Professional Documents

Culture Documents

Gtz2006 en Croatia Tax Brief Report Ex Post Evaluierung

Uploaded by

ulhasvasantkadamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gtz2006 en Croatia Tax Brief Report Ex Post Evaluierung

Uploaded by

ulhasvasantkadamCopyright:

Available Formats

Ex-post Evaluation 2006 Advice on Developing Croatias Tax System, Croatia

Brief Report

Produced by: Forschungsstelle fr Internationale Agrarund Wirtschaftsentwicklung, Im Neuenheimer Feld 330, D-69120 Heidelberg This report was produced by independent external experts. It reflects only their opinion and assessment.

Published by: Deutsche Gesellschaft fr Technische Zusammenarbeit (GTZ) GmbH Evaluation Unit Dag-Hammarskjld-Weg 1-5 65760 Eschborn Germany Internet: http://www.gtz.de

Eschborn, December 15, 2006

Contents Page 1. 2. Tabular overview Description of the project/programme 2.1 2.2 2.3 3. Project/programme title, project objective, indicators, contribution to overarching objectives/ intended results Problem situation (sector), framework conditions in the country (political / economic / social / environmental) Concept and advisory approach of the project/programme (target groups, partners, levels, regions, modes of delivery) 2 3 3 3 4 5 5 5 6 7

Results of the evaluation 3.1 3.2 3.3 3.4 Overall rating Performance measurement in line with the 5 international evaluation criteria (with brief explanations) Performance measurement of MDG /poverty / gender Conclusions and recommendations

1.

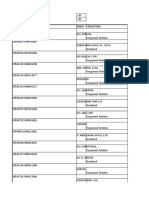

Tabular overview Advice on Developing Croatias Tax System 1992.4817.0 01.09.1993 30.06.1999 German contribution: 1.233.706,-Partner contribution: provided by the Ministry of Finance (lead executing agency) with its general activities; there were no budget appropriations for the project; Contribution of a third party: there were no budget appropriations for the project input provided by the Ministry of Finance of Baden-Wrttemberg. Implementation of a working, market-economy oriented tax system in the fields of tax law and tax administration. Implementation of an academy of finance intended for the systematical professional training of the tax administrations staff. Ministry of Finance of the Republic of Croatia Tax department of the Ministry of Finance headed by the General Tax Director None

Project/programme title Project/programme number Overall term Overall costs

Objective of the project/programme

Lead executing agency Implementing organisations

Other organisations and donors involved Target groups

Target group of the project is the total population of Croatia Forschungsstelle fr Internationale Agrar- und Wirtschaftsentwicklung, Im Neuenheimer Feld 330, D69120 Heidelberg July 2006 to December 2006 1

Institute performing evaluation

Evaluation period Overall rating

On a scale of 1 (very good, significantly better than expected) to 6 (the project/program is useless, or the situation has deteriorated on balance)

Individual rating

Relevance: 1 Effectiveness: 1 Impact: 2 Efficiency: 1 Sustainability: 2

2. 2.1

Description of the project/programme Project/programme title, project objective, indicators, contribution to overarching objectives/ intended results

The advising activities on the introduction of a new tax system in Croatia aimed to implement an effective, market-economy oriented public financial system based on the three components of tax law, tax administration and institutionalized professional training in the form of an academy of finance. The target indicators named refer to the two components tax law and tax administration: Drafts have been submitted to Parliament. The description of tasks as well as the attribution of powers to the Ministry of Finance and the subordinate authorities have been defined in a binding and transparent manner on all levels. All functional levels of tax administrations staff are well informed on the objectives and contents of the reform measures. Information on the different taxes and taxation procedures is available.

The intended (indirect) results are described by the main objective according to which Croatias public financial system is to be geared to a system of social market-economy within a democratic state 1 . The social market-economy model is interpreted by the experts as defined by Ludwig Erhard, in other words positive social effects are expected from an effective and employment-generating economy, with the social security system playing a subsidiary part. 2.2 Problem situation (sector), framework conditions in the country (political / economic / social / environmental) In terms of the main objective, the tax system reform needed to be adapted specifically to the countrys constitution and its general economic constitution. In the latter basic and fundamental principles of the market-economy system, such as the right to private property and the freedom of trade, are enshrined in law. In fact, however, the transition process was discredited by serious irregularities concerning the privatization of former national enterprises.

The appraisers assume that democracy includes the rule of law.

The reform of tax law needed to satisfy the multi-functionality of tax systems in marketeconomy systems including more than the fiscal function (raising of revenues). In particular the specific features aimed at economic efficiency and income distribution. The main task of the tax administration reform consisted in avoiding division of the tax administration into two parts one for corporate bodies and one for private individuals and in building up a united tax administration. From a political and historical point of view, Croatias separation from multi-national Yugoslavia in 1991 led in a most decisive way to the development of the framework conditions existing at the start of the project and consequently to the transition of Croatia as former part of a socialist federal republic to an independent country adopting the Western model. Initially, Croatias economic conditions were characterized by the disastrous effects and consequences of the civil war, but also by regained monetary stability. 2.3 Concept and advisory approach of the project/programme (target groups, partners, levels, regions, modes of delivery) The project was not differentiated by target groups: Its target group was Croatias total population. The project was carried out by the following organizations: a) GTZ, b) Croatias Ministry of Finance (lead executing agency), c) Int-Fis Agency for International Fiscal Analyses GmbH, and d) Baden-Wrttembergs Ministry of Finance. The project as a whole was actually based on three key elements: tax law, tax administration, and an academy of finance. With regard to the projects overall term of nearly six years it should be emphasized that all advice was given by short-term experts. The procedure applied to perform their work can be characterized as the shuttle-principle 2 . The German contribution was directed by the GTZ headquarters and within this framework also by the German short-term experts themselves (delegated implementation on site) as well as by a GTZ coordination office in the Croatian Ministry of Finance. This project coordination office acted as a counterbalance, guaranteeing continuity of the project activities, to the advising activities of the short-term experts. The GTZ surveyed and effectively supported the project by using its planning and regulatory instruments. Three workshops (ZOPP system, i.e. Objectives-oriented Project Planning), one project success control, one project evaluation and one seminar discussing the results of the evaluation took place.

Here one could also speak of intermittent missions.

3. 3.1

Results of the evaluation Overall rating

As far as the projects overall rating is concerned, the five evaluation criteria are of different significance. Sustainability is of comparatively high significance because it exerts a decisive influence on the amount of the present value of future project benefits as an indicator of success. As effectiveness together with sustainability is a critical factor for impact, this criterion is also of higher than average significance. Efficiency, on the contrary, is relatively insignificant, because, compared to the considerable effects of the tax system reform on the total economy, the mere efficiency of the project is of minor importance. Based on the different results the overall rating of the project and its achievement of the development goals is very good. 3.2 Performance measurement in line with the 5 international evaluation criteria (with brief explanations) The performance measurement in line with the 5 international evaluation criteria leads to a very positive impression of the projects success in the achievement of the development goals. Relevance The project objectives correspond to a high, or extraordinarily high, degree with the needs of the target group, the policies of the cooperating country and its institutions, the global development goals as well as the donors principles of development policy. This is therefore definitely a very good result. It is important to emphasize that this reform project and its underlying model were given high priority by the cooperating country and that it was of high relevance, especially to the poor population groups. Effectiveness The complete achievement of all project objectives resulted in the grade very good. The project is not responsible for some directly negative effects (for instance: contradictions between implementing regulations and substantive tax law); the reasons for these negative effects are not due to the project itself.

Impact Together with the high effectiveness of the project its convincing models in the fields of tax administration and tax law (the latter being exemplary) contributed significantly to the achievement of chief development goals; thus, the grade good is awarded. An aggravation of the situation after the implementation of the reform is not in contradiction with this assessment; but of course this needs to be taken into consideration when assessing sustainability. Efficiency The project realized a) a high efficiency on the technical and organizational level, b) a sufficient input level, and c) a high project output per invested DM. Because of these results the grade very good is awarded. Sustainability It should have been possible to work against the observed, though not neutrally classified system deteriorations after the implementation of the reform by starting project activities such as information and communication campaigns. These negative effects, which result only marginally from the project itself, did not alter the established and very important fundamental structure in the fields of tax administration and tax law. In addition, system deteriorations can be easily corrected within the solid fundamental structures. Therefore it seems appropriate to award the grade good. 3.3 Performance measurement of MDG /poverty / gender

With regard to poverty reduction two facts should be emphasized: Firstly, with the tax system generating fiscal abundance, conditions were given to finance numerous social projects. Secondly, it seems to be obvious that the whole system encouraged efficiency and investments thus weakening other significant factors which exerted a negative influence on labor demand. The architects of the tax reform project vehemently rejected the use of different value-added tax rates in order to correct distortions of the social system. It seems at least understandable that the initiators of the tax reform followed a conception implying optimum division of tasks between the fiscal and the social system, so that the system transition is not charged a priori with a faulty design. At the beginning the tax exempt amount of the income tax system did not sufficiently take into consideration the subsistence level. It was no problem, however, to 6

realize improvements on the technical level within the framework of the reform model later on. MDG From the results obtained we may conclude that the reform project can be expected to contribute directly and substantially to the solution of problems and/or higher abilities to find solutions to problems in the following areas 3 : economic growth and increased active participation of the poor (MDG 1,8); reduction of the fiscal deficit development finance (MDG 1,8); guaranteeing basic social services strengthening social security (MDG 1-6 and 8).

Gender The project is neither gender differentiated nor was any gender analysis carried out. The project was considered gender neutral from the outset. Due to the lack of previous sociostructural analyses it was not possible to carry out any gender analysis during the evaluation of the project. 3.4 Conclusions and recommendations

Two results that differ significally from each other characterize the project and the changes accomplished by Croatia subsequently. These results are: on the one hand, the unusually high project success, and on the other hand, system deteriorations in tax law and decreasing performance of tax administration after conclusion of the project. The changes introduced after the project was concluded and that were mainly criticized in a negative way, were primarily the result of a normal political process. Donor institutions such as the GTZ or the World Bank are in a dilemma: On the one hand it is possible to achieve a considerable degree of transition, that cannot be achieved otherwise, by introducing a good tax system and implementing it well, on the other hand tax law especially tends to be susceptible to discretionary political influences. Nevertheless it should be noted that the Croatian tax reform was not established on a broad political basis. In addition, according to the project scheme, popular communication and information campaigns were not planned within the projects framework. Both can be regarded as missed opportunities to stabilize the tax system.

On this, cf. the ten priority areas of the German Governments Programme of Action (see German Governments 12th Development Policy Report).

The donor institution should at least try to find ways to lead a broad political dialogue with the partner country. It does not seem possible, however, to stabilize the tax system without finding compromises as far as concrete measures are concerned. In the case of Croatia, it would have been worthwile to take steps symbolizing distribution justice (for instance, reduced value-added tax rates on basic food), because distribution problems dominated the political tax discussion. A choice has to be made between limited economic inefficencies that need to be accepted, on the one hand, and enormous potential stabilization effects, on the other. The experience gained from this project shows that all projects dealing with the implementation of complex system reforms and, in addition, directly touching the interests of most members of a society, should include information and communication campaigns.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ethnic Conflicts in The World TodayDocument16 pagesEthnic Conflicts in The World TodayapiyaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Fight Club - Critical ReceptionDocument7 pagesFight Club - Critical ReceptionMatt ComptonNo ratings yet

- MCQ Pattern English I-II SemesterDocument10 pagesMCQ Pattern English I-II Semesterulhasvasantkadam50% (6)

- Eastern Broadcasting v. DANS, 137 SCRA 628 (1985)Document2 pagesEastern Broadcasting v. DANS, 137 SCRA 628 (1985)Jasmin MacabacyaoNo ratings yet

- Absolutism and Constitutionalism Thesis StatementsDocument3 pagesAbsolutism and Constitutionalism Thesis Statementsapi-282463341No ratings yet

- Giles Ji Ungpakorn - A Coup For The Rich - Thailand's Political CrisisDocument141 pagesGiles Ji Ungpakorn - A Coup For The Rich - Thailand's Political CrisisScribtUser1988100% (2)

- What Happened To The European Left?: Sheri BermanDocument8 pagesWhat Happened To The European Left?: Sheri BermanDerek JensenNo ratings yet

- China's Road To The Korean War: Chen JianDocument356 pagesChina's Road To The Korean War: Chen JianMas UyungNo ratings yet

- SsssssDocument467 pagesSsssssAkunpalsu2016 PalsuNo ratings yet

- The RADICAL RIGHT in Contemporany EuropeDocument28 pagesThe RADICAL RIGHT in Contemporany EuropeAlexandre de Almeida100% (1)

- Professor Grammar's Rule Book PDFDocument66 pagesProfessor Grammar's Rule Book PDFdianita192100% (6)

- Structure ofDocument3 pagesStructure ofulhasvasantkadamNo ratings yet

- Circular - Grievance Cell Establish in All Colleges & Educational InstituteDocument26 pagesCircular - Grievance Cell Establish in All Colleges & Educational InstituteulhasvasantkadamNo ratings yet

- Software quality factors: Understandability, completeness, conciseness, portability, maintainability, testability, usability, reliabilityDocument2 pagesSoftware quality factors: Understandability, completeness, conciseness, portability, maintainability, testability, usability, reliabilityulhasvasantkadamNo ratings yet

- MA SemI&IIDocument34 pagesMA SemI&IIulhasvasantkadamNo ratings yet

- List of MCQ Examination Centres For Summer 2013 ExaminationsDocument11 pagesList of MCQ Examination Centres For Summer 2013 ExaminationsulhasvasantkadamNo ratings yet

- Basem 1Document63 pagesBasem 1ulhasvasantkadamNo ratings yet

- SRTMU Nanded B.A. I Year - Sociology - Syllabus - W.E.F. 2013-14Document14 pagesSRTMU Nanded B.A. I Year - Sociology - Syllabus - W.E.F. 2013-14ulhasvasantkadamNo ratings yet

- UGC GuidelineDocument79 pagesUGC GuidelineChristopher Olsen100% (1)

- B.a., B.com., B.sc. I Year - Marathi (SL), B.A. I Year - Marathi (Optional) - Syllabus - W.E.F. 2013-14Document7 pagesB.a., B.com., B.sc. I Year - Marathi (SL), B.A. I Year - Marathi (Optional) - Syllabus - W.E.F. 2013-14ulhasvasantkadamNo ratings yet

- SRTMU Nanded B.A. I Year - Political Science - Syllabus - W.E.F. 2013-14Document7 pagesSRTMU Nanded B.A. I Year - Political Science - Syllabus - W.E.F. 2013-14ulhasvasantkadamNo ratings yet

- Net Notif 2006Document3 pagesNet Notif 2006Shafeeq Ali MNo ratings yet

- SRTMUN UG English Syllabus 2013 BA, BCom, BSC First Year Compulsory EnglishDocument9 pagesSRTMUN UG English Syllabus 2013 BA, BCom, BSC First Year Compulsory Englishulhasvasantkadam50% (2)

- SRTMU Nanded B.A. I Year - Sociology - Syllabus - W.E.F. 2013-14Document14 pagesSRTMU Nanded B.A. I Year - Sociology - Syllabus - W.E.F. 2013-14ulhasvasantkadamNo ratings yet

- AQARDocument18 pagesAQARKalaiarasu SubramanianNo ratings yet

- Awa Novdec 09Document26 pagesAwa Novdec 09ulhasvasantkadamNo ratings yet

- Teaching Oral Communication Skills A Task-Based ApproachDocument11 pagesTeaching Oral Communication Skills A Task-Based ApproachAhmed Al-fifNo ratings yet

- UGC GuidelineDocument79 pagesUGC GuidelineChristopher Olsen100% (1)

- API 2013 UGC in EnglishDocument16 pagesAPI 2013 UGC in EnglishRitesh KeshriNo ratings yet

- Specimen MCQ Optional English-IIDocument5 pagesSpecimen MCQ Optional English-IIulhasvasantkadamNo ratings yet

- MCQ English Structure ExamDocument5 pagesMCQ English Structure ExamulhasvasantkadamNo ratings yet

- Gtz2006 en Lesotho SFCP MNRDocument9 pagesGtz2006 en Lesotho SFCP MNRulhasvasantkadamNo ratings yet

- Gender Sensitization Womens SafetyDocument5 pagesGender Sensitization Womens SafetyulhasvasantkadamNo ratings yet

- Shastri News Winter and Spring EditionDocument13 pagesShastri News Winter and Spring EditionulhasvasantkadamNo ratings yet

- SRTMUN UG English Syllabus 2013 BA, BCom, BSC First Year Compulsory EnglishDocument9 pagesSRTMUN UG English Syllabus 2013 BA, BCom, BSC First Year Compulsory Englishulhasvasantkadam50% (2)

- Gtz2010 en Evaluation Report Analysis 2008 2009Document48 pagesGtz2010 en Evaluation Report Analysis 2008 2009ulhasvasantkadamNo ratings yet

- API 2013 UGC in EnglishDocument16 pagesAPI 2013 UGC in EnglishRitesh KeshriNo ratings yet

- Politics-IR UK 2014 WebDocument36 pagesPolitics-IR UK 2014 Webnthu55660% (1)

- A Comparative Analysis of Evolution and Structure of Local Government Systems in Nigeria and LiberiaDocument7 pagesA Comparative Analysis of Evolution and Structure of Local Government Systems in Nigeria and Liberiarobert0rojerNo ratings yet

- Carlos Schonerwald Associate Professor Economics ProfileDocument3 pagesCarlos Schonerwald Associate Professor Economics ProfileCarlos SchönerwaldNo ratings yet

- Achebe On Conrad As A RacistDocument15 pagesAchebe On Conrad As A RacistM.ZubairNo ratings yet

- Fishman - On The Significance of Public ProtestDocument6 pagesFishman - On The Significance of Public ProtestSamira FonsecaNo ratings yet

- Code of Conduct PTI CanadaDocument15 pagesCode of Conduct PTI CanadaPTI Official0% (1)

- Hinton, William - Shenfan - The Continuing Revolution in A Chinese Village.Document541 pagesHinton, William - Shenfan - The Continuing Revolution in A Chinese Village.JoséArdichottiNo ratings yet

- Kant Arendt Compte RenduDocument28 pagesKant Arendt Compte Rendusarah2kNo ratings yet

- Constitutional Meanings, Classifications and FunctionsDocument10 pagesConstitutional Meanings, Classifications and FunctionsJackson LoceryanNo ratings yet

- Report - Recommendations For Electoral Law Reform in NamibiaDocument146 pagesReport - Recommendations For Electoral Law Reform in NamibiaMilton LouwNo ratings yet

- Notas Consenso Por JustaposiçãoDocument10 pagesNotas Consenso Por JustaposiçãoulyssespoaNo ratings yet

- Trade UnionismDocument16 pagesTrade UnionismSoumya SahooNo ratings yet

- 7 Step Road Map of Burmese RegimeDocument13 pages7 Step Road Map of Burmese Regimetineyintharvoice50% (2)

- Kenya's Political Journey: A History of Parliamentarians 1944-2007Document176 pagesKenya's Political Journey: A History of Parliamentarians 1944-2007Brandon Miller-de la Cuesta100% (2)

- DECEMBER 1 - Romania's National Day: Union Day or Ziua Marii Uniri (In Romanian), 1 December Commemorates A MemorableDocument1 pageDECEMBER 1 - Romania's National Day: Union Day or Ziua Marii Uniri (In Romanian), 1 December Commemorates A MemorableOana Maria DorosNo ratings yet

- National Culture, Globalization and The Case of Post-War El SalvadorDocument22 pagesNational Culture, Globalization and The Case of Post-War El SalvadorRebecca KatsarisNo ratings yet

- 750 1767 1 PB PDFDocument811 pages750 1767 1 PB PDFAtiyatna PutriNo ratings yet

- Plutocracy Is Rule by The: Modern PoliticsDocument3 pagesPlutocracy Is Rule by The: Modern PoliticsAvicena AlbiruniNo ratings yet

- Ethnic Conflict & Accommodation: Comparative PerspectiveDocument4 pagesEthnic Conflict & Accommodation: Comparative PerspectiveHazadNo ratings yet

- Constitution of BNPDocument16 pagesConstitution of BNPBari KhanNo ratings yet

- Karnala Trip - Avian Paradise and History of Karnala FortDocument7 pagesKarnala Trip - Avian Paradise and History of Karnala FortmehakNo ratings yet