Professional Documents

Culture Documents

RSRM Ipo

Uploaded by

Mohammad Jubayer AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RSRM Ipo

Uploaded by

Mohammad Jubayer AhmedCopyright:

Available Formats

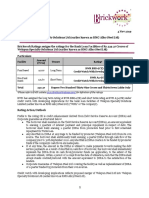

Credit Rating Report (Surveillance)

Ratanpur Steel Re-Rolling Mills Limited

Particulars Ratanpur Steel Re-Rolling Mills Limited BDT 111.97 million aggregate Long Term Outstanding (LTO) BDT 750.00 million aggregate CC(pl) and CC(H) limit* BDT 1,000.0 million aggregate Short term Funded and Non funded limit Rating Out Look Date of Rating: 04 October 2012 Validity: The Entity rating is valid up to 31 December 2013 and the loan ratings are valid up to limit expiry date of respective credit facilities or 31 December 2013 whichever is earlier. Rating Based on: Audited financial statements up to 30 June 2012 and Management information up to December 2011, bank liability position as on 31 August 2012, and other relevant quantitative as well as qualitative information up to the date of rating declaration. Auditor: Huda Vasi and Co Methodology: CRABs Corporate Rating Methodology (www.crab.com.bd) Analysts: Munir Uddin Ahmed munir@crab.com.bd Khandakar Shahed Royhan shahed@crabrating.com Rationale: Credit Rating Agency of Bangladesh Limited (CRAB) has assigned AA3 (Pronounced Double A Three) rating in the Long Term to Ratanpur Steel Re-Rolling Mills Limited (hereinafter also referred to as RSRM or the Company) and AA3 (Lr) to BDT 111.97 million Long Term Outstanding (LTO) and BDT 750.0 million aggregate Cash Credit of the Company. CRAB has also assigned ST-2 rating to BDT 1,000.0 million aggregate Funded and Non-funded limit. CRAB has performed the present rating assignment based on audited financial statements up to June 2012 and other relevant information. The rating also takes into account business profile, past record and trend of operating performance, balance sheet strength and loan repayment history. In assessing, the Loan Ratings (Lr) CRAB also considers the security arrangements against each exposure along with the entitys fundamentals. Ratanpur Steel Re-Rolling Mills Ratings AA3 AA3(Lr) AA3(Lr) ST-2 Stable Remarks Entity Please see Appendix-1 for details

Lr - Loan Rating; ST Short Term. * Due to its revolving nature, CRAB views Cash Credit (CC) as long-term facility.

incorporated as a private limited company on 22 April 1986 and converted into public limited company on 26 June 2012. RSRM is engaged in manufacturing different graded (40, 60 and 75 grades) deformed rods in different sizes (5.5 mm to 32 mm) since 1986.

RATING INDICATORS

Rating Strengths Rating Concern

Initially production capacity of RSRM was 50,000 MT/ per year, which was increased to 156,000 MT per year in 2011 and utilization of production capacity of the Company is in increasing trend. Rating reflects the growth in business, moderate scale of operations along with high competition intensity, its improved EBITDA margin and managing of price volatility at raw material procurement. The ratings also reflect the assessment of the moderate operation as well as experience of the Companys promoters alongside.

Business is profitable Experienced Management Long standing customer ties with

Low profit margin High COGS profitability. limits

Borrowed fund/equity ratio is declining. Backward linkage facilities

Unstable source

energy

CRAB I CRAB Ratings on Corporate Credit Digest I 10 October 2012

Page 1 of 4

CRAB Rating Report

Ltd

(RSRM)

was

Steel

Ratanpur Steel Re-Rolling Mills Ltd.

The capital structure has improved significantly. The equity of the company increased from BDT 322.7 million in FY 10-11 to BDT 1,422.6 million in FY 11-12 as BDT 943.9 million revaluation surplus of land included in equity and the company reinvested its profit. In FY 10-11 RSRM separated its Ship Breaking unit and another sister concern incorporated by the name of Ratanpur Ship Re-Cycling Industries Limited and took over all business transaction along with assets & liabilities regarding ship breaking unit of Ratanpur Steel Re-Rolling Mills Limited. Consequently borrowed fund of the company decreased from BDT 2,361.0 million in FY10-11 to BDT 1,294.6 million in FY 1112. As a result borrowed fund/Equity ratio decreased from 7.3(x) in FY10-11 to 0.9(x) in the year FY 11-12. The rating also supported by the continuous demand prevailing in the construction sector, thus sustaining capacity utilization, but any constraint imposed to this sector may hamper Companys growth. In FY 2011-12, the Company sold 91,392 MT MS Rod which was 62,000 MT and 23,230 MT in FY 10-11 and FY 09-10 respectively. The sales revenue increased during the observation period due to increase in product price and quantity of sales. The main reasons for increasing product price are increase in utility expenses (gas, electricity and water) and labor cost. Net profit after tax of the Company decreased from BDT 163.96 million in FY 10-11 to BDT 155.96 million in FY 11-12 as the company has paid deferred tax of BDT 85.0 million in FY 11-12. Net profit after tax is expected to increase during upcoming years as its utilization of capacity is in increasing trend. Moderate operating profitability coupled with debt repayment translated into improvement in RSRMs borrowed fund/EBITDA from 6.5(x) in FY10-11 to 2.1(x) in FY11-12.

Key Rating Drivers: An increase in capacity utilization and/or introducing backward linkage facility and/or reduced Borrowed Fund to EBITDA (6.5x in FY10-11 to 2.1x in FY11-12) and/or increased Operating Profit Margin (7.7% in FY10-11 to 8.8% in FY11-12) and/or any positive changes in operation, could be a positive rating factor. Unstable energy source, labor unrest and/or inefficiency working capital management, disparity between growth potentiality and exposure to debt led capital structure, could be a negative rating factor.

www.crab.com.bd; www.crabrating.com

Page 2 of 4

Ratanpur Steel Re-Rolling Mills Ltd.

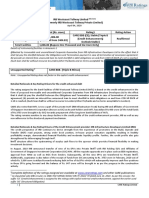

CRAB RATING SCALES AND DEFINITIONS Long Term (Corporate)

Long Term Rating AAA Triple A AA1, AA2, AA3* Double A A1, A2, A3 Single A Definition

Companies rated in this category have extremely strong capacity to meet financial commitments. These companies are judged to be of the highest quality, with minimal credit risk. Companies rated in this category have very strong capacity to meet financial commitments. These companies are judged to be of very high quality, subject to very low credit risk. Companies rated in this category have strong capacity to meet financial commitments, but are susceptible to the adverse effects of changes in circumstances and economic conditions. These companies are judged to be of high quality, subject to low credit risk. Companies rated in this category have adequate capacity to meet financial commitments but more susceptible to adverse economic conditions or changing circumstances. These companies are subject to moderate credit risk. Such companies possess certain speculative characteristics. Companies rated in this category have inadequate capacity to meet financial commitments. Have major ongoing uncertainties and exposure to adverse business, financial, or economic conditions. These companies have speculative elements, subject to substantial credit risk. Companies rated in this category have weak capacity to meet financial commitments. These companies have speculative elements, subject to high credit risk. Companies rated in this category have very weak capacity to meet financial obligations. These companies have very weak standing and are subject to very high credit risk. Companies rated in this category have extremely weak capacity to meet financial obligations. These companies are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest. Companies rated in this category are highly vulnerable to non-payment, have payment arrearages

BBB1, BBB2, BBB3 Triple B

BB1, BB2 , BB3 Double B B1, B2, B3 Single B CCC1, CCC2, CCC3 Triple C CC Double C

C Single C

allowed by the terms of the documents, or subject of bankruptcy petition, but have not experienced a payment default. Payments may have been suspended in accordance with the instrument's terms. These companies are typically in default, with little prospect for recovery of principal or interest.

D (Default)

D rating will also be used upon the filing of a bankruptcy petition or similar action if payments on an obligation are jeopardized.

*Note: CRAB appends numerical modifiers 1, 2, and 3 to each generic rating classification from AA through CCC. The modifier 1 indicates that

the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end of that generic rating category.

CRAB I CRAB Ratings on Corporate Credit Digest I 10 October 2012

Page 3 of 4

Ratanpur Steel Re-Rolling Mills Ltd.

LONG-TERM RATING: LOANS/FACILITIES FROM BANKS/FIS (All loans/facilities with original maturity exceeding one year)

RATINGS AAA (Lr) (Triple A) Highest Safety AA (Lr)* (Double A) High Safety A (Lr) Adequate Safety BBB (Lr) (Triple B) Moderate Safety BB (Lr) (Double B) Inadequate Safety B (Lr) High Risk CCC (Lr) Very High Risk CC (Lr) Extremely High Risk C (Lr) Near to Default D (Lr) Default DEFINITION Loans/facilities rated AAA (Lr) are judged to offer the highest degree of safety, with regard to timely payment of financial obligations. Any adverse changes in circumstances are unlikely to affect the payments on the loan facility. Loans/facilities rated AA (Lr) are judged to offer a high degree of safety, with regard to timely payment of financial obligations. They differ only marginally in safety from AAA (Lr) rated facilities. Loan/facilities rated A (Lr) are judged to offer an adequate degree of safety, with regard to timely payment of financial obligations. However, changes in circumstances can adversely affect such issues more than those in the higher rating categories. Loans/facilities rated BBB (Lr) are judged to offer moderate safety, with regard to timely payment of financial obligations for the present; however, changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal than for issues in higher rating categories. Loans/facilities rated BB (Lr) are judged to carry inadequate safety, with regard to timely payment of financial obligations; they are less likely to default in the immediate future than instruments in lower rating categories, but an adverse change in circumstances could lead to inadequate capacity to make payment on financial obligations. Loans/facilities rated B (Lr) are judged to have high risk of default; while currently financial obligations are met, adverse business or economic conditions would lead to lack of ability or willingness to pay interest or principal. Loans/facilities rated CCC (Lr) are judged to have factors present that make them very highly vulnerable to default; timely payment of financial obligations is possible only if favorable circumstances continue. Loans/facilities rated CC (Lr) are judged to be extremely vulnerable to default; timely payment of financial obligations is possible only through external support. Loans/facilities rated C (Lr) are currently highly vulnerable to non-payment, having obligations with payment arrearages allowed by the terms of the documents, or obligations that are subject of a bankruptcy petition or similar action but have not experienced a payment default. C is typically in default, with little prospect for recovery of principal or interest. C (Lr) are typically in default, with little prospect for recovery of principal or interest. Loans/facilities rated D (Lr) are in default or are expected to default on scheduled payment dates.

*Note: CRAB appends numerical modifiers 1, 2, and 3 to each generic rating classification from AA through CCC. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end of that generic rating category. SHORT-TERM CREDIT RATING: LOANS/FACILITIES OF BANKS/FIS

(All loa ns/faciliti es with original mat urity within one year) DEFI NITIO N ST- 1 Highest Grade ST- 2 High Grade ST- 3 Adequate Grade ST- 4 Marginal ST- 5 Inadequate Grade ST- 6 Low est Grade This rating indicat es t hat the degree of safety regarding ti mely pay ment on the l oans/facilities is v ery strong. This rating indicat es t hat the degree of safety regarding ti mely pay ment on the l oans/facilities is strong; how ever, the relative degree of saf ety is low er than that for issues rated higher. This rating indicates that the degree of safety regarding ti mely pay ment on the loans/faciliti es is adequate; how ever, the issues are more vulnerable to the adverse effects of cha ngi ng circumstances than issues rated in the two hi gher categories. This rating indicat es that the degree of safety regarding ti mely payment on the loans/faciliti es is margi nal; and the issues are quit e vulnerable to the adverse eff ects of changing circumstances. This rating indicat es t hat the degree of safety regarding ti mely pay ment on the l oans/faciliti es is mi ni mal , and it is lik ely to be a dversely affected by short-ter m adversity or less favorable conditi ons. This rating indicat es t hat the l oans/facilities are expect ed t o be in default on maturity or is in d efault.

Copyright 2012, CREDI T RATI NG A GENC Y OF BANGLA DESH LIMITED ("CRAB"). All rights reserved. A LL I NFO RMATIO N CO NTAI NED HEREI N I S PRO TEC TED BY COPYRI GHT LAW AND NO NE O F SUCH INFORMA TION MAY BE COPIED OR OTHERWISE REPRO DUC ED, REPACKAGED, FURTHER TRA NSMI TTED, TRA NSFERRED, DISSEMI NATED, REDI STRIBUTED OR RESO LD, OR STORED FO R SUBSEQUENT USE FOR A NY SUC H PU RPOSE, IN W HOLE O R IN PART, IN ANY FORM O R MANNER O R BY ANY M EANS WHA TSO EVER, BY ANY PERSO N WITHOU T CRABS P RIOR W RITTEN CONSENT. All information contained herein is obtained by CRAB from sources believed by it to be accurate and reliabl e. B ecause of the possibility of huma n or mechani cal error as well as other factors, however, such infor mation is provided as is without warranty of any kind and CRAB, in particular, makes no representation or warranty, express or implied, as to the accuracy, timeli ness, complet eness, merchantability or fitness for any particular purpose of any such information. Under no circumstances shall CRAB have any liability to any person or entity for (a) any loss or da mage in whol e or in part caused by, resulting from, or relating to, any error (negligent or other wise) or other circumstance or contingency within or outside the control of CRAB or any of its directors, officers, employees or agents in connection with the procurement, coll ection, compilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory or incidental da ma ges whatsoever (incl uding without li mitation, lost profits), even if C RAB is advised in a dvance of the possibility of such da mages, resulting from the use of or inability to use, any such infor mation. The credit ratings and financial reporting analysis observations, if any, constituting part of the infor mation contained herein are, and must be construed sol ely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hol d any securities. NO WARRA NTY, EXPRESS OR IMPLIED, AS TO THE ACCURAC Y, TIMELINESS, COMPLETENESS, MERC HANTABILI TY OR FITNESS FO R ANY PARTICULA R PURPOSE OF A NY SUC H RATI NG OR OTHER OPINION O R I NFORMA TION IS GIVEN O R MA DE BY CRAB IN ANY FORM OR MA NNER WHATSOEVER. Each rating or other opinion must be w eighed solely as one factor in any invest ment deci sion made by or on behalf of any user of the information contained herein, and each such user mu st accordingly make its own study and evaluation of each security and of each issuer and guarantor of, and each provider of credit support for, each security that it may consi der purchasing, holding or selling.

www.crab.com.bd; www.crabrating.com

Page 4 of 4

You might also like

- Secured first-ranking bonds prospectus for NZ$39.8M offerDocument48 pagesSecured first-ranking bonds prospectus for NZ$39.8M offerfaiyazadamNo ratings yet

- CRA OverviewDocument26 pagesCRA OverviewayushhammingcodeNo ratings yet

- Bond Risks and Yield Curve AnalysisDocument33 pagesBond Risks and Yield Curve Analysisarmando.chappell1005No ratings yet

- CFA Level I Quantitative Methods Study TipsDocument8 pagesCFA Level I Quantitative Methods Study TipsMohammad Jubayer AhmedNo ratings yet

- Real Estate Investment AnalysisDocument67 pagesReal Estate Investment AnalysisRheneir MoraNo ratings yet

- R05 Time Value of Money Practice QuestionsDocument11 pagesR05 Time Value of Money Practice QuestionsMohammad Jubayer AhmedNo ratings yet

- R05 Time Value of Money Practice QuestionsDocument11 pagesR05 Time Value of Money Practice QuestionsMohammad Jubayer AhmedNo ratings yet

- R05 Time Value of Money Practice QuestionsDocument11 pagesR05 Time Value of Money Practice QuestionsMohammad Jubayer AhmedNo ratings yet

- R05 Time Value of Money Practice QuestionsDocument11 pagesR05 Time Value of Money Practice QuestionsMohammad Jubayer AhmedNo ratings yet

- Wizz Air Holdings PLC Annual Report and Accounts 2018Document123 pagesWizz Air Holdings PLC Annual Report and Accounts 2018PeterAttilaMarcoNo ratings yet

- The Credit Investor's Handbook: Leveraged Loans, High Yield Bonds, and Distressed DebtFrom EverandThe Credit Investor's Handbook: Leveraged Loans, High Yield Bonds, and Distressed DebtNo ratings yet

- R05 Time Value of Money IFT Notes PDFDocument28 pagesR05 Time Value of Money IFT Notes PDFAbbas0% (1)

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaNo ratings yet

- Blackbook Project On Credit RatingDocument74 pagesBlackbook Project On Credit RatingRagini Sundarraman62% (13)

- J.hull RIsk Management and Financial InstitutionsDocument31 pagesJ.hull RIsk Management and Financial InstitutionsEric Salim McLaren100% (1)

- Convertible Bonds: Fixed-Income Securities That Can Be Converted Into StocksDocument4 pagesConvertible Bonds: Fixed-Income Securities That Can Be Converted Into StockspallavimakkanNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Padma PolyCotton Knit Fabrics Limited - 2011Document5 pagesPadma PolyCotton Knit Fabrics Limited - 2011fahim_bdNo ratings yet

- Petromax Refinery Rating Report 2012Document4 pagesPetromax Refinery Rating Report 2012Hassan Md RabiulNo ratings yet

- Epyllion LTD Rating Report 2011Document4 pagesEpyllion LTD Rating Report 2011Boni AminNo ratings yet

- CP Bangladesh Company Limited Rating Report 2012 CheckedDocument3 pagesCP Bangladesh Company Limited Rating Report 2012 CheckedMuannis MahmoodNo ratings yet

- SRC Chemicals Private LimitedDocument8 pagesSRC Chemicals Private Limitedgcgary87No ratings yet

- The Hongkong and Shanghai Banking Corporation Limited, Bangladesh BranchesDocument4 pagesThe Hongkong and Shanghai Banking Corporation Limited, Bangladesh Branchesjubayer2252No ratings yet

- Credit Rating ExplainedDocument25 pagesCredit Rating ExplainedDileep SinghNo ratings yet

- Rating Rationale - Hero Steel Oct 2019Document4 pagesRating Rationale - Hero Steel Oct 2019Puneet367No ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Welspun-Specialty-Solutions-4Nov2019 BrickworkDocument7 pagesWelspun-Specialty-Solutions-4Nov2019 BrickworkPuneet367No ratings yet

- 06 - Aditi Jhanwar MFS Presentation PDFDocument21 pages06 - Aditi Jhanwar MFS Presentation PDFAditi JhanwarNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Track Components - ICRADocument8 pagesTrack Components - ICRAPuneet367No ratings yet

- Credit Rating: Prof - Bijoy GuptaDocument21 pagesCredit Rating: Prof - Bijoy GuptaManash GopeNo ratings yet

- Agrani 1Document1 pageAgrani 1Mohsinat NasrinNo ratings yet

- CreditratingDocument20 pagesCreditratingNeethu NairNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Muthoot Finance LimitedDocument11 pagesMuthoot Finance LimitedKhasimvali ShaikNo ratings yet

- Larsen & Toubro Limited - R - 26062020 PDFDocument12 pagesLarsen & Toubro Limited - R - 26062020 PDFdeepesh dhanrajaniNo ratings yet

- RL Steel Jan 2017 ICRADocument6 pagesRL Steel Jan 2017 ICRAPuneet367No ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- Onshore Construction Company Private LimitedDocument7 pagesOnshore Construction Company Private Limitedhesham zakiNo ratings yet

- Lower-Rated Chinese Real Estate Developers Remain Vulnerable To Market ShiftsDocument9 pagesLower-Rated Chinese Real Estate Developers Remain Vulnerable To Market Shiftsapi-227433089No ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Default Study 2005 by RAMDocument36 pagesDefault Study 2005 by RAMMeor Amri100% (1)

- 20d1226 0216NamuraShipbuildingDocument8 pages20d1226 0216NamuraShipbuildingpeyockNo ratings yet

- Rating Rationale - Adani Wilmar LimitedDocument13 pagesRating Rationale - Adani Wilmar LimitedAnjum SamiraNo ratings yet

- Standardisation Rating Symbols Definitions CRISILDocument10 pagesStandardisation Rating Symbols Definitions CRISILsunil_k_agrawal5487No ratings yet

- CARE_Sunflag_4.01.2024Document9 pagesCARE_Sunflag_4.01.2024Swapnil SomkuwarNo ratings yet

- Shri Balaji Rollings Private Limited Receives Ratings From CAREDocument4 pagesShri Balaji Rollings Private Limited Receives Ratings From CAREData CentrumNo ratings yet

- Sakthi Finance Limited R 20022020Document9 pagesSakthi Finance Limited R 20022020Elan ChelianNo ratings yet

- SREI INFRASTRUCTURE FINANCE RATINGS REVALIDATEDDocument5 pagesSREI INFRASTRUCTURE FINANCE RATINGS REVALIDATEDpassitsNo ratings yet

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- A Report On Silver River Manufacturing CompanyDocument59 pagesA Report On Silver River Manufacturing CompanyManish JaiswalNo ratings yet

- Credit RatingDocument48 pagesCredit RatingChinmayee ChoudhuryNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Rustomjee Realty Private LimitedDocument7 pagesRustomjee Realty Private LimitedScribdNo ratings yet

- Credit Appraisal and Risk Rating at PNBDocument48 pagesCredit Appraisal and Risk Rating at PNBAbhay Thakur100% (2)

- SP Rating ActionDocument9 pagesSP Rating ActionJoko PrasetyoNo ratings yet

- Electromech Material R 08022018Document8 pagesElectromech Material R 08022018amol_patil51429514No ratings yet

- RatingsScale 2008 PDFDocument13 pagesRatingsScale 2008 PDFPradeep272No ratings yet

- Valuka Feeds Crab ReportDocument2 pagesValuka Feeds Crab ReportPrince AsifNo ratings yet

- Banking Statistics and ConceptsDocument218 pagesBanking Statistics and ConceptsShamanth1No ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Super Screws Private Limited: Summary of Rated InstrumentsDocument7 pagesSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNo ratings yet

- Arcelormittal Sa: Summary of Rated InstrumentsDocument6 pagesArcelormittal Sa: Summary of Rated Instrumentspavan reddyNo ratings yet

- Financial Institutions: 2013 Outlook: Major Indian Non-Bank Finance CompaniesDocument10 pagesFinancial Institutions: 2013 Outlook: Major Indian Non-Bank Finance Companiess_suraiyaNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Alliance Holdings Limited: Credit Rating ReportDocument5 pagesAlliance Holdings Limited: Credit Rating ReportrontterNo ratings yet

- Press Release: Detailed Rationale & Key Rating Drivers For The Credit Enhanced DebtDocument8 pagesPress Release: Detailed Rationale & Key Rating Drivers For The Credit Enhanced DebtANUBHAVCFANo ratings yet

- Literature Review On Corporate Debt RestructuringDocument8 pagesLiterature Review On Corporate Debt RestructuringaflsiosbeNo ratings yet

- Rating RationaleDocument7 pagesRating Rationalevaibhav pachputeNo ratings yet

- PresentationSUMMARY (A)Document2 pagesPresentationSUMMARY (A)Rakib HasanNo ratings yet

- Naman Mall Management Company - R - 06112020Document7 pagesNaman Mall Management Company - R - 06112020Bholey RiftNo ratings yet

- R19 Monetary and Fiscal Policy IFT NotesDocument33 pagesR19 Monetary and Fiscal Policy IFT NotesMohammad Jubayer AhmedNo ratings yet

- Equity Investments: Learning OutcomesDocument3 pagesEquity Investments: Learning OutcomesMohammad Jubayer AhmedNo ratings yet

- R20 International Trade and Capital Flows PDFDocument36 pagesR20 International Trade and Capital Flows PDFROSHNINo ratings yet

- Derivatives: Learning OutcomesDocument2 pagesDerivatives: Learning OutcomesMohammad Jubayer AhmedNo ratings yet

- R20 International Trade and Capital Flows IFT NotesDocument33 pagesR20 International Trade and Capital Flows IFT NotesMohammad Jubayer AhmedNo ratings yet

- R14 Demand and Supply Analysis Consumer Demand PDFDocument27 pagesR14 Demand and Supply Analysis Consumer Demand PDFAbhijeet PatilNo ratings yet

- R21 Currency Exchange Rates QuestionsDocument5 pagesR21 Currency Exchange Rates QuestionsMohammad Jubayer AhmedNo ratings yet

- R21 Currency Exchange Rates PDFDocument34 pagesR21 Currency Exchange Rates PDFAbhijeet PatilNo ratings yet

- R14 Demand and Supply Analysis - Consumer Demand IFT NotesDocument28 pagesR14 Demand and Supply Analysis - Consumer Demand IFT NotesMohammad Jubayer AhmedNo ratings yet

- R20 International Trade and Capital Flows QuestionsDocument5 pagesR20 International Trade and Capital Flows QuestionsMohammad Jubayer AhmedNo ratings yet

- R15 Demand and Supply Analysis - The Firm IFT NotesDocument36 pagesR15 Demand and Supply Analysis - The Firm IFT NotesMohammad Jubayer AhmedNo ratings yet

- R21 Currency Exchange Rates IFT NotesDocument35 pagesR21 Currency Exchange Rates IFT NotesMohammad Jubayer AhmedNo ratings yet

- R14 Demand and Supply Analysis Consumer Demand QuestionsDocument3 pagesR14 Demand and Supply Analysis Consumer Demand QuestionsMohammad Jubayer AhmedNo ratings yet

- R07 Statistical Concepts and Market Returns IFT NotesDocument27 pagesR07 Statistical Concepts and Market Returns IFT NotesMohammad Jubayer AhmedNo ratings yet

- R13 Demand and Supply Analysis - Introduction IFT NotesDocument61 pagesR13 Demand and Supply Analysis - Introduction IFT NotesMohammad Jubayer AhmedNo ratings yet

- R13 Demand and Supply Analysis - An Introduction QuestionsDocument5 pagesR13 Demand and Supply Analysis - An Introduction QuestionsMohammad Jubayer AhmedNo ratings yet

- l1 Econ r13 Demand and Supply IntrodcutionDocument31 pagesl1 Econ r13 Demand and Supply IntrodcutionRavi AdvaniNo ratings yet

- R06 Discounted Cash Flow Applications IFT NotesDocument32 pagesR06 Discounted Cash Flow Applications IFT NotesMohammad Jubayer AhmedNo ratings yet

- R06 Discounted Cash Flow ApplicationsDocument35 pagesR06 Discounted Cash Flow ApplicationsRaviTejaNo ratings yet

- R07 Statistical Concepts and Market Return Practice QuestionsDocument13 pagesR07 Statistical Concepts and Market Return Practice QuestionsMohammad Jubayer AhmedNo ratings yet

- R06 Discounted Cash Flow Applications Practice QuestionsDocument7 pagesR06 Discounted Cash Flow Applications Practice QuestionsMohammad Jubayer AhmedNo ratings yet

- Write Up of Explanation PDFDocument23 pagesWrite Up of Explanation PDFAnonymous 3upMZGYs4DNo ratings yet

- R03 Introduction To GIPS IFT NotesDocument7 pagesR03 Introduction To GIPS IFT NotesMohammad Jubayer AhmedNo ratings yet

- R03 Introduction To GIPSDocument9 pagesR03 Introduction To GIPSankitNo ratings yet

- Pakistan Credit Rating Agency LimitedDocument6 pagesPakistan Credit Rating Agency LimitedMubeen MalikNo ratings yet

- S&P CMBS FrameworkDocument9 pagesS&P CMBS FrameworkMarija BeleskaNo ratings yet

- RatingDocument34 pagesRatingRaj YadavNo ratings yet

- Fixed Income Securities AssignmentDocument7 pagesFixed Income Securities AssignmentRajat SharmaNo ratings yet

- Multiple Choice Questions - 2016 PromotionDocument136 pagesMultiple Choice Questions - 2016 PromotionNavneet PatelNo ratings yet

- BIS CDO Rating MethodologyDocument31 pagesBIS CDO Rating Methodologystarfish555No ratings yet

- Altman Rijken (2004) (Ratings Stability)Document45 pagesAltman Rijken (2004) (Ratings Stability)as111320034667No ratings yet

- Mydin IM PDFDocument108 pagesMydin IM PDFOilandGas IndependentProjectNo ratings yet

- Fs Mai PRJCTDocument48 pagesFs Mai PRJCTManish JangidNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Rating Report - Daikin Airconditioning India PVT LTD - August 2017Document7 pagesRating Report - Daikin Airconditioning India PVT LTD - August 2017Bhavin SagarNo ratings yet

- Moodys Disclosures On Credit Ratings of Fiji - 19 January 2012Document5 pagesMoodys Disclosures On Credit Ratings of Fiji - 19 January 2012Intelligentsiya HqNo ratings yet

- Hull RMFI3 RD Ed CH 18Document14 pagesHull RMFI3 RD Ed CH 18Ella Marie WicoNo ratings yet

- IBPA Yield Curve: Daily Price & Fair Values Indonesia Corporate BondsDocument11 pagesIBPA Yield Curve: Daily Price & Fair Values Indonesia Corporate Bondsbintar_21No ratings yet

- Virgo Aluminium R 30042019Document4 pagesVirgo Aluminium R 30042019Jagan NarayanNo ratings yet

- CRAB RatingDocument62 pagesCRAB RatingRashed MahmudNo ratings yet

- Hull RMFI4 e CH 21Document16 pagesHull RMFI4 e CH 21jlosamNo ratings yet

- ViscoVery SOM (Clustering)Document173 pagesViscoVery SOM (Clustering)Alexandra Ana Maria NastuNo ratings yet

- Power Grid AGM Notice and Annual Report for FY 2018-19Document361 pagesPower Grid AGM Notice and Annual Report for FY 2018-19Uday KumarNo ratings yet

- Charles Schwab Investment Management, Inc 211 Main ST., San Francisco, CA 94105-1905Document8 pagesCharles Schwab Investment Management, Inc 211 Main ST., San Francisco, CA 94105-1905MarketsWikiNo ratings yet