Professional Documents

Culture Documents

Cost of Capital BVU2011 - 12 - Czaplinski

Uploaded by

kapurrrnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Capital BVU2011 - 12 - Czaplinski

Uploaded by

kapurrrnCopyright:

Available Formats

B V

usiness

From the developers of Pratts Stats

aluation

pdate

Timely news, analysis, and resources for defensible valuations

Vol. 17, No. 12, December 2011

International Cost of Capital: Cost of Equity/CAPM

By Nancy Czaplinski, CPA/ABV, CFA, ASA

There are many approaches to the development of both the equity and debt components of the cost of capital for countries other than the U.S. This article focuses on a select number of approaches applicable to development of the equity component of the international cost of capital using the capital asset pricing model (CAPM). The CAPM models discussed here are limited to the following: 1. Local CAPM model 2. Yield spread 3. Volatility spread 4. Local country risk exposure model (Prof. Damodaran) A. Country default spread added on to CAPM, and B. Adjusted for relative standard deviation of equity/bond markets 5. Country credit rating method (Erb-Harvey-Viskanta) There are many points for business appraisers to consider when applying each of these models, as summarized below. Local CAPM model. Local CAPM is our first choice in developing a cost of capital in situations where information is available and the cash flows are in local currency. The local CAPM is used to develop a cost of equity in the local currency and

begins with a local risk-free rate, a beta based on local exchanges and a local equity risk premium (EP). The local CAPM must be applied to local cash flows (local to local). Therefore, practitioners must make additional adjustments relating to exchange rate, business, specific industry, or sector risks as deemed necessary. A good source of government risk-free rates of return is Bloomberg, but the practitioner must take into consideration the fact that some country/ local government debt may not be free of default risk. Some countries, such as Venezuela, do not have government debt in local currency, thereby providing a challenge to application of the local CAPM model. Challenges result when the EP for some countries is not available or is deemed unreliable. An EP can be calculated if bond and equity markets have enough history, but valuation practitioners need to be careful about the composition and concentration of bond and equity markets in a country. Calculations based on historical results from exchanges with short histories and volatilities may not be deemed applicable to the longer-term outlook. If EP is still not available, it is possible to use that of another comparable country if a published source is available as a benchmark. Morningstars International Equity Risk Premia Report provides EPs for 16 countries. A country must have at least five years of quality equity and risk-free return data to be included in Morningstar. Another source that might be considered is Market Risk Premium Used in 56 Countries in 2011: A Survey with 6,014 Answers (see sidebar for complete citation).

Reprinted with permissions from Business Valuation Resources, LLC

BVResources.com

International Cost Of Capital: Cost Of Equity/capm

Business Valuation Update

Executive Editor: Legal Editor: CEO, Publisher: Managing Editor: Graphic & Technical Designer: Customer Service: VP of Sales: President: Jan Davis Sherrye Henry Jr. David Foster Janice Prescott Monique Nijhout Stephanie Crader Lexie Gross Lucretia Lyons

Editorial Advisory Board

CHRISTINE BAKER CPA/ABV/CFF PARENTEBEARD NEW YORK, NY NEIL J. BEATON CPA/ABV, CFA, ASA GRANT THORNTON SEATTLE, WA JOHN A. BOGDANSKI, ESQ. LEWIS & CLARK LAW SCHOOL PORTLAND, OR NANCY J. FANNON ASA, CPA/ABV, MCBA FANNON VALUATION GROUP PORTLAND, ME JAY E. FISHMAN FASA, CBA FINANCIAL RESEARCH ASSOCIATES BALA CYNWYD, PA LYNNE Z. GOLD-BIKIN, ESQ. WOLF, BLOCK, SCHORR & SOLIS-COHEN NORRISTOWN, PA LANCE S. HALL, ASA FMV OPINIONS IRVINE, CA JAMES R. HITCHNER CPA/ABV, ASA THE FINANCIAL VALUATION GROUP ATLANTA, GA THEODORE D. ISRAEL CPA/ABV/CFF, CVA ECKHOFF ACCOUNTANCY CORP. SAN RAFAEL, CA JARED KAPLAN, ESQ. MCDERMOTT, WILL & EMERY CHICAGO, IL GILBERT E. MATTHEWS CFA SUTTER SECURITIES INCORPORATED SAN FRANCISCO, CA Z. CHRISTOPHER MERCER ASA, CFA MERCER CAPITAL MEMPHIS, TN JOHN W. PORTER, ESQ. BAKER & BOTTS HOUSTON, TX RONALD L. SEIGNEUR MBA CPA/ABV CVA SEIGNEUR GUSTAFSON LAKEWOOD, CO BRUCE SILVERSTEIN, ESQ. YOUNG, CONAWAY, STARGATT & TAYLOR WILMINGTON, DE JEFFREY S. TARBELL ASA, CFA HOULIHAN LOKEY SAN FRANCISCO, CA GARY R. TRUGMAN ASA, CPA/ABV, MCBA, MVS TRUGMAN VALUATION ASSOCIATES PLANTATION, FL KEVIN R. YEANOPLOS CPA/ABV/CFF, ASA BRUEGGEMAN & JOHNSON YEANOPLOS, P.C. TUCSON, AZ

Yield spread model (country spread). This model may be used for a subject company in a specific country, but not a multinational subject company. The model is easy to use because it starts with the U.S. risk-free rate and the U.S. EP and adjusts for yield spreads between U.S. and local country government bonds. The model is also useful if local country government debt is issued in U.S. dollars (Venezuela is an example of a country that issues government debt in U.S. dollars rather than local currency). When employing this approach, valuation professionals should remember that the country must issue dollar-denominated debt. If it doesnt, practitioners may use the countrys credit rating to find countries with comparable country credit ratings and then utilize that countrys dollar-denominated risk-free yield as a proxy for the subject country. The practitioner should keep in mind that comparable credit ratings may not always serve as a proxy for the subject countrys risk-free yield and they should proceed with caution. In addition, issues such as government credit quality may prevent use of the country government yield. Lastlybecause yield spreads are based on debt, which is less volatile than equity markets keep in mind that debt is not necessarily a proxy for equity, and this model could possibly underestimate the CAPM. As with some of the other models, the currency risk must be either in the cash flows or an additional adjustment to the discount rate. Furthermore, the use of dollar-denominated or euro-denominated debt is not an accurate reflection of the equity and currency risk of the subject country, and a lower CAPM may result. Volatility spread model. This model is easy to use because it starts with the U.S. risk-free rate and the U.S. EP and adjusts the EP based on specific country stock market volatility to that of the (mature) U.S. stock market. As with the yield spread model, we use this method for a countryspecific subject company valuation, not a multinational subject company. The model is useful if the stock market in the local country is diversified

Reprinted with permissions from Business Valuation Resources, LLC December 2011

Business Valuation Update (ISSN 1088-4882) is published monthly by Business Valuation Resources, LLC, 1000 SW Broadway, Suite 1200, Portland, OR, 97205-3035. Periodicals Postage Paid at Portland, OR, and at additional mailing offices. Postmaster: Send address changes to Business Valuation Update, Business Valuation Resources, LLC, 1000 SW Broadway, Suite 1200, Portland, OR, 97205-3035. The annual subscription price for the Business Valuation Update is $359. Low cost site licenses are available for those wishing to distribute the BVU to their colleagues at the same address. Contact our sales department for details. Please feel free to contact us via email at customerservice@BVResources.com, via phone at 503-291-7963, via fax at 503-291-7955 or visit our web site at BVResources.com. Editorial and subscription requests may be made via email, mail, fax or phone. Please note that by submitting material to BVU, you are granting permission for the newsletter to republish your material in electronic form. Although the information in this newsletter has been obtained from sources that BVR believes to be reliable, we do not guarantee its accuracy, and such information may be condensed or incomplete. This newsletter is intended for information purposes only, and it is not intended as financial, investment, legal, or consulting advice. Copyright 2011, Business Valuation Resources, LLC (BVR). All rights reserved. No part of this newsletter may be reproduced without express written consent from BVR.

BusinessValuation Update

International Cost Of Capital: Cost Of Equity/capm

and has history. For example, Thailand, India, and Germany have fairly diversified stock markets that are somewhat comparable to the U.S. Other stock markets, such as in Russia, China, Brazil, and South Africa, are not as diversified and have concentrations in specific industries that result in a lack of comparability of stock market volatilities. Valuation professionals should consider how diversified the stock market is and be careful of the stock market/index used. Volatility of the country stock market above that of the U.S., however, implies a country level risk. Generally, this method is applied to U.S. dollar net cash flows and the exchange rate risk must be treated in either the expected cash flows or as an adjustment to the discount rate. Sources for additional information on International Cost of Capital Methods

Damodaran, Aswath. Equity Risk Premiums (ERP): Determinants, Estimation and Implications, The 2011 Edition, updated Feb. 2011. Stern School of Business. Internet: www.stern.nyu.edu/~adamodar/ pdfiles/papers/ERP2011.pdf Fernandez, Pablo, Javier Aguirreamalloa, and Luis Corres Avendano.Market Risk Premium Used in 56 Countries in 2011: A Survey with 6,014 Answers. April 25, 2011. Internet: papers.ssrn.com/sol3/papers. cfm?abstract_id=1822182 Harvey, Campbell R. 12 Ways to Calculate the International Cost of Capital, Oct. 14, 2005. Internet: faculty.fuqua.duke.edu/~charvey/...2006/ Harvey_12_ways_to.pdf International Cost of Capital Report 2011. Morningstar. Internet: corporate.morningstar.com/ib/asp/subject. aspx?xmlfile=1423.xml International Equity Risk Premia Reports. Morningstar. Internet: corporate.morningstar.com/ib/asp/subject. aspx?xmlfile=1424.xml Pratt, Shannon, and Roger Grabowski. Cost of Capital, Fourth Edition. Internet: www.bvresources. com/bvstore/selectbook.asp?pid=PUB195

Local c ount r y r isk exp o su r e mo d e l (Damodaran). This model is easy to use because it starts with the U.S. risk-free rate and the U.S. equity premium. It is also useful if the local country has a viable equity market and the government debt is issued in U.S. dollars. The models theory is to utilize the country default spread as adjusted for the standard deviation of the local equity market to the local bond market. This adjusted default spread is then added to the U.S. CAPM. To estimate the long-term country default spread, the practitioner should start with the country credit rating (from Moodys: www.moodys.com) and compare that to the country credit rating of a mature market, such as the U.S. The difference in the ratings can be measured in points, arriving at the default spread. The standard deviation of the local equity market and the local bond market can be calculated if both markets have adequate history and would not necessarily be deemed emerging economies. For situations where there is not enough history to develop standard deviations or if markets are in such turmoil that current calculations may not be deemed representative of the long term, a benchmark such as 1.5, may be appropriate. The model is applied to net cash flows expressed in U.S. dollars, and exchange risk must still be considered as either an adjustment to cash flow or to the discount rate. It is important to note that the country default spread may not be an adequate indicator of risk in the equity markets. Country credit rating model (Erb-HarveyViskanta). The CCRM model is the easiest of nonlocal models to apply. It can be applied across many countries, including developed and emerging markets. This model works well for valuation work with legal entities or reporting units in multiple countries, and where a reported equity premium is not available, such as Thailand; where government debt issued in local currency in nonexistent, such as Venezuela; and where local stock market industry diversification is in question, such as Russia, Venezuela, Brazil, and China.

Reprinted with permissions from Business Valuation Resources, LLC December 2011

BusinessValuation Update

International Cost Of Capital: Cost Of Equity/capm

CCRM is based on a regression model that relates market returns with country credit ratings. The country credit rating is the independent variable, and the historical equity returns are the dependent variable. Although many countries do not have data for risk-free debt or equity returns denominated in local currency, country credit ratings still exist. CCRM considers actual equity returns, which are converted to U.S. dollars, historical volatility and forward-looking country credit ratings from Institutional Investor via Morningstar. Two CCRM models are available: the logarithmic model and the linear model. The logarithmic model focuses on the percentage movement in the risk rating as a more relevant measure than the absolute movement in the risk rating. When using this model, we start with the development of a U.S.-based CAPM and add to that the difference between the subject country credit rating and the U.S. (mature market) credit rating.

The model incorporates currency and exchange risk but does not necessarily incorporate company and industry risks. Practitioners must also be careful of the cash flows used and how risk is presented in the cash flows. CCRM is forward looking with the use of country credit ratings, but the subjectivity of the credit ratings is a disadvantage. Conclusion. As evidenced by the above, there are a number of available models that can be used to develop a country-specific CAPM. The valuation practitioner is encouraged to apply as many models as possible, thereby allowing for a more comprehensive approach to the countryspecific CAPM. It is with much thought as to the country, the company, and the industry that the cost of equity is concluded. Nancy Czaplinski is vice president & managing director at American Appraisal Associates. She can be reached at 414-225-1035 or nczaplinski@ american-appraisal.com.

Reprinted with permissions from Business Valuation Resources, LLC 4

BusinessValuation Update

December 2011

You might also like

- BEC Written Communications Questions & AnswersDocument17 pagesBEC Written Communications Questions & AnswersSerwina Chow100% (4)

- Santander Consumer Finance Case StudyDocument8 pagesSantander Consumer Finance Case StudyKennedy Gitonga ArithiNo ratings yet

- PeopleSoft Security TablesDocument8 pagesPeopleSoft Security TablesChhavibhasinNo ratings yet

- Interpreting The Banking Numbers CfaDocument17 pagesInterpreting The Banking Numbers Cfastone_baluNo ratings yet

- Dollar GeneralDocument62 pagesDollar GeneralGammaIotaSigma110% (1)

- LNG Master Sales Agreement & Their Value in A Destination Flexible LNG Market - Steven MilesDocument33 pagesLNG Master Sales Agreement & Their Value in A Destination Flexible LNG Market - Steven Mileskapurrrn50% (2)

- 4 Continental and National Differences in The Financial Ratios of Investment Banking Companies An Application of The Altman Z Model.Document14 pages4 Continental and National Differences in The Financial Ratios of Investment Banking Companies An Application of The Altman Z Model.TathianaNo ratings yet

- IMEF Case 15 AnalysisDocument5 pagesIMEF Case 15 AnalysisHoward McCarthyNo ratings yet

- Measuring Country Risk: Executive SummaryDocument5 pagesMeasuring Country Risk: Executive SummarytinhoiNo ratings yet

- Measuring Country Risk: Executive SummaryDocument5 pagesMeasuring Country Risk: Executive SummaryAbhishek PuriNo ratings yet

- Mckinsey Appraisal - AppraisalDocument8 pagesMckinsey Appraisal - Appraisalalex.nogueira396No ratings yet

- The Right Financing: The Perfect Financing For You. Yes, It Exists!Document17 pagesThe Right Financing: The Perfect Financing For You. Yes, It Exists!Anshik BansalNo ratings yet

- Target-Date Series Research Paper 2013 Industry SurveyDocument6 pagesTarget-Date Series Research Paper 2013 Industry SurveyuylijwzndNo ratings yet

- PDF CR Analysis - NewDocument67 pagesPDF CR Analysis - NewBhavishya SalalpuriaNo ratings yet

- Do You Know Your True Cost of CapitalDocument11 pagesDo You Know Your True Cost of CapitalwegrNo ratings yet

- Thesis Credit Rating AgenciesDocument4 pagesThesis Credit Rating AgenciesWhoCanWriteMyPaperForMeUK100% (2)

- The Treatment of Nonperforming Loans in Macroeconomic StatisticsDocument18 pagesThe Treatment of Nonperforming Loans in Macroeconomic StatisticsAnonymous A0jSvP1No ratings yet

- Balm Economics of BankingDocument4 pagesBalm Economics of BankingAarti YadavNo ratings yet

- Topic 4 Types of RisksDocument33 pagesTopic 4 Types of RisksSimaSergazinaNo ratings yet

- Research Paper On Country Risk Analysis: by Ajinkya Yadav MBA - Executive Finance PRN - 19020348002Document18 pagesResearch Paper On Country Risk Analysis: by Ajinkya Yadav MBA - Executive Finance PRN - 19020348002Ajinkya YadavNo ratings yet

- Discounted Cash FlowDocument50 pagesDiscounted Cash Flowgangster91No ratings yet

- Portførmulas: The Formulaic Trending Monthly AbstractDocument11 pagesPortførmulas: The Formulaic Trending Monthly Abstractdiane_estes937No ratings yet

- Lack of Comparability in Global FinanceDocument13 pagesLack of Comparability in Global FinanceAnuj RungtaNo ratings yet

- Milne Travel: Fund Lineup ForDocument41 pagesMilne Travel: Fund Lineup ForjamilneNo ratings yet

- Research Paper On Currency Risk ManagementDocument4 pagesResearch Paper On Currency Risk Managementfzpabew4100% (1)

- Cash Flow Literature ReviewDocument6 pagesCash Flow Literature Reviewelfgxwwgf100% (1)

- Despite Relatively Calmer Markets, Systemic and Specific Funding Risks For Banks Have Not Gone AwayDocument17 pagesDespite Relatively Calmer Markets, Systemic and Specific Funding Risks For Banks Have Not Gone Awayapi-227433089No ratings yet

- Chapters 10 and 12 Credit Analysis and Distress Prediction3223Document45 pagesChapters 10 and 12 Credit Analysis and Distress Prediction3223alfiNo ratings yet

- Ch.03. The Power of Cash Flow RatiosDocument10 pagesCh.03. The Power of Cash Flow RatiosCosmin AiroaiNo ratings yet

- References: Marx, L. (1998) - Efficient Venture Capital Financing Combining Debt and EquityDocument9 pagesReferences: Marx, L. (1998) - Efficient Venture Capital Financing Combining Debt and Equitycons theNo ratings yet

- Literature Review On Capm ModelDocument5 pagesLiterature Review On Capm Modelaflshtabj100% (1)

- Issues in Cross Border ValuationDocument2 pagesIssues in Cross Border ValuationNilotpal AddyNo ratings yet

- Performance Evaluation of JP Morgan Chase Bank: Sadia ZamanDocument17 pagesPerformance Evaluation of JP Morgan Chase Bank: Sadia ZamanAjith VNo ratings yet

- Literature Review On Financial DeepeningDocument5 pagesLiterature Review On Financial Deepeningafmzadevfeeeat100% (2)

- 2007-11-26 Financial Services Exposures To Subprime, Why We Are Not Seeing Red' Weekly July 27 2007Document9 pages2007-11-26 Financial Services Exposures To Subprime, Why We Are Not Seeing Red' Weekly July 27 2007Joshua RosnerNo ratings yet

- Tactical Asset Allocation Alpha and The Greatest Trick The Devil Ever PulledDocument8 pagesTactical Asset Allocation Alpha and The Greatest Trick The Devil Ever PulledGestaltUNo ratings yet

- Term Paper FinanceDocument5 pagesTerm Paper FinanceBestCustomPapersSingapore100% (2)

- Company Valuation Literature ReviewDocument8 pagesCompany Valuation Literature Reviewhpdqjkwgf100% (1)

- Final Accounts ConclusionsDocument6 pagesFinal Accounts ConclusionsayeshaNo ratings yet

- Pecking Order Asy Me TryDocument49 pagesPecking Order Asy Me TryXinyuan 李馨媛 LiNo ratings yet

- Dharan Valuation Issues in The Coming Wave of Goodwill and Asset ImpairmentsDocument4 pagesDharan Valuation Issues in The Coming Wave of Goodwill and Asset ImpairmentsDhaval JobanputraNo ratings yet

- Research Paper Investment BankingDocument8 pagesResearch Paper Investment Bankingefjr9yx3100% (1)

- Cost of Capital - What It Is & How To Calculate It - HBS OnlineDocument4 pagesCost of Capital - What It Is & How To Calculate It - HBS OnlineSazidur RahmanNo ratings yet

- Do You Know Your Cost of CapitalDocument12 pagesDo You Know Your Cost of CapitalSazidur RahmanNo ratings yet

- The Discount Rate in Emerging Markets: A GuideDocument31 pagesThe Discount Rate in Emerging Markets: A GuideIvan Saidd Tacuri BellidoNo ratings yet

- Asset Liability Management in Developing Countries - A Balance Sheet ApproachDocument36 pagesAsset Liability Management in Developing Countries - A Balance Sheet ApproachZainab ShahidNo ratings yet

- Research Paper On Bond MarketDocument5 pagesResearch Paper On Bond Marketgz8qarxz100% (1)

- PHD Thesis On Balance of PaymentsDocument8 pagesPHD Thesis On Balance of Paymentsafcmfuind100% (2)

- Digging Deeper Into Key Areas: Strictly FinancialsDocument28 pagesDigging Deeper Into Key Areas: Strictly FinancialsSean SpositoNo ratings yet

- Credit Rating Agencies DissertationDocument7 pagesCredit Rating Agencies Dissertationdipsekator1983100% (1)

- Dissertation On Determinants of Capital StructureDocument8 pagesDissertation On Determinants of Capital StructureCollegePaperServiceUK100% (1)

- Dollar GeneralDocument112 pagesDollar GeneralSajal SinghNo ratings yet

- Credit Rating of Banks As Its Impact On Their ProfitabilityDocument45 pagesCredit Rating of Banks As Its Impact On Their ProfitabilityMuhammad Ali100% (1)

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- RM Research Report Winter 2010Document15 pagesRM Research Report Winter 2010Hikmet KayaNo ratings yet

- Southland Capital Management - Executive SummaryDocument6 pagesSouthland Capital Management - Executive SummaryhowellstechNo ratings yet

- Literature Review On Analysis of Financial StatementsDocument4 pagesLiterature Review On Analysis of Financial Statementsea98skahNo ratings yet

- Thesis LboDocument5 pagesThesis Lbodeborahquintanaalbuquerque100% (2)

- Thesis On Currency Risk ManagementDocument7 pagesThesis On Currency Risk Managementlisakennedyfargo100% (2)

- 2016 International Valuation Handbook: Guide to Cost of CapitalFrom Everand2016 International Valuation Handbook: Guide to Cost of CapitalNo ratings yet

- Innovation Killers: How Financial Tools Destroy Your Capacity to Do New ThingsFrom EverandInnovation Killers: How Financial Tools Destroy Your Capacity to Do New ThingsRating: 4 out of 5 stars4/5 (3)

- Process Plant Piping OverviewDocument133 pagesProcess Plant Piping Overviewskdalalsin100% (8)

- Human Sexuality - A Theosophical Analysis PDFDocument0 pagesHuman Sexuality - A Theosophical Analysis PDFkapurrrnNo ratings yet

- An Explanation of Low Energy Nuclear ReactionDocument22 pagesAn Explanation of Low Energy Nuclear ReactionAzhan AhmedNo ratings yet

- Project Finance: An Overview of Key Concepts and TrendsDocument13 pagesProject Finance: An Overview of Key Concepts and TrendsMahantesh BalekundriNo ratings yet

- Life Cycle Analysis For Heavy VehiclesDocument16 pagesLife Cycle Analysis For Heavy VehicleskapurrrnNo ratings yet

- Well To Wheels - Fossil FuelsDocument74 pagesWell To Wheels - Fossil FuelskapurrrnNo ratings yet

- A Glimpse of Jugaad TechnologyDocument28 pagesA Glimpse of Jugaad TechnologyrsundharNo ratings yet

- ANSI Vs API Pump Comparison PDFDocument6 pagesANSI Vs API Pump Comparison PDFkapurrrnNo ratings yet

- Software Cost EstimateDocument9 pagesSoftware Cost EstimatekapurrrnNo ratings yet

- Currencies and EconomicsDocument8 pagesCurrencies and EconomicskapurrrnNo ratings yet

- Unit Conversion SI UnitsDocument6 pagesUnit Conversion SI UnitsJhanvi Rao NarayanaNo ratings yet

- Life Cycle Analysis For Heavy VehiclesDocument16 pagesLife Cycle Analysis For Heavy VehicleskapurrrnNo ratings yet

- A Mathematicians Apology - CommentsDocument22 pagesA Mathematicians Apology - CommentskapurrrnNo ratings yet

- Aviation Fuel 2003 Report 7294712Document78 pagesAviation Fuel 2003 Report 7294712kapurrrnNo ratings yet

- Heavy Crude Processing 808157080Document7 pagesHeavy Crude Processing 808157080kapurrrn100% (1)

- FT PR 3Document2 pagesFT PR 3victorsondavisNo ratings yet

- Ten Things About The LCFSDocument2 pagesTen Things About The LCFSkapurrrnNo ratings yet

- HitlerDocument11 pagesHitlerkapurrrn0% (1)

- Escalation On Major ProjectsDocument24 pagesEscalation On Major ProjectskapurrrnNo ratings yet

- Fparu Djsa&: /kez Ds Fy, Cfynku Nsus Okys PKJ Vej "KGHNDocument2 pagesFparu Djsa&: /kez Ds Fy, Cfynku Nsus Okys PKJ Vej "KGHNkapurrrnNo ratings yet

- Getting Past "Rational Man/Emotional Woman": How Far Have Research Programs in Happiness and Interpersonal Relations Progressed?Document27 pagesGetting Past "Rational Man/Emotional Woman": How Far Have Research Programs in Happiness and Interpersonal Relations Progressed?kapurrrnNo ratings yet

- Life Cycle Analysis For Heavy VehiclesDocument16 pagesLife Cycle Analysis For Heavy VehicleskapurrrnNo ratings yet

- Punjabi AmritaDocument8 pagesPunjabi AmritakapurrrnNo ratings yet

- Composite Floor EconomyDocument4 pagesComposite Floor EconomykapurrrnNo ratings yet

- Kabir Ke DoheDocument36 pagesKabir Ke Doheapi-3708828100% (10)

- Punjabi PoetryDocument88 pagesPunjabi PoetrykapurrrnNo ratings yet

- Presentation On Cost Estimation in A Construction CompanyDocument18 pagesPresentation On Cost Estimation in A Construction CompanycoxshulerNo ratings yet

- A Glimpse of Jugaad TechnologyDocument28 pagesA Glimpse of Jugaad TechnologyrsundharNo ratings yet

- Brochure en 2014 Web Canyon Bikes How ToDocument36 pagesBrochure en 2014 Web Canyon Bikes How ToRadivizija PortalNo ratings yet

- Pipeline Welding SpecificationDocument15 pagesPipeline Welding Specificationaslam.ambNo ratings yet

- A Database of Chromatographic Properties and Mass Spectra of Fatty Acid Methyl Esters From Omega-3 ProductsDocument9 pagesA Database of Chromatographic Properties and Mass Spectra of Fatty Acid Methyl Esters From Omega-3 ProductsmisaelNo ratings yet

- Annual Plan 1st GradeDocument3 pagesAnnual Plan 1st GradeNataliaMarinucciNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument2 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCesar ValeraNo ratings yet

- Prlude No BWV in C MinorDocument3 pagesPrlude No BWV in C MinorFrédéric LemaireNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Kaydon Dry Gas SealDocument12 pagesKaydon Dry Gas Sealxsi666No ratings yet

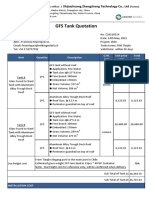

- GFS Tank Quotation C20210514Document4 pagesGFS Tank Quotation C20210514Francisco ManriquezNo ratings yet

- Mil STD 2154Document44 pagesMil STD 2154Muh SubhanNo ratings yet

- AtlasConcorde NashDocument35 pagesAtlasConcorde NashMadalinaNo ratings yet

- Techniques in Selecting and Organizing InformationDocument3 pagesTechniques in Selecting and Organizing InformationMylen Noel Elgincolin ManlapazNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlhajarawNo ratings yet

- Flowmon Ads Enterprise Userguide enDocument82 pagesFlowmon Ads Enterprise Userguide ennagasatoNo ratings yet

- Special Power of Attorney: Benedict Joseph M. CruzDocument1 pageSpecial Power of Attorney: Benedict Joseph M. CruzJson GalvezNo ratings yet

- Worksheet 5 Communications and Privacy: Unit 6 CommunicationDocument3 pagesWorksheet 5 Communications and Privacy: Unit 6 Communicationwh45w45hw54No ratings yet

- ITP Exam SuggetionDocument252 pagesITP Exam SuggetionNurul AminNo ratings yet

- Paradigms of ManagementDocument2 pagesParadigms of ManagementLaura TicoiuNo ratings yet

- Kate Elizabeth Bokan-Smith ThesisDocument262 pagesKate Elizabeth Bokan-Smith ThesisOlyaGumenNo ratings yet

- CBSE Class 6 Whole Numbers WorksheetDocument2 pagesCBSE Class 6 Whole Numbers WorksheetPriyaprasad PandaNo ratings yet

- Beauty ProductDocument12 pagesBeauty ProductSrishti SoniNo ratings yet

- PEDs and InterferenceDocument28 pagesPEDs and Interferencezakool21No ratings yet

- Precision Machine Components: NSK Linear Guides Ball Screws MonocarriersDocument564 pagesPrecision Machine Components: NSK Linear Guides Ball Screws MonocarriersDorian Cristian VatavuNo ratings yet

- CENG 5503 Intro to Steel & Timber StructuresDocument37 pagesCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachNo ratings yet

- Journals OREF Vs ORIF D3rd RadiusDocument9 pagesJournals OREF Vs ORIF D3rd RadiusironNo ratings yet

- Paper 4 (A) (I) IGCSE Biology (Time - 30 Mins)Document12 pagesPaper 4 (A) (I) IGCSE Biology (Time - 30 Mins)Hisham AlEnaiziNo ratings yet

- CFO TagsDocument95 pagesCFO Tagssatyagodfather0% (1)

- LIST OF ENROLLED MEMBERS OF SAHIWAL CHAMBER OF COMMERCEDocument126 pagesLIST OF ENROLLED MEMBERS OF SAHIWAL CHAMBER OF COMMERCEBASIT Ali KhanNo ratings yet