Professional Documents

Culture Documents

1902 - Bir

Uploaded by

Lilian Laurel CariquitanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1902 - Bir

Uploaded by

Lilian Laurel CariquitanCopyright:

Available Formats

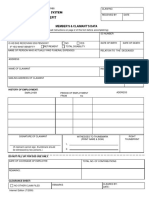

To be filled up by BIR

DLN:

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Individuals Earning Purely Compensation Income, and Non-Resident Citizens / Resident Alien Employee

Application for Registration

2 Date of Registration

(To be filled up by BIR) (MM/ DD/ YYYY)

BIR Form No.

1902

July 2008 (ENCS) New TIN to be issued, if applicable (To be filled up by BIR) 3 RDO Code

(To be filled up by BIR)

Fill in all applicable white spaces. Mark all appropriate boxes with an X.

1 Taxpayer Type Local Employee Resident Alien Employee Part I 4 TIN

(For Taxpayer w/ existing TIN)

Taxpayer / Employee Information 5 Sex

Male Female

6 8

Citizenship Date of Birth

(MM/ DD/ YYYY) (MM/ DD/ YYYY)

Taxpayer's Name

Last Name First Name Middle Name

Local Residence Address

10 Telephone No.

No. (Include Building Name)

Street

Barangay/Subdivision

11 Zip Code

District/Municipality City/Province

12 Municipality Code

13 Foreign Residence Address

14 Tax Type Form Type ATC Income Tax BIR Form 1700 - (For Individual Earning Compensation Income/Resident Alien Employee) II 011 Personal Exemptions Part II 15 Civil Status 16 Employment Status of Spouse: Single Widow/Widower Unemployed Legally separated Married Employed Locally Employed Abroad with qualified dependent child/ren without qualified dependent child/ren Engaged in Business/Practice of Profession 17 Claims for Additional Exemptions/Premium Deductions for husband and wife whose aggregate family income does not exceed P250,000 per annum Husband claims additional exemption and any premium deduction Wife claims additional exemption and any premium deduction 18 Spouse Information (Attach Waiver of Husband) Spouse Taxpayer Identification Number Spouse Name 18A 18B 18C Spouse Employer's Taxpayer Identification Number 18D Last Name Spouse Employer's Name First Name Middle Name

Additional Exemptions Part III 19 Names of Qualified Dependent Child/ren (refers to a legitimate, illegitimate, or legally adopted child chiefly dependent upon & living with the taxpayer; not more than 21 years of age, unmarried, and not gainfully employed; or regardless of age, is incapable of selfsupport due to mental or physical defect).

Last Name First Name Middle Name Date of Birth ( MM / DD / YYYY ) Mark if Mentally / Physically Incapacitated

19A 20A 21A 22A

19B 20B 21B 22B

19C 20C 21C 22C

21D 19D 21D 20D 21D 21D 21D 22D

19E 20E 21E 22E

Part IV For Employee With Two or More Employers (Multiple Employments) Within the Calendar Year 23 Type of multiple employments Successive employments (With previous employer(s) within the calendar year) Concurrent employments (With two or more employers at the same time within the calendar year) [If successive, enter previous employer(s); if concurrent, enter secondary employer(s)] Previous and Concurrent Employments During the Calendar Year TIN Name of Employer/s

24 Declaration I declare, under the penalties of perjury, that this form has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. TAXPAYER (EMPLOYEE) / AUTHORIZED AGENT

(Signature over printed name)

Part V 25 Type of Registered Office 26 Taxpayer Identification Number

HEAD OFFICE

Employer Information BRANCH OFFICE 27 RDO Code

(To be filled up by BIR)

28 Employer's Name (Last Name, First Name, Middle Name, if Individual/ Registered Name, if Non-Individual)

29 Employer's Business Address 30 Zip Code 31 Municipality Code

(To be filled up by the BIR)

33 Effectivity Date

(Date when Exemption Information is applied)

34 Date of Certification

(Date of Certification of the Accuracy of the Exemption Information)

(MM/ DD/ YYYY)

32 Telephone Number

(MM/ DD/ YYYY)

35 Declaration I declare, under the penalties of perjury, that this form has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Stamp of BIR Receiving Office and Date of Receipt

Attachments Complete? EMPLOYER / AUTHORIZED AGENT

(Signature over printed Name)

Title / Position of Signatory

(To be filled up by BIR)

Yes

No

ATTACHMENTS: (Photocopy only)

For Individuals Earning Purely Compensation Income - Birth Certificate or any valid identification card of applicant showing complete name, address, birth date and signature (Driver's license, PRC ID or passport) - Marriage Contract, if applcable - Waiver of husband to claim additional exemption , if applicable - Birth Certificate/s of dependent/s, if applicable - Employment Certificate or valid company ID with picture and signature, if available

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

You might also like

- Bir Form 1902Document4 pagesBir Form 1902fatmaaleah100% (1)

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Bir Form 1601-CDocument4 pagesBir Form 1601-Csanto tomas proper barangay100% (1)

- 2550 MDocument2 pages2550 MJose Venturina Villacorta100% (3)

- RDO No. 114 - Mati City, Davao OrientalDocument694 pagesRDO No. 114 - Mati City, Davao OrientalLRM0% (1)

- Affidavit of Loss. Phone and SimDocument1 pageAffidavit of Loss. Phone and SimK LeajanNo ratings yet

- Affidavit of Loss orDocument1 pageAffidavit of Loss orvmm lawfirmNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- Acknowledgment Receipt - Antonio T. PitoralDocument2 pagesAcknowledgment Receipt - Antonio T. PitoralSandie SubidaNo ratings yet

- BIR Form 1604EDocument2 pagesBIR Form 1604Ecld_tiger100% (2)

- Affidavit Loss Savings CBU Passbooks CooperativeDocument2 pagesAffidavit Loss Savings CBU Passbooks CooperativeNoel Ephraim Antigua0% (1)

- Certification Proud SeniorsDocument1 pageCertification Proud SeniorsFrancisLayagNo ratings yet

- CenomarDocument2 pagesCenomartoscanini2008100% (1)

- GSIS AAO Form for City TreasurerDocument7 pagesGSIS AAO Form for City TreasurerCarlo P. Caguimbal0% (1)

- Esrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeDocument1 pageEsrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeGina Garcia100% (1)

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- SBMA ID Card Infosheet (RENEWAL)Document1 pageSBMA ID Card Infosheet (RENEWAL)Renan Roque100% (1)

- Pag Ibig+Member's+Data+Form+ (MDF) +Print+No.+911146020078Document2 pagesPag Ibig+Member's+Data+Form+ (MDF) +Print+No.+911146020078Reynaldo Juanito Ludo Laforteza80% (5)

- 1701A Annual Income Tax ReturnDocument1 page1701A Annual Income Tax ReturnmoemoechanNo ratings yet

- Funeral bpn-103 PDFDocument2 pagesFuneral bpn-103 PDFHazel SabadlabNo ratings yet

- HDMF Contributions and Loan PaymentDocument29 pagesHDMF Contributions and Loan PaymentRocelle IndicoNo ratings yet

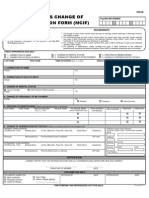

- MEMBER’S CHANGE OF INFORMATION FORM (MCIF) INSTRUCTIONSDocument2 pagesMEMBER’S CHANGE OF INFORMATION FORM (MCIF) INSTRUCTIONSlucci_1182No ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument12 pagesFor BIR Use Only Annual Income Tax Returnmiles1280No ratings yet

- SBMA ID Application FormDocument1 pageSBMA ID Application Formzab04148114No ratings yet

- TRAVEL RECORDS Form Revised PDFDocument2 pagesTRAVEL RECORDS Form Revised PDFMonNo ratings yet

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- Annual Income Tax Return: (DonotentercentavosDocument2 pagesAnnual Income Tax Return: (DonotentercentavosKuhramaNo ratings yet

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- Affidavit of Non-FilingDocument1 pageAffidavit of Non-FilingMon0% (1)

- SSS E1 FormDocument2 pagesSSS E1 Formdana50% (2)

- 2316 (1) 1Document2 pages2316 (1) 1dolores100% (1)

- Authorization Letter - RedentorDocument3 pagesAuthorization Letter - Redentorzarajane pagalNo ratings yet

- Agency Authorized Officer (AAO) Commitment Form: Government Service Insurance SystemDocument3 pagesAgency Authorized Officer (AAO) Commitment Form: Government Service Insurance SystemAnonymous pHooz5aH6VNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Dave Pagara100% (4)

- PAYMENT SLIP COPYDocument4 pagesPAYMENT SLIP COPYLeo Archival ImperialNo ratings yet

- Statement of Management's Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management's Responsibility For Annual Income Tax ReturnAlice Ordoño LedamaNo ratings yet

- Affidavit of Legitimation (Pepito)Document1 pageAffidavit of Legitimation (Pepito)Lenier Sanchez100% (1)

- Affidavit of LossDocument2 pagesAffidavit of LossRoMeo0% (1)

- SSS Change RequestDocument3 pagesSSS Change RequestAngelica SarzonaNo ratings yet

- WAIVER - Capelco FormDocument2 pagesWAIVER - Capelco FormDoit Etre SebastianNo ratings yet

- Application for Authority to Print Receipts and InvoicesDocument1 pageApplication for Authority to Print Receipts and InvoicesShane Shane100% (4)

- Bpi Endorsement LetterDocument1 pageBpi Endorsement LetterLawrence MangaoangNo ratings yet

- BAC Reso 7 - Asset DisposalDocument2 pagesBAC Reso 7 - Asset DisposalNicole SantoallaNo ratings yet

- Application for BIR RegistrationDocument1 pageApplication for BIR RegistrationRidz TingkahanNo ratings yet

- Bir Form 1902Document2 pagesBir Form 1902Jayson Garcia100% (1)

- 1902-Fill Up FormsDocument1 page1902-Fill Up FormsChantelieCadornaNo ratings yet

- Bir Form 1902Document2 pagesBir Form 1902wyleign100% (1)

- 1902Document2 pages1902CHRISTOPHER VILBARNo ratings yet

- Bir 1902Document1 pageBir 1902Marc Howard Detera PanganibanNo ratings yet

- BIR 1902 (Quezon)Document1 pageBIR 1902 (Quezon)Rayross Jamilano YacabaNo ratings yet

- Bryce 1902Document1 pageBryce 1902rusmah10No ratings yet

- BIR Form 1902 Registration ApplicationDocument2 pagesBIR Form 1902 Registration ApplicationJay-r Eniel ArguellesNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasJay-r Eniel ArguellesNo ratings yet

- BIR Form 1902Document1 pageBIR Form 1902Gizelle Taguas33% (3)

- Bir Form 1901Document2 pagesBir Form 1901jaciemNo ratings yet

- RMC No 9-2015, eTIS BIR FORM 2305 PDFDocument2 pagesRMC No 9-2015, eTIS BIR FORM 2305 PDFJulius Alano100% (1)

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- Bir Form 1901 BlankDocument4 pagesBir Form 1901 BlankLecel Llamedo100% (1)

- BIR Form 1901 ApplicationDocument4 pagesBIR Form 1901 ApplicationAlvin John Benavidez SalvadorNo ratings yet

- BIR Form 1901 ApplicationDocument4 pagesBIR Form 1901 ApplicationAlvin John Benavidez Salvador50% (2)

- 2017 2018, Ipcrf, Ko, FinalDocument11 pages2017 2018, Ipcrf, Ko, FinalLilian Laurel CariquitanNo ratings yet

- Deped Sec - Briones MessageDocument1 pageDeped Sec - Briones MessageLilian Laurel CariquitanNo ratings yet

- 1 - The Skeletal System and Its Function PDFDocument9 pages1 - The Skeletal System and Its Function PDFBana BearNo ratings yet

- Tracing Bottom UpDocument1 pageTracing Bottom UpLilian Laurel CariquitanNo ratings yet

- Traceable Number OneDocument1 pageTraceable Number Onerai_mahi7487No ratings yet

- Nouns Part IIDocument13 pagesNouns Part IILilian Laurel CariquitanNo ratings yet

- How to Use Adverbs of Manner EffectivelyDocument2 pagesHow to Use Adverbs of Manner EffectivelyNecoriña GalegaNo ratings yet

- Traceable LinesDocument1 pageTraceable LinesLilian Laurel CariquitanNo ratings yet

- Philippines Math Test 1 for Grade 1Document2 pagesPhilippines Math Test 1 for Grade 1Lilian Laurel CariquitanNo ratings yet

- QotesDocument15 pagesQotesLilian Laurel CariquitanNo ratings yet

- Tracing Top DownDocument1 pageTracing Top DownLilian Laurel CariquitanNo ratings yet

- Tracing Lines UpDocument1 pageTracing Lines UpLilian Laurel CariquitanNo ratings yet

- Tracing Bottom UpDocument1 pageTracing Bottom UpLilian Laurel CariquitanNo ratings yet

- Traceable LinesDocument1 pageTraceable LinesLilian Laurel CariquitanNo ratings yet

- Traceable Lines SlantedDocument1 pageTraceable Lines SlantedLilian Laurel CariquitanNo ratings yet

- CleanersDocument3 pagesCleanersLilian Laurel CariquitanNo ratings yet

- Tracing Lines DownDocument1 pageTracing Lines DownLilian Laurel CariquitanNo ratings yet

- Tracing Top DownDocument1 pageTracing Top DownLilian Laurel CariquitanNo ratings yet

- Certification: District of Dalaguete I Amonsao Elementary SchoolDocument1 pageCertification: District of Dalaguete I Amonsao Elementary SchoolLilian Laurel CariquitanNo ratings yet

- Tracing Lines UpDocument1 pageTracing Lines UpLilian Laurel CariquitanNo ratings yet

- Traceable LinesDocument1 pageTraceable LinesLilian Laurel CariquitanNo ratings yet

- Tracing Lines SlantedDocument1 pageTracing Lines SlantedLilian Laurel CariquitanNo ratings yet

- Name PlateDocument2 pagesName PlateLilian Laurel CariquitanNo ratings yet

- Book Numbers: Name of Pupils Book Names Grade 5 Math WikaDocument10 pagesBook Numbers: Name of Pupils Book Names Grade 5 Math WikaLilian Laurel CariquitanNo ratings yet

- August 19, 2013Document1 pageAugust 19, 2013Lilian Laurel CariquitanNo ratings yet

- Dr. Arden MonisitDocument2 pagesDr. Arden MonisitLilian Laurel CariquitanNo ratings yet

- Catolohan Zone MeetingDocument1 pageCatolohan Zone MeetingLilian Laurel CariquitanNo ratings yet

- Magnetic Pick Up: You Will NeedDocument6 pagesMagnetic Pick Up: You Will NeedLilian Laurel CariquitanNo ratings yet

- Nutrition Trivia and Answers K 5Document3 pagesNutrition Trivia and Answers K 5Drilon HazelNo ratings yet

- Activity Cards in MathDocument7 pagesActivity Cards in MathLilian Laurel CariquitanNo ratings yet

- Gems & Jewellery Feasibility ReportDocument53 pagesGems & Jewellery Feasibility ReportKrishna Varshney100% (3)

- Case Study - Management Control - Texas Instruments and Hewlett - PackardDocument20 pagesCase Study - Management Control - Texas Instruments and Hewlett - PackardJed Estanislao80% (10)

- Conceptual Framework History PaperDocument43 pagesConceptual Framework History PaperLucia OrtegaNo ratings yet

- Hire Purchase AccountingDocument123 pagesHire Purchase AccountingLallan Sharma50% (2)

- Product and Period Costing TechniquesDocument20 pagesProduct and Period Costing TechniquesZander0% (1)

- HGST Philippines PayslipDocument2 pagesHGST Philippines PayslipMvans MnlstsNo ratings yet

- PCNC List of Requirements For AccreditationDocument4 pagesPCNC List of Requirements For AccreditationNCRENo ratings yet

- MANAGEMENT AND ORGANIZATIONAL BEHAVIORDocument7 pagesMANAGEMENT AND ORGANIZATIONAL BEHAVIORAnonymous nTxB1EPvNo ratings yet

- City BankDocument328 pagesCity BankKhandaker Amir EntezamNo ratings yet

- Mas Quizbowl QuestionsDocument18 pagesMas Quizbowl QuestionsLauren ObrienNo ratings yet

- Integrated Strategy Optimisation for Complex Mining OperationsDocument8 pagesIntegrated Strategy Optimisation for Complex Mining OperationsCarlos A. Espinoza MNo ratings yet

- Notice: Taxable Imported Substances Determinations: Synthetic Linear Fatty AlcoholsDocument1 pageNotice: Taxable Imported Substances Determinations: Synthetic Linear Fatty AlcoholsJustia.comNo ratings yet

- R12 ORACLE APPS module overviewDocument87 pagesR12 ORACLE APPS module overviewAllam ViswanadhNo ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- Asiatec Draft PROSPECTUS For BiddingDocument312 pagesAsiatec Draft PROSPECTUS For BiddingZarifibne ArifNo ratings yet

- Haryana Statistical Abstract 2016-17: Socio-Economic Data on Agriculture, Population, Education, Health and MoreDocument707 pagesHaryana Statistical Abstract 2016-17: Socio-Economic Data on Agriculture, Population, Education, Health and MoreDeepakNo ratings yet

- GST Under Group ListDocument7 pagesGST Under Group ListAmir AwatiNo ratings yet

- Stern 2015-2016 PDFDocument157 pagesStern 2015-2016 PDFFred PhillipsNo ratings yet

- 12th Biology Important 235 Mark Questions English Medium PDF DownloadDocument6 pages12th Biology Important 235 Mark Questions English Medium PDF DownloadNandhakumarNo ratings yet

- Kwame Nkrumah University Mechanical Engineering QuizDocument9 pagesKwame Nkrumah University Mechanical Engineering QuizMohammed Abdul-MananNo ratings yet

- Economics MCQs on Income Elasticity, GDP, Inflation & Pakistan's EconomyDocument11 pagesEconomics MCQs on Income Elasticity, GDP, Inflation & Pakistan's Economyisrarhussain588No ratings yet

- BBA Strategic Management - IDocument135 pagesBBA Strategic Management - IbijayNo ratings yet

- PCE Sample Questions - SET 3 (ENG)Document17 pagesPCE Sample Questions - SET 3 (ENG)Goh Koon Loong75% (4)

- Munjal Showa 31st Annual Report 2015 16Document112 pagesMunjal Showa 31st Annual Report 2015 16maayan21No ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- Indemnity bond training costsDocument2 pagesIndemnity bond training costsdrakshayambaNo ratings yet

- Working Capital ManagementDocument13 pagesWorking Capital ManagementDr. Prasad JoshiNo ratings yet

- Akash BrahmbhattDocument73 pagesAkash Brahmbhattnisarg_No ratings yet

- Industry Analysis Fundamentals: Porter's Five Forces FrameworkDocument21 pagesIndustry Analysis Fundamentals: Porter's Five Forces FrameworkAbhishekNo ratings yet

- Chapter1 ExpectedutilityDocument89 pagesChapter1 ExpectedutilitySijo VMNo ratings yet