Professional Documents

Culture Documents

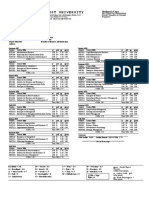

MASB9 Revenue Pg5

Uploaded by

hyraldCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MASB9 Revenue Pg5

Uploaded by

hyraldCopyright:

Available Formats

MASB9 Revenue pg5

http://www.masb.org.my/index.php?option=com_content&view=articl...

Sitemap

Location Map

Home

About Us

Our Standards

Other Pronouncements

Draft Pronouncements

Events

Media Room

General

Publication Order

Home

Our Standards

MASB Approved Accounting Standards for Private Entities

Interest, Royalties and Dividends

1. Revenue arising from the use by others of enterprise assets yielding interest, royalties and dividends should be recognised on the bases set out in paragraph 31 when: 1. it is probable that the economic benefits associated with the transaction will flow to the enterprise; and 2. the amount of the revenue can be measured reliably. 1. Revenue should be recognised on the following bases: 1. interest should be recognised on a time proportion basis that takes into account the effective yield on the asset; 2. royalties should be recognised on an accrual basis in accordance with the substance of the relevant agreement; and 3. dividends should be recognised when the shareholder's right to receive payment is established. 1. The effective yield on an asset is the rate of interest required to discount the stream of future cash receipts expected over the life of the asset to equate to the initial carrying amount of the asset. Interest revenue includes the amount of amortisation of any discount, premium or other difference between the initial carrying amount of a debt security and its amount at maturity. 2. When unpaid interest has accrued before the acquisition of an interest-bearing investment, the subsequent receipt of interest is allocated between pre-acquisition and post-acquisition periods. In such circumstances only the post-acquisition portion is recognised as revenue. When dividends on equity securities are declared from pre-acquisition net income, those dividends are deducted from the cost of the securities. If it is difficult to make such an allocation except on an arbitrary basis, dividends are recognised as revenue unless they clearly represent a recovery of part of the cost of the equity securities. 3. Royalties accrue in accordance with the terms of the relevant agreement and are usually recognised on that basis unless, having regard to the substance of the agreement, it is more appropriate to recognise revenue on some other systematic and rational basis. 1. Revenue is recognised only when it is probable that the economic benefits associated with the transaction will flow to the enterprise. However, when an uncertainty arises about the collectability of an amount already included in revenue, the uncollectable amount, or the amount in respect of which recovery has ceased to be probable, is recognised as an expense, rather than as an adjustment of the amount of revenue originally recognised.

Disclosure

1. An enterprise should disclose: 1. the accounting policies adopted for the recognition of revenue including the methods adopted to determine the stage of completion of transactions involving the rendering of services; 2. the amount of each significant category of revenue recognised during the period including revenue arising from: 1. the sale of goods; 2. the rendering of services; 3. interest; 4. royalties; 5. dividends; and 3. the amount of revenue arising from exchanges of goods or services included in each significant category of revenue. 1. An enterprise should discloses any contingent liabilities and contingent assets in accordance with MASB 20, Provisions, Contingent Liabilities and Contingent Assets. Contingent liabilities and contingent assets may arise from items such as warranty costs, claims, penalties or possible losses.

Effective Date

1. This Standard becomes operative for financial statements covering periods beginning on or after 1 January, 2000.

Page | 1 2 3 4 5 6 7

Malaysian Accounting Standards Board Suite 5.02, Level 5, Wisma UOA Pantai, 11 Jalan Pantai Jaya, 59200 Kuala Lumpur. Tel : 603-2240 9200 Fax : 603-2240 9300 Email : masb@masb.org.my Financial Reporting Foundation and Malaysian Accounting Standards Board 2010. All Rights Reserved.

Site engineered by Ace Touchtone Sdn Bhd

1 of 1

20/10/2010 5:16 PM

You might also like

- AS9 Revenue RecognitionDocument2 pagesAS9 Revenue RecognitionrajNo ratings yet

- Accounting Standard 9Document8 pagesAccounting Standard 9GAURAV JAINNo ratings yet

- Revenue Recognition: Accounting Standard (AS) 9Document13 pagesRevenue Recognition: Accounting Standard (AS) 9Abhishek SinghNo ratings yet

- 07FAR1 IM Ch7 1LPDocument4 pages07FAR1 IM Ch7 1LPargxn22No ratings yet

- Ias 18 Revenue Recognition FinalsDocument8 pagesIas 18 Revenue Recognition FinalssadikiNo ratings yet

- Summary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheDocument28 pagesSummary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheSangram PandaNo ratings yet

- Business Combination and ConsolidationDocument21 pagesBusiness Combination and ConsolidationRacez Gabon93% (14)

- AFSR M1Document22 pagesAFSR M1Tayyab AliNo ratings yet

- Technical Interview Questions Prepared by Fahad Irfan - PDF Version 1Document4 pagesTechnical Interview Questions Prepared by Fahad Irfan - PDF Version 1Muhammad Khizzar KhanNo ratings yet

- 2021-2024 Semester-I Division-A Accounting Standard-9 Revenue Recognition Subject:Financial AccountingDocument8 pages2021-2024 Semester-I Division-A Accounting Standard-9 Revenue Recognition Subject:Financial AccountingTushar NarangNo ratings yet

- IAS 18 Revenue: Technical SummaryDocument2 pagesIAS 18 Revenue: Technical SummaryKyleRodSimpsonNo ratings yet

- Business Combination and ConsolidationDocument21 pagesBusiness Combination and ConsolidationCristel TannaganNo ratings yet

- AS 9 - Revenue RecognitionDocument15 pagesAS 9 - Revenue RecognitionMansi NigadeNo ratings yet

- TX03 Inclusions and Exclusions To or From Gross IncomeDocument8 pagesTX03 Inclusions and Exclusions To or From Gross IncomeAce DesabilleNo ratings yet

- Study MaterialDocument7 pagesStudy MaterialGochi GamingNo ratings yet

- Rev RogDocument3 pagesRev RogDibyansu KumarNo ratings yet

- Technical Interview Questions Prepared by Fahad IrfanDocument8 pagesTechnical Interview Questions Prepared by Fahad Irfanzohaibaf337No ratings yet

- Three Sections Account Provides Financial Settlement SummaryDocument7 pagesThree Sections Account Provides Financial Settlement SummaryDominic HoNo ratings yet

- Summary of IFRS 3 Business CombinationDocument5 pagesSummary of IFRS 3 Business CombinationAbdullah Al RaziNo ratings yet

- Tax Treatment of Stocklending/Sale and Repo TransactionsDocument5 pagesTax Treatment of Stocklending/Sale and Repo TransactionsWasis SusilaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Accounting ExamplesDocument124 pagesAccounting ExamplesGirish KhareNo ratings yet

- Business Combination and Consolidation PDFDocument21 pagesBusiness Combination and Consolidation PDFP.Fabie100% (2)

- Accounting Standards 7,9,10Document10 pagesAccounting Standards 7,9,10Nishita ShivkarNo ratings yet

- REVENUE RECOGNITION AS09Document8 pagesREVENUE RECOGNITION AS09BharathNo ratings yet

- Accounting LearningsDocument4 pagesAccounting LearningsLovely Jane Raut CabiltoNo ratings yet

- International Accounting Standard (IAS-18) : RevenueDocument14 pagesInternational Accounting Standard (IAS-18) : RevenueRavi BhaisareNo ratings yet

- NegotiationSeries Step Acquisition Accounting Sept09 GL IFRSDocument12 pagesNegotiationSeries Step Acquisition Accounting Sept09 GL IFRSArif AslamNo ratings yet

- Revenue Recognition Semester 1Document19 pagesRevenue Recognition Semester 1AbhayNo ratings yet

- Combined Analysis of The Companies in The Mutual Fund IndustryDocument3 pagesCombined Analysis of The Companies in The Mutual Fund IndustryUnza TabassumNo ratings yet

- Day 13 - Insurance - SADocument3 pagesDay 13 - Insurance - SAVarun JoshiNo ratings yet

- Lesson 5 Tax Planning With Reference To Capital StructureDocument37 pagesLesson 5 Tax Planning With Reference To Capital StructurekelvinNo ratings yet

- Master NoteDocument9 pagesMaster NoteCA Paramesh HemanathNo ratings yet

- JW MarriottDocument4 pagesJW MarriottroshanNo ratings yet

- Notes To The Financial Statements SampleDocument6 pagesNotes To The Financial Statements SampleKielRinonNo ratings yet

- Sec Memo 11, s2008Document5 pagesSec Memo 11, s2008aian josephNo ratings yet

- Acct 3021 Quizzes For Exam I IDocument4 pagesAcct 3021 Quizzes For Exam I IMelissa BrownNo ratings yet

- REGULAR INCOME TAX: KEY ITEMS AND RULESDocument24 pagesREGULAR INCOME TAX: KEY ITEMS AND RULESAce ReytaNo ratings yet

- Revenue Recognition Principles ExplainedDocument8 pagesRevenue Recognition Principles ExplainedshekarNo ratings yet

- Revenue and Receipts ReportingDocument6 pagesRevenue and Receipts ReportingMaria Cecilia ReyesNo ratings yet

- Notes To Fs - SeDocument8 pagesNotes To Fs - SeMilds LadaoNo ratings yet

- Departmental Interpretation and Practice Notes No. 33 (Revised)Document21 pagesDepartmental Interpretation and Practice Notes No. 33 (Revised)Difanny KooNo ratings yet

- Revenue Recognition: Submitted To: Submitted byDocument16 pagesRevenue Recognition: Submitted To: Submitted byPranav ShandilNo ratings yet

- IFRS (H)Document9 pagesIFRS (H)Ullas GowdaNo ratings yet

- Audit of Insurance Business - 1Document28 pagesAudit of Insurance Business - 1ANMOL GUMBERNo ratings yet

- Deductions From Gross IncomeDocument49 pagesDeductions From Gross IncomeRoronoa ZoroNo ratings yet

- IAS18Document2 pagesIAS18Farah DibaNo ratings yet

- Pas 12 Income TaxesDocument9 pagesPas 12 Income TaxesAllegria AlamoNo ratings yet

- 19668ipcc Acc Vol1 Chapter-3Document20 pages19668ipcc Acc Vol1 Chapter-3Vignesh SrinivasanNo ratings yet

- Due Diligence-Tax Due Dil - FinalDocument6 pagesDue Diligence-Tax Due Dil - FinalEljoe VinluanNo ratings yet

- SBR Revision (Analysis)Document41 pagesSBR Revision (Analysis)Ling Xuan ChinNo ratings yet

- Revenue Recognition: Accounting Standard (AS) 9Document13 pagesRevenue Recognition: Accounting Standard (AS) 9Awadhesh TiwariNo ratings yet

- Luspe - AC54 - Unit IX - Summary NotesDocument4 pagesLuspe - AC54 - Unit IX - Summary NotesEDMARK LUSPENo ratings yet

- !masb9 1Document25 pages!masb9 1aizatarief2015No ratings yet

- ReceivablesDocument16 pagesReceivablesJanela Venice SantosNo ratings yet

- Schedule C Business Income TaxDocument12 pagesSchedule C Business Income TaxJichang HikNo ratings yet

- Nykaa E Retail Mar 19Document23 pagesNykaa E Retail Mar 19NatNo ratings yet

- Note FinantionalDocument4 pagesNote FinantionalhvhvmNo ratings yet

- RR 2-2001Document7 pagesRR 2-2001Eumell Alexis PaleNo ratings yet

- MASB9 Revenue Pg7Document3 pagesMASB9 Revenue Pg7hyraldNo ratings yet

- MASB7 Construction Contract3Document1 pageMASB7 Construction Contract3hyraldNo ratings yet

- MASB10 Leases Pg2Document2 pagesMASB10 Leases Pg2hyraldNo ratings yet

- Lembaga Piawaian Perakaunan Malaysia: Malaysian Accounting Standards BoardDocument1 pageLembaga Piawaian Perakaunan Malaysia: Malaysian Accounting Standards BoardhyraldNo ratings yet

- MASB7 Construction Contract1Document2 pagesMASB7 Construction Contract1hyraldNo ratings yet

- MASB7 Construction Contract7Document3 pagesMASB7 Construction Contract7hyraldNo ratings yet

- MASB9 Revenue Pg3Document1 pageMASB9 Revenue Pg3hyraldNo ratings yet

- MASB9 Revenue Pg6Document2 pagesMASB9 Revenue Pg6hyraldNo ratings yet

- MASB9 Revenue Pg4Document2 pagesMASB9 Revenue Pg4hyraldNo ratings yet

- MASB7 Construction Contract6Document2 pagesMASB7 Construction Contract6hyraldNo ratings yet

- MASB9 Revenue Pg1Document2 pagesMASB9 Revenue Pg1hyraldNo ratings yet

- MASB6 The Effects of Change4Document2 pagesMASB6 The Effects of Change4hyraldNo ratings yet

- MASB9 Revenue Pg2Document1 pageMASB9 Revenue Pg2hyraldNo ratings yet

- MASB7 Construction Contract8Document4 pagesMASB7 Construction Contract8hyraldNo ratings yet

- MASB7 Construction Contract5Document2 pagesMASB7 Construction Contract5hyraldNo ratings yet

- MASB7 Construction Contract4Document2 pagesMASB7 Construction Contract4hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg9Document1 pageMASB5 Cash Flow Statements Pg9hyraldNo ratings yet

- MASB6 The Effects of Change3Document3 pagesMASB6 The Effects of Change3hyraldNo ratings yet

- MASB6 The Effects of Change1Document2 pagesMASB6 The Effects of Change1hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg8Document2 pagesMASB5 Cash Flow Statements Pg8hyraldNo ratings yet

- MASB7 Construction Contract2Document2 pagesMASB7 Construction Contract2hyraldNo ratings yet

- MASB6 The Effects of Change2Document2 pagesMASB6 The Effects of Change2hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg7Document4 pagesMASB5 Cash Flow Statements Pg7hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg6Document2 pagesMASB5 Cash Flow Statements Pg6hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg5Document1 pageMASB5 Cash Flow Statements Pg5hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg4Document2 pagesMASB5 Cash Flow Statements Pg4hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg3Document2 pagesMASB5 Cash Flow Statements Pg3hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg1Document2 pagesMASB5 Cash Flow Statements Pg1hyraldNo ratings yet

- MASB5 Cash Flow Statements Pg2Document2 pagesMASB5 Cash Flow Statements Pg2hyraldNo ratings yet

- SAES-A-205 Change Contact NameDocument27 pagesSAES-A-205 Change Contact Namesaleem naheed100% (1)

- Bank Demand Guarantee and Standby Letter of Credit As Collaterals in International Trading OperationsDocument3 pagesBank Demand Guarantee and Standby Letter of Credit As Collaterals in International Trading OperationsKyle MuñozNo ratings yet

- Honda Two WheelerDocument20 pagesHonda Two WheelerAryaman SolankiNo ratings yet

- 02 Regionalism Vs RegionalizationDocument39 pages02 Regionalism Vs RegionalizationRaden Wisnugroho80% (10)

- Managing corporate treasury risks with TableauDocument46 pagesManaging corporate treasury risks with TableauIonNo ratings yet

- Corporate Governance Rules Made StricterDocument5 pagesCorporate Governance Rules Made StricterAldrich FernandesNo ratings yet

- Project ReportDocument6 pagesProject ReportMayank SinhaNo ratings yet

- Inventory ManagementDocument88 pagesInventory ManagementSudhir Kumar100% (2)

- Cost Concept and ClassificationDocument32 pagesCost Concept and Classificationharry potterNo ratings yet

- Accident-Incident Investigation ProcedureDocument2 pagesAccident-Incident Investigation Procedureishaharom100% (1)

- BrochureDocument2 pagesBrochureEdward GutierrezNo ratings yet

- Hajar TAQI: Education Work ExperiencesDocument1 pageHajar TAQI: Education Work ExperiencesMozammel AhmedNo ratings yet

- AEG Enterprises Financial AnalysisDocument5 pagesAEG Enterprises Financial AnalysisGing freexNo ratings yet

- GyanodayaDocument25 pagesGyanodayaAyush SharmaNo ratings yet

- The Consumer Protection Act 2018 Edited CopyDocument75 pagesThe Consumer Protection Act 2018 Edited CopyAbhishek K100% (1)

- Environmental Testing - Part 2-27: Tests - Test Ea and Guidance: Shock (IEC 60068-2-27:2008 (EQV) )Document16 pagesEnvironmental Testing - Part 2-27: Tests - Test Ea and Guidance: Shock (IEC 60068-2-27:2008 (EQV) )GM QCNo ratings yet

- A Long Haiku About My Locked-Down Mind - Founding FuelDocument6 pagesA Long Haiku About My Locked-Down Mind - Founding Fuelmansavi bihaniNo ratings yet

- Social Media Content Strategy TemplateDocument29 pagesSocial Media Content Strategy TemplateAreeba AlkaafNo ratings yet

- Current Affairs August 2 2023 PDF by AffairsCloud New 1Document26 pagesCurrent Affairs August 2 2023 PDF by AffairsCloud New 1Rishabh KumarNo ratings yet

- MBA105 - Almario - Parco - Assignment 3Document10 pagesMBA105 - Almario - Parco - Assignment 3nicolaus copernicusNo ratings yet

- Sub: External Surface Cleaning of Different Coolers Installed at Various Process Complexes of MH-AssetDocument4 pagesSub: External Surface Cleaning of Different Coolers Installed at Various Process Complexes of MH-AssetPrathamesh OmtechNo ratings yet

- Report On DARAZ Bangladesh Prepared ForDocument31 pagesReport On DARAZ Bangladesh Prepared ForFarhanur RahmanNo ratings yet

- Employees As Customers-An Internal Marketing StudyDocument12 pagesEmployees As Customers-An Internal Marketing Studyraad fkNo ratings yet

- Motion by Design - Complete Motion Graphic GuideDocument27 pagesMotion by Design - Complete Motion Graphic GuidefalahanajaNo ratings yet

- Module 3 - Overhead Allocation and ApportionmentDocument55 pagesModule 3 - Overhead Allocation and Apportionmentkaizen4apexNo ratings yet

- NISM-Series-XXII: Fixed Income Securities Certification ExaminationDocument5 pagesNISM-Series-XXII: Fixed Income Securities Certification ExaminationVinay ChhedaNo ratings yet

- TranscriptDocument1 pageTranscriptRehman SaïfNo ratings yet

- Lecture 1 TextDocument9 pagesLecture 1 TextStepan RychkovNo ratings yet

- CRM ChristyDocument11 pagesCRM ChristySiril muhammedNo ratings yet

- Lesson 1: MNS 1052 3-chiều thư năm. Cô Trinh. Team Code: t11m5ze doanvx@isvnu.vnDocument47 pagesLesson 1: MNS 1052 3-chiều thư năm. Cô Trinh. Team Code: t11m5ze doanvx@isvnu.vnHong NguyenNo ratings yet