Professional Documents

Culture Documents

F6 1999 Jun A

Uploaded by

Dylan Ngu Tung HongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F6 1999 Jun A

Uploaded by

Dylan Ngu Tung HongCopyright:

Available Formats

Answers

12

Certificate Examination Paper 7(M) Tax Framework (Malaysia)

Answers and Marking Scheme Marks

Kualitech Sdn Bhd Year of Assessment 1998 Note Profit before taxation Interest income Provision for stock obsolescence Warranty reserve Bonus Employees Provident Fund Lease amortisation Replacement of tools Lease rental of car Lease rental of lorry Repair of factory roof Repainting of factory Renovation of office premises Architects fees General provision at 31.12.97 Specific provision at 31.12.97 (190 170) Bad debts recovered (30 17) General provision at 1.1.97 Depreciation Registration of trademark Donation Development expenditure Cost of exhibits Overtime pay Rental of space Entertainment RM000 + 3,000 180 49 77 14 5 13 145 7 250 20 13 120 500 8 2 80 3 5 24 4,294 (921) Adjusted income Add: Balancing charge Less: Capital allowances Statutory income Interest income Aggregate income Less: Donation Total/chargeable income Notes: (1) Provision for stock obsolescence is an unrealised loss therefore not deductible. Warranty reserve of RM49,000 (05% x RM98 million) is a provision therefore not deductible. (2) Deduction for bonus is restricted to two months of the employees salary as follows: RM000 40 30 20 22 112 (189) 77 12 3,373 9 3,382 330 3,052 620 3,672 2 3,670 921 RM000 700 1 1 2 3 4 5 6 6 05 05 05 05 1 1 05 05 1 05 05 05 05 05 05 05 05 05 05 05 05 05 05 05 05 1

7 7 7 7 8 8 9 10 10 10 11

05 05 1 05 05

05 05 1

Mr Mr Mr Mr

Beh RM240,000 x 2/12 = Nathan RM180,000 x 2/12 = Long RM120,000 x 2/12 = Rais RM132,000 x 2/12 =

Restricted to Bonus actually paid Add back

13

(3)

Deduction for Employees Provident Fund contributions is restricted to 19% of the employees remuneration as follows: RM Mr Behs salary and bonus: RM280,000 x 24% = RM280,000 x 19% = Add back 67,200 53,200 14,000

Marks 1

(4) (5) (6)

Lease amortisation is a capital expenditure therefore added back. Deduction for tools is allowable on a replacement basis, hence no adjustment necessary. Deduction for lease rental of the car is restricted as follows: Lease rental 1.4.96 to 31.12.96 RM3,000 x 9 Lease rental 1.1.97 to 31.12.97 RM3,000 x 12 Restricted to Add back RM000 27 36 63 (50) 13

05 05 1

No restriction for lorry as it is for commercial transportation of goods, hence no adjustment necessary. (7) Bad and doubtful debts are adjusted as follows: Specific provision for non-trade debt is not deductible, therefore add back RM20,000. Recovery of non-trade debt RM13,000 is not taxable as it was not deductible when it was written off. Registration of trademark is a capital expenditure therefore added back. Donation to an approved institution will be deducted in arriving at the total income. Payment for the services of an approved research company qualifies for double deduction under s.34B(1)(b) of the Income Tax Act, 1967.

05

05 05 1

(8)

(9)

05

(10) Revenue expenditure (excluding the cost of exhibits) incurred in participating in international trade fair qualifies for double deduction as both the fair and the companys participation were approved by the Minister. (11) Entertainment expense is specifically disallowed under s.39 (l) of the Income Tax Act, 1967. (12) Interest accrued for the period 1 January 1997 to 31 October 1997 is 10/12 x RM480,000.

05 05

14

Marks 2 Mr Gan Video rental business profit as per accounts Add back: Fine Statutory income Rental semi-detached house Gross rental RM4,000 x 6 Less: Quit rent RM200 x 6/12 Assessment RM600 x 6/12 RM 12,000 3,000 3,000 15,000 1 05

24,000 100 300 400 23,600

1 1 1

Royalties (RM9,000 6,000 exemption) Section 11 deemed income flat Less: Assessment Interest on loan Repairs and repainting

3,000 7,200 350 3,000 4,000 7,350 Nil

15 05 05 05 05 05 1

Aggregate income Less: Donation restricted to Total income Less: Personal relief: Self Chargeable income Tax on RM10,000 Tax on 6,600 at 6% Tax payable Mrs Gan Salary Entertainment allowance Directors fees Furnishings Car: Volvo RM5,000 x x 9/12 Fuel RM1,500 x 9/12 Proton RM3,600 x 3/12 Fuel RM1,200 x 3/12 Driver RM300 x 3 Leave passage to Paris Leave passage to Australia Accommodation defined value Less: Entertainment expense restricted to RM 25000 39600 64600

41,600 20,000 21,600 5,000 16,600

05

RM 48,000 6,000 10,000 64,000 1,680 1,875 1,125 900 300 900 Exempt 2,000 36,000 108,780 6,000 102,780 5,000 5,000 (max) 1,300 3,200 14,500 88,280 RM 8,95000 4,75280 13,70280 40000 13,30280

05 05 05 05 15 05 05 05 05 1 1 15 2

Total income Less: Personal relief Self Employees Provident Fund and life insurance premium Medical premium Child Chargeable income Tax on RM70,000 Tax on 18,280 at 26% Less: Rebate on computer

05 1 1 1

1 05

Tax payable

15

Marks 3 (a) (i) The badges of trade present in the above situation are: Existence of business interest in similar field Method of finance Profit-seeking motive Nature of asset Modification of asset Organisation of sales Period of ownership. (ii) Frequency of transactions Acquisition method Formation of a company 1 1 1 1 1 1 1 1 1 1 1 1 1

(b) High Court Court of Appeal Federal Court

Fairway Sdn Bhd (a) Dividend franking account Balance as at 1.1.95 Tax chargeable for YA 96 RM3m x 30% Tax on dividends paid 1.1.95 to 31.12.95 Balance as at 1.1.96 Tax chargeable for YA 97 RM4m x 30% Tax on dividends paid: 12.1.96 RM14m x 30/70 11.7.96 RM42m x 30/70 Tax charge Balance as at 1.1.97 Tax chargeable for YA 98 RM7 x 28% Tax on dividends paid (deemed): 10.1.97 RM432m x 28/72 Balance (b) Fairway could pay gross dividends up to one million computed as follows: RM280,000 x 100/28 2 RM000 Nil 900 Nil 900 1,200 2,100 (600) (1,800) (300) Nil 1,960 1,960 (1,680) 280 1 05 05 05 05 05 05 1 1 15 1 05

(a) Encik Indot is not liable to real property gains tax as the transaction falls under Paragraph 3(b), Schedule 2 of the Real Property Gains Tax Act,1976, whereby the disposal price is deemed equal to the acquisition price, hence no gain/no loss situation for Encik Indot. Puan May is liable to real property gains tax as follows: Disposal price Less: Acquisition price Permitted expenses RM 280,000 220,000 30,000 250,000 Chargeable gain Less: Exemption 5% of chargeable gain or RM5,000 whichever the greater Tax payable at 30% = RM7,500 (disposal within 2 years 10.3.97 to 2.3.99) (b) The (i) (ii) (iii) acquirer has the following obligations: File a return to the Inland Revenue Board within one month of the date of acquisition Retain 5% of the consideration i.e. RM10,000 until a certificate of clearance is received from the IRB and Remit the money to the IRB when directed to do so. 30,000 5,000 25,000

05 1 1 05 1 05 15

1 1 1

16

Marks 6 (a) A taxable person has the following responsibilities: (i) Issue invoices to include service tax (ii) Keep record of sales and service tax for six years (iii) File service tax return within the stipulated period (iv) Make payment within the stipulated period (b) (i) Meals Drinks Cigarettes Inter-branch billing Cover charges Food Parking fees RM 35,000 20,000 8,000 30,000 2,000 5,000 100,000 Service tax payable at 5% RM5,000 (ii) Blossom must file the return and pay the tax by 28 May 1998 i.e. within 28 days after the end of the taxable period (March April). 1 1 1 1

05 05 05 05 05 05 05 05 1 2

(a) Year of assessment 1997 Employment: Salary Allowance Leave pay 1.12.96 to 31.1.97 Section 25(6)* Statutory income Royalties RM22,000 less 20,000 exemption Total income Year of assessment 1998 Interest income deemed derived from Malaysia Section 15(b) i.e. the interest was paid by a resident in Malaysia and the debt was secured by the land situated in Malaysia. Total income

RM 77,000 11,000 14,000 102,000 2,000 104,000 1 05 05 05 15

5,500 5,500

2 05 15 3

* The leave pay appropriate to the year 1997 could have been dealt with as income for YA 98 if Miss Watson had chosen to do so but this would not be beneficial because she is not resident for the basis year 1997. (b) The employment income of RM80,000 is deemed to be derived from Malaysia as the employment was exercised in Malaysia, therefore it is liable to Malaysian tax.

(a) (i) (ii)

Rantop can by 15 April 1998 request for revision of instalment payments in terms of the amount and the number of instalments. Computation of the balance payable and the penalty Tax payable as per notice of assessment 10.9.98 Less: Instalment payments Difference and balance payable 30% of tax payable Excess which would attract penalty Penalty at 10% RM7,100 RM 280,000 125,000 155,000 84,000 71,000

1 1 1 1 1 1 3

(b) A claim for repayment must be made by 31 December 1999 i.e. within six years from the end of the year of assessment (1993) in which the assessment was made.

17

You might also like

- 9mys 2010 Dec A PDFDocument7 pages9mys 2010 Dec A PDFGabriel SimNo ratings yet

- Taxation Suggested Solution: LessDocument9 pagesTaxation Suggested Solution: LesskannadhassNo ratings yet

- F6 Pilot PaperDocument19 pagesF6 Pilot PaperSoon SiongNo ratings yet

- F6mys 2009 Dec AnsDocument8 pagesF6mys 2009 Dec AnsAshwinee BalasundaramNo ratings yet

- Advanced Taxation and Strategic Tax Planning PDFDocument11 pagesAdvanced Taxation and Strategic Tax Planning PDFAnuk PereraNo ratings yet

- F6mys 2007 Dec PPQDocument19 pagesF6mys 2007 Dec PPQAnslem TayNo ratings yet

- BBFT2013 Taxation Marking Scheme BreakdownDocument7 pagesBBFT2013 Taxation Marking Scheme BreakdownPoiPoiiNo ratings yet

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingNo ratings yet

- 1.1 11 (D), 11 (E), 11 (O0,12 (C) 2022Document15 pages1.1 11 (D), 11 (E), 11 (O0,12 (C) 2022AmogelangNo ratings yet

- T 5 Business Expenses PT 2 2015Document15 pagesT 5 Business Expenses PT 2 2015DarshiniNo ratings yet

- Chapter 11 ADVANCED ACCOUNTING SOL MAN GUERRERODocument12 pagesChapter 11 ADVANCED ACCOUNTING SOL MAN GUERREROShiela PilarNo ratings yet

- Tutorial 9 Answer WHTDocument3 pagesTutorial 9 Answer WHT璇詠No ratings yet

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument20 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTang Swee ChanNo ratings yet

- ACW291 CHP 9 Withholding Tax - 231117 - 153847Document33 pagesACW291 CHP 9 Withholding Tax - 231117 - 153847hemaram2104No ratings yet

- Franchise Accounting Multiple Choice QuestionsDocument12 pagesFranchise Accounting Multiple Choice QuestionsYa LunNo ratings yet

- F6 2000 Jun QDocument11 pagesF6 2000 Jun QDylan Ngu Tung HongNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Sales & Service TaxDocument13 pagesSales & Service TaxWeiling TanNo ratings yet

- Quiz 3: Profit Before Taxation - s4 (A) 67,069Document5 pagesQuiz 3: Profit Before Taxation - s4 (A) 67,069fujinlim98No ratings yet

- Fundamentals Level – Skills Module Taxation (MalaysiaDocument12 pagesFundamentals Level – Skills Module Taxation (MalaysiaBeeJuNo ratings yet

- AnswerDocument4 pagesAnswerZati TyNo ratings yet

- Tutorial 3 WHT DiscussDocument6 pagesTutorial 3 WHT DiscussAqila Syakirah IVNo ratings yet

- The University of Nottingham: Suggested Solution (I)Document5 pagesThe University of Nottingham: Suggested Solution (I)Hoang BaoNo ratings yet

- Topic5 Capital Allowance Student 2016Document3 pagesTopic5 Capital Allowance Student 2016Veenesha MuralidharanNo ratings yet

- Calculating Deferred Tax for Permai BhdDocument3 pagesCalculating Deferred Tax for Permai Bhddini sofiaNo ratings yet

- F6PKN 2013 Jun Ans PDFDocument14 pagesF6PKN 2013 Jun Ans PDFabby bendarasNo ratings yet

- Capital AllowancesDocument22 pagesCapital AllowancesAmogelangNo ratings yet

- WHT Calculations for Various Income Types and DatesDocument16 pagesWHT Calculations for Various Income Types and DatesDik Ah SholehahNo ratings yet

- TXVNM 2019 Dec ADocument8 pagesTXVNM 2019 Dec AMinh AnhNo ratings yet

- ENGINEERING ECONOMY METHODSDocument54 pagesENGINEERING ECONOMY METHODSdummy accoutNo ratings yet

- Taxation Management and PlanningDocument10 pagesTaxation Management and PlanningJoel EdauNo ratings yet

- Taxation 2013 NovDocument25 pagesTaxation 2013 NovAshok 'Maelk' RajpurohitNo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Balance Sheet:: Profit and Loss AccountDocument6 pagesBalance Sheet:: Profit and Loss AccountAhmed JavaidNo ratings yet

- Malaysian Tax FrameworkDocument11 pagesMalaysian Tax FrameworkDylan Ngu Tung HongNo ratings yet

- Suggested Solutions TPExfpPDocument6 pagesSuggested Solutions TPExfpPtarangtgNo ratings yet

- 2009 June QuestionsDocument10 pages2009 June QuestionsFatuma Coco BuddaflyNo ratings yet

- Dec 06Document13 pagesDec 06Kelly Tan Xue LingNo ratings yet

- BBCA3183 - Finals TaxationDocument10 pagesBBCA3183 - Finals TaxationDivesha RaviNo ratings yet

- P6mys 2011 Dec QDocument10 pagesP6mys 2011 Dec QJayden Ooi Yit ChunNo ratings yet

- Q1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsDocument17 pagesQ1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsCliNo ratings yet

- Taxation AnswerDocument13 pagesTaxation AnswerkannadhassNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- PA301Q Financial Accounting 2Document11 pagesPA301Q Financial Accounting 2maybeNo ratings yet

- Closed End Fund CompanyDocument33 pagesClosed End Fund CompanyIvy LiewNo ratings yet

- 10-Practical Questions of Individuals (78-113)Document38 pages10-Practical Questions of Individuals (78-113)Sajid Saith0% (1)

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- IFRS16 Lease In-Class PracticesDocument11 pagesIFRS16 Lease In-Class PracticesDAN NGUYEN THENo ratings yet

- DTA/WTAX Q&ADocument3 pagesDTA/WTAX Q&AHafiz MusannefNo ratings yet

- Understanding Financial Ratios and Liquidity PositionDocument14 pagesUnderstanding Financial Ratios and Liquidity PositionKhayraNo ratings yet

- Analyzing Financial Statements and Accounting EventsDocument9 pagesAnalyzing Financial Statements and Accounting Eventsgiorgos1978No ratings yet

- Chapter 5 Property, Plant and Equipment GuideDocument14 pagesChapter 5 Property, Plant and Equipment GuideNaSheeng100% (1)

- Pe III Taxation II May Jun 2010Document3 pagesPe III Taxation II May Jun 2010swarna dasNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Successful: This Is A System Generated Notice. No Signature Is RequiredDocument1 pageSuccessful: This Is A System Generated Notice. No Signature Is RequiredDylan Ngu Tung HongNo ratings yet

- Robbins Mgmt6 Ch06 BBDocument9 pagesRobbins Mgmt6 Ch06 BBJayden ChanNo ratings yet

- Heat Pump Dryer: User ManualDocument56 pagesHeat Pump Dryer: User ManualDylan Ngu Tung HongNo ratings yet

- Summary of Bill of Quantities for Gn. Fuvahmulaku Jetty ProjectDocument28 pagesSummary of Bill of Quantities for Gn. Fuvahmulaku Jetty Projectymk_ahmadnazrulafiziNo ratings yet

- Horizontal DistanceDocument33 pagesHorizontal DistanceDylan Ngu Tung HongNo ratings yet

- F7int 2009 Dec AnsDocument10 pagesF7int 2009 Dec AnsSorphea YongNo ratings yet

- Hess513 Wastewater Enginering - Problem Statement: P01: How Clean or Dirty Water Is?Document5 pagesHess513 Wastewater Enginering - Problem Statement: P01: How Clean or Dirty Water Is?Dylan Ngu Tung HongNo ratings yet

- Hes 2131 Tut LevellingDocument52 pagesHes 2131 Tut LevellingDylan Ngu Tung HongNo ratings yet

- What Is PBLDocument13 pagesWhat Is PBLDylan Ngu Tung HongNo ratings yet

- CH 01Document13 pagesCH 01J-hyeon Yu100% (1)

- Hes 2131 Tut LevellingDocument52 pagesHes 2131 Tut LevellingDylan Ngu Tung HongNo ratings yet

- TraverseXL V1 0Document61 pagesTraverseXL V1 0Dylan Ngu Tung HongNo ratings yet

- 2008 Jun - Question Paper F8 Audit PDFDocument5 pages2008 Jun - Question Paper F8 Audit PDFCool RapperNo ratings yet

- 1 - Tutorial Exercise - Descriptive StatisticsDocument1 page1 - Tutorial Exercise - Descriptive StatisticsDylan Ngu Tung HongNo ratings yet

- Tut 1Document1 pageTut 1Dylan Ngu Tung HongNo ratings yet

- Audit Paper F8 FundamentalsDocument20 pagesAudit Paper F8 FundamentalsXin LiNo ratings yet

- Sarikei Branch Bank StatementDocument2 pagesSarikei Branch Bank StatementDylan Ngu Tung HongNo ratings yet

- F8int 2010 Dec QDocument7 pagesF8int 2010 Dec QKashif KamranNo ratings yet

- MTH10007 Notes s1-2015Document208 pagesMTH10007 Notes s1-2015Dylan Ngu Tung Hong0% (1)

- 2008 Jun - Question Paper F8 Audit PDFDocument5 pages2008 Jun - Question Paper F8 Audit PDFCool RapperNo ratings yet

- 2008 Jun - Question Paper F8 Audit PDFDocument5 pages2008 Jun - Question Paper F8 Audit PDFCool RapperNo ratings yet

- Malaysian Tax FrameworkDocument11 pagesMalaysian Tax FrameworkDylan Ngu Tung HongNo ratings yet

- F6 2000 Jun QDocument11 pagesF6 2000 Jun QDylan Ngu Tung HongNo ratings yet

- F6 2000 Dec QDocument10 pagesF6 2000 Dec QDylan Ngu Tung HongNo ratings yet

- Taxation (Malaysia) : Monday 7 June 2010Document10 pagesTaxation (Malaysia) : Monday 7 June 2010Saayesha RamNo ratings yet

- F6 1999 Dec ADocument10 pagesF6 1999 Dec ADylan Ngu Tung HongNo ratings yet

- Chapter 3 - Human RightsDocument3 pagesChapter 3 - Human Rightsbrownskinwhiteflesh_friedchickenNo ratings yet

- F6 2000 Dec ADocument8 pagesF6 2000 Dec ADylan Ngu Tung HongNo ratings yet

- 2003 Jun ADocument15 pages2003 Jun ADylan Ngu Tung HongNo ratings yet

- CONTEX vs. CIRDocument3 pagesCONTEX vs. CIRAnneNo ratings yet

- PF ESI P.tax Brochure - THTI-KolDocument10 pagesPF ESI P.tax Brochure - THTI-KoldurjoNo ratings yet

- The Regional Director Bureau of Internal RevenueDocument1 pageThe Regional Director Bureau of Internal RevenueRomrick TorregosaNo ratings yet

- Navi Loan Account StatementDocument1 pageNavi Loan Account StatementBorah SashankaNo ratings yet

- Executive Summary: Sandeep Kumar & AssociatesDocument28 pagesExecutive Summary: Sandeep Kumar & AssociatesAarti YadavNo ratings yet

- How I Helped Persuade The Australian Government To Cut The Capital Gains Tax in Half.Document28 pagesHow I Helped Persuade The Australian Government To Cut The Capital Gains Tax in Half.Alan ReynoldsNo ratings yet

- Income Statement: Clymel Cebu Music SchoolDocument3 pagesIncome Statement: Clymel Cebu Music SchoolLorn RobNo ratings yet

- Tax Invoice Cum Challan: Description of Goods Amount Disc. % Per Rate Quantity Hsn/SacDocument3 pagesTax Invoice Cum Challan: Description of Goods Amount Disc. % Per Rate Quantity Hsn/SacDebopriyo RoyNo ratings yet

- Aoxxxxxx4b A1 PDFDocument6 pagesAoxxxxxx4b A1 PDFGeethaNo ratings yet

- Answer Key Ch8Document12 pagesAnswer Key Ch8Zarah RoveroNo ratings yet

- This Receipt Is Computer Generated and No Signature Is RequiredDocument1 pageThis Receipt Is Computer Generated and No Signature Is RequiredExcellentMan ThankyouAllahNo ratings yet

- MT100Document349 pagesMT100Hari NNo ratings yet

- Summary For The Preparation of Bank Reconciliation StatementDocument5 pagesSummary For The Preparation of Bank Reconciliation StatementGhalib HussainNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasCeslhee AngelesNo ratings yet

- Page 4 11.02-Refund Full Case OnlyDocument152 pagesPage 4 11.02-Refund Full Case OnlyFely DesembranaNo ratings yet

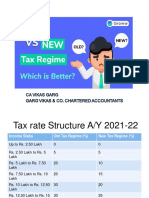

- Tax Regime Analysis: Opt for Old or New Tax SlabsDocument9 pagesTax Regime Analysis: Opt for Old or New Tax Slabsscintillating26No ratings yet

- JM Mini Pizza Worksheet For The Year Ended 2021 Trial Balance Adjustment Adjusted Trial Balance Income Statement Balance SheetDocument4 pagesJM Mini Pizza Worksheet For The Year Ended 2021 Trial Balance Adjustment Adjusted Trial Balance Income Statement Balance SheetAbegail PanangNo ratings yet

- Cadillac Tax: An Offset To The Tax Subsidy For Employer-Sponsored Health InsuranceDocument285 pagesCadillac Tax: An Offset To The Tax Subsidy For Employer-Sponsored Health InsuranceJohnny Castillo SerapionNo ratings yet

- Wisconsin July BillDocument2 pagesWisconsin July BillAce MereriaNo ratings yet

- Card Statement: Statement Date Last Payment DateDocument2 pagesCard Statement: Statement Date Last Payment DateS.M. Shamsuzzaman Salim0% (1)

- January: Date Name of Statue Form Name of To Be Sent To ReturnDocument8 pagesJanuary: Date Name of Statue Form Name of To Be Sent To Returnjimit0810No ratings yet

- Taxation and Fiscal PolicyDocument3 pagesTaxation and Fiscal PolicyBanana CrazyNo ratings yet

- Access funds anywhere with ATMsDocument10 pagesAccess funds anywhere with ATMsprofessor_manojNo ratings yet

- InvoiceDocument2 pagesInvoiceiworldvashicmNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceMOHIT SHARMANo ratings yet

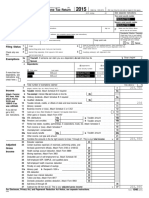

- Tax ReturnDocument15 pagesTax ReturnCristóbal Rodas100% (1)

- Chola 31148 2019 7 Payslip PDFDocument1 pageChola 31148 2019 7 Payslip PDFDass Prakash100% (1)

- Customer Transactions Statement SummaryDocument3 pagesCustomer Transactions Statement SummaryKulit BawangNo ratings yet

- Income Taxation Edt 2022 Sol ManDocument35 pagesIncome Taxation Edt 2022 Sol ManJessa50% (2)

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet