Professional Documents

Culture Documents

Lender Liquidation Checklists

Uploaded by

BONDCK88507Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lender Liquidation Checklists

Uploaded by

BONDCK88507Copyright:

Available Formats

MN 2-FLP Exhibit 4 (Par.

358)

OPTIONAL LENDER LIQUIDATION CHECKLISTS

BORROWER: ___________________________________________________ DATE: ________________

Within 150 days after the payment due date (or date of non-monetary default), all lenders will prepare a Liquidation Plan. SEL and CLP lenders will submit the Liquidation Plan to FSA for Agency review. The Agency review should be completed within 20 days.

PART A LIQUIDATION PLAN

See Paragraph 358 (or other listed 2-FLP Paragraphs) for more details:

A current balance sheet or best available similar information and/or bankruptcy schedules. The proposed method for maximizing collection from remaining security. The proposed method for maximizing collection on the debt from non-security items and judgment possibilities. If the borrower converted security, will litigation be cost effective? Will civil or criminal action be pursued? If no action is being taken, why not? A recommendation regarding release of liability for the borrower. A current independent appraisal(s) of all remaining security. If an appraisal is ordered but not yet received, state so and estimate the security value. If FSA concurs an appraisal is not needed, submit a list of security yet to be sold. A time schedule for liquidation of all security. An estimated loss claim if the liquidation period is expected to exceed 90 days. If this is not submitted, then submit an estimate of reasonable liquidation expenses. A Guaranteed Farm Loan Default Status Report, Form FSA-2248, if not submitted within the previous 60 days. If still sold on the secondary market, the lenders plan to repurchase (Par. 374). A copy of the acceleration letter (Par. 357C). An estimate of any expected protective advances not yet incurred (Par. 359E).

04-13-09

2-FLP (Rev.) 1 MN Amend 2

Page 1

MN 2-FLP Exhibit 4 (Par. 358)

PART B ESTIMATED LOSS CLAIMS

An Estimated Loss Claim should be submitted by the lender no later than 150 days after the missed payment due date unless the account has been completely liquidated. Delays beyond 150 days will generally result in less interest accrual coverage by FSA than a claim timely submitted. For bankruptcy cases see 2-FLP Paragraph 342.

See Paragraph 359 (or other listed 2-FLP Paragraphs) for more details.

An Estimated Loss Claim, Form FSA-2254 should be submitted no later than 150 days after the due date unless complete liquidation will be done by then. A current net recovery calculation worksheet showing liquidation expenses (see Exhibit 10). A ledger documenting all loan and protective advance amounts & purposes, interest accrual (separate for any protective advance), payments and interest rate changes including identifying the current rate (see Instructions to Form FSA-2254 & Par. 360C). If the note has Interest Assistance (IA), submit a final IA claim, Form FSA-2222 (Par. 228C). A list of security disposed of by the borrower with documentation as to what happened to the proceeds (Par. 264A & 360C). Include all mortgaged land and all chattels on hand at or acquired since the last complete security reconciliation occurred. Updated Electronic Funds Transfer account information (Par. 360C). The name, address and Social Security Number of any co-borrower, guarantor, or co-signer if the loan was made using an application form with a revision date July 20, 2001 or later. For loans made before July 10, 2008, the Liquidation Decision Date: ____________ (Normally the earliest of the following events): The date the borrower clearly agreed to liquidate, or The date the borrowers mediation rights ended, or The date the borrower filed bankruptcy, or 120 days past due.

Tips for properly preparing Estimated Loss Claims:

For Principal Balance amount, use the amount owed when the account became past due. If collections have been made since then show the amounts and all liquidation expenses in the loss claim form. For loans dated July 10, 2008 or later, loss claims should show accrued interest of no more than 150 days after the first missed payment due date. For loans dated before July 10, 2008, FSAs responsibility to pay accrued interest usually stops 210 days from the first missed payment due date, but no more than 90 days after the Liquidation Decision Date. Default interest, late charges and packager or outside consultant fees for loan servicing are not payable by FSA. If they are included in the lenders records, for loss claim purposes the account must be recalculated without them. 04-13-09 2-FLP (Rev.) 1 MN Amend 2 Page 2

You might also like

- Cal Judicial Changes-2012 SummaryDocument64 pagesCal Judicial Changes-2012 SummaryBONDCK88507No ratings yet

- Majority Action-Sb 1638 BillDocument6 pagesMajority Action-Sb 1638 BillBONDCK88507No ratings yet

- 2010 Malpractice ChartDocument2 pages2010 Malpractice ChartBONDCK88507No ratings yet

- Peace Officers Legal Source BookDocument76 pagesPeace Officers Legal Source BookBONDCK88507No ratings yet

- Occ Agreement Boa Ea2012 039Document9 pagesOcc Agreement Boa Ea2012 039BONDCK88507No ratings yet

- Commissioned Officer's HandbookDocument133 pagesCommissioned Officer's HandbookBONDCK88507100% (2)

- Declaration Under Probate Code Section 13101Document1 pageDeclaration Under Probate Code Section 13101BONDCK88507No ratings yet

- Gov Cali Claim FormDocument4 pagesGov Cali Claim FormBONDCK88507No ratings yet

- For Recorder'S Use: (The Undersigned)Document1 pageFor Recorder'S Use: (The Undersigned)BONDCK88507No ratings yet

- 2012 11 09 - Tribal Consumer Financial Services Regulatory Code - EnactedDocument31 pages2012 11 09 - Tribal Consumer Financial Services Regulatory Code - EnactedBONDCK88507No ratings yet

- Lic402. Surety BondDocument1 pageLic402. Surety BondBONDCK88507No ratings yet

- Invitation For Bid Child SupportDocument25 pagesInvitation For Bid Child SupportBONDCK88507No ratings yet

- California Financial CodeDocument2 pagesCalifornia Financial CodeBONDCK88507No ratings yet

- GlossaryDocument4 pagesGlossaryBONDCK88507No ratings yet

- DOJ Post Award Instructions SF-425Document26 pagesDOJ Post Award Instructions SF-425BONDCK88507No ratings yet

- DOJ-Debt Mngtmt-Claim at GlanceDocument38 pagesDOJ-Debt Mngtmt-Claim at GlanceBONDCK88507No ratings yet

- InjunctionDocument3 pagesInjunctionrodclassteam100% (1)

- California 'Quiet Title' Victory Paul Nguyen v. Chase Et AlDocument4 pagesCalifornia 'Quiet Title' Victory Paul Nguyen v. Chase Et AlDinSFLANo ratings yet

- COUNTY of LOS ANGELES - Anticipation Note-Series A EtcDocument212 pagesCOUNTY of LOS ANGELES - Anticipation Note-Series A EtcBONDCK88507No ratings yet

- Claims Collection Litigation Report (CCLR)Document7 pagesClaims Collection Litigation Report (CCLR)BONDCK88507No ratings yet

- Credit and Debt Management HandbookDocument3 pagesCredit and Debt Management HandbookBONDCK88507No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SKSE Securities LimitedDocument2 pagesSKSE Securities LimitedsunitdaveNo ratings yet

- Assignment June 2022Document3 pagesAssignment June 2022AirForce ManNo ratings yet

- Survey of Accounting 6Th Edition Warren Solutions Manual Full Chapter PDFDocument46 pagesSurvey of Accounting 6Th Edition Warren Solutions Manual Full Chapter PDFzanewilliamhzkbr100% (5)

- UntitledDocument71 pagesUntitledIsaque Dietrich GarciaNo ratings yet

- Tutorial Week 3 QuestionsDocument9 pagesTutorial Week 3 QuestionsShermaine WanNo ratings yet

- Journal Ledger & Trial BalanceDocument32 pagesJournal Ledger & Trial BalanceMr. Demon ExtraNo ratings yet

- Instructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesDocument9 pagesInstructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesMonicDuranNo ratings yet

- IDEAL RICE INDUSTRIES AccountsDocument89 pagesIDEAL RICE INDUSTRIES Accountsahmed.zjcNo ratings yet

- FM16 Ch26 Tool KitDocument21 pagesFM16 Ch26 Tool KitAdamNo ratings yet

- General Quarter 2 - Week 1: ZZZZZZDocument14 pagesGeneral Quarter 2 - Week 1: ZZZZZZJakim Lopez0% (1)

- OverviewDocument18 pagesOverviewGaurav SinghNo ratings yet

- Shweta TybbiDocument72 pagesShweta Tybbishwetalad887% (30)

- Bank service charge noticeDocument3 pagesBank service charge noticeDr GoherNo ratings yet

- PNB v. CA and Ramon LopezDocument2 pagesPNB v. CA and Ramon LopezRebecca ChanNo ratings yet

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- Effects of Merchant Banking on Financial Growth of ICICIDocument62 pagesEffects of Merchant Banking on Financial Growth of ICICIij EducationNo ratings yet

- Value Beat 121013Document3 pagesValue Beat 121013zarr pacificadorNo ratings yet

- Group 4 Assignment Campus Deli 1Document9 pagesGroup 4 Assignment Campus Deli 1namitasharma1512100% (4)

- High Tire PerformanceDocument8 pagesHigh Tire PerformanceSofía MargaritaNo ratings yet

- Clarkson Lumber SolutionDocument8 pagesClarkson Lumber Solutionpawangadiya1210No ratings yet

- Joy 1Document27 pagesJoy 1rp63337651No ratings yet

- Quizzes - Topic 6 - Leases - Xem L I Bài LàmDocument4 pagesQuizzes - Topic 6 - Leases - Xem L I Bài LàmHải YếnNo ratings yet

- Fcma, Fpa, Ma (Economics), BSC Dubai, United Arab Emirates: Presentation byDocument42 pagesFcma, Fpa, Ma (Economics), BSC Dubai, United Arab Emirates: Presentation byAhmad Tariq Bhatti100% (1)

- PNB AN 30.9.2020 Eng 1st PageDocument1 pagePNB AN 30.9.2020 Eng 1st PagecanilreddyNo ratings yet

- FAR: KEY ASPECTS OF PROPERTY, PLANT AND EQUIPMENT ACCOUNTINGDocument13 pagesFAR: KEY ASPECTS OF PROPERTY, PLANT AND EQUIPMENT ACCOUNTINGAl ChuaNo ratings yet

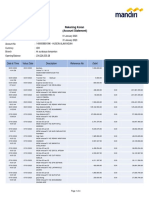

- Rek Koran Mandiri PT HAI Jan-April 2023Document14 pagesRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoNo ratings yet

- Gold As A Portfolio DiversifierDocument14 pagesGold As A Portfolio DiversifierJamil AhmedNo ratings yet

- E Math Exam PracticeCh5 8Document4 pagesE Math Exam PracticeCh5 8chitminthu560345No ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- mPassBook - 20230114 - 20230413 - 6005 UNLOCKEDDocument3 pagesmPassBook - 20230114 - 20230413 - 6005 UNLOCKEDAshish kumarNo ratings yet