Professional Documents

Culture Documents

Daily Agri Report, May 07

Uploaded by

Angel BrokingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Agri Report, May 07

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Tuesday| May 07, 2013

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Tuesday| May 07, 2013

Agricultural Commodities

News in brief

Withdrawal of Additional Margin on Potato(POTATO) Contracts

Trading and Clearing members are hereby informed that in terms of Byelaws, Rules and Regulations of the Exchange, and as directed by the Forward Markets Commission, Additional Margin of 15% (in Cash) on both Long and Short side in Potato (SYMBOL:POTATO) May 2013, June 2013 and July 2013 expiry contracts have been withdrawn with effect from beginning of day Tuesday, May 07, 2013. Further, Special margin of 20% (in Cash) on Long side will be continued to be levied in above contracts. (Source NCDEX)

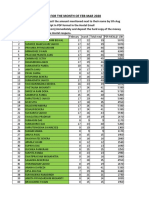

Market Highlights (% change)

Last Prev. day

as on May 06, 2013

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

19674 5971 54.14 96.16 1468

0.50 0.46 0.60 0.58 0.26

1.48 1.13 -0.11 1.76 0.05

6.63 7.52 -1.23 3.73 -6.81

16.89 17.38 1.23 -2.37 -10.74

.Source: Reuters

Govt moves Food Bill, hopeful of passage today

The National Food Security Bill was moved in the Lok Sabha on Monday amid disruptions. Moving the Bill, Food and Consumer Affairs Minister K.V. Thomas said wide consultations were held among political parties, State Governments and other stakeholders on the landmark legislation of the United Progressive Alliance. The Government has decided to move 70 amendments to the Bill. The amendments will make the framework of the Bill simpler, provide more flexibility to States in its implementation and to address some of the concerns raised by them. There would be only one category of beneficiaries now, with uniform entitlement of five kilograms per person per month, Thomas said. He said the entitlements of Antyodaya Anna Yojana (AAY) households, which constitute poorest of the poor will, however, be protected at 35 kg per household per month..

(Source: Business Line)

Rice market seen stable on supply curbs

It is hard to anticipate the rice market future at present and it is unlikely to see any major alteration this week and market may continue to rule around current levels, said traders. Some fresh buying pushed Pusa-1121, Sharbati and PR 14 rice varieties upwards, while all other aromatic and non-basmati rice varieties managed to maintain their previous levels, on Monday. (Source: Business Line)

Over 56 lakh tonne of wheat procured in Haryana

Over 56.76 lakh tn of wheat have so far arrived in grain markets of Haryana during the current procurement season. A spokesman of the Food and Supplies Department said out of it, over 56.68 lakh metric tn of wheat has been procured by the Government agencies at the minimum support price and 7,490 tn of wheat has been purchased by the private millers and traders. He said HAFED has procured over 21.90 lakh tn of wheat, Food and Supplies over 14.13 lakh tn, Food Corporation of India over 7.06 lakh tn, Haryana Agro Industries Corporation over 5.46 lakh tn, Haryana Warehousing Corporation over 5.14 lakh tn and CONFED had purchased 2.96 lakh tn of wheat.. (Source: Business Line)

Cardamom slips below Rs 600 a kg as demand slows

The cardamom market lost its flavour last week as supply outstripped demand at the auctions. Consequently, the individual auction average price dropped to below Rs 600 a kg. Export buying was reportedly slow due to poor quality material. Material arriving at the auction was of inferior quality. The current season has come to an end. The next season is expected to commence with an early crop by mid-June. Hence, those who are holding carry forward stocks started liquidating on the assumption that the prices may not move up in the coming days but might fall further, they said. Arrival of 7 mm and above good colour cardamom has declined while the buyers were also limited. (Source: Business

Line)

Soyameal exports dip 70% in April

The countrys soyameal exports fell 70% to 1,00,000 tn in April due to sluggish global demand. Shipments of soyameal, used as animal feed, stood at 3.36 lakh tn in the same month last year. Exports fell as the Indian soybean meal prices are not competitive in comparison to international rates, the Indore-based SOPA said in a statement. Till April of 2012-13 oil year (October-September), the exports have declined by 13.6% to 26.97 lakh tn against 31.21 lakh tn in the same period last year.

(Source: Business Lines)

Bihar opens highest number of wheat procurement centres

After paddy, Bihar has again set an ambitious target to procure wheat from its farmers for central pool. According to official sources, the state has planned to almost double its wheat procurement for 2013-14 rabi procurement season to 1.5 million tones as against the earlier procurement of 0.8 million tones. However, in the current season, Bihar is yet to procure any. In MP & UP, however it has been observed that private traders have been active this year in purchasing wheat directly from farmers & are not waiting for the government to make the first move which could lead to lower than expected procurement for the central pool. (Source: Business Standard)

Sugarcane pay to UP farmers tops estimates, but dues remain

As the 2012-13 sugarcane crushing season rounds off in Uttar Pradesh, the total dues to farmers have exceeded the state government estimates set last year. Against the Rs 21,500 crore pegged for the current season, the dues have breached Rs 22,402 crore, about 4.2% higher. With fourfive mills still crushing and expected to continue for a week, the total payments could only rise. The main factor behind higher payments is the rise of 17% in the state price, known as SAP, which is Rs 280/qtl for common variety vis--vis Rs 240/qtl on the previous year. The prices for early and rejected/unsuitable varieties of cane had been hiked to Rs 290/qtl and Rs 275/qtl compared to Rs 250/qtl and Rs 235/qtl respectively on December 7, 2012. During 2011-12, the total payments were Rs 18,200 crore in UP. (Sour e Business Standard)

Cotton futures rise for 3rd straight session on weather worries

ICE cotton rose on Monday for a third straight session, on buying by investors worried about the supply outlook due to unfavorable crop weather in the United States, the world's top exporter of the fiber, dealers said. The most-active July contract on ICE Futures U.S. CTN3 rose 0.96 cent, or 1.1 percent, to settle at 87.39 cents per lb. Cotton traders worried about drought conditions in Texas, the country's top growing region. Those worries componded last week's concern about too much rain that has delayed cotton planting in the Southeast ( Source: Reuters)

Fertilizer subsidy may not fall as Urea cost rises

The centres fertilizer subsidy is unlikely to reduce even after new plants are set up under the Urea investment policy because the production cost is expected to shoot up due to high global price of gas, according to credit rating agency CRISIL. The govt has received 15 investment proposals for setting up of gas- based urea fertilizer plants in response to the New Investment Policy 2012 under which companies are incentivized to set up new plants $ expand existing capacity.(Source Financial Chronicle

www.angelcommodities.com

Commodities Daily Report

Tuesday| May 07, 2013

Agricultural Commodities

Chana

Chana futures continued to trade on a negative note yesterday as higher arrivals of the new crop have mounted pressure on the prices. Demand from stockists also remains dull. However, reports of lower yield in MP supported prices at lower levels. The spot as well as the Futures settled 0.73% and 1.46% lower on Monday. Higher supplies of the new crop from the major producing states such as Madhya Pradesh, Rajasthan and Maharashtra is seen pressurizing prices in the physical markets. However, concerns over the yield in Madhya Pradesh, the largest chana producing state, due to unfavorable weather conditions has been seen supporting prices at lower levels. Chana prices may find support at lower levels as stockists will build inventories at lower levels to meet the demand for the entire season.

Market Highlights

Unit Rs/qtl Rs/qtl Last 3400 3373 Prev day -0.73 -1.46

as on May 06, 2013 % change WoW MoM 0.00 -3.55 -1.06 -3.79 YoY -17.07 -17.49

Chana Spot - NCDEX (Delhi) Chana- NCDEX May'13 Futures

Source: Reuters

Technical Chart - Chana

NCDEX June contract

Demand supply scenario

Higher returns earned in 2012, coupled with a hike in minimum support prices (MSP), have helped expand overall acreage in 2012-13 season. The Centre has hiked the MSP by 14 per cent to Rs 3,200 a quintal for chana and as part of its strategy to encourage farmers to grow more pulses to reduce import dependence. Chana sowing in the current season is 5.65% higher at 95.17 lakh ha compared to previous year. Acreage is up in Rajasthan, Maharashtra, MP and AP at 15.7 lakh ha, 12.53 lakh ha, 32.99 lakh ha and 7.33 lakh ha respectively. According to third advance Estimates released on 3 May 2013, Total pulses output for 2012-13 season has been pegged at 18 mn tn, up 5.76% compared to previous year. The target for 2012-13 pulses crop output was set at 18.24 million tonne during the year. Out of the total pulses output, kharif output is estimated at 4.03% lower at 5.95 mn tn while rabi pulses output is pegged 9.25% higher at 12.05 mn tn compared with the final estimates of 2011-12. Chana output is pegged marginally lower to 8.49 mn tn compared with its second advance estimates of 8.57 million tonnes. However,Chana output is expected to breach its 2010-11 record of 8.2 mn tn in 2012-13. Erratic weather in M.P. lowered the yield. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source:

Agriwatch).

rd

Source: Telequote

Technical Outlook

Contract Chana May Futures Unit Rs./qtl Support

valid for May 04, 2013 Resistance 3490-3530

3415-3435

Trade Scenario

According to IBIS, imports of chana in the month of February declined to 0.46 lakh metric tonnes compared to 2.31 lakh metric tonnes during the previous month. India imports Chana mainly from Australia and Canada and higher availability in these countries at comparatively cheaper rates is seen boosting imports of Chana to meet the domestic shortfall. In Australia, total chickpea production in 201213 is estimated to have increased to a record 713000 tones as compared with 485000.

Outlook

We expect Chana prices to continue to decline today. Increasing arrivals of the new crop may pressurize prices at higher levels. However, value buying may emerge at lower levels. Any improvement in demand from stockists may restrict a major downside. Overall output in the current season is comparatively higher and thus no major upside is expected over a medium term.

www.angelcommodities.com

Commodities Daily Report

Tuesday| May 07, 2013

Agricultural Commodities

Sugar

Sugar prices traded on a negative note yesterday and touched a new contract low of Rs 2909 on account of higher supplies from mills which have been seen offsetting the summer demand while the spot gained due to improvement in demand from the bulk consumers. Sugar prices in the domestic markets are seen consolidating at lower levels. The spot settled 0.14% higher while the Futures settled 0.17% lower on Monday. The Government has cleared the partial decontrol of sugar. According to this, the government will now have to buy sugar from the mills at open market prices. Also the release mechanism will be done away with, after September 2013. States will decide on the FRP of cane. Indian sugar mills produced 23 million tonnes of the sweetener between Oct. 1 and March 31, about 2 percent less than a year earlier. The Central Government has decided to make available quantity of 104 lakh tons of sugar, as non-levy quota for open market sale, for the 6 months of April, 2013 to September, 2013.

Market Highlights

Unit Sugar Spot- NCDEX (Kolhapur) Sugar M- NCDEX May '13 Futures Rs/qtl Last 3043

as on May 06, 2013 % Change Prev. day WoW 0.14 0.63 MoM -0.85 YoY 3.48

Rs/qtl

2914

-0.17

-0.82

0.45

1.01

Source: Reuters

International Prices

Unit Sugar No 5- LiffeMay'13 Futures Sugar No 11-ICE May '13 Futures $/tonne $/tonne Last 496.8 395.78

as on May 06, 2013 % Change Prev day WoW -0.88 1.60 -0.74 1.83 MoM -1.60 0.91 YoY -11.25 -14.42

Domestic Production and Exports

According to ISMA, Indias Sugar production between October April stood at 24.52 mn tn, lower by 3% during the same period last year. Maharashtras production dipped 10% to 8 mn tn while production in Uttar Pradesh increased by 7% to 7.43 mn tn.

India is likely to produce 24.6 mn tn of sugar in 2012-13 year ending on Sept. 30, higher than the previous estimate of 24.3 mn tn, the Indian Sugar Mills Association (ISMA) said last week. With the opening stocks of 6.5 mn tn, domestic Sugar supplies are estimated at 30.8 mn tn against the domestic consumption of around 22. 5 mln tn for 2012-13. Exports are not viable as international prices have also declined significantly. A severe drought in top sugar producing Maharashtra state has been affecting new plantation and is likely to affect on sugar production in the year starting from Oct. 1, 2013.

.Source: Reuters

Technical Chart - Sugar

NCDEX June contract

Global Sugar Updates

Liffe sugar remained closed on account of May Day while ICE Raw Sugar settled 1.6% higher on Monday, its largest single day gains in over two months on account of short coverings. Sugar prices in the international markets are trading at their lowest levels in since July 2010 on account of a global surplus situation for the third consecutive year. According to Unica, South-Central Brazil cane crush projected at 589.60 million tons for 2013/2014. Main center-south sugar cane crop will produce a record 35.5 mn tn of sugar in the 2013/14 season, higher by 4.1% compared to 34.1 mn tn last year. Heavy rain in the cane belt of top world sugar producer Brazil has slowed early progress of an expected record cane harvest. Brazil's sugar production will jump to a record level in the 2013/14 season just now starting, with a surge in cane output from an expanded planted area, favorable weather and efforts to renew old and less productive cane plants. Expectations of abundant supplies from the 2013-14 harvest in the other leading producers, such as Thailand, Mexico and the United States have kept prices under pressure. Sugar prices are trading around 2 year lows.

Source: Telequote

Technical Outlook

Contract Sugar May NCDEX Futures Unit Rs./qtl Support

valid for May 04, 2013 Resistance 2970-2990

2920-2940

Outlook

Sugar is expected to trade on a mixed note today. Prices may consolidate at lower levels over the next few days. Improvement in demand from the bulk manufacturers will support prices at lower levels. A decline in sugar production may also support prices at lower levels. However, supplies will continue to remain high as millers will release stocks to clear cane arrears. This will offset summer season demand.

www.angelcommodities.com

Commodities Daily Report

Tuesday| May 07, 2013

Agricultural Commodities

Oilseeds

Soybean: Soybean traded on a positive note as poor supplies in the

domestic markets supported prices at lower levels. However, sharp gains have been capped on the back of IMDs prediction of a normal rd monsoon. According to the 3 advance Estimates, Soybean output is pegged at 14.14 mn tonnes. The spot as well as the Futures settled 0.1% and 0.84% higher on Monday. Special Margin (in Cash) of 10% on the Long side has be imposed in Soyabean May 2013, June 2013 & July 2013 expiry contracts with effect from beginning of day Tuesday, April 30, 2013. Indias soy meal exports in April are likely to fall to 200,000 tonnes, down 36 percent from a year ago, unless buying from Iran improves. Exports of Soybean meal during March, 2013 was 3,20,265 tonnes as compared to 4,61,892 tonnes in March, 2012 lower by 30.66% y-o-y.

Market Highlights

% Change Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX May '13 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX May '13 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 4031 4007 733.8 718.7 Prev day 0.10 0.84 -0.37 -0.07

as on May 06, 2013

WoW 0.20 3.35 -0.87 -0.40

MoM -0.32 -0.53 2.62 0.84

YoY 10.74 10.86 -2.83 -4.78

Source: Reuters

International Markets

Soybean gained 1.69% w-o-w on account of tight supplies of soy crop. Farmer selling has slowed down. Expectations of lower ending stocks in USDAs Monthly crop report to be released next week also supported prices. Large South American crop coupled with forecasts for US weather to improve in the coming week have capped sharp gains. Sentiments remain weak on account of smooth supplies from Brazil coupled with demand fears amid bird flu in China. Data released by National Oilseed Processors Association showed the U.S. soybean crush rose marginally to 137.08 million bushels in March, in line with forecasts for a slight gain from 136.3 million bushels in February. Soy oil stocks edged lower to 2.765 billion lbs, versus 2.79 billion lbs in February. Brazil's government lowered its forecast for the 2012/13 soybean crop from 82.1mn tn to 81.9 mn tn.

International Prices Soybean- CBOTMay'13 Futures Soybean Oil - CBOTMay'13 Futures Unit USc/ Bushel USc/lbs Last 1445 48.69

as on May 06, 2013 Prev day -0.72 -0.96 WoW -1.85 -1.56 MoM 6.08 -0.29

Source: Reuters

YoY -2.07 -8.65

Crude Palm Oil

as on May 06, 2013 % Change Prev day WoW -0.09 0.44 -3.13 -1.59

Unit

CPO-Bursa Malaysia May '13 Contract CPO-MCX- May '13 Futures

Last 2229 457.3

MoM -5.99 -1.25

YoY -33.82 -25.80

MYR/Tonne Rs/10 kg

Refined Soy Oil: Ref soy oil as well as MCX CPO settled 0.18% and

1.01% lower w-o-w tracking weak palm oil prices on KLCE. Palm oil prices on the KLCE have declined as many investors have exited the markets ahead of the general elections to be held on Sunday. Indian government increased the base import price on crude soybean oil by US $9 per tons to US $1103. Besides, base import price on crude palm oil set at US $ 824 and reduced base import price on palmolein crude as well as refined to US $ 864 per tons and US $861 per tons. Imports of all vegetable oils, including non-edible oils, fell 7.5 per cent to 896,714 tn in March, pulled down by the drop in palm oil imports. Palm oil imports dropped 12% to 708,262 tn in March. Malaysia, the world's No.2 palm oil producer, will set its crude palm oil export tax for May at 4.5 percent, unchanged from April. Exports of Malaysian palm oil products from April 1 to 25 increased 5.2% to 1,123,129 tonnes from 1,067,140 tonnes shipped during March 1 to 25.

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX May '13 Futures Rs/100 kgs Rs/100 kgs Last 3401 3388 Prev day -0.15 -0.82 WoW -2.02 -1.85

as on May 06, 2013 MoM -4.53 -4.88

Source: Reuters

YoY -13.29 -14.31

Technical Chart Soybean

NCDEX June contract

Rape/mustard Seed: Mustard Futures declined by 2.12% last

week on account of higher supplies of the new crop. Sowing of Mustard seed is up by 2.2% at 67.23 lakh ha. Agriculture ministry in its third advance estimates, pegged mustard output at 7.36 mn tn, up by 11.5%.

Outlook

Soybean prices may gain today on account of poor supplies in the domestic markets. However, higher margins coupled with forecast of a normal monsoon may cap sharp upside in the prices. Weak meal export demand may also pressurize prices. However, poor supplies in the domestic markets may support prices. Soy oil and CPO may trade sideways with a negative bias. Weak international markets are expected to pressurize prices. However, comfortable stock levels may cap sharp upside.

Source: Telequote

Technical Outlook

Contract Soy Oil May NCDEX Futures Soybean NCDEX May Futures RM Seed NCDEX May Futures CPO MCX May Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for May 04, 2013 Support 682-688 3850-3880 3380-3400 452-455 Resistance 698-703 3930-3960 3450-3485 460-462

www.angelcommodities.com

Commodities Daily Report

Tuesday| May 07, 2013

Jeera Agricultural Commodities

Jeera futures declined by 0.95% on Monday due to weak demand from the domestic as well as international markets. Overall higher production estimates have also pressurized prices. However, declining arrivals from its peak supported prices at lower levels. Prices have declined sharply over the past few weeks on account of higher supplies of the new crop. Good supplies from Rajasthan also pressurized prices. Domestic as well as overseas demand is expected to improve in the coming days. According to Gujarat State Agri Dept. sowing in Gujarat is reported at 3.352 lakh ha in 2013 compared with 3.719 lakh ha last year. According to the Rajasthan State Budget 201314, it has exempted jeera from VAT. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,400-2,425 tn (FOB Mumbai) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 8-9 lakh bags.

Market Highlights

Unit Jeera Spot- NCDEX (Unjha) Jeera- NCDEX May '13 Futures Rs/qtl Rs/qtl Last 13429 12763 Prev day -0.02 -0.95

as on May 06, 2013 % Change WoW 0.82 -0.35 MoM -1.44 -6.42 YoY 1.66 -3.72

Source: Reuters

Technical Chart Jeera

NCDEX June contract

Production, Arrivals and Exports

Arrivals in Unjha were reported at 16,000 lakh bags on Monday. Production of Jeera in 2012-13 is expected around 38-40 lakh bags (55 kgs each), same as last year. Exports of Jeera between Apr 2012- Jan 2013 stood at 64,400 tn, an increase of up 86%. (Source: Factiva)

Source: Telequote

Outlook

Jeera Futures may trade on a mixed note with a negative bias today. Higher output and weak demand may pressurize prices. However, any improvement in overseas as well as domestic demand may support prices. Overall trend remain positive for the Jeera prices as they are likely to stay firm as Syria & Turkey have stopped shipments.

Market Highlights

Prev day -2.48 -3.83

as on May 06, 2013 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX May '13 Futures Rs/qtl Rs/qtl

Last 6120 6072

WoW -4.62 -4.68

MoM -4.31 -7.52

YoY 86.12 67.64

Turmeric

Turmeric prices declined sharply yesterday on account of weak domestic as well as overseas demand coupled with higher supplies. However, there are expectations of improvement in overseas demand in June. Overall output is expected to be low. Unseasonal rains in Andhra Pradesh have damaged about 9240 tonnes of turmeric. The spot as well as the Futures settled 2.48% and 3.83% lower on Monday.

Technical Chart Turmeric

NCDEX June contract

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad stood at 3,000 bags and 14,000 bags respectively on Monday. Expectations are that production may be lower by 40-50%. There are reports of some crop damage in Erode region. Turmeric production in 2012-13 is expected around 45 lakh bags. Production in Nizamabad is expected around 12 lakh bags. Production in 2011-12 is projected at historical high of 10.62 lakh tn. It is estimated that next years carryover stocks would be around 10 lakh bags. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric is expected to trade with a negative bias today. Weak exports data coupled with higher supplies of the fresh crop and huge carryover stocks may pressurize prices at higher levels. However, export demand coupled with demand from stockists may support prices at lower levels. Crop damage and output concerns may also support prices at lower levels.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX May Futures Turmeric NCDEX May Futures Rs/qtl Rs/qtl

Valid for May 04, 2013

Support 12650-12750 5980-6070 Resistance 13100-13240 6280-6380

www.angelcommodities.com

Commodities Daily Report

Tuesday| May 07, 2013

Agricultural Commodities

Kapas

NCDEX Kapas as well as MCX Cotton opened lower on Monday on expectations CCI and NAFED will offload stocks in May after an unsuccessful bid to offload of 2.5 lakh bales of cotton in April 2013. However, prices recovered in the later part of the session and settled higher on account of emergence of fresh demand at lower price levels. Also, firm international markets supported an upside in the prices. The Cotton Corporation of India (CCI) and the National Agricultural Cooperative Marketing Federation of India (NAFED) are expected to offload over 8 lakh cotton bales (a bale weighs 170 kg) in the domestic market this month and the asking price may be lower by Rs 1,000 per candy than the previous price. In April, the government had offered a price of Rs 39,500 per candy, which received lukewarm response from the textile industry. (Source:

Economic Times dated 6th May 2013)

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 1049 18200

as on May 06, 2013 % Change Prev. day WoW 0.72 -0.29 0.11 0.61 MoM YoY 14.09 -5.54 0.61 1.73

NCDEX Kapas Apr Futures MCX Cotton May Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit USc/Lbs Last 85.31 93.6

as on May 06, 2013 % Change Prev day WoW 0.70 2.05 1.85 3.08 MoM -1.71 -1.99 YoY -0.88 -4.44

India's imports of cotton this year could reach 1.5 mn bales, missing earlier estimates of more than 2 mn as the govt may to start selling its stockpiles. Cotton supplies since the beginning of the year in October 2012 until February 10, 2013 were down at 183.4 lakh bales, down from 189.27 lakh bales a year earlier.

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Domestic Production and Consumption

CAB in its latest meet has projected cotton crop at 34 mn bales for 201213 season compared to the previous estimates of 33 mn bales. Mill consumption is expected to go up from 22.3 million bales last year to 23.5 million bales. Exports are estimated at 8.1 mn bales. While Import are estimated 2.5 mn bales.

Global Cotton Updates

ICE Cotton futures extended the gains of the previous session and settled 3% last week on strong export sales data and U.S. plantings delays which prompted worry over upcoming supplies. US export sales for the week ending April 25 reached 314,400 running bales, up 32% from previous week and most since mid-January. According to China Cotton Association, China will continue with its stockpiling policy this year which will boost imports. According to the USDA report, planting intentions for the 2013-14 season are said to be at a 4 year low. Also, there are expectations of good export demand from China. Reports of India and China releasing stocks from the state reserve led to a decline in the prices. USDA has initially forecasted US Cotton acreage for 2013-14 season, at smallest in 20 yrs, however, with recent surge in prices, farmers may decide to plant more cotton. The planting intention data is schedule to be released on 28th march 2013.

Source: Telequote

Technical Chart - Cotton

MCX May contract

Source: Telequote

Outlook

We expect Cotton prices to trade with upward bias during the intraday taking cues from the firm international markets. US cotton planting intentions were reported at a 4 year low. China will continue its stockpiling policy, may also support prices. In the domestic markets, sharp upside will be capped as offloading from the state reserves may ease supplies in the short term.

Technical Outlook

Contract Kapas NCDEX April 14 Fut Cotton MCX May Futures Unit Rs/20 kgs Rs/bale

valid for May 04, 2013 Support 1020-1035 17850-18030 Resistance 1060-1070 18310-18420

www.angelcommodities.com

You might also like

- Daily Agri Report, April 03Document8 pagesDaily Agri Report, April 03Angel BrokingNo ratings yet

- Daily Agri Report, May 17Document7 pagesDaily Agri Report, May 17Angel BrokingNo ratings yet

- Daily Agri Report, May 11Document7 pagesDaily Agri Report, May 11Angel BrokingNo ratings yet

- Daily Agri Report, May 09Document7 pagesDaily Agri Report, May 09Angel BrokingNo ratings yet

- Daily Agri Report, April 29Document8 pagesDaily Agri Report, April 29Angel BrokingNo ratings yet

- Daily Agri Report, June 05Document7 pagesDaily Agri Report, June 05Angel BrokingNo ratings yet

- Daily Agri Report, May 14Document7 pagesDaily Agri Report, May 14Angel BrokingNo ratings yet

- Daily Agri Report, August 16 2013Document9 pagesDaily Agri Report, August 16 2013Angel BrokingNo ratings yet

- Daily Agri Report, June 03Document7 pagesDaily Agri Report, June 03Angel BrokingNo ratings yet

- Daily Agri Report Aug 13Document8 pagesDaily Agri Report Aug 13Angel BrokingNo ratings yet

- Daily Agri Report Oct 22Document8 pagesDaily Agri Report Oct 22Angel BrokingNo ratings yet

- Daily Agri Report, March 25Document8 pagesDaily Agri Report, March 25Angel BrokingNo ratings yet

- Daily Agri Report, June 12Document7 pagesDaily Agri Report, June 12Angel BrokingNo ratings yet

- Daily Agri Report Nov 2Document8 pagesDaily Agri Report Nov 2Angel BrokingNo ratings yet

- Daily Agri Report Oct 29Document8 pagesDaily Agri Report Oct 29Angel BrokingNo ratings yet

- Daily Agri Report, March 18Document8 pagesDaily Agri Report, March 18Angel BrokingNo ratings yet

- Daily Agri Report, June 06Document7 pagesDaily Agri Report, June 06Angel BrokingNo ratings yet

- Daily Agri Report, June 17Document9 pagesDaily Agri Report, June 17Angel BrokingNo ratings yet

- Daily Agri Report, June 08Document7 pagesDaily Agri Report, June 08Angel BrokingNo ratings yet

- Daily Agri Report, March 13Document8 pagesDaily Agri Report, March 13Angel BrokingNo ratings yet

- Daily Agri Report, August 12 2013Document9 pagesDaily Agri Report, August 12 2013Angel BrokingNo ratings yet

- Daily Agri Report, May 30Document7 pagesDaily Agri Report, May 30Angel BrokingNo ratings yet

- Daily Agri Report 14th JanDocument8 pagesDaily Agri Report 14th JanAngel BrokingNo ratings yet

- Daily Agri Report Nov 8Document8 pagesDaily Agri Report Nov 8Angel BrokingNo ratings yet

- Daily Agri Report, May 02Document8 pagesDaily Agri Report, May 02Angel BrokingNo ratings yet

- Daily Agri Report, June 11Document7 pagesDaily Agri Report, June 11Angel BrokingNo ratings yet

- Daily Agri Report Aug 11Document8 pagesDaily Agri Report Aug 11Angel BrokingNo ratings yet

- Daily Agri Report, February 12Document8 pagesDaily Agri Report, February 12Angel BrokingNo ratings yet

- Daily Agri Report, August 06 2013Document9 pagesDaily Agri Report, August 06 2013Angel BrokingNo ratings yet

- Daily Agri Report, March 12Document8 pagesDaily Agri Report, March 12Angel BrokingNo ratings yet

- Daily Agri Report, April 26Document8 pagesDaily Agri Report, April 26Angel BrokingNo ratings yet

- Daily Agri Report, February 13Document8 pagesDaily Agri Report, February 13Angel BrokingNo ratings yet

- Daily Agri Report, May 23Document7 pagesDaily Agri Report, May 23Angel BrokingNo ratings yet

- Daily Agri Report Nov 21Document8 pagesDaily Agri Report Nov 21Angel BrokingNo ratings yet

- Daily Agri Report 10th JanDocument8 pagesDaily Agri Report 10th JanAngel BrokingNo ratings yet

- Daily Agri Report Nov 9Document8 pagesDaily Agri Report Nov 9Angel BrokingNo ratings yet

- Daily Agri Report, May 18Document7 pagesDaily Agri Report, May 18Angel BrokingNo ratings yet

- Daily Agri Report Oct 3Document8 pagesDaily Agri Report Oct 3Angel BrokingNo ratings yet

- Daily Agri Report September 06 2013Document9 pagesDaily Agri Report September 06 2013Angel BrokingNo ratings yet

- Daily Agri Report, May 08Document7 pagesDaily Agri Report, May 08Angel BrokingNo ratings yet

- Daily Agri Report September 04 2013Document9 pagesDaily Agri Report September 04 2013Angel BrokingNo ratings yet

- Daily Agri Report, February 18Document8 pagesDaily Agri Report, February 18Angel BrokingNo ratings yet

- Daily Agri Report, May 15Document7 pagesDaily Agri Report, May 15Angel BrokingNo ratings yet

- Daily Agri Report Aug 10Document8 pagesDaily Agri Report Aug 10Angel BrokingNo ratings yet

- Daily Agri Report, July 19 2013Document9 pagesDaily Agri Report, July 19 2013Angel BrokingNo ratings yet

- Daily Agri Report Oct 18Document8 pagesDaily Agri Report Oct 18Angel BrokingNo ratings yet

- Daily Agri Report, April 02Document8 pagesDaily Agri Report, April 02Angel BrokingNo ratings yet

- Daily Agri Report, May 24Document7 pagesDaily Agri Report, May 24Angel BrokingNo ratings yet

- Daily Agri Report Nov 15Document8 pagesDaily Agri Report Nov 15Angel BrokingNo ratings yet

- Daily Agri Report Oct 6Document8 pagesDaily Agri Report Oct 6Angel BrokingNo ratings yet

- Daily Agri Report, June 22Document9 pagesDaily Agri Report, June 22Angel BrokingNo ratings yet

- Daily Agri Report, August 23 2013Document9 pagesDaily Agri Report, August 23 2013Angel BrokingNo ratings yet

- Daily Agri Report Sep 25Document8 pagesDaily Agri Report Sep 25Angel BrokingNo ratings yet

- Daily Agri Report, July 30 2013Document9 pagesDaily Agri Report, July 30 2013Angel BrokingNo ratings yet

- Daily Agri Report 9th JanDocument8 pagesDaily Agri Report 9th JanAngel BrokingNo ratings yet

- Daily Agri Report 24th DecDocument8 pagesDaily Agri Report 24th DecAngel BrokingNo ratings yet

- Daily Agri Report, June 07Document7 pagesDaily Agri Report, June 07Angel BrokingNo ratings yet

- Daily Agri Report, August 08 2013Document9 pagesDaily Agri Report, August 08 2013Angel BrokingNo ratings yet

- Daily Agri Report, February 27Document8 pagesDaily Agri Report, February 27Angel BrokingNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2018From EverandFood Outlook: Biannual Report on Global Food Markets: November 2018No ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Account Statement: Customer Cash PositionDocument5 pagesAccount Statement: Customer Cash PositionrizkyNo ratings yet

- Product Manager QuestionsDocument4 pagesProduct Manager Questionsartsan3No ratings yet

- Pragya Singh DT ProjectDocument30 pagesPragya Singh DT ProjectSalman SiddiquiNo ratings yet

- Pre-Feasibility Study, Feasibility Study & Business PlanDocument16 pagesPre-Feasibility Study, Feasibility Study & Business PlanNyle Joy DalunazaNo ratings yet

- Condo Concepts GuideDocument3 pagesCondo Concepts GuideChris Quijano AyadeNo ratings yet

- Jurisprudence of Renewal of LeaseDocument2 pagesJurisprudence of Renewal of Leasehenson montalvoNo ratings yet

- CMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistDocument5 pagesCMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistVikrant SadanaNo ratings yet

- HDFC Bank ProfileDocument6 pagesHDFC Bank ProfileARDRA VASUDEVNo ratings yet

- Firm Merger Announcement LetterDocument2 pagesFirm Merger Announcement LetterIvy Maines DiazNo ratings yet

- Module 2-Maritime TransportDocument114 pagesModule 2-Maritime Transportjdsflsdfg100% (2)

- Logistics Avendus ReportDocument78 pagesLogistics Avendus ReportUjjawal Kumar100% (1)

- HRM CaseDocument4 pagesHRM Caseujhbghjugvbju0% (1)

- Finishes (Wall Tiles & Screeding)Document10 pagesFinishes (Wall Tiles & Screeding)Ler Kai HuiNo ratings yet

- Introduction To Supply Chain ManagementDocument19 pagesIntroduction To Supply Chain ManagementSneha Karpe100% (1)

- BFC Employment Application Form Bahrain - Docx2 15 2Document4 pagesBFC Employment Application Form Bahrain - Docx2 15 2Abbas Ali100% (1)

- Mohamed Bakouche Rezkia - LinkedInDocument3 pagesMohamed Bakouche Rezkia - LinkedInBoufrina ToufikNo ratings yet

- CTP-13 Exam Prep GuideDocument22 pagesCTP-13 Exam Prep GuideDeepak100% (1)

- Documents Required for Housing Loan TakeoverDocument1 pageDocuments Required for Housing Loan TakeoverRathinder RathiNo ratings yet

- The Abstract of Journal of US-China Public Administration (2011.01)Document17 pagesThe Abstract of Journal of US-China Public Administration (2011.01)Bung EddieNo ratings yet

- Business Ethics Governance and Risk - Chapter 2 PPT BPhji2dfOODocument15 pagesBusiness Ethics Governance and Risk - Chapter 2 PPT BPhji2dfOOmridul jainNo ratings yet

- Northwell Inc SWOTDocument2 pagesNorthwell Inc SWOTPaul ACrackerNo ratings yet

- LNG Contracts For StartersDocument4 pagesLNG Contracts For Startersragola123100% (1)

- Income Sttatement & Balance Sheet Further Consideration: DetailsDocument8 pagesIncome Sttatement & Balance Sheet Further Consideration: DetailsXX OniiSan XXNo ratings yet

- Tool Estimation SheetDocument2 pagesTool Estimation Sheetsaravananpg247196% (54)

- Binance NDADocument2 pagesBinance NDAWest100% (1)

- FAQDocument3 pagesFAQFaisal MohammedNo ratings yet

- Mess Bill Hostel Students ICT BhubaneswarDocument2 pagesMess Bill Hostel Students ICT BhubaneswarAnkita PriyadarsiniNo ratings yet

- Employee Relationship Management (MCQ)Document46 pagesEmployee Relationship Management (MCQ)bijay67% (6)

- Practice Perf CompDocument28 pagesPractice Perf CompsooguyNo ratings yet

- PFRS 3 Business Combinations SummaryDocument4 pagesPFRS 3 Business Combinations SummaryKryzzel Anne JonNo ratings yet