Professional Documents

Culture Documents

Providence Rates Presentation

Uploaded by

Statesman JournalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Providence Rates Presentation

Uploaded by

Statesman JournalCopyright:

Available Formats

2014 Medical Renewal Providence

Administrative fees from Providence are unchanged from the 2013 rates Statewide ASO fee is $52 PEPM Providence Choice fee is $93.21 PEPM - Fees have been unchanged since 2010

Other fixed costs: PEBB admin fee: 0.4% load Commissions: 0.16% load Rx Rebates: - Statewide: $4.02 PEPM - Providence Choice: $1.39 PEPM PPACA Fees (Applied to medical rates only): - Reinsurance Fee: $13.65 PEPM - Comparative Effectiveness Fee: $0.45 PEPM - Oregon Children's Reinsurance Fee: $3.33 PEPM

Assumptions used for the self-insured plans Claims incurred through December 2012 and paid through February 2013 Trend rates of 7.5% for medical and prescription drugs for both Statewide and Choice - VSP trend of 3% Excludes OMIP and Self-Insured Tax No cost increase assumed for HCR OOP Fully loaded rates are on the following page

MERCER

April 12, 2013

2014 Medical Renewal Proposal Providence

Providence 2014 Rate Proposal Full-Time Medical Plan (Fully Loaded premium equivalents, including VSP) Employee 2013 Statewide Rates 2014 Statewide Rates % Change Statewide 2013 Prov Choice Rates 2014 Prov Choice Rates % Change Prov Choice $1,060.62 $1,028.09 -3.1% $935.06 $911.82 -2.5% Employee & Spouse/Partner $1,421.08 $1,377.50 -3.1% $1,252.94 $1,221.82 -2.5% Employee & Child(ren) $1,219.62 $1,182.23 -3.1% $1,075.33 $1,048.60 -2.5% Employee & Family $1,452.90 $1,408.36 -3.1% $1,281.01 $1,249.20 -2.5%

Note: Percentage increase for part-time plans mirrors change for full-time plans shown above. Based on 30,367 total enrolled in Statewide and 10,638 in Prov Choice as of March 2013.

The above Providence rates include: Addition of Active Employee PEBB administration of 0.4% Excludes Funding Assessment Includes consultant commissions of 0.16% Includes Childrens Reinsurance Fee Excludes OMIP, Provider Tax Includes PPACA Reinsurance Fee and Comparative Effectiveness Fee Includes 2014 VSP rates

MERCER April 12, 2013

2014 Medical Renewal Providence

Mercer recommends that PEBB consider adding margin to the rates to account for potential legislation to reinstate the OMIP and self-insured fees PEBB could retain the 2013 rates, excluding funding assessment, for both the Statewide and Choice plans which would be sufficient to cover those plan rates Another option would be to include a 2% margin to account for OMIP and selfinsured fees which could be used to fund any potential change to the out-ofpocket maximum

Mandated plan changes Update current out-of-pocket maximums and limitations to comply with PPACA non-Grandfathered plan requirements Change alternative care benefit limits from 60 days per provider to 60 visits per type of service - PPACA prohibits the limitation of benefits based on provider types Coverage of certain diagnostic procedures that may be related to clinical trials

MERCER

April 12, 2013

You might also like

- Coding Billing - PPSXDocument35 pagesCoding Billing - PPSXmanjuNo ratings yet

- 2015 Humana Small Group Rate Filing PDFDocument19 pages2015 Humana Small Group Rate Filing PDFmoconsumerNo ratings yet

- Contract of Lease-Water Refilling StationDocument4 pagesContract of Lease-Water Refilling StationEkeena Lim100% (1)

- Canadian Pharmacy Services FrameworkDocument76 pagesCanadian Pharmacy Services Frameworkkuber1100% (1)

- Financial ManagementDocument52 pagesFinancial ManagementMohammad Azad KhanNo ratings yet

- Auditing For Managers - The Ultimate Risk Management ToolDocument369 pagesAuditing For Managers - The Ultimate Risk Management ToolJason SpringerNo ratings yet

- Progress ReportDocument5 pagesProgress Reportapi-394364619No ratings yet

- Employee Benefits and Services (Discussion)Document8 pagesEmployee Benefits and Services (Discussion)Janine padronesNo ratings yet

- Ethics, Governance and SustainabilityDocument408 pagesEthics, Governance and Sustainabilityshamli23No ratings yet

- UntitledDocument8 pagesUntitledapi-242724019No ratings yet

- AMA MACRA Summary PDFDocument6 pagesAMA MACRA Summary PDFiggybauNo ratings yet

- Health Care Plan - Cost Management Recommendations Executive SummaryDocument3 pagesHealth Care Plan - Cost Management Recommendations Executive SummaryJohn Q CitizenNo ratings yet

- Macra QPP Fact SheetDocument14 pagesMacra QPP Fact SheetiggybauNo ratings yet

- GDUFA Draft Guidance on Prior Approval Supplement ReviewsDocument14 pagesGDUFA Draft Guidance on Prior Approval Supplement ReviewsSreekanth ChNo ratings yet

- Physician Quality Reporting System (PQRS) OverviewDocument3 pagesPhysician Quality Reporting System (PQRS) Overviewvikas_ojha54706No ratings yet

- NHI4UHC Day2 Session3 Purchasing Needed Health Services: Determining Which Needed Services To Be Covered: JapanDocument6 pagesNHI4UHC Day2 Session3 Purchasing Needed Health Services: Determining Which Needed Services To Be Covered: JapanADB Health Sector Group100% (1)

- Summary of Health Care Reform SeminarDocument8 pagesSummary of Health Care Reform SeminarTheFedeliGroupNo ratings yet

- Complex Care Management ToolkitDocument9 pagesComplex Care Management Toolkitumi khasanahNo ratings yet

- GPO PremierDocument12 pagesGPO Premierapi-26219976No ratings yet

- Budget - Dhcs FACT SHEET For Stakeholders - AB 1629 Re AuthorizationDocument3 pagesBudget - Dhcs FACT SHEET For Stakeholders - AB 1629 Re Authorizationchristina_jewettNo ratings yet

- 3rs Final RuleDocument19 pages3rs Final RuleRitesh KumarNo ratings yet

- Electricity Facts Label for Free Power 100 - Indexed PlanDocument2 pagesElectricity Facts Label for Free Power 100 - Indexed Planroh009No ratings yet

- MCO Pass Through LTR 8.14.18Document3 pagesMCO Pass Through LTR 8.14.18Karen KaslerNo ratings yet

- ASH 2014 Medicare Physician Fee Schedule Final Rule SummaryDocument10 pagesASH 2014 Medicare Physician Fee Schedule Final Rule SummaryLiza GeorgeNo ratings yet

- APSCUF Faculty Contract SummaryDocument4 pagesAPSCUF Faculty Contract SummaryPennLiveNo ratings yet

- Fitch Presser On Impact ReportDocument6 pagesFitch Presser On Impact Reportthe kingfishNo ratings yet

- The Impact of The Economic Recovery Act of 2009 On HealthcareDocument31 pagesThe Impact of The Economic Recovery Act of 2009 On Healthcareasg_akn8335No ratings yet

- 2015 Anthem Small Group 4-1-2015 Rate Filing PDFDocument40 pages2015 Anthem Small Group 4-1-2015 Rate Filing PDFmoconsumerNo ratings yet

- 2024 QPP Proposed Rule Fact Sheet and Policy Comparison TableDocument61 pages2024 QPP Proposed Rule Fact Sheet and Policy Comparison Tablelegality.officeNo ratings yet

- Hospital Outpatient Prospective Payment System 2019 Updates - Shared1Document112 pagesHospital Outpatient Prospective Payment System 2019 Updates - Shared1Nunya BiznesNo ratings yet

- 01.08.13 BOC Agenda Packet For Ipad FinalDocument40 pages01.08.13 BOC Agenda Packet For Ipad FinalThunder PigNo ratings yet

- Health Payment Brief 2011Document8 pagesHealth Payment Brief 2011char2183No ratings yet

- RVU Brief IntoDocument3 pagesRVU Brief IntoQMx2014No ratings yet

- Building A New Partnership For ValueDocument16 pagesBuilding A New Partnership For ValuePartnership to Fight Chronic DiseaseNo ratings yet

- PEF Contract SummaryDocument10 pagesPEF Contract SummaryJimmyVielkindNo ratings yet

- HSMN Healthcare Payment MethodologiesDocument20 pagesHSMN Healthcare Payment MethodologiesMarvin Whitfield100% (1)

- PWC Using Multiple Discount Rates BulletinDocument4 pagesPWC Using Multiple Discount Rates BulletinElizabeth KrusemarkNo ratings yet

- Actuarial Valuation of Post-Retirement Medical BenefitsDocument13 pagesActuarial Valuation of Post-Retirement Medical BenefitskshitijsaxenaNo ratings yet

- Know Options Medicare Participation GuideDocument4 pagesKnow Options Medicare Participation Guidecharanmann9165No ratings yet

- EL Star Ratings White Paper PDF DownloadDocument5 pagesEL Star Ratings White Paper PDF DownloadHarsh VardhanNo ratings yet

- PDF Kaleida Final Bargaining Report 2019 Summary PageDocument3 pagesPDF Kaleida Final Bargaining Report 2019 Summary PageAnonymous ChsWJUXo8No ratings yet

- This Is Only A Summary.: Premier PlanDocument8 pagesThis Is Only A Summary.: Premier Planmandeep2610No ratings yet

- Tobacco Cessation, Why It Maters For EmployersDocument19 pagesTobacco Cessation, Why It Maters For EmployersIndonesia TobaccoNo ratings yet

- Ta 2012Document19 pagesTa 2012api-22677365No ratings yet

- Do You Know The Fair Market Value of Quality?: Jen JohnsonDocument8 pagesDo You Know The Fair Market Value of Quality?: Jen JohnsonG Mohan Kumar100% (1)

- Global Compensation Guidelines - Executive Summary Apr 14Document14 pagesGlobal Compensation Guidelines - Executive Summary Apr 14Monica EscribaNo ratings yet

- HCC Computation ManualDocument195 pagesHCC Computation Manualykbhaumik123No ratings yet

- Finance Jordan NikiDocument50 pagesFinance Jordan NikigenerationpoetNo ratings yet

- KPMG Macra Brief - FinalDocument6 pagesKPMG Macra Brief - FinalrsumnerwhiteNo ratings yet

- Edu 2013 10 Ret Plan Exam Case Kuk671xDocument20 pagesEdu 2013 10 Ret Plan Exam Case Kuk671xjusttestitNo ratings yet

- Oregon Health Authority Description of Budget ReductionsDocument2 pagesOregon Health Authority Description of Budget ReductionsStatesman JournalNo ratings yet

- Accounts Pays LaDocument7 pagesAccounts Pays Laasshole666No ratings yet

- A Case Study - II PRC On Pensions: 9 Current Issues in Retirement BenefitsDocument17 pagesA Case Study - II PRC On Pensions: 9 Current Issues in Retirement BenefitsramchanderNo ratings yet

- Summary of 2020 Changes To The Medicare Physician Fee Schedule, Quality Payment Program, and Other Federal ProgramsDocument25 pagesSummary of 2020 Changes To The Medicare Physician Fee Schedule, Quality Payment Program, and Other Federal ProgramsJared DeraneyNo ratings yet

- Managed Care NPRM 09 2015Document3 pagesManaged Care NPRM 09 2015api-293754603No ratings yet

- CFA Level 2 FSADocument3 pagesCFA Level 2 FSA素直和夫No ratings yet

- EHRs and Meaningful Use: A Guide to Stage 1 & 2 RequirementsDocument4 pagesEHRs and Meaningful Use: A Guide to Stage 1 & 2 RequirementsNkeletseng MakakaNo ratings yet

- Chapter Seven RHC Coding and Billing IssuesDocument24 pagesChapter Seven RHC Coding and Billing IssuesShurieUNo ratings yet

- Pay Delivery System - by Ankur AgrawalDocument9 pagesPay Delivery System - by Ankur AgrawalPuravRajNo ratings yet

- U.S. Employers Expect Health Care Costs To Rise 4% in 2015: SEPTEMBER 2014Document4 pagesU.S. Employers Expect Health Care Costs To Rise 4% in 2015: SEPTEMBER 2014Automotive Wholesalers Association of New EnglandNo ratings yet

- Ias 8 Accounting Policies, Changes in Accounting Estimates and Errors Presentation By: Anthony M. Njiru November 2017Document32 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errors Presentation By: Anthony M. Njiru November 2017syed younasNo ratings yet

- Health Care Reform White PaperDocument5 pagesHealth Care Reform White Papervanessa_parks_1No ratings yet

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationFrom EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNo ratings yet

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

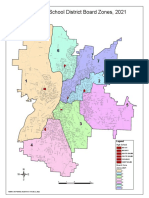

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- Cedar Creek Fire Aug. 16Document1 pageCedar Creek Fire Aug. 16Statesman JournalNo ratings yet

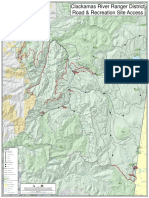

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocument1 pageSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNo ratings yet

- BG 7-Governing StyleDocument2 pagesBG 7-Governing StyleStatesman JournalNo ratings yet

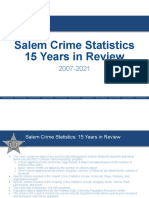

- Salem Police 15-Year Crime Trends 2007 - 2021Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNo ratings yet

- Salem Police 15-Year Crime Trends 2007 - 2015Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocument11 pagesSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- WSD Retention Campaign Resolution - 2022Document1 pageWSD Retention Campaign Resolution - 2022Statesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Zone Alternates 2Document2 pagesZone Alternates 2Statesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

- Failed Tax Abatement ProposalDocument8 pagesFailed Tax Abatement ProposalStatesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

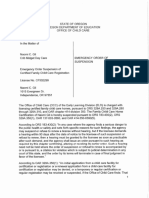

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- SB Presentation SIA 2020-21 Annual Report 11-9-21Document11 pagesSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNo ratings yet

- Torta de Riso Business PlanDocument25 pagesTorta de Riso Business PlanSalty lNo ratings yet

- Group 1 RRLDocument19 pagesGroup 1 RRLAngelo BolgarNo ratings yet

- Pic32mx1xx2xx283644-Pin Datasheet Ds60001168lDocument350 pagesPic32mx1xx2xx283644-Pin Datasheet Ds60001168lR khanNo ratings yet

- Desarmado y Armado de Transmision 950BDocument26 pagesDesarmado y Armado de Transmision 950Bedilberto chableNo ratings yet

- DPD 2Document1 pageDPD 2api-338470076No ratings yet

- SMG Wireless Gateway ManualV2.2.0Document95 pagesSMG Wireless Gateway ManualV2.2.0shahedctgNo ratings yet

- JuliaPro v0.6.2.1 Package API ManualDocument480 pagesJuliaPro v0.6.2.1 Package API ManualCapitan TorpedoNo ratings yet

- Dynamics of Fluid-Conveying Beams: Governing Equations and Finite Element ModelsDocument22 pagesDynamics of Fluid-Conveying Beams: Governing Equations and Finite Element ModelsDario AcevedoNo ratings yet

- Identifying Community Health ProblemsDocument4 pagesIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNo ratings yet

- Appendix 9A: Standard Specifications For Electrical DesignDocument5 pagesAppendix 9A: Standard Specifications For Electrical Designzaheer ahamedNo ratings yet

- RIE 2013 Dumping and AD DutiesDocument21 pagesRIE 2013 Dumping and AD Dutiessm jahedNo ratings yet

- Coca Cola Concept-1Document7 pagesCoca Cola Concept-1srinivas250No ratings yet

- AGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFDocument54 pagesAGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFAnonymous rIKejWPuS100% (1)

- Encore HR PresentationDocument8 pagesEncore HR PresentationLatika MalhotraNo ratings yet

- LK BMHS 30 September 2021Document71 pagesLK BMHS 30 September 2021samudraNo ratings yet

- RAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefDocument26 pagesRAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefMardiana MardianaNo ratings yet

- TVS Sport User Manual BS6Document69 pagesTVS Sport User Manual BS6tonemetoneNo ratings yet

- Python Lecture PSBCDocument83 pagesPython Lecture PSBCPedro RodriguezNo ratings yet

- Gilette Case - V3Document23 pagesGilette Case - V3Vidar Halvorsen100% (3)

- Fayol's Principles in McDonald's ManagementDocument21 pagesFayol's Principles in McDonald's Managementpoo lolNo ratings yet

- KCC Strategic Plan 2020-2023Document103 pagesKCC Strategic Plan 2020-2023Kellogg Community CollegeNo ratings yet

- 38-St. Luke - S vs. SanchezDocument25 pages38-St. Luke - S vs. SanchezFatzie MendozaNo ratings yet

- Secure Access Control and Browser Isolation PrinciplesDocument32 pagesSecure Access Control and Browser Isolation PrinciplesSushant Yadav100% (1)

- Power Efficiency Diagnostics ReportDocument16 pagesPower Efficiency Diagnostics Reportranscrib300No ratings yet

- COKE MidtermDocument46 pagesCOKE MidtermKomal SharmaNo ratings yet

- ID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFDocument11 pagesID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFAmelia AmelNo ratings yet