Professional Documents

Culture Documents

SAP CO Sample Question - 01

Uploaded by

Rizve AhmedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAP CO Sample Question - 01

Uploaded by

Rizve AhmedCopyright:

Available Formats

Management Accounting (CO) with SAP ERP 6.

0 (Some Sample Question)

Q1. Cost elements classify an organizations valuated consumption of production factors within a controlling area. A cost element corresponds to a cost-relevant item in the chart of accounts. Which of the following are types of cost elements? (More than one answer is correct) A. B. C. D. Primary cost elements Revenue cost elements Secondary cost elements Personnel cost elements

Answer: A, B, C Cost elements in Controlling (CO) are closely related to the general ledger accounts used in Financial Accounting (FI). This is because the SAP R/3 System is structured as an Integrated Accounting System: Cost elements document which costs (differentiated by category) are incurred within a settlement period, and in which amount. They provide information concerning the value flow and the value consumption within the organization. Cost Element Accounting and Cost Center Accounting/Internal Orders are closely linked in the R/3 System. Each posting to an account that is also a cost element, is assigned either to a cost center or order. This ensures that at period-end the data is subdivided by cost elements and cost centers/internal orders for analysis purposes. Primary Cost/Revenue Elements A primary cost or revenue element is a cost or revenue-relevant item in the chart of accounts, for which a corresponding general ledger (G/L) account exists in Financial Accounting (FI). You can only create the cost or revenue element if you have first defined it as a G/L account in the chart of accounts and created it as an account in Financial Accounting. The R/3 System checks whether a corresponding account exists in Financial Accounting. Examples of primary cost elements include: Material costs

Personnel costs Energy costs Secondary Cost Elements Secondary cost elements can only be created and administrated in cost accounting (CO). They portray internal value flows, such as those found in internal activity allocation, overhead calculations and settlement transactions. When you create a secondary cost element, the R/3 System checks whether a corresponding account already exists in Financial Accounting. If one exists, you can not create the secondary cost element in cost accounting. Examples of secondary cost elements include: Assessment cost elements Cost elements for Internal Activity Allocation Cost elements for Order Settlement There are no Personnel cost elements in CO

Q2. With reference to the controlling module (CO), which of the following statements are true? (More than one answer is correct) A. Controlling provides information for management decision-making B. Controlling (CO) and Financial Accounting (FI) are independent components in the SAP system. C. One of the main task of Controlling is planning. D. Controlling can be implemented completely independently of FI Answer: A, B, C Controlling provides you with information for management decision-making. It facilitates coordination, monitoring and optimization of all processes in an organization. This involves recording both the consumption of production factors and the services provided by an organization. As well as documenting actual events, the main task of controlling is planning. You can determine variances by

comparing actual data with plan data. These variance calculations enable you to control business flows. Income statements such as, contribution margin accounting, are used to control the cost efficiency of individual areas of an organization, as well as the entire organization. Controlling (CO) and Financial Accounting (FI) are independent components in the SAP system. The data flow between the two components takes place on a regular basis. Therefore, all data relevant to cost flows automatically to Controlling from Financial Accounting. At the same time, the system assigns the costs and revenues to different CO account assignment objects, such as cost centers, business processes, projects or orders. The relevant accounts in Financial Accounting are managed in Controlling as cost elements or revenue elements. This enables you to compare and reconcile the values from Controlling and Financial Accounting. Although Controlling can be implemented independently of FI, there is some basic configuration that needs to be done in FI. (Note: Watch out for the word completely in the answer choice!)

Q 3. Overhead Cost Controlling component enables you to plan, allocate, control, and monitor overhead costs. Which of the following fall under Overhead Cost Controlling? (More than one answer is correct) A. Cost Element Accounting B. Cost Center Accounting C. Internal Orders D. Activity Based Costing E. Plant based Costing Answer: A, B, C, D The key areas of Overhead Cost Controlling are:

Cost Element Accounting Cost and Revenue Element Accounting details which costs and revenues have been incurred. Accrual is calculated here for valuation differences and additional costs. Cost Accounting and Financial Accounting are also reconciled in Cost Element Accounting. This means that the tasks of Cost and Revenue Element Accounting stretch beyond the bounds of Overhead Cost Controlling. Cost Center Accounting Cost Center Accounting determines where costs are incurred in the organization. To achieve this aim, costs are assigned to the subareas of the organization where they have the most influence. By creating and assigning cost elements to cost centers, you not only make cost controlling possible, but also provide data for other application components in Controlling, such as Cost Object Controlling. You can also use a variety of allocation methods for allocating the collected costs of the given cost center/s to other controlling objects. Internal orders Overhead Orders are internal orders used either to monitor overhead costs for a limited period, or overhead incurred by executing a job, or for the long-term monitoring of specific parts of the overhead. Independently of the cost center structure, internal orders collect the plan and actual costs incurred, enabling you to control the costs continuously. You can also use internal orders to control a cost center in more detail. You can assign budgets to jobs. These budgets are then monitored automatically by the SAP system to ensure that they are kept to. Activity-Based Costing In contrast to the responsibility and function-oriented basis of Cost Center Accounting, Activity-Based Costing provides a transaction-based and cross-functional approach for activity output in which several cost centers are involved. The emphasis is not on cost optimization in individual departments, but the entire organization.

Q 4. You can use different currencies in the Controlling component (CO). Which of the following currencies are valid in Controlling? (More than one answer is correct) A. Controlling area currency B. Object currency C. Exchange rate Currency Answer: A, B The following currencies are valid in Controlling: Controlling area currency The system uses this currency for cost accounting. This currency is set up when you create the controlling area. It is based on the assignment control indicator and the currency type. Object currency Each object in Controlling, such as cost center or internal order, may use a separate currency specified in its master data. When you create an object in CO, the SAP system defaults the currency of the company code to which the object is assigned as the object currency. You can specify a different object currency only if the controlling area currency is the same as the company code currency. There is an object currency for the sender as well as one for the receiver. Transaction currency Documents in Controlling are posted in the transaction currency. The transaction currency can differ from the controlling area currency and the object currency. The system automatically converts the values to the controlling area currency at the exchange rate specified. The system always translates actual data with the average rate (exchange rate type M). You store the exchange rate type for each currency. You can specify a different exchange rate type for planning data in the version. All three currencies are saved in the totals records and the line items. This enables you to

use the different currencies for evaluations in the information system. This is only possible if you specified that all currencies should be updated for the given controlling area.

Q 5. Controlling makes use of two different types of controlling objects, True Controlling Objects & Statistical Controlling Objects. Which of the following are Statistical Controlling Objects? (More than one answer is correct) A. B. C. D. Cost Centers (for account assignment of revenues) Profit Centers Projects Statistical internal Orders

Answer: A, B, D For postings in external accounting that use a cost element as the account, you need to use a special account assignment logic. This enables the system to ensure that data is reconcilable with all the relevant application components. These rules for the account assignment logic always apply for postings in internal accounting (Controlling). Account assignment distinguishes between true and statistical Controlling objects. True Controlling Objects Cost centers (for account assignment of costs) Orders (true) Projects (true) Networks Make-to-order sales orders Cost objects Profitability segments Real Estate Objects Business Processes You can use true Controlling objects as senders or receivers.

Statistical Controlling Objects Cost centers (for account assignment of revenues) Cost centers, if a true account assignment object already exists Statistical Internal Orders Statistical projects Profit centers You can indicate internal orders and projects in each master record as statistical. You can also specify Statistical Controlling objects as account assignment objects in addition to true Controlling objects. You cannot allocate costs on statistical Controlling objects to other objects. Account assignments are for information purposes only.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shipboard: Micrpoclimate' Coolin SysemsDocument47 pagesShipboard: Micrpoclimate' Coolin Sysemsjakalae5263No ratings yet

- VPRS-4300D Catalogue PDFDocument4 pagesVPRS-4300D Catalogue PDFHoàngTrầnNo ratings yet

- GGGDocument23 pagesGGGWarNaWarNiNo ratings yet

- Line Tension and Pole StrengthDocument34 pagesLine Tension and Pole StrengthDon BunNo ratings yet

- VHDL ExperimentsDocument55 pagesVHDL Experimentssandeepsingh93No ratings yet

- 2023 Key Stage 2 Mathematics Braille Transcript Paper 1 ArithmeticDocument8 pages2023 Key Stage 2 Mathematics Braille Transcript Paper 1 ArithmeticMini WorldNo ratings yet

- GAS-RELEASE CALCULATORDocument3 pagesGAS-RELEASE CALCULATOREduardo Paulini VillanuevaNo ratings yet

- The Gist of NCERT General Science PDFDocument148 pagesThe Gist of NCERT General Science PDFSatyajitSahooNo ratings yet

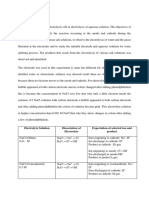

- Discussion Exp 2 Chm674Document4 pagesDiscussion Exp 2 Chm674Eva Lizwina MatinNo ratings yet

- Deep Glow v1.4.6 ManualDocument6 pagesDeep Glow v1.4.6 ManualWARRIOR FF100% (1)

- Elec4602 NotesDocument34 pagesElec4602 NotesDavid VangNo ratings yet

- G5 Fi 125 (Sr25aa) PDFDocument122 pagesG5 Fi 125 (Sr25aa) PDF陳建璋No ratings yet

- BIS 14665 Part 2Document6 pagesBIS 14665 Part 2Sunil ChadhaNo ratings yet

- Hacking TechniquesDocument84 pagesHacking Techniquesgourmetcomidas4No ratings yet

- Instantaneous Waterhammer EquationDocument10 pagesInstantaneous Waterhammer EquationkiranNo ratings yet

- Association of Genetic Variant Linked To Hemochromatosis With Brain Magnetic Resonance Imaging Measures of Iron and Movement DisordersDocument10 pagesAssociation of Genetic Variant Linked To Hemochromatosis With Brain Magnetic Resonance Imaging Measures of Iron and Movement DisordersavinNo ratings yet

- Product Information: Introducing The Machine Information Center (MIC) MiningDocument44 pagesProduct Information: Introducing The Machine Information Center (MIC) MiningKolo BenduNo ratings yet

- Formation and Evolution of Planetary SystemsDocument25 pagesFormation and Evolution of Planetary SystemsLovelyn Baltonado100% (2)

- Ace Signal and System PDFDocument144 pagesAce Signal and System PDFYash Rai100% (1)

- 034 PhotogrammetryDocument19 pages034 Photogrammetryparadoja_hiperbolicaNo ratings yet

- Vorplex - MST - Airblowing and Water FlushingDocument14 pagesVorplex - MST - Airblowing and Water FlushingAmirHakimRusliNo ratings yet

- Quizlet-Philippine Electrical CodeDocument2 pagesQuizlet-Philippine Electrical Codena zafira0% (1)

- The Experimental Model of The Pipe Made PDFDocument4 pagesThe Experimental Model of The Pipe Made PDFGhassan ZeinNo ratings yet

- Westfalia Separator Installation DiagramDocument68 pagesWestfalia Separator Installation DiagramOno Jr Araza100% (3)

- Ellipse Properties and GraphingDocument24 pagesEllipse Properties and GraphingREBY ARANZONo ratings yet

- Alili M S PDFDocument20 pagesAlili M S PDFStatsitika ITNo ratings yet

- Electrical Plant Load AnalysisDocument36 pagesElectrical Plant Load AnalysisJesus EspinozaNo ratings yet

- (PPT) Design of A Low-Power Asynchronous SAR ADC in 45 NM CMOS TechnologyDocument42 pages(PPT) Design of A Low-Power Asynchronous SAR ADC in 45 NM CMOS TechnologyMurod KurbanovNo ratings yet

- 14GMK 6250 TelescopeDocument13 pages14GMK 6250 TelescopeВиталий РогожинскийNo ratings yet

- Tunnel NoiseDocument11 pagesTunnel Noisesylvestrew100% (1)