Every Day Life 4 AaaaaDocument5 pagesMATH PROBABILITY Book Every Day Life 4 AaaaaurkerNo ratings yet

- Fasb Fin Instruments Credit Lossess The Iasb Proposes A New Expected Credit Loss ModelDocument41 pagesFasb Fin Instruments Credit Lossess The Iasb Proposes A New Expected Credit Loss ModelurkerNo ratings yet

- Perpetual American Put OptionsDocument36 pagesPerpetual American Put OptionsurkerNo ratings yet

- Science Grade 7: Active Reading Note-Taking GuideDocument140 pagesScience Grade 7: Active Reading Note-Taking Guideurker100% (1)

- The Infamous Net - Book.Riddles!: Version 3.0b Compiled by Mark ManningDocument105 pagesThe Infamous Net - Book.Riddles!: Version 3.0b Compiled by Mark ManningKimlon100% (4)

- MAG Bloomberg Business Week 18 14 October 2010Document106 pagesMAG Bloomberg Business Week 18 14 October 2010urkerNo ratings yet

- Kids Maths Grade 7 Test Questions 2010 07Document8 pagesKids Maths Grade 7 Test Questions 2010 07urkerNo ratings yet

- Hi3518 HD IP Camera SoCDocument1,254 pagesHi3518 HD IP Camera SoCLuis LopezNo ratings yet

- 13 Internal Audit Procedure Integrated Preview enDocument3 pages13 Internal Audit Procedure Integrated Preview enBogdan CorneaNo ratings yet

- Safety Relief Valve Set Pressure and Seat Leakage TestDocument30 pagesSafety Relief Valve Set Pressure and Seat Leakage TestAnonymous ffje1rpa100% (1)

- ID1Plus and ID1 Plus-A Compact Terminals. Rapid Weighing-In With LED Analog DisplayDocument4 pagesID1Plus and ID1 Plus-A Compact Terminals. Rapid Weighing-In With LED Analog DisplaytolaaolaNo ratings yet

- Grade Seperation System and Road Junction SystemDocument13 pagesGrade Seperation System and Road Junction SystemAnil Jangid100% (1)

- Sist en 13018 2016Document8 pagesSist en 13018 2016a0931474125No ratings yet

- Ais10 ch06Document309 pagesAis10 ch06habtamuNo ratings yet

- En 1498Document14 pagesEn 1498SozhanSureshkumarNo ratings yet

- Power Steering in Automobiles: - Presented byDocument21 pagesPower Steering in Automobiles: - Presented byKarthik KardekerNo ratings yet

- KBWM DC Drive Series ManualDocument9 pagesKBWM DC Drive Series ManualKBElectronicsincNo ratings yet

- BS en 16281-2013Document28 pagesBS en 16281-2013Vag KatsikopoulosNo ratings yet

- p1 PinoutDocument1 pagep1 PinouthakyNo ratings yet

- IEC 61850 Certificate Level ADocument2 pagesIEC 61850 Certificate Level AJovan JovanovićNo ratings yet

- Lovely Professional UniversityDocument19 pagesLovely Professional UniversitySukhvinder Singh DhimanNo ratings yet

- Imo MSC 1 Circ 1578 Guidelines On Abandon Ship Drills Using Lifeboats June 2017Document6 pagesImo MSC 1 Circ 1578 Guidelines On Abandon Ship Drills Using Lifeboats June 2017Deepesh MerchantNo ratings yet

- RA - Ohl.019. Working in Close Proximity of OHL.Document12 pagesRA - Ohl.019. Working in Close Proximity of OHL.marvinNo ratings yet

- TD 8 Book 2 Lot1 28112012 EDocument101 pagesTD 8 Book 2 Lot1 28112012 EИван РистићNo ratings yet

- Case Study - Nguyen Hoang Exim Co. - QualityDocument2 pagesCase Study - Nguyen Hoang Exim Co. - Qualitysusmitabiswas0% (1)

- DM Fadg 2017Document51 pagesDM Fadg 2017wal1547No ratings yet

- Glor - Io Wall HackDocument889 pagesGlor - Io Wall HackAnonymous z3tLNO0TqH50% (8)

- British Standard Whitworth - Wikipedia, The Free EncyclopediaDocument2 pagesBritish Standard Whitworth - Wikipedia, The Free EncyclopediaIvan DuncanNo ratings yet

- Pressure Test ProceduresDocument5 pagesPressure Test Procedureszaxader100% (1)

- MST Global - AXON Core DatasheetDocument2 pagesMST Global - AXON Core DatasheetedgarNo ratings yet

- App Note: Flyport WiFi Webserver Configuration PageDocument5 pagesApp Note: Flyport WiFi Webserver Configuration PageIonela CraciunNo ratings yet

- 3G Parameters NotesDocument4 pages3G Parameters NotesБотирали АзибаевNo ratings yet

- Process Datasheet For Relief ValveDocument3 pagesProcess Datasheet For Relief Valvemadhu8087No ratings yet

- Cisco Security Control Framework (SCF) ModelDocument12 pagesCisco Security Control Framework (SCF) Modelravin.jugdav678No ratings yet

- Risk Assessment Example and TemplateDocument8 pagesRisk Assessment Example and TemplateEmmelinaErnestine0% (1)

- Pmnetwork: Most Influential 1969-2019Document62 pagesPmnetwork: Most Influential 1969-2019Mubasher HussainNo ratings yet