Professional Documents

Culture Documents

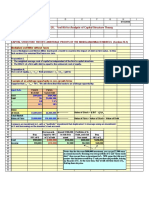

Significance of Capital Budgeting

Uploaded by

soujnyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Significance of Capital Budgeting

Uploaded by

soujnyCopyright:

Available Formats

Significance of capital budgeting The key function of the financial management is the selection of the most profitable assortment

of capital investment and it is the most important area of decision-making of the financial manger because any action taken by the manger in this area affects the working and the profitability of the firm for many years to come. The need of capital budgeting can be emphasised taking into consideration the very nature of the capital expenditure such as heavy investment in capital projects, long-term implications for the firm, irreversible decisions and complicates of the decision making. Its importance can be illustrated well on the following other grounds:(1) Indirect Forecast of Sales. The investment in fixed assets is related to future sales of the firm during the life time of the assets purchased. It shows the possibility of expanding the production facilities to cover additional sales shown in the sales budget. Any failure to make the sales forecast accurately would result in over investment or under investment in fixed assets and any erroneous forecast of asset needs may lead the firm to serious economic results. (2) Comparative Study of Alternative Projects Capital budgeting makes a comparative study of the alternative projects for the replacement of assets which are wearing out or are in danger of becoming obsolete so as to make the best possible investment in the replacement of assets. For this purpose, the profitability of each projects is estimated. (3) Timing of Assets-Acquisition. Proper capital budgeting leads to proper timing of assetsacquisition and improvement in quality of assets purchased. It is due to ht nature of demand and supply of capital goods. The demand of capital goods does not arise until sales impinge on productive capacity and such situation occur only intermittently. On the other hand, supply of capital goods with their availability is one of the functions of capital budgeting. (4) Cash Forecast. Capital investment requires substantial funds which can only be arranged by making determined efforts to ensure their availability at the right time. Thus it facilitates cash forecast. (5) Worth-Maximization of Shareholders. The impact of long-term capital investment decisions is far reaching. It protects the interests of the shareholders and of the enterprise because it avoids over-investment and under-investment in fixed assets. By selecting the most profitable projects, the management facilitates the wealth maximization of equity shareholders. (6) Other Factors. The following other factors can also be considered for its significance:It assist in formulating a sound depreciation and assets replacement policy. It may be useful n considering methods of coast reduction. A reduction campaign may necessitate the consideration of purchasing most up-todate and modern equipment. The feasibility of replacing manual work by machinery may be seen from the capital forecast be comparing the manual cost an the capital cost. The capital cost of improving working conditions or safety can be obtained through capital expenditure forecasting.

It facilitates the management in making of the long-term plans an assists in the formulation of general policy. It studies the impact of capital investment on the revenue expenditure of the firm such as depreciation, insure and there fixed assets.

Meaning and definition of prospectus and the various contents of a prospectus. After the receipt of certificate of incorporation, if the promoters of a public limited company wishes to issue shares to the public, he will issue a document called prospectus. It is an invitation to the public to subscribe to the share capital of the company. The companies Act, 1956 defines prospectus as any document described or issued as a prospectus and include any notice, circular, advertisement or other documents inviting deposits from the public or inviting offer from the public for the subscription of shares. It is circulated among the public in printed pamphlets. It gives all necessary information about the company so that the prospective shareholders may fully understand the objectives and the plans of the company. Objectives: Prospectus is issued with the following broad objectives: It informs the company about the formation of a new company. It serves as a written evidence about the terms and conditions of issue of shares or debentures of a company. It induces the investors to invest in the shares and debentures of the company. It describes the nature, extent and future prospectus of the company. It maintains all authentic records on the issue and make the directors liable for the misstatement in the prospectus. Contents: The following important matter are included in the prospectus: The prospectus contains the main objectives of the company, the name and addresses of the signatories of the memorandum of association and the number of shares held by them. The name, addresses and occupation of directors and managing directors. The number and classes of shares and debentures issued. The qualification share of directors and the interest of directors for the promotion of company. The number, description and the document of shares or debentures which within the two preceding years have been agreed to be issed other than cash. The name and addresses of the vendors of any property acquired by the company and the amount paid or to be paid.

particulars about the directors, secretaries and the treasures and their remuneration. The amount for the minimum subscription. If the company carrying on business, the length of time of such businesses. The estimated amount of preliminary expenses. Name and address of the auditors, bankers and solicitors of the company. Time and place where copies of balance sheets, profits and loss account and the auditors report may be inspected. The auditor's report so submitted must deal with the profit and loss of the company for each year of five financial years immediately preceding the issue of prospectus. If any profit or reserve has been capitalized, the particulars of such capitalization will be stated in the prospectus. Companies Act 1956, defines a Prospectus as any document described or issued as prospectus and includes any notice, circular, advertisement inviting deposits from the public or inviting offers from the public for subscription or purchase of any shares in, or debentures of a body corporate. In simple words, it may be defined as an invitation to the public to subscribe to a companys shares or debentures. The following are the contents of Prospectus; 1. Name and Registered office of the company 2. The main objects of the company 3. Remuneration of the Directors 4. Names, addresses, descriptions and occupations of the Directors, Managing Directors, Secretaries, Treasurers and Managers 5. Particulars of the property of the company 6. Amount of preliminary expenses 7. Amount of expenses of the issue 8. Details of every contract with the company 9. Time and Place where contracts may be inspected 10. Name and address of the auditors and bankers of the company 11. Particulars of reserves and reserves capitalized 12. Time of opening and closing of subscription list A prospectus means any document describe or issue as a prospectus and includes any notice, circular, advertisement or other documents inviting deposits from the public or inviting offers from the public for the subscription or purchase of shares in or debentures of a day corporate. The main contents of a prospectus are: I. Main object of the company with the names, addresses, description and occupation of signatories to the memorandum and the number of shares subscribed for by them. II. Number and classes of shares and the nature and extent of the interest of holders thereof in the property and profits of the company.

III. The number of redeemable preference shares intended to be issued and the date of redemption or where no date is fixed; the period of notice required for redeeming the share s and proposed method of redemption. IV. The number of shares. if any, fixed by the Article as the qualification of a director and the remuneration of the directors for the service. V. The names, occupation and addresses of directors, managing director and manager together with any provision in the Articles or a contract regarding their appointment remuneration or compensation for loss of office. VI. The time of opening of the subscription list should be given in the prospectus. VII. The amount payable on application and allotment on each share should be stated. If any prospectus is issued within two years, the details of the shares subscribed for any allotted. VIII. The particular about any option or preferential right to be given to any person to subscribe for shares or debentures of the company. IX. The number of shares or debentures which within the two preceding year been issued for a considerations other than cash. X. Particulars about premium received on shares within two preceding years or to be received. XI. The amount or rate of underwriting commission. XII. Preliminary expenses. XIII. The names and addresses of auditors, if any, of the company. XIV. Where the shares are of more than one class, the rights of voting and rights as to capital and dividend attached to several classes of shares. XV. If nay reserve or profits of the company have been capitalized, particulars of capitalizations and particulars of the surplus arising from any revaluation of the assets of the company.

XVI. A reasonable time and place at which copies of all accounts on which the report of auditors is based may be inspected.

You might also like

- OrganisationDocument12 pagesOrganisationsoujnyNo ratings yet

- Reserve Bank of IndiaDocument2 pagesReserve Bank of IndiasoujnyNo ratings yet

- Duties and Functions of Company SecretaryDocument4 pagesDuties and Functions of Company Secretarysoujny100% (1)

- Linkage Between Business and EnvironmentDocument14 pagesLinkage Between Business and EnvironmentsoujnyNo ratings yet

- Doctrine of UltraDocument1 pageDoctrine of Ultrasoujny100% (1)

- Cadbury Committee ReportDocument4 pagesCadbury Committee ReportsoujnyNo ratings yet

- What Is A PerquisiteDocument8 pagesWhat Is A PerquisitesoujnyNo ratings yet

- The Evolution of IncomeDocument4 pagesThe Evolution of IncomesoujnyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Account Statement From 10 Aug 2021 To 9 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 10 Aug 2021 To 9 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAsheera AishwaryaNo ratings yet

- 2014 Annual Report enDocument21 pages2014 Annual Report enMax meNo ratings yet

- Advanced Financial Accounting Canadian Canadian 7th Edition Beechy Solutions Manual Full Chapter PDFDocument68 pagesAdvanced Financial Accounting Canadian Canadian 7th Edition Beechy Solutions Manual Full Chapter PDFsahebmostwhatgr91100% (9)

- Analisis Laporan Keuangan Rumah Sakit Berdasarkan PDFDocument13 pagesAnalisis Laporan Keuangan Rumah Sakit Berdasarkan PDFNathaniaElizabethNo ratings yet

- Reading 50: Introduction To Alternative InvestmentsDocument68 pagesReading 50: Introduction To Alternative InvestmentsAlex PaulNo ratings yet

- 06 Departmental AccountsDocument6 pages06 Departmental AccountsUjwal Singh XI - A '51' CSNo ratings yet

- I. Ms Concepts, Practices and Standards II. Cost Concepts and Classifications Iii. Financial Statement AnalysisDocument6 pagesI. Ms Concepts, Practices and Standards II. Cost Concepts and Classifications Iii. Financial Statement AnalysisDensNo ratings yet

- Assuming That Pride in Its Internal Records Accounts For ItsDocument1 pageAssuming That Pride in Its Internal Records Accounts For ItsMiroslav GegoskiNo ratings yet

- Contoh Soal SAP 010 - Financial Accounting (Batch 1&2)Document19 pagesContoh Soal SAP 010 - Financial Accounting (Batch 1&2)Jhoni100% (3)

- Ishares Msci Brazil Etf: Fact Sheet As of 03/31/2020Document2 pagesIshares Msci Brazil Etf: Fact Sheet As of 03/31/2020SupermanNo ratings yet

- Introduction To Investment BankingDocument45 pagesIntroduction To Investment BankingHuế ThùyNo ratings yet

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDocument11 pagesChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANo ratings yet

- Debentures and BondsDocument3 pagesDebentures and Bondsremruata rascalralteNo ratings yet

- Partnership Dissolution - 2Document27 pagesPartnership Dissolution - 2Trisha GarciaNo ratings yet

- Ar 2017 2018Document237 pagesAr 2017 2018Anonymous mMtf10f4No ratings yet

- IMTCDL FINC512 Exam GuideDocument30 pagesIMTCDL FINC512 Exam GuidePranav Sharma0% (1)

- Legislation Guide: Document Revision 1.33 - December 2017Document43 pagesLegislation Guide: Document Revision 1.33 - December 2017khemiri RawiaNo ratings yet

- NFO Winter ReportDocument64 pagesNFO Winter ReportAbhinav Singh RathourNo ratings yet

- Search Site: IAS 36 - Impairment of AssetsDocument9 pagesSearch Site: IAS 36 - Impairment of AssetsNeriza PonceNo ratings yet

- Far15 Long Term Liability 1Document9 pagesFar15 Long Term Liability 1Joana TatacNo ratings yet

- ExamSAP DenaNurAiniyahDocument26 pagesExamSAP DenaNurAiniyahREG.A/1120101019/DENA NURNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Document9 pagesFundamentals of Accountancy, Business and Management 2: Quarter 2 - Module Week 1Joana Jean SuymanNo ratings yet

- CH - 14 - Capital Structure Decision Part 1Document67 pagesCH - 14 - Capital Structure Decision Part 1Fitria Yuliani KartikaNo ratings yet

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNo ratings yet

- Register Free: Syllabus Revision 20% Guaranteed Score Doubt Solving NasaDocument16 pagesRegister Free: Syllabus Revision 20% Guaranteed Score Doubt Solving NasaKavita SinghNo ratings yet

- Statement of Accounts: Today's StatementsDocument1 pageStatement of Accounts: Today's Statementsхуивпи дрилоNo ratings yet

- Bnesr 1 For Abm 12 Business Ethics and Social ResponsibilityDocument22 pagesBnesr 1 For Abm 12 Business Ethics and Social ResponsibilityPamela MorteNo ratings yet

- XVA Special Report 2018Document31 pagesXVA Special Report 2018trevinooscar100% (3)

- Annual Report 2014Document249 pagesAnnual Report 2014BETTY ELIZABETH JUI�A QUILACHAMINNo ratings yet

- 5.1 Financial Statement Analysis CH 25 I M PandeyDocument21 pages5.1 Financial Statement Analysis CH 25 I M Pandeyjoshi_ashu100% (2)