Professional Documents

Culture Documents

Case 11

Uploaded by

Neil CalvinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 11

Uploaded by

Neil CalvinCopyright:

Available Formats

C-11-1

Minicase 11 Divisional Cost of Capital

Diageo PLC (Diageo) operates three major lines of business: restaurants, alcoholic beverages, and food items. Its major restaurant chain is Burger King. Major food items include Haagen Dazs ice cream. Alcoholic beverages include the Segrams brands. Restaurants account for about 25% of sales and 10% of profits, alcoholic beverages contribute 50% of sales and 60% of profits, and food items account for 25% of sales and 30% of profits. The Restaurant Industry The U.S. restaurant industry is highly competitive with a large number of national chains competing with local restaurants. The national chains offer a menu of choices ranging from fast food (McDonalds, Burger King, KFC Fried Chicken, Pizza Hut, Taco Bell (Mexican), CKE Restaurants Carls Jr., and Wendys) to casual family-style dining (TGI Fridays, Applebees, and Bob Evans Farms), and full-service restaurants (Shoneys).

The long-term outlook for the restaurant industry is favorable. The industry will continue to benefit from two-wage-earner families, who have larger disposable incomes but less time to prepare meals at home. Consequently, industry analysts expect that the trend toward eating away from home or bringing prepared meals home will continue into the foreseeable future, primarily benefiting the more efficient restaurant operators. Overview of Diageo Exhibit 11-1 furnishes income statements for Diageo and Exhibit 11-2 furnishes balance sheets. Diageo has book liabilities of $18.1 billion, and book value of stockholders equity of $7.3 billion. The market value of Diageos stockholders equity is much greater. With 788 million common

C-11-2

shares outstanding and a share price of $55.875, the market value of its stockholders equity is $44.0 billion, or roughly six times its book value. Financial Leverage Diageo measures financial leverage on both a market value and an historical cost basis. Diageo believes it appropriate to measure debt net of its available cash. This approach takes into account its large investment portfolios held outside the U.S. These portfolios are managed as part of Diageos overall financing strategy and are not required to support day-to-day operations. Net debt reflects the pro forma remittance of the value of these portfolios (net of related taxes) as a reduction of total debt. Total debt includes the present value of operating lease commitments. Diageo believes that market leverage (defined as net debt expressed as a percent of net debt plus the market value of equity, based on the year-end stock price) is the most appropriate measure of its financial leverage. Unlike historical cost measures, the market value of equity primarily reflects the estimated net present value of expected future cash flows that will both support debt and provide returns to shareholders. Diageo has established a long-term target range of 20%-25% for its market net debt ratio, which it believes will optimize its cost of capital. Cost of Capital Diageo has reported its overall cost of capital to be approximately 10%. It has not reported costs of capital separately for its three lines of business. Estimate Diageos WACC using the information furnished in this case and the market data in Exhibits 11-3 and 11-4. Assume a 34% income tax rate and a target long-term debt rating of A-2. Then estimate a WACC for Diageos restaurant business using the information in Exhibit 11-5.

Questions

C-11-3

1. Diageo subtracts the value of its portfolio of short-term investments, which is held outside the United States and is not required to support day-to-day operations, from its total debt when calculating its net debt ratio. Use Diageos net debt ratio to calculate Diageos overall WACC. 2. Should Diageo use its overall cost of capital to evaluate its restaurant investments? Under what circumstances would it be correct to do so? 3. Estimate the cost of capital for Diageos restaurant business. 4. Explain why there is a difference between Diageos overall cost of capital and the cost of capital for its restaurant business.

C-11-4

EXHIBIT 11-1

Diageo Income Statements (Dollars in millions)

Two Years Ago Amount $25,021 22,114 2,907 (573) 89 2,423 835 $1,588 $1.96 $0.62 % 100 88 12 (2) 10 4 6 One Year Ago Amount $28,472 25,271 3,201 (645) 108 2,664 880 (32) $1,752 $2.22a $0.70 % 100 89 11 (2) 9 3 6 Latest Year Amount $30,421 27,434 2,987 (682) 127 2,432 826 $1,606 $2.00 $0.78 % 100 90 10 (2) 8 3 5

Net sales Costs and expenses Operating profit Interest expense Other income (expense) Pretax income Income taxes Effect of accounting changes Net income Earnings per share Dividends per share

Before cumulative effect of accounting changes.

____________________________________________________________________________________________ Source: Diageo PLC, Annual Reports to Shareholders.

C-11-5

EXHIBIT 11-2

Diageo Balance Sheets (Dollars in millions)

One Year Ago Assets Cash and cash equivalents Short-term marketable securities (at cost) Other current assets Total current assets Investments in unconsolidated affiliates Property, plant, and equipment (net) Intangible assets (net) Other assets Total assets Liabilities and Stockholders Equity Accounts payable Short-term borrowings Other current liabilities Total current liabilities Long-term debt Other liabilities Total liabilities Stockholders equity (790 million shares outstanding one year ago; 788 million shares in latest year) Total liabilities and stockholders equity 6,856 $24,792 28 100 7,313 $25,432 29 100 $1,452 678 3,140 5,270 8,841 3,825 17,936 6 2 13 21 36 15 72 $1,556 706

a

Latest Year % 1 5 14 20 5 40 32 3 100 Amount $382 1,116

a a

Amount $331 1,157 3,584 5,072 1,295 9,883 7,842 700 $24,792

% 2 4 16 22 6 39 30 3 100

4,048 5,546 1,635 9,870 7,584 797 $25,432

6 3 12 21 33 17 71

2,968 5,230 8,509

b

4,380 18,119

Approximates market value. Market value equals $8,747 million. ____________________________________________________________________________________________ Source: Diageo PLC, Annual Reports to Shareholders.

a b

C-11-6

EXHIBIT 11-3

Selected Market Data for Diageo

Diageos beta Riskless returns: Short-term Intermediate-term Long-term

1.00 Market risk premium: 5.13% 5.50 6.00 Short-term Intermediate-term Long-term 8.40% 7.40 7.00

C-11-7

EXHIBIT 11-4

Fair Market Yield Curves

3 MO 6 MO 1 YR 2 YR 3 YR 4 YR 5 YR 7 YR 10 YR 20 YR 30 YR

A1 6.00% 5.89 5.58 5.60 5.69 5.80 5.84 6.06 6.08 6.68 6.71

A2 6.03% 5.92 5.59 5.60 5.69 5.89 5.89 6.09 6.23 6.75 6.75

A3 6.05% 5.94 5.73 5.61 5.79 5.95 6.09 6.17 6.37 6.87 6.81

Source: Bloomberg, L.P.

C-11-8

EXHIBIT 11-5

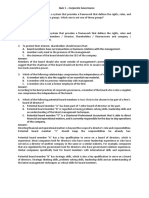

Selected Data for Comparable Restaurant Companies

PREFERRED STOCK FIRM Applebees International Bob Evans Farms Brinker International CKE Restaurants McDonalds NPC International Shoneys Wendys International LISTED NASDAQ NASDAQ NYSE NYSE NYSE NASDAQ NYSE NYSE BETA 1.30 0.95 1.70 1.15 1.00 0.80 0.90 1.15 TOTAL DEBT ($ MILLIONS) $ 28.5 54.7 104.7 86.7 4,820.1 81.4 440.4 147.0 STOCK ($ MILLIONS) $ 411.1 -

COMMON SHARES (MILLIONS) 31.0 42.3 72.1 18.4 694.0 24.5 41.5 103.4

CLOSING STOCK PRICE ($) $ 22.750 19.000 15.125 16.000 45.125 7.250 10.250 21.250

Sources: Bloomberg, L.P., and Value Line Investment Survey .

You might also like

- Apple I Car PresentationDocument20 pagesApple I Car PresentationRagini Sundarraman100% (1)

- DynatronicsDocument24 pagesDynatronicsFezi Afesina Haidir90% (10)

- Diageo RefenceDocument7 pagesDiageo RefenceKenny HoNo ratings yet

- Citibank CFO PresentationDocument29 pagesCitibank CFO PresentationDiego de AragãoNo ratings yet

- Assessing Martin Manufacturing-AnswerDocument4 pagesAssessing Martin Manufacturing-AnswerKhai Eman50% (2)

- DG Case StudyDocument9 pagesDG Case StudyRitz Tan CadeliñaNo ratings yet

- Barbados Sugarcane Executive SummaryDocument8 pagesBarbados Sugarcane Executive SummarysarkariaNo ratings yet

- 5419 Advance AccountingDocument5 pages5419 Advance AccountingmansoorNo ratings yet

- Quiz 1 Answers Fusionné CompresséDocument161 pagesQuiz 1 Answers Fusionné CompresséSlim Charni100% (1)

- Solution Manual For Introduction To Corporate Finance 2nd Edition by MegginsonDocument27 pagesSolution Manual For Introduction To Corporate Finance 2nd Edition by Megginsona340726614No ratings yet

- Rider University PMBA 8020 Module 1 Solutions: ($ Millions)Document5 pagesRider University PMBA 8020 Module 1 Solutions: ($ Millions)krunalparikhNo ratings yet

- Ch06 ProbsDocument7 pagesCh06 ProbsJingxian XueNo ratings yet

- ExercisesDocument13 pagesExercisesalyNo ratings yet

- BAC Q4 2013 PresentationDocument25 pagesBAC Q4 2013 PresentationZerohedgeNo ratings yet

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683auntyprosperim1ru100% (15)

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683verawarnerq5cl100% (14)

- Solution To MBA Question 25Document7 pagesSolution To MBA Question 25tallyho2906No ratings yet

- Light S.A. Corporate Presentation: Citi's 16th Annual Latin America ConferenceDocument26 pagesLight S.A. Corporate Presentation: Citi's 16th Annual Latin America ConferenceLightRINo ratings yet

- Final Valuation Report GSDocument8 pagesFinal Valuation Report GSGennadiy SverzhinskiyNo ratings yet

- Georgetown Case Competition: ConfidentialDocument17 pagesGeorgetown Case Competition: ConfidentialPatrick BensonNo ratings yet

- Bank of America Merrill Lynch 2009 Global Industries Conference December 8, 2009Document29 pagesBank of America Merrill Lynch 2009 Global Industries Conference December 8, 2009traunerdjtNo ratings yet

- 05-Financial Stratement AnalysisDocument8 pages05-Financial Stratement AnalysisPratheep GsNo ratings yet

- Chapter 14 SolutionDocument9 pagesChapter 14 Solutionbellohales0% (1)

- CH 01Document11 pagesCH 01Zohaib ImtiazNo ratings yet

- Comm 217 ProjectDocument3 pagesComm 217 Projectthemichaelmccarthy12No ratings yet

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Module 1 Homework AssignmentDocument3 pagesModule 1 Homework Assignmentlgarman01No ratings yet

- Performance 6.10Document2 pagesPerformance 6.10George BulikiNo ratings yet

- 2011.06.30 ASX Annual ReportDocument80 pages2011.06.30 ASX Annual ReportKevin LinNo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- MCD2010 - T8 SolutionsDocument9 pagesMCD2010 - T8 SolutionsJasonNo ratings yet

- PREP COF Sample Exam QuestionsDocument10 pagesPREP COF Sample Exam QuestionsLNo ratings yet

- MCQ On FM PDFDocument28 pagesMCQ On FM PDFharsh snehNo ratings yet

- f9 2006 Dec PPQDocument17 pagesf9 2006 Dec PPQMuhammad Kamran KhanNo ratings yet

- Constellation Software IncDocument8 pagesConstellation Software IncSugar RayNo ratings yet

- Group 7 Group AssignmentDocument16 pagesGroup 7 Group AssignmentAZLINDA MOHD NADZRINo ratings yet

- Financial Ratios For Chico ElectronicsDocument8 pagesFinancial Ratios For Chico ElectronicsThiago Dias DefendiNo ratings yet

- Bradford Amidon ACG2021 Sec. 002Document15 pagesBradford Amidon ACG2021 Sec. 002nintuctgNo ratings yet

- DocxDocument8 pagesDocxKristine Joyce MacanasNo ratings yet

- Reign Gagalac (MIDTERMS)Document4 pagesReign Gagalac (MIDTERMS)Rouise GagalacNo ratings yet

- Why Are Ratios UsefulDocument11 pagesWhy Are Ratios UsefulKriza Sevilla Matro100% (3)

- Finman FinalsDocument4 pagesFinman FinalsJoana Ann ImpelidoNo ratings yet

- BSMM8110-1-R7-2023S - Group Project - 2023 Summer - Group 6Document27 pagesBSMM8110-1-R7-2023S - Group Project - 2023 Summer - Group 6tongthanhthao265No ratings yet

- 2Q2013earningsCall8 8Document32 pages2Q2013earningsCall8 8sabah8800No ratings yet

- Q3FY23 Press ReleaseDocument15 pagesQ3FY23 Press ReleaseDennis AngNo ratings yet

- READING 10 Industry and Company AnalysisDocument26 pagesREADING 10 Industry and Company AnalysisDandyNo ratings yet

- JPMorgan Global Investment Banks 2010-09-08Document176 pagesJPMorgan Global Investment Banks 2010-09-08francoib991905No ratings yet

- Finance Pq1Document33 pagesFinance Pq1pakhok3No ratings yet

- MCQ On FMDocument32 pagesMCQ On FMShubhada AmaneNo ratings yet

- MCQ On Financial ManagementDocument28 pagesMCQ On Financial ManagementibrahimNo ratings yet

- Constellation Software Inc. Q308: Historical Figures Restated To Comply With Revised DefinitionDocument3 pagesConstellation Software Inc. Q308: Historical Figures Restated To Comply With Revised DefinitionrNo ratings yet

- Libby Financial Accounting Chapter14Document7 pagesLibby Financial Accounting Chapter14Jie Bo TiNo ratings yet

- 2-4 2006 Dec ADocument13 pages2-4 2006 Dec AAjay Takiar50% (2)

- 3Q2013earningsCall11 7Document32 pages3Q2013earningsCall11 7sabah8800No ratings yet

- Finman4e Quiz Mod09 032014Document8 pagesFinman4e Quiz Mod09 032014Brian KangNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Over Work GuidelineDocument46 pagesOver Work GuidelineNeil CalvinNo ratings yet

- Fujishiro eÇÇKaorieÇüDocument216 pagesFujishiro eÇÇKaorieÇüNeil CalvinNo ratings yet

- AirAsiaTata JVDocument2 pagesAirAsiaTata JVNeil CalvinNo ratings yet

- CS Harley - May 2013Document16 pagesCS Harley - May 2013Neil CalvinNo ratings yet

- Problem The FijianDocument2 pagesProblem The FijianNeil CalvinNo ratings yet

- Case Study OECDocument11 pagesCase Study OECNeil Calvin50% (2)

- Case Study SUMMARY Rv3 - HigginsDocument12 pagesCase Study SUMMARY Rv3 - HigginsNeil CalvinNo ratings yet

- Footwear InternationalDocument5 pagesFootwear InternationalNeil CalvinNo ratings yet

- Burger King CASE SUMMARY FinalDocument11 pagesBurger King CASE SUMMARY FinalNeil CalvinNo ratings yet

- Marketing Strategies of Burger King and Holiday InnDocument69 pagesMarketing Strategies of Burger King and Holiday Inndinkar133750% (2)

- AirAsiaTata JVDocument2 pagesAirAsiaTata JVNeil CalvinNo ratings yet

- Burger King CASE SUMMARY FinalDocument11 pagesBurger King CASE SUMMARY FinalNeil CalvinNo ratings yet

- Case SummaryDocument2 pagesCase SummaryNeil CalvinNo ratings yet

- Caribbean BauxiteDocument3 pagesCaribbean BauxiteAdeel Ahmad Bhatti100% (2)

- Retails StrategyDocument1 pageRetails StrategyNeil CalvinNo ratings yet

- Road To HellDocument3 pagesRoad To HellNeil CalvinNo ratings yet

- Leadership StylesDocument6 pagesLeadership StylesNeil CalvinNo ratings yet

- Maha ThirDocument2 pagesMaha ThirNeil CalvinNo ratings yet

- The Work Is GoodDocument1 pageThe Work Is GoodNeil CalvinNo ratings yet

- Maha ThirDocument2 pagesMaha ThirNeil CalvinNo ratings yet

- List of University in BruneiDocument1 pageList of University in BruneiNeil CalvinNo ratings yet

- Quick Tips For Safe Working PDFDocument3 pagesQuick Tips For Safe Working PDFNeil CalvinNo ratings yet

- The Work Is GoodDocument1 pageThe Work Is GoodNeil CalvinNo ratings yet

- Strauss Printing Services Statement of Cash Flows For The Year Ended December 31, 2013 Cash Flow From Operating ActivitiesDocument2 pagesStrauss Printing Services Statement of Cash Flows For The Year Ended December 31, 2013 Cash Flow From Operating ActivitiesChristian Shino Delos SantosNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalSirshajit SanfuiNo ratings yet

- BO - 08 - LC9 - V4 Financial Close Updated 2022Document121 pagesBO - 08 - LC9 - V4 Financial Close Updated 2022anneNo ratings yet

- Foundations of Financial Management Canadian 10th Edition Block Solutions ManualDocument35 pagesFoundations of Financial Management Canadian 10th Edition Block Solutions Manualwinifredholmesl39o6z100% (21)

- Compre FAR19Document16 pagesCompre FAR19Gwen Cabarse PansoyNo ratings yet

- FinalCase 5 SAP For ATLAMDocument28 pagesFinalCase 5 SAP For ATLAMShahrul IzwanNo ratings yet

- Busn 10th Edition Kelly Test BankDocument18 pagesBusn 10th Edition Kelly Test Bankthomasriddledisrgzembc100% (34)

- KK Akuntansi Perusahaan JasaDocument38 pagesKK Akuntansi Perusahaan JasaRamzy FarrazNo ratings yet

- Financial ManagementDocument17 pagesFinancial Managementcorpuzkrystal01No ratings yet

- 75 - Largerhinoliverecommendation - DLF LTDDocument5 pages75 - Largerhinoliverecommendation - DLF LTDamit ghoshNo ratings yet

- Mini Project AccountsDocument16 pagesMini Project AccountsTia SoniNo ratings yet

- Assignment AccDocument47 pagesAssignment Acchakimstars2003No ratings yet

- Foa Ii Individual AssignmentDocument3 pagesFoa Ii Individual Assignmentyosef mechalNo ratings yet

- Internship Report Veena - Copy of VeenaDocument32 pagesInternship Report Veena - Copy of VeenaBhuvan MhNo ratings yet

- Financial Engineering Class Sesi 1 Ver 2.0Document16 pagesFinancial Engineering Class Sesi 1 Ver 2.0Davis FojemNo ratings yet

- CA-Midterm-Sem 2022-1 N IE-2021-1Document3 pagesCA-Midterm-Sem 2022-1 N IE-2021-1DENI MARTOPO ADINo ratings yet

- J K CementDocument6 pagesJ K CementdantroliyaNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Cgu MCIcaseDocument20 pagesCgu MCIcasekrishy19100% (2)

- Ghazi Fabrics: Ratio Analysis of Last Five YearsDocument6 pagesGhazi Fabrics: Ratio Analysis of Last Five YearsASIF RAFIQUE BHATTINo ratings yet

- Calculating Profit - Extra ExercisesDocument4 pagesCalculating Profit - Extra ExercisesРустам РажабовNo ratings yet

- Shareholder EquityDocument26 pagesShareholder Equityismailhasan85No ratings yet

- Sas#10 Acc150Document4 pagesSas#10 Acc150Mekuh Rouzenne Balisacan PagapongNo ratings yet

- Accounting Basics 1 QuizDocument6 pagesAccounting Basics 1 QuizRegine Pahigo HilladoNo ratings yet

- Topic 6Document41 pagesTopic 6Umut YASARNo ratings yet

- MoyesDocument2 pagesMoyesMira AmirrudinNo ratings yet