Professional Documents

Culture Documents

Revisiting Directed Brokerage: Still No Free Lunch

Uploaded by

Wayne H Wagner0 ratings0% found this document useful (0 votes)

29 views2 pages" . . . capturing 3 cents of commission cost the directing sponsors 10.3 cents of investment performance . . ."

Original Title

Revisiting Directed Brokerage: Still no Free Lunch

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document" . . . capturing 3 cents of commission cost the directing sponsors 10.3 cents of investment performance . . ."

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views2 pagesRevisiting Directed Brokerage: Still No Free Lunch

Uploaded by

Wayne H Wagner" . . . capturing 3 cents of commission cost the directing sponsors 10.3 cents of investment performance . . ."

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

grorrp

COMMENTARY 57 DECEMBER 1998

RET'ISTTING DIRECTED BROI(ERAGE: STTLL NCD FREE LUNGH

A 7996 Plexus study of one clrent's drrected and non-dtrected trades concluded that whrle drrected

trades had lower tmpact and commisslon cosrs, trmrng and opporlunity costs outwelghed the sav-

ings. More importanLly, drrected lradlng discourages lradrng rn raptdly movrng sltuattons. leadtng to

significant underperformance relatlve to non-dtrected trades. Thls follow-up study of more clients and

a longer time frame, comes to slmrlar conclusrons that [7J dlrected trades show no cost advantage

when adjusted for expected costs, ancl [2J rndrrectly emphaslzrng lower cost trades leads to lower

returns than reallzed throuqh non-dlrected trades.

How many sponsors would agree that NYSE Rule 122 specifically prohibits

higher commissions can lead to a member firm from trading a stock with

Plexus now has r"-rp to nine quarters of

many, we suspect.

"...CgptUring 3( Of COtn- broker at a time. directed trading data for eight clients.

Sponsors who cap- Since the trader's This sample provides both a deeper

mission

ture commissions cost the direct- iob is to control pool for comparison and a good cross-

forfundadministra- ing sponsors 10.3( of ,

'information

flow section over time. The sample in-

tion implicitly be- perform&nce..." to brokers in a cludes both large-cap and small-cap

lieve that a higher way that secures as well as value and growth strate-

commission buys nothing of value. best execution for all accounts, seqllenc-

gies. ln 1Q98, the sample included

Consequently. rnanagers continue to ing of directed trades naturally results. $48 bil. of decisions of which 22%

feel pressure to direct commissions represented directed decisions.

When prices move rapidly, timing

to designated brokers for sponsor use. Because the analysis covered a

becomes a priority. Accounts that di-

The burden ofproof that commissions broader range of investment styles, the

rect trades to specific firms lose timing

can be a tool, not just a cost, has effects of delays were reduced. Tim-

advantage whrle recapturing cornrnis-

fallen on the manager. Managers in- ing costs for directed trades fell, com-

sions. How are we to assure this tradeoff

tuit that direction alfects investment paring more favorably to the non-di-

is in the client's best interest?

perfomance, but seldom possess suf- rected trades. However, the bench-

ficient information to demonstrate mark costs for directed trades also fell.

that they are using commissions ef- As a result, directed trades lagged

fectively. The 1996 Plexus study of a growth their benchmark by 400%, compared

Measuring the true cost of direction manager's directed trading showed to 8% for non-directed trades.

requires looking beyond the obvious that:

An interesting finding was that im-

costs of commissions and direct im- o Directed trades cost more than pact and commissions converged for

pact. It needs to include timing costs non-directed trades; 1 I 2 bp as con- the two groups of trades. Directed

incurred while a directing broker trasted to 83 bp. impact * commission costs rose from

seeks or awaits liquidity, as well as 25 to 2l bp, while non-directed costs

foregone returns when liquidity fails o The ratio ofcosts to expected costs fell from 39 to 33 bp. This is consis-

to develop. These costs capture the were more unfavorable for directed tent with the steady drop in average

effects of disruptions to a manager's trades: 560 o ove r expectation com-

commission rates due to increased use

normal execution strategies. While pared to 40o over expectation.

of Proprietary Trading Systems such

proponents of direction argue that di-

o Serious problems developed in ex- as lnstinet and ITG/Posit. The ques-

rection should not disrupt a manager's tion appears to be no longer the level

perienced net returns, -3.l9oA for

process, we show that differences re- of commissions; rather how the com-

directed trades vs. +0.470% for non-

sulting from the sequencing of trades missions are used.

directed. As a result, directed ac-

can be significant.

counts realized lower returns for

traded shares.

Returns: tlre Bottorn Llne fon

The News!

In the first study, we concluded that the On a cumulative basis, non-directed

most damaging aspect of directing bro- trades retumed +212 bp versus a loss Take a look at our new Website at

kerage was the 'adverse selection' in- of 87 bp for directed trades. Consis- www.plexusgroup.com. Find out

cured when directed brokers fail to ac- tent with theory, directed trades out- more about Plexus. study past

cess liquidity in last moving situations. performed in only one period -- a commentaries, and soon access

Because our first study covered a growth/ quafter when average decision returns Plexus Group services online.

momentum-oriented manager, missed were negatlve.

trades led to a large difference in retums" The "Plexus Group Sixth Con-

Momentum-style managers and small

Adding more styles dampens the differ- ference Summary" is now arrail-

ential. but the perfonnace gap persists.

cap managers appear to need all the

broker flexibility and cooperation they ablelWrite to us for a free copy,

The significant difference for plan can muster. Value managers, however, 0r e-mail your request to

sponsors again occurred in the realized find time delay can be an ally, and di- info@plex usgroup.com.

rates of return frorn trading. Market- recting may result in serendipitious de-

adjusted 30-day retllrns for directed lays. The exceptions are worth know-

trades averaged bp versus +23 bp ing to a sponsor who wants to effec-

for non-directed-10

trades. tively direct commissions. Upcoming Speeches

Gonclusions ary 25-26. New york:

iunu

"New Technologies

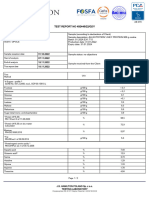

The table below summarizes the re- The lesson is that effective direction of

tWayne lhagner)

sults. The benefits of recaptured com- trading requires careful planning. Plexus

"Measuring Best Execution"

missions, assumed to be 3l per share, Group recommends: (Steve Glass)

are added to gains which arise because

smaller directed trades have lower com-

1' Direct only a modest portion of

mission and impact costs. oft'setting commissions(10-30%)basedonboth CBOE, Risk Management

and capitalization' For

these gains is the finding that directed manager style January 27 -30, Scottsdale:

trades are more costly compared to their example' a large-cap value manager "Managing Transaction Costs"

can tolerate more directed trades than

benchmark (of what they should cost). (lVayne Wagner)

Finally, the performance of directed a small-cap value or large-cap growth

trades suffers when they are delayed or manager'

too 2. Choose directed brokers in consulta-

abandoned because prices moved

quickly. The performance penalty tion with the manaser.

Reprint any portion of this

amounts to almost 15d per share.

3. Use steo-outs as an alternative material with credit given to:

Adding all the components together, the

study shows that capturing 3p of com- 4. Consider whether the seruices pur-

mission cost tlle directing sponsors chased are essential to manager

plexuggroue

10.31 per share of performance relative performance.

to non-directing accounts.

5. Install a monitoring program to evalu- 11150 W. Olympic Blvd., #900

ate executions and perfotmance. Los Angeles. CA 90064

PH: 310.3 12.55A5

len-Oiree+cC ,

FAX: 310.312.5506

TRADING PERFORMANCE

i+aCe+ . nHl;. Also available at

3 0c 3 0(

rvrvw.p lexus group. c om.

i 0 0c

56 2C 40 0c l6 2C

x'ro trodino cos t over oenchm o'k

@ Plexus Croup, 1998

E

4 50 l6 2C il7e

U nderoerformonce ot oirecied trodes due to delovs

l0 3c -4 5C l4 8C

ond missed trodes

You might also like

- The Pension Promise and The Shadow AssetDocument3 pagesThe Pension Promise and The Shadow AssetWayne H WagnerNo ratings yet

- The Blindmen and The ElephantDocument3 pagesThe Blindmen and The ElephantWayne H WagnerNo ratings yet

- Decision Timliness and DurationDocument4 pagesDecision Timliness and DurationWayne H WagnerNo ratings yet

- Should I Fire My Trader or Pay Him A MillionDocument6 pagesShould I Fire My Trader or Pay Him A MillionWayne H WagnerNo ratings yet

- Immediacy Cost-Opportunity CostDocument3 pagesImmediacy Cost-Opportunity CostWayne H WagnerNo ratings yet

- Investment Management Cover and PrefaceDocument5 pagesInvestment Management Cover and PrefaceWayne H Wagner100% (1)

- What We Learned On Our Way To Our PublisherDocument2 pagesWhat We Learned On Our Way To Our PublisherWayne H WagnerNo ratings yet

- Payment Oriented BrokerageDocument2 pagesPayment Oriented BrokerageWayne H WagnerNo ratings yet

- Noble Challenges FlyerDocument1 pageNoble Challenges FlyerWayne H WagnerNo ratings yet

- The Maps Are Being RedrawnDocument3 pagesThe Maps Are Being RedrawnWayne H WagnerNo ratings yet

- The Moped LawDocument2 pagesThe Moped LawWayne H WagnerNo ratings yet

- Measuring Trade DifficultyDocument2 pagesMeasuring Trade DifficultyWayne H WagnerNo ratings yet

- Handicaps and HandcuffsDocument4 pagesHandicaps and HandcuffsWayne H WagnerNo ratings yet

- If Best Execution Is A Process, What Does The Process Look Like?Document5 pagesIf Best Execution Is A Process, What Does The Process Look Like?Wayne H WagnerNo ratings yet

- Melting IcebergsDocument4 pagesMelting IcebergsWayne H WagnerNo ratings yet

- Research: How Are PAEG/Ls FormedDocument4 pagesResearch: How Are PAEG/Ls FormedWayne H WagnerNo ratings yet

- Institutional Order Flow and The Hurdles To Superior PerformanceDocument9 pagesInstitutional Order Flow and The Hurdles To Superior PerformanceWayne H WagnerNo ratings yet

- The Search EngineDocument4 pagesThe Search EngineWayne H WagnerNo ratings yet

- The Changing Role of The Buyside TraderDocument4 pagesThe Changing Role of The Buyside TraderWayne H WagnerNo ratings yet

- Trading TruthsDocument3 pagesTrading TruthsWayne H WagnerNo ratings yet

- Can Systems Make A Good TraderDocument4 pagesCan Systems Make A Good TraderWayne H WagnerNo ratings yet

- How Big Is The Strike Zone?Document2 pagesHow Big Is The Strike Zone?Wayne H WagnerNo ratings yet

- Time of Day Effects On Trading CostsDocument2 pagesTime of Day Effects On Trading CostsWayne H WagnerNo ratings yet

- Sneaking An Elephant Across A Putting Green: A Transition Case StudyDocument2 pagesSneaking An Elephant Across A Putting Green: A Transition Case StudyWayne H WagnerNo ratings yet

- What Do The Good Desks Do?Document4 pagesWhat Do The Good Desks Do?Wayne H WagnerNo ratings yet

- Persistence of Price MovementDocument2 pagesPersistence of Price MovementWayne H WagnerNo ratings yet

- How Big Is Too BigDocument4 pagesHow Big Is Too BigWayne H WagnerNo ratings yet

- Drifting Icebergs: Perceptions and Reality in Trading CostsDocument2 pagesDrifting Icebergs: Perceptions and Reality in Trading CostsWayne H WagnerNo ratings yet

- Is Eliminating Tracking Error Hazardous To Your Wealth?Document3 pagesIs Eliminating Tracking Error Hazardous To Your Wealth?Wayne H WagnerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Black BookDocument9 pagesBlack Book148 Kanchan SasaneNo ratings yet

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- El Gambrisino 2008-11Document8 pagesEl Gambrisino 2008-11ghosthikerNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviteja tankalaNo ratings yet

- (Cases in Radiology) Catherine M. Appleton, Kimberly N. Wiele - Breast Imaging Cases (Cases in Radiology) - Oxford University Press, USA (2011)Document263 pages(Cases in Radiology) Catherine M. Appleton, Kimberly N. Wiele - Breast Imaging Cases (Cases in Radiology) - Oxford University Press, USA (2011)Huyen NguyenNo ratings yet

- Tidu 262Document24 pagesTidu 262Aman MohantyNo ratings yet

- ANIMOMETERDocument2 pagesANIMOMETERKarthikeyan VisvakNo ratings yet

- A320Document6 pagesA320Atharav Ansil ChowdharyNo ratings yet

- ALLWheyproteinNOWE 638060866855526804Document2 pagesALLWheyproteinNOWE 638060866855526804gyshylsashaNo ratings yet

- CHN ReviewerDocument15 pagesCHN ReviewerHazel Zulla100% (1)

- Product Data Sheet Magtech Magnetic Level Indicators en 2883066Document22 pagesProduct Data Sheet Magtech Magnetic Level Indicators en 2883066Daniel MarshalNo ratings yet

- RICS New Rules of Detailed MeasurementDocument6 pagesRICS New Rules of Detailed MeasurementmkjailaniNo ratings yet

- Advanced Engineering Mathematics by Erwin Kreyszig - Advanced Engineering Mathematics For Everyone!!!! PDFDocument3 pagesAdvanced Engineering Mathematics by Erwin Kreyszig - Advanced Engineering Mathematics For Everyone!!!! PDFRose Hunter0% (3)

- Fluid Power Formulas GuideDocument4 pagesFluid Power Formulas GuidemahaveenNo ratings yet

- Ntfs and FatDocument44 pagesNtfs and FatamitzagadeNo ratings yet

- Supplier ListDocument16 pagesSupplier ListSarvajeet VermaNo ratings yet

- Survey Report For Lasho & Loikaw Hospital ProjectDocument288 pagesSurvey Report For Lasho & Loikaw Hospital Projectlwin_oo2435No ratings yet

- Decreased Intracranial Pressure With Optimal Head Elevation of 30 or 45 Degrees in Traumatic Brain Injury Patients (Literatur Review)Document4 pagesDecreased Intracranial Pressure With Optimal Head Elevation of 30 or 45 Degrees in Traumatic Brain Injury Patients (Literatur Review)Theresia Avila KurniaNo ratings yet

- Edith Bonomi CV SummaryDocument1 pageEdith Bonomi CV SummaryEdithNo ratings yet

- Airport Pavement Design and EvaluationDocument104 pagesAirport Pavement Design and Evaluationwanjailani91% (11)

- Dutch Lady: Financial Statement AnalysisDocument17 pagesDutch Lady: Financial Statement AnalysisNurqasrina AisyahNo ratings yet

- Prerequisite For Service Entry Sheet SAP-FioriApp.Document4 pagesPrerequisite For Service Entry Sheet SAP-FioriApp.praveennbsNo ratings yet

- Sangeetha ResumeDocument7 pagesSangeetha Resumesangee_radharishnanNo ratings yet

- Sap Signavio Process Manager Workspace Admin Guide enDocument146 pagesSap Signavio Process Manager Workspace Admin Guide enLyster Machado100% (1)

- Mortgage Dispute ResolvedDocument175 pagesMortgage Dispute ResolvedGabrielle Adine SantosNo ratings yet

- Civil Constraction Method - DrainaseDocument7 pagesCivil Constraction Method - DrainaseIrvan MaulaNaNo ratings yet

- Asan NamazDocument33 pagesAsan Namazsaamir_naeem67% (3)

- Mt80hp4ave MT80 4viDocument5 pagesMt80hp4ave MT80 4viIRAN FREONNo ratings yet

- Inspire Awards - EditedDocument2 pagesInspire Awards - EditedVamsee Krishna Reddy BheriNo ratings yet

- Mercantilism Simulation Chart Notes Teacher VersionDocument2 pagesMercantilism Simulation Chart Notes Teacher Versionapi-281321560No ratings yet