Professional Documents

Culture Documents

After Tax Cash Flow - ADITYA - REPORT - Final

Uploaded by

adtyshkhrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

After Tax Cash Flow - ADITYA - REPORT - Final

Uploaded by

adtyshkhrCopyright:

Available Formats

Cash Flow After Tax

A measure of financial performance that looks at the company's ability to generate cash flow through its operations. It is calculated by adding back non-cash accounts such as amortization, depreciation, restructuring costs and impairments to net income. Cash Flow Before Taxes less Income Tax Liability equals Cash Flow After Taxes. CFAT = Net Income + Depreciation + Amortization + Other Non-Cash charges Also known as "After-Tax Cash Flow".

CFAT is important for investors because it gauges a corporation's ability to pay dividends. The higher the CFAT, the better positioned a business is to make distributions. CFAT also measures the company's financial health and performance over time and in comparison to competitors. Tax liability represents the amount of income produced by the property that is subject to taxation. In this case, the propertys net operating income (i.e., income less operating expenses) is first converted to taxable income. This is accomplished by taking the net operating income and deducting for depreciation, mortgage interest, and amortized loan points. Then the taxable income is multiplied by the investors marginal income tax rate (i.e., combined fed and state) to calculate the investors income tax liability.

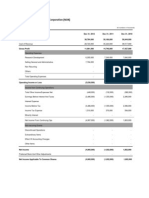

CASH FLOW ILLUSTRATIONS Illustration I Naveen Enterprises is considering a capital project about which the following information is available: The investment outlay on the project will be Rs. 100 million. This consists of Rs. 80 million on plant and machinery and Rs. 20 million on net working capital. The entire outlay will be incurred at the beginning of the project. The project will be financed with Rs. 45 million of equity capital, Rs. 5 million of preference capital, and Rs. 50 million of debt capital. Preference capital will carry a dividend rate of 15 percent; debt capital will carry an interest rate of 15 percent. The life of the project is expected to be 5 years. At the end of 5 years, fixed assets will fetch a net salvage value of Rs. 30 million whereas net working capital will be liquidated at its book value. The project is expected to increase the revenues of the firm by Rs. 120 million per year. The increase in costs on account of the project is expected to be Rs. 80 million per year (This includes all items of cost other than depreciation, interest, and tax.) The effective tax rate will be 30%. Plant and machinery will be depreciated at the rate of 25 percent per year as per the written down value method. Hence, the depreciation charges will be:

First year : Rs. 20.00 million Second year : Third year : Fourth year : Fifth year : Rs. 15.00 million Rs. 11.25 million Rs. 8.44 million Rs. 6.33 million Determine the project cash flows

Items 1 2 3 4 Fixed assets Net working capital Revenues Costs (other than depreciation & interest)

0 (80.00) (20.00)

120 80

120 80

120 80

120 80

120 80

5 6 7 8 9 10 11 12 13 14

Depreciation Profit Before Tax Tax Profit After Tax Net Salvage value of fixed assets Recovery of Working Capital Initial Outlay Operating Cash Flow ( 8 + 5 ) Terminal Cash Flow ( 9+ 10 ) Net Cash Flow ( 11 + 12 + 13 ) (100.00) 100 (100.00)

20 20 6 14.0

15 25 7.5 17.5

11.25 28.75 8.63 20.12

8.44

6.33

31.56 33.67 9.47 10.10

22.09 23.57 30.00 20.00

34.0

32.5

31.37

30.53 29.90 50.0

34.0 80

32.5 65

31.37 53.75

30.53 79.90 45.31

Book value of Investment

You might also like

- Kelly PayslipDocument1 pageKelly PayslipadtyshkhrNo ratings yet

- New Doc 21Document1 pageNew Doc 21adtyshkhrNo ratings yet

- Gmail Snooze Feature - Aditya Shekhar 04072017Document5 pagesGmail Snooze Feature - Aditya Shekhar 04072017adtyshkhrNo ratings yet

- Chasecase PaperDocument10 pagesChasecase PaperadtyshkhrNo ratings yet

- The Total Plant Standard: Based On Four Principles of Success - Process Mapping - Fail-Safing - Teamwork - CommunicationDocument7 pagesThe Total Plant Standard: Based On Four Principles of Success - Process Mapping - Fail-Safing - Teamwork - CommunicationadtyshkhrNo ratings yet

- ExtraDocument1 pageExtraadtyshkhrNo ratings yet

- University, Mumbai Campus, Maharashtra. My Technical Background Is Computer Science andDocument1 pageUniversity, Mumbai Campus, Maharashtra. My Technical Background Is Computer Science andadtyshkhrNo ratings yet

- Comparison Between Single and Multiple Source of FinancingDocument5 pagesComparison Between Single and Multiple Source of FinancingadtyshkhrNo ratings yet

- Venugopal Dhoot: Videocon IndustriesDocument9 pagesVenugopal Dhoot: Videocon IndustriesadtyshkhrNo ratings yet

- MCB 2Document11 pagesMCB 2adtyshkhrNo ratings yet

- Table 2.6: Bank Group-Wise Selected Ratios of Scheduled Commercial Banks: 2011 and 2012Document3 pagesTable 2.6: Bank Group-Wise Selected Ratios of Scheduled Commercial Banks: 2011 and 2012adtyshkhrNo ratings yet

- MMADocument5 pagesMMAadtyshkhrNo ratings yet

- Hong Kong DisneylandDocument10 pagesHong Kong DisneylandAnkur SinhaNo ratings yet

- The Third Syndication StrategyDocument2 pagesThe Third Syndication StrategyadtyshkhrNo ratings yet

- Strategy 5: Best Efforts Strategy: Hold Amounts (HK$ MN) #1 (Ex 8a) #2 (Ex 8b) #3 (Ex 8c) #4 #5 #6Document2 pagesStrategy 5: Best Efforts Strategy: Hold Amounts (HK$ MN) #1 (Ex 8a) #2 (Ex 8b) #3 (Ex 8c) #4 #5 #6adtyshkhrNo ratings yet

- Management of Commercial BankingDocument11 pagesManagement of Commercial BankingadtyshkhrNo ratings yet

- MCB Presentation)Document3 pagesMCB Presentation)adtyshkhrNo ratings yet

- Chase Should Have Bid For The Loan Mandate in Such A Way To Maximize The Investment Fee Income After Controlling For Risks InvolvedDocument5 pagesChase Should Have Bid For The Loan Mandate in Such A Way To Maximize The Investment Fee Income After Controlling For Risks InvolvedadtyshkhrNo ratings yet

- Strategy 2: Joint MandateDocument4 pagesStrategy 2: Joint MandateadtyshkhrNo ratings yet

- Strategy 4 and 6Document4 pagesStrategy 4 and 6adtyshkhrNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceDocument19 pagesChapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceHenry RizqyNo ratings yet

- F1.4 201412Q1Document31 pagesF1.4 201412Q1Ziping ZhaoNo ratings yet

- Suryaa Hotel Bal SheetDocument3 pagesSuryaa Hotel Bal Sheetarjun chauhan100% (1)

- Philippine Standard On Auditing 510 Initial Audit Engagements-Opening BalancesDocument13 pagesPhilippine Standard On Auditing 510 Initial Audit Engagements-Opening BalancesSebastian GarciaNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisglcpaNo ratings yet

- Revision Notes Group Accounts PDFDocument11 pagesRevision Notes Group Accounts PDFEhsanulNo ratings yet

- EngagementDocument47 pagesEngagementJean CabigaoNo ratings yet

- LMGT 211 Material Management With NOTESDocument4 pagesLMGT 211 Material Management With NOTESNeil RodriguezNo ratings yet

- Analisis Laporan KeuanganDocument3 pagesAnalisis Laporan KeuanganRiska ANo ratings yet

- LCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Nov-2017Document20 pagesLCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Nov-2017Aung Zaw HtweNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentRavi s MobileNo ratings yet

- Shouq AlmutairiDocument8 pagesShouq AlmutairiSeu4EduNo ratings yet

- Nokia Financial StatementsDocument5 pagesNokia Financial StatementsSaleh RehmanNo ratings yet

- Hoba Icare Answer KeysDocument15 pagesHoba Icare Answer KeysMark Gelo WinchesterNo ratings yet

- Balance Sheet FormatDocument2 pagesBalance Sheet FormatDilfaraz Kalawat100% (3)

- Book KeepingDocument14 pagesBook KeepingFabiolaNo ratings yet

- Tugas P5.1: Nama Farah Nur Lailatun Nikmah NIM 175020300111045 NIM Akuntansi Keuangan Lanjutan 2 - CA No Absen5Document12 pagesTugas P5.1: Nama Farah Nur Lailatun Nikmah NIM 175020300111045 NIM Akuntansi Keuangan Lanjutan 2 - CA No Absen5farahNo ratings yet

- Module 1 - IntAcc1Document7 pagesModule 1 - IntAcc1kakimog738No ratings yet

- Introduction To InvestmentsDocument16 pagesIntroduction To InvestmentsWilyn Grace AljasNo ratings yet

- Online Trading of RelianceDocument74 pagesOnline Trading of Reliance2562923No ratings yet

- Askivy Article Preparing Your CV For Private EquityDocument3 pagesAskivy Article Preparing Your CV For Private EquityIvy YuNo ratings yet

- Working Capital Management B.anithaDocument112 pagesWorking Capital Management B.anithaVinod KumarNo ratings yet

- Business PlanDocument27 pagesBusiness PlanCJ Paz-ArevaloNo ratings yet

- Corporate Finance Final ExamDocument30 pagesCorporate Finance Final ExamJobarteh FofanaNo ratings yet

- Balance SheetDocument28 pagesBalance SheetrimaNo ratings yet

- Finc600 Week 4 Practice QuizDocument5 pagesFinc600 Week 4 Practice QuizDonald112100% (3)

- Mark Scheme (Results) Summer 2008: GCE Accounting (6002) Paper 01Document19 pagesMark Scheme (Results) Summer 2008: GCE Accounting (6002) Paper 01Faiz Mohammed ChowdhuryNo ratings yet

- Exam Financial Statement AnalysisDocument18 pagesExam Financial Statement AnalysisBuketNo ratings yet

- BIMB Vs BSN PDFDocument10 pagesBIMB Vs BSN PDFIelts TutorNo ratings yet

- Chapter 15 - Pelaporan Segmen Dan Evaluasi KinerjaDocument12 pagesChapter 15 - Pelaporan Segmen Dan Evaluasi Kinerjaagung yohanesNo ratings yet